Yves here. I’m old enough to remember 1987. M&A activity was hot and was clearly the biggest driver of stock prices before the crash.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

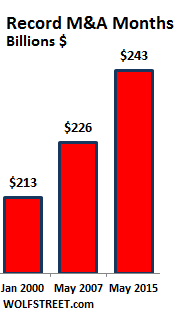

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results.

The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results.

May included Charter’s $90-billion acquisition of Time Warner Cable and Bright House. Charter will issue around $30 billion in junk-rated debt to accomplish this, likely the second largest junk-debt deal ever, behind that of TXU in October 2007, which is now in bankruptcy [read… Junk-Debt Apocalypse Later].

May also includes Avago’s $37-billion acquisition of Broadcom, the largest tech deal since the dotcom bubble blew up.

This pressure to buy drives up prices and premiums, and the “synergies” needed to make these deals work even on paper will be harder and harder to come by. “Synergies” is corporate speak for cost-cutting, so mass layoffs, which will be announced with fanfare to push the shares higher. For these companies, it seems the only way to grow revenues is to acquire other companies, and the only way to grow profits is to cut costs. It’s not productive, hurts the economy, and mucks up the future of the company. But what the heck, it looks good on paper.

These deals are financed by a mix of shares, new debt, and cash raised with prior debt issuance – the “dry powder.” Much of this debt is in form of junk bonds and junk-rated leveraged loans, which banks then either sell to loan funds or craftily slice and dice and fabricate into highly-rated collateralized loan obligations (CLOs). Some of these CLOs are then put through the Wall Street sausage maker again to reemerge as tipple-A rated bonds denominated in yen for the Japanese market.

Loading up overleveraged junk-rated companies with more debt – even if it’s still cheap – has consequences down the road: US default rates are creeping up, hitting 2% in May, the highest in 17 months, according to S&P Capital IQ’s LCD:

There were eight corporate defaults during the month, and all were public. Magnetation and Patriot Coal filed for bankruptcy; Colt Defense and Tunica-Biloxi Gaming Authority/Paragon Casino skipped bond coupons; Warren Resources and Midstates Petroleum inked sub-par bond exchanges; and SandRidge Energy and Halcon Resources completed bond-for-equity exchanges, also below par.

The report forecast a default rate of 2.5% by December 2015 and 2.8% by March 2016, assuming cheap debt continues to flow without limits. Once the money dries up, defaults will soar. Layoffs and defaults are the bitter aftertaste of M&A booms.

Downgrades are now hailing down on these companies. In May, Standard & Poor’s downgraded 41 issuers with total debt of $71 billion, but it only upgraded 18 issuers with total debt of about $43 billion – for a downgrade ratio by count of 2.28x, more than double the ratio of 1.0x in 2014 and 0.89 in 2013. It’s getting messier out there.

When our corporate heroes are not busy buying each other’s shares, they’re buying their own shares. In April, S&P 500 companies announced an all-time record of $133 billion in buybacks. It’s attracting the ire of the largest money managers in the world.

Blackrock Managing Director Rick Rieder wrote:

While some defend the buyback practice as a method of returning cash to shareholders, others, including my colleague Larry Fink, have argued that some companies today are focusing on maximizing short-term shareholder value at the expense of investing in the future.

In my opinion, today’s boom is just one economic distortion created by the Federal Reserve’s excessively accommodative monetary policy.

The boom is, in essence, a response to today’s extraordinarily low interest rates….

Using debt to fund buybacks and dividends eventually crowds out long-term investment in the company’s core business and threatens its credit quality, which is, according to Rieder, “what we are seeing today.”

Oh, and we almost forgot, there are other consequences. Blackrock’s Rieder:

Indeed, the global economy is witnessing a massive redistribution of wealth and income with borrowers, equity shareholders, and short-term investors benefiting; and savers, bondholders and longer-term investors being placed at risk.

Monetary policy wins again.

Investment bank Natixis just pulled the rug out from under self-satisfied, complacent, monetary-policy-fattened markets. Read… Today’s ‘Liquidity Regime’ Is ‘Far More Dangerous for Investors’

It truly is equity shareholders vs. bondholders. In about ten years we’ll know if the insurance companies have been sunk by ZIRP.

David Swensen asserts that equity holders always prevail over bond holders, to the point that he won’t even own corporate bonds.

After all, option-compensated execs typically own lots of shares. Bonds, not so much.

Dunno how he can say that. In bankruptcy court it’s pretty clear cut that bondholders are senior to both common and preferred stock. GM went a little weird, but that was an exception, I’m pretty sure. I had some WorldCom stock. Stockholders didn’t even get a lawyers foot in the door at bankruptcy court. There was a class action later. Got 3% of my investment back after only 6 years. GE Vulture Capital picked up the company for about $5B in “debtor in possession” financing – a couple days before WorldCom filed for bankruptcy. But I think they still had to share with whomever was holding the corporate bonds.

Company is about to finish a domestic acquisition of a company that is three times the size of our market share in a specific area. Although the rhetorical word like “synergy” hasn’t been used, “global footprint” has been, also known as layoffs. The best part is the inversion will save billions as the buyer is foreign and we already cut 2K jobs in the past 2 years.

We have been buying back shares (billions) every year since 2009, while our price continues on to all-time highs.

I think you’re talking about Singapore’s Avago buying Broadcom? Broadcom is about 3X the sales of Avago. But synergies and global footprint??? Broadcom already has near global monopolies for it’s successful products.

No, Sigma.

sssh…some people may think the fed creates unemployment, once they get laid off after a merger or acquisition.

Are we still complaining about layoffs subsequent to mergers? I thought this is what Marty & Felix were griping about 30 years ago (also: talking their book).

In any case, if you don’t want to layoff workers, don’t sell your company to the public; you don’t become 9-10 figures deep overnight for nothing. If you don’t want to partake in that system, don’t buy stocks.

It’s a political problem, principally, and it lies in the fact that so few Democrats actually give a shit about an equitable and just social order. I mean, even in New York City we elected a guy to manage pensions based on his support of gay marriage or whatever.

If you’re looking for ‘crashbait,’ reflect on the Fed’s single discount rate hike on Sep 4, 1987, followed by a record crash six weeks later.

Unfortunately for Dr. Hussman, though, the more typical scenario is that it takes multiple rate hikes to kneecap stocks. The late Marty Zweig codified this observation into his “Three Steps and a Stumble” heuristic.

In the last go-round under the dynamic duo of Magoo and the Bernank (mid-2004 to mid-2006), thirteen (13) quarter-point baby steps drove the yield curve into inversion. Yet it took another 15 months for stocks to crest.

Bubble III, comrades: you gotta disbelieve to keep it alive!

It’s like a boxing match, Jolly “the Bubble” Bankster versus the Brick “the Asteroid” Plunger. Will the Asteroid pop the Bubble with a rate hike right cross or will the Bubble smash the Asteroid into a cloud of short-squeeze dust? So far there’s been about 7 knockdowns and the Asteroid’s been laid flat with a referee count. It’s not looking good for The Asteroid. But it’s hard to know what round we’re in.

Almost makes you think rate hikes aren’t closely correlated to much of anything, other than some narrative that exists in the minds of the Fed and Wall Street. Is going from .25% to .5% after 7 years a rate hike or a love tap? Was it Ben with his eventual normalization to 6% the thing that gave us the GFC, or was it Toxic Waste and an overleveraged financial system in general. How ’bout turning off the home mortgage ATM spigot? Could consumer demand plummet when you don’t give them money to spend anymore? Does China matter?? And most of all, where is it that we get those .25% credit cards?????

“Bubble III, comrades: you gotta disbelieve to keep it alive!”

…until a tropical depression becomes a hurricane and disrupts the ebb and flow…

To paraphrase a conversation ChrisTINA Laggard had when she was finance “minister” of France:

CT: “Yo hank, wassup with the tsunami heading this way?”

Hankster: “fuhgettaboutit, it’s being taken care of”

As anyone who has experienced a hurricane will attest, the fear is in anticipation but the pain is in the aftermath, for most…

Debt in bond form has really gone berserk, with no consideration to the life of the issuer, much less ability to pay. As if a city will have better finances in the future, or a school system. Hell, I want to finance my retirement that way, but death messes up that sweet racket.

That municipalities take out debt is not the problem. The problem is that we (you?) have elected politicians that are racing to the bottom of pushing America’s tax burden onto its lower classes.

Yes!

I’ll grant you, to a certain point, the first sentence and the latter part of the second, but “citizens united” just “legitimized” what has been going on a long time, i.e., pols beholden to banksters…

You’re adorably ignorant. A “bankster” at best makes a mere 7 figures annually; her capacity to donate, on an individual level and in strictly financial terms, is hardly enough on its own to swing an election. If the bankster can’t corrupt on an individual level, perhaps she shouldn’t be villainized on one?

I won’t defend Citizens United, but needless to say politicians have been beholden to plutocratic interests long before Citizens United. Be that as it may, no amount of Koch Brother money can force one to vote a certain way….

Perhaps, at the end of the day, most people simply aren’t capable of taking care of themselves and acting (much less voting) in their best interests in the face of a predatory capitalism which time and again — be it mortgage loans or student loans or payday loans — they fall prey. Maybe that’s the case for social democracy?

I’m immune to flattery, but thanks for the feedback nonetheless. “7 figures” seems like a lot by any standard, but for banksters that doesn’t seem to even qualify as “capo” pay…but that’s not the point I’m trying to make. Apparently, you’ve shown a sensibility with the term “bankster” and we seem not to agree on the meaning of the term. Since it has been a recurrent theme, it might be worth further clarifying the meaning. From my POV, I use the term in the same vain as plutocrat, kleptocrat, oligarch, life-sucking oner etc., to describe the few people that have appropriated the power and privilege with a strong sense of entitlement without an understanding nor sense of noblesse oblige. There’s been much effort by Madison Ave. to make us believe that this privilege is the result of merit…but without the noblesse oblige, and some scrutiny, it becomes obvious that this power and privilege has been and is indeed antithetical to the very concept of meritocracy.

As far as “most people simply aren’t capable of taking care of themselves”…this is where I believe we diverge sharply. Assuming you have potable water, sanitary system, functioning electricity, a roof that doesn’t leak, modern appliances, food, clothes, use some sort of transportation, which in turn use roads and bridges etc. etc. etc. (this can go on for pages)…Unless you do everything for yourself, it seems that without the effort and cooperation of countless others, you couldn’t take care of yourself either. It certainly seems that we’re a lot more interdependent than the superficiality peddled by Madison Ave. would have us believe…

there’s plenty of modern-day thoreau’s walking the streets of detroit. not that they have a choice.

But, those are real words, “bankster” is a pejorative term. Sure “Madison Avenue”, as it were, can do its PR and fool a low common denominator…. But isn’t that the purpose of PR? At least their cashmere blankets are helping them sleep better at night. What’s your excuse for appealing to populist (re)sentiment through nonsense?

The point I was trying to make is that the problems in finance are principally systemic. By villainizing human beings by such a superficial discrimination — of one of the oldest professions! — you’re being reductive of these fundamental, systemic flaws. Any argument that relies on the term to criticize the financial industry is self-evidently a poor argument. (Aside: even on a level of plain civility, Yves was a banker; surely there are decent bankers out there.)

PS: socially, I happen to fucking hate bankers ;)

“Tipple A rated” sounds right

Wasn’t Patriot Coal part of that legal fraud by Peobody Coal to unload almost all of its retirement benefits on a small company (patriot) while the assets went somewhere else? In that sense Patriot was doomed from the start and shouldn’t be counted as one of the failures cited?

“Once the money dries up, defaults will soar.”

-No kidding! I would never have known that if I never got my PhD in tautologies.

Establishing and manipulating credit conditions is what the Fed does; and after the economy slows/declines as a corollary to higher rates, so the Fed will lower rates again and the market grows. (Cycles!). It’s pretty tragic that this is the depth of leftist financial analysis, espousing the same facile Judeo-Christian financial ideologies as Glen Beck — eeeevil credit — I can’t decide whether this is the tragedy or the farce.

Kudos again! Economics is not a morality play.

I agree about “Cycles!” but it seems that the delusional “belief” in the “wisdom” of the cyclists is the real farce AND tragedy. What some refer to as tautology, others refer to as rhythmic repetition. It’s been long known that even a lie, repeated often enough (unchallenged), takes root as belief. Reason and facts may challenge beliefs, but beliefs are what compel action (or inaction)…

The flip-side of credit is debt. Un-regulated credit bubbles eventually pop when the corresponding debt capacity is exceeded and snaps…you can only stretch a rubber band so much…Does solving a debt crises with more debt make sense to you?

Meh, if I wanted to listen to middle aged white dudes project their own financial insecurity onto the eeevil bubble-making Fed I’d turn on CNBC. I generally expect better content here.

“Does solving a debt crises with more debt make sense to you?”

Neither here nor there…but that’s sort of how restructuring works? In any case, “more debt” is not exactly how the financial crisis was “solved” — personally, I think the “resolution”, however unavoidable, hardly solved much as it created similar though-latent systemic flaws — but that’s best left to Yves.

Anyway, the economy is not a rubber band and the Fed are not fingers (just like a CDS is not fire insurance on your neighbor’s home). As a rule, financial-crisis analogies tend to be erroneously reductive of the complexities they purport to explain.

For a seemingly intelligent commenter, at times you can seem somewhat presumptuous. I was inferring QE in the question…we seem to agree that the ‘crisis’ was never really solved, but view it from different POV’s…rubber band was intended as an analogy to physical limits, of which any economy is certainly subject to…as far as CDS’s, CDO’s, these are definitely best left to Yves…what little I’ve been able to discern since 2008, I owe a debt of gratitude to Yves, NC and everyone here, including you.

I don’t think it goes much deeper than this: http://www.realforecasts.com/why-do-yield-curves-of-treasury-securities-forecast-business-cycles-so-well/

Most excellent article. Much obliged!

I notice in today’s WSJ that Petrobras sold 100 yr bonds at 8.45%. The bonds were offered at an 80% discount to the dollar. Petrobras has very high costs , significantly exceeding the current price of oil. I wonder if the next ‘reset’ like 2007-8 will be credit market based. With ZIRP we have lots of really bad values out there.

Just a sign that money is too cheap. Which is to say that we’re giving Wall Street more money than it can find productive uses for, so instead of expanding operations, the titans are just buying up existing companies.

It’s going to take a lot of pain to dislodge the stable equilibrium the Fed Reserve has created: http://www.salientpartners.com/epsilontheory/post/2015/05/22/sometimes-a-cigar-is-just-a-cigar

The left side scale is so warped as to make the graph misleading and useless.