By Philip Pilkington, a London-based economist and member of the Political Economy Research Group at Kingston University. Originally published at his website, Fixing the Economists

The other day my friend Rohan Grey — a lawyer and one of the key organisers behind the excellent Modern Money Network (bringing Post-Keynesian economics to Columbia Law School, yes please!) — directed me to an absolutely fascinating piece of writing. It is called ‘Taxes For Revenue Are Obsolete’ and it was written in 1945 by Beardsley Ruml. Ruml was the director of the New York Federal Reserve Bank from 1937-1947 and also worked on issues of taxation at the Treasury during the war.

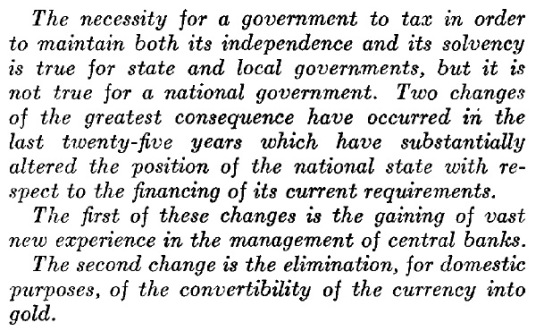

The article lays out the case that taxation should not be focused on revenue generation. Rather, Ruml argues, it should be thought of as serving other purposes entirely. He writes:

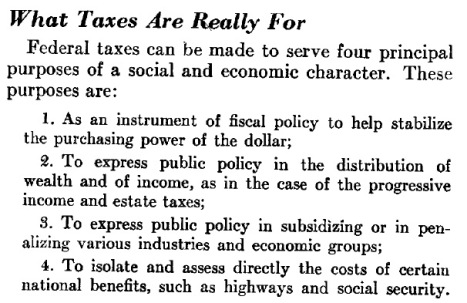

Basically Ruml is making the same case that the Modern Monetary Theorists (MMTers) make: a country that issues its own sovereign currency and is unconstrained by a gold standard does not require tax revenue in order to fund spending. This is because the central bank always stands by ready and able to buy any sovereign debt issued that might lead to the interest rate rising. Indeed, it does this automatically in the way that it conducts its interest rate policy. Ruml then outlines what taxation is really for in such a country.

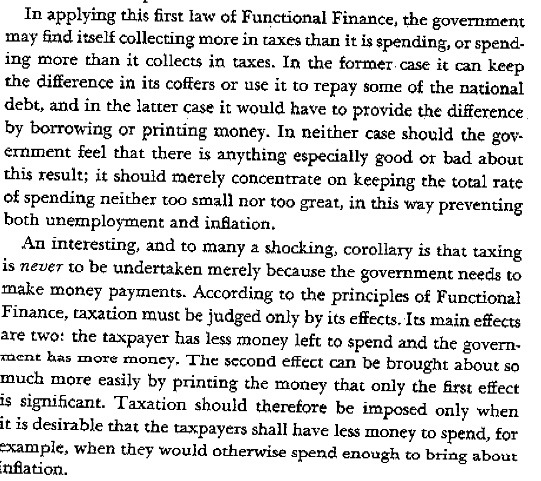

This is a fantastic summary and I really couldn’t put it better myself. The interesting question, however, is why people were making such statements at this moment in history? It should be remembered that the economist Abba Lerner had published a paper entitled ‘Functional Finance and the Federal Debt‘ just two years earlier which made a very similar case. In that classic paper he wrote:

So, what was it about this moment in history that allowed for such a clear-eyed view of government spending and taxation policies? The answer is simple: the war. World War II allowed economists, bankers and government officials to see clearly how the macroeconomy worked because the government was basically controlling the economy. World War II was perhaps the only time in history when capitalist economies were run on truly Keynesian principles. (You can make a case that the Nazi economy in the 1930s was also run on these principles, however, so perhaps it is better to say: a capitalist economy in a democratic state).

This meant that those working in government institutions and banks could see exactly what was happening and why it was happening. Because the central banks were exercising full control over the market for government debt and because the governments were running massive fiscal deficits it became crystal clear what the taxation system was really doing: first and foremost it was suppressing aggregate demand for goods and services in certain parts of the economy. In doing so it had two broad functions: an anti-inflation function and a redistribution function.

The experience of the war, I would argue, was the main reason why the neo-Keynesian economists in the US actually understood macroeconomic policy in a clear-sighted way. I do not believe that their theories would have allowed them to properly understand the economy. But their experiences in the war — from reading the daily newspapers to working in economic institutions — left a lasting impression that allowed them to properly understand the macroeconomic policy tools in the 1950s and 1960s. The textbooks that they were teaching said one thing but their experiences in the war told them another. (An exception to this might be James Tobin whose theoretical writings do reflect some of the war experiences).

When the younger generation came of age in the 1970s the mainstream economic theory ensured that they had absolutely no idea what they were talking about. They only had what they were being taught in the classroom and did not have the real-world experience that the older generation had. Everything went downhill from there and that, I think, is where the seeds were sown for the economic turmoil and confusion we live with today. It is also the key reason why the economists of the next generation must be taught in an entirely different way from the previous generation.

People like Rohan Grey and his colleagues in Columbia Law School as well as the blogs are having an enormous effect in this regard. But the mainstream institutions simply cannot respond because they are filled with dinosaurs who sense their underlying irrelevance. This makes them defensive and basically impossible to deal with. Nevertheless, events today are also having their own effect, even if these are not as pronounced as the effects that World War II had on the economists of the day. The failure of the QE programs to generate employment was a key step in giving people a clear-sighted view of what monetary policy is and how it works (or doesn’t!). While the clear stagnation that has set in after the crisis may help to loosen the idea of long-run full employment equilibrium that the mainstream holds so dear. Again, the mainstream will likely retain such ideas in theory, but they will probably be easier to deal with in practice. We’ve seen this movie before. It doesn’t end well. But it makes our lives easier in the short-run and puts the mainstream on the defensive with regards theory.

Meanwhile, there are a couple of people who might be considered the Rumls of our time. Former Deputy Secretary of the Treasury Frank Newman is a good example of this. His book Freedom From the National Debt is a document on par with Ruml’s excellent 1945 article. He has also got some play in the national news media. But not nearly enough of course. I will leave the reader with a short clip from Fox News where Newman makes very clear that the national debt in the US is a misnomer and not a huge concern (for a more in depth analysis by Newman try this talk given by Newman at the Columbia Law School)**

**Note that the case Newman makes in the Fox News clip is the same that I was making in this post. It is an argument that basically allows us to show that the endogenous money argument largely works even if we ignore central bank action and it runs directly contrary to the narrative embedded in the ISLM.

Brace yourself for the Tea Party left, Phillip.

Naw they’ll just ignore anything that does not conform to their ideological bias or better stated beliefs about stuff…

skippy…. but one can have a wee bit of excited expectation… bated breath thingy…

Brace yourself for the Tea Party left, Phillip.

Philip himself here represents the anti-tax left. As well as the anti-facts left. Notice the absence of primary sources. It’s Ruml says, and Lerner says, and Newman says. As opposed to, say, the Treasury Financial Manual. The Federal Reserve Act. Emergency Banking Act of 1933. Financial Statements from the Reserve Banks, the Board of Governors, USG. The US Code. Materials that lawyers such as Grey and researchers such as Pilkington would be able to invoke with ease, if only they supported the MMT narrative.

We in the Soddy camp deploy these sources here all the time. Our concern is financialization, the hegemony of the financial sector, burgeoning private, public and commercial indebtedness, disemployment. And with these, the staggering concentration of wealth, the loss of democratic accountability and self-governance. Serfdom, in a word.

Others will have to carry the ball today. Looking forward to seeing some of you at Rethinking Economics 2014.

“Primary sources”

The primary source for a monetary system is arithmetic, ie accounting. A monetary system is an accounting system first and foremost, and only the state (the Central Bank is a creature of the state) can create money out of thin air and add it to the system.

Taxes can’t do that…taxes can only remove money from the system.

Opinions about accounting are irrelevant no matter where they come from. What matters is that the numbers add up.

“Opinions about accounting are irrelevant …What matters is that the numbers add up.”

…and keep adding up into the accounts of the foreordained “few good men”…

“only the state… can create money out of thin air and add it to the system…taxes can only remove money from the system.”

This is no doubt true…but shouldn’t these two powers be integrated and coordinated? It seems to me that both are determined by politics, despite the “public” posturing…but controlled by the “public-private” toggle-switch.

My point was that appeals to authority…”primary sources”… are subordinate to the tyranny of arithmetic.

Yes politics determines how money gets spent. MMT tells us we aren’t constrained by lack of money, which, after all, is an unlimited resource, the only one I can think of we can’t run out of.

Therefore, any argument that is based on a supposed lack of financial resources is wrong from the get-go and needs no further discussion.

Yet that is the argument we keep having.

Thanks for your honest feedback…your point about the tyranny of arithmetic is well taken and received.

From my POV, there has been a tremendous amount time, effort and resources put into embedding the idea of scarcity of financial resources into our collective thinking. Instead of asking “why we keep recycling this argument?”… imho, is how to respond to abreactions when they surface?

Although I was always a BIG fan of “The Count”, he was not my favorite character.

Accounting is just a system designed to make numbers add up….., and in the case of “double-counting”, also to balance, in accounts, ostensibly to reveal the financial condition of the entity being “Counted”..

Accounting is obviously no big deal, since the modern global financial economy is living on the life support granted by changing global financial accounting norms when they last failed.

In other words, its a recognition that it is the money power that really ‘counts’, and we can have any kind of accounting system we want to keep that money power afloat.

BTW, has anyone called for an “accounting” for money where the accounts don’t add, and the columns don’t balance?

Did Benes and Kumhof revisit the Chicago Plan without dozens of pages that explained the accounting outcomes?

https://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

Or, did Dr. Yamaguchi not provide extensive analysis of the workings of a public money system in an open macro-economy ….also always in terms of financial accounting and economic outcomes?

The numbers add up and down……and balance across

But, one point commands disagreement.

The primary source for a monetary system is sovereignty. No monetary system can begin counting the units until the Money Statutes have been drawn. A monetary system is a legal construct designed for the purpose of enabling a national economy, and any accounting system that works is adequate. See Del Mar’s “A History of Monetary Systems”.

Did Benes and Kumhof revisit the Chicago Plan without dozens of pages that explained the accounting outcomes?

No. Rather than show how it would function in the real world, they chose to run a DSGE model of the banking system. That’s how they collected “evidence” in support of Fischer’s plan.

So congratulations, your personal crusade has been adopted by two neoclassical economists based on the same sort of toy model which has failed at every turn. Real confidence grabber there.

But I forget, technical detail isn’t your thing and is obviously “no big deal”.

Models never fail. But reality often does.

Ha ha.

Technical detail? DSGE ?

I guess you missed the technical detail where Benes and Kumhof designed a new DSGE model that includes money, banks and debt, so correcting for DSGE’s historic criticisms from people like Keen, who added those to his new MINSKY model, copying what was originally done by Dr. Yamaguchi, who came to the same conclusions as Benes and Kumhof, and who developed the systems-dynamic macro-economic model being copied by Keen.

So, we’ve advanced from “Shoot the Messenger” to “Just Shoot Down the Model, even if it makes no sense.” Why not ask Keen for his opinion of the Kumhof research?

So, since the IMF researchers they have already corrected for the ‘real-world conditions of money, banks and debt, do you have any valid criticisms you would like to raise, or other ‘technical details’?

If you understood DSGE models you would be aware their failures lay not in “money, banks and debt” but in their inability to anticipate and generate useful output from shifts in probability distributions, wherein economic actors alter their behaviors and violate the assumptions necessary to make the model work “efficiently”.

Standard neoclassical claptrap.

I give you Keen, who takes neo-classicist Krugman to task for the failures of DSGE macro-economic modeling ( more deeply explained at Keen’s websites) these being just what I said.

What do you offer?

The modeling attack you presented is more akin to the Austrian criticism of economic modeling in general. “THIS is why we can’t model our claimed economic outcomes.”

So, is Keen another neo-classical dude? Does he criticize Kumhof’s work as he does Krugman’s?

Hardly.

Truth is Kuumhof had to use A DSGE model, because that is what the IMF has always used, and he is an IMF modeler and researcher. But, first he fixed the shortcomings, based on the earlier modeling of Yamaguchi. Way before Keen.

Again, the proof is in pudding.

The results. The accounting outcomes.

Re: points of economic thought, …………….nobody has ever regarded any economist who challenged the traditional academic and economic teachings about debt, money and banking , like Simons, Fisher and others have done before Kumhof, as neo-classical anything.

Another eye of the beholder kind of thing, for which I advised ‘tunnel-vision therapy’.

FYI, each is far more advanced in the heterodoxy of monetary economics than anyone you have ever mentioned.

Kumhof and Yamaguchi espouse debt-free public money issuance as a matter of systemic money and banking reform, as called for by Minsky. How is their work downsized into the neo-classical pigeon-hole of which Krugman would represent the furthest left (public purposed liberalism)?

It’s far more mature from s science and learning posture to shoot neither the messengers or their models.

Like Ruml and Lerner said.

Look at the outcomes.

These economists support the monetary postures of every progressive political movement, and about every progressive party since the Greenbacks, in the colorful history of this subject.

That includes Green Party US today.

Read the platform of the 1912 Progressive party.

From when they understood the money power to be what it is.

Leijonhufvud also noted something more ominous though. He saw clearly that the tendency was actually moving further and further away from empirical reality. He wrote:

EconTribe`1

For a while economics survived the turn to weird ‘savage mind’ style behavior. People who were more inclined toward the reality of doing practical work had a set of tools that were at least somewhat workable. But Leijonhufvud could see this changing especially with the rise of the general equilibrium theorists. Today this has completely taken over. DSGE models are claimed to be cutting edge for policy analysis and some even believe that Real Business Cycle models say something about the real world. Whereas the likes of Frank Hahn knew well that the general equilibrium framework was just an intellectual game, the students took it literally. That is when we entered what we might call the ‘dark age of economics’ and that is where we remain today.

Austrians at one time called themselves the “psychological school” – sadly it was based on the individual, with in, the barter model. That’s two big Oops wrt societal organization imo.

Skippy… Some kinda do the same with positive and negative stuff…. we will repeat~

This is the guy who thought damaged currency kept by the national mint were a slush fund in case government ran out of lunch money. Nor does he appear capable of understanding that his personal views are an interpretation and therefore do not shape reality.

It’s a standard tactic of polemicists to write in as non-specific a manner as possible so they can’t be pinned down, so when Phillip discusses Ruml’s work, Econ responds with, “Oh yeah, well Federal Reserve Act!”, a document which (contrary to his continued insistence the Fed is wholely private) very openly makes the central bank a collection of public-private partnerships falling under political control of the legislative branch.

If one responds to his insistence the CB is a private banking institution by pointing out requirement of the FRA that the Chairman is subordinate to the Secretary of the Treasury, or requirement of law that the CB act as agent of Treasury, he moves the goal posts to talking about “regional banks”. When one points out the regional banks are required to execute policies as directed by the chairman and board of governors, he again moves the posts, talking about stock ownership. When one responds that those stocks proffer no voting rights, he dodges again and brings up “profits”.

This is not a person arguing in good faith.

EconCCX : warning ! ‘bad faith’ police have your comments in their sights……..

So, are you saying that having a private central bank (Hamiltonian) under governmental money statutes would require the supremacy of that bank over government?

Or, that what Hamilton proposed was not a UK-style private central bank?

Or, that the legal and institutional FACTs that the FRBNY is a private bank-corporation, and that NONE of its employees work for the government, and that the courts have found, as far as they’ve looked, that the Fed is not a governmental body……….that despite all of these realities to what matters in the public versus private debate, that there is ‘anything’ that makes this private employer institution part of the government?

With the exception being that it is doing the government’s business of issuing the nation’s money.

How come in each iteration of “Yeah, but…” above, it is the respondent in disagreement with your premise that is acting in bad faith. What makes any of those claims (though not made here) not valid?

Is it because they follow a “Yeah but…..postulation of the MMT cadre ?

Oh, come off it. These are primary sources in the sense that they were created at the time by people active at the time. The material you mention are not the sole types of primary sources. Phil wonders why they wrote the kind of things they did. The principal reason is that most were New Dealers, and probably understood the New Deal better than Roosevelt himself until toward the end of his fourth term.

In his last speech, he laid out the principles of a Second Bill of Rights, one which would behoove us to implement today. Quoting from Roosevelt:

“In our day these economic truths have become accepted as self-evident. We have accepted, so to speak, a second Bill of Rights under which a new basis of security and prosperity can be established for all—regardless of station, race, or creed.

Among these are:

The right to a useful and remunerative job in the industries or shops or farms or mines of the nation;

The right to earn enough to provide adequate food and clothing and recreation;

The right of every farmer to raise and sell his products at a return which will give him and his family a decent living;

The right of every businessman, large and small, to trade in an atmosphere of freedom from unfair competition and domination by monopolies at home or abroad;

The right of every family to a decent home;

The right to adequate medical care and the opportunity to achieve and enjoy good health;

The right to adequate protection from the economic fears of old age, sickness, accident, and unemployment;

The right to a good education.

All of these rights spell security. And after this war is won we must be prepared to move forward, in the implementation of these rights, to new goals of human happiness and well-being.”

Sadly, he was mistaken that these principles had become self-evident. If you wish to see him setting out this Second Bill of Rights, just have a look at the end of Michael Moore’s Capitalism: A Love Story. His team were put onto this film of Roosevelt delivering these principles to camera by a phone call to have a look in the archives of the University of North Carolina, if I remember correctly. The Roosevelt Library had never heard of the film, nor had anyone else they asked. When they got to the library in question, they found that the Roosevelt materials were not cataloged but in boxes indexed only by year. They eventually found what they were looking for in a box labeled 1944.

You can also see what Moore saw on youtube: https://www.youtube.com/watch?v=3EZ5bx9AyI4. This recording was made on 11 January 1944. Sadly, he was dead by 12 April of the same year. And unfortunately, in the following election, the electoral college selected Truman instead of Roosevelt’s choice, his vice president, Henry Wallace. The general explanation for his selection was (and still is) that Truman was considered to be more malleable to the interests of the rich elites than Wallace would ever be. Though speculation on my part, it is more likely than not, I think, that Roosevelt’s Second Bill of Rights would have had a better chance of implementation than they ever had with Truman, which basically was none.

Addendum: Roosevelt’s Second Bill of Rights would have had a better chance of implementation with Wallace as President than they ever had with Truman.

The Bible was the “primary source” that rejected Galieo’s endorsement of a “non-primary” source: Copernicus’ book. The primary source argument is bogus, especially in the field of economics. There are no “primary” sources that can be trusted.

@jerry hamrick The primary source argument is bogus, especially in the field of economics. There are no “primary” sources that can be trusted.

The primary source I’m referring to are the ones that govern and document the relationship between the Federal Reserve Banks, the US Government, and the commercial banks. They are contracts, and create consequences for those who do not abide. The financial statements describe how the parties themselves depict the interactions.

These documents are internally consistent, and make clear that Reserve Notes, printed by the US’s BEP and authorized by the SecTreas as national bank notes formerly were, are issued by a private bank consortium. They’re valid to pay down government debt because they aren’t government debt. They’re the notes of USG’s creditors. That’s why they’re assets to USG when USG possesses them, and why USG must borrow and tax to obtain them and to augment TGA balances.

If these primary sources supported the MMT position, would not our MMT friends cite and excerpt them with confidence, as we critics do? But they don’t, so of course our friends are going to deny the validity of the very binding covenants under which the system operates, and cite each others’ opinions instead.

Interesting post. Here in Europe, those that are wedded to the euro believe in magical things like theoretical targets to right ourselves. We come up with names like: Stability and Growth Pact to show the world we mean to put “fiscal discipline” in our budgets. Heaven forbid a eurozone nation make the fatal mistake of going over the 3% rule for deficits or the 60% GDP debt rule. Because if they violate these rules, well, nothing happens from the Commission position, but at the national level, look out. Righties have used the 60% rule to whack budgets — and to raise taxes. Debt is used as a bludgeon tool of first resort on social spending.

Real-Tea-Party Progressive here…..indeed …..in that we STILL refuse to pay the public tax in the coin of the private banking realm in charge today…..in this case federal reserve bank-credit and not that commanded by the British bankers of yore.

Interesting that the content of Ruml’s speech was never made anything like a public policy proposal, so it could be debated in the forums, as MMT is trying to do, nor did Ruml provide any explanation for where the government would acquire the resources to pay its Bills. Thus, an empty gesture.

In reality, this speech was the extent of Ruml’s bone to the then-current corporatocracy, for whom Ruml, a most colorful Fed chief to be sure, was providing fodder in yet another call for an end to ‘corporate’ taxation. Admittedly, he raised some interesting points that never went anywhere, and should have. So, one wonders why they did not.

In pairing the FF of Lerner with Ruml’s off-script dialogue, one major problem emerges for the reader, and for the MMT adherents. Lerner ALWAYS called for public debt or money printing to fill government deficits…..

If (LOL) the government is spending more than it collects in taxes “it would have to provide the difference by borrowing or printing money.”

Note: no claim that government could close the deficit gap by ‘spending more money into existence’, as even skippy has now come to believe. Wha’s up with that?

IOW, while Lerner advanced a novel and progressive political-economic paradigm that should have been more widely advanced at the time, he made no claim that slightly imitates the MMT foundational error that the government creates money when it spends. Rather, ironically, Lerner advanced the idea that government also had the power to (somehow) create and issue new monies as needed.

I offer no more proof than to observe that a government that has that power (to create money when it spends …..as called for in the Kucinich reform Bill) has no need whatsoever to balance its deficits with either debt or money-‘printing’, which was more than the coining of a phrase at the time.

So, to which tenet should we grasp?

Ruml’s empty focus on the functional ‘effect of taxation’…….perhaps incorrectly?

Or Lerner’s more advanced recognition that the GBC is real in today’s monetary economy? Deficit balances need a funding source.

Or even Newman’s that public debt is GRRRRRRREAAT !

While Lerner almost always, included government money printing in his government budget discussions, he left little direction on how it could be done.

Despite Lerner’s very insightful and wonderful ideas, I am left with the progressive irony is his call for money-printing to ease taxation, rather than to ease government debt issuance.While both circulate endogenous money between the public and private sector, the latter results in a permanent transfer of wealth from the public TO the private sector…..an effect with which Mr. Newman, and logically MMT, is obviously enamored.

“Printing” is just slang for spending money into existence.

That’s it?

Of course it isn’t.

I’ve never heard an MMT advocate opine in favor of ‘money printing’…..that being the terminology safe harbor for fools, cranks and reformers. Were MMT to begin to advocate for money-printing, It would GREATLY confuse the dialogue, even more than now, .

Of course, Martin Wolf used the term, as an opposite to the banks creating the money.

But, FYI, Mr. Lerner was not a slang thrower.

Did he EVER join the two notions, printing money and government issuing the money, anywhere in his writings? No, because one was an understood option… of currency issuance(see below)…..and the other was never relevant to Lerner’s economic model of functional finance, tho it should have been.

It is thus that Lerner explained on occasion that he meant either actually ‘printing’ the money’ (why not, since the case has been made for government issuance via ‘printing more currency’ for a couple of generations, notably by Edison and Ford for The Muscle Shoals Project), or comically, as in Newman, just issuing more debt.

FYI, then, in 1948 Milton Friedman wrote on “A Monetary and Fiscal Framework for Economic Stability’, wherein he backed the work of Soddy, Fisher and Simons calling for a sovereign fiat money system wherein the government spent money into existence (to save capitalism). Irony? for sure.

The larger irony is that there IS a track of historic economic work, as above, that supports and advocates for two things

1. That government is the monopoly issuer of the currency, and

2 that government spends money into existence.

On these pages they, and we who join them, are called, disparagingly, money cranks.

Why?

So, here money cranks are those who advocate for the things that MMT say already exist.

Meanwhile , those who vacuously claim they exist at present, and that they describes the system we have today, are perceived as the smartest kids in the room.

Irony abounds.

Thanks.

I’ve never heard an MMT advocate opine in favor of ‘money printing’

I have, for years. The MMT academics and Mosler made an explicit decision to eschew the term, which I have been arguing for years was a terrible rhetorical mistake of the kind that Lerner warned against, Of course Lerner identified the two terms money printing and spending money into existence, which are about as far apart in meaning as “two” and “2” which is to say no difference at all. And of course Lerner understood very well that money is, was and always must be a form of debt. Not – debt-based, which is loony concept if there ever was one, but debt itself, according to the universal meaning of the concept of debt. There are still insights from Lerner and earlier thinkers that need to be paid more attention to by even our MMT superheroes.

Obviously, Cal, you’re conflating the term ‘money printing’ with the actual ‘issuing the money’, same as Lib above.

How about some clarity here, rather than confusing my statement just because I used the quote from Lerner?.

In my statement that you repeat, I soft-quoted ‘money printing’ to make it more than two words stuck together To make it mean ‘the issuance of money’.

Stated in-person, here, I have never seen an MMT-advocate opine in favor of ACTUAL government money-issuance…..putting actual M1 currency-money directly into circulation, which is what the Kucinich Bill does.

That’s my point, and it stands as the obvious truth.. I read through many of the early MMT debates where the decisions to ‘eschew’ terms, and advance memes were made, and thus, my statement.

So, since MMT’s arrival “on the money-scene” a half dozen years ago, I have never seen it used “to mean the issuance of money through spending money into existence.” Again, that’s what it means to reform advocates.

I already agreed above that Lerner identified ‘money printing’ as the real thing, saying it is what should be done to advance the economy when needed. Never said he didn’t, tho he sometimes used the term to describe issuing more debt as well.

Gawd, Cal, did you really go so far as to say that money was ‘debt itself’ ?

And, worse, to claim, “” according to the universal meaning of the concept of debt.””

To be sure, your claim goes beyond ‘concept of debt’ to ‘debt’ itsef, claiming this is the nature of money, again.

Please have a read of these definitions in F.A. Mann’s “The Legal Aspect of Money”, the international legal scholars’ guide to these matters..

Perhaps you can expand that unproven, anywhere, wild-assed notion (money is debt itself) to the issuance of Greenback ‘money’, or how it applies to Lord Adair Turner’s proposal for “Permanent Overt Money Finance” (issuing debt-free money) of deficits….. A Volker’s Group of Thirty publication here.

http://www.group30.org/images/PDF/ReportPDFs/OP%2087.pdf

Turner, being a reformed central banker and former head of regulation and supervision of the UK’s Financial Services industry, has clearly identified his POMF proposal as the same debt-free money proposal as Simons, Fisher and Friedman, only slightly limited to allow some FRB..

Debt-free money makes sense to me, also to Simons, Fisher, Friedman, Turner, Kumhof, and Yamaguchi. But it’s like turnips to MMTers…..unable to swallow.

It’s not eschewing the term that’s the problem, but the close-mindedness of those still advocating for this debt-based, bankers school of money, rather than the actual sovereign, fiat money of public purpose.

Friedman was a bag man for developers and a PR flack e.g. low ethical social disposition.

Fisher – Eugenics

Simons – “pure assets” and “pure money,” – tautology based on object fetishes, yet, can’t understand the relationship between fraud and contracts and business cycles.

Skippy… pro tip… until you can plug in criminal psychology into DSGE macro-economic modeling widgets, the entire exercise is a circle jerk.

PS. concentrating a problem is not much of a solution imo…

Skippy — Shooting Messengers R Us.

PS. criminal psychology workings abound with debt-based money. No modeling needed. All obvious from empricism at work. U R here.

Elbridge, what quote from Lerner? I haven’t seen much evidence that non MMTers have even read Lerner. Hell, I think that the MMT academics should read him more. Anybody who has knows that he understood that money is debt and that printing money is spending it into existence, and that governments do it all the time.

I have never seen an MMT-advocate opine in favor of ACTUAL government money-issuance They only do so in practically every piece they write. But they also understand that there is no real, major difference with the current system. Do I have to dig up where Lerner says there is no real difference in his Economics of Control again?

Printing bonds, printing money. As sane economists like Lerner, Keynes and FDR and anybody who listened to them knew – they’re the same damn thing. Hard to say which is more awesomely strange, more deranged, the idea that government currency like FR notes, and government credit/debt like Tbonds, are not one and the same thing, or the idea of having a nonzero rate of unemployment.

Calling Greenbacks not debt, is using the word debt in a weird and incoherent non-dictionary way. A debt is a moral obligation, that is all. That is the basic meaning. It is a purely moral concept. Since money is and always was debt, money is a purely moral concept. That is all. It is because everyone naturally understands money so well, understands everything else in terms of such moral concepts, that we can have such crazy theories about something so familiar but not understood., Was ist bekannt, ist nicht erkannt.

Shoe-horning? What shoe-horning?

“Elbridge, what quote from Lerner?”

The part I put in quotes.

“it would have to provide the difference by borrowing or printing money.”

That followed, if the government spent more than it collected in taxes, .

So, obviously no MMT construct by Lerner that the government IS creating money BY spending, because the government IS spending its budget……but it still needs ‘revenue’ to fund deficits.

Were the MMT construct operative, “that the government creates money by spending”, then there would be NEED for neither “debt”, nor MORE money-creation.

Which proves again the balance of your para, though oft-repeated, in error. As…

“ he (Lerner) understood that ……… printing money is spending it into existence, and that governments do it all the time.”

Sorry. Painfully obvious…..NOT.

Do you really not see the contradiction, Cal, that IF government was spending money into existence ‘all the time., there would never be need for either debt issuance, or a call for money-printing, because it was already happening ‘all the time’. Blatant contradiction abounds in MMT-think.

From CaI

“”I have never seen an MMT-advocate opine in favor of ACTUAL government money-issuance.” They only do so in practically every piece they write. But they also understand that there is no real, major difference with the current system. Do I have to dig up where Lerner says there is no real difference in his Economics of Control again?”

Yes, absolutely.

And to be clear of the difference between what MMT says every day, and opining ‘in favor of’ ACTUAL government money issuance” , here.

As the above Lerner – MMT contradiction shows, there is a difference between making an empty and false claim that the government DOES create money when it spends, which MMT does in every piece they write, with zero proof of any truth to that claim, and opining in favor of the government actually spending money into existence, as all the public money advocates do. Every day.

A proposal. I will defer to your idea, IF you can provide ANY proof that the government DOES create and issue new money into existence (expanding the money supply) when it spends. So, a simple link to prove that being the case will suffice. Even any clear statement by the Treasury, who would DO the money creation, will suffice.

But I’ve never seen anything except a claimed imperative, errantly based on sovereignty, and voluminous innuendo to make the case. Any proof that the government creates money when it spends? And, since when, and how is it authorized?

Because, if there is no proof, and if we KNOW that banks create ALL the money that ends up in new M1 money, then somebody needs to be opining in favor of public money creation, as a matter of fact, as a matter of law, as a matter of essential public policy. Claiming that it happens magically, somehow, is a credibility gap away from opining in favor of public money creation ‘in every piece they write’..

Either it happens. Or it doesn’t.

If it happens, reformers can celebrate with MMT. If not, MMT should join with reformers “opining in favor of ACTUAL government money issuance”.

Finally, sorry, but this “debt” tap dance has long been shown for its more ludicrous qualities over and over, including in this thread.

Here presented by Cal, as

“A debt is a moral obligation, that is all.” Extreme shoe-horning.

When discussing money and banking, debt is a written legal agreement between a lender and a borrower with many conditions and definitions included. When budgets don’t balance between spending and revenues, Lerner says the Guv must borrow or print. Borrowing is increasing your debts.

A debt is a legally binding contract settled according to the written agreed conditions, always enumerated in ‘money’ terms. You pay off debts with money, so money cannot BE debt.

“The Legal Aspect of Money”, covers both ‘money’ and ‘debt’ in terms of their universally accepted legal definitions.

That’s where you will learn why currency is money, and T-Bills are not money, but debt. Legally.

It’s not that most people have any problem understanding what debt is, as, with debt-based money, it takes the place of real money issuance. And the problem of the national economy today is as far from being saturated in ‘moral obligation’ as it gets.

Quibbles…

No such thingy as “REAL MONIES” its inaccurate to use such word construct, its just artful word play.

Lets not forget where the – M – classification came from and why that metric was established either, sadly its more exclusive of reality than inclusive and can institute behavioral group think e.g. herd mentality.

Seems the major rub is some think of money as an irrevocable event, cemented in time and space, and not a chain of expectations played out to infinity… till the demise of our species.

Skippy… balance sheet expansion is ex nihilo creation, whether private or public, its just an expectation of future events… eh.

PS. Positive money [word traps] seems to be just another means of invoking divinity rights and not those of the public.

The usual witty smithing, but zero in the way of informing us about anything at all.

Yes, there is a difference between our present banker-school non-money and even that which MMT claims, which would be ‘real’ money, because the government would create and issue it into permanent existence.

The delegation by Congress to the private bankers of OUR power to create ‘money’ requires vast accommodation.

We the people involuntarily accommodate the fact that it is not possible for banks to create ‘money’, because the business model of ‘capital’ requires LENDING it into circulation, rather than the MMT facade that government, had it retained the ‘money’ power, ISSUES the ‘money’ directly into circulation by spending, without any LENDING, without any ‘debt’, via issuing national equity, rather than this bullshit, so-called ‘bank-credit’.

As such, we the people are users of the bankers’ money system, including our government, which borrows the bankers’ money and pays interest on that money that it collects from taxpayers, who really can’t afford it.

Too bad you can’t see the difference.

Tunnel-vision therapy in order.

FYI, AS money is a legal social construct, YES, ex-nihilo is the nature of money issuance no matter who does it.

But it will be done for either private or public good, depending.

And you like the private banker flavor, why?

Note: no claim that government could close the deficit gap by ‘spending more money into existence’, as even skippy has now come to believe. Wha’s up with that?

I’m afraid no one can help when you’re the only person who can’t understand that spending money into existence = money printing = crediting accounts. If you had an inkling of what Sovereign Money was about you’d know it and MMT agree on far more than they disagree, but you’ve just got to turn it into some sort of death-match.

Good luck.

Per usual, the input becomes distorted by optical bending and exacerbated by out of context use.

Can’t finger out how back filling poorly underwritten privately issued credit could be conflated to the commentator’s conclusion and Governmental limits.

Skippy… seems to gloss over the captured bag holders thingy too…

Nice try, Ben.

And thanks for adding what I also added elsewhere….creating M1 money(*).

“”spending money into existence = money printing = crediting accounts(*).””

I’d like to work from the premise that this is something we all agree on.

And that our substantive disagreement is about whether this is indeed happening now, or not. Because, if it isn’t, it SHOULD.

Obviously, when Lerner wrote, he did not believe it was happening then.

And, as I always ask, if not then, WHEN DID IT START?

1934? 1971 ?? 1973?? or NEVER?

Here’s are the MMT tenets at issue on “spending money into existence”……the first part.

“Government is the monopoly issuer of the currency(money) and issues the money into existence through government spending. IOW, there is no need for either debt or taxes to pay for government spending(Kelton), only for either financial(liquidity preference) or economic (price stability) purposes (Wray, Mosler, Fullwiler).”

What cannot happen is squaring this description with Lerner’s use of the ‘money printing’ term.

From my statement above, with Lerner in quotes.

If (LOL) the government is spending more than it collects in taxes “it would have to provide the difference by borrowing or printing money.”

If it is not painfully obvious to any student of money that Lerner here does not agree with the MMT tenet as given, then we need some tunnel-vision therapy.

IF the government WERE spending money into existence when it spends, then there could be no deficit to ‘balance’ with ‘money printing’, BECAUSE the government spends its entire budget.

Lerner called for either money-printing, or debt.

MMT calls for debt.

Why does the Guv need debt if it not only ‘possesses’ the money-issuing power, but actually issues the money?? Makes no sense whatsoever.

Stop the obfuscation.

We want reform so that the Guv CAN issue money when it spends.

Because it does not do it now.

It is thus that Guv NEEDs either debt or money-printing (as in Fisher’s 100 Percent Money) to balance deficits.

As Lerner obviously agrees.

As to an inkling of what sovereign money is about,

https://sovereignmoney.eu/modern-money-and-sovereign-currency/

It’s way past time for MMT to stop fighting against the erroneous Austrian and Austerians classicists, and address these money SYSTEM issues of reform.

Whenever you’re ready.

If government cannot receive money through borrowing, borrowing can’t finance spending.

I would suggest that even prior to the war II it was the Federal Reserve policy of austerity that cause the nation to fall back into recession in 1937.

I would have to agree. I think the economy falling in 1937 was much more closely related to the Fed being in unprecedented territory. The leaders clearly were not fans of the policies they embarked on in the 30’s, and they went into austerity mode as soon as they could. Unfortunately it was too soon. However, it was a learning experience for the Fed, and the consequences of changing policy direction was clear. This had the effect of changing some of the archaic theory on which many in the Fed at this time were sympathetic toward.

From a spellbinding two-page opus on ‘famous Iowans’:

On April 15, tax day, most Americans would be shocked if they had to pay their yearly income tax total all at once. They can thank Beardsley Ruml for the nation’s tax withholding plan.

“Why should we be paying taxes on last year’s income, which already is gone, out of present income, which we haven’t yet received?” he asked. “Why not put the income tax on a pay-as-you-go basis, skipping a year to make this possible?” Despite some naysayers, Congress adopted a modified version of the system in 1943, after approving a 75 percent to 100 percent tax abatement on 1942 taxes.

Ruml’s “painless” plan came during World War II, a time when most Americans did not have the cash on hand to pay their taxes. Under the new system, they could meet their income tax bills as they earned their money. Ruml was known as an “idea man,” a genius, a thinker known for his fresh ideas. He called himself “a registered Republican who votes Democrat.”

http://data.desmoinesregister.com/famous-iowans/beardsley-ruml

————

If gov ‘doesn’t require tax revenue to fund spending,’ why did Ruml (along with his sidekick Milton Friedman) design a fiendish, permanent system for picking our pockets?

Watch what they do, not what they say.

Only a person who is either A) intellectually dishonest or B) has poor reading comprehension skills could read this post and not understand Ruml’s positions on why we need taxes, just re-read the “What Taxes Are For” box.

My admittedly outrageous ‘doesn’t require tax revenue to fund spending’ quip is lifted straight from PhilPil’s third paragraph.

If you think it ventures rather far outside the four corners of Ruml’s utterly conventional paean to central planning, well, I agree with you.

Would Ruml approve of being made a posthumous poster boy for MMT? Probably not. Nevertheless, as a willing tool of central planners, Ruml is fair game for appropriation by the most extreme central planning movement, MMT (which could be described as communism with a floating exchange rate).

Sigh. A monetary economy is just a form of communism. Always was, always will be. Practically everybody used to know this in practice and even in theory. Lerner told Trotsky even. But amnesia won a temporary victory over anamnesis.

The capitalists are just the pigs who remember, remember the future, who understand this. They use their knowledge to show that they are more equal than the other animals, and send the others to the knackers when they outlive their usefulness to their capitalist directed central planning farm.

Haygood doesn’t get that increasing taxation frees real resources for acquisition by the public sector. Say like, during a big war when more materials are needed for defense.

But then he’s been told this exact thing by several people in the past and yet is back again having failed to absorb the information, or even retain knowledge of the argument. I suspect the movie Memento was based on his intellectual life.

The existing Tax Code proves the point made by Ruml, it is governments which decide who is rich and who is poor!

Changes to the Tax Code since WWII have created Nation States run by and for the benefit of CentaMillionaire$ and Billionaire$. Governments worldwide are responsible for creating the “Class Warfare” that now divides Humanity, creating enormous inequality and civil unrest!

Denmark, the happiest nation on earth, has a high standard of living, the least inequality and one of the highest income tax rates on earth.

Clearly, equality has NEVER been the Public Policy of OUR republic and the Tax Code stands as proof!

Graetz and Newman in the extended (https://www.youtube.com/watch?v=Ae7PO-j7TIc) agreed was the real problem of the debt issue is the trade deficit which in the long run sells our economic production to foreign interest. This issue was least discussed perhaps because Newman is a does not want to admit that globalization (free trade) is our most dangerous activity for the health of the nation, aside from our debt based money system.

I will take this opportunity to recommend Bad Samaritans, as the neoliberal’s policies have been running a trade deficit since 1980 all the while telling us we depend on globalization which many economists say is correct. When the truth is we have almost zero benefit for USA from the trade policies of the past fifty years, and the trade deficit looks like a backwards L since 1980.

The book also makes short work of the (The Lexus and the Olive Tree by Thomas Friedman) in the first few chapters.

http://www.amazon.com/Bad-Samaritans-Secret-History-Capitalism/dp/1596915986/ref=sr_1_1?ie=UTF8&qid=1408456231&sr=8-1&keywords=bad+samaritans

I would characterize Newman’s national political economic view as one where WE should not mind using some other country’s money system, and labor, to produce the goods we consume, as long as WE are able to continue issuing government debt to make up for the foregone economic activity needed to provide the revenue for basic public services.

Jobs are not important.

Wage Income is not important.(only that earned on monetary assets)

Public Debt is important.

Newman, put another way “I never met a government debt I didn’t like.”

And he has more recently been CEO of a Chinese Development Bank.

Said Napoleon: “Money and finance know no Mother country.”

And MMT embraces these banker guys……why?

“World War II was perhaps the only time in history when capitalist economies were run on truly Keynesian principles. ”

This romanticizing of the war years by MMT befuddles me. Has no one looked through their grandparents’ stuff? Ration coupons? Loved ones separated from each other for years? Japanese internment camps? Suspension of worker rights, like striking? Massive destruction of property around the globe? Massive interruption of global trade, both people and goods?

Even today, we are dealing with unfortunate consequences of the war economy like employer-based health insurance, the Selective Service System, and a national security state that never disappeared.

Taxation is a revenue source. It’s the very first item in the list. To say that taxation funds purchasing power and purchasing power funds government spending is to say that taxation funds government spending.

Of course a sovereign government can print unlimited amounts of currency units. That’s kinda the basics of the mathematical concept of infinity. What matters is who gets the currency units, how that money is used to direct labor. In a nation that has spent such a mindbogglingly large number of currency units on war over the past decade and a half, it seems particularly tone deaf to discuss war in the context of the government’s ability to spend currency units.

One of the primary insights of MMT is that governments are resource-constrained, not financially constrained.

A government can always afford to buy that which is for sale in it’s own currency, i.e. a resource is available.

During WWII America was resource constrained, hence rationing.

Agreed, mostly*. My question is, who disagrees? Who in a position of power in the US over the past 5, 10, even 40 years, believes that government is financially constrained?

*The question of what is ‘for sale’, though, is a bit of a sticky wicket.

Washunate:

While many of the debits of War World II that you list were very real and accurate, I think you missing the context of the analogy back to this “golden time.” Most often today the lament is that we cannot find or better, create, the “moral equivalent” of war to mobilize depressed and directionless economies, where the leaders of the center-right politically, and economically, applaud and celebrate the “unknown” direction because it implies “freedom” for the grand entrepreneurs to come up with the great new thing…policy by serendipity, in reality.

But there is another layer to this two step with the World War II economy: it was only a grand cause, a threat to the nation and its businesses by external enemies, that could invoke a suspension of the grand generalization and pieties that have dominated the private economy – the economy – since the early 19th century in Great Britain, the “classical days.” The inability to rally the US, or Europe, around fighting global warming as the needed and logical civilian equivalent of the “moral equivalent of war” makes this case clearly: large and powerful sections of the private sector consider this direction heresy, and the rest of their “colleagues” will not actively contest the terrain.

Looked at from just a slightly different angle, this is the reason we have no new New Deal today, and where the old one is anathema to most of the Democratic Party, why Social Democracy of whatever mixture between public and private sectors can gain no serious traction, and why a whole new vocabulary must be invented under MMT.

One interesting intellectual and policy gambit to solve this grand dilemma is posed by Gar Alperovitz’s “What Then Must We Do,” essentially, the most radical proposal on the table, the change the ownership patterns of capital itself. This will all be done non-ideologically, the anti-thesis of Upton Sinclair’s EPIC campaign in the California during the 1930’s…Gar is low key, no tensions, encouraging the faithful to go off and build the new institutions quietly. When the worker owned co-ops emerge, their practicality and non-confrontational character and achievement will persuade the “center” and presumably the right, who will recognize this as a genuine manifestation of the good national character. We will live happily ever after, no more stalemate and ideological confrontations: the American genius for compromise will have solved all today’s troubles.

There’s a little exaggeration and elbowing in my presentation here, but I think its a fair summary. Emotionally it’s the opposite of the atmosphere of “the moral equivalent of war,” and yet promises to go deeper than a new New Deal, social democracy…what it does to the edifice R. Wray is constructing around MMT I will leave him to answer. By the way, I’m not supposed to have this one way dialogue with Gar’s ideas, it might be demoralizing.

Best to everyone.

“”…… to solve this grand dilemma is posed by Gar Alperovitz’s “What Then Must We Do,” essentially, the most radical proposal on the table, the change the ownership patterns of capital itself.””

Funny, I wish it were a ‘proposal’ to do so…… so we could be working on that.

Rather it is an essential goal to be achieved on the path to true economic democracy.

Changing the ownership patterns of ‘capital ‘ itself.

‘Capital’ is nothing more nor less than money, once acquired.

So here’s a clue for progressives.

If it comes down to changing the ownership patterns of money, and capital, itself, then perhaps thought should be given to the private privilege of money CREATION AND ISSUANCE by the private bankers y’all abhor. Because they ARE the One Percent.

That’s what the Kucinich Bill does.

Changes it back to a public RIGHT from a private PRIVILEGE.

Then, and only then, will all those other things happen.

And, we’re not doing that, why?

“‘Capital’ is nothing more nor less than money, once acquired.” No, it isn’t, unless you regard money as a social relation.

‘Capital’ is nothing more nor less than money, once acquired.

We’ll let the planet know that capital goods don’t exist.

Ben,

Why don’t you give up trying to think of something clever to say, and instead try to add something to the dialogue…… something more than just another Benny the J put-down to people that don’t agree with Ben, and with MMT??

I was trying to differentiate between money and capital, hoping for further dialogue on their relationship….. an important aspect of debt-based money.

.

What I got was, first, no it isn’t ..(capital, as per Alperowitz being the non-public aspect of money)…..and then, ………unless you believe money is a social construct.

Could have been, If you believe that money is a social construct, then you’re right. If not, then, no way, BECAUSE ……… and we might be discussing what followed BECAUSE…

Of course, money is a social construct, one made legal through the sovereignty of the state.

Money is a national legalized social construct, and when money statutes convey its legal status, it becomes the universal exchange media for that national economy.

That’s how all modern monetary economies work today, for that reason.

Because they work, we are glad to use national money systems.

A workable system is what keeps us using the money system, regardless of what the government accepts in payment of fees and taxes.

It is ‘capital’ that is debt, and not ‘money’.

It is capital that is loaned and borrowed in an endogenous money system..

And it is only because we accept the bankers’ school of debt-based money, that money is created and issued as a debt (capital, a monetary asset), rather than as sovereign money.

It is very unfortunate, tragic indeed, that MMT does not understand anything not connected to the bankers school ideas, and thus has no context for understanding the potential of the sovereign fiat money system of tomorrow.

http://sovereignmoney.eu/sovereign-money-in-critical-context

And, , ‘capital goods don’t exist’……….why ?

“…missing the context of the analogy…”

No worries about presentation, I very much agree. It is the underlying ‘moral equivalent of war’ where I really disagree with Mosler and Wray and others. They posit that work in the formal economy is valuable in and of itself. That certainly is a legitimate view, but I happen to disagree. They’re monetarists, of a fashion, claiming that monetary policy requires a buffer stock, like the gold bugs; they just pick a different buffer (full employment rather than full gold). Again, legitimate, but I disagree. I think modern money is realizing that ‘there is no spoon’: buffer stocks not only aren’t required, they don’t exist. Political economy is shaped by the processes governing the system, not any artificial monetary constraints. Just look at the US dollar: gold, silver, copper, and unemployment represent four different buffer stocks that have failed spectacularly to anchor prices in terms of the dollar just over the past century. And that’s as a global superpower. The areas with the greatest government involvement – like medicine, academia, finance, real estate, and of course defense – are precisely those areas where the bloat and waste and mismanagement are biggest.

I think we should minimize formal employment, not maximize it. Leisure time – time for hobbies and families and travel and reading and hiking and cooking and exploring and painting and singing – that is humanity at its best. Our civic decay is directly tied to people having to work so much that they can’t participate in the institutions that make democracy work. Formal employment is a necessary evil, not something to be pursued as a matter of public policy. Especially considering environmental devastation and how authoritarian most workplaces have become. It’s almost like highly paid academics and former finance guys don’t want to talk about how crappy tens of millions of actual jobs are in 21st century America. Public policy should employ people because their labor rebuilds our country, not because it gives them a job – and those who are working for the government should be permanent professionals, not minimum wage temp workers. Many entire departments should be shut down, not expanded, from TSA to DEA. The unemployment problem in the US is not lack of something to do; rather, it is that being out of work for even a short amount of time is so catastrophic for the bottom 80 to 90% of workers (because wages are so low relative to prices that even people in the top half of workers have trouble saving…). The solution to that problem is quite simple: universal health and unemployment insurance. Put the power to spend the currency units directly into the hands of those with the highest marginal propensity to consume, not stuffed suits in either government or private bureaucracy.

Pilkington was making a more narrow point here, so I didn’t go into that kind of context, but there it is if you’re curious for my $.02. Probably not worth as much as it used to be…

You’re being a jackass if you reject MMT.

Tyler:

Not rejecting it at all, not even remotely. The problems MMT)ers is(are) having winning intellectual traction, and they are making some progress or we wouldn’t be constantly seeing it discussed at NC, is that it is asking the economics profession and most of the business world to strip themselves of their governing myths, the “Secrets of the Temple.” It is asking the profession and the political world to govern with fully rational and conscious instruments of policy, and their implied more democratic means, although that remains to be seen if that is built in.

What Wray and let’s throw in Galbraith for good measure can’t quite factor in is the extent to which they are facing the irrational elements of passion and power behind the reigning constructs, the magic of the unguided market just nudged a bit by the sympathetic fed’s policies (in reality well more than a bit, as NC readers well know.) So the MMT’s are entering the great realm of near religious intensity that Polanyi and few others have written so insightfully about in “The Great Transformation”: what it took in terms of intensity and comprehensiveness to put the early 19th century laissez-faire world together…this near fanaticism about the market is still the animating passion behind the policies of the Right…and if you catch them on the wrong day, the Center too…(Gene Sperling, are you listening with your worship of the cycles of creative destruction at the core of capitalism)….

These are the forces resisting and baffling Krugman, because he is too much the rationalist to grasp the irrationality behind the status-quo. Along comes Wray and the other MMTer’s who want us to live fully in the sunlight, no shadows and no curtains/illusions…and create our own fully shaped and guided democratic capitalism…if this is too much for the ruling Democratic Party, just witness the gales of irrationalism that it sets off amidst the Right…global warming opponents give you a great clue. Keynes said when the facts change he will change his mind; you know what the Right’s response is, environmentally and economically: they’ll attack the theory(ies) which threaten to re-arrange those facts.

‘You’re being a jackass if you reject MMT.’

Don’t you think ‘MMT denialist’ is a more neutral-sounding term? /snark

That’s very open minded of you.

And unexpected.

Pilkington is one of the chosen few who understands Monetary Sovereignty, However, there is one implication that is wrong. I discuss this at The vast difference between the Effect and the real Purpose of federal taxation

In short, while the theoretic purpose of taxation is to narrow the Gap, the real purpose is to widen the Gap.

Education will not solve the problem, for It is not ignorance that influences our leaders. It is bribery, and only a public, angered by the bribery, can force changes.

Rodger,

I’m 100% with you on abolishing the FICA tax.

uninformed public

Yes, the public is uninformed and misinformed. That said, they seem to be increasingly aware that the Republicans only care about the rich.

“”Pilkington is one of the chosen few who understands Monetary Sovereignty””

For those not chosen by Rodger to understand “Monetary Sovereignty”, and yet being mindfully curious about sovereign money, please see Dr. Joseph Huber’s “Modern Money Theory and New Currency Theory”

http://www.paecon.net/PAEReview/issue66/Huber66.pdf

And more at sovereignmoney.eu

Thanks.

Huber’s clueless on MMT. Mistakes abound. One example–he says MMT recently discovered Minsky, somehow missing the fact that Wray studied under Minsky in the 1980s and wrote several papers with and about Minsky in the 1990s. Anyone using Huber as an authority on MMT is not worthy paying attention to.

Notice to those who come here to learn.

“”Anyone using Huber as an authority on MMT is not worthy paying attention to.””

S. MMT Authority

In other words, reader, do NOT open that Sovereign Money – MMT link and see for yourself.

Which could be worthwhile as regards ‘this specific complaint…… which, sorry, needs some parsing and clarifications.

“”Anyone using Huber as an authority on MMT is not worthy paying attention to.””

Funny, because I was using Huber as an authority on monetary sovereignty.

I never mentioned his work on MMT, but included the link to the MMT-sovereign money analysis as related to this thread.

The rest of your critique is similarly misplaced.

stf

“”Huber’s clueless on MMT. Mistakes abound. One example–he says MMT recently discovered Minsky, somehow missing the fact that Wray studied under Minsky in the 1980s and wrote several papers with and about Minsky in the 1990s. Anyone using Huber as an authority on MMT is not worthy paying attention to.””

“Somehow missing the fact”?

Actually, if you do not opine on something (Wray and Minsky) , it is rather impossible to missing some facts thereon.

The statement was about MMT and Minsky, and not about Wray and Minsky.

Is the ‘fact’ of when Wray worked with Minsky relevant in any way to when MMT brought Minsky into its money-economic ideas? Dr. Huber did not opine on the matter of the

Wray and Minsky collaboration in the ’80s. What was MMT as a money-economic concept at the time? The criticism might be valid if MMT and Minsky were joined at that time.

Were they?

Huber dates MMT’s ‘recent’ entry to the field of ‘novel’ monetary ideas as 1995-onward, and this would be the period in which the Minsky-MMT “idea” connection might be relevant.

Huber describes this as the period when Warren, Randy, yourself and others pulled together the MMT identity.

Is that not correct?

Was it earlier by a decade?

Would that make any difference?

I am not aware that he said anything of the period of Randy’s work with Minsky, nor implied that Dr. Wray also discovered Minsky in that recent ( 1995-onward) timetable.

The proof of your claim lies in when MMT thinkers adopted Minsky’s ideas.

Wray’s 1998 publication on “Understanding Modern Money” has 8 discreet page-index references to ‘Innes’ and 12 to ‘Knapp’, but none to Minsky (There are two bibliography references to Minsky).

Perhaps you could opine further on Dr. Huber’s ‘clueless mistakes’, which abound.

Thanks.

Sorry to bust everyone’s MMT bubble here. Unfortunately(?), it’s the privately owned and operated Federal Reserve banks that actually issue US currency, not the US government, nor even the Fed Board.

To a large extent, the Fed Board is reasonably construed as a government agency, but its powers of governance are severely limited. QE is of course cited as exemplifying the government printing money, but that’s been largely to buy up bad private bank debt, proving rather than disproving my point. The proportion of government debt that the Fed banks retain is pretty much the same now as in 2008 – about 18%.

OK, in a national emergency the Fed Board and banks are likely to collaborate with the government, but then again, so am I, and that doesn’t make me a government agent, at least not unless until such occasion arises, resulting in my being conscripted.

Vaguely calling the Fed a “creature” of the state makes no point whatsoever. Every national bank and corporation has a state charter, making them all a “creature” of the state–the proper legal term is “instrumentality.”

Of course, if a government is defined or implicitly conceived of as an elected government plus its central bank(s) (aka monetary authority), then I concede the point. But that’s not a legal definition, nor is it warranted under even common law constructions of ostensible control.

Clifford, sorry to bust your bubble but your comment, while not completely false, is seriously misleading. Since the government is the sole issuer of the currency and legitimates and ensures its use through taxation thereby driving the monetary circuit, though this isn’t the only driver, the first spender can only be the government. Where do you think these banks get their money in the first place? Surely, you don’t think it comes from deposits. If you do, and I’m not saying you do, then you deeply misunderstand how the system operates.

What you say about QE is right. It is a mechanism to keep otherwise insolvent banks afloat, without going through the process of dividing the banks up into good vs. bad banks and then writing the bad banks off. This is probably not being considered because of the perceived effect this would have on investors. And this does constitute a problem, as some of these unfortunate investors are pension funds. These funds should not have been allowed to invest in the many and varied types of derivative scams. But in the absence of sufficient regulation, they did so invest. Because individual pensioners should be protected, there are difficulties in the good bank – bad bank scenario. But it is surely not beyond the intelligence of government officials to find ways of solving this problem.

The proportion of government debt, whether 18% or 5%, is irrelevant. The so-called national debt clock is nothing of the sort. Ask yourself to whom is this money owed. It is money owed to the American public as a collective group. The clock should be called the US national resource clock. There is no public debt crisis in the US or the UK.

There are problems in the Eurozone, but these are due to the absurd design of the Euro structure and the rules governing it. Unlike the US and the UK, and other countries, none of the members of the Eurozone can issue their own currency and adjust its value as needed for internal purposes. Therefore, what Ruml and others say has no application to them. The problems here are political, as you mention.

And that applies, as you mention, to the Fed and its regional banks. What the Fed can’t do is engage in fiscal spending. Only government though Congress can do that. It is this kind of spending that Keynes and New Dealers like Ruml and Hopkins envisaged as a solution. The Constitution itself demands that the government honor its debts public and private. And with the fiat currency system we have now, there is no reason it can’t do so. However, if Congress prevents this from happening, has congress thereby committed an unconstitutional act? I have not seen any discussion of this yet.

Larry, sorry to bust YOUR bubble, but the governemnt does not issue any but 3% of the currency. The banks do the rest, not from deposits, but as loans against assets of the bank (not deposits), creating money where it did not exist so they don’t loan either the actual assets or the deposits. They are, however, liable if the loan is not repaid. Then, that “asset” becomes a liability. The Fed prevented this by issuing dollars through QE because the FRB is special among banks in that it can issue money as an issuer of last resort. However, QE is actually a bunch of purchases of “toxic” assets form banks that are made to look non-toxic by being purchased by the FRB. Some people might call this legalized money-laundering, but hey, if all you care about is propping up the banking system – as the Fed does – this is one way to do it.

The government gets its money through an entirely different mechanism, through authorizing spending, then either using what’s in their account or borrowing from the FRB by issuing Treasuries which the Fed is basically authorized to buy, though mostly they are sold to foreigners (Cliff’s point about only 18% of Treasuries being owned by the Fed, above). Of course, we owe interest on our Treasuries, good for them, and bad for us, and yes, even though we have a fiat money system that technically cannot run out of money. The problem is not running out of money, it is running out of buyers of our debt. That hasn’t happened in part because it is an Ugly Contest, with the Euro and Yen and Pound not being particularly more attractive to investors.

But anyway, MMT ignores all this, doesn’t care about debt, and keeps repeating the mantra that debt doesn’t matter. It also ignores the enormous Rentier class that is being force-fed like a Christmas Goose, except it is us who are being slaughtered, not the goose.

“The problem is not running out of money, it is running out of buyers of our debt.”

First off, the primary dealers (initial buys) are required to buy the debt by regulatory rule. And if the did not the FED would and if the FED hesitated then the US Secretary of the Treasury would require it. There are no bond vigilantes!

Secondly, if you are a holder of US Federal Reserve, reserve balances you have limited choices in obtaining income from them… lend them to other financial institutions in need, buy coin and currency, or buy US treasuries (or clear and settle payments, but that’s just moving them around). In net you CAN NOT DO ANYTHING ELSE WITH THEM!!! Why would holders of such assets, which are US Liabilities, not trade them for interest baring US Assets?!

correction… “not trade them for interest baring US Assets?!” should read, “not trade them for interest baring US liabilities?!

You mistakenly beg the question at the outset: “Since the government is the sole issuer of the currency…” The currency is NOT issued by the government (except for coins). Title 31 limits United States notes to $300 million. A monopoly over note issuance is granted to the privately owned Federal Reserve banks, under Title 12. True, the nation could rescind Title 31 ‘s limit and restart issuing US currency. I think it should.

Yes

Mistakenly ??

@larry:

“The clock should be called the US national resource clock.”

So, let’s think this through a bit more. Take, for example, the rather sizable component of the national debt which has been devoted to serial post-WW2 warmongering. In what form has that “produced something”, i.e. economic resources available to the same American public “to whom the debt is owed”?

Now for a specific example of such spending much in the news of late: The monies spent on multiple bouts of “humanitarian intervention/regime change/spreading-of-freedom-and-democracy” in Iraq have indeed resulted in some real tangible resources. I’ve been hearing a lot about U.S.-provided “resources” in the form of weapons being captured by ISIS from fleeing “just in it for the money” U.S.-resource-funded Iraqi army troops, and now additional U.S. resources are being deployed to reduce those earlier-provided resources to scrap metal. Do you think we’ll ever recover at least the scrap value?

Anyone who believes that a U.S. government which “feels less spending-constrained due to the wonders of MMT thinking” will somehow, magically “do the right thing” and spend the resulting money into existence in a wiser, less war-and-inequality-promoting fashion than currently is a fool. In fact is even worse than a fool, because promoting an even more recklessly profligate version of the manifest evils which have resulted from U.S. government spending on steroids is in fact promoting evil.

“”Since the government is the sole issuer of the currency and legitimates and ensures its use through taxation thereby driving the monetary circuit, though this isn’t the only driver, the first spender can only be the government.””

LOL

1. How do you know the government is the sole issuer of the currency?

2. When did the government become the sole issuer of the currency?

3. How, exactly (law and regulation) did the federal government become the sole issuer of the currency.

4. It is the national Money Statutes that ensure the use of the money units defined therein, and of only the money units defined therein….. and not ‘taxation’.

3. How, in a $15 Trillion national economy, requiring $15 Trillion in money throughput, can the government, with a $4Trillion economy (Budget) and $4Trillion throughput(spending), be the first spender of all that $15 Trillion of ‘money”?

“”with the fiat currency system we have now, there is no reason it(Congress) can’t do so. However, if Congress prevents this from happening, has congress thereby committed an unconstitutional act? I have not seen any discussion of this yet.””

Please Google the charges by Congressman Louis T. McFadden, then Chair of the House Banking and Currency Committee against the Federal Reserve Banking System Board, and others..

May 23d, 1933…… just a couple of months after FDR closed down the banks…..for holiday.

I’m sure un-Constitutional is in there somewhere, along with Treason, etc.

“”Where do you think these banks get their money in the first place?””

Larry, not sure where YOU think the new money comes from, but please have a read of this many-decades-old Fed publication

MODERN MONEY MECHANICS

A Workbook on Bank Reserves and Deposit Expansion

http://lisgi1.engr.ccny.cuny.edu/~makse/Modern_Money_Mechanics.pdf