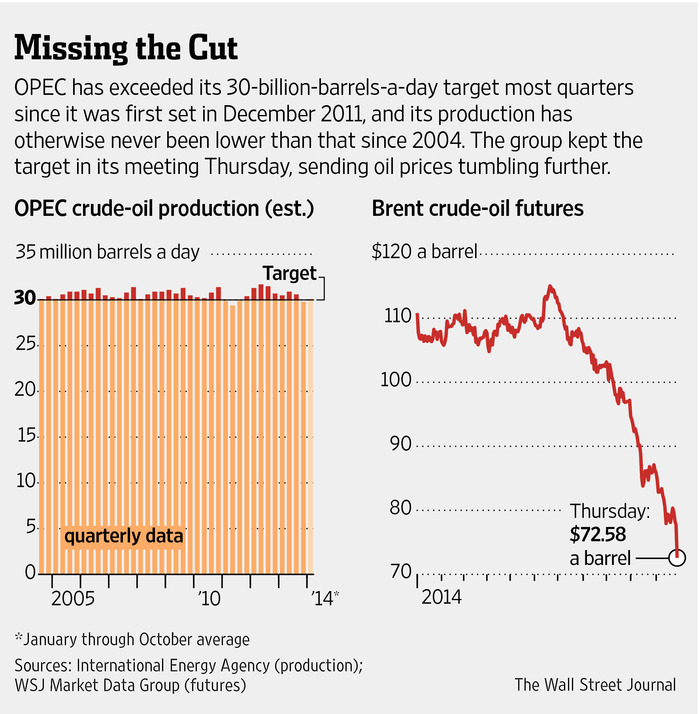

After a testy meeting, OPEC agreed to maintain current production targets. The failure to support oil prices via reducing production led to a sharp fall in prices on Thursday, with West Texas Intermediate crude dropping by over 6% and Brent plunging over 8% before rebounding to finish the day 6.7% lower, at $72.55 a barrel. Many analysts believe that oil could continue its slide to $60 a barrel.

The ripple effects hit currency markets and, of course, energy stocks. The Wall Street Journal emphasized the potential upside for the US economy, with lower energy prices giving consumers more money to spend elsewhere. Energy importing countries will also benefit. In keeping with our reaction to Saudi’s earlier decision to let oil prices slide, more and more commentators are seeing the OPEC refusal to support the market as at least in part designed to target the US shale gas industry. despite official denials. From the From the Financial Times:

“I wouldn’t call it a price war, but it’s a very aggressive test for US shale,” said Jamie Webster, oil analyst at IHS Energy, a consultancy. “It’s a new gambit for Opec to try.”…

Amrita Sen, oil analyst at Energy Aspects said: “This is becoming a battle of [who has] the deep pockets and survival of the fittest.”…

Although some analysts had thought the cartel may surprise observers with an output cut, others argued that driving prices higher would only encourage US shale drillers and other high-cost producers. All the while, Opec would only continue to lose market share, they said.

“Those producers that have been hardest hit by the oil price drop have been persuaded [ . . .] that the only way to counter the surge in US shale oil production is to allow lower prices to pare back supply over time,” said Bill Farren-Price, head of Petroleum Policy Intelligence.

But it isn’t clear how many North American producers will blink first in this game of chicken. From the Journal:

While some, including ConocoPhillips Co., have already announced plans to spend less in 2015, many more won’t unveil next year’s budget for several more weeks.

In Canada, industry officials said the slide in prices wouldn’t likely lead to immediate production costs. Suncor Energy Inc., Canada’s largest oil sands producer, still expects crude to recover to “the $90 to $100 range,” chief executive Steve Williams said.

In a separate story, the pink paper points out that this de facto price cut is shellacking prices of bonds issued by energy companies:

Since the start of the year, the average yield for junk-rated energy debt has risen from 5.67 per cent to 7.31 per cent, while total returns for the year hover at 0.13 per cent. In contrast, the overall junk bond market has a total return for 2014 at 4.17 per cent, after a price loss of some 2 per cent.

Martin Fridson, chief investment officer at Lehmann Livian Fridson Advisors, said the drop in energy debt prices this year has effectively wiped out the 6 per cent coupon paid by the paper and adds “energy is heavily over-represented in the distressed segment” of the junk market.

Currently, 180 junk debt issues in Bank of America Merrill Lynch high-yield index are trading at very low prices, representing 7.9 per cent of the overall market, said Mr Fridson. Within the current distressed sector of the market, energy accounts for 52 issues, a share of 28.89 per cent.

The pressure on the junk market has come as the broad US equity market has continued rallying into record territory. During the near six-year bull market for risk assets, prices for both low-rated debt and equities have risen largely together, with the current divergence becoming a major talking point among investors.

While the US default rate remains low, such a measure is backward looking and was also moribund in 2007 ahead of the financial crisis. Deutsche Bank credit analysts recently said that if oil drops to $60 a barrel it could be the catalyst that pushes some energy companies into trouble and sparks a rise in the US corporate default rate.

An open question is how many banks have high exposures to energy companies. Keep in mind, as many banks learned to their woe in the early 1980s oil rout, that it isn’t just the direct exposures that wind up counting. Being a lender to real estate developments in oil boom towns also puts one at risk.

In the 1970s, the Saudis inflicted pain on the global economy via price hikes that kicked rising inflation into a higher gear. Riyadh is again amplifying a broad international trend, this time towards deflation. But in the first use of the oil weapon, central bankers were eventually able to strangle inflation by engineering a deep recession. By contrast, monetary authorities’s creative efforts to beat incipient and actual deflation has looked like the cliched pushing on a string. This OPEC-induced energy rout is unlikely to be as damaging near-term as the 1970s oil shock, but the impact it does have may prove to be harder to remedy.

It seems Houston area economists have been surprised by oil’s sharp decline. So far construction is still going strong, but multi-family and higher end of outer burbs is looking pretty saturated…

http://aaronlayman.com/2014/11/katys-high-end-housing-market-take-hit-collapse-oil-prices/

I am skeptical of this narrative, that OPEC is some how targeting US energy to maintain its market share. It seems to forget that China’s oil demand is contracting thanks to “the great slow down” as they seem to be calling it. (I half expect them to call it the “Great Correction” or something.) I also suspect that US unconventional oil needs to many much of what it produces any way and are slowing the consumption crash.

I suspect that when the US oil system eventually shuts down, the drop in fuel supplies will not collapse as some might predict.

NB, Code Name D: China’s Crude Oil Imports Surge Despite Slow Demand: As China’s economic growth slows, the country is buying more oil abroad, a seeming contradiction that may add to the world energy market’s unease. Asia’s economic powerhouse has reported that its gross domestic product (GDP) growth, the broadest index of economic expansion, in the third quarter slipped to 7.3 percent, its weakest rate in five years. … But China’s net imports of crude oil this year have taken a more bullish track, climbing 8.8 percent through September to 6.1 million barrels per day, Platts reported earlier. Imports in September were the second highest on record despite lax demand this year.

in a nitpicking matter, i’m sure Yves meant to headline that shale oil was possibly being targeted by OPEC, not shale gas…so when i link to this article in my newsletter, i will change that accordingly…

I think China is still adding tens of millions of motor vehicles / year to its fleet, while the US fleet has reached equilibrium. Quick google search shows US vehicle-miles have been flat for a few years, and declining per-capita (this is a good thing, IMO). China still rising, expected continue.

They would be wise to build their petroleum strategic reserve now.

No, the belief is that the Saudis are trying to dampen the development of all potential substitutes for oil, such as renewables, along with US shale gas. For shale gas to serve as a substitute for current oil uses AND exported, infrastructure needs to be built and the end users that can use shale gas as a substitute also need to make investments. The thesis is that OPEC wants to force prices lower and keep them there long enough to make these investments look unattractive, at least over the next few years. Both low and volatile prices will do that.

Unattractive for the next few years. What happens after that? All these shale gas companies will be out of business and no new ones will emerge when oil prices go back up after a few years?

Not sure if that’s a good long term strategy.

Agree – even if some of them do go out of business, doesns’t it put a ceiling on the prices that OPEC can demand?

Rule one: Never pretend to posse the power of telepathy. So unless you can show me in writing or a speech where OPEC says this, I remain skeptical as to their motivations. And even then, OPEC is not a monolithic organization that is driven by one opinion. There is likely an array of rational to convoluted thinking that leads to its actions.

That said, I am still skeptical of any alleged attempt to suppress alternative sources. One, OPEC isn’t actually doing any thing – they are standing pat on its quotas. Passive action such as “not making any changes” doesn’t strike me as a convicting nefarious master plan.

Two, US unconventional oil is already top heavy as it is. Its damage and instability is entirely self-inflected. It’s not a viable threat to OPEC. Why bother to assassinate a dying man?

Three, investments into renewable energy systems are not likely to be influence or deterred by short term market fulgurations. Lower prices will sour their prospects only in the free market nations where pro-oil propaganda is already decimated without challenge.

Far more likely, this is just an ideological doge to place blame on the collapsing OPEC market, rather than confronting yet another epic free market failure.

Do all Americans believe that every long game is a conspiracy and therefore cannot and does not exist?

Not all do. Some don’t. I don’t.

The theory that KSA is taking easy non-action to keep oil price low enough long enough to exterminate high-cost rivals now, so that KSA can raise prices later without any in-the-meantime-exterminated rivals to worry about . . . makes sense to me.

This is an illustration of a peculiar form of propaganda in America, wherein wherever the fact that various elites are conspiring together to screw other elites or people in general various words such as “tinfoil” and “conspiracy” are thrown around to “discredit” whomever had the gall to point out that elites are constantly conspiring with each other to screw people over in ever newer and more inventive ways. Obviously this is a strategy used by elites, and one that really only works on a populace as gullibly ignorant and stupid as Americans normally are.

I suggest you read the news before casting aspersions.

1. Most of the OPEC members wanted a production cut. The meeting took 5 hours and was tempestuous. Observers report that the Saudis forced the stand pat on the rest of OPEC.

2. Plenty of oil mavens agree with this reading. This is not a speculative interpretation. OPEC is clearly trying to force other producers to cut production. And Saudi production is most directly competitive with Texas and Bakken. All are light sweet crude. The surplus is greatest in those grades

3. The US media is spinning the oil price plunge as a plus for the US, via lower prices. The US media is not in “blame OPEC” mode.

As we said earlier, the move by OPEC was remarkably out of character, and many analysts agreed with our reading.

And it has been confirmed:

http://www.reuters.com/article/2014/11/28/us-opec-meeting-shale-idUSKCN0JC1GK20141128

And do you refuse to look at data? We’ve provided information in earlier posts that US shale production by 2019, had it continued on current trajectories, would generate nearly 2x forecasted US demand.

No, I gather you’d prefer to remain attached to your existing beliefs.

Monetary authorities’ creative efforts to beat incipient and actual deflation has looked like the cliched pushing on a string.

‘Inchoate’ might be a better adjective than ‘creative.’ Hurling spaghetti at the wall to see if anything sticks doesn’t take any creativity; just desperation.

While the late-2008 oil price slide briefly pushed the US into deflation, that was in conjunction with a financial crisis and deep recession. So far, deflation is not very likely this time round. The main risk is that central bankers again try to ‘do something’ even more destructive.

Since you’re bringing up deflation and central bankers: how can there ever be the risk of deflation if you’re a sovereign who can always print more money and pass it on to all citizens? More money chasing the same assets always works if the right agents receive enough money, right?

I think it’s the pass it on to all citizens part of your logic that does not accord with reality. Only the politically connected ever get the money.

I agree with your view on reality, but that doesn’t make it a logical fallacy. Someone is making the decision to not pass it on to all citizens. It is possible though. I bet if you give every American $1,000 you get inflation. And since the gov/CB could decide to do so, accepting deflation is a choice.

Hence the question if the possibility of deflation by dropping oil prices should be worried about at all, especially in the US (as a sovereign currency issuer).

Thank you Rene for Money Power to the Little People.

Print money and pass it all to citizens. Not one cent to Too Big Business nor Too Big Government (the government can seek consent for worthy projects by democratic processes such as legislated taxation – the way it has been implied since the founding of the nation).

New money to the people and the people will never go hungry.

That’s going back popular sovereignty or the sovereignty of the people.

My inflation/deflation definition is this:

Food/energy/housing/healthcare/other essentials prices – wages.

For the 0.01% and the government who legitimizes the definition: Wages, excluding food and energy.

If you use People’s Inflation/Deflation Index, with falling wages, and falling oil prices, we come just barely even. It’s pretty stable now, with the easing inflation via plunging oil prices.

With your definition a good representative of The People would optimize policy for maximum deflation. It would incentivize ‘wage issuers’ or employers to maximize wages within their own constraints (i.e. tax cuts for high wage/profit ratios?) and government would refrain from inflationary monetary policy.

Yeah, I could live in a world like that. We’d run out of oil much sooner, but that’s another debate.

As much as I like a good conspiracy theory, this price decline is not the result of one. Too many competing interests make this all but impossible. The problem is demand is flatlining and headed down from here. The market is currently in the denial phase of the death of Big Oil. The echoing refrain, “The bottom is in, it’s a geopolitical ploy, no way can this last,” are the last desperate attempts to deny the Oil Bubble has popped. The great thing about bubbles is that no matter how big they get, they remain virtually invisible until the bankruptcies and bailouts begin. We still have a few months to go before the truth sets in.

Just like the Fed created banks on steroids that led to the financial crisis, the government also paved the way for the oil boom with tax breaks, lacks safety and environmental rules and nearly free land to drill. The cost of this energy independence will be the bankruptcy of a good size chunk of the our “booming” economy. The Chinese have nothing on us when it comes to subsidies to encourage malinvestment.

The reason to think that there might be more to this is that this is not how OPEC normally responds to a price decline, particularly since the price of oil is below the Saudi’s fiscal breakeven (which is different from their production breakeven). The kingdom won’t get enough in oil revenues to support its annual budget with oil at below $90 a barrel (or at least that’s a level I’ve seen reported; sources no doubt vary in their estimates). So the Saudis have strong incentives to go for a higher prices and are incurring real costs to allow oil prices to continue to fall.

And I suggest you go review the history. Oil fell below $90 directly as a result of the Saudis saying they would not support it at this level, and took another big leg down as a result of the OPEC inaction.

Moreover, this washout does not change the long-term outlook for higher oil prices. While there are substitutes for oil for many uses (building heating being a biggie), there really isn’t one yet for the internal combustion engine. And if OPEC can delay substitution for other uses by whipsawing prices and killing some producers (price uncertainty is just as deadly for investment as low prices), they preserve demand for oil v. oil substitutes and maximize the return on a limited resource. This is all entirely rational predatory pricing.

The Saudis have a lot of built-in flex in their budget, since much of it is inessential spending, such as supporting worldwide Wahhabism, extreme luxury for the Saudis, ridiculous building projects.

What they budget, and what they need are very different.

In their quest for ‘alternative’ investments, many pension funds bought long-only total return commodity funds. To maximize investment capacity, some of these funds depend on the GSCI (Goldman Sachs Commodity Index), which is weighted to global production volumes.

Problem is, at the beginning of 2014, the GSCI had a 47% weight in West Texas and Brent crude; and nearly 70% in the energy sector as a whole, including products such as gas oil, heating oil and gasoline.

http://www.spindices.com/documents/index-news-and-announcements/20131107-sp-gsci-composition-and-weights-2014.pdf

By contrast, other commodity funds using equally weighted indexes (such as symbols GCC and USCI, to mention two examples) are basically flat for November.

Goldman Sachs, comrades — watch your wallets!

GSG is one publicly-traded commodity fund indexed to the GSCI. It’s down almost 4 percent at today’s open, producing a loss of about 9 percent during November.

How much damage could a run on high yield debt do to the broader market?

Are the risks insignificant or could we be looking at the first of many dominoes?

HIgh yield is really a very separate market. High yield bonds are “story” paper. They trade very much on a name-by-name basis since default risk is real, so you have to understand the company. Investment grade corporate bonds trade on attributes: duration, maturity, coupon, rating, etc.

Having said that, the high yield market is often the canary in the coal mine for the rest of the economy, but it also gives a lot of false positives.

What idiot entity is selling CDS on high yield bonds? Surely they must be European banks, right?

Investors overpaying for yield after years of low rates (Reuters) – http://uk.reuters.com/article/2014/11/20/us-investment-yearend-yield-idUKKCN0J421C20141120

“The high-yield market is sort of in a bubble and sooner or later there will be a price paid for that,” said Carl Icahn, the billionaire investor who said he owns credit default swaps on high yield debt against the 5-year U.S. Treasury note. That means he’s essentially shorting high yield debt while going long on the U.S. five-year note. “We think the risk-reward is great in that CDS,” he said.

Almost any first- or second-tier bank will write CDS on high yield bonds, or loans. All they really require is a liquid enough market to get an accurate spread over the relevant index (Treasuries or Libor). It’s a big market now.

…the drive to wipe out higher-cost US shale producers could have far-reaching consequences for global financial markets. Energy projects in the United States have been heavily financed through the issuing of high-risk or junk bonds. In 2010, energy and materials companies made up 18 percent of the US high-index yield, a measure of so-called sub-investment grade borrowers. Today they account for 29 percent, as a result of massive borrowing by drilling companies.

Research carried out by Deutsche Bank showed that should the price fall to $60 per barrel, which is eminently possible, there could be a default rate as high as 30 percent among some US borrowers.

A report published earlier this month in the British Telegraph warned that the “rush to pump more oil in the US has created a dangerous debt bubble in a notoriously volatile segment of corporate credit markets, which could pose a wider systemic risk in the world’s biggest economy

Not keen on the theory or the lingo, but the more gunpowder (debt) the bigger the explosion (default). Following the analogy, the harder the rock the more gunpowder needed to break it apart (vis-a-vis “kinda” Fracking). Fracking is an effective, profitable industry despite its risk because our debt building financial industries love this. Think of the history, even if it blows up they expect a bail-out or they dump the toxicity on other institutions. The industry is so leveraged because it is so risky. It only became profitable in the last 10 years (from rising oil prices) and that has been on a razors edge. My layman’s opinion of the outcome, bad, very bad.

PS – thought this article was interesting, more coherently describes some themes from before…

https://rbnenergy.com/stop-in-the-name-of-opec-why-u.s.-shale-crude-production-won-t-halt-overnight

It is interesting. Thank you. Confirms things I’ve been told elsewhere.

Although realities might not match the hyperbole, I h/b wondering about both the direct and indirect speculative exposures of the mega-banks in energy, metals and other sectors, including their respective exposures in both junk bonds and equities (as well as who is on the other side of those futures and derivatives trades)? The recent illiquidity that culminated on October 15th is a harbinger of the road ahead IMO, and as in that instance could include unanticipated losses in currency futures and swaps.

… Shaping up to be a shoot-out at the OK corral among competing interests within the global elite? I fervently hope so and that the road kill includes some specific intermediaries, but also hope that our retirement pension funds and 401(k) funds are not caught in the crossfire.

Salient related link:

http://www.washingtonsblog.com/2014/11/big-banks-take-huge-stakes-aluminum-petroleum-physical-markets-manipulate-prices.html

Peteybee is posting very good thoughts on natural gas and oil in comments and attention should be paid.

It’s sad to see the conspiracy mongering going on here backed by precious little of data. Conventional wisdom is treated as fact when it is not, and CW is then used to attribute all manner of nefarious intentions to energy market actors.

As a simple exercise, compare Saudi oil production levels from 1980 to current, against US production and WTI price of the same interval. It will enlighten you all as to what Saudi oil cuts can accomplish against a bursting oil price bubble. All the data is available on EIA/Wikipedia or the BP oil review. Hopefully it will enlighten this crowd about how OPEC “should” be acting.

And please please please stop moving from oil markets to shale gas in your blog posts. They are quite different. Why? Because a decline in oil directed drilling in the US is bullish for natural gas pricing in the future (2016 and beyond).

Last please, don’t refer to Bentek as anything other than farce, they are no better than the FT or NYtimes for “analysis.”

I’m sorry Peteybee, my tone will probably deprive you of the audience your posts deserve.

wow, thanks :-)

BTW I don’t regard any of this as conspiracy theory mongering. I really like this website. Yves and Lambert are doing a great job. I mostly don’t have an axe to grind on this subject either, I’m more interested in democracy reform and US foreign policy now.

I think the environmental criticisms of fracking (i.e., wastewater) are valid. I think the call for sustainable use of our natural resources on a global and national level is absolutely essential if we want the next generation to have a decent life on earth. But I just think the peak oil concept, which made sense a couple of years ago, has turned out to be premature, and it seems like there’s a hesitation to dig into data that contradicts it (not necessarily on this site, but lets say among the community of people who “care”).

No worries, you post informative stuff, want others to learn.

I agree with your third paragraph completely.

I used to really dig this website. I first started reading NC posts in 07/08. It’s getting to be so long ago, I don’t really remember when ;), but I think i was referred by a Barry Ritholtz link. I thought I learned a ton at the time. But I have to say. Given how off base the energy writing is, makes me wonder what exactly is the area of expertise at NC, and how badly misguided NC’s posts on other topics are. I work in energy markets for a living, and the certainty expressed here (coming from sources as ridiculous as the FT or bentek (barf)) is just sad. The oil market is just too complex for that.

Oh well, it’s just a blog and not really going to impact my life too much. I just come around every so often to see how the old crowd is doing.

FWIW, I think the commodity bust is upon us (frankly we are a couple years into it, so that isn’t an insightful comment). Boom times will come again, but not for a while. Look to India or Sub Saharan Africa for leading tells.

The Saudis don’t have to kill the entire array of shale oil drillers in the U.S. If they can force the weakest into bankruptcy then, as noted above, the junk bond market will go pear shaped. That will deny funding (or at least make it prohibitively expensive) to all shale drillers. All that leverage gives the Saudis leverage. Just as there is inertia in present operations keeping them going as they lose money, there will be mobilization delays in the ramp up of production in a future higher-price scenario. There certainly would be more cost and delay on the financial end.

The Saudis are willing to spend some of their sovereign wealth now and make it back later.

Mosler on Saudi motivations.

So, what does this mean for renewable energy development in the USA in the near/long term? I’m afraid very little. Realism tells me that major refiners have diversified portfolios of producing wells (including: tight rock, tar sands, deep water, the few-and-far-between shallow fields). Dipping oil price will only hurt the lower people on the industry hierarchy (small to mid-scale contractors/drillers, independent logistical operations, etc). This is not “hurting” Exxon, BP, Shell, and all of the big players since all the essential infrastructural components that require their refining are still in existence. We still use petroleum for nearly all transit, agriculture, resource extraction, and heavy/consumer product industry. They have a guaranteed market and nearly all of their risk is sidelined by sub-contracting and subsidy. The oil industry is a Capitalists ideal model of a low profit risk ratio. I saw a comment above mentioning our witnessing the death of “Big Oil”. I strongly disagree. There is zero indication, either socially or politically, that we are making any move to divorce from our oil partnership. OPEC is playing games (or not, it doesn’t matter) and major refiners are turning some accounting knobs and pushing some payroll buttons and everything will be that same as it was before. The only thing stopping their Juggernaut is complete depletion of feasibly extracted oil.

Though there is no, “conspiracy”, to rig or manipulate oil on the markets one could argue that the conspiracy is writ on the entire order of modern society. There is a social and political reliance on petroleum, and in turn, petroleum is supported politically and socially, and so on. I would argue the petroleum industry controls nearly every aspect of modern existence and the onus is on the realm of the social and political to break it. We may consider that the oil industry operates in a similar manner to a manifold of trusts that motivate and restrict society as they wish. Why not prosecute these industries as trusts? This would certainly create tumult, but it would open the door for real alternative investment and oil divestment without the petroleum industry handicap. The pragmatic approach is dangerous for our future, maybe it is time to become a bit “crazy”.

Looks like renewables are going to get hit really hard, as will attempts to bring NG vehicles to the US :-(

Just a question about the physical mechanics of a fracked well. I have been told by an not completely unreliable source that fracked wells can’t really be “turned off”. My source was fairly adamant that a lot of the production in fracked wells is of a use-it-or-lose-it nature.

If this is true, and if someone here with certain knowledge about this would chime in about its veracity, how would this ground-truth effect the equation in a “lower than production cost” set of wells?

Mr. Ennis,

It doesn’t make sense financially to shut off a well. You would be delaying the largest cash flows of that well for a date in the future. It may also not make sense physically, because of some suspected damage to the well channels (my own term for the path hydrocarbons flow through to the main well bore) by stopping flow for a period of time. I don’t know of any published data on this. It has happened so infrequently that I assume it’s a guarded secret, but again, I just don’t know.

The way the domestic US natural gas market alleviated the supply boom caused by the shale tech shift was displacing coal fired power plants and running very inefficient natural gas units instead. Outside of filling storage, I don’t know of a competing commodity oil products could displace. The most expensive crude to actual lift from the earth is probably Canadian oil sands, so I would guess you’d see cutbacks there first. You will see a big drive to curtail production when the contango in the crude market gets much steeper (5-10 bucks for 1 year time spread). It’s currently less than $2. No reason to shut-in at that level.

For Pirate’s sake! It’s certainly possible that this is a coordinated US-Saudi policy, to stress the economies of Russia, Iran & Venezuela simultaneously.

Personally, I’d bet $ that that’s the actual endgame.