Yves here. The premise I disagree with in this post is that the Fed is primarily concerned about the real economy in its decision as to whether to raise interest rates. The central bank is instead desperate to back out of its ZIRP corner. It appears to recognize that negative real interests rates are helping speculators and allowing corporations to prop up the stock market by funding share buybacks. But loan demand remains slack, a clear sign that more stringent rate policy is not warranted out of any concern of real economy pressures. The Fed instead appears to want to latch on to any semi-good run of economic data to increase rate levels, so it will have wriggle room to drop them in the event of a crisis.

By Edward Lambert. Originally published at Angry Bear

Should the Fed raise the base interest rate? They really shouldn’t at this point. Will they? They probably will because they still see years of growth. I do not see years of growth ahead… Let me explain.

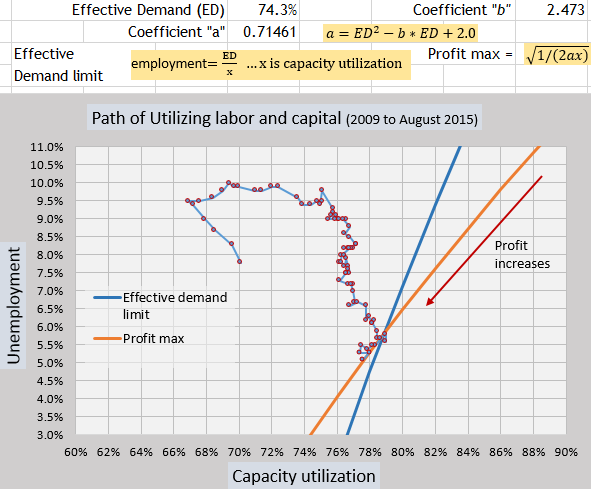

Almost one year ago I wrote that capacity utilization would start falling. (link) It has fallen since that time, even until today’s report that capacity utilization in August was 77.6%. This number was below expectations but perfectly in line with a limit line in a model that I use.

The model plots the movement of capacity utilization and unemployment. The model has two limit lines that act upon the increasing utilization of labor and capital. One for Effective Demand (basically labor share) and one for Profit Maximization (equation in graphs). The utilization of labor and capital moves toward the limits during a business cycle to increase profits. Once the movement hits the limits, profits are further increased by only moving downward along the limits, which means that capacity utilization will decrease as unemployment falls. This pattern has existed for decades before a recession. When the plot starts to pull away from the limits, a recession is beginning.

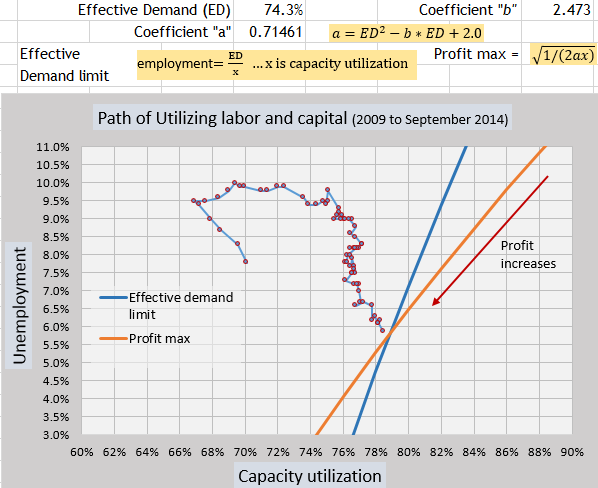

Here is the model from a year ago.

When I saw the plot reaching the limit lines last year, I wrote…

“My sense is that firms are in a race to maintain profit shares at the end of a business cycle. They felt the chill of declining profits in September. From here on out, firms will have to contract in order to maintain profit shares, as seen by the plot hitting the orange line. Now firms will have to contract capital utilization while trying to maintain the same output in order to maintain profit rates.”

So here is the model with data since September of 2014. The coefficients seen at the top are the same in both graphs for easier comparison. The coefficients though can change if labor share was to significantly change.

Yes, everyone loves the fact that unemployment is falling, but at the same time capacity utilization is falling perfectly to keep profits maximizing. Is that a good thing? Well, the business cycle stays alive and more people get hired. However, this process has its limits. Capacity utilization is now being maxed out on profits. Generally throughout the economy, it is currently only profitable to lower unemployment at some cost of capacity utilization. When capacity gets restricted too much without labor share rising, a recession becomes easier to trigger. Then we would see the plot moving up and to the left with capacity utilization falling and unemployment rising.

So the Fed decides this week whether they should raise the Fed rate or not. They are encouraged by the low unemployment number. Yet, from my perspective, the economy is very close to the end of the business cycle and too sensitive to tightening of monetary policy. The Fed could push the economy into a recession with a Fed rate rise. Basically, the Fed can no longer raise the Fed rate during this business cycle. It is too late.

According to the graphs, the natural rate of unemployment would be where the plot touches the limit lines. In this business cycle, it appears to be around 5.6%. So we have already passed the natural rate of unemployment. It is doubtful that we will see much if any inflation as conditions just do not support inflation with low interest rates promoting supply vis-a-vis weak labor share of income.

So the Fed is seeing that unemployment will drop further, and they expect some rise in inflation. However, if they are expecting a few more years of growth in this business cycle… I beg to differ.

In order to extend the life of this business cycle, the Fed should really not liftoff the interest rate.

I wonder if the Fed is that concerned about goosing markets. It’s hard to say because we’ve been in ZIRP for so long, and much of their advice comes from high ranking bankers or bank sympathizers who will maintain nothing can be done about the policy.

I have to take a second issue with this piece, and that is the measurement of unemployment. Given the declining rate of labor force participation we’ve witnessed in the recovery in addition to the fact that so many people are working in part-time jobs while demanding full, I would argue that we’re nowhere near the natural rate (whatever that is) of unemployment.

Finally, let’s say the Fed has some concern that interest rate raises will have a negative impact on the real economy in terms of unemployment. I don’t think there’s anything they can really do until fiscal policy from the government level provides a meaningful stimulus in terms of hiring and productive capital utilization.

always scratch my head when articles (blatantly or ignorantly or dismissively) ignore addressing U-6 unemployment, which is currently at Oct. 2003 levels.

https://research.stlouisfed.org/fred2/series/U6RATE

I agree with your point about the unemployment measure and the too easy assumption of a natural rate of unemployment figure.

More fundamentally, what the author seems to accept without comment is that profits can continue to rise as unemployment falls. In the classic model, at least what was assumed in the post-war period up until the 70s, falling unemployment would >>> rising wage share and falling profits. With stricken unions this no longer holds, wages tend to lag. And the following only adds to the confusion:

Doesn’t a drop in capacity utilization correlate pretty strongly with a rise in unemployment? It seems that the relationship he claims would only be possible if you’re talking about workers working less hours but remaining employed. Certainly possible, but shouldn’t this be specified, since reliance on overtime vs. employing more workers is definitely related to the assumptions about the connection between the rate of unemployment and profits.

One quibble. The economy is in a recession. There has been no actual economic growth for over a decade and a half now. Alas, war, housing bubbles, and financial bailouts don’t actually produce real wealth for the average household, no matter what nominal numbers are engineered from GDP deflators and deficit spending.

The Fed can’t meaningfully raise rates until public policy at the highest levels decides what it’s doing. Until then, ZIRP is required to keep the lights on.

And there we go. Another quarter down where the Fed hearts ZIRP4Evah.

On which planet is unemployment low? Here’s a graph of the employment rate since 2005.

Thank you for pointing out what everybody (except the economists) seems to know. And we also know that the BLS stats don’t show the true situation of deprivation and struggle that persists. Basically, the economy is dysfunctional because it is not intended to benefit the vast majority of people.

The government economists and politicians always seem to ignore the high level of under-employment. A person doesn’t have to do much work to be considered employed. From the BLS FAQ:

Note that in (b), a person can do no work at all and be considered employed.

I suppose the point of (b) is to cover the cases of people who are on vacation or out on sick leave. Still, it seems as though this could be used to include other cases, such as a person who is on an unpaid leave of absence.

I think the initial intro by Yves paints the situation well. FED, having popularized the notion to those with ears, or some brains, that short rates will start to move ever so higher (plodding gradually towards 0.50% perhaps). They don’t have to make a move, but they really can’t afford the lost credibility. I want to assume they know what’s what.

I think the UST yield curve, particularly the slope, informs all you need to know. The US may be the harbor among most developed countries, but we’d do well to sustain 2.5% GDP for more than 1-2 quarters.

Yellen seems to have abdicated after a mansplaining. Unemployment is over 10%, no inflation but, hey, the wealthy want a touch of interest to keep them happy.

The author has lot of faith in the U-3. As with shadow banking, hiding the facts or defining terms to one’s advantage works great when your building a theory and explanations seem rational, but it’s all smoke and mirrors. It may be a great model, my math skills aren’t there to test it, but I’m sure if you start with “bad” (imaginary) numbers you’ll wind up with the same. I’ll also quibble as others have with the concept of”natural unemployment rate” and note that since 08 and possibly preceding that the most emphasis has been on “natural profit rate”. Backed into a corner seems more likely as our host contends. That said it may be interesting if the equation had some alternative numbers plugged into it.

Very nice. Apart from whatever the Fed might do, when one extrapolates, this is a nice illustration of the New Normal (elevated unemployment & low growth) and why we’re going to be stuck here for the foreseeable future. Because what business will invest (ex-M&A activity) when the result is a shrinking margin?

We haven’t bottomed yet though. There is still profit growth to be made through globalization, efficiency and deregulation. We all know how that’s going to shake out.

Hi Yves,

I like your angle on the piece. The Fed’s actions are suspicious. For example, Do they really want wages to rise?

My point is that I see the economy dancing at the end of the business cycle. Most people do not see that because they expect numbers to return to normal levels seen in previous biz cycles. But the labor share number was not supposed to drop either. It was supposed to be stable. But labor share shows no sign of rising back up to its former levels. The Fed is not looking at labor share like I do. They do not see how labor share can limit the economy. So in that light, your view that the Fed does not care about the real economy is spot on. They do not see the real economy.

How is that not like starting smoking just so you can quit smoking?

I don’t know. For some time now I’ve had the feeling that the Fed has become totally sick to death of having to stand in for the lack of fiscal policy (aka braindead austerity) as well as its theoretical role of monetary policy. So when we say it doesn’t care about the real economy maybe its trying to create one of those famous “expectations” that its now starting the withdrawal from this doomed attempt at being a fiscal surrogate.

To put it another way: The Fed is saying “Oh No! Another f*****g shutdown” … Deal with it yourself … Goodbye.

The Sears guy? Seriously?

Hmm. At Angry Bear, his name is spelled with a “B”: “Edward Lambert”. Perhaps the spelling “Lampert” with a “P” is a typo.

Aiee, will fix, thank!