A new article in Bloomberg gives a well-researched overview of a mess-in-the-making that regulators are choosing to ignore: the leveraged loan market. For newbies, “leveraged loans” means “risky loans to big companies”. For the most part, they fund private equity buyouts and restructurings. The juicy fees on these financings, 1% to 5% of the amount raised, versus an average of 1.3% for junk bonds, is a big reason why none of the incumbents is particularly eager to change a market that is working just fine for them in its current, creaky form.

The problems with leveraged loans are twofold. The first is that they are in the stone ages from an operational standpoint. It takes an average of 20 days to settle a leveraged loan, up from just under 18 days in the last leveraged loan boom, the eve of the financial crisis in 2007. That contrasts with 3 days or fewer for junk bonds. When investors buy new loan participations, the delays can extend into months since investors make binding commitments to fund the loan but the underlying acquisition can be held up. That also means if interest rates rise between the time of commitment versus when the transaction settles, investors are stuck with having to fund a deal at a rate that is now below market, leaving them in a loss position on a mark-to-market basis from the get-go.

And get a load of this:

While buyers and sellers can trade stocks and bonds among themselves, they need the approval of corporate borrowers before they can exchange loans. Clerks must then update loan documents to reflect new lenders.

With loans, “there’s a high amount of faxing going on still,” said Virginie O’Shea, a senior analyst at Aite Group LLC in London. “People don’t realize that fax machines are still around in this day and age but they are.”

This primitive state of affairs results from the fact that loans are not securities and thus are not subject to the tender ministrations of the SEC, including its rules on settlement. And the Fed and OCC have politely not taken any apparent interest in this market.

Why does this matter? One large investor segment in leveraged loans is retail chumps, um, mutual funds. Investors in bond funds expect to be able to sell them readily. That isn’t the case with funds that invest in leveraged loans:

“It’s a critical issue,” said Beth MacLean, a money manager at Newport Beach, California-based Pacific Investment Management Co., which oversees $1.97 trillion, including the world’s biggest bond mutual fund. “Any single retail fund not being able to meet their redemptions would have a ripple effect on the whole market.”….Mutual funds bought 32 percent of new loans last year, up from 15 percent in 2012, LSTA data show.

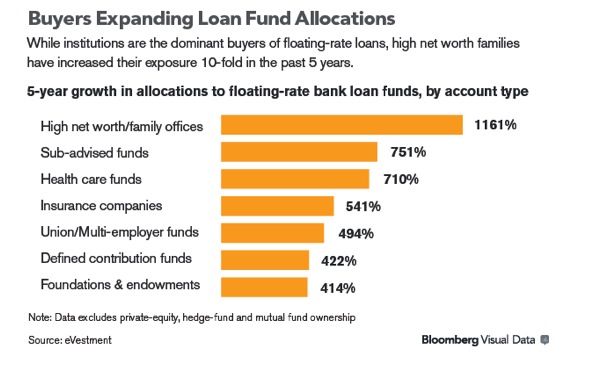

The article states that mutual fund investors, perhaps spooked by a sharp fall in junk bond prices, have pulled $4.7 billion out of leveraged loan funds this year, indicating that the funds can withstand a moderate level of withdrawals. The story also points out that funds recognize the liquidity risk and hold cash buffers (which of course lowers returns, undercutting the rationale for owning this paper in the first place). And as this chart shows, except for the mutual fund investors, most other participants are long term investors and presumably aren’t put off by the illiquidity of these loans:

So what kind of problem might this turn out to be? A run on one leveraged loan mutual fund that turned into a run on these funds across the market would not be a systemic event. It would be more akin to the auction rate securities mess, where investors who thought they had accounts that were liquid found them frozen. The ARS debacle had upside and downside: in the ARS case, the investors got paid huge premium rates for not being able to withdraw their principal. By contrast, here, a run would almost certainly be the result of a fall in market value of the loans, and the rush to the exit would intensify price pressures. Investors would be uncertain as to when they could get out and what the price of their assets would be (even though the funds would be require to provide prices, they don’t mean much if you can’t execute a transaction). The second-order effect would be to further reduce access to financing for private equity transactions, and those have helped keep the stock market aloft (admittedly nowhere near as much as stock buybacks).

But the bigger issue here is that even if this isn’t the biggest disaster in the making, it’s one the banks have no incentive to prevent, and there’s not regulator to be found who is willing to make them shape up. So the usual rule of caveat emptor goes double for this financial product.

So they are securitized and mutual funds can trade them, it just takes a long time to trade? I am confused as to how these are actually structured. Does this include revolver and Term Loan A or is this just subordinated debt?

Pfft.. we’ll just bail them out when they crash.. Next!!!

I’m sure the powers that be can convince the rubes that the olds must tighten their belts because the rich NEEDED to be saved from themselves. Nevermind that these are the same risktakers that insist they deserve the money they get from investing because they are such a bunch of risk takers. Pfft, indeed.

Seeing as there really isn’t any recovery and that all gains in this world are not made from investing in real growth but from speculating. Speculating is just another word for gambling. In gambling as in speculating there has to be two sides to each bet. How long before some super leverage bet goes wrong again causing a cascading or domino effect?

As R Foreman suggests, the belief is that there is no risk in gambling. The only real risk today is in actual production as this involves owning factories, paying workers and buying raw materials in an atmosphere where the consumer has borrowed beyond what they can realistically repay. So there aren’t a whole bunch of new customers waiting to buy with enough money or credit to do it.

Yet, you can not have no risk in a game where there are actual risks and actual expenses. Especially where all the insurance is either in faith that the Central Banks supported by tax dollars or derivatives guaranteed by the other side of the trade are all there is.. How big has the derivative game gotten? Way bigger than the entire world GDP. So when this finally goes down next time, there will be NO way to bail it out..

Even war is no longer a growth industry. No war means that production is no longer needed and then we really have a down turn. So we have to maintain war just to keep from diving into a depression.

And everything is priced as No Risk?

I guess the gobermint could just print the money instead of borrowing it into existence and we could all just pretend. You pretend to work and I’ll pretend to pay you.. Worked well for the USSR.

Good comment. I got lost in the argument about the time delay, making money for the creditors. What else is there?

“Bail-IN” is the scheme for the next expected massive banksters’ losses, no matter how large. Real assets from institutions and municipalities and individuals will be seized and “compensated” with bonds of indeterminate value in the failed banks. I imagine that any remaining faith in the dollar will determine the plan’s efficacy. Hail Goldman Caesar.

http://awakenlongford.wordpress.com/2014/09/19/who-is-d-flynn-is-there-another-national-banking-crisis-looming/

It is easy to see that all these debts cannot be paid, but impossible to predict when the end will come. I don’t think the Fed can rescue all the yield chasing lemmings, but I didn’t think it could rescue all the creditors last time either. Today’s Tbill yield is rather low. On $100,000 you make $2.35 in 3 months How much would you like to invest safely?.

RE: “Even war is no longer a growth industry. No war means that production is no longer needed and then we really have a down turn.”

There’s actually a danger of “no war” ? Really? When, where, and how did this ever happen? Surely there’s some mistake?!

No worries the MIC has the next two to three planned out to make sure they can maximize those profits. We’re going to take the cost of those F35s out of school lunches for the poor dontcha know because we’re a Christian nation(and nothing says Christian like bombing the crap out of people.)

So, where the article’s text reads,

“Banks have no incentive to drag out the time it takes to settle a loan, according to Bram Smith, executive director of the New York-based LSTA, the market’s main lobbying group.”

are we reading that right? (Doesn’t the bank earn more on the loan the longer it remains in service?) I know that, in my experience, a banker has never objected to my paying the bank more in fees. Or did the author intend to write,

“Banks have no incentive not to drag out the time it takes to settle a loan, “….

and, thus, by the logic of the article, fax machines and voice-telephone negotiations rather than high-speed automated settlement operations–the way the programmed equity traders do.

I feel compelled to provide more detailed explanation than Bloomberg or NC have, please forgive the pedanticism or keep scrolling down if details bore you.

“Settlement” refers to the process by which a transaction’s details are reconciled by the parties and any third party stakeholders on their own books and records, and the cash and other transfers that need to be made are made. In the liquid securities market, you enter an order to buy or sell a stock on Day “T” and by T+3 (the third day after the order is filled) (or T+1 in the liquidest markets) the change in position appears on your statement and your cash balances have changed to reflect the transaction. That is “T+3 Settlement.” Behind the scenes there’s all sorts of sub-transactions going on where your broker may have executed transactions with third-party brokers in order to facilitate your original order. Those all need to be booked and settled as well, which is why the settlement of the original transaction (your order) is not “settled” immediately upon execution (execution is the moment the transaction is binding on the parties, in this case, when the order is marked “filled” by your broker).

Just for comparison, in the world of buying houses, the equivalent concepts are signing the contract for purchase/sale of the house on T (that’s “execution”) and having the closing 60 or 90 (etc.) days later (i.e. T+60 or T+90 “settlement”). The parties are obligated to “close” (or settle) the sale (subject to certain contingencies because houses are complicated) but there is paperwork and math to do in the meantime, and the title company needs to do its thing, and those take time.

The BBG article confuses the primary market with the secondary market for bank loans. Slow settlement times in the market for bank loans don’t have anything to do with the money banks make on the origination of the loan (the same way that the sale of a house by an owner-occupier doesn’t make any money for the original developer), it has to do with investors buying and selling pieces of a loan long after it has been made, the same way bonds are traded in the secondary market after the original proceeds of the bond issue have been obtained by the issuer/borrower (which trading also makes money for the banks but in a different department!)

Settlement times are longer for bank loans than for publicly-traded bonds (for example) primarily because the terms of bank loans are more typically customized to meet the needs of a specific borrower rather than the fairly rigid set of requirements that the bond market expects and requires for a fungible security. A borrower might want the ability to defer interest payments for seasonality reasons, or to have an irregular amortization schedule, or to have a revolving feature, or it might have oddball collateral, and these things are hard to obtain and manage and explain to the lender if the source of funding is bonds sold in the public bond market. So these terms get privately negotiated between the company looking to borrow and a bank, or small group of banks, or a large group of banks that has appointed one bank as the “lead”, etc. So the banks make the loan and the company gets financing. The secondary market occurs when a bank that participated in the original deal wants to reduce its exposure and someone else is willing to take on the exposure. It is those types of trades that have now become the trillion dollar “leveraged loan” market with more hedge funds buying and selling loan participations.

As BBG and NC suggest, there is an arbitrary line drawn where a loan, or an interest in a piece of a loan, becomes a “security” under the securities laws, and that line is kinda fuzzy but cuts bank loan participation interests our of the definition. You could argue the point about whether that is still a good idea from a policy perspective but banks are supposed to be sophisticated (!) and able to evaluate the risk of a loan (!!) without the protections of the securities laws. That’s the theory, anyway.

So, long settlement times are a product of the fact that bank loans are not securities and are not required to settle in the time a bond transaction is required to settle, but also the fact that the customization of loan terms mean not all transactions actually settle. As with a house sale, if the buyer discovers a flaw during inspection, they may not close. But imagine also there is a homeowners association that has to approve the transaction in order for it to close, so that takes time to get, and there’s local government and title companies and tax authorities, etc. that need to chime in.

In the bank loan context, due to the customized features of the loan that make it different from a bond, the loan docs may restrict who can acquire interests in the loan in the secondary market–they may want only institutional investors of a certain size, or they may not want pension money (which is covered by ERISA and may therefore come with unpleasant strings attached from the perspective of the borrower). So these things take time. Hence, the long settlement times.

Having said all of that, there is no doubt that hedge funds will exploit any opportunity to obtain something for as little money down as possible, which is what happens with long settlement times–a fund can buy a loan participation and sell it and reap the profit, before the original purchase has settled and therefore before any payment needs to be made, so they get implicit no-cost financing of their position by the seller.

Hedge funds and other private money are a large part of the flow at LSTA these days, and LSTA certainly knows which side its bread is buttered on, and therefore may not be fully incentivized to shorten those times. No doubt, as BBG and NC note, this makes these not really appropriate investments for public mutual funds or any other investor that needs daily liquidity, and if there’s ever a run, there will be mass confusion about who owns what when, and there will be a follow-on run on fax machine toner, and while that is an analytically separate question from the quality of the credit of the underlying loans in this sector, the run is likely to come at a time when that credit quality has become an issue, so they are correlated in fact if not analytically. In short, just another case of phantom liquidity.

very interesting

J.C. — Wow, thank you. That was very interesting and very helpful. I can think of just one question for the moment– are there, in any given single loan deal (or package) any number of leveraged parties? One only? or some other fixed number? Who, typically–if there even is a typical case–is usually a or the leveraged party in these deals? And, if there are several in a given deal, can they all have various degrees of leverage in their participation? Ooops, that’s more than one question. I’ll try to look for a background reading source–Wikipedia or other. I found the LSTA’s site. Thanks so much for your explanations! All of it was new to me.

“Leverage” just refers to borrowed money. The “leverage” in “leveraged loans” like the ones in the original post are called “leveraged” because the loans are made to companies that already have substantial debt. They are analogous to the “high yield” (formerly known as “junk) part of the bond market–intentionally of poorer than average credit quality. So in that sense there is typically only one “leveraged party” because there is usually only 1 borrower entity (or group of affiliated entities) that is doing the borrowing in any particular deal.

However, the lenders themselves are almost certainly using borrowed dollars to provide the loaned funds so in that sense they too are “leveraged.” And the hedge funds that buy the loans in the secondary market are also likely using at least some (as much as they can, actually) funds borrowed from banks to do so, and those banks are using dollars they have borrowed to fund the loan to the hedge funds, and so on . . .

At the bottom of the pile of leverage is bank shareholder equity, the amount of which is dictated by regulators in the form of a “leverage ratio,” which determines the maximum amount of borrowing a bank can do for every dollar of shareholders’ equity they have. (There is also the very substantial leverage fed into the system from the shadow banking sector, which has its own set of dynamics, but that is a whole nother story).

Thanks again–this tells me what I wanted to know: in effect, there are multiple interested parties on various aspects of the deal and numerous of them are leveraged– that is, they are risking not simply a stake, but, moreover, a stake which is partly or wholly borrowed; so their potential losses are not funds they actually have. There is something akin to (short) margin-selling going on, then.

Of course, we must assume that common banking sense dictates that the bank’s participations never place their shareholder’s equity at risk since this lesson in catastrophic foolishness was learned in the sub-par mortgage fiascoes–right?

Oh, wait!…..

the title reads “An accident waiting to happen. The $1 Trillion Leveraged Loan Market”

“Moral-hazard” is far too polite a term. Their lack of morals, our hazards.

;^ )

The thing is, the same is true of any financeable asset–Apple stock, life settlements, copper futures. In many assets the leverage pressure on the long side is countered by the leverage applied on the short side (i.e. people using leverage to short-sell the asset in question)–but in that case you have a situation akin to pushing down hard on the brakes and the gas pedal at the same time while sitting at the wheel of a large truck filled with explosives.

Anyway, I’m headed to the People’s Climate March. See you all there!

James Cole, the IMF reported (top left of page 61) in their October 2008 “Global Financial Stability Report” that in August 2008 the haircut for Senior leveraged loans was 15–20 percent, and for Mezzanine leveraged loans, it was 35+ percent.

http://www.imf.org/external/pubs/ft/gfsr/2008/02/pdf/text.pdf#page=61

My question is: What was the typical haircut for Senior leveraged loans and for Mezzanine leveraged loans in the weeks & months AFTER the collapse of Lehman Brothers & AIG — in Sep., Oct., Nov., and Dec. 2008?

^^^^ I’m referring above to page 61 of the pdf file, which is page 42 of the actual IMF document entitled “Global Financial Stability Report: Financial Stress and Deleveraging. October 2008.”

What’s your best guess of the haircut on mezz levered loans AFTER the collapse of Lehman & AIG ?

Thanks in advance.

I don’t know but certainly much higher than the August 2008 numbers, unless the loans in question were somehow eligible to be put to the Fed window as collateral.