By Nick Cunningham, a Washington DC-based writer on energy and environmental issues. You can follow him on twitter at @nickcunningham1. Originally published at OilPrice

Oil analysts and commodity traders watch the price of crude swing down and up, and are trying to figure out when and to what extent the OPEC “price war” will force supply reductions from US shale. Any insight into this development can clarify the trajectory of oil prices.

But, of course, oil market dynamics are complex and fluid. US shale supply is hugely important for oil prices, but one of the more underreported factors influencing the price of oil is the pace of demand growth coming from China.

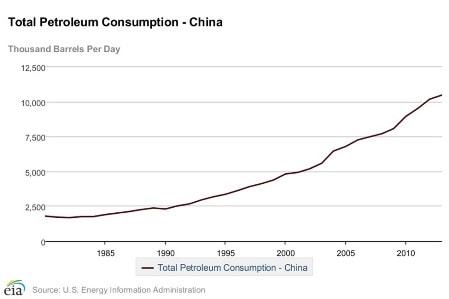

Consumption of oil in China has climbed rapidly and consistently since it took off in 1990, accelerating into overdrive in the 2000s. The inexorable surge in demand caused oil markets to tighten in the lead up to the financial crisis, and then again in subsequent years as the global economy recovered.

The rise in US shale production managed to finally halt the climb in prices, adding enough supply to send prices downwards. Much of the analysis since last year’s bust has been focused on what is going on in Texas and North Dakota, as well as on key decisions made in Vienna every six months.

But the story in China has been overlooked. When it comes to demand, China is arguably the most important country to watch.

And despite accounting for much of the world’s growth in demand in the 21st Century, China’s oil imports have been all over the map in recent months. In April, China imported 7.4 million barrels per day, a record high and enough to make it the world’s largest oil importer. But a month later, imports plummeted to just 5.5 million barrels per day. Much of that had to do with Chinese refineries going offline for maintenance, suggesting that the slowdown may have been just a slight detour from China’s seemingly ceaseless climb in import demand.

On the other hand, China’s exceptionally high levels of imports could be temporary. China is in the midst of filling up its strategic petroleum reserve, a project aimed at stockpiling 100 days’ supply in a reserve by 2020. China has seized the opportunity of low oil prices to fill up its strategic reserve as quickly as it can, buying up crude while it is cheap. This elevated level of imports has soaked up some of the glut, diverting several hundred thousand barrels per day of global supplies to China.

But what happens when China stops buying extra oil for its stockpile?

“We need to understand the dilemma of hidden demand in China, where you have two types of demand – normal demand and strategic stockpiling. The latter won’t last forever,” Jamie Webster of IHS Energy told Reuters in an interview. That could send prices down because once China stops vacuuming up a lot of the excess supply floating around for its strategic reserve, that additional oil will stay on the market.

But the bigger question is over how much oil China is actually burning – as opposed to stockpiling – and the magnitude of its rate of growth. In 2014, China’s growth in demand slowed to just 3 percent compared to the year before, adding just 300,000 barrels per day. In previous years the growth rate was often twice as high. The deceleration in oil demand growth can be attributed to a slowing economy – China’s GDP is growing at its lowest rate in a quarter century.

Demand is indeed inching up in the US because of low oil prices, but maybe not enough to really move the needle on oil prices. Efficiency efforts in the US and Europe are keeping demand largely stagnant.

The developing world, led by China, represent the most important demand-side factor when it comes to affecting the trajectory of oil prices. But after years of solid growth, China is now raising a lot of questions for the oil markets.

It is amazing how far off all the predictions about peak oil have been. Given that, I put little faith in any crystal ball projections about future price movements in oil.

Tight oil is peak oil.

Actually in addition to getting the time period right, the peak oil predictors (some of them at least) have been saying that we will see wild price swings of the sort we are seeing on the way down from the peak (which by the way has a ways to go). Fracking being profitable at all is a perfect sign that we are running out of cheap, easily recoverable oil.

When you have tunnel vision every place you look looks like a tunnel. Hard even to see the rifling grooves on the barrel you are looking down.

Predictions about short term oil prices are only useful to those who are engaged in speculating or manipulating prices. If your perspective and that of the articles’ author were to expand to include increments of decades instead of the time it takes to fill the tanks of a strategic reserve you might stand a chance of understanding that exponential growth of an economy based upon consumption of a finite energy source is mathematically impossible.

Peak oil is not a theory or theorem. It is a mathematical fact with the same certainty as 2 + 2 = 4. Only the short term timing is unknown.

Would agree on the post. Yep, China is possibly poised for some crash, with some impact on energy consumption.

In am sorry to say something which does not seem to be on any agenda: military conflicts. The situation is not exactly clean in Asia. One should possibly stop focusing on Ukraine and Africa-Middle-East and start considering the level of tension that a drastic crisis of our current global economy could indeed trigger in some parts of Asia.

In case of a massive reduction in global trade, a huge investment campaign à la Marshall-Miti such as the 2008-2009 one are of course not the most probable outcome. In case of significant in financial markets, the chances that “strategic stock-piling” of commodities does indeed grow significantly are alas IMHO a possible outcome.

As we say here: “Le pire n’est jamais certain (mais, enfin, il se produit souvent)” .The worst is never certain (but, in the end, it occurs frequently).

PS: no I am NOT exactly a neocon reader with an inclination for Stratfor prose, just a plain old European with nightmares at times.

as i pointed out last week, “the Chinese have been buying vehicles at a rate of over 2 million a month, around 40% more than Americans buy, with a 49% increase in Chinese SUV sales in the first quarter of this year now accounting for a quarter of Chinese sales…apparently they have a serious problem with road rage in China, and as a result Chinese drivers are buying more SUVs, for intimidation and defensive purposes, all trying to drive a bigger car than their neighbors…as a result, Chinese gasoline sales are up 20% from a year ago, and they have since surpassed US as the largest oil importer of crude oil… the point is, if OPEC holds their output steady at 30 million barrels per day for long enough, demand for oil and its products will outstrip their supply, prices will rise, and US frackers will be back in the drivers seat…”

China’s economy appears to be slowing significantly as that nation transitions to a domestic consumer-based economy and an expanded geopolitical economic footprint from an insular, export based-real estate-‘bridges to nowhere’ economic model.

Near term, I see a “correction” in the Shenzhen et al stock market Ponzi evaporating a lot of money and possibly near-term demand for oil in China. However, at the macro level that can be quietly fixed in a “command and control” economy within a time period that enables those in control to remain.

Bottom Line: Continued increase in long-term demand for oil from China and its neighbors, putting upward pressure on the international price of oil as the planet continues to heat up and acidification of the oceans worsens. Surely hope I’m both very wrong and that the political will develops to reverse course, both here and there. As others have noted, military conflict also evidently presents a tempting diversion and racket for those in control, both here and there sadly. All very counterproductive.

Yup. They like cars in India too! This represents a market 10X bigger than America for the global automotive sector. Also, too, jawbs!

Moral: If we got rid of everything that’s illegal, immoral, or fattening, we wouldn’t have an economy left.

China’s economic miracle looks like the largest Ponzi scheme in the history of the world, dwarfing even the efforts of Wall Street’s bankster cabal. Growth based upon building ghost cities constructed with no re-bar in the concrete. What happens when the politically connected class have all moved their stolen wealth to London and Vancouver real estate shelters and fled China? And what evidence that this soon-to-be-crumbling gross mus-allocation of wealth can be the basis for “transition to a a domestic consumer-based economy?

An more to the point, in what fantasy world can China’s population become the consumer and growth engine in a world of finite resources and critically finite inability to absorb more Co2 in its oceans and atmosphere?

Yes, but everything is awesome back at the ranch: (spitting out your coffee in 3…2…1) http://www.npr.org/2015/06/11/413395080/americas-next-economic-boom-could-be-lying-underground

Wow! I really marvel at the overwhelming number of ignorant fat pigs ready for slaughter.