Lambert here: Et tu, Australia? For the connoisseur of accounting control frauds, sadly, Australia may provide a valuable parallel case in a second member of the Five Eyes. I wonder if the Australians will manage to prosecute any CEOs?

By Paul Egan and Philip Soos, co-authors of Bubble Economics: Australian Land Speculation 1830 – 2013. Originally published at Macrobusiness.

Exuberant household credit growth over the last twenty years has a sinister dimension: the likelihood of widespread predatory lending and bank fraud. Every developed country, including Australia, has laws to regulate and hopefully prevent predatory lending, defined as providing credit to a borrower in full knowledge they lack the capacity to repay it in a timely manner, if at all.

Relevant laws and regulations stipulate loan amounts must not exceed the assessed debtor repayment capacity, based on their assessed wages and other income. Lenders have an obligation to calculate income flows of potential borrowers as part of the risk assessment associated with extending finance, particularly with large and long-term loans like mortgages.

Fraudulent lending to residential borrowers was a key factor in the US housing bubble post-2006, when a large and insolvent subprime mortgage cohort was revealed by the collapse in land prices. Finance was extended to millions of Americans without the property and required assessments of their capacity to finance debt payments.

Subprime mortgages, usually known as low-doc and no-doc loans, are designed to overcome difficulties the self-employed and those with irregular incomes and/or credit histories have meeting the criteria for conventional mortgages – providing an opportunity to demonstrate capacity to pay in other verifiable ways.

Subprime lending reached the heights of absurdity with so-called NINJA loans, where aspiring owner-occupiers and investors without an income, job or assets were provided with mortgages they were clearly unable to service. Banks used creative accounting to manipulate loan application forms (LAFs) and inflate assets and incomes, fabricating a positive assessment of borrowers’ capacity to service much larger loans than was possible.

Borrowers sometimes falsified their details, to create ‘liar loans’. Some mortgages were so predatory that borrowers could not even make the first payment. Regardless of the creative accounting employed, millions of borrowers in the US were provided with jumbo-sized loans based on this practice. When the housing market boomed in the early to mid-2000s and the unemployment rate remained low, defaults and foreclosures were kept in check.

Once the housing bubble collapsed, however, the economy quickly deteriorated and unemployment and subprime borrower defaults surged, triggering a tidal wave of foreclosures that continue to this day. In effect, many borrowers were entrapped by the fraud perpetrated by the FIRE sector and have become modern-day debt serfs.

The subprime scandal was exacerbated by a variety of exotic mortgages with obscure titles that borrowers could not properly understand, for instance, Option ARMs, 2/28 hybrid ARMS and Alt-A loans. Many of these loans had a honeymoon period consisting of low interest rates for the first year or two before resetting to much higher rates, resulting in ballooning interest payments. These subprime mortgages preyed on borrowers, as lenders did not expect they would amortise the loan over the contract period.

The second stage of the subprime crisis was set in motion by lender securitisation. Mortgages were bundled and stratified into residential mortgage-backed securities (RMBSs) and collateralised debt obligations (CDOs), before being on-sold to unsuspecting investors by investment banks. Additionally, the ratings agencies frequently provided AAA ratings for these securities, misleading investors into believing they were high quality and low risk, when in fact the CDOs often comprised the highest risk mortgages repackaged by investment banks.

Identifying whether a similar form of subprime fraud is widespread in Australia’s banking system and housing market deserves close scrutiny. Deregulation and privatisation of the financial sector since the 1980s has increased competitive pressures and the potential for fraud, as commercial lenders are provided with an incentive to maintain robust profitability via strong credit growth.

Substantial evidence of subprime fraud has been provided by Denise Brailey, a criminologist and president of the Banking & Finance Consumers Support Association (BFCSA). It is a public-interest organisation dedicated to protecting investors and the pursuit of compensation for victims of predatory finance. Brailey is responsible for eleven inquiries investigating the predations of the FIRE sector and compliant regulators between 1997 and 2010.

Having worked in this field since the 1980s, Brailey has witnessed first-hand the financial and social destruction wrought by a multitude of scams and predatory lending, including the ‘finance brokers scandal’ in Western and South Australia, and the ‘mortgage solicitor scams’ stretching down the east coast from Queensland to Tasmania.

Brailey alleges that since 1996, commercial lenders have engaged in widespread subprime fraud through over-lending to owner-occupiers and property investors, far beyond their ability to finance the debt. At the centre of the alleged fraud are loan application forms (LAFs), with borrower metrics altered by lenders without the knowledge, authority or consent of borrowers. The value of borrowers’ assets and incomes are radically inflated, justifying the approval of large loan sums, to the benefit of lenders and the broker channel.

As defaults typically show several years after loan origination, subprime borrowers struggle for an extended period before eventually succumbing, to the great benefit of the lenders in the form of higher interest payments, including penalties. Lenders then realise borrowers’ entire equity through foreclosure and sale. Similar to the US, Australian mortgage fraud is more closely linked with low-doc and no-doc mortgages than conventional (prime) mortgages.

The process of alleged fraud begins with a potential borrower completing a three page LAF detailing their current assets and incomes. In the back office, the broker inputs the borrower’s details into a password-protected online ‘service calculator’, an application determining the amount of credit the lender, associated with the broker, is willing to provide.

The service calculator amounts to a black box, as brokers are not provided with any information as to how this application functions; it simply provides a ‘calculated’ futuristic income based upon the basic provided income details entered and then uses accounting add-ons and add-backs providing tax incentive ‘advantages’, to produce greater incomes. This in turn enables the banks to significantly increase the volume of lending.

This is where the first form of alleged fraud is committed: the service calculator manipulates the total debt service ratio (TDS), making borrowers appear as though they can service mortgages beyond their financial capacity. The results are noted on the service calculator form (SCF) and income work sheet (ICW), and along with several other pages, are attached to the original three page LAF and faxed to the lender.

Overall, an additional eight pages are usually added to the LAF to make eleven in all, and this is considered the broker’s copy of the LAF. Evidence shows forms completed by the borrower are not encouraged or accepted. All forms are completed in the hand-writing of the officer or agent of the lender and, at times, both writers are present, with details added days after the signature has been completed. Internal tweaking of these forms has been noted as common industry practice.

The second phase of the alleged fraud is committed when the credit assessors (CA) at the commercial lender receives the faxed copy of the LAF (the bank’s version). The CA then alters the assets and income of the borrower, creating the illusion the borrower is wealthier than they really are. Items that are added include luxury vehicles, investment properties, stock market portfolios, imputed rents, secondary incomes, exaggerated primary employment income, and even the anticipated rise in the capital value of the borrower’s home or investment property (estimated and unrealised future capital gains).

White-out liquid is often used to erase the original details, allowing the CA to make alterations. Once the changes have been made, the newly inflated asset and income figures are again inputted into the lender’s service calculator, ‘confirming’ the borrower can service a mortgage that is really too large. By this stage, the bank’s copy of the LAF can amount to more than thirty pages.

When the borrower’s details are sufficiently manipulated to the point of loan approval, the CA notifies the broker of the outcome and the borrower receives the mortgage. The lenders’ own criteria suggest that for a subprime mortgage to be approved, the borrower needs to have an Australian Business Number (ABN) for a minimum of two years as proof of their employment status. Yet, for those without an ABN, the business development managers (BDMs) at the banks were instructing brokers how to create ABNs for borrowers online, in one day, to ensure speedy mortgage approval.

As government and regulators have refused to investigate despite the mounting evidence, no one knows just how widespread the subprime mortgage fraud is. Brailey says that every subprime LAF she has examined is manipulated, and around 18 per cent of full-doc loans are also fraudulent. For those who have difficulty in believing our industry has committed fraud, the following details the numerous control frauds that have occurred over the last couple of decades.

William K. Black, professor of economics and law at the University of Missouri-Kansas City, published a book in 2005 called The Best Way to Rob a Bank is to Own One: How Corporate Executives and Politicians Looted the S&L Industry, detailing the fraud committed by S&L management. He was previously the head litigant for the S&L regulator (the Bank Board) during the 1980s and helped to clean up the industry.

His book, while very detailed and dry, provides an excellent account of regulatory public executives who strived to protect the worst fraudsters in the industry, turning a blind eye to obvious financial predations, while damning ‘mum and dad’ investors. Black later developed the concept of control fraud, whereby executives use the institution they manage as a mechanism to commit fraud. The weapon of choice to be wielded is accounting, confirming that the pen (or computer) really is mightier than the sword. Black explains:

Fraudulent lenders produce guaranteed, exceptional short-term “profits” through a four-part strategy: extreme growth (Ponzi-like), lending to uncreditworthy borrowers, extreme leverage, and minimal loss reserves. These exceptional “profits” render “private market discipline” perverse, often defeat regulatory restrictions, and allow the CEO to convert firm assets to his personal benefit through seemingly normal compensation mechanisms. The short-term profits also cause the CEO’s stock options holdings to appreciate. Fraudulent CEOs that follow this strategy are guaranteed to obtain extraordinary income while minimizing the risks of detection and prosecution. The optimization strategy for lenders that engage in accounting control frauds explains why such firms fail and cause catastrophic losses. Each element of the strategy dramatically increases the eventual loss. The record “profits” allow the fraud to continue and grow rapidly for years, which is devastating because the firm grows by making bad loans. The “profits” allow the managers to loot the firm through exceptional compensation, which increases losses.

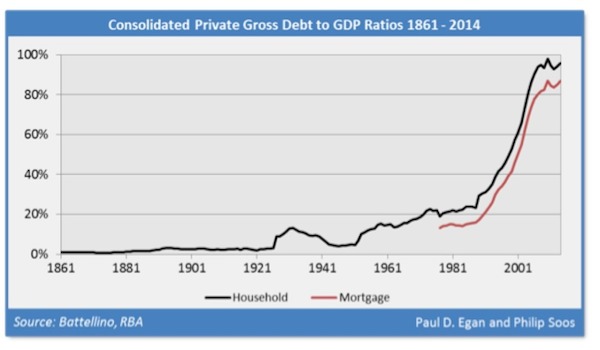

According to this four-part strategy – extreme growth (Ponzi-like), lending to uncreditworthy borrowers, extreme leverage, and minimal loss reserves (including obnoxious pay packets for bank CEOs) – it appears control fraud is present within Australia’s banking system. Overall, mortgage loans have grown exponentially over the last two decades, indicated below.

The Big Four banks have employed extreme leverage and pitiful loss reserves to maximise return on equity and profits. In 2013, against the entire loan portfolio, these banks were highly leveraged: ANZ (30.3x), CBA (30.3x), NAB (29.4x) and WBC (31.3x). Against the residential mortgage portfolio, the banks were geared: ANZ (71.4x), CBA (76.9x), NAB (52.6x) and WBC (83.3x). The average capital charge providing for bad and doubtful debts was: ANZ (1.4%), CBA (1.3%), NAB (1.9%) and WBC (1.2%).

The Big Four banks, providing the bulk of lending and financial system assets, have used the generous, opaque and manipulated internal ratings-based (IRB) framework to determine wafer-thin capital buffers. Dynamic LVR or mortgage rehypothecation, combined with the Basel II lowering of mortgage risk-weights, has amplified the leverage.

A couple of months ago, Prosper Australia fielded a walk-in, an anonymous bank risk manager who alleged the Big Four had manipulated prudential regulation APS 210 by lending each other short-term collateral and deceptively declaring it to be Tier 1 capital. Hence, it is possible a significant proportion of the banks’ already tiny capital buffers are bogus.

While data on three of the four strategies are publicly available (growth, leverage and loss reserves), the scale of predatory lending in the mortgage market is less clear. Episodes of predatory lending have been well documented by the BFCSA, but the true extent has yet to be revealed as the government and regulators (RBA, ASIC, APRA, ATO, AFP, Treasury, FOS and COSL) resolutely refuse to investigate lending fraud. Such an investigation would reveal a massive control fraud in operation, and oblige the supervising authorities to suppress these practices, which would end the housing bubble forthwith.

Australia’s recent economic history reveals a surprising large number of control frauds, which regulators have done next to nothing to prevent and prosecute. In fact, ASIC has a long history of ignoring the obvious, and even protecting the control frauds while condemning victims. The ongoing debenture-funded pyramid business scams is but one example.

It has never been a better time to be a criminal, as long as you’re a white-collar criminal in the FIRE sector. History teaches us a lot, which is why the history of control frauds isn’t taught anywhere because political and economic elites don’t want the public to realise the plague of theft they’ve been engaged in. History is left up to individuals like Denise Brailey and Evan Jones to tell, whose work was used in our book Bubble Economics: Australian Land Speculation 1830-2013.

The disparity between white and blue-collar criminals has never been larger. If I defraud my neighbour of $10,000, I’ll be charged, prosecuted and sent to jail for a couple of years. In contrast, if I’m a banking executive who robs borrowers and loots the treasury of untold billions of dollars, I’ll be praised by politicians, business groups, the mass media and the economics profession for ‘creating wealth’.

Former Rolling Stones journalist Matt Taibbi’s latest book, The Divide: American Injustice in the Age of the Wealth Gap, provides a fascinating insight into the divisions in US society. The most predatory control frauds were rescued by government bailout, while tens of millions of people rot in prison for petty and often victimless crimes. Given the recent history of numerous control frauds in Australia, perhaps an enterprising writer will author a similar book.

Australia has two major control frauds rapidly growing without restraint, namely the subprime mortgage and debenture-funded pyramid business scams, which Brailey estimates will cause over $100 billion in losses – each. ASIC’s leadership knows full well about these control frauds, for Brailey has informed them repeatedly for over a decade. But when you’re the head of ASIC on $700,000 annually with every conceivable perk, you tend to have more in common with the financial robber barons you’re supposed to regulate than protecting the common rabble from their predations.

As Australian economist Phillip J. Anderson has so well documented in his book on US real estate cycles from 1800 to 2008, fraud is never detected by the mainstream for two reasons. The first is that FIRE sector executives and managers are extremely powerful politically, financially and legally, so few will tangle with them. Secondly, during the boom phase of an asset bubble, the public is too self-centred to care, speculating to make paper profits (phantom wealth). It’s only when asset bubble burst do the frauds rise visibly to the surface for all to see.

Thanks to the tireless work of Denise Brailey, we know exactly how the subprime mortgage control fraud operates, evidenced with thousands of LAFs and leaked emails. Government, regulators and economists can’t pretend to not have noticed beforehand. Once this widespread criminal activity becomes public, regulators and public executives should be prosecuted for negligence and dereliction of duty alongside the FIRE sector executives who have committed the fraud.

Meantime, lenders continue to manipulate LAFs, providing unconscionable loans to ‘mum and dad’ investors who will inevitably go bankrupt. Many Australians have and will continue to lose everything they own due to the unchecked predations of the FIRE sector. If it’s bad now, once the largest housing bubble in the post-WW2 era finally bursts, the losses will exponentially mount, along with the suffering it entails. Even the IMF noted that seizure of collateral during a downturn the FIRE sector has itself caused is a form of usury.

Australia’s credit-based banking system, operating by the modes of deregulation, self-regulation, desupervision and de facto decriminalisation, has and will inevitably continue to generate toxic and recurring control frauds. Industry cannot be allowed to profit from control fraud and government has a civic obligation to prosecute those who perform criminal acts on innocent parties.

Only one way to stop it is the Introduction of Glass – Steagall bank separation legislation .

Let’s add accounting control fraud to RICO, including prison time and forfeiture of the “fruits of the crime”… all of the income derived from the crime, all property that the income purchased and any property where the crime was committed. Until we strip the criminals of the $$$, they will continue to steal. Fraud is after all theft. Because it is white collar theft we treat it differently.

I think it is already conspiracy to commit a crime and hence under rico.

We just need to prosecute. That would be the Justice departments job, a job they have abrogated.

They meaning the big leader and his appointee the attorney general.

Ps speaking about the US. I’m sure Australia has a similar law man

aussie banks have little to no prop trading. what derivatives trading they do is client driven. the last derivative problem in oz (that I’m aware of) was NAB fx option scandal when fx dealers defrauded the bank… it’s aussie loan books that are the proble, so GlassStegal is exactly the wrong solution.

CEO pay provides a useful pointer here. The ANZ bank CEO (NZ only) gets about $1 for every human in NZ. The untold millions should be told.

Bill Black always gives credit to the people who first brought up control fraud; most notably George Akerlof and Paul Romer added their voice to this point in1993 in their article “Looting: The Economic Underworld of Bankruptcy for Profit.”

He elaborates every day and Bangs on about it ( justifiably) but does not claim it as his Idea.

I understand Australian politics to be much more rough and tumble than American politics. Is anyone there applying the lessons from Americas’ experience to rail against the Australian Neo Liberal Putsch?

I moved here in 2005 after Bush was reappointed the second time and I just couldn’t stand it any more. AUS politics are VERY different from the US. For starters it’s Parliamentary, which means a third or fourth or even fifth party can gain quite a bit of real power. Secondly it’s broadcast live for hours each day on the radio, something called Question Time which is not just softball questions and sound bites but rather the Opposition taking the existing Government to task in very vocal ways. Lastly, voting is mandatory by law, a great feature which necessarily means the politics naturally moves to the center instead of screechy extremes.

Having said all that, the Government of Abbott are the worst kind of corporo-fascists, essentially just doing Rupert’s bidding. But their proposed budget, the document that lays out their plans, has been completely DOA. Abbott is such a tone-deaf ideologue that finally the head of the Chamber of Commerce, Ground Zero for corporate Australia, had to tell him to drop his attempt to dismantle the excellent health system and make it more like the US. With the best economy in the G-20, that virtually sailed through the Great Recession, it’s pretty hard for them to claim “oh oh the sky is falling, our 22% debt/GDP is killing us”. Luckily they are only in power for three years and if we’re even luckier they can be tossed mid-stream.

Tax the rich not the poor, corporate advisers tell Tony Abbott

“Corporate advisers are calling on the Abbott government to consider taxing the wealthy – by scrapping a raft of concessions available to them – in order to achieve a hike in the GST and lower corporate and personal tax rates.

EY tax partner Glenn Williams told Fairfax Media that the only way the government could afford to deliver significant company tax cuts and personal tax cuts was to raise taxes elsewhere.

There was limited scope to raise the marginal tax rate – people earning more than $180,000 are already expected to pay almost 50 per cent tax on income they earn – but the government could look at removing popular tax breaks that mainly benefited the wealthy, such as dividend imputation, negative gearing and capital gains tax concessions. These tax breaks are used by higher income earners to reduce their marginal tax rate, and thereby pay less tax.

“You can’t go above 50 per cent [income tax for people on the top marginal tax rate] because then there’s a disincentive to work,” he said. “But there’s a general consensus that the tax burden has to fall on those who are more well off.”

Mr Williams, whose comments come ahead of a government paper next week cavassing options for tax reform, said changes to the tax system could not be divorced from cost of living issues. “In terms of personal tax, there’s some work to be do at the lower end of the [tax] bracket, including lowering the threshold [when individuals start paying tax],” he said.

Mr Williams, who advises Australian companies on tax and has been involved in previous debates on tax reform, said despite Tony Abbott’s promise before he got elected not to raise the GST his first term, it was still a possibility for long-term change. Mr Williams said raising the rate and broadening the base would do the government the “least amount of political damage”.

http://www.theage.com.au/business/the-economy/tax-the-rich-not-the-poor-corporate-advisers-tell-tony-abbott-20141201-11xo8q.html

Skippy…. testosterone tone abbott [ TT ] is finding rank ideology and policy advice… cough orders… from decrepit ideologues like Murdock… is a sure way to get permanently sin binned in the political arena.

Re: bursting of Aust property bubble. Possible but unlikely, at least to the.degree found in the US circa 2008.Property bubble in Aust is supported by a gross — grotesque — undersupply of affordable proper. ties; and by a significant level of international investment.

Naturally, this is a great environment for a spot of fraud…no one really wants to count the cost till the party is over…

The property lending fraud has gotten so bad that it may require land reform in the US, and that usually requires revolution. I don’t know how bad it is in Australia.