We warned readers who are still keen to take the Syriza “Hope is coming” slogan as something more promising that a subconscious echo of the Obama 2008 “Hope and change” campaign, that the memo that Greece signed with the Eurogroup last week did not represent a victory or a lessening of austerity. As we pointed out:

There is no way of putting a pretty face on this document. It represents a huge climbdown for Syriza. Despite loud promises otherwise, they’ve agreed to take bailout funds, and the top and the close of the memo confirm that the baillout framework is still operative (emphasis ours):

The Eurogroup notes, in the framework of the existing arrangement, the request from the Greek authorities for an extension of the Master Financial Assistance Facility Agreement (MFFA), which is underpinned by a set of commitments. The purpose of the extension is the successful completion of the review on the basis of the conditions in the current arrangement, making best use of the given flexibility which will be considered jointly with the Greek authorities and the institutions…

We remain committed to provide adequate support to Greece until it has regained full market access as long as it honours its commitments within the agreed framework.

Translation: Despite all the softening language, the Eurogroup and the Troika (or as docg calls them, the Eumenides), see the bailout framework, with all of the required structural reforms, as still operative. And keep in mind that those structural reforms, which included items like reforming (in Troika-speak, cutting) pensions and continuing with the privatizations are on unless Greece can persuade the Troika that the government can find the money to replace what they lose by rolling existing measures back. As Bloomberg reporter Erik Schatzker put it at the beginning of the week:

Austerity is here to stay. The question is how austerity is defined…Greece is still bound by the terms of the bailout….They still have to hack off one of their limbs. The situation before was that the ECB, the IMF, and the European Commission were telling the Greece which limb of their limbs they’d have to hack off. Now the Greek government gets to decide, is it going to be my right arm is it going to be my left leg? But at the end of the day, it pretty much amounts to the same thing

Tuesday’s events bore that reading out. Greece did win approval of a list of reforms that included a lot of its campaign promises, such as a “Guaranteed Basic Income scheme” and expanding temporary employment for the unemployed, as being adequate to serve as a basis for further negotiation with the aim of winning Troika and Eurogroup approval so that funds could be released to Greece. The government put some items in that indicate that it thinks it can fund some of its programs through reforms, such as:

Identify cost saving measures through a thorough spending review of every Ministry and rationalization of non-salary and non-pension expenditures which, at present, account for an astounding 56% of total public expenditure.

Some commentators were already skeptical of where the official compromise stood. For instance:

Greece secures eurozone bailout extension for four months http://t.co/PPCVFCAKgp this…solves…nothing.

— Comrade_Chompsky (@dravazed) February 25, 2015

And Robert Peston of the BBC, one of the harshest mainstream critics of the Greek government, today compared Syriza to Tony Blair. Ouch.

And another troubling sign is that Varoufakis’ long list with proposals like reforming VAT in a way that “maximizes actual revenues without a negative impact on social justice” did not sit well the Greece’s money minders. While all of the members of the Troika waived the initial reforms through, the ECB and the IMF made clear that they expect Greece to hew closely to the existing structural reforms. Expect to see significant changes in the reform list before the triumverate will approve the release of funds.

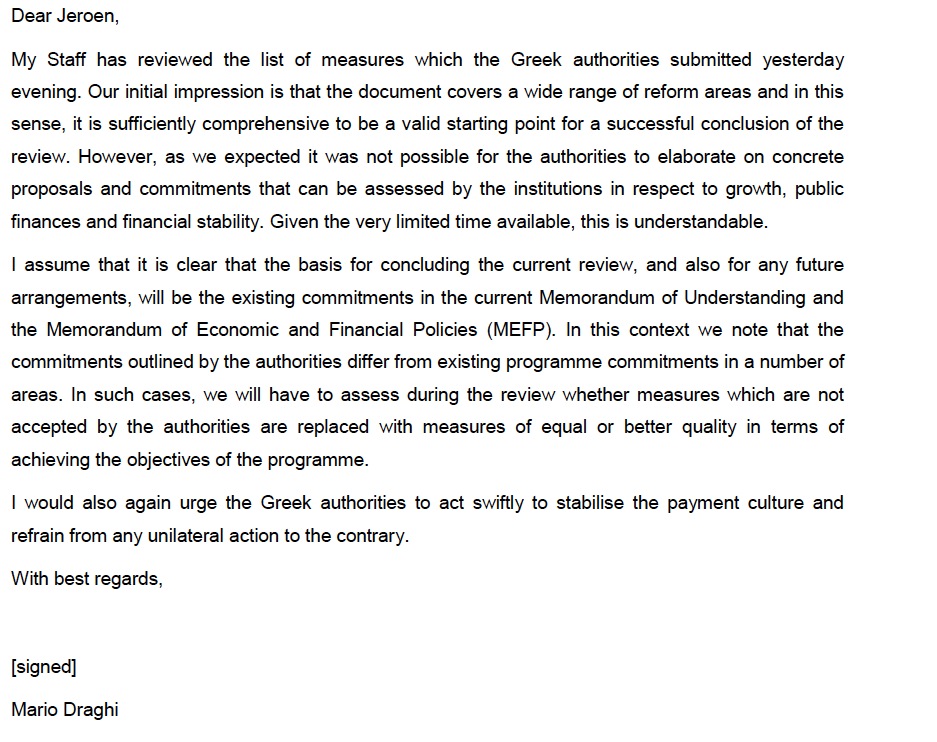

Here is the operative section of the ECB’s letter. You can read between the lines that this amounts to giving Greece a barely passing grade:

Translation: substitutions to the existing bailout structural reforms not permitted unless they produce similar or better outcomes, with “outcomes” measured in terms of budgetary impact.

The IMF was even more tart, or in the words of Chris Giles, “sniffy”. While the letter did note that the reform list wasn’t terribly specific, that was understandable given that the government was new in office, and approved of their commitment to tackling tax avoidance and corruption. But after that thin praise, it switched gears and took issue with its failure to show similar resolve as far as wearing the existing austerity hairshirt is concerned:

In quite a few areas, however, including perhaps the most important ones, the letter is not conveying clear assurances that the Government intends to undertake the reforms envisaged in the Memorandum on Economic and Financial Policies. We note in particular that there are neither clear commitments to design the envisaged comprehensive pension and VAT policy reforms, nor unequivocal undertakings to continue already-agreed policies for opening up closed sectors, for administrative reforms, for privatization, and for labor market reforms. As you know, we consider such commitments and undertakings to be critical for Greece’s ability to meet the basic objectives of its Fund-supported program, which is why these are the areas subject to most of the structural benchmarks agreed with the Fund.

This reads as even less accommodating than the not-exactly-warm-and-fuzzy ECB letter. Note in particular that the IMF is not keen about Greece deviating from the current privatization program, pension “reform,” and labor market reforms. These were areas where Syriza had promised rollbacks during its election campaign and reiterated the importance of canceling and/or redoing privatizations and implementing measures to strengthen labor bargaining power and improving wage levels. Varoufakis’ reforms contained measures of that sort, although his worker proposals were stepped down from the campaign platform.

The Wall Street Journal said IMF “slammed” Greece. Further observations:

Ms. Lagarde’s letter calls on Greece’s new government to bolster its proposed economic overhauls, judging them insufficient to meet the fund’s requirements.

“It forces Greece to be serious, and it forces the eurozone to say, ‘Look, we’re not going to give you any of this bridge financing unless you start working on implementation on day one,’” said Mr. [Jacpb] Kirkegaard [of the Peterson Institute].

And the Telegraph:

But in a blow to the government, which faces a potential domestic backlash for bowing to eurozone conditions, both the IMF and the ECB reminded Athens they held a veto over providing further cash and could yet demand more concessions…

Tracked changes on documents submitted by Athens at midnight on Monday showed the Commission had worked closely with Mr Varoufakis in drafting the plans. Syriza’s proposals to overhaul its tax system and state revenue measures now closely resemble promises made by past Greek governments….

Troika officials will also demand much more detail on promises to carry out labour market reforms and commitments not to “roll back privatisations that have been completed”.

Conservative German MPs will also seek assurances on the measures when the Bundestag votes to extend the EU-IMF programme on Friday.

A second Wall Street Journal article explained why the IMF is not likely to relent:

In contrast to the eurozone, whose weaker members would face the immediate fallout of renewed market panic over Greece, the IMF represents 188 states around the world, many of which are already grumbling over the fund’s disproportionate support to a small European country.

It was the IMF—along with Germany—that in 2012 pushed through a restructuring of Greece’s privately held debt, against initial resistance from the European Commission and a majority of eurozone governments. And according to European and Greek officials, the IMF was also the main obstacle to disbursing the latest €7.2 billion disbursement of the country’s bailout last fall when the previous government was still in power.

One interlocutor suggested that things were not as dire for Greece as they appear, since the ECB is a bit trapped by not wanting to pull the plug on its support for Greek banks, since that would lead to a disorderly Grexit and a recognition of losses by the central bank. Since the Germans do not believe in allowing central banks to operate with negative capital (ie, “print” or monetize the losses), the Bundesbank would almost certainly insist on a taxpayer level to shore up the ECB’s capital, which would set off a political firestorm across the Eurozone. So the argument is that Greece holds stronger cards than it seems. But the ECB and the IMF have no incentive to release funds to the government. They can play the game of starving the Greek bureaucracy, and making it defer payments and fail to deliver on existing programs, which will gnaw away at Syriza’s credibility and support.

And do not forget that the German paper FAZ reported that the ECB board believes that Greece really wants a Grexit but does not want to look as if it is the precipitating party. If the ECB and the IMF believe that Varoufakis’ letter is more of the same, withholding funds might force the Greeks to take initial steps toward a Grexit, such as introducing quasi currencies like tax anticipation notes.

I’ve fallen prey in negotiations with far less at stake than the Greeks have of talking myself into deals I should not have gotten into because at each step I persuaded myself that the unfavorable terms were not as bad as they looked or I could make the long odds break in my favor. It’s far too easy to get caught up in the dynamic of the negotiations and lose sight of how terms you are fighting over translate, or more important, will be translated by the party with more power, into what you are expected to deliver. Maybe the Greeks will be lucky. Maybe the IMF and the ECB will blink. But the odds don’t favor those outcomes.

….to take the Syriza “Hope is coming” slogan as something more promising that a subconscious echo of the Obama 2008 “Hope and change” campaign…

——————

Obama was a Clinton-style neoliberal “New Democrat” from the get-go. This could easily be seen from, amongst other things, his choice of Clinton-retread advisers and prospective cabinet members, and his association with groups like Robert Rubin’s Hamiliton Project. Obama’s “Hope and Change” was deliberate deception–faux populism.

Syriza, in contrast, is not a neoliberal party. Their promise of hope is genuine, their populism real. If they fail to any produce positive change–and we won’t know if they will for quite a while– it won’t be for lack of trying. Huge difference.

Syriza, in contrast, is not a neoliberal party. Their promise of hope is genuine, their populism real. If they fail to any produce positive change–and we won’t know if they will for quite a while– it won’t be for lack of trying. Huge difference.

And you say this makes SYRIZA “better” than Obama? How? What I have observed is a party making promises it never intended to keep (its post-election negotiating strategy being the tipoff), getting elected on those promises, making irksome noises to offend its overlords (what you call “fighting,” presumably), then immediately surrendering and declaring its failure a success. As I have said, this dubious strategy could still succeed if there is a Leftist uprising across Europe but the manner in which SYRIZA has conducted itself after the initial protestations suggests that is unlikely and this will indeed be the Greek version of Obama’s Eleven Dimensional Chess. I hope I am wrong. We will see.

And you say this makes SYRIZA “better” than Obama?

With an anti-austerity party in power, there is at least a chance of escaping or softening the austerity regime. With a neoliberal party, there is no chance at all. Obama is a neoliberal, militarist and global warmonger. Yes, Syriza is better.

Regarding the recent agreement, James K. Galbraith writes:

“In fact, there was never any chance for a loan agreement that would have wholly freed Greece’s hands. Loan agreements come with conditions. The only choices were an agreement with conditions, or no agreement and no conditions. The choice had to be made by February 28, beyond which date ECB support for the Greek banks would end. No agreement would have meant capital controls, or else bank failures, debt default, and early exit from the Euro. SYRIZA was not elected to take Greece out of Europe. Hence, in order to meet electoral commitments, the relationship between Athens and Europe had to be “extended” in some way acceptable to both.

[…]Provisions relating to tax administration, tax evasion, corruption, and modernization of public administration are, broadly, good policy and supported by SYRIZA. So it was not difficult for the new Greek government to state adherence to “seventy percent” of the memorandum.

The remaining “thirty percent” fell mainly into three areas: fiscal targets, fire-sale privatizations and labor-law changes. The fiscal target of a 4.5 percent “primary surplus” was a dog as everyone would admit in private. The new government does not oppose privatizations per se; it opposes those that set up price-gouging private monopolies and it opposes fire sales that fail to bring in much money. Labor law reform is a more basic disagreement – but the position of the Greek government is in line with ILO standards, and that of the “programme” was not. These matters will now be discussed. The fiscal target is now history, and the Greeks agreed to refrain from “unilateral” measures only for the four-month period during which they will be seeking agreement.

[…]the political sea-change that SYRIZA’s victory has sparked goes on. From a psychological standpoint, Greece has already changed; there is a spirit and dignity in Athens that was not there six months ago. Soon enough, new fronts will open in Spain, then perhaps Ireland, and later Portugal, all of which have elections coming. It is not likely that the government in Greece will collapse, or yield, in the talks ahead, and over time the scope of maneuver gained in this first skirmish will become more clear. In a year the political landscape of Europe may be quite different from what it appears to be today.”

——-

It seems to me that Syriza coming to power has opened new possibilities. It all may end in failure–or it might not–the future is open.

Krugman’s analysis of the agreement is that it’s kicking the can down the road five months. The people who’ve read the details closely say that it’s all sentences with double meanings, which can be read one way by Greece and the other way by Germany.

That’s…. OK. It means it’s a nothingburger and the thing to look at is what happens *next*. This gives the Syriza government some time to figure out what’s actually going on (they didn’t have a shadow cabinet or anything, you know).

Galbraith is right:

Thus, Syriza needs time for two things: 1) to gain control over the government bureaucracy prior to any major event like Grexit, and 2) time to convince the public that it is sincerely trying to square the circle and win Troika acceptance of a program the Greek people can live with. Thus, the negotiations continue. And of course Yves is right that the Troika is bearing down and trying to crush the Greeks, using every advantage they can.

But, Grexit is a given. However much Syriza may surrender in order to win Troika approval, the people of Greece are simply not going to tolerate much more Austerity. So Syriza has the choice of capitulation in order to keep Greece in the Euro, or refusal. If they capitulate, then they will face increasing political opposition within Greece and eventually will be replaced with a government that will refuse to capitulate further, thus triggering Grexit. That party will probably be Golden Dawn of course, which bodes well for nobody.

Since the Troika will never admit that Austerity has created a death spiral, there’s zero hope for a long term sensible outcome. And no matter whether the imbeciles in Germany believe that Grexit would be “contained” that belief is a fantasy.

So, this is a tragedy that is foreordained. The long-term question is “can Syriza manage to stay in power and handle the intensely negative fallout of Grexit after being forced out or will some other party step in?” And the most important question is “what effect will all this have on Portugal, Spain and Italy?”

Isn’t the Greek public though part of the problem? They, understandably, want an end the disastrous austerity. However, the also don’t want to leave the EU. Syriza doesn’t have a mandate at this point to leave the EU. Staying in the EU guarantees austerity, the leaders of the EU, the IMF, Germany all are committed to austerity and won’t budge. So, what is Syriza to do but try their best to make austerity slightly less horrible?

It seems that a referendum on leaving the EU is in order. If the Greek people chose to stay in the EU or to leave then Syriza has the responsibility to explain the implications. However, staying in the EU and expecting an end to austerity is illogical. It isn’t going to happen. This should also be a warning to the countless other countries in the EU that are in similar positions as Greece, or will be at least. Hell awaits.

Look, a poltician under any name or disguise is like being back at school when the spelling bee bullied the bumble bee.

They all come with a sting and we’re still facing bees.

I hate to break it to you, but Syriza has amounted to nothing from the very start.

Syriza was always a short-lived dream, at most a diversion, some red meat thrown to the people of Greece to

calm them down

Tsipras knew from the start he could never deliver on the outrageous promises he was making writing

off the exit option and he kept piling up lies he sold his countrypeople on

As for Varoufakis, with all is rugged appeal, his economics has always been pretty shaky, to say the least

Forget his modest proposal (a central bank running up debt with a private bank??)

Look at this video for a primer in YV’s thought

https://www.youtube.com/watch?v=1KSmcUyAZwU

His takeaway from the Argentina’s case is that he would let Greece default, but without abandoning the peg,

that is without exiting the Euro. How long will it then take for the current account deficit to rise back

to unsustainable levels?

Can’t Professor Varoufakis see the link between competitiveness and rising trade deficit?

He talks about public debt, which is at best a periferal issue, but never tackles the issue of private debt which

is at the heart of the present crisis…Sorry chap, that’s an F

He also says we cannot devalue because we don’t have drachmas in our pockets… YV fails to grasp

that 90 percent plus of what’s called money is just accounting numbers on computers; cases where

you first print the bills and then exit are few and far between

To top it off he says that Greece got no soyabeans (sic) to sell abroad, and he may have a point here. Notice tho that export fetish is stille there …we are in the Troika’s frame of mind…what about import substitution policies, expansionary fiscal policies made possible by the exchange rate flexibility?

There is more, but you get my drift, don’t you…

His “modest proposal” uses fiscal transfers, in the forms of EIB investments, to re-balance Greece and other countries economies without having to recourse to deficit-devaluation cycles. This would be a first step towards a “federalization” of Europe, where eurobonds exist and at least part of some social policies come from “federal” budgets.

“This would be a first step towards a “federalization” of Europe”

Well, yes, but go tell Berlin…

For an insider’s critical take on Syriza, check out The Alternative in Greece by Stathis Kouvelakis. His bio on Jacobin says that he serves on the Syriza central committee. Pay particular heed to his historical analogies in the final section, called “How to Avert Total Defeat.” The allusion to Lenin—unless it’s George Orwell—may cause a shudder, but it does call to mind the two Russian revolutions of 1917. Syriza’s victory looks something like the first. It’s not a neoliberal party, but it’s hamstrung by its unthinkable, Grexit, the equivalent of ending the war with Germany. Its reformist, “errant Marxist” intelligentsia came up with reasonable, humane, civilized proposals, but without a plan and the will to assert democratic and economic sovereignty, Syriza can’t escape the underling’s suffer-what-we-must position when up against an unrelenting neoliberal project for domination. For all the media talk of Syriza as a party of the far or radical left, that’s the tragedy of the moderate. So far.

The Greek electorate wants (1) to remain in the Euro and in Europe and (2) a better deal from the Troika. Unfortunately, (1) contradicts (2), because (1) means Syriza has no weapons, hence no bargaining power, hence can’t get a better deal.

Of course, faced with a weird form of democratic deficit, one arrives at… The leading role of the party! Which is how I read the Jacobin piece.

Interesting take. Here’s another, perhaps no likelier than direct democracy without representative or party intermediaries …

Capitalism didn’t come about exclusively because somebody named Adam Smith dreamed it up. It doesn’t exist as a reifiable thing outside history. It grew and continues to evolve out of practices and power relationships, with “theories” for their description, rationalization, and evangelism. The EU money managers can beat back democratic sovereignty because money knows no borders, but politics does, and that fragmentation weakens it, even apart from the multiplicity of cross-purposes inherent in any mass movement. For a Varoufakis to escape the TINA trap, the Greek left needs not only ideology but trading partners. To answer neoliberalism, which is borderless practically by definition, the left may need a counter-EU for the transition away from the euro. A tall order with risks of its own, but if the EU can’t, or can’t yet, change from within and a Syriza can’t, or won’t, go it alone for fear of horrific repercussions, it might need to fight neoliberalism’s internationalism with internationalism of its own. The song’s already written.

Time for a referendum, I’d say. Their strategy was dictated by popular opinion: their voters mostly wanted out of austerity but not the EU. At this point, they should be asked which they really want. Of course, that’s what got Papandreou overthrown, the end for Pasok. But Syriza is on stronger ground electorally.

Also: as others have pointed out, they’re really playing for time, betting that upcoming elections in the EU will give them a much stronger hand – or produce a mass exit from the Euro, probalby the only real solution.

Anyone seen polling #’s from Germany? Is Merkel as shaky as she should be? Yesterday I posted a poll that showed shockingly high support for radical change – in Germany. That society is trembling.

To quote a colleague:

“He [Varoufakis] has said and written that a Greek exit would be catastrophic. There have been many opportunities for the Greek gov’t to hint otherwise. At some point it’s not legality, political maneuvering, or popular support. It is just what the leaders believe. It is why Jamie Galbraith is defending the deal on the merits and not with a three dimensional chess analogy.”

It would be highly cruel for Syriza to be openly maneuvering for Grexit when that “solution” would bring horrific suffering to the Greek people in the near term. Plus, they did not campaign on Grexit and cannot claim any mandate for it. It’s completely different however if they are FORCED out for refusing to compromise on basic principles. They keep saying that their red lines in the sand are not bluffs but real red lines. That remains to be seen of course and we’ll know more how far they are willing to bend in the next 4 months.

But Syriza cannot sell continued Austerity to the Greek people. They can compromise all they want, but if they go beyond what the public will accept then they will simply lose support to more extreme politicians, particularly Golden Dawn. I would expect support for Nazism to shoot upwards in the next 6 months anyway since the death of hope for immediate positive change and the continuing stalemate with the Troika will only increase radicalism on the left and right margins. Varoufakis has said repeatedly that given current political reality, only Golden Dawn is going to profit from chaos, so his job is to save the Eurozone despite itself.

Given the fatal imbecility of the Troika and the governing political classes in Germany and the North and their fatuous belief that Grexit can be “contained” there’s simply no hope for solutions within the Eurozone. The Greeks have already endured Great Depression level suffering. They simply won’t starve quietly for an indefinite period. In 1932 hungry mobs stoned the Presidential limousine as Hoover drove through the streets of Washington and democracy collapsed into chaos in Germany. The same thing is going to have to happen, because the 1% are always like the Bourbon Dynasty of France. “They never forget and they never learn.”

“Despite all the softening language, the Eurogroup and the Troika (or as docg calls them, the Eumenides), see the bailout framework, with all of the required structural reforms, as still operative”

——-

The EG/Eumenides may show greater “flexibility” and acquiesce to some real, if limited, softening of austerity; a number of analysts have made that case in detail, and I’m sure their arguments will be repeated again here.

Equally important, however, is the question: does Syriza see the previous bailout framework, with all its required reforms, as still operative?. If they don’t, expect a long, grueling, crisis-ridden war ahead, the course and outcome of which is not simple to predict.

Syriza need the money and does not seem to have done much in the way of contingency planning. It keeps trying to act as if it can negotiate, when the Troika sees it as a supplicant. The Troika does have some reasons not to want to force Greece into a Grexit, but the Northern bloc, which has the most say, views a Grexit as a contained event. The US thinks otherwise, but not giving the Greeks the extension would have led to the riskiest version, a disorderly Grexit. The other reason for cutting Syriza some slack is they are the only party independent of the oligarchs and thus able to implement real reforms. However, the government is utterly inexperienced, so it may be unable to execute well enough even with genuine intent there.

Recall that the IMF sees its credibility at stake, and it feels it has already given Greece more slack than it deserves.

If Greece does not bow to the IMF and ECB soon, it will be forced to engage in budgetary experiments that will be de facto path-paving for a Grexit. The US might not want a better planned Grexit, but the ECB looks to see that what the Greeks are saying they want if they continue to defy the Troika. If the IMF is of that view too, they won’t see any reason to be very indulgent.

Given that they continue to insist on the adoption of policies that their own research has shown to be counter-productive, they should be worried about their credibility.

The research side and the program side are two different beasts.

The New York Fed also produces research that is often far more enlightened than its policies, and it has not suffered an iota for that either. The IMF’s power lies in its program side, not its research wing.

Due to the utter, counterproductive failure of every “Washington Consensus” plan implemented to date, the IMF has no credibility whatsoever among global voters, or among the majority of governments around the world. So what credibility does it have to lose?

Since when do “global voters” have any power? The US, nominally a democracy (or more accurately, a republic), had the TARP passed over clear, overwhelming public opposition. That was part of the biggest transfer of wealth from the public purse in history. And we’ve discussed at length why the “paid back the TARP” meme is three card monte. And look at the Asian Crisis. It’s still called the “IMF shock” in South Korean because its citizens perceive that they didn’t need to knuckle under to the IMF but nevertheless were required to.

The Eurzone has even more of a democratic deficit than the US does, with the ECB and unaccountable Eurozone bureaucrats calling many of the shots. As we’ve discussed in past posts, the ECB has a particularly influential role in the Greek negotiations.

Indeed. This seems to be the major problem with the line of thinking that says we can recapture/reform our gov’ts and multi-national agencies if we just “get good people into them.” The sad truth of the matter is that the “good people” almost never make it to a decision-making level–all those seats being reserved for insiders and political appointees.

The good people do what they can, but the bad people make sure that isn’t a whole lot. But in this age of information, I have to wonder why more journos aren’t holding Lagarde’s feet to the fire as to why, exactly, they are ignoring their own research in their policy requirements. Has Christine had to answer for that yet?

It’s not just a line of thinking; it’s a rationalizing narrative and an identifying narrative. In particular, the machinations of retail politics serve much the same role as the thymus: selecting for people who respond to the Exceptionalism of the ruling class, but not to the point of attacking it. The hero narrative provides an energy sink for too-rambunctious kids so that they “behave” during dinner.

Do we know that the oligarchs aren’t in league with the Troika?

Doesn’t a weakened Greek Government play into the hands of the oligarchs?

If the Troika wanted to cut Syriza some slack, wouldn’t they have given the new government some time to organize and not force an early negotiation?

I’d go a step further…

Isn’t the Troika itself an oligarchy?

No, remember that the Greeks are “dirty Greeks” and their top wealthy are not well represented in the Davos crowd.

The ECB was perfectly content to crush Cyprus because its wealthy were Russians and British retirees, for the most part. A lot of foreign pressure was applied to Germany, including from NATO, which is why they backed off a bit last week.

At the risk of being a broken record, if (assuming that my premise holds water) the real policy decisions are taken by the German finance ministry bureaucrats and — the real big hitter — the Bundesbank then nothing, absolutely nothing, is going to change. Unless and until Syriza can do some serious convincing.

It’s not even as if the Bundesbank has been a secret squirrel about where it stands. In fact, they’ve gone on what amounts to a PR offensive to make it even more clear than it was before (if that was possible) what its mentality is (see here, here and here).

Syriza should have read these signals a bit better in my humble opinion. Cosying up to the Bundesbank would have been my first move. But then, we can all be armchair experts can’t we… Greece has no good options and only a few less-dreadful ones so is probably making the best of its weak hand.

Syriza is playing for its voters. They know they have to sever the euro ties with Germany, but the voters want to stay in the euro, so they have to show that they gave it a good shot before leaving.

Think about it this way and you see that Syriza is doing things pretty much exactly right.

Maybe, but that assumes that for Greece, life outside the Eurozone is better than life inside the Eurozone. There is scant evidence to validate that assumption so it would by necessity be a gamble. What Greece needs to actually provide a fix for its problems is non-extractive foreign direct investment to rebuild its economy. And for some things, like healthcare and education, it does also need what you’d probably best term “aid”.

Being inside the Eurozone or outside the Eurozone does nothing whatsoever to facilitate either of those (and you could argue the remaining in the Eurozone is better for attracting foreign investment). I know sometimes round here we can end up basically arguing against everything capitalist (I’m no stranger to that on occasions!) but even though Greece has gone through / is going through a horrible episode of The Failure of Capitalism, trying to figure out how it can somehow “escape the system” is probably not going to produce anything which will benefit Greece.

I think rather that it needs to work out how it can convince the other actors in the system to adopt policy responses which are a little more in Greece’s interests; Greece’s’ interests are actually the same interests as those of the other actors, by and large. Instead, we seem to have ended up with heads’ of state / IMF ego politicking, which won’t get anyone anywhere.

The Greeks took what they wanted. It’s only a 4-month truce period for the next battle. There are no specific commitments actually from the Greek side in Varoufakis list. Tsipras will exploit this period to build coalitions, search for alternative funding (BRICS) and get ready for Grexit if necessary.

With all due respect, I do not know what you are smoking.

It is not a four month truce. The Greek government is out of money as of early this week, Feb 24. That was reported two weeks ago in the Greek press. The government has to bend to the IMF and the ECB or else default on an IMF loan coming due in March, as well as not make payments to employees and vendors in Greece, which will intensify the contraction and create ill will in the population.

Russia and China are not riding in to the rescue. It’s too geopolitically fraught and too unrewarding. Russia has already rebuffed Greece for now, and the Chinese have similarly been cool. If they actually do harbor any interest, they get far more bang for the buck with less hassle if they wait until a Grexit and pick up the pieces then.

Yves

Can you expand on “It’s too geopolitically fraught” Like in what way?

Russia extending any support to Greece would greatly escalate over-high US hostility. Plus Russia is already an ally with Turkey, and Turkey hates Greece, so Russia has other reasons not to do more than bare minimum moves to help Greece, like agricultural trade. And Russia is in no position to extend much support to a basket case like Greece with oil prices where they are. There is no upside to Russia acting now. There is an old saying in finance, that you don’t buy a company on the courthouse steps (pre bankruptcy) unless you expect competition buying it out of bankruptcy. There’s no willing competition in the “helping Greece” category.

And Greece was told off by IIRC the EC and NATO after its loose cannon defense minister kept trying to make overtures to Russia that they needed to cut that out if they wanted to negotiate for money as well as stay in NATO. So going to Russia is a non-starter from every perspective.

I’ve linked to it before, and don’t have time to find it now since I desperately need to turn in, but China has already had an official say what amounts a statement of no interest.

I think I know which link you mean about China and I read it.

In terms of Russia and Turkey though. What is it that Russia is afraid of losing from Turkey?

IMF: “the letter is not conveying clear assurances that the Government intends to undertake the reforms envisaged in the Memorandum on Economic and Financial Policies.”

——–

If the letter does NOT contain “clear assurances” (IMF), nor “concrete proposals and commitments” (ECB) , how can it said at this point that Syriza has capitulated?

Straw man I never said that Syriza capitulated. I said the ECB and the IMF are making it very clear that Syriza needs to toe the line in order to get bailout funds. Both the Troika and the Eurogroup need to approve a final list of reforms before any of the bailout money is released. As the post stated, if Syriza doesn’t get with the program, it will have to do things like not pay government employees, vendors, pensioners. or use funny scrip to pay them like tax anticipation notes, and default on the IMF in March. The government is out of money and needs the dough. I doubt the IMF is very kind to a country that is in default. That will no doubt work against Syriza not only in negotiating with the IMF over getting any money during the four months, but will be seen as a demerit in trying to reach a longer-term deal before Greece has even bigger payments due over the summer.

Basically, the not-very-coded message to Greece was that it needs to comply with the existing bailout terms or start looking into other options.

“Straw man I never said that Syriza capitulated. “

Okay sorry, I wasn’t referring to you in particular with that question. Others posting here have used that term or similar (“the level of betrayal is Obama-esque”.)

————

“I said the ECB and the IMF are making it very clear that Syriza needs to toe the line in order to get bailout funds”

If Syriza has NOT capitulated, i.e has not. agreed to accept austerity conditions without significant softening, and the troika et al. are still demanding that they do, then the war is still on, and it could be a very long one.

Are you predicting that at some point in the very near future Syriza will be forced to either capitulate or take steps toward default/Grexit?

You keep ignoring information and engage in broken record tactics. That is dishonest argumentation and not welcome here. And the straw manning is another tactic of this type.

Syriza has no staying power with no ability to fund government operations and its banks on ECB life support. That means it has no bargaining leverage. You keep acting as if it does. Syriza has repeatedly made statement that were utter bluster, that it didn’t need the bailout money, that it could go beyond March without getting outside help, that Russia was interested in funding them. You don’t make statements like that in negotiations where you will be caught out bluffing repeatedly with an empty hand. It reduces your credibility and raises questions about basic competence (are they just terrible negotiators or do they also have no handle on the state of the governments’s finances?)

Syriza can fund government operations by printing money. Syriza has *ALL* the leverage; the IMF, Germany, ECB has NO leverage.

Let’s get down to brass tacks. The Bank of Greece has its own printing press and prints its own banknotes. Greece also has a local mint which can mint coins. Greece has its own computers for making electronic bank records.

Who’s going to stop them if they start printing money without ECB authorization? Nobody, that’s who.

The problem here is that the IMF, ECB, and Germany *think* they have leverage, when they have NOTHING. This is causing them to act insane in the negotiations. They should not bluff.

Syriza leadership is firmly committed to not leaving the euro.

I keep telling readers not to want Syriza to be something different than what it is. Only about 1/3 of its MPs are willing to go that route. The majority are bourgeois pro-Europeans. And Varoufakis himself, the loudest about the importance of staying in, exercises disproportionate clout not merely by virtue of being Finance Minister but also by having gotten far more votes than any other MP.

The level of betrayal is Obama-esque. The only “hope” in the aftermath of SYRIZA’s humiliation would have been for other Euro-supplicant nations to join with Greece and challenge the neoliberals. If that were to happen, SYRIZA’s “strategy” might be validated. Unfortunately, SYRIZA’s utter capitulation coupled with its pathetic claims of success make that Leftist resurgence very unlikely. The lies are probably more corrosive than the failure. The more likely result now is a quick collapse of the SYRIZA goverment. In fact, if they had any pride or decency they would simply admit failure and resign so someone else could try to do better. But I expect the Greek people will take matters into their own hands regardless unless, like Obama in U.S. politics, SYRIZA has destroyed hope altogether. Tragic.

A lot will depend on the reaction of the Greek people. How much more can they take before the brutality strips away any illusion that things will get better or are still livable. If “reforms” go after pensions with enough vengeance, for instance, public opinion between age groups may well coalesce. I don’t think Europeans, particularly French, Greeks and Spaniards but by no means limited to them, are quite as gullible to propaganda as we are when the chips are really down, so media attempts to portray the elderly as public menaces trying to mooch a free ride will be less successful than the same efforts here. They have lived through too much horror too recently to fully trust what any government tells them though it is true that all the modern cheap junk encapsulated in the term, convenience stuff (including tech) has sadly had an incredibly powerful numbing effect on virtually everyone.

A lot will depend on the reaction of the Greek people.

Yes, and that Greek-man-on-the-street piece in the morning links was not very encouraging. Also, perhaps an even more important question is how SYRIZA’s play is intrepreted in the other Euro-supplicant nations. Has SYRIZA really fought I think it would have given great encouragemnt to its potential (and essential) comrades. I think there was tremendous excitement when SYRIZA was vocalizing its position and its objections to austerity. Now? It appears that part of the deal was for SYRIZA to STFU. That won’t help build solidarity, IMO. But things are still in flux and time will tell.

P.S.

It’s tough to make predictions, especially about the future.

— Yogi Berra

:-)…

[…]perhaps an even more important question is how SYRIZA’s play is intrepreted in the other Euro-supplicant nations. Has SYRIZA really fought I think it would have given great encouragemnt to its potential (and essential) comrades.

I agree, but I have been quite surprised by Podemos’ lack of enthusiasm as well as that of Marine Le Pen. Reading Yves’ comments, it seems that they have said little or nothing to encourage SYRIZA’s efforts before or (I’m not so sure of after) the capitulation. If SYRIZA was so important when they were calling a spade a spade, why not at least some supportive noise from the comrades?

I stand corrected on Marine Le Pen.

I am not surprised by Podemos’ and the Italian Grillo’s party because, like Syriza, they are a fraud. Their anti-austerity posturing is totally bogus: you can’t possibly do away with austerity and keep the common currency. Their purpose is just to fill up a void, a political space, so that the people think that they can rely on somebody to fight the good fight. But that’s an illusion

As for the French, they seldom look further than their own belly button, so they have not taken good notice of what’s happening in Greece. But one can rest assured that everybody else will take notice when Marine Le Pen wins the next election…And that’s the real tragedy…

There is another way to look at it, which is that it is necessary to run through all the easy/fake options first in order to open up space for more radical options. I think most people hold out hope that things can be fixed without severe pain/disruption, at least to their own lives. And it takes the failure of those half-measures to awaken people to the need for more serious measures.

Paper tiger Greece engages in kabuki theater “gamesmanship” so long as they avoid printing up reserve drachma and changing banking/payment systems to handle a new currency.

Without that real threat, they remain the EU’s b*tch. Note the result.

If Syriza was preparing the metal plates to print drachma from they day they got into office, they wouldn’t have managed to print them yet. There’s a reason for kicking the can down the road four months.

Confirmation the Eurogroup was washing hands Pilate-style when authorizing troika to take the lead in negotiations. They’ve accepted Greece will either obey or leave and don’t much care which any more.

honestann, a commenter on ZH, made a statement that seems to sum it up:

Greece is acting like a first grader who thinks he needs permission to go the rest room in order to avoid crapping his pants.

(correct me if i’m wrong, but) Yves has repeatedly made the claim that over 90% of previous Greece’s bailout funds went right back into the coffers of the international banking system. for Syriza not to even mention this and allow the discourse to focus on “tax collection” (thus accepting the legitimacy of these previous “contracts”) certainly makes them appear to be the new kinder-and-gentler hall monitors installed to keep the little kiddies in line.

If Greece has been forced to accept the results of a con scheme, that makes it doubly egregious. Let’s hope something good happens this week.

http://criticallegalthinking.com/2015/02/23/greek-debt-confidence-trick/

great article, thanks.

But what Vourafakis’ statement also represesents is a hand-grenade in terms of the Keynesian ‘confidence trick’ that is necessary to maintain the fiction that the loans on the books by the French and German banks are still ‘performing.’ According to a Wall Street Journal Report, “European Central Bank President Mario Draghi warned Mr. Varoufakis that such statements threatened to accelerate the flight of deposits from Greek banks, officials present at the meetings said. Draghi was urging him to be careful,” said one official who was present Monday. “Careless communication is not good for the banks.”

this reminds me of the statement BoomDiesel made at last Friday’s press conference, something to the effect that THE BANKING SYSTEM MUST NOT BE QUESTIONED.

another quote : Under Maastricht accounting standards, it is clear that as long as Germany and the EU can classify its loans through the troika as debt that is still owed, it will not be reflected as losses to German and French banks.

so who has more to lose really?

wonder if the Hellenic Republic is beholden by the legalese in one of the many “Agreements” to stick to the Maastricht standards?

This is not going anywhere as an argument with TPTB. And I doubt the NPV calculation is right, since with deflation, the present value of deferred debt is actually higher, not lower.

‘The IMF represents 188 states around the world, many of which are already grumbling over the fund’s disproportionate support to a small European country.’

IMF quotas are roughly proportional to the economic size of countries, so rich countries dominate. By unwritten agreement, a European

stoogedirector (currently Christine Lagarde) always heads the organization’s main office in Washington DC.Traditionally, the IMF pushed devaluation as part of its rescue package. This dynamic is on display with a vengeance in Ukraine, as the Ukies let the hryvnia slide to a chorus of IMF ‘attaboys.’

Not so in Greece, the odd man out. Treating its eurozone membership as an unassailable constraint, the IMF’s program for Greece involves ‘sweating out the deflation.’

One can contemplate that if the IMF really were rendering independent advice, it might find itself at odds with the Eurogroup over the harshness of Greek austerity. But with IMF director Christine Lagarde being a product of eurozone politics, the best interests of borrowers, and the IMF as a lender, get subsumed to the failing struggle to maintain the flawed design of the euro currency.

Under Bretton Woods, Greece already would have devalued some 15% to 30% against the dollar and euro, and would be promptly on the mend. But now (to quote a prominent resident of Père Lachaise cemetery) ‘you are locked in a prison of your own devise.’

I’m told otherwise, that the European program team at the IMF is a bunch of knee-breakers.

Yes; agreed. Whereas if the IMF were giving unconflicted advice, it likely would split with the Eurogroup (whose primary objective is to ‘preserve the union’ rather than to help Greece recover). A more objective IMF, following the Hippocratic oath, would tell Greece, ‘it’s your choice if you want to stay in the EZ, but its rules mean a decade of depression.’

Speaking of Ukraine, yesterday the hryvnia was at 33 per dollar. Today, Reuters reports that some exchanges were made at 39 hryvnias per dollar, until trading ground to a halt entirely.

Two troubled IMF programs, with a night-and-day difference in how the currency regime is being handled (but badly, in both cases).

The four months gives SYRIZA a slight chance to get control of the Greek Dawn dominated police. Failing that they have no chance to exit the EZ and retain power.

Yeah. The IMF, ECB, and Germany are objectively pro-Golden Dawn. Syriza, however, has a tricky political problem of defanging Golden Dawn while getting control of the government.

So, given this analysis, what would you do if you were Greece now. I would go dark for a few days and let everyone speculate. I would create technical obstacles to capital flight and bank withdrawals, not controls exactly just red tape. I would respond to Draghi with my own Dear Jeroem letter asking for detailed clarification of the last line of Mario’s in light of the upcoming failure of the Greek banking system if, in fact, the recently negotiated agreements are to be interpreted by the ECB and the IMF as merely a continuation of the previous Memorandum. I might go in for a little name calling–talk about negotiating in bad faith and about overriding the prerogatives of a sovereign state. What certainly seems clear is that the Troika and its constituents were quite happy with the way they had things structured and are reverting to form and, more importantly, that they have not not really heard the message that under those conditions a) Greece will certainly succumb to crisis near term and b) under any imaginable circumstance Greece’s capacity to repay is severely impaired. Varoufakis will have to repeat this a thousand times before it reaches the ears of the Bundesbank. I expect Greece will learn to extort small advances from its creditors at the ultimate moment without compliance with the conditions. Anyone who has handled loan workouts is familiar with the situation where the debtor calls up and says, “I need funds today to cover payroll. The checks have already been released to employees.” To the extent that Germany controls the disbursements, they also control the moment at which Greece defaults. As for leaving the EURO, does anyone really know how that will work and what will happen after?

I’m afraid you don’t understand the ECB’s warning. If Greece takes the position that it or its banks are insolvent, the ECB will be (in theory) forced to end its backstop to the Greek banking system, which would lead to its immediate collapse. Greece would then be forced into a disorderly Grexit. It would need to impose capital controls, nationalize its banks, and start issuing its own currency again in order to recapitalize them.

Basically, the message to Greece was no more talking about insolvency and bankruptcy if you are negotiating with us, and Greece has dutifully complied.

Now the ECB does not like that idea because it will also lead to losses that will ultimately hit Eurozone taxpayers. But the party that will suffer the most is Greece and depositors in Greek banks.

But this is inevitable. You can’t take a loan from a loan shark with impossible compliance terms, and expect a different long-term outcome. The troika will choke the Greek economy, and the Greek economy will go bankrupt. It may be satisfying for the Germans to whip a work-mule, but when that mule dies and everyone is horrified by the spectacle, why should we be surprised that it died? Syriza would be well advised to take matters into its own hands and find creative and destructive ways–short of war–to pester, nag, debilitate, and otherwise frustrate the functioning of the EC bureaucracy, payments systems, loan terms, foreign policy goals (especially regarding Ukraine). File dozens of suits in the European court, such as German gold reparations from WWII, or to get clarifications on rulings that pit one country against another, or better yet, everyone against Germany. The Germans get a pass on trade surpluses. Why is that? And Syriza needs to lay the groundwork for inevitable default. If they have to go down, they should go down fighting.

I think you misunderstand the objectives. There is a large contingent that is utterly indifferent to Greece’s fate. Indeed, the lenders would argue that profligate Greece is getting what it deserves. You underestimate the level of bigotry against Greeks in Europe.

Moreover, crushing Greece would serve another objective: of showing the enormous human costs of defying the Troika to scare rebellious Portuguese, Spanish, and Italian voters into thinking twice.

However, Marine Le Pen will not be deterred. The voting rules in France work against her (on a second round, the establishment parties, if they can agree on which non-Le Pen horse to promote, can beat her back) But there is a possibility that her opponents will be divided and she could win in 2017. And the officialdom also underestimates how dangerous on many levels it would be to have a failed state in Europe, which is what will happen if the Troika continues on its merciless course.

It’s the neoliberal equivalent of the domino theory. When Nixon and Kissinger crushed Allende in another south, it meant to show that the U.S. would not countenance a leftist regime in its sphere of “influence,” a word like “defense” in Defense Department. It fomented a right-wing coup rather than let another Castro slip under the fence.

Defying the Troika will cause an instant economic boom which will be visible within six months.

The Troika therefore must keep extending money to Greece in order to deter a simultaneous Spanish, Italian, Portuguese exit. But I’m not sure they realize this.

Defying the Troika means a banking system collapse. I suggest you look at what happened to Iceland and Cyprus. Michael Hudson and Jeff Sommers have done a lot of work that demonstrates that Iceland is still suffering from the aftermath of the banking system bust, that it’s “recovery” is another one of those “bounce off a bottom” that is overhyped by the financial media and economists.

Greece has already reduced wage rates by over 15% and has gotten way less in the way of improvement in exports than economic model predict.

re iceland, i have no data on the country, but i would bet that the malaise is largely gone and inequality has lessened.

according to wikipedia, the GDP per capita is roughly $42k with an unemployment rate of 4.4%. only blemish appears to be high inflation, but unless things were massively better pre-crisis, it’s hard to see how that is anything less than a stunning success story by global standards.

iceland listened to the will of its people, jailed its criminal bankers and nationalised its failed banks, and that creates a huge boost to national morale. of course, iceland has dominion over its currency, and not having that is a massive disadvantage for greece.

saying iceland is suffering seems to be a scare tactic to keep other nations from taking over their financial institutions and reining them in.

You are correct that I do not understand the ECB’s warning. Are you explaining then that the rules are such that ECB can prop up an insolvent country or its banks so long as they, the insolvent country and its banks, do not accurately or honestly describe their condition? And the rationale for this is to prevent the recognition of the loss content in the Greek situation, since that means the German taxpayer will have to bear the losses. I have in mind the Pettis piece posted on your site which basically said we are watching a struggle about who will pay, the German middle and working classes or the Greek. And so the whole structure of agreements and memorandums and reviews and so forth is just meant to provide an edifice for keeping the cost of protecting the German taxpayer as low as possible. Is that what it all means?

Another thing I do not understand is what is meant by disorderly Grexit, or orderly Grexit for that matter. There is surely some formal, legal mechanism or framework for separating a country from the EURO currency union, whether voluntary or involuntary, as a result of the decision of the departing member or as a result of a decision of the remaining members. What is it? One can say that a country that is forced to issue its own currency in the face of a systemic bank collapse has de facto departed the single currency union, but it would also seem to represent a series of defaults under a variety of agreements, treaties and contracts. Is it disorderly Grexit or default that triggers the unwelcome recognition of impaired Greek paper on the books of the Bundesbank? Either way, the finger on the trigger is not Greek.

Finance Minister Wolfgang Schäuble has it right. Syriza lied to its supporters to get elected and they are probably lying to us (its creditors) about meeting its obligations. In less than a month, they have managed to completely discredit themselves to all parties involved, achieve nothing of substance, and cast a shadow on future reform movements, all to get a deal that changes and solves nothing.

I don’t think they lied. I think they had a misconception of what they were getting into. Its one thing to spout political theories and campaign rhetoric within ones own backyard. Its quite another when you go out into the world and face people who have been wielding power for years when you have not. I think Syriza expected reason and as many have mentioned, do not have a contingency plan in place to deal with unreasonableness. The Syriza team are neophytes in the knife fighting that is international politics.

It takes a lot of confidence and willpower to turn the status quo on its head. I don’t think Syriza has arrived there yet.

In the immortal words of Frank Underwood. “If you don’t like how the table is set, turn over the table.” Syriza should listen.

They did lie when they said after they got into office that they had the ability to get through at least March with no bailout money, and perhaps as long as till May. Ekathimerini reported the last week or perhaps even the week before that that the government would be out of funding on February 24.

And they lied (or exaggerated to a degree that is the same thing) in so far as they have called these negotiations successful. This sort of doubletalk rankles particularly since it is so contradictory to the message of transparency and honesty they were using towards Germany just hours before they caved. One wonders just how much this back-flip will “fester” with the Greek people.

Pffft. Syriza does not need outside funding.

I don’t know whether they realize it or not, but they have their own mint and their own printing press at the Bank of Greece.

It’s even easier to generate money through electronic accounting: you just order it done.

I may be the only person who paid attention to where the notes and bills are actually printed.

Doesn’t that qualify under applicable EU law as “counterfeiting”, and wouldn’t it be well within some European police force’s mandate to arrest or seize anyone or anything involved?

*Sigh*

No, plenty of readers have commented on this and I was aware of it before he crisis broke. There’s even been discussion of the fact that the serial numbers on Greek-printed euronotes end in “Y”.

Printing more euros than authorized would lead to the Eurozone authorities coming down on Greece like the wrath of God. If you think they are ugly now, you ain’t seen ‘nuthing yet.

Well said. Brutal and succinct.

Tell us, Yves, what do you think Varoufakis was thinking?

Did he think that if he managed to get a few critical words changed (in the agreement) and got his reform package passed, he would have 4 to 6 months to turn things around and rally support for an easing of austerity?

Is that it?

But what now? Now that the troika plans to micromanage every decision (or no $$$) what can Varoufakis do to save his reputation?

I know that must sound trivial, but it now looks like he’ll either be tagged a “sellout” or the man who blew up Greece.

Which way forward?

I am not a mind reader and do not know Varoufakis well enough to opine.

He is an extremely charismatic speaker and is impressively smart, energetic and cool under stress. But he has been given a huge battlefield promotion and I worry that certain critical elements of his new role are so far outside his previous experience that he does not know what he does not know, which is a dangerous position to be in.

Here in the American South we have a saying:

“Don’t go to a gunfight with a switchblade”

Mr Yaroufakis needs help fast.

Jim

The real question is whether Varoufakis is treating the Troikia and Germany as if they’re dealing in good faith (they’re not), or whether he’s running a show-of-good-faith act to prove to the Greek people that the EU is worthless and they need to leave. The latter makes sense.

I quoted this colleague earlier in the thread, and it bears repeating:

“He has said and written that a Greek exit would be catastrophic. There have been many opportunities for the Greek gov’t to hint otherwise. At some point it’s not legality, political maneuvering, or popular support. It is just what the leaders believe. It is why Jamie Galbraith is defending the deal on the merits and not with a three dimensional chess analogy.”

But the colleague might find that reading many statements by Varoufakis show that Nathanael’s position, while lacking some nuance, may be closer to the truth than his own. For YV has “hinted otherwise”.

Varoufakis has put the probability of failure with the Troika & Grexit at >50%. He has said that “we are ready for” it. And just today, he said, “Anything is better than confining us to an austerity hole where we shrink every day,” Yanis Varoufakis interview: ‘Anything’s better than austerity’

So the question is whether Syriza, Tsipras, Varoufakis will actually do what they have often said – put leaving austerity above everything else, including remaining in the Euro. It is still too early to tell, and I do not think that the recent deal tells us this. Rather, what happens in Greece in the next few months will be crucial.

Costas Lapavitsas & Heiner Flassbeck judiciously evaluate the recent deal. They recently wrote a book Against the Troika, which, like Varoufakis, roughly predicted the recent course of events, but unlike him they urge a Grexit & do not exaggerate its (negative) consequences as YV does. But both of them have given qualified support to the recent deal:

Costas Lapavitsas: “The deal was a partial victory, in that it bought time. Any other outcome last Friday would have been catastrophic. But there is no doubt in my mind that the Troika is setting the parameters, even if most of the party is still reluctant to learn this harsh lesson. We’re wet behind the ears,”

Heiner Flassbeck: “What Greece is now proposing and what the Euro Group has approved for four months, has in reality no great importance for the future of the euro zone. Greece has won a small victory, because it was not explicitly required to continue the extremely restrictive fiscal policy . . . ” (Google translation)

Jamie Galbraith seems to be his consigliere…does that reassure you at all vis-a-vis the problem of not knowing what he doesn’t know?

A related speculation: although I don’t know what the Euro-politics equivalent of a Bill Clinton political genius would be, if there were such a person to advise on political strategy who could make a third in that Varoufakis-Galbraith anti-Troika, I’d feel more rationally optimistic.

Of course, the absence of such a strategist for European matters is probably the exact corollary of the same difference between American and European federalism which has made the Euro circle so impossible to square : it is the nature of the case that they can’t have one master politician who “speaks their language.” Instead, they have Angela Merkel!

Be careful what you wish for, though: that lack of an uber-persuasive European voice is an advantage too, given past experience with those who aspired to being Masters of Europe.

No, Galbraith has never run a large government bureaucracy or run an important international negotiation, let alone one with these stakes.

I agree entirely, this is imho one of your most astute takes on Syriza’s dilemma.

I wonder who could serve as V’s advisor on negotiating strategy – does the Lazard team have negotiation specialists? I know they’re been retained to deal (only?) with the debt portion of Greece’s problems, but surely there is someone there who is as clear-sighted, hard-headed, and pragmatic as … well, you! Your final paragraph in this post was very helpful in helping me understand what went awry during the negotiations.

Btw, the figures most frequently cited in the Greek media note that incomes have decreased ~ 25%, and for pensioners and public sector employees, ~40%. The official unemployment figure I saw most recently was +27% overall, and between 50-60% for under-thirties. I stress that these are unofficial numbers – almost everyone knowledgeable in the media cites 60% for the under-thirty group.

Thank you for not sugar-coating Syriza’s failure, Yves. A lot of us had high hope’s for Varoufakis, and his virtually unconditional surrender feeds into growing cynicism of pervasive corruption and dishonesty (not necessarily attributable to Yanis personally) under a global neoliberal regime, especially post-Obama. It’s easy to succumb to wishful thinking, but for me the pendulum has swung far in the other direction — pretty much all pols are self-serving snakes in suits, without a shred of integrity. Your objectivity is appreciated.

Greece ranks high to middling on Transparency.org’s corruption index. It will be interesting to see whether Syriza is as captive to its source of bribes as US pols, or whether it will indeed go after the oligarchs in a serious way within the strictures of the Troika’s conditions. We’ll soon see, but FWIW my bet is no, that firesale privatizations, regressive VAT taxes, and pension/labor “reforms” will proceed before clawbacks, nationalization of assets, or wealth taxes. Tsipras’ speeches will then resemble the hollow tele-scripts of our own fauxgressive charlatan. I do hope to be proven wring, honestly.

This and other commentary is like someone whose been told by a grandmaster – “I’m going to win this game of chess”. After 5-6 moves the person is yelling – “you’ve barely done anything, and the opponents king is not in danger”.

Yes, we’re just in the opening, and it the small strategic advantages being accumulated here that are what is going to tell down the road – assuming of course Syriza continues to play well.

Ok, you think Greece has got a raw deal, but compared to what ? Do you acknowledge that this is quite close to what YV was asking for 3 weeks ago ? Maybe you think he had already capitulated then. Seriously, I’m genuinely confused about what the people criticizing this deal are bench marking it against. It seems to be a scenario where the Troika says ‘sure implement all your election promises immediately, and here’s E50B to do it’.

Yves raises the good point that the government will be out of money in March, whereas bailout funds will likely not be disbursed until April. I was wondering about that myself. There’s a disconnect there, because running out of funds was meant to have put pressure on them in the negotiation, but this makes no sense if, post agreement, they are going to be allowed to run out of funds anyway. I suspect the ECB will now let them issue some T-bills. In any case, having gone through all this trouble, its unlikely that the Troika is going to induce another crisis immediately.

Can’t speak for anyone else, but I’d offer a few thoughts as one of the ‘criticizers’:

1) I would say it’s important to distinguish between Tsipras and Varoufakis. Tsipras is the politican making statements and setting expectations. Varoufakis is one of the ministers brought into the government, someone who has spent much of his time outside of Greece in academia in the US and Australia.

2) What Tsipras laid out was not a tactical project of improving the terrain. He explained a years long process of opposing the concept of extend and pretend, of treating matters of solvency as if the issue is liquidity, of basic human qualities of dignity and pride. If you set big picture expectations, you can’t later claim minor victories as meaningful. That bait and switch is one of the core elements of technocratic liberal enablers throughout the western world, and so someone offering genuine change should be particularly aware of that pattern of behavior of over-promising and then lowering expectations.

3) Syriza took leaving EMU off the table. Like Nancy Pelosi refusing to consider impeachment of George Bush or Barack Obama refusing to consider national healthcare, Syriza demonstrated they were publicly handcuffing themselvse before negotiations even began. There are only two explanations at the polar extremes for such behavior; there is no middle ground. Either an option is taken off the table publicly because it’s actually being implemented privately and time is needed to make it happen, or, the negotiating position is being purposefully undermined to make concessions that wouldn’t otherwise have had to be made more palatable to the public.

4) and perhaps most fundamentally:

Compared to rejecting the legitimacy of financial fraud generally and the Greek ‘bailouts’ specifically.

@washunate, thanks for your reply. I appreciate you engaging the discussion.

I think what you wrote is instructive. You offer no specifics of what Syriza gained (or not) in the current agreement, vs what they promised, or what they gave up compared to what they promised. For example your answer to 4) is just rhetoric. What have they caved on exactly ? You acknowledge in 2) that its a years long process, but why do you think they’ve abandoned that years long process ?

As far as threatening to leave EMU, I think you are just wrong. When Varoufakis says something like ‘if the proposed reforms are rejected, the agreement is dead’, what do you think that means ? You want them to come out and openly blackmail the Eurogroup, but that would be counterproductive, because the Eurogroup can’t be seen to be blackmailed. Everyone understands Grexit is a possible scenario. The right way (which they have done) is to show with your negotiating position that you don’t rule out Grexit, but to make friendly noises about ‘working with our partners’, so that those partners can make concessions without putting themselves in an unsustainable political situation. Varoufakis’ statements about this are actually remarkably direct by normal diplomatic standards.

Yeah, I’m not trying to convince you, just offering a different perspective. I think the most important thing to keep in mind for those of us who aren’t Greek is that we’re not Greek. We really don’t know the nuances and specifics.

However, Varoufakis is a prolific communicator, shall we say. I agree with him on many fronts, and in general like his energy. But he went to negative Nellie mode on this on a topic where I fundamentally disagree with him. He proposes, broadly speaking, that our current system of debt-based Anglo-American empire, what he generally calls capitalism, is flawed. I agree so far. But his policy option is to fix it – save it – rather than replace it with something else. So he has been saying borderline ridiculous things about how hard it would be for Greece to leave EMU. Yes of course there are specific logistical obstacles, but those are solvable problems if one is interested in solving them. Varoufakis is trying to figure out, to negotiate, the specifics of how Greece can pay off the bankster debt that was socialized onto the public. Now that’s a perfectly legitimate approach if one accepts the fundamental premise that our existing financial/monetary/whatever system should be saved.

But that’s not what Tsipras ran on. He ran on figuring out, negotiating, how to extricate Greece from those financial obligations. How to acknowledge the plain truth that unpayable debts won’t be paid.

What Syriza has lost so far, I’d suggest, are two specific things:

1) the ability to claim that the debt is illegitimate, and

2) the credibility of standing for something, of either building a collaborative relationship with Germany OR leading an opposition to financial fraud

This is early in the game, and like Senator Obama when he voted for EESA and FISAA and generally scaremongered right along with the neoliberal warmongers we shouldn’t completely write this government off. It’s possible Syriza has some kind of 11 dimensional chess game they are playing. We can only know that for sure in hindsight.

But at this point, it sure looks like they caved. It seems increasingly likely to me that the extend and pretend game that Syriza opposed for years while out of power will continue now that they are in power.

This is one of those things where I do hope I’m wrong. That would be quite preferable to being right.

The government is out of money NOW. March was what the government was trying to pretend, but Ekathimerini reported that it was going to be out of cash as of February 24. It has a big IMF payment due in March that it cannot make unless it cuts a deal on the reforms pronto. The IMF negotiating team is sure to use that pressure to its advantage.

There is a good account of recent developments here

http://www.telegraph.co.uk/finance/economics/11435649/Greece-to-stop-privatisations-as-Syriza-faces-backlash-on-deal.html

In particular, they’re not really out of money:

“We have various buffers, including €3bn or €4bn at the Bank of Greece. We expect to be able to issue €2bn to €3bn in T-bills soon,” he said. The ECB’s support for Greek banks – curtailed two weeks ago – should be “back to normal” by mid-March.

Also from NYT:

Yanis Varoufakis, said Greece had no immediate threat to government liquidity but “will definitely have a problem” meeting its obligation to make a debt payment of about €1.5 billion next month to the International Monetary Fund and around €7 billion in July and August to the European Central Bank.

But even this is really missing the point. Forcing the Greek government to run out of money, or to default on a payment (e.g to the IMF) is a political act. Even if you think that the local IMF team are savage, this is irrelevant in the short term. The local IMF team is not in a position to force anything at that level. Ditto, the ECB (which wants to avoid seeming political at all costs) is not going to precipitate a crisis. There has been a *political* agreement to give Greece until April to flesh out their program, and four months to begin implementation. The financial moves by the IMF and ECB will conform with that. Period.

The link above already shows (as was more or less obvious), that the Syriza team is *not* going to be knuckling under to the Troika teams in Greece. They’re going to be doing it their way for the next four months. After that there will be another negotiation the outcome of which depends partly on what happens between now and then. The IMF and ECB will give their assessments at that point and that will factor into the negotiation.

But in the intervening period, its simply unrealistic to believe that Syriza will be forced by the Troika to do anything they don’t want to do, and especially not anything not explicitly guaranteed in the new agreement.

Varoufakis’s plan to modify the austerity program clearly hasn’t worked.

The question is whether he will comply with pension-cutting, labor-bashing, employment-slashing policies or force the ECB to crash the banking system thus paving the way for a Grexit…which might be a public relations victory for Syriza. (maybe??)

Is there a third choice?

I don’t see it.

So far as I can tell, the structural reforms are still on the table. But IIRC, it’s the structural reforms that cross Syriza’s red lines: They can’t be gutting pensions and selling off the Parthenon and “liberalizing” the labor markets and expect to stay in power; that directly betrays their own voters. So the real economy stuff is a circle that has not been squared, and can’t be.

I wonder if there’s any data on who exactly was doing the bank run. Was it ordinary Greeks? Or was it a form of capital strike? Or both? (One thing the institutions and the institutionlaized agree on is that the oligarchs need to disgorge a lot of taxes; moving their money out of the country would be a way for the oligarchs to prevent that, especially if it sparked a bank run.)

Well the IMF already said pretty clearly that it did not like Syriza’s lack of resolve as far as pension “reforms” are concerned…..

The ECB can cut off Greece whenever it wants–that is, whenever it wants to perform a felo de se. The Eurocrats caved because they had no politically viable choice, and the Greeks gave them the word–“arrangements”–that let them pretend to have hung tough. What Varoufakis and Tsipras needed was TIME, and they got that, knowing full well that they had won the battle but that the war lies ahead. If unexpectedly terrible weather lies not ahead, this Quatre Bras can lead to a very different outcome at Waterloo.

Hang on though . . . from all I’ve read and heard, even IF the austerity measures, after all this kerfuffle, continue apace, virtually unchanged, Greece still won’t be able to pay back what it owes. Whoever it’s present creditors are, they’re not going to see their money again.