Yves here. I’m quite interested in reader reactions to this scheme. My big reservation is that the amount of the scrip devised by the authors, the TCC, has to be limited to the an amount of discount of future tax payments that is deemed to be credible. Given that Bill Mitchell has estimated that Greece needs to run deficits on the order of 10% of GDP in order to bring the economy back to growth. The World Bank shows Greek tax revenues at 22.4% of GDP as of 2012. Perhaps I am missing something, but it is hard to see on an aggregate level how enough TCC can be issued to achieve the desired growth targets.

And there are other challenges to Greece independent of the merits of this idea. The big ones are that the seemingly inevitable IMF default may lead the ECB to decide to increase the collateral haircuts for banks for use with the ELA. Most experts believe that the default alone will accelerate the bank run and force Greece to impose capital controls, since Greek banks will run out of eligible collateral irrespective of whether the ECB makes its standards tougher (it just happens faster in that event). Many experts believe that capital controls would dampen economic activity, both directly and indirectly (via hurting confidence). The ECB may also decide to use the threat of removing the ELA to force Greece into a Cyprus-style bail in. That would be a huge hit to an already weak economy. It’s hard to see, even if TCCs work as well as the authors believe they might, that they could offset downdrafts of this magnitude. Moreover, even normally sensible economic writers like Wolfgang Munchau have suggested that Greece should accept a fiscal surplus target of 2.5%, which is severely contractionary. If Greece winds up agreeing to terms like that, again it is hard to see even how a well designed parallel currency can undo the damage.

By Biagio Bossone, Chairman, Group of Lecce; Member of the Surveillance Committee, Centre d’Études pour le Financement de Développement Loca and Marco Cattaneo Chairman, CPI Private Equity. Originally published at VoxEU

Introducing a Parallel Currency in Greece

The first column in this two-part series (Bossone and Cattaneo 2015) illustrated various options to design a parallel currency for Greece, which aims to avoid Grexit while helping Greece repay its external debt and resume economic recovery. This second part presents an evaluation of the different options, reports the results of our research – which simulates the application of a tax credit certificates programme to the case of Greece – and draws some conclusions.

Evaluation of the Alternative Parallel Currency Proposals

The proposals discussed in Part I can be evaluated on the basis of how each type of currency design would be expected to impact domestic aggregate demand and fiscal variables. The following observations can be made.

• Cochrane’s IOUs seem to be working at best as a stopgap measure, in that they would enable to government to make payments and release euros to service the debt. Yet, the solution would likely not be sustainable over the medium term, since the IOUs would create a new class of government euro-denominated debt obligation, which nobody would know whether, when, and how the Greek government would honour. Also, issuing IOUs would only replace scarce euros but would have no stimulation effect on domestic aggregate demand, output, and employment.

• With regards to Parentau’s tax anticipation notes (TANs), unlike Cochrane’s IOUs, they would not represent debt obligations for the issuing government. As to the other effects, they depend on how the proposal is interpreted. If the tax notes are issued and used as a replacement for scarce euros for government payments, they would act as a stopgap measure, like Cochrane’s IOUs, but would do nothing to add to domestic aggregate demand. This conclusion would change if the issuing government were to assign them to citizens as extra (additional) endowments, supplementary to their income sources. Regarding their impact on the budget, as tax notes were used to extinguish tax liabilities, they would cause shortfalls of government euro revenues and increase the deficit to be financed with new debt or taxation. Unlike tax credit certificates (TCCs), the notes would bear no deferred maturity and would not provide time for new fiscal resources to be generated as an offset. Finally, unlike the tax certificates proposal, Parentau’s tax notes would not be issued to enterprises with a view to reducing their tax bill and, hence, their labour cost, thus improving their external competitiveness.

• As to Varoufakis’ proposal, the FT-coins would not bring many additional resources into the economy. Individuals get FT-coins in exchange for euros they already possess. The creation of additional purchasing power for individuals and enterprises would only grow inasmuch as the FT-coins were sold at a premium vis-à-vis their face value, based on their above-par tax-worth to the state. Giving them away free of charge – similar to helicopter money, as per the tax certificates proposal – would make their impact more effective. As in the TCC model, the multiplier effect set off by the additional spending would have to generate the resources to cover the euro shortfalls that would affect the budget at the time of FT-coin redemption. However, all else equal, the multiplier effect triggered by the FT-coins would be weaker than under the TCC option since the spending leakages through the external trade channel would not be offset by larger exports through labour cost reductions (which TCCs make possible).

• Finally, the TCC option would not suffer from the above weaknesses. TCCs would create additional spending power, avoid negative external trade effects, and generate resources to offset euro shortfalls from tax reductions at TCC maturities. They would also have safeguards to protect the budget from the risk of fiscal under-performances (see below).

Implementing a TCC Programme in Greece

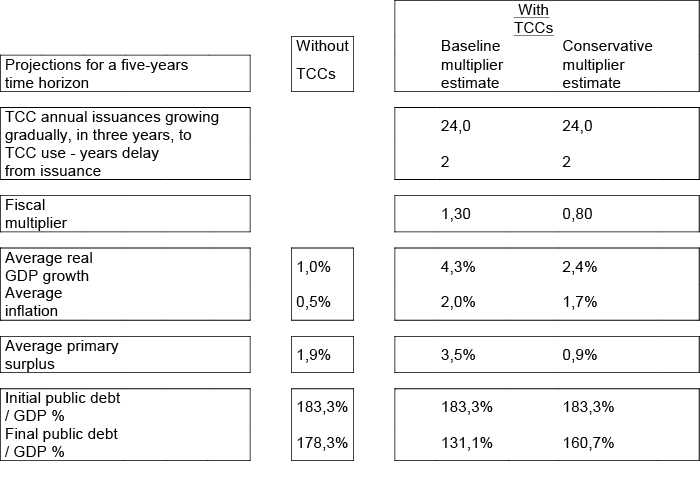

Introducing TCCs in Greece could take the economy rapidly out of depression by prompting a strong recovery of output and employment. In the Annex below, a ‘base case’ (without TCCs) is compared with an alternative scenario (with TCCs) contemplating the issuance of €8 billion (4.5% of GDP) equivalent of TCCs in the first year of the programme, increasing to €16 billion, and €24 billion in the second and third years, respectively, and staying unchanged thereafter. The alternative scenario is run under two different hypotheses:

• A ‘baseline’ hypothesis, which assumes a 1.3 fiscal multiplier (that is, a 1.3 increase in GDP per every TCC issued on a yearly basis); and

• A ‘conservative’ hypothesis, based on a much lower fiscal multiplier of 0.8.1

In the base case, Greece achieves some modest real growth, with the 1.9% average primary surplus only allowing it to attain a very limited reduction in the public debt ratio, from 183% to 178% in five years. On the other hand, in the alternative scenario under the baseline hypothesis (1.3 multiplier), output strongly rebounds with real GDP growth averaging 4.3% over the five-year forecast timeframe. Meanwhile, the average primary surplus grows to 3.5% of GDP, causing the public debt ratio to fall to 131%.

Even under the conservative hypothesis (0.8 multiplier), Greece would average a more than decent 2.4% real GDP growth, while the public debt ratio would fall to less than 161% and the primary surplus would undershoot the 1.9% target, averaging 0.9% nonetheless.

What to Do in Case of Fiscal Underperformance

A number of escalating safeguard clauses would be introduced in the TCC programme to protect the budget from the event of fiscal revenues not growing in line with the primary surplus targets:

• First, the Greek government could announce a commitment to paying a fraction (presumably, a small one) of its public expenditure with TCCs.

• Second, taxpayers could be entitled to receive TCCs as compensation for additional euro tax payments. Basically, this is equivalent to replacing a tax rise with a compulsory TCCs-for-euro swap.

• Third, TCCs holders could be incentivised to postpone the use of TCCs for tax discounts by receiving an increase in their face value (equivalent to an interest being paid on TCC holdings in the form of additional TCCs).

• Fourth, the government could raise euros in the market by placing TCCs with longer maturities instead of debt bonds.

It should be noted that these safeguards are much less pro-cyclical than those that would be imposed by the EU to secure budget targets in the event of fiscal under-performance. It can be immediately seen that one or more of these safeguards, possibly used in combination, would easily accommodate even significant shortfalls in primary budget surplus targets.

As an example, under the conservative hypothesis above, the resulting 1% primary surplus shortfall (0.9% instead of 1.9%), equivalent to approximately €2 billion in the case of Greece, could be accommodated by offering some interest inducement to the bearers of TCCs maturing every year (up to €24 billion, as assumed above). Alternatively, the postponed inducement could be used to delay €1 billion equivalent of maturing TCCs, while €0.5 billion could be recovered from using TCCs to pay for some government expenses and the residual gap could be covered through a compulsory TCCs-for-euro swap with high-income earners. The impact of such safeguard measures would obviously compare much favourably with the recessionary effects of the same adjustment operated via spending cuts and/or tax hikes under the Stability and Growth Pact.

Conclusion

There are alternatives to austerity as the only adjustment rule for Greece, a rule that while dramatically impoverishing the country is also proving ineffective in reviving credible growth prospects. Introducing a currency in parallel to the euro could help Greece change trajectory and move out of depression rapidly, provided that the currency is designed in a way that carries incentives for private-sector spending.

A variety of options have been proposed. These have been illustrated and discussed in this two-part column. All options require the state to transform future tax revenues into immediate spending capacity. Each option, however, has a very different expected impact on domestic aggregate demand and fiscal sustainability. We believe that only the tax credit certificates, used as a quasi-currency, would have enough power both to create new spending capacity and to generate enough resources to pay for themselves over a recovering economic cycle. Also, sufficient safeguards can be built on these certificates, which would protect the budget against the risk of fiscal under-performance in a way that would prevent new austerity measures from becoming necessary.

See original post for references

Annex

The ‘base case’ assumes an agreement is reached between Greece and its creditors, whereby debt is refinanced in exchange for a Greek commitment to generate an average primary budget surplus of 1.9% of GDP over a five-year time horizon. Based on recent market indications, this is broadly consistent with the most favourable attitude toward Greece, which creditors would be prepared to take in order to avoid a potentially disruptive default, with possible Grexit. The base case also assumes that Greece is able to achieve an average 1% GDP real growth under the base case, while inflation (currently strongly negative) would average 0.5% per year.

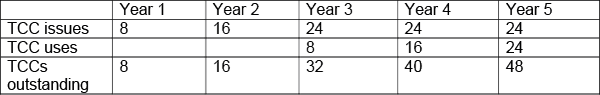

In the alternative scenario, due to TCC use for tax reduction two years after issuance, the schedule of TCC issues, uses, and amounts outstanding would be as follows:

The total amount of TCCs outstanding would then attain €48 billion at the end of Year 5, to stay unchanged thereafter.

The simulation results are reported in the prospect below. Our simulation exercises can be made available to readers by request.

Note that TCC issuances are not included in the public budget, since TCCs do not imply any reimbursement commitment for the issuing government and (accordingly) do not constitute debt items.

Endnotes

[1] Note that a quota of the TCC issuance is allocated to enterprises as a function of their labour costs, which directly improves Greece’s competitiveness and offsets through larger export the external trade imbalances that would otherwise be caused by the extra import driven by demand growth. Also note that the value of 1.3 chosen as a baseline hypothesis is the midpoint of the 0.9–1.7 range estimated by Blanchard and Leigh (2013). This value is rather prudent considering that the fiscal multiplier tends to be considerably higher in situations of economic depression.

The review of TAN’s seems to run counter to my understanding:

Wouldn’t these shortfalls just be filled by reissuing an equivalent number of TAN’s, and doing this perpetually? (not requiring ‘new fiscal resources’ to be generated either)

True (though businesses can get a tax break by snapping up TAN’s if there’s any kind of discount), though this is just a matter of government policy – i.e. whether government wants to subsidize businesses in this way; no reason it can’t be done with TAN’s.

The scrip would have to be gold-backed in order to work. Greece has a couple hundred tons of gold. So it is feasible. Perhaps. Arguably.

Kas, my friend: how dare you mention the “G” word ?

No one should ever want such ‘barbarous relic’ even considered for anything financial, should we ?

Modern ideas are welcome, not things from the past.

If we only could get currency backed with CO2, carbon sequestering would soon be a solved problem… ☺

Things are moving in Greece, as every day: Alt Finance Minister Mardas decided the transfer of central government deposit balances at commercial banks to BoG account by Jun 5, according to Manos Giakoumis

This got dismissed a little after, it is just looking in the sofa for change: “the transfer involves only accounts with 0 transactions as of 2010 or accounts w/ balance <€100”

agreed the amounts described are way too small

these are not times to be “testing” a theory…the WIR exists in switzerland so there is no need to try to “guess” what an effect could be…it has worked fine for many years there…

But if it is to work, although IASB/IFRS issues do come into play, it must be a much bigger part of the question of capital availability.

The amount to be issued by the government should be tied to the amount of money people or enterprises have deposited in Greek Banks in Greece.

thus the government would announce, two weeks from today, we will issue new money to be used only in greece. It will not be legal tender for euro debts within the eurozone. There will be no restrictions in its use for commerce by the greek government. The finance ministry will attempt to develop bilateral agreements with non euro nations to accept the new currency. It will not be designed to fully replace the euro. It will be able to be used to pay up to 50% of ones tax burdens.

The conversion rate will be ten new moneys to one euro with an original issue discount at 80 cents on the dollar (200 basis points) guaranteed by the government for 90 days and will free float thereafter. The New Money will be issued at 35% of the deposits at hand which have been there for 60 days OR which are left there for 90 days…meaning..if you did not pull your money out of the banking system, you get the goodies..if you want to play with the new toys, you have to put your money into a greek bank for at least 90 days…

Further, the government will issue the new currency to employees and pensioners…employees will get 90% of euros in pay and 17.5% in new currency. Thus the employees will receive a potential effective raise if the market is strong for the new currency. Pensioners will get 95% in euros and 12.5% in new currency.

so in effect, if someone has 1000 euros on deposit, they will have 3500 new currency in their parallel account. (this one for one nonsense people keep trying to break out for the new drachma is a non starter)

This might create inflation, but here the market might give the new wizard the benefit of the doubt in his ability to manage the finance ministry…he has created a large amount of brand credibility in the creativity department. Now Minister Varoufakis might use it to cash in some hope for Hellas.

As to the other problems with creditors…the two clown parties which ran greece into the ground did a major disservice to the country by taking 100K creditors who had invested in bonds and reduced it to a few dozen major institutions. The debt can not be managed in the present form. The assets of the nations need to be used to distribute the debts and reduce the general overhang of debt, with convertable bonds as an incentive. DEH, the electric utility, might have a fair market value of 6 billoin to 8 billion dollars based on revenue vs other utilities. The debt could be cleaved with maybe 5 billion distributed to DEH. Thus, the finance ministry, over time, could play money ball. Trading off fading or failing baseball stars with bad long term contracts and negotiate deals that are manageable. One might be able to put together a deal to extinguish a few billion dollars, but right now, to get out from under the problem.

good luck jim, this concept will self destruct in five eons

Yves is ‘quite interested in reader reactions to this scheme‘(sic)

Okay…

(1) All of these are attempts to re-invent the wheel.

But the wheel has already been invented… and it is round.

(2) Argentina tried all of the above (or deviations thereof) not that long ago, to no avail.

Pseudo-currencies or quasi-currencies do not work within a monetary union by sheer definition

(3) With any of the above ‘schemes’ Greece would be (de facto) leaving the euro even though it might or might not default to its euro (now foreign) debt.

(4) All these seemingly intelligent monetary gimmicks actually are fully proven monetary failures.

Europe’s trapdoor has slammed shut weeks ago.

(5) Under current circumstances the only ‘choice’ open to Greece is to decide what percentage of its euro debt will be honored after defaulting.

In Argentina’s case it was 30% (approx.) and I dare to guess that in Greece’s case it’d be pretty close to that.

Take care guys, and brace for the impact not only on the EZ but also upon the US dollar.

Isn’t the question “how much longer can the can-kicking go on”? Let’s face it, every nation today is insolvent if you try to “balance the books”, China went from $8 trillion in bank credit in 2000 to $28 trillion today, the US including our unfunded liabilities etc etc. Given the track record I’d suggest that the kicking can continue for quite some time. In 2000 it was tech stocks and commodities where the inflation showed up, in 2006 it was houses, this time it’s in financial assets so people can pretend it’s not rampant inflation destroying their purchasing power. Turning scrip into confetti by issuing boatloads of it always has the same end result.

Haircuts for holders of Argentine or Russian debt are one thing,…but haircuts for euro-denominated debt is a whole different thing, when the US defaulted in 1971 they had the power to just say “F-U” to the holders of their paper who were promised gold…and Euro holders probably similarly feel they can just weather any storm.

On TANs etc, isn’t it “who’s the issuer of my scrip, and why do I trust them? What power do they have to make good on their promises”? It’s about preferences, if I was Greek and I was offered paper from a shaky government denominated in a scheme that I knew put the issuer at a disadvantage (in Euros) that required the issuer to even *have* a taxable economy I would do two things: hide as much of my income as possible, and desperately seek to get some good-quality scrip, or some kind of money-good collateral, in my hands (heaven forbid that would be shiny stuff with no counterparty in a vault somewhere). They could end up with a three-tier system like Vietnam: The Dong, USD, and gold. They hate the Dong, they think it’s rubbish, so they spend it at the local market as fast as they can. They like the dollar, and everybody has a hoard. But for the real store of wealth they trust gold, something like 90% of real estate transactions *settle* with physical gold.

They could try something like the Bristol Pound, a complementary currency that is pegged 1:1 with the GBP. It can only be spent in and around Bristol, originally if you wanted to cash out for actual GBP you had to pay demurrage. In regular exchange it’s 1:1. In fact they could do this today by telling citizens they can only accept Euro notes beginning with “N” serial number (issued in Greece), they could print the hell out of them, ha ha Brussels now what are you going to do?

Varoufakis is an advisor to a company called Tembusu in Singapore, they are preparing an independent digital currency consensus ledger, but frankly the tech is too complex and insecure for retail usage so that’s not really an answer.

Pretty much the status quo, eh?

It seems self defeating to tether any new parallel currency to the Euro. To envision a new parallel currency for Greece really depends on how you define the economic problems facing Greece. If the problem is how to survive within the present structure, then maybe it makes sense to adopt an extend and pretend currency strategy. Issuing a currency that is worth more tomorrow then it is today is in itself deflationary. If the goal of the new currency is to kickstart a moribund economy, why design a currency that is not likely to circulate or whose value is defined by some other currency. If a parallel currency is to revive the domestic economy of Greece. that is to engage fully the productive capacity of the Greek people, then it will have to be quite separate from the euro such that the Greek government can issue as much of it as it deems necessary to meet funding for the public purpose and to meet the requirements of the domestic economy for a medium of exchange. While taxation is a device for supporting the value of domestic currencies and ensuring that labour that is expended for the public purpose is shared across a society, it is not imperative in economies where the productive capacity is hobbled by high rates of unemployment. If there is to be money circulating in society that is not controlled by private banks, governments need to issue currency for the public purpose which are not recovered through taxation.

This is all so convoluted; basically just a way to give greece some semblance of sovereign money; let them write up a bunch of treasury notes, everyone will buy them up and greece will have operating cash… but if trade is winding down globally and greece cannot make a surplus this isn’t going to do much to pay off the debt is it? Wish Michael Hudson would speak up here and tell us just how irrational all this is. Or isn’t.

Not even my friend Michael Hudson should find rationality in any aspect of Greek finances or any proposed ‘solutions’ thereof, including any/all of the schemes proposed hereinbefore

…”… most of the Greek banking system’s so-called “capital” consists of deferred tax assets; and the collateral posted for its $87 billion of ELA loans consists of the debt and guaranteed bonds of a Greek government that is self-evidently insolvent“.

Hmmm…

…:…Never has such a gargantuan scam been pulled off in plain sight by official national and superstate institutions. Never has a central bank accepted such outright financial trash as collateral for massive advances to its member banks”

Clear enough ?

(David Stockman via his ‘Contra Corner’ blog)

Increasing aggregate demand and employment are lofty goals but it is easy to play with numbers while still avoiding the reality that the current economic structure of Greece has been hollowed out. The Greek government has been:

Incapable of addressing tax collection

Incapable of breaking restrictive cartels

Incapable of addressing an elite that enjoys the status quo

Burdened by the flight of educated youth

Burdened by demographics

Does not streamline rules that impede business creation

Does not consolidate a massive amount of rules/laws that aid lawyers and overburden the judiciary

Is embedded with a large toll taking that goes on by graft and corruption.

Where are these “new jobs” going to come from? The Greek government seems incapable of internally devising modern computer systems to aid governance; has botched past “growth” grants and continues to bloat the unproductive civil service. Is Greece to hire more tax collectors? What “growth” programs has Greece proposed? Re-establishing the Christmas (13th month) pension bonus? Hiring low pay patronage jobs? Giving significant wage increases/benefits to large unions that work in the power industry?

The fact is that the Greek economy has been hollowed out and structured to protect the many that rake off the system to the detriment of the country as a whole. There really doesn’t appear to be a desire to “reform” and in essence that lack of restructuring will condemn Greece. What you will see is a continuation of politics as usual; a lack of follow through on legislation and a country that can’t balance their books. Devising parallel currencies may slow the fall into a deep abyss but it will all move forward to a point of realization that the economy of Greece is currently a dead corpse that money transfusions will not bring back to life.

There is a wide gap between the wants of Greeks, the ability of the government and the cultural/economic restructuring that has to take place. One can academically look at many alternatives suggested to improve the Greek system but if the Greeks don’t want to address their own demons, these academic exercises are likely futile.

I’d just remark that your phrase “the fact is that the Greek economy has been hollowed out and structured to protect the many that rake off the system to the detriment of the country as a whole”…pretty well describes the US as well.

So it’s just a matter of scale and raw power, with the little guy, whether it’s the Greek nation or the entire US middle class, getting steamrolled.

I agree. Very sad. Never thought that graft, corruption, non-transparency, selective enforcement of the law and the political structure would ever get this bad.

Can you explain this on You Tube in 5 minutes? There is the question of the strength of the Euro and it as based on the Petrodollar. Isn’t it pegged to the Petrodollar?

I don’t myself see the European Union as Mature. Nor do I see the Central Bank of the Euro as mature. If all had been so great and Greece deserve to be crushed along with Spain, the situation wouldn’t have come to exist.

How much corruption in the Greek Banking sector is the cause of the crisis?

Inventory of real and human capital assets as a composition of a real currency note of individual to the nation is called for, not just for Greece, but for all Western economies.

Corporations ought not be able to shop for tax deals in nations linked to others by the trade of the multinationals so far as to whack out any nationalism based citizen benefits.

The people are in it together since in the overpopulated world corporations become so powerful by dint of access to every market and the ability to crush any competition that all ought via the transaction taxes on financial markets divided to all as the government of governments in opposition to the corporations of corporations at the throats of the people requires either worldwide currency reform, or disparities so great as to create nations for sale whole.

In this area of creative economics I think it very good to keep at the creating till perfect of alternatives to the Petrodollar and any currencies dependent on it, for the Petrodollar Imperative is same as if we were talking about Gold during a gold rush. Oil is harder to get and running out and producing through its use degradation of the habitat. The oil industry infrastructure can find every drop and regardless of how it is used price wise as an economic weapon we know what happened to the American Indians who had land where the gold in greatest quantity was last discovered. Was all of Egypt’s gold mined by the Pharos? The expected tax returns is getting close at the Insurodollar basis as predicated on human capital, without the beneficial component of the Insurodollar meaning gold and bit coin will siphon away what also will be the flee of the young Greeks, same as all out of Ireland fled to Australia. You see what I mean? The Insurodollar gives leverage to labor in creating individual inheritance, a difficulty Communism does not surmount in system. (Insurodollar is the partial pooling of equity of citizen policies given at birth or buy in.) Transcendian, my youtube channel has my own talking head talks on it. It goes back only to be found 2003 via Internet Archives, and was published in Transcendia and Transcendian Passports 2014.

Big picture, I take it as a good sign that lots of options are being discussed. But it still sounds like reality is not really being considered in these proposals.

At a conceptual level, there are essentially six ways for a government to address currency-denominated debt.

1) Repudiate debt,

2) Print new currency units,

3) Ask for charity from other countries,

4) Take currency units from other countries,

5) Raise taxes, and/or

6) Cut spending.

Parallel currencies do not do any of these things, and Greece can’t do numbers 2 or 4, so some combination of debt repudiation, charitable gifts, tax increases, and spending cuts are still required with any of the schemes described here.

As far as details, here are a few specific problems I see in the weeds, although certainly not exhaustive (and that doesn’t mean they’re insurmountable, just not explained yet):

Rapidly strikes me as rather sensationalist and unsubstantiated. In addition, and perhaps most glaring in the whole idea, is that output and employment is a completely separate issue from debt obligations(!).

Focusing on Greek GDP is irrelevant within the specific debt problem and counterproductive in terms of bigger picture thinking. This is true everywhere that GDP is misused, and especially true in a place like Greece where a significant chunk of economic activity happens outside formal GDP.

What makes that conservative?

So ultimately government workers/contractors are shouldering the risk that TCCs will have nonzero transaction costs? That is the very austerity which TCCs claim to solve.

So the mechanism that actually solves the problem is a tax increase, not a parallel currency?

So the mechanism for incentivizing people to lend euros to the government is paying interest? It’s a “TCC” not a “bond”.

So the mechanism for incentivizing people to lend euros to the government is paying interest? It’s a “TCC” not a “bond”.

I really dislike this kind of comparison. It is lesser of two evils deception, not intellectually honest examination of an idea. If pro-cyclical policies are bad, then propose something that isn’t pro-cyclical.

Easily and significant again strike me as sensationalist and unsubstantiated.

Agreed, they are called debt repudiation and asking for charity. TCCs don’t get you around the basic math that to pay off currency-denominated debts with internal resources, you have to either increase taxes or cut spending.

Okay, now show us how you know that Greece is currently facing a “currency denominated debt crises?”

Most discussions around here identify the problem as Greece being bleed dry of Euros. Its ability to produce domestically has been dismantled and deported mostly to Germany. As goods inter into Greece, Euros necessarily leave Greece – never to return. Eventually you run out of cash.

The debt was a stop-gap attempt to stem the tide through barrowing. But as Greece barrowed more, it ends up owing more from ever increasing interest rates.

Bail outs only prevent Greece from defaulting which would have forced massive hair-cuts to the TBTF banks financing Greek debt. So they were really bail-outs for the banks, not for Greece. All it did was set back the clock – but never addressed the crises. Meanwhile, the trade deficit continues to bleed Greece of cash.

So your six “conceptual solutions” completely miss the main issue.

That has already been tried. Austerity, remember?

Both of which have already been tried. Not only has it not solved the problem, it hasn’t even reversed the crises.

Debts that can’t be paid won’t be.

This is Greece’s fundamental problem – it can not pay back its debt. It has already had its industry dismantled and exported; it’s becoming increasingly deprived of capital. Hell, they won’t even deploy minimal capital to keep what little Euros they still retain from leaving the country.

So, are you agreeing with me that TCCs are not a realistic mechanism for addressing the situation in Greece at any sort of meaningful scale?

I feel like this footnote needs its own discussion. First of all, we are talking theoretical models here. Essentially the author is just guessing at a number and plugging it in.

Secondly, economic depression certainly has been the condition in the West for the past couple decades, but that doesn’t mean it’s the same depression as we have had previously. What is going on right now is not a lack of aggregate output. The problem isn’t that we’re not working enough hours. Rather, what is happening is a crime spree. Concentration of wealth and power has reached extreme levels; increasing GDP doesn’t do anything about that.

We have plenty of wealth; what we lack is a mechanism for distributing it fairly. That makes this fundamentally different than other “situations of economic depression”. To be willfully blind to this difference is to inadvertently (or even purposefully) support the established, mainstream, monetarist way of thinking, not alternatives thereto.

We are incredibly blessed. Quantity is no longer the problem for our human species; we have an overabundance of the basic building blocks of life. Quality of life is the question of our time.

The situation reminds me of the apologists who insist the Bible is perfect. The mere fact that you need apologists in the first place to defend the inerrancy of the Bible in and of it self proof that the Bible is not perfect. And yet apologists toil away under this assumption which they not only hold as true – but inviolate.

We are told that the Euro is perfect. But the fact that Greece is considering an “parallel currency” is in and of itself that the Euro is not perfect. And yet those who are considering and perhaps working to build such a system will likely do so under the inviolate assumption that the Euro is in fact – perfect.

Me sure to have a ready supply of popcorn folks, because this is going to be hilarious – in a horrible painful sort of way.

I didn’t read the whole thing. But what I did read, while some what well reasoned, all fail to consider the true source of the problem. The fact that the Euro accumulates wealth to a few while draining it form every one else without any means of replenishing the supply of Euros. The parallel currency doesn’t even seem to acknowledge this as an issue, let alone seek to answer it. So how is this any thing other than finding a way to make the hole deeper?

To be fair, there is nothing Greece can do to address this problem as it’s a problem with the neo-liberal thinking that define the Euro in the first place. Grexist is really there only option at this point – as flawed and as wrought with risk as it may be. But here too there is a danger of remaining in the neo-liberal pyridine –

I will have to leave this to the financial wizards here. But if I held an asset, like real estate or stock, I seriously doubt I would accept a basket full of TANs or whatever. Similarly, if I were a business person with any sizable stock of goods to sell I would likely not want any of the TANs. So, bottom line, you have to force me to take them.