Yves here. A minor quibble with Tverberg’s otherwise provocative analysis. She claims that China has reduced its use of debt to try to prop of growth, when recent evidence says the reverse, that China is still very much using this approach even thought the marginal returns are falling.

By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

What is ahead for 2016? Most people don’t realize how tightly the following are linked:

- Growth in debt

- Growth in the economy

- Growth in cheap-to-extract energy supplies

- Inflation in the cost of producing commodities

- Growth in asset prices, such as the price of shares of stock and of farmland

- Growth in wages of non-elite workers

- Population growth

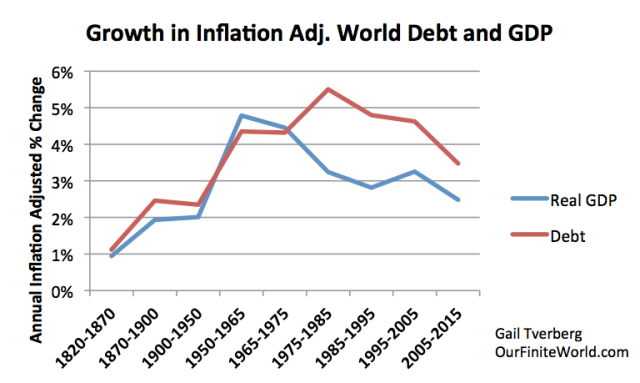

It looks to me as though this linkage is about to cause a very substantial disruption to the economy, as oil limits, as well as other energy limits, cause a rapid shift from the benevolent version of the economic supercycle to the portion of the economic supercycle reflecting contraction. Many people have talked about Peak Oil, the Limits to Growth, and the Debt Supercycle without realizing that the underlying problem is really the same–the fact the we are reaching the limits of a finite world.

There are actually a number of different kinds of limits to a finite world, all leading toward the rising cost of commodity production. I will discuss these in more detail later. In the past, the contraction phase of the supercycle seems to have been caused primarily by too high population relative to resources. This time, depleting fossil fuels–particularly oil–plays a major role. Other limits contributing to the end of the current debt supercycle include rising pollution and depletion of resources other than fossil fuels.

The problem of reaching limits in a finite world manifests itself in an unexpected way: slowing wage growth for non-elite workers. Lower wages mean that these workers become less able to afford the output of the system. These problems first lead to commodity oversupply and very low commodity prices. Eventually these problems lead to falling asset prices and widespread debt defaults. These problems are the opposite of what many expect, namely oil shortages and high prices. This strange situation exists because the economy is a networked system. Feedback loops in a networked system don’t necessarily work in the way people expect.

I expect that the particular problem we are likely to reach in 2016 is limits to oil storage. This may happen at different times for crude oil and the various types of refined products. As storage fills, prices can be expected to drop to a very low level–less than $10 per barrel for crude oil, and correspondingly low prices for the various types of oil products, such as gasoline, diesel, and asphalt. We can then expect to face a problem with debt defaults, failing banks, and failing governments (especially of oil exporters).

The idea of a bounce back to new higher oil prices seems exceedingly unlikely, in part because of the huge overhang of supply in storage, which owners will want to sell, keeping supply high for a long time. Furthermore, the underlying cause of the problem is the failure of wages of non-elite workers to rise rapidly enough to keep up with the rising cost of commodity production, particularly oil production. Because of falling inflation-adjusted wages, non-elite workers are becoming increasingly unable to afford the output of the economic system. As non-elite workers cut back on their purchases of goods, the economy tends to contract rather than expand. Efficiencies of scale are lost, and debt becomes increasingly difficult to repay with interest. The whole system tends to collapse.

How the Economic Growth Supercycle Works, in an Ideal Situation

In an ideal situation, growth in debt tends to stimulate the economy. The availability of debt makes the purchase of high-priced goods such as factories, homes, cars, and trucks more affordable. All of these high-priced goods require the use of commodities, including energy products and metals. Thus, growing debt tends to add to the demand for commodities, and helps keep their prices higher than the cost of production, making it profitable to produce these commodities. The availability of profits encourages the extraction of an ever-greater quantity of energy supplies and other commodities.

The growing quantity of energy supplies made possible by this profitability can be used to leverage human labor to an ever-greater extent, so that workers become increasingly productive. For example, energy supplies help build roads, trucks, and machines used in factories, making workers more productive. As a result, wages tend to rise, reflecting the greater productivity of workers in the context of these new investments. Businesses find that demand for their goods and services grows because of the growing wages of workers, and governments find that they can collect increasing tax revenue. The arrangement of repaying debt with interest tends to work well in this situation. GDP grows sufficiently rapidly that the ratio of debt to GDP stays relatively flat.

Over time, the cost of commodity production tends to rise for several reasons:

- Population tends to grow over time, so the quantity of agricultural land available per person tends to fall. Higher-priced techniques (such as irrigation, better seeds, fertilizer, pesticides, herbicides) are required to increase production per acre. Similarly, rising population gives rise to a need to produce fresh water using increasingly high-priced techniques, such as desalination.

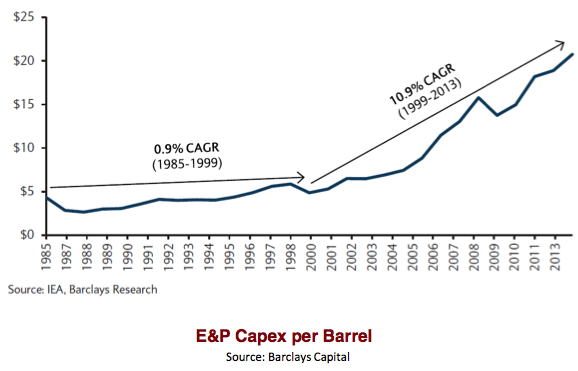

- Businesses tend to extract the least expensive fuels such as oil, coal, natural gas, and uranium first. They later move on to more expensive to extract fuels, when the less-expensive fuels are depleted. For example, Figure 1 shows the sharp increase in the cost of oil extraction that took place about 1999.

- Pollution tends to become an increasing problem because the least polluting commodity sources are used first. When mitigations such as substituting renewables for fossil fuels are used, they tend to be more expensive than the products they are replacing. The leads to the higher cost of final products.

- Overuse of resources other than fuels becomes a problem, leading to problems such as the higher cost of producing metals, deforestation, depleted fish stocks, and eroded topsoil. Some workarounds are available, but these tend to add costs as well.

As long as the cost of commodity production is rising only slowly, its increasing cost is benevolent. This increase in cost adds to inflation in the price of goods and helps inflate away prior debt, so that debt is easier to pay. It also leads to asset inflation, making the use of debt seem to be a worthwhile approach to finance future economic growth, including the growth of energy supplies. The whole system seems to work as an economic growth pump, with the rising wages of non-elite workers pushing the growth pump along.

The Big “Oops” Comes when the Price of Commodities Starts Rising Faster than Wages of Non-Elite Workers

Clearly the wages of non-elite workers need to be rising faster than commodity prices in order to push the economic growth pump along. The economic pump effect is lost when the wages of non-elite workers start falling, relative to the price of commodities. This tends to happen when the cost of commodity production begins rising rapidly, as it did for oil after 1999 (Figure 1).

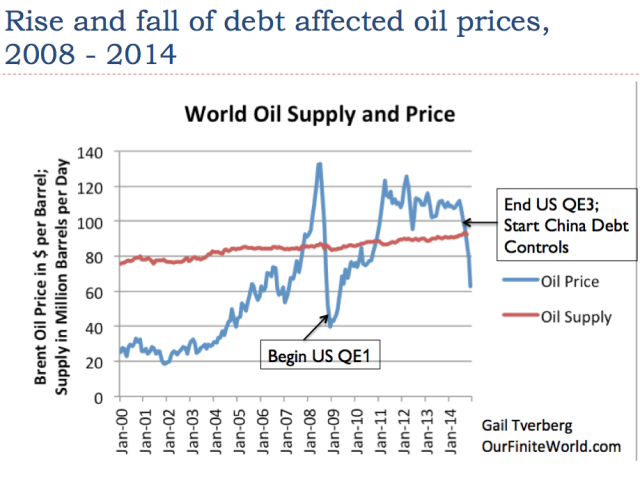

The loss of the economic pump effect occurs because the rising cost of oil (or electricity, or food, or other energy products) forces workers to cut back on discretionary expenditures. This is what happened in the 2003 to 2008 period as oil prices spiked and other energy prices rose sharply. (See my article Oil Supply Limits and the Continuing Financial Crisis.) Non-elite workers found it increasingly difficult to afford expensive products such as homes, cars, and washing machines. Housing prices dropped. Debt growth slowed, leading to a sharp drop in oil prices and other commodity prices.

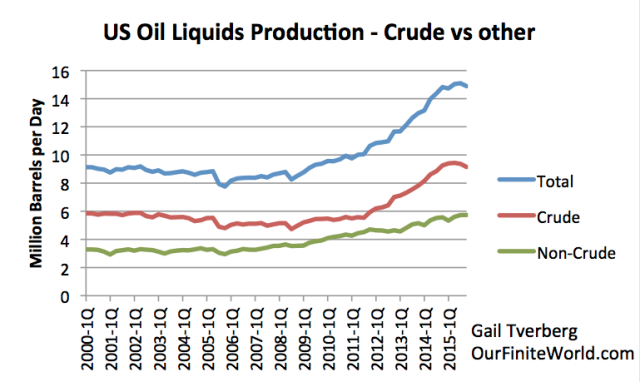

It was somewhat possible to “fix” low oil prices through the use of Quantitative Easing (QE) and the growth of debt at very low interest rates, after 2008. In fact, these very low interest rates are what encouraged the very rapid growth in the production of US crude oil, natural gas liquids, and biofuels.

Now, debt is reaching limits. Both the US and China have (in a sense) “taken their foot off the economic debt accelerator.” It doesn’t seem to make sense to encourage more use of debt, because recent very low interest rates have encouraged unwise investments. In China, more factories and homes have been built than the market can absorb. In the US, oil “liquids” production rose faster than it could be absorbed by the world market when prices were over $100 per barrel. This led to the big price drop. If it were possible to produce the additional oil for a very low price, say $20 per barrel, the world economy could probably absorb it. Such a low selling price doesn’t really “work” because of the high cost of production.

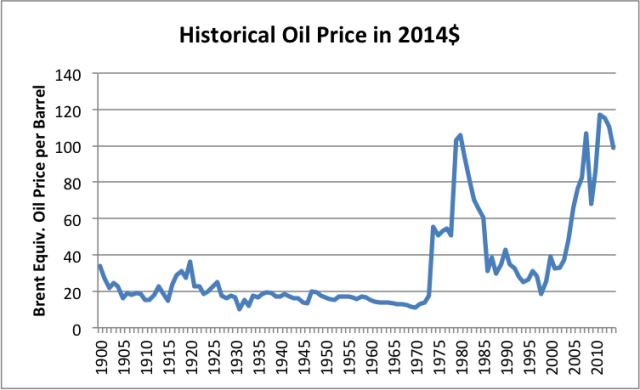

Debt is important because it can help an economy grow, as long as the total amount of debt does not become unmanageable. Thus, for a time, growing debt can offset the adverse impact of the rising cost of energy products. We know that oil prices began to rise sharply in the 1970s, and in fact other energy prices rose as well.

Looking at debt growth, we find that it rose rapidly, starting about the time oil prices started spiking. Former Director of the Office of Management and Budget, David Stockman, talks about “The Distastrous 40-Year Debt Supercycle,” which he believes is now ending.

In recent years, we have been reaching a situation where commodity prices have been rising faster than the wages of non-elite workers. Jobs that are available tend to be low-paid service jobs. Young people find it necessary to stay in school longer. They also find it necessary to delay marriage and postpone buying a car and home. All of these issues contribute to the falling wages of non-elite workers. Some of these individuals are, in fact, getting zero wages, because they are in school longer. Individuals who retire or voluntarily leave the work force further add to the problem of wages no longer rising sufficiently to afford the output of the system.

The US government has recently decided to raise interest rates. This further reduces the buying power of non-elite workers. We have a situation where the “economic growth pump,” created through the use of a rising quantity of cheap energy products plus rising debt, is disappearing. While homes, cars, and vacation travel are available, an increasing share of the population cannot afford them. This tends to lead to a situation where commodity prices fall below the cost of production for a wide range of types of commodities, making the production of commodities unprofitable. In such a situation, a person expects companies to cut back on production. Many defaults may occur.

China has acted as a major growth pump for the world for the last 15 years, since it joined the World Trade Organization in 2001. China’s growth is now slowing, and can be expected to slow further. Its growth was financed by a huge increase in debt. Paying back this debt is likely to be a problem.

Thus, we seem to be coming to the contraction portion of the debt supercycle. This is frightening, because if debt is contracting, asset prices (such as stock prices and the price of land) are likely to fall. Banks are likely to fail, unless they can transfer their problems to others–owners of the bank or even those with bank deposits. Governments will be affected as well, because it will become more expensive to borrow money, and because it becomes more difficult to obtain revenue through taxation. Many governments may fail as well for that reason.

The U. S. Oil Storage Problem

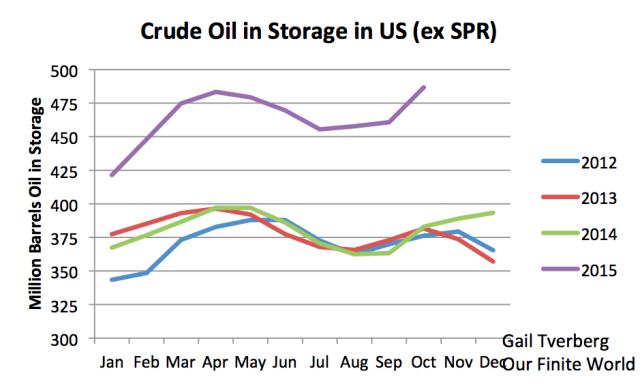

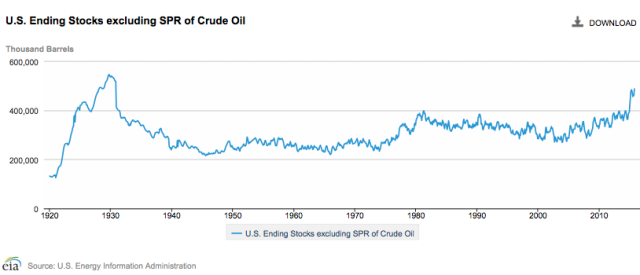

Oil prices began falling in the middle of 2014, so we might expect oil storage problems to start about that time, but this is not exactly the case. Supplies of US crude oil in storage didn’t start rising until about the end of 2014.

Once crude oil supplies started rising rapidly, they increased by about 90 million barrels between December 2014 and April 2015. After April 2015, supplies dipped again, suggesting that there is some seasonality to the growing crude oil supply. The most “dangerous” time for rapidly rising amounts added to storage would seem to be between December 31 and April 30. According to the EIA, maximum crude oil storage is 551 million barrels of crude oil (considering all storage facilities). Adding another 90 million barrels of oil (similar to the run-up between Dec. 2014 and April 2015) would put the total over the 551 million barrel crude oil capacity.

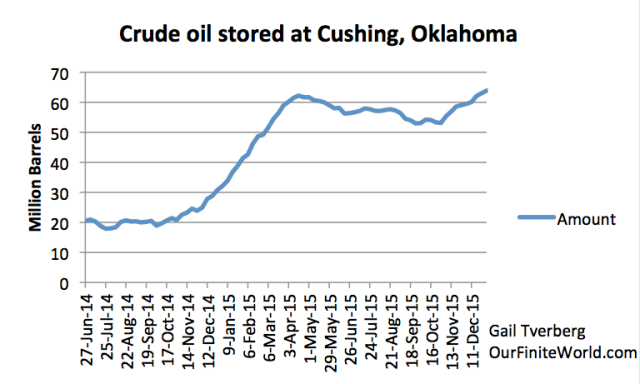

Cushing, Oklahoma, is the largest storage area for crude oil. According to the EIA, maximum working storage for the facility is 73 million barrels. Oil storage at Cushing since oil prices started declining is shown in Figure 7.

Clearly the same kind of run up in oil storage that occurred between December and April one year ago cannot all be stored at Cushing, if maximum working capacity is only 73 million barrels, and the amount currently in storage is 64 million barrels.

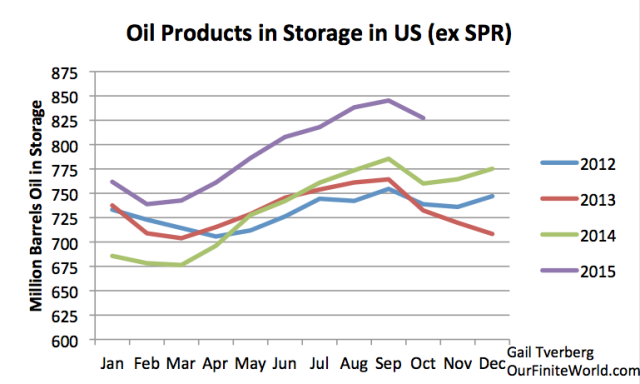

Another way of storing oil is as finished products. Here, the run-up in storage began earlier (starting in mid-2014) and stabilized at about 65 million barrels per day above the prior year, by January 2015. Clearly, if companies can do some pre-planning, they would prefer not to refine products for which there is little market. They would rather store unneeded oil as crude, rather than as refined products.

EIA indicates that the total capacity for oil products is 1,549 million barrels. Thus, in theory, the amount of oil products stored can be increased by as much as 700 million barrels, assuming that the products needing to be stored and the locations where storage are available match up exactly. In practice, the amount of additional storage available is probably quite a bit less than 700 million barrels because of mismatch problems.

In theory, if companies can be persuaded to refine more products than they can sell, the amount of products that can be stored can rise significantly. Even in this case, the amount of storage is not unlimited. Even if the full 700 million barrels of storage for crude oil products is available, this corresponds to less than one million barrels a day for two years, or two million barrels a day for one year. Thus, products storage could easily be filled as well, if demand remains low.

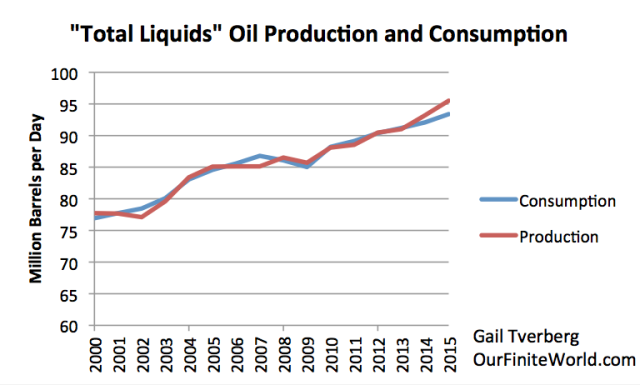

At this point, we don’t have the mismatch between oil production and consumption fixed. In fact, both Iraq and Iran would like to increase their production, adding to the production/consumption mismatch. China’s economy seems to be stalling, keeping its oil consumption from rising as quickly as in the past, and further adding to the supply/demand mismatch problem. Figure 9 shows an approximation to our mismatch problem. As far as I can tell, the problem is still getting worse, not better.

There has been a lot of talk about the United States reducing its production, but the impact so far has been small, based on data from EIA’s International Energy Statistics and its December 2015 Monthly Energy Review.

Based on information through November from EIA’s Monthly Energy Review, total liquids production for the US for the year 2015 will be over 800,000 barrels per day higher than it was for 2014. This increase is likely greater than the increase in production by either Saudi Arabia or Iraq. Perhaps in 2016, oil production of the US will start decreasing, but so far, increases in biofuels and natural gas liquids are partly offsetting recent reductions in crude oil production. Also, even when companies are forced into bankruptcy, oil production does not necessarily stop because of the potential value of the oil to new owners.

Figure 11 shows that very high stocks of oil were a problem, way back in the 1920s. There were other similarities to today’s problems as well, including a deflating debt bubble and low commodity prices. Thus, we should not be too surprised by high oil stocks now, when oil prices are low.

Many people overlook the problems today because the US economy tends to be doing better than that of the rest of the world. The oil storage problem is really a world problem, however, reflecting a combination of low demand growth (caused by low wage growth and lack of debt growth, as the world economy hits limits) continuing supply growth (related to very low interest rates making all kinds of investment appear profitable and new production from Iraq and, in the near future, Iran). Storage on ships is increasingly being filled up and storage in Western Europe is 97% filled. Thus, the US is quite likely to see a growing need for oil storage in the year ahead, partly because there are few other places to put the oil, and partly because the gap between supply and demand has not yet been fixed.

What is Ahead for 2016?

- Problems with a slowing world economy are likely to become more pronounced, as China’s growth problems continue, and as other commodity-producing countries such as Brazil, South Africa, and Australia experience recession. There may be rapid shifts in currencies, as countries attempt to devalue their currencies, to try to gain an advantage in world markets. Saudi Arabia may decide to devalue its currency, to get more benefit from the oil it sells.

- Oil storage seems likely to become a problem sometime in 2016. In fact, if the run-up in oil supply is heavily front-ended to the December to April period, similar to what happened a year ago, lack of crude oil storage space could become a problem within the next three months. Oil prices could fall to $10 or below. We know that for natural gas and electricity, prices often fall below zero when the ability of the system to absorb more supply disappears. It is not clear the oil prices can fall below zero, but they can certainly fall very low. Even if we can somehow manage to escape the problem of running out of crude oil storage capacity in 2016, we could encounter storage problems of some type in 2017 or 2018.

- Falling oil prices are likely to cause numerous problems. One is debt defaults, both for oil companies and for companies making products used by the oil industry. Another is layoffs in the oil industry. Another problem is negative inflation rates, making debt harder to repay. Still another issue is falling asset prices, such as stock prices and prices of land used to produce commodities. Part of the reason for the fall in price has to do with the falling price of the commodities produced. Also, sovereign wealth funds will need to sell securities, to have money to keep their economies going. The sale of these securities will put downward pressure on stock and bond prices.

- Debt defaults are likely to cause major problems in 2016. As noted in the introduction, we seem to be approaching the unwinding of a debt supercycle. We can expect one company after another to fail because of low commodity prices. The problems of these failing companies can be expected to spread to the economy as a whole. Failing companies will lay off workers, reducing the quantity of wages available to buy goods made with commodities. Debt will not be fully repaid, causing problems for banks, insurance companies, and pension funds. Even electricity companies may be affected, if their suppliers go bankrupt and their customers become less able to pay their bills.

- Governments of some oil exporters may collapse or be overthrown, if prices fall to a low level. The resulting disruption of oil exports may be welcomed, if storage is becoming an increased problem.

- It is not clear that the complete unwind will take place in 2016, but a major piece of this unwind could take place in 2016, especially if crude oil storage fills up, pushing oil prices to less than $10 per barrel.

- Whether or not oil storage fills up, oil prices are likely to remain very low, as the result of rising supply, barely rising demand, and no one willing to take steps to try to fix the problem. Everyone seems to think that someone else (Saudi Arabia?) can or should fix the problem. In fact, the problem is too large for Saudi Arabia to fix. The United States could in theory fix the current oil supply problem by taxing its own oil production at a confiscatory tax rate, but this seems exceedingly unlikely. Closing existing oil production before it is forced to close would guarantee future dependency on oil imports. A more likely approach would be to tax imported oil, to keep the amount imported down to a manageable level. This approach would likely cause the ire of oil exporters.

- The many problems of 2016 (including rapid moves in currencies, falling commodity prices, and loan defaults) are likely to cause large payouts of derivatives, potentially leading to the bankruptcies of financial institutions, as they did in 2008. To prevent such bankruptcies, most governments plan to move as much of the losses related to derivatives and debt defaults to private parties as possible. It is possible that this approach will lead to depositors losing what appear to be insured bank deposits. At first, any such losses will likely be limited to amounts in excess of FDIC insurance limits. As the crisis spreads, losses could spread to other deposits. Deposits of employers may be affected as well, leading to difficulty in paying employees.

- All in all, 2016 looks likely to be a much worse year than 2008 from a financial perspective. The problems will look similar to those that might have happened in 2008, but didn’t thanks to government intervention. This time, governments appear to be mostly out of approaches to fix the problems.

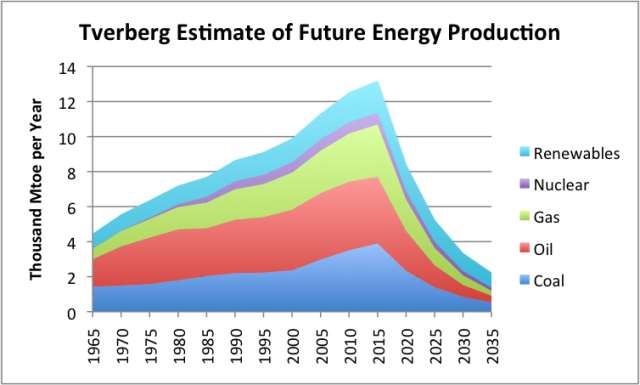

- Two years ago, I put together the chart shown as Figure 12. It shows the production of all energy products declining rapidly after 2015. I see no reason why this forecast should be changed. Once the debt supercycle starts its contraction phase, we can expect a major reduction in both the demand and supply of all kinds of energy products.

Conclusion

We are certainly entering a worrying period. We have not really understood how the economy works, so we have tended to assume we could fix one or another part of the problem. The underlying problem seems to be a problem of physics. The economy is a dissipative structure, a type of self-organizing system that forms in thermodynamically open systems. As such, it requires energy to grow. Ultimately, diminishing returns with respect to human labor–what some of us would call falling inflation-adjusted wages of non-elite workers–tends to bring economies down. Thus all economies have finite lifetimes, just as humans, animals, plants, and hurricanes do. We are in the unfortunate position of observing the end of our economy’s lifetime.

Most energy research to date has focused on the Second Law of Thermodynamics. While this is a contributing problem, this is really not the proximate cause of the impending collapse. The Second Law of Thermodynamics operates in thermodynamically closed systems, which is not precisely the issue here.

We know that historically collapses have tended to take many years. This collapse may take place more rapidly because today’s economy is dependent on international supply chains, electricity, and liquid fuels–things that previous economies were not dependent on.

I have written many articles on related subjects (unfortunately, no book). These are a few of them:

Oops! Low oil prices are related to a debt bubble

Why “supply and demand” doesn’t work for oil

Economic growth: How it works; how it fails; why wealth disparity occurs

We are at Peak Oil now; we need very low-cost energy to fix it

Yep. Responses to this unfolding economic disaster depend upon us. We can either meekly submit to enslavement under neo-feudal masters, or, challenge the banksters and attempt to build a more humane system.

Nice to see some attention made to the commodity side of the disaster. Even from the heterodoxy, its all to easy to focus only on the fiscal side.

The interesting thing, which is hardest to explain to people, is that the cost of extracting and processing commodities can rise as their market prices fall. This seems crazy at first blush, but given a vast array of credit being extended to the commodity producers, they can keep on chugging along at a loss for quite some time. This is what we see in the US fracking industry–totally unprofitable enterprises kept alive by massive infusions of new capital. But the minute the credit ceases, the firms all go bust. The question is: when will the credit stop flowing? Or, can the capitalist class somehow keep the credit rolling in forever? I know that sounds crazier than the falling prices with rising costs conundrum, but this rickety mess should have gone down in 2008 but was kept alive by unimaginable infusions of money, credit, and promises of more to backstop literally the entire global financial system. Can the elites pull this trick again? And again? I just don’t know.

I’m starting to think it is the case that as long as everyone believes in the trick the trick can continue to work. It’s not surprising that such tricks work given the abstract nature of money itself – the value of money is what everyone believes it is (And, as a result, we can re-arrange value in many different ways). I think people will continue to have faith in this system as long as the system doesn’t change too suddenly and in too drastic of a direction. If we believe that credit can stabilize the system we can produce credit that will stabilize the system but the moment people lose faith it will all come crashing down.

The flip side of credit is debt. Exceeded debt carrying capacity can’t be remedied with more debt…pound of flesh, scorched earth etc., but no paper losses because markets.

Just tell them that the financial break even point of extracting shale oil is around 60-80 bucks a barrel. While some oil companies aren’t profitable at a 100 bucks per barrel. The amount of oil being pumped is irrelevant due to the fact the debts need to be serviced like you mentioned.

It begins to get complicated when you explain how the energy rate of return on a barrel of conventional oil is much higher than oil from unconventional sources. This causes the net energy that society benefits from to be reduced. Throw in some Joseph Tainter and watch their heads spin like that possessed chick from the Exorcist. It is especially enjoyable if they are an economist.

Probably because they’re possessed by evil spirits too!

I think this also applies to the of profitless wonders with billion dollar valuations in the “tech” industry.

I have never taken an economics class in my life. To the untrained eye, it just looks like our economy is a ponzi scheme.

Ponzi Scheme AKA Musical Chairs!

The cynic in me believes perhaps “our” banks got a wink&nod from the Fed and or Treasury that oil loans will be backstopped and keep the financing flowing because patriotism and Evil Russia.

Personally, I think we are seeing the current “Final Unwounding” right now. I think by the 3rd quarter of 2016, the global economy begins its recovery.

No recovery in our lifetimes due to constant war and the ensuing chaos; all pre-planned. You are dreaming if you think otherwise. The only solution would be a debt jubilee and the execution of all bankers and politicians that serve the men behind the curtain.

Those two thoughts are not congruous. We do understand how the economy works pretty well. We understand that extreme and growing inequality tends to bring economies down. It creates all kinds of wasteful frictions as people jocky for position rather than produce valuable work.

That’s why the US has been stuck in a depression that shall not be named going on two decades now. Concentration of wealth and power, particularly malinvestment, has been banging up against that wall of diminishing returns for so long that the entire structure of society is crumbling away. Huge portions of both public and private activity at this juncture creates little or no actual wealth.

Thank You

Date: January 9, 8723 at 2:52 pm

No kidding, Star Date 8723

Mine now says 9250, HA! It’s later than you think!

In the US there are ideologues still using the 18th century economic theories of William Petty. That being anything above subsistence and workers won’t work. NC, where I live sees reports of 25 precent food insecurity, and no one even mentions that in political races and while democrats do have a plan to advance the minimum it is wonderfully dependent on constant readjustment accounting for inflation instead of a fiat amount like 15 dollars.

Impossible to discuss with the GOP legislature married to factually disproven ideology either way.

It is not the only state like that and the US Congress instead of anything like FDRs New Deal is apparently out for the blood of the working man.

Mature industries in the US essentially became immature when faced with competition creating a better car for example.

It wasn’t even commonly accepted as significant that much of Detroit’s work went right across the border where the government simply took the need to negotiate healthcare and pensions off the table.

Wall Street is a joke on the idea of what buying stocks was supposed to even do for the economy, like providing money to finance new industry or growth. Signs of failure were the purchase of deeds with citizen gifts arranged by government and well dressed liars and Tiabbi told us all about it in the Rolling Stone and later horrified in Divide.

Rents go up, and useless baubles are on the market.

Generals as seen explained on this site run foreign policy. While exoskeletons would advance materials moving in first and last stages they are reserved for the military, who doesn’t care either way.

Jared Diamond became depressed in his book Collapse. I recommend LA or Montevideo.

The Beats are now dead. More to be beatdown. They did note one thing: The Atom Bomb changed everything. Leading the way with junk, and if you’re an old hippie you have to hate Burroughs for that.

A Government of Government could go to war with the big five and another after the bomb, and we could watch it on TV with cameras underwater in killer subs.

Montevideo if you want to just watch.

P.S. I offer and continue to offer an alternative currency as the Insurodollar to the Petrodollar. Changes the paradigm far as the environment. Human capital may of its own accord become more valuable in the short, and the long run.

Pepe Escobar at ICH and Russia Insider says oil surplus is shallow and can fad fast, that being bad for Saudi Arabia & US plans to destabilize Russia.

True or not, agree with the article posted by Yves few days back, that Russia must move to decouple from US dollar to save itself from US hegemonic plans. Hope Putin understands this and acts.

Ambitious and thought-provoking piece. However, some of the linkages ascribed to the end of cheap-to-extract oil and other commodities remain unclear to me. For example, “slowing wage growth of non-elite workers” is not a recent phenomena and can also be ascribed to other factors. We have seen flat real wages in the U.S. since 1971, even while U.S. worker productivity has more than doubled since that time. Over that same time period, the prices of oil and other commodities have been highly variable.

Maybe the missing linkage is the ascent of neo-liberalism?

The physics the article describes would still obtain in a Keynesian or socialist economy, but perhaps either would be better equipped to recognize and adapt to the supercycle?

I would offer that where you are unclear about the linkage of “slowing wage growth of non-elite workers” due to this not being a recent phenomena, it does seem that the accelerated marginalization of more middle class falling down into the non-elite worker category (through devaluation of compensation that increasingly lack pensions/benefits, etc.) … in the globalized free market capitalism race to the bottom in squeezing human/environmental capital for profit…validates it as a linkage.

Also, I commend you on your Comment Profile name.

Well said.

I do wonder if people get seduced by this “physics of the economy” argument that Gail and others put forward.

If it weren’t so elegantly appealing, it might get picked to pieces for the rampant confirmation bias, cherry-picking of dynamics, speculation, and misattribution of causes.

Example: oil prices. It’s arguable that oil prices are in large part driven by oversupply from disruptive technology (shale), and positive feedback loops with Saudi’s etc pushing them down further to grab market share. That’s got nothing to do with debt limits.

Gail used to say debt limits causes low commodity prices, but clearly that’s not what’s happening.

And it’s not clear at all why commodity prices should spark contagion and global economic collapse. A few defaults and crises in exporting countries, yes – but mass failed banks and governments? Seems like pure speculation. The burden of proof has not been met there.

Yes, if all the dynamics in the original post were true and allowed to run rampant without any balancing feedback loops, things would be grim. But is that really the case? I doubt it, and I’m not seeing a rigorous argument supporting it.

Huh? Shale has to do with debt limits. John Dizard has been questioning shale for a while because they wells are short tailed and the high debt levels assumed not just high but rising prices. If you talk about shale and don’t talk about debt, you are missing its economics.

And to her larger point re debt, if there is insufficient end demand due to debt overhang, you get deflation. He claim here is not bold. You are choosing to blow it off. You need to deal with it. You in fact are engaging in projection, accusing her of a lack of rigor when your complaints are decidedly non-rigorous.

Case Closed

As this case clearly demonstrates, participation is irrelevant. Government is a gravity machine, a waste of time and resources, being systematically liquidated accordingly. You might want to do something more productive with your life, or not.

Experts in stupid deciding who will and who will not have children is pretty damn stupid, but there you have it – Obamacare chasing its own tail, consuming everything in sight. Consumers cannot learn, and the majority is always consumers being told to what to do by agency, neither of which can see beyond their own self-obsession in the eyes of others, a test of popularity. The critters need automated cars so they can continue looking at themselves in the mirror.

That medical equipment is junk, antibiotics suppress the immune system, and immunization causes autism over generations, distilling DNA away from natural water, oxygen and nutrients, for those who want to live in a box, who are welcome to it. The economy is in great shape, excluding all the gas leaks. And Pollyanna is the canary.

Humanity’s only limitation is its own stupidity, willful ignorance. Can you imagine what this lot would do with the ability to traverse the universe?

Space travel is not an intellectual or physical problem. Communism, capitalism and socialism in a symbiotic, bipolar relationship, always results in fascism. You don’t give the car keys to a spoiled two-year-old.

There’s nothing new about kidnapping children to enforce economic slavery, under Islam, Christianity, or the US Constitution. They all have Family Law in common, with a different dress. They all promise due process, beginning with a conclusion and seeking data to support it, blaming the individual for system stupid.

The data is whatever the experts in stupid say it is, and as you can see, they have no interest in the cause of the symptoms they create, to take advantage of each other. The test is always one of intent. If you Googled best places to have children, you would get the worst places, beginning with San Francisco, easily confirmed by demographics and the resulting financials. Why do you suppose that is?

Feudalism rules work out, with more and more infrastructure to nowhere, an intellectual vacuum for the sake of fashion. The isms deserve each other, along with the government they produce, liars lying to liars expecting a better outcome. Don’t venture into other people’s marriages expecting a happy outcome.

The ivory tower morons have created a positive feedback loop between credit and surveillance, rewarding compliance with the rent and penalizing non-compliance with the debt. They have given credit to capital, the upper middle class, the middle middle class, and the lower middle class, on a gradient, all to no avail other than natural resource liquidation, and the people they haven’t given it to don’t want it. The flipside of participation is non-participation., in the actuarial ponzi.

Government is a human being, absent responsibility and accountability, and sadly, US Government is as good as it gets, better seeing best as the enemy. Labor doesn’t need the petrodollar, the cleanest dirty shirt in the money laundering scheme. And crypto-currency is just a more efficient hashed stack, the latest and greatest outlet for money launderers.

There simply is no substitute for Grace, that which is truly rare and valuable, which no government in History has yet produced, travelling backwards in time, fixated on the rear-view mirror, popularity in the eyes of others similarly self-obsessed, in denial, anger and depression – tldr. Three-phase is an implicit compiler of functions, two operands and an operator, and vice versa. Where does the power come in, the dc controller is irrelevant except as a counterweight, and where does the power exit?

The Persians are still the most elegant programmers. Don’t let the dress fool you. And not everyone in California is the fool of Empire.

What is the relationship between the speed of light, frequency and division by zero?

Augustine already did this, and more coherently.

‘What is the relationship between the speed of light, frequency and division by zero?’ Good question. Maybe you can help me with this one first posed by Stephen Wright: If you car could travel at the speed of light, would your headlights work? The answer to that question may contain precisely what you’re looking for.

Don’t let the Archdruid read this. His head will swell unbearably.

It’s especially interesting because it draws some of the linkages between natural limits and economic and financial responses. Evidently complex feedback systems sometimes respond perversely, especially to adverse inputs. Of course, we know this, if we think about it, from our own bodies.

I think I’ll take copies of this to the Green Party talk on Ecological Economics in a couple of weeks.

There is a core conflict between the ‘Greens’ as a whole vis a vis all participants in the mass consumption society at large, and within the Party itself – between those that believe we can re-engineer the entire economy while maintaining most or all of consumerism, of a US/Western standard of living and those who see the planet’s limits effectively ruling that form of economic organization out completely.

Gail seems to fall into the latter category, but I’m not at all sure she has it right with respect to the core cost-of-energy argument. I think you could make as good or better a case re our current economic doldrums being based on letting capitalism run increasingly amok, with wealth distribution decisively headed up the income ladder as the reason real wages have gone nowhere since the early ’70’s rather than a simple effect of rising energy costs – and it’s absolutely evident the US/Saudis could drive up the price of energy again tomorrow if desired.

The real problem is we cannot use fossil fuel energy in the amounts we’d like without destroying the entire biosphere – but try telling either our own populations in the West, or China, India, Russia and others who use a piddling fraction per capita of what we do. So, though we have enough affordable fossil fuel energy for scores of years (obviously still limited) it’s what we’re doing with it (the entire range of environmental blights) that must, and will, be curtailed – one way or other, and I fear, it’s almost certainly going to be ‘other’ as in not good, not good at all for a great portion of humanity.

…this was an amazing and cogent piece of analysis of where we are, how we got here, and why we don’t know where to go… but, in a nutshell: we are uninspired – the future is “wide open”.

We do, of course, know where we have to go if we want billions of people now alive – and perhaps the habitability of our planet for higher life forms – to survive. We are just too enthralled with the prospect of converting the world’s real wealth into debts that can survive the uncertainties of life and/or our own mortality. We would have a very different economy if the goal was to produce the necessities of life as efficiently as possible – according to the laws of science, not those passed by politicians wholly owned by the 0.001%.

For the last 100+ years, we HAVE had a full-employment program for all the money bankers, financiers and politicians can create; for non-elite workers, not so much.

Excellent.

I’m wondering if a lot of the apparent paradoxes mentioned would be more easily understood if prices were not left in units of dollars, but translated into units of (say) percent of the per capita average disposable income.

Such a measure would mathematically incorporate into the graphs and equations some of the feedback-loop causes that Tverberg discusses verbally. It would to some extent remove the arbitrariness and false impressions introduced into the managed money/debt/credit supply and pricing structure for political purposes.

Speculating optimistically, it might make the need to improve the general public’s economic condition clearer to all.

The “derivative” payout on this is next to nothing. Don’t fall for that lie. Commodities and oil are paper tigers.

‘As long as the cost of commodity production is rising only slowly, its increasing cost is benevolent. This increase in cost adds to inflation in the price of goods and helps inflate away prior debt, so that debt is easier to pay.’

This is a fallacy. When the monetary unit was stable (i.e., gold-backed), secular inflation in the US and UK from 1790-1930 was almost nonexistent, despite vast increases in population and commodity production.

By contrast, both countries saw their price level rise by a factor of 20 to 30 times in the last two-thirds of the 20th century. This inflation was associated with fiat currency, not commodity production costs.

Tverberg’s final chart showing energy production crashing to Cro-Magnon levels definitely qualifies as “psycho bearish.” She and Dr Hussman ought to throw an Apocalypse of Doom party.

You are using too big a sample. Britain had significant inflation from 1793-1816 or so, then things flattened out, then she had significant deflation from 1873-1896 (“The Great Depression”) then a return to modest inflation before WWI changed the dynamic forever. You are pulling the old Economist’s trick of one foot in boiling water and one foot in an ice bath and declaring the situation “overall, temperate.”

Nitpick: the period 1873-1896 was called the “Long Depression”.

The “Great Depression” corresponded to the period 1929-1939.

Not in British historiography–we call that period The Great Depression, and the post-29 crash The Slump.

“Too big a sample” is rarely a problem in economics. Sure, inflation happened in wars, usually with convertibility suspended. Then it was “sweated out” afterward.

To go back even farther, Peter Bowden’s farm price index, from The Agrarian History of England and Wales, increased from 0.78 in the year 1500 to 1.00 in 1740. No evidence of rising production costs there.

The centuries-long record of essentially no secular inflation in commodity prices (absent the “rubber ruler” of fiat currencies) disproves Tverberg’s trifecta of mistaken claims that (1) commodity production costs are rising; (2) increased commodity costs are benevolent; and (3) rising commodity prices “add to inflation.”

Inflation happened at other times than in wars, and the fact that a bout of it is “sweated out” over a longer period doesn’t keep it, or deflation, from having severe and irreperable effects on those who live (or fail to live) through it.

A certain amount of caution is in order generalizing between periods as well. 1500-1750, for example, spans a transition from feudalism to early capitalism. A large fraction of foodstuffs were not marketed at all, but were consumed by the producers, with subsistence agriculture being the occupation of a very large fraction of the English population (and with prices and distributions to the destitute being subject to a wide range of controls by crown and church.)

As recently as the U.S. civil war a large fraction of the populace was effectively outside the money economy altogether. (In the Georgia back country, for example, most stores were trading establishments, with endless haggling about which things the farmers could produce were tradeable for what the stores sold.)

While earlier periods had less inflation than monopoly era capitalism (and note that the transition from competitive capitalism to shared monopoly in itself generates upward movement in prices) this didn’t stop crises of a nasty nature from manifesting themselves with great regularity.

Food prices for the working class were a big enough problem in Britain for the Corn Law(wheat, as we call it) repeal struggle to be a bfd. (Though again that was as much due to wages being driven down as to prices rising.)

If you think the monetary system in the United States was “stable, ie gold-backed” throughout the period you cite, then a refresher on the ability of state-authorized banks to issue their own currencies, the periodic collapse of such institutions, etc. would be useful. I don’t believe we went on a “hard-money” standard until 1848. And that was a bimetallic standard. We were gold only from 1873-78, but then silver was remonetized. In 1934 the domestic economy was moved to a silver standard, with international settlements remaining in gold.

About a year ago, I spent several weeks on her website arguing with people about how thorium nuclear reactors would change the global energy picture beginning about 2025. They would not hear of such a thing.

This woman is hard core when it comes to oil. (I grew up in southeast Texas not far from where oil was discovered there). She strikes me as typical of the oil patch people which are of two kinds — oil has peaked or no it hasn’t — but either way the world will be a catastrophic environment to have to live without it. No matter how much I tried to educate them on the promise of the thorium age, these people were just dense.

I take what she says with a grain of salt.

‘I grew up in southeast Texas not far from where oil was discovered there.’

Spindletop, comrade. My elementary school was named for Anthony F. Lucas, the petroleum engineer who drilled it.

They ain’t gonna name any schools in Texas for Gail Tverberg, whose psycho bearish forecast of a production collapse would mean the end of Texas as we know it.

oil has peaked?

No, it hasn’t. Global reserves are up 2.5X what they were in 1990. We’re awash in the stuff. And it’s renewable. Depleted oil fields fill up all the time. Eg: Iran. Discovered a massive field in the last decade in a previously depleted field. Not up for searching to get links.

There are two kinds of inflation: demand-pull and cost-push.

• The former is when too many dollars chase too few goods and services (available to buy).

• The latter is pressure from the supply side, like the price of oil and commodities.

In the 1970s, oil went from $3/barrel to over $30 in under seven years. 10X rise. Inflation soared because of those costs, food transportation, driving your car to work, heating, air conditioning, cost of operating businesses, producing products, etc. etc. etc. This was also exacerbated by labor contracts that tied wages to the cost-of-living index. Every time those costs went up, which they did dramatically with 10X the operating costs, labor got a wage increase, further imperiling businesses trying to make it. Add Volker’s ham-fisted and ignorant handling of the Fed during his first two years affecting available credit–because he didn’t understand central bank operations–and the interest rate was 20-22%.

It had nothing to do with fiat currency. Domestic fiat currency (from 1934 on) produced the middle class, something that the gold standard could not do.

Incidentally, it was Jimmy Carter who turned things around, although Reagan gets credit for it. Carter deregulated natural gas in 1978. it took three years for the power plants to retool from oil to natural gas–into Reagan’s term–but the price of oil dropped to $10/barrel by 1990.

And of course, the US directing the Saudis to flood the globe with oil to inflict damage on the Soviet Union (Saudis obliged out of fear of becoming ‘another Iran’) and ending the Iraq/Iran war had nothing to do with the oil price bottoming out in the late 80’s. And had you used 1991, the argument won’t work at all, oil having rocketed back up due to Gulf War I.

Not really.

here are the prices.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=F000000__3&f=M

Remember, that buying Canadian oil was 20% (?) cheaper.

Your own chart shows your claim for $10/b oil to be wildly off, whereas the spike I refer to was in latter ’90 into early ’91 (quite visible), not 1991 as I asserted.

You see oil as low as $10/b very briefly in 1994 (bond crisis) but not more than a couple months at anything like that low until 1998/99, i.e., the Asian Financial Crisis – a template for what took place in 2008, and in some respects for the current low price, which is a reflection of both too much production due to ultra-loose money and the impact those same Fed-led loose money policies had over time on the rest of the world, as in an enormous, global asset bubble gone bad, first in China, then oil, now emerging markets, coming to our door soon.

It is tragic–for people and the planet–that the following statement from the main post is so widely believed as to be beyond question:

The greatest productivity is achieved by small-scale holdings–I believe this was UN research findings.

Techniques such as Holistic Management (see the Savory Institute website have shown that much of the accepted wisdom about land/livestock management is simply wrong, in applications on 4 continents over decades. Correctly managed livestock–which considers all the unique factors of the people, environment, climate, goals and other conditions such as government regulations–can occur without the inputs that are commonly assumed to be necessary, and result in land regeneration and regeneration of natural waterways on an extraordinary scale in terms of productivity, biodiversity, soil depth and more–even in the most desertified of conditions.

Colin Seis and “pasture cropping” combines these methods with agriculture.

Masanobu Fukuoka is another shining light in showing how greater productivity, greater diversity, reduction or elimination of outside inputs (e.g. fertilizer, conventional irrigation), and regeneration and improvement of soil quality can be achieved together.

Not to mention Permaculture of diverse kinds, as Lambert has documented here on NC.

Additionally, tools developed at the Perelandra Nature Research Center make it possible for anyone with the desire to do so to work even more closely with the intelligence of nature (and use this enhanced 2-way communication together with any basic approach one chooses, such as those mentioned above).

IOW, there is no reason to accept the assumed inevitability of current food production methods with their destruction of soil and waste of precious resources. We should never assume the continuation of these devastatingly ineffective practices–which are often problematic from the economic perspective as well.

While not the focus of the interesting main post, I couldn’t let that initial statement stand unchallenged.

For an impressive array of folks who are putting some of these things into practice, see the recent conference “Artisans of the Grasslands”.

This is not theory. These approaches are practical, widespread across diverse ecosystems, and available now.

Exactly. Along with Alan Savory’s great TED talk about how to reverse desertification with high density low duration grazing, is another favorite of mine, a video called “Soil Carbon Cowboys.” The three “cowboys” featured in this article demonstrate the great potential of high density low duration grazing. Inputs are extremely small compared to traditional cattle raising. See for yourself.

https://vimeo.com/80518559

One of the “cowboys” in the video has a PhD in agriculture and he predicts (on another video) that we are nearing the tipping point in flipping to grass fed cattle and that high density low duration grazing is about to become how all cattle are raised in the US. This is a paradigm changer in the works.

That link is superb–and only 12 minutes! It’s a real eye-opener.Thank you. It’s great that ASU will be gathering data about the things that matter.

This is the especially important because soils are much the most promising potential carbon sink, capable (on a world scale) of soaking up enough of the black stuff to significantly improve the climate while becoming more fertile and drought resistant.

Savory’s discoveries about grazing land are an important source for that. A recent book called “Only the Soil Can Save Us” documents soil’s potential in mitigating climate change. It’s focused on grazing land – one that deals with arable soils would be very helpful. One big factor is permanent crops, things like chestnuts and hazelnuts instead of cereal grains. Another is returning as much organic matter as possible from the wast streams.

It’s a big issue with potentially huge implications, the best kind of geo-engineering. I’ll send in any links I see about it; wish I knew where that book is, but you can look it up.

We have not really understood how the economy works, so we have tended to assume we could fix one or another part of the problem.

This statement is reminiscent of Joseph Tainter’s analysis. Complexity creeps up on society over time in an ongoing effort to solve problems. Complexity requires energy and resources however, and more complexity requires more energy and resources. Inevitably a society becomes so complex that it simply can’t sustain itself on the resource base available to it, whereupon it immediately collapses. There aren’t many exceptions to this model in history (there was one exception identified by Tainter), and the American empire is basically showing every symptom of a society that’s about to undergo a catastrophic collapse. Gail’s analysis is very complementary to the work of Tainter.

Yes, we are now seeing the all-too-familiar kind of complexity that causes collapse, which might better be called ‘complication’ rather than complexity.

Competition for dollars encourages aggressive intermediation by middlemen and rent-seekers in system flows that are already functioning reasonably well. This impedes important flows and rewards unproductive competitors while draining away the resources of productive cooperators. Perhaps worse, our socioeconomic system encourages the artificial construction of complications that provide these parasites their best opportunities.

Complication is the negative synergy that results from the arbitrary control of the flow of dollars by those with a conflict of interest. The production of dollars, the interest paid on dollar debts, and the ways that dollar flows are labeled and channeled by accounting and tax laws distort what could be a far more productive and efficient flow of resources.

Well designed complexity could serve the same constructive ends in the economy as it does in nature and in our own bodies, enhancing efficiency and resilience, if our economic system could rid itself of the parasites who create complications for their profit rather than the constructive complexity of efficient regulatory feedback loops.

Sadly, this is probably not something that voters will understand, so the parasites are winning and will continue to prosper until their prey is sucked dry.

I wonder if any economist (I’m a physical scientist) has ever calculated the total dollar flow that goes to institutions like the IRS, tax lawyers, accountants, lobbyists, bribes to influence tax legislation, and the inefficiency cost of the kind of trickery currently being used to avoid taxes by corporate maneuvering? That would only be a fraction of the losses that could be avoided in a system that allocated rewards to productive activity rather than financial manipulations, and included the complexity required for self-regulation as opposed to the kind of imposed-by-corruptible-officialdom regulation that we now suffer under.

With referrence to the IRS specifically, do you mean how much of the dollars going to IRS stay inside the IRS instead of passing through it to the government in general?

Actually I was thinking of the budgeted cost of operating the IRS (plus auxiliary services like H&R Block or whoever they’ve morphed into since I left), rather than any illicit interceptions. Especially when compared with the ease and low cost of collecting a transaction tax by adding some required code to the computers that will all too soon handle the e-dollar flows in our cashless society.

But I’m afraid jgordon is right (also below). Too many in our society already owe their prosperity (or at least their livelihoods) to their paid positions in very inefficient social mechanisms. Increased efficiency would be anathema to too many.

“inefficient social mechanisms.”

Be very careful of where you point that metric mate….

I had always thought that the amount of money IRS spends to collect taxes is a small percent of the taxes it collects ( and passes on to government). The “H & R Block” problem could be solved by simplifying and shrinking the amount of tax-related rules and regs so that more people would find them easier to follow.

A “transaction” tax would be super-duper ultra-hyper regressive in being designed to tax those goods and services transactions that people engage in through their daily survival and modest-enjoyment lives. The vast revenue-streams flowing back to the upper class through the various upper-class money pumpjacks ( “investments”) would not be taxed.

About “cashless” , if the threat of cashless society is reliably seen coming several years in advance, those who can will store large amounts of raw cash in order to do bussiness in the Freedom Patriot Cash Markets. Those who can’t store cash ahead, and are forced into total chip-based cashless tracking and permission of their every transaction . . . will learn to buy modestly vast amounts of one commodity or another and then do barter between themselves . . . so many rolls of toilet paper for so many cans of beefaroni, etc. Probably based on the “cashless price” of these things. And those who can do so, will do more unmonetized production of their own food, roofwater, bio-compoo, home-heat harvesting, etc.

A decade or so ago, it turned out that the IRS, like the Pentagon, could not be audited.

Dave Barry had a wonderful time with that, but then the report just sort of disappeared.

A further implication of MMT is that it doesn’t really matter, as long as the money gets taken out of the economy. You kind of wonder where it turns up, though.

As previously mentioned, there is exactly one example of a society decomplexifying itself to avoid total collapse (that being the Byzantine Empire). Every other society out there, when faced with the fact that the society has exceeded the resource base required to support it, has “chosen” to undergo an haphazard catastrophic collapse instead. That has some implications for your comment:

1) Societies becoming too complex to manage is an inevitable process. No one can/will manage complexity. It just happens.

2) Needed reform is basically impossible. All the crooks and inefficiencies infesting the system that you mention are par for the course. It’s like leaving damp carpet alone and then being surprised that mold started growing on it. There is simply no such thing as a social system that operates efficiently indefinitely.

3) Let’s back track on number 2 here: “reform” is possible, but not needed reform. The sorts of reforms that are required to stave off collapse involve making the society less complex and less energy intensive. This sort of reform is a non-starter in America. As soon as you mention that everyone–the government, the people, the corporations–should do a lot less and use a lot less energy, everyone freaks out. So, collapse it is.

At this point it’s basically an engine with 99 times more friction than function…

This conference by physicist Geoffrey West might be of interest to you…

http://library.fora.tv/2011/10/25/Growth_Innovation_and_the_Accelerating_Pace_of_Life

Strange piece with a few interesting thoughts along with a lot of nonsense. Not sure why Yves thought it was worth publishing. At first I thought I might be missing something but I read it a second time and it’s not very coherently argued.

Quite a few readers disagree with you. Her piece is overly ambitious. That is not the same as “nonsense”.

I believe there is at least some nonsense in this article. I’m just back from Nepal one of the poorest country in the world. Now, after the April 2015 quake, the country is under a blockade from India. It’s possibile to find gasoline only in the black market at 4 USD per liter. This is plain obvious: if an indespensable resource like oil is scarce the price goes UP not down while all the expenses for less indispensable stuff are cut to pay for the increased price. I’ve read many Tverberg’s post in the past where she is speaking of arguments she doesn’t really know like most of their readers (like thermodynamics, yep ! an actuary speaking of dissipative systems after some readings on wikipedia, Prigogine is surely revolting in his grave) while at the same time sounding pretentious like when she is telling us that the economy is a complex network. Really ? Everybody know it, and if oil will be worldwide scarse one day, its price will go UP and everything else will be cut, from leisure to education to healthy food to health care, like in Nepal now. Oil is down because supply exceeds demand and the speculative future market is boosting the downtrend like always. When (not if) supply will not be enough we will probably have a massive dose of stagflation a boom in prices boosted by speculators and then a new bust. In an increasingly unstable world it will be possibile to see prices swing wildy from say 20 to 150 and back to 20 in a short time. A dream for speculators, a nightmare for all the others. We’re going to be Nepali soon.

If we cut a huge percentage of the world’s trees over the next few months, we’d flood the lumber markets and prices would tank… Despite having dilapidated our forests.

There can be long lags especially in a market where participants are disconnected from the big picture and are essentially navel-gazers.

This only would matter because we need forests for other purposes i.e. climate. I

If wood was just a pure resource with no other purpose, waiting to be extracted and “refined”, and we could store it, it wouldn’t matter if we extracted it all at once.

Of course, the long lags do produce ineffeciencies, e.g. misuse of resources during a glut.

Prices swing wildly with lags, but, doesn’t mean the world will collapse.

Ok, I will go with overly ambitious. I have no problem with the idea of a finate planet, a debt super cycle, stagnant “non-elite wages” etc. My issue is that the piece lacks a coherent narrative and thesis. It’s all over the place and at times makes sense and at other times nonsense. I still can’t figure out how oil storage makes it way into the discussion. Maybe I am dense and don’t get it. In any case, I am all for provocative discussions that offer non conventional ideas but I only have so much time and prefer things that are more cogently argued.

. . . I still can’t figure out how oil storage makes it way into the discussion.

I think the premise is that as oil storage capacity is reached, and lots of oil is being pumped without a place to store it, the oilpatch infrastructure turns into a liability from an asset. That blows a hole in the debt taken on to get all this oil, and perhaps Gail is generous when she says oil could get to $10.00 per barrel, so evermore oil has to be pumped at evermore declining prices, just to pay the interest on that massive debt.

Taken to it’s logical conclusion, soon we will be getting paid to fill our tanks.

Really? Will they give me a car and pay for the insurance too?

No. Cars can be stored anywhere. But the fuel storage capacity in those cars is humongous.

No? But how can I store fuel in a car if they won’t give me a car and pay for the insurance? Don’t they even CARE?

The City of the Mind

sometimes museums show art work produced by people who live on the very margins of psychological normality. There was one dude who spent years making a full room sized city out of tin foil

There were turrets and towers and buildings of various types and shapes with the tin foil pinched and sculpted. you know how they light scultptures in museums. They make it so you can look at things in a way that isolates them in your mind. It was quite striking to see what this mind had produced. I can still remember the whole room behind the velvet rope was lit with a low yellowish glow of soft ceiling lights reflecting off the foil.

You had to be impressed. There was something about it. It wasn’t beautiful but it was strange and potent. You thought to yourself ‘”Jesus Christ. This dude was a wacko.” But still you looked and it made you wonder.

it doesn’t have to be tin foil

Profoundly moving and insightful. Yes, in a way we each dwell in our own city. But I suspect I would have some difficulty explaining this concept to a Syrian refugee seeking refuge for himself or herself and their family. After all, there is Maslow’s hierarchy.

I was thinking of the author of this post. This post is like the tinfoil city I remember surveying with a sense of wonder and astonishment. It’s really a prodigous feat of slightly deranged imagination, wandering in loopy circumnavigations through an enchanted forest of part imaginary, part real analytical constructs. But one cannot criticize the energy (no pun intended) required to stitch these abstractions together into a thesis. That’s not trivial. I can see in my mind the man at work building his tin-foil city, the focus, the intensity, the rapture at the glory in the mind as the afternoon light fades out the window and the lamplight takes over. He missed lunch and now he’ll miss dinner. he’s bent over pushing foil into a tower and he can’t be interrupted. Maybe we’re all a little bit like that man. If we’re honest.

It does smack of this. It’s seductive, because the econophysics is so elegant, but when it comes down to it, the argument doesnt stand up to scrutiny – too many non-sequiturs and questionable premises.

Unfortunately, this writer misapplies the physical science, yet again, in a vain attempt to gain a theoretical understanding of what is going on the political economy of the world today. With some insights here and there, the conclusion that the government has run out of intervention options because the 2nd law of thermodynmics can not be breached without, I don’t know, blowing up the sun or having the moon crash into the earth or some other superstitious calamity arising out of anxiety ridden analysis that lead nowhere, yet again.

The chief problem that the writer identifies is the inability of matching rising prices to rising wages. If wages fall for any reason, too much debt to service reducing consumption of finished goods, too little wage increases in the face of inflating commodity prices, too few people in the work force bringing home a paycheck, because they are in college or over 50 and forced out of the workforce, or disabled, etc. The surplus of profits that once was used to bolster wages, benefits, new plant and equipment expansion has been replaced by debt. Debt was okay until it grew faster than wages, causing additional burdens on energy and the cost of energy to manufacture or consume cars, SUVs etc. A simple answer, although not one that solves the whole problem, because nothing ever solves the whole problem, is to use the credit formation power of the US Treasury to deposit money into bank accounts, namely the Social Security Trust Fund.

Right now, monthly electronic deposits go out to 59 million American and in 2015 the amount totaled $870bil.

The amount of stock buy backs, which could have easily been distributed as an increase in jobs and wages and pensions contributions was instead destroyed as corporate America doles out cash to shareholders and took equity in the form of stocks out of existence. It is over $1Trillion in 2015 and $Trillions more in the past 15 years. The US Treasury could deposit triple the amount the SSA sends out monthly using the stock buy backs as the asset to back up the credit formation. At triple, the additional money would be a little more than the adequate stimulus amount recommended by Obama’s advisers, but Larry Summers squashed in the final report to offer some Keynesian demand. The widely dispersed money to 20% of the population that does not work for the most part will add demand to the economy as a good component to any over all policy adjustments whether to help in recovery from an economic collapse or to simple rectifying income inequality as reparation for corporate wage suppression and political oppression of the citizenry.

The government can do a lot more, just as long as you are not brain washed by neo-liberal platitudes which includes Scientism, the cultic belief in science as the absolute purveyor of truth transcending human meaning which must be adhered to or else. Our problems do not lie in the sub atomic particles of science dear reader, they are contained in ourselves, in our essential humanity. Change your mind, your politics and change the world.

Great comment.

The article is not without virtues, however it’s conclusions are rendered, at best, tenuous due to its reliance on a more or less neoliberal view of markets being autonomous, closed systems. Politics — power relations — are either absent or nugatory. Economic or resource outcomes are the result of technical economic cause and effect relations.

“The problem of reaching limits in a finite world manifests itself in an unexpected way: slowing wage growth for non-elite workers”

As if that is the only, let alone main reason for wage stagnation….6

It may be..probably is… true that we are beyond political/policy ‘fixes”. However, that’s no reason to write as if politics is not a fundamental reason why we find ourselves in increasingly

dangerous circumstances.

Change your mind, your politics and change the world.

As the saying goes- that’s it in a nutshell.

Well, it seems to me that most major economic theories have a more or less mechanical or hydraulic feel to them, which frequently manifests in figures of speech– equilibrium, priming the pump, etc.

People, meanwhile, need to live their finite lives with some intention. Greed, or more neutrally the desire to accumulate resources, can on some level be seen as an attempt to defend oneself from economic theory.

That some of the most avid practitioners of greed also promote economistic views of the world and our created world of human possibility is simply irony lost.

@ Paul Tioxon: Sounds like you are a fellow believer in MMT. I was greatly disappointed that the Great Recession stimulus wasn’t much larger and devoted towards SS recipients, who would spend.

Further disappointment followed when the SS tax cut stimulus wasn’t larger and also at it’s demise.

Our supply-side psychosis needs to be lifted with demand side economics, with the full monetary and fiscal support of the Monetarily Sovereign US Govt.

Very good comment. These kind of dynamics are what Gail entirely misses. Also, political factors in prices e.g. oil.

Yes the world is an econophysical system, but it’s not simply some hydraulic flow of energy and money.

Governments can and will attempt solutions like this if it comes to it.

While Tverberg’s analysis of quantitative change in normal oil markets is quite accurate, I’m always struck by her insensitivity to qualitative changes in technology that comes about in long waves. Before we used gasoline, the economy was based on coal, steel and rail. Before that, it was based on steam. We’re coming close to the end now of Moore’s law in semiconductors, making the oil economy almost two full generations old.

“Trees don’t grow to the sky,” as my old economics professor Walt Rostow was fond of saying. Technologies have a birth, a middle age and a death. We’ve always had these problems as old technologies approach their grave. The debt that used to drive increased efficiency starts to peter out because scientists and engineers run out of new ways to make old gadgets more efficient. The fact is this debt supercycle has repeated itself time and time again. Kondratieff noticed it in commodities and Rostow extended the pattern of analysis to technology itself.

The difference is between productive and unproductive debt. Investing an extra $1 in oil today isn’t going to make its technology much more efficient next year. But if you look at utility scale solar, it seems to get about 10-20% most cost-effective every year. In recent bids, solar has already beaten out standard forms of power generation in Indian and Chile. At the present rate of progress – and there are plenty of reasons to expect some quantum leaps on the way – building a new solar plant will be cheaper in most of the United States by 2017.

Tverberg’s assumptions about the cost of renewables are hilarious and show utterly no real understanding of how fast technology is changing. It’s a bit like saying you expect Intel to release a processor next year that’s actually slower, more expensive and has less memory. That’s not the way it works.

How hard is it for her to notice Moore’s Law in semiconductors and apply her otherwise fine mathematical skills to extrapolate a chart of solar efficiency improvements over the last forty years until she figures out that the oil industry will be broken by the sunk cost fallacy that seems to keep sucking so many hedge fund dollars into fracking?

The fact is even pretty staid and well-captured government agencies/fossil fuel lapdogs now project the cost of a megawatt from solar power generation falling to 30% of the present cost of oil and gas production within ten to twenty years.

Where is that in Tverberg’s chart?

Figure out the battery problem – which looks to take no more than another five to ten years at most, according to Musk – and the main benefit of the internal combustion engine, portability, evaporates. Now demand from transportation starts to evaporate. How much longer until it’s cheaper to yank carbon directly out of the air to make fertilizers and plastics instead of expensively pumping it out of deep wells, shipping it and piping it into distant refineries?

Wonder what the Republican Party will look like when the fossil fuel funding arm of its party collapses? Will it take investment banks with it?

Understand now why the Koch’s are so vigorously attacking solar everywhere?

All this has happened before. The main problem in the 1930s was overproduction of oil to the point of damaging fields and difficulty propping up end demand to sustain the price. This is what projects like the Tennessee Valley Authority were about. Government had to step in to create and stabilize demand for the new technology. In countries like Germany where they’re doing this effectively, their energy costs are dropping. This is also one of the reasons electricity demand has decoupled from economic growth recently. Efficiency is another big driver working against oil.

For such a wealthy country (I’m going to start saying that a lot), it’s interesting how resistant the US is to experimenting with new energy technologies. It’s true that there are well positioned extant interests that lobby for political and public relations protection for old dirty tech, but what’s astonishing is how readily everyone else falls for that from politicians to investors to entrepreneurs to political constituencies–some of whom parrot innovation talk without apparently thinking very much about what they’re saying.

I emphasize “willing to experiment” because it’s clear that many particular experiments will prove inadequate, and should be altered, scaled back or abandoned. But for such a wealthy country an unwillingness to experiment in MANY different directions, in this or any other policy area is unnecessary.

I think there must be something deeply wrong in the structure of the way we think that people always think there is ONE RIGHT WAY, even if the major political constituencies disagree about what that one right way is.

Wealthy country? Really? Other than the MMT tool, where is that wealth and where does it reside?