As we indicated earlier today, the Eurogroup appears to still have its hand in the mix of determining whether the reform list submitted by Greece is adequate. A meeting is set to review the proposed Greek reforms tomorrow. The journalists who are in the mix are sending tweets that suggest that they are not yet clear on some key issues in the state of play. As of this posting, only some high level details of the reform list have leaked out.

Plan for tomorrow… List to be submitted to EZ FinMins in the morning, Eurogroup will convene via teleconference in the afternoon #Greece

— Jonathan Ferro (@FerroTV) February 23, 2015

BBC claims the reforms proposal is “late”…

Greece to send reform plan to eurozone finance ministers on Tuesday morning, missing Monday deadline, officials say http://t.co/oyjorLdOTt

— BBC Breaking News (@BBCBreaking) February 23, 2015

….but Greece begs to differ:

#Varoufakis tells live on #CNN that GR delivered reform letter today & it was Eurozone finance ministers who asked delay. #Greece #Eurogroup

— Siegfried Muresan (@SMuresan) February 23, 2015

That is in keeping with Ambrose Evans-Pritchard’s puzzlement about the delay:

Baffled by reports that Greek proposal will not be presented till Tuesday. Athens sent it to Declan Costello at EC mid-day Monday

— A Evans-Pritchard (@AmbroseEP) February 23, 2015

However, as you’ll see later in this post, the Eurogroup did insist on reviewing and discussing the reform package on Tuesday, hence that reason for the meeting timing. But it is possible to square the circle, since Greece could be taking advantage of the Eurogroup schedule and is making some final tweaks.

Note that the markets seem to regard this meeting as a matter of form; Bloomberg doesn’t have a story on it on its first page. Its featured Greece stories are analyses: Who Won the Greek Showdown in Europe? Economists say Greece lost and Morgan Stanley: The Odds of Greece Staying in the Euro Zone Haven’t Gotten Any Better. That may be because Greek government says the package is in line with what was discussed Friday. However, the reason for kicking the matter over to the Eurogroup may be concerns that the proposals are not specific enough. Or it could confirm what we’d suggested from our first readings of the memo: that the requirement that the Eurogroup approve any disburement of funds means that they will continue to be involved, just not on the front lines as before.

#Greece gov't official says Tuesday submission of list of reform promises agreed with #Eurogroup ~RTRS

— Yannis Koutsomitis (@YanniKouts) February 23, 2015

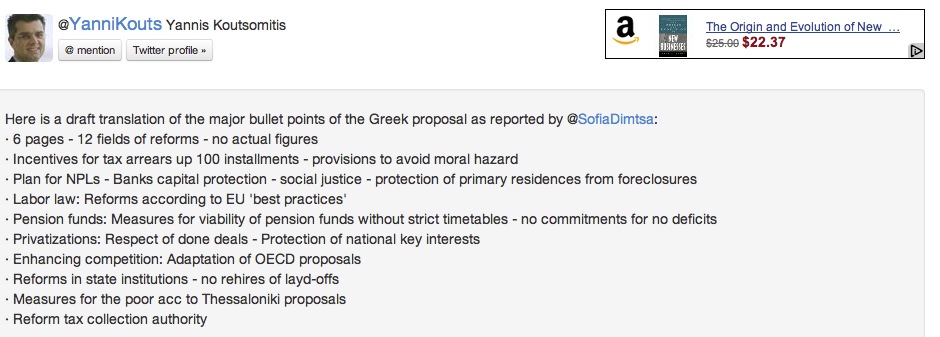

@SofiaDimtsa:, via Yannis Koutsomitis has the most detailed report on the content of the reform package, and it is still a high level summary (click to enlarge or view here):

Notice this contradicts a Guardian story yesterday that said the reform list did include estimates of impact of some of the measures to improve tax collection. And “EU best practices” on labor is very disconcerting, since it implies a forced embrace of “labor flexibility” as in further reduction of labor protections and bargaining rights. That would seem to be inconsistent with earlier reports, including a government announcement, that Greece was seeking an increase in the minimum wage. Perhaps that section is more of a mixed bag than the headline for that section suggests.

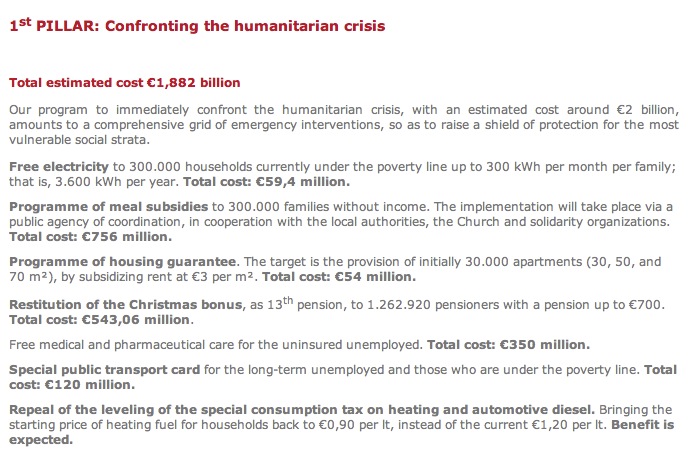

The Financial Times’ Brussels reporter says the proposal includes Pillar One from the Syriza campaign platform, the humanitarian goals:

For what it's worth, "pillar one" of Thessaloniki plan #Greece govt says is in reform list totals €1.9bn in spending: http://t.co/svzbCFgq29

— Peter Spiegel (@SpiegelPeter) February 23, 2015

For what it's worth, "pillar one" of Thessaloniki plan #Greece govt says is in reform list totals €1.9bn in spending: http://t.co/svzbCFgq29

— Peter Spiegel (@SpiegelPeter) February 23, 2015

That is not a surprise, since at the press conference after the Friday meeting, Yanis Varoufakis stated that he would be focusing on matters Greece and its “partners” agreed upon, and said that included humanitarian relief. As we noted in our post earlier today, Ambrose Evans-Pritchard had tweeted that Greece had also included Here are details from the campaign platform:

Finally, the fact that Schauble appears to have been reined in by Merkel may not give Greece as much relief from Eurogroup extremism as hoped. Bloomberg reports (hat tip Santiago) that Spain has become the new heavy:

As euro-region finance ministers turned the screw on Greece in Friday’s talks, the group’s usual enforcer, Wolfgang Schaeuble of Germany, was eclipsed by Spain’s Luis de Guindos, according to two people with direct knowledge of the talks.

De Guindos took the toughest line with Greek Finance Minister Yanis Varoufakis as the bloc forced him to adhere to the terms of the country’s existing bailout to retain access to official financing, the people said, asking not to be named because the conversations were private. When the group rejected Schaeuble’s call for a Tuesday meeting to scrutinize Greece’s plans to meet those conditions, De Guindos insisted, winning agreement for a teleconference, they said….

De Guindos has been in the running to replace Jeroen Dijsselbloem of the Netherlands as head of the euro-region finance ministers’ group when the Dutchman’s term expires this year.

Presumably reporters will ferret out more about the reform list and the Troika’s feedback on it. Stay tuned.

Update 3:20 PM: I felt compelled to include this Paul Mason interview with the German deputy finance minister, at least in part because you never see reporters in the US ask tough questions like these:

Given the stickiness of the talks the past few weeks I’m curious what a Grexit referendum would look like now? I imagine the older generations would want nothing to do with it, even if it was a better option all around, but the younger generations… Based on what little I have read and seen (translated) the past few days from Greeks being interviewed in the streets they seem to be at the end of their rope. At this point, most are probably willing to try damn near anything. I’m thinking these next 4 months are going to be planning damage control for when they exit the Euro. Otherwise, it will be the same as before with even more bitterness.

I live in north-eastern Greece and I have the same feeling. A referendum, will most likely lead to a Greek exit. I believe that it’s the SYRIZAs last resort because they don’t want to handle a Greek exit. At least not officially. There are two main economists (pure economists if you will) in SYRIZA. The first one is our current (and much loved) Finance Minister and the second one is Kostas Lapavitsas[1]. Mr Lapavitsas is a strong supported of going back to the Drachma (own currency), devalue and boost our economy. So if the situation goes to that and Varoufakis doesn’t feel like being able to handle the situation there’s another guy, ready to take the torch. They don’t get along very well I might add.

The situation is exactly as you portrayed it: The elderly doesn’t want any kind of change, while the young ones don’t have nothing to lose and need a radical change ASAP. The problem is that people below 45 are now massively being added to the young-group because of unemployment. So all in all I believe that more than 51% of Greeks, given the Greece vs Europe kind of rhetoric that grew wild the last two weeks, will vote for “Greek exit” given the choice.

That’s speculation, I’m not 100% sure though.

[1] https://www.soas.ac.uk/staff/staff31299.php

As another resident of Greece (northern), I’m afraid I agree. We spent Clean Monday with close friends, one of whom is a professor of communications and leading Greek EU communications expert, as well as a regular contributor of long-form opinion/analysis pieces to various print/online publications here. She is a long-time party member and was so despondent she couldn’t even discuss the party’s strategy – she is convinced that the first death-blow has been dealt not to the eurozone, but to the EU itself. The far (true) left faction of Syriza (which as nc readers will now well know, is itself a coalition party), to which Lapavitsas belongs, has pretty much had it, as have the Greek people themselves, including over-40 voters.

I suspect the four-month lifeline will be used to complete Plan B, viz. an orderly exit and reversion to a national currency, presumably the drachma. A disheartening prospect, but given the behavior of Greece’s EU/EMU partners over the past two weeks, there really aren’t (m)any (?) options left.

At this point, it no longer substantively matters how many “oligarchs” are tracked down, or how many large deposits in Swiss and EMU banks are confiscated, or whether the Greeks pay the final installment of their IRS obligations, or how they’ll sort out the land cadastre (honestly, it’s not difficult – I spent yesterday discussing this subject with a senior engineer from a major city planning office – the taxation software is already linked to property records, and property must now be declared to be heritable – but really, who cares any more?). No matter what they do, this government won’t be able to satisfy the Troika’s demands, ever.

My very humble view at this moment: Greece will be compelled to leave the EMU (and presumably the EU), and will turn to a new partner, China, which is going to get its port in Piraeus, and which will help Greece upgrade its infrastructure to become the fast-track corridor for Chinese goods en route to Southeastern and Eastern Europe. The country will return to (sustainable, non-GMO) agriculture (only 32% of cultivable land is currently in use) to feed itself and provide luxury produce to the global 1%. Greeks will again concentrate on what they have done best since antiquity, viz. trade/commerce. Foreign exchange will be earned through tourism (currently 18%; perhaps it will rise to 25%) directed towards the Far East, and through exploitation of Greece’s own considerable – actually, massive – mineral and energy reserves, including enough geothermal to power the entire Aegean.

Greece has done the heavy lifting for the EU over the past 20-30 years in an area which hasn’t even been broached in the Anglophone press, viz. as primary reception country of economic refugees from the Middle East. This role will now pass to Italy, which won’t be at all happy, but again, who cares?

Of course, this humble take could change tomorrow if the Eurogroup accept the very, very modest Keynesian measures Greece is proposing in lieu of the Troika’s regime. How many readers of nc are willing to bet on such an about-face?

Finally: Yves, thanks for including the Paul Mason interview in this post – he’s very knowledgeable and well-connected to reliable Greek sources, probably the only Western journalist who really has a good sense of what Syriza is all about, and of what’s happening on the ground.

The empire will continue to meddle in the Middle East and there will be more refugees to succor, whether it’s provided by Italy, Spain or other countries.

dbk,

I concur, and I put this up earlier on another site.

Sandals on the Sidewalk in Salonica (23 Feb 2015)

My humble take here in Greece on the Greek situation after close to 40 years here and in Portugal is as follows and full-disclosure I am not a Greek, an economist or a lawyer. I have seen at least three devaluations of the drachma in my early days here and suffered from them and capital controls. I was here in Greece when they entered the EU (1981) and in Portugal when they entered the EU (1987). I have lived through Chernobyl and the aftermath in Greece and later Portugal as my wife had a thyroid tumor, diagnosed and treated in Portugal in 1989 (free) after her exposure in 1886 while hiking in the mountains of Bulgaria during the Easter period then. I also was here in Greece in 1990 when the media was full of the count down to the days that Athens would run out of water.

I recall the ERM (the snake), currency restrictions and needing to maintain about five bits of money in various currencies to travel easily plus lines as I crossed borders got entry and exit stamps in my passport and paid duty on goods shipped between EU countries.

The so-called hard left here in SYRIZA contains folks who lived through WW II and the Greek civil war like Glezos and Theodorakis along with the junta. Just my take as I sit with my sandals in front of my computer and read what the pundits pronouncements.

This might also be worth some consideration here:

http://www.nakedcapitalism.com/2015/02/greece-get-eurogroup-approval-reforms-meeting-set-tuesday.html

Update 3:20 PM: I felt compelled to include this Paul Mason interview with the German deputy finance minister, at least in part because you never see reporters in the US ask tough questions like these:

https://www.youtube.com/watch?v=zKZn7OIbRMQ

If Greece leaves the eurozone, oh my what an opportunity Papandreou missed in 2010.

Back then, the Greek debt was held by private banks, and almost all of it was under Athenian Law, with all the power to the gov’t to decide its fate, with no collective action clauses.

That debt was converted into debt held by Euro taxpayers or otherwise debt issued under London law.

Had Greece only defaulted back in 2010, it could have decided whom to pay, and when. It might have been out of its current coma by now.

Had Greece defaulted in 2010, the rest of Europe would have had to make 2 or 3 decisions. One, how do you save the cratering banks with all these bad loans on the books? Two, how do we make a more perfect union that includes political symbiosis? Three, should we simply hack the eurozone into pieces?

The reason Greece didn’t default is likely it was convinced that it could still maintain a European future. That defaulting would have tarnished the name of Greece as deadbeats forever.

I’d submit that the slander visited on Greece increased exponentially over what would have happened in 2010 if only because such a small little country messed with the markets repeatedly over the last 5 years. Still deadbeats, perhaps even worse.

There was absolutely no gain at all from not defaulting immediately. The only benefit came to the surplus Eurozone nations.

Surprising that Papandreou wasn’t aware of the intention to punish Greece.

Here is an old article by Mark Weisbrot saying exactly that, and more:

European Authorities Still Punishing Greece – Can They Be Stopped?

Papandreou was made well aware of the intent to punish Greece – his own finance minister immediately colluded to and succeeded in preventing the referendum Papandreou had proposed.

Defaulting would not have tarnished the name of Greece as a deadbeat forever – at least it did not have that effect for the leading defaulter of the 20th century – Germany.

“Surprising that Papandreou wasn’t aware of the intention to punish Greece.”

Dan, Papandreou is or was a euroelite I doubt he ever even cared. It is not the first time he has sold out Greeks.

To try to explain I will post this quote. This is a quote by a Greek who knows more about it than me. In the quote he was responding to someone about why he insults Papandreou by calling him the “Lesser Papandreou”:

“I definitely dislike the “Lesser Papandreou”, a person that has no right to be in a leadership position of anything in Greece. This position was not gained because of his intellectual capabilities or his political skills or even his efforts, but because of his family’s connections (he was promoted by his dad). Pure nepotism in action. But the major reason for my intense dislike of this person is because of his support of the Annan plan for Cyprus, an insult to Greece and Cyprus, and a plan that was an insult to the thousands of dead and missing in Cyprus (among the dead, several of my friends and army comrades). No Greek politician even dared support this plan. In the debates prior to the election, he apologized for his support for the Annan plan. Interestingly, the “Lesser Papandreou” offered as an excuse the commitments he had extended to “foreign diplomats” …which really tells you a lot about the character of Yiorgakis.”

dbk, any real Keynesian recovery for Greece led by Syriza, no matter how modest, will not be allowed because then the debacle of Greek establishment parties will spread to Spain, Portugal, Ireland, and later on to other countries, France, Italy, even Germany, and we cann’t have that; that would be a disaster for our political elites in Europe, they would have to find employment in the private sector, disappear from TV screens, no one would listen to their patronizing and sanctimonious platitudes, no one would look up to them for favors and sponsorship. I’m serious, this is the most important factor.

Anyways, if the Greeks have the spine to walk themselves out of the Eurozone I’m pretty sure there would a flood of European tourists after the country stabilizes, specially the leftist and hippy kind of them.

It would be interesting to know what the sentiment inside Greece is regarding Syriza’s agreeing to extend the bailout, contradicting what they campaigned on. Is the view on the streets that they had no choice and people should continue to support the government, or is it that the government back-down should be opposed? And if so, what is going to be the result in terms of popular support? Which way do the Greeks tend now that it’s clear that the Troika will not agree to any substantial changes in Austerity?

Since many Greeks had doubts about the leaderships intentions to stay in the euro, the agreement produced a significant rise in popularity. 87% according to the Public Issue poll.

Syriza has many problems inside party leadership. It has absolutely no problems with the Greek people.

Great coverage about a very thorny issue! Thanks.

I think there will be an agreement, and I hope De Guindos, an ex-Lehman Brothers turned into Finance Minister will be put the last in the candidate list for EG President. If the negotiation fails, it would be deeply ironic if petty political ambitions such as internal Spanish politics derail the European project. I don’t think De Guindos is expecting to be EG President: there will be elections in Spain. Even if the PP governs again there are odds that in a reshuffled government he would no longer be Finance Minister, specially if they need to resort to the Grand Coalition with either PSOE, Citizens or other parties.

“it would be deeply ironic if petty political ambitions such as internal Spanish politics derail the European project.”

“Do you not know, my son, with how little wisdom the world is governed?” Axel Oxenstierna, 1648.

Reuters:

http://www.reuters.com/article/2015/02/23/us-eurozone-greece-bank-deposits-idUSKBN0LR0TL20150223

Estimates that Greece used up its €3 billion ELA increase have been discussed here at NC since the middle of last week. JPM: we came, we saw, we grokked.

Presumably the €23 billion of remaining financing consists of investment-grade EFSF bonds, representing the last liquid collateral available to Greek banks.

When JPM compares €23 billion of collateral to €25 billion of deposit outflow in under eight weeks, the problem is obvious: eight more weeks and it’s game over (assuming outflows don’t accelerate more).

Losing €25 billion of deposits on a €170 billion end-2014 base — call it a 15 percent decline — must do severe damage. As leveraged institutions, banks cannot shed assets fast enough to offset a rapid loss of deposits, without encountering a dire shortage of liquidity that portends risk of ruin if confidence falters.

Reporting lags mean we won’t get the full story for a couple of months. But it sounds like life-threatening trauma to me. This is a game of chicken played with lit-fuse dynamite.

Maybe things are moving a little too fast for the “buying time” strategy to work?

The suits think not. But then, Lehman’s failure in Sep. 2008 totally blindsided them. They are not in control to the degree they think they are.

This is the problem with the bankers running the country (which they actually do). They are so busy stuffing their own pockets and not giving a rat’s ass about the poor people. They have no clue what will happen to their own fat asses when the peoples finally realise what’s going on. They are hoping the survellience state and cops with elbow pads will keep them safe forever.

Oh, not quite. As is often the case, they are trusting in the top 20% or so, who are quite accustomed to the petit-elite lifestyle and the satisfaction of ruling over others, to continue identifying with them. As long as the enforcer class and the elite have common interests and common culture, the enforcer class is just as invested in reproducing a subordinate working class as are the elite.

I’m just waiting for Oakland (County, Mich.) University to add to their selection of corporate shibboleth billboards: “Synergize to Excel.” “Dissemble to Succeed.” “Aspire to Fellate.”

Ah yes, it will be the handwringers and hangeroners who will be hunkered around the piano as the plaster falls from the ceiling.

The evil masterminds will be in the escape pod on their way to a tropical paradise.

More dissent within SYRIZA:

https://greekanalyst.wordpress.com/2015/02/23/the-scathing-letter-of-syriza-mp-and-economist-costas-lapavitsas/

“What exactly will change in the next four months of this ‘extension,’ such that the new negotiation with our partners will happen under a better position?”

Inquiring minds want to know.

The Greek “humanitarian” proposals appear very modest; in terms of what they cost barely a rounding error taken individually. That there will be so much review seems like overkill, and speaks to how bad the situation has become.

On Business Insider, someone is saying that there is no mechanism for an exit from the EURO, voluntary or involuntary, and if that is true, perhaps we should be talking about a default and its consequences.

Putting both the high-level national politics and the semantic details of the “agreements” aside, this whole exercise still looks to me like a basic insolvency negotiation, wherein the creditors do not want to advance new money after bad unless this somehow improves their chances of recovery, whilst the debtor or rather those changed with the management of the debtor have a claim on continued funding if only to prevent greater losses to creditors if things fall apart completely.

It is standard for creditors to keep moving the goalposts so as to keep the debtor focussed on their payback rather than other things. Why aren’t the Greeks imposing capital controls to slow the bank run and why aren’t they introducing scrip or vouchers or tax anticipation notes, or whatever you want to call it, an alternative currency in circulation?

In the Greek proposals, the main thing seems to be the tax collection effort. Does anyone think these claims can be packaged up and sold to a vulture fund?

Humanitarian measures unveiled (artist’s conception):

http://tinyurl.com/qhzvggq

State sanctioned tax farming can be very lucrative.

I think they can get a lot for rights to go after Greek oligarchs.

Will the oligarchs offer even better money to hang back?

There is only one choice: free ponies for everybody forever.

What options give free ponies to everybody forever (including, of course, the poor poor poor children and the poor poor poor old people, we MUST think of our glorious future and our heroic past when thinking about free ponies).

Grexit? No free ponies.

Pay the Germans: No free ponies (well, except for the Germans, but I’m talking about Greeks getting free ponies)

Somebody better make up some bullshit about how to get free ponies in a hurry!

Sorry, your program fails the Turing test.

With 100’s of billions of euro leaving Greek banks, we are faced with the prospect of Greek businesses and ordinary citizens having all their savings in foreign institutions.

This begs me to ask the question what would happen after the Grexit? Surely there will be tremendous latent demand for the new Drachma. Citizens and businesses remaining in Greece will want to repatriate their savings to spend or pay taxes at some point in time. I’m suspecting the Chicken Littlers worst projections on the collapse of the new Drachma might be a tad overplayed.

When I hear of Grexit, I think of the Lebanese Diaspora.

There are more Lebanese outside of Lebanon than within.

And that’s the tragedy we are facing if Greeks are exiting Greece, not just Greece exiting the Euro.

“Home sweet home.” – sorry to hurt your ego, but people don’t really want to go to America or Germany – that is the other side of the story.

“Incoming serfs, sorry, immigrants are good for this country (from this country’s perspective, maybe).”

I’m living in Melbourne which I think might have more Greeks than Greece, which is fine because they are good people and more would be welcomed by me. Though I’m not sure I can eat any more souvlakis than I already do.

50 Shades of Greek Grey…

This is a great video where Gordon Kerr of Cobden Partners discusses the Euro and how much better Greece would be in abandoning it. I aprticular liked the statement where he said “Greece cutting themselves off from this mess” meaning the Euro currency, ” wouldn’t necessarily be a bad thing. He goes on to talk about how the big central banks don’t have a clue as to the exposure they are facing. He also talked about how Citibank has said that Greece would have every right to write off 300 billion in euro debt if the ELA’s are not extended.

I think Syriza has a plan here. They have to bend over backwards making it look like Greece did everything it could to make things work. And when they don’t, they can bail. Often in all this talk of high finance people forget we are talking about a small country that recently went through a civil war. They absoultely do not want to face that again. Reasonable people are scared to death of Golden Dawn and the facists and they do not want to go down that road. If things do not improve soon, and they are not seen as standing up to the ECB, I believe Syriza knows that their government will fall. And no one wants to deal with what might possibly take its place.

This is a very important video – thanks for the link.

The interview is with a co-founder of Cobden Partners. And, according to this site:

http://www.theautomaticearth.com/tag/eu/

Varoufakis was urged to consider Cobden Partners as financial advisors, before Syriza chose to go with Lazard.

If Citibank is correct in its assessment then the strong party in this negotiation isn´t the Eurogroup – it´s Greece.

Interesting comments from James K. Galbraith in a post today at Social Europe, “Reading The Greek Deal Correctly”:

FM Varoufakis’s first words to JKG upon his visit to the finance ministry: “Welcome to the poisoned chalice.”

“Large-scale Keynesian policies were never on the table as they would necessarily imply exit . . . . Investment funds have to come from better tax collection, or from the outside, including private investors and the European Investment Bank.”

JKG’s assessment of Friday’s agreement: “Greece won a battle—perhaps a skirmish—and the war continues. . . . It is not likely that the government in Greece will collapse, or yield, in the talks ahead, and over time the scope of maneuver gained in this first skirmish will become more clear.”

Thanks for the link

“Greece won a battle . . . “

After being pounded for years and despite an election mandate to end austerity, Greece has metaphorically agreed to give up its airspace to a no-fly zone and allow weapons inspectors (spies) free reign in the country. It is unclear exactly what Greece “won” in return as that is yet to be fully ironed out, but Syriza has agreed to ‘sell it’ (whatever “it” is) to the people with fancy labels that position continuing unjustified hardships as a cheerfully shared burden. Yanis got an early start on this propaganda duties in his Friday news conference, proclaiming that Greece has seized its own destiny and ALL Europeans are better off as a result. While these are offered as truisms, what is behind these glib phrases is anything but ‘truth’.

Now that Greece has capitulated, further negotiations can continue with respect to a full disarmament. Its for the children!

=

There can be no democratic choice against the European treaties.

– Schauble

=

=

=

H O P

Professor Dr. Heiner Flassbeck on the Real News Network claims that Germany has violated written/unwritten (?) agreements in Euro group. Could someone clarify??

http://therealnews.com/t2/index.php?option=com_content&task=view&id=767&Itemid=74&jumival=13275

Agreed Upon Currency Union Targets: Wages must be in line with national productivity and commonly agreed inflation target

annual wage↑ = inflation + unit labour cost↑(productivity)

e.g., 2% inflation target + 5%↑ unit labour costs (productivity) = requires 7%↑ annual wage

Germany: 2% inflation + 1.5%↑ productivity = but only 1.5%↑ wages (not 3.5%↑ wages needed)

France: 2% inflation + 1.5%↑ productivity = appropriate 3.5%↑ wages

Germany’s “Beggar Thy Neighbour” Policy: Depressed wages resulting from Hartz reforms and depreciation of the real exchange rate due to the low euro value gives Germany huge trade advantages; i.e., improved competitiveness/↑current account surpluses within the Euro and internationally

Good catch! If these consistently surplus countries would just raise their wages and living standards for their citizens a lot of the pressure on the Eurozone would be relieved. Does anybody know which treaty or agreement Dr. Flassback was talking about?

He is talking about the Macroeconomic Imbalance Procedure.

If it’s a farce, then hey, it’s SUPPOSED to be amusing, right? At this point, however, it gets REALLY amusing.

Consider: WHAT will the “Institutions” decide to do if the newly revised list expected for tomorrow still isn’t satisfactory? What CAN they do? Withdraw the bailout program and let Greece fend for itself? But that’s precisely the outcome they’ve been trying to avoid. Greece would certainly default, which would probably lead to Grexit. Even if Grexit could be avoided, the default in itself would be devastating for the Eurozone, possibly fatal.

Well, what other option would they have, but to keep sending Varoufakis back to the drawing board indefinitely — until he totally capitulates, which would be disastrous for HIM?

Neither side can afford to give in to the other, but neither is in a position to say “to Hell with it, we’re outa here.” So we can look forward to an endless series of negotiations, where fresh proposals are continually offered and then rejected — until finally someone wakes up and says “To Hell with it” anyhow, regardless. What will happen then is anyone’s guess.

What fools these mortals be!

They will become more likely to push Greece into a Grexit. That is their revenge.

Here’s a link to Varoufakis’ Friday presser in Greek and English. Previously, I’d only heard a short audio clip in him, in which he sounded rather stressed out. But here he seems to have recovered his usual manner, rather vigorous, voluble and optimistic:

https://www.youtube.com/watch?v=cPObMrKH0lU

Very much worth listening to if one wants a deeper understanding.

Note that Yanis talks of:

I find it strange that he never says anything about the suffering of the Greek people (this would’ve been a great time to do so). And, he views what remains unspecified (like VAT and Pensions) as a great achievement – despite the fact that any proposal for these, as well as all aspects of the fiscal agenda is subject to review by the Troika and Eurogroup. Given these facts and the determined opposition that he faced, I find his attitude rather cavalier.

As Yves points out, Greece is still on a tight leash. And Syriza also seems to have made crucial concessions that are now settled-business like: accepting the full debt and repayment schedule; a ‘partnership’ that commits Syriza to take a Euro-centric viewpoint (vs. a Greek one); and a timetable that keeps the pressure on Syriza to accept further concessions.

=

Also see my comment above.

=

=

H O P

They haven’t really accepted the full debt and repayment schedule. These will be negotiated during the next four months. (It is according to Yves the part which ‘everyone’ knew was going to be renegotiated). What the language about being committed to its creditors really means is that they won’t unilaterally default during the coming four month period.

Yes, there are supposed to be negotiations, to the end of April, on a longer-term agreement but this is the framework that they are starting and negotiating under.

As Yves stated above, “they will become more likely to push Greece into a Grexit.” Being pushed off the cliff is different than jumping. Varoufakis at the Friday press conference responded to several inaudible questions apparently attempting to determine Greece’s future moves. Several key responses indicate there will be no jumping, but (consistent with his previous statements regarding the ELA being pulled) didn’t rule out being pushed:

40:05–“We are in trouble. If our list of reforms is not backed by the institutions, this agreement is dead and buried. Can I be more clear than this?”

55:56–“The fundamental difference between [the Greek governments of 2010 and 2012] and ours is, as I said before, they never imagined the possibility of saying ‘no.’ If you can’t imagine the possibility of saying ‘no,’ you’re not bargaining, you’re not negotiating, and if you’re not negotiating in the environment like that of the crisis of the Eurozone, you end up accepting a deal in the end, as John Maynard Keynes said once about the Versailles Treaty, it’s not only bad for the weak, it’s bad for the strong.”

57:33–”If our list of reforms doesn’t work and we fail in implementing them, we will have to face up to the Greek people and our partners and say, ‘we have failed,’ and will have to suffer the consequences.”

These statements, together with J. K. Galbraith’s statement (see above) that “it is not likely that the government in Greece will collapse, or yield, in the talks ahead,” underscores the likelihood that any Grexit would be caused (or perceived to be caused) by forces external to Greece, and hence not a breach of election promises.

Gary, I was able to make out the question at 40:05. As I remember it, the question was along the line of, “What happens if you can’t reach an agreement on Monday [now Tuesday]?” I read that as, “If you try to push us farther than we are willing to go, we will default.” I guess we’ll see tomorrow how far YV and his boss are willing to go … remembering that they’re only making 4-month-long commitments at this point (I hope).

OMG! That interview was totally hilarious:

Oh, that is classic. The more times that senior ministers get forced to answer questions like that the better chances there will be some kind of change. It’s like a classic Monty Python moment:

Wow. U.S. journalist acting like this is unheard of:

A: “The program (austerity) had delivered a positive growth perspective in Greece.”

Q: “The program of which you speak destroyed a quarter of Greece’s output. Is that success? Is that a growth program?”

Summary of some of the items in the Greek reform proposals,

http://www.telegraph.co.uk/finance/economics/11430744/Tensions-high-as-Greece-scrambles-to-keep-rescue-deal-alive.html

I have to say that if they get anything like this the Germans are going to be made to look like fools very quickly.

There will be no deal from Dr Death Schauble that does not involve Greek suffering.

He is so not looking forward to his new best friend Yanis implementing a successful policy.

Let’s not forget; time kills any deal! This will drag into next week. No way Euro-DE will accept proposed measures as they will be not specific enough.

I think one needs to clarify things here on this blog. One issue the Greek have with Europe is that the Troika has insisted on counterproductive (austerity when one should be spending) or else ideology driven (privatization) reforms. This has (and largely rightly) been discussed very often here on NC. But there is another dimension to the troika that NC and her readership has not grasped.And that is that the Troika has insisted on reform of the bureaucracy, namely the tax collection system. People here seem to think that Greece is like the US. Far from it. The only entities paying taxes are big corporations and their employees. About a million self employed though basically just underdeclare their income and then “come to an agreement” with tax officials. The problem was always that the oversight of tax officials came from within their ranks. One of the conditions of the Troika has always been that oversight over tax collection must be taken away from the tax authority and given to outsiders. That condition was fulfilled by the Samara government. But the union of tax collectors didn´t like this break of precedent at all and naturally supported Syriza. The message got through to tax payers and from last year (when a win of Syriza began to look likely) Greeks started to decrease their tax payments. Now evidently the finance ministry of Greece has met expectations and indeed changed the regime of Greek tax supervision. This is the gist of a long article in the FAZ (not online). I believe the article is entirely credible. It basically means that Syriza might have the right ideas about rolling back austerity. But does either not have the will or else the ability to do something about the utter inefficiency of state instiutions. After all what is the use of creating growth by rolling back austerity if the state can´t in return participate by receiving higher tax receipts.

I was always sure that Greece would remain in the Euro and Syriza would come to an agreement with the Euro zone. I am even sure that Germany would tolerate quite a roll back of austerity if Syriza would indeed implement the tax bureaucracy reforms that Samaras had agreed to after much arm twisting. But if Syriza is seen rolling back these entirely reasonable reforms I believe Greece will be kicked out as there is no way that Greece will ever become financially independent.

Now evidently the finance ministry of Greece has met expectations and indeed changed the regime of Greek tax supervision.

Evidently? How is he supposed to have done that? As far as I know he hasn’t done anything except going from meeting to meeting and writing proposals.

On the face of it I consider the whole thing dubious since I never heard about this point of disagreement. There are several explanations that fit the fall in tax revenue:

Bullshit numbers and one offs. That a country in Greece’s condition can run a primary surplus at all is surprising. So I’m not surprised if it turns out that the projections the old goverrnment and the Troika cooked up turn out once again to have been bogus.

People are tapped out. Taxes have been rising and incomes falling.

Oligarchs want the new government to die and are paying nothing.

Allies of the old parties in the bureaucracy want the new government to die.

I don´t believe the article is bullshit at all. It is now online. Here: http://www.faz.net/aktuell/politik/ausland/europa/steuern-bei-reichen-die-probleme-in-griechenland-13445378.html

The headline says it all: Taxing the rich – problems in Greece. The author (Rainer Herrmann) is an excellent journalist. Which doesn´t preclude the possibilty that he might have an agenda. I just don´t see which might be his interest in making like that something up. Greece is a nightmare that everybody in Berlin sorely wants to be over. If Syriza manages meaningful change in the bureaucracy I gurarantee they will be forgiven almost anything. If they don´t everybody knows there will be no light at the end of the tunnel whatever other policies the government might pursue. Greece is a classical case of a state where everything is based on patron client relationships. Efficiency doesn´t count – only who you know. It is a sort of system already prevalent in ancient Rome ago and quite prevalent all around the Eastern and Southern side of the Mediteranean

Greece is a nightmare that everybody in Berlin sorely wants to be over.

Oh how horrible for those in Berlin suffering from problems they helped cause.

Greece is a classical case of a state where everything is based on patron client relationships. Efficiency doesn´t count – only who you know. It is a sort of system already prevalent in ancient Rome ago and quite prevalent all around the Eastern and Southern side of the Mediteranean

As things stand Greece has an inept bureaucracy even by (Southern – ) Italian standards

Really? How do you know that everything is like that? What is your experience for making such a sweeping generalization?

Beside the point that none of this solves the euro crisis even if Greece did not exist as a country. It would just be the next weakest link that that would be in its position. So I fail to see why you even bring something like this up.

Who caused the problem? Maybe Goldmann Sachs who allowed Greece to cook the books and thereby gain entry to the Euro zone? It is to easy to say that solely Berlin caused it. And it is to facile to say that austerity over problem over. If you want to abolish the whole system I agree. But if we want to have a serious talk about things within the framework as it exists then alas one for instance needs to mention that Greece doesn´t even have a functioning land registry. How then to raise taxes on land if you don´t know exactly who owns what? One reason that these (and a few other things) don´t exist is the very fact that the cronies of goverments past could very nicely do without these things. From the point of view of other EU members Greece isn´t worth a penny or debt forgiveness or whatever if these things can´t be righted. Or take the whole gas scam. Greece has some hugely important refineries supplying the Balkans. Year in and year out production doesn´t match sales as a lot of Diesel and Gas is sold off the books. That doesn´t even happen in Italy and in well known to anybody who has ever done more in Greece than spend a holiday there.That is the whole point. It is Grexit and be damned if Syriza isn´t seen to be acting on these and a few other things. If though Syriza manages to get meaningful change done in the next four month there will be huge relief in the EU and then I suspect Greece will be cut some serious slack. Remember: Grexit is also a big risk for the EU and one would rather avoid it.

Who caused the problem? Maybe Goldmann Sachs who allowed Greece to cook the books and thereby gain entry to the Euro zone?

It is already been established that people already new about Greece’s finances when they entered. They simply turned a blind eye. And Greece is not the only one to have used creative accounting.

It is to easy to say that solely Berlin caused it.

Well I never said this I said they helped and they helped greatly. It is also easy to blame everything on so called Greek corruption as if any of the E.U states or their politicians are any cleaner. Only on the outside and only in peoples minds. Or that if Greece was a paragon of virtue this crisis would not have happened.

Greece doesn´t even have a functioning land registry. How then to raise taxes on land if you don´t know exactly who owns what? One reason that these (and a few other things) don´t exist is the very fact that the cronies of goverments past could very nicely do without these things.

Really? It doesn’t have a functioning land registry? People not only have been paying tax on the land they have for a long time. They have been double taxed due to the memorandum and austerity measures. The government knows exactly who owns what. How else could they make people pay again for something they already been taxed on. News writes up a report about some people getting away with not paying some land tax and all of a sudden the whole country is thought to be like this.

Or take the whole gas scam. Greece has some hugely important refineries supplying the Balkans. Year in and year out production doesn´t match sales as a lot of Diesel and Gas is sold off the books.

Were did you read this?

And even if the gas scam is true. You think corruption on this level does not happen in any other part of Europe? Please if you believe this you are living in Disneyland.

All you seem to have is a negative preconceived view of how things are in Greece. And a mythical rosy view of what the North is.

Hypothetical speaking even if everything you said was true and then reformed. Greece would still go back to running trade deficits. All these things are pointless and are just used as excuses to keep pushing austerity and squeeze Greece of what ever is left. And not help in any meaningful way or admit any wrong doing on the E.U’s part.

I find it funny that you think the E.U has Greece’s best intentions at heart and only wants to help. If only these mythical reforms would be completed. The E.U would just move the goal posts again.

Here the letter from Greece to Europe: http://www.faz.net/aktuell/wirtschaft/eurokrise/griechenland/reformliste-griechenlands-liegt-faz-net-vor-13446713.html?printPagedArticle=true#pageIndex_2

All the right noices about the reform of the bureaucracy. If Syriza manages to really implement these proposals or at least start on them they are in for a honey moon. But it will be extremely difficult. Take VAT collection. I don´t know how things are now but not so long ago must small business and services was conducted in cash and without bills. We will see.

He might be honest but he still starts like this when talking about taxing the rich.

In Frage kommen vor allem die drei Gruppen Reeder, Freiberufler und kleine Selbständige, vor allem Kleingewerbetreibende.

I give him the first group but the others are mostly not what you would call “the rich”.

But this is beside the point. I do not know how this external review process works and can’t say if Tsipras has abolished it or whether that is a good or bad idea. What I am sure about is that Berlin is certainly not ready to forgive everything if they reform the bureaucracy. Politics is about power and Angela’s hegemony over Europe is based on those failed austerity policies. I don’t see her giving that up easily.

and …

http://www.ft.com/intl/cms/s/0/0460fb7a-bc14-11e4-b6ec-00144feab7de.html#axzz3SXXdgJPA

thanks for playing.

I wonder if the German Parliament or the financial press will now notice who “won” this round of the negotiation.