Yves here. The paper below is comparatively short and well-written, but don’t let that fool you. Its author, Servaas Storm, gave the best talk at last year’s Institute for New Economic Thinking annual plenary, and he continues to do important work. His new article makes a devastating attack on a fundamental belief driving Eurozone policy, that the member economies need to be made more “competitive,” meaning labor needs to be squeezed, for the currency union to achieve more growth. Recall that for Greece, one of the key battles that the ruling coalition lost was over labor “reforms” which were all meant to reduce worker bargaining power.

This article shows, decisively, how wrong-headed this worker-crushing approach is. It shows that labor is a comparatively small percent of the cost of wholesale goods, and in the case of Germany, how the reductions in labor costs (the Haartz reforms) had almost nothing to do with Germany’s growth in exports. Instead, the bigger effect of the wage reduction in Germany was to constrain domestic demand, which led the European Central Bank to set interest rates unduly low, which then set off excessive borrowing and real estate speculation in the periphery countries. That in turn led to banking crises that the bailouts transfigured into sovereign debt crises.

By Servaas Storm, Senior Lecturer in Economics, Delft University of Technology and co-author, with C.W. M. Naastepad, of Macroeconomics Beyond the NAIRU (Cambridge, MA: Harvard University Press), which won the Myrdal Prize of the European Association for Evolutionary Political Economy. Originally published at the Institute for New Economic Thinking website

It is high time to look more closely at the labor cost competitiveness myth.

Progress in economics “is slow partly from mere intellectual inertia,” wrote Joan Robinson (1962, p. 79) long ago, because “[i]n a subject where there is no agreed procedure for knocking out errors, doctrines have a long life.” As a recent illustration of such inertia, it took more than five years since Eurozone crisis started full-force (in May 2010) to come to a more or less reasonable “consensus diagnosis” as proposed by a group of economists associated with CEPR (in “Rebooting the Eurozone,” published in Vox on 20 November 2015).1

Even though this diagnosis marked a substantial advance, it invited strong critiques by Peter Bofinger (2015), one of the five members of Germany’s Sachverständigenrat, and from Oxford University’s Simon Wren-Lewis (2015).2 Both critics argue that the “consensus diagnosis” inappropriately focuses just on the deficit-crisis countries of Southern Europe, while neglecting the role of Germany, and of German wage moderation in particular, in bringing about the intra-Eurozone current account imbalances which are arguably at the heart of the Eurozone problématique.

The sad truth, however, is that Bofinger and Wren-Lewis are right for the wrong reason—hence their interventions are less than helpful, because rather than knocking out the remaining errors in the “consensus diagnosis”, they help perpetuate a mistaken doctrine: that relative unit-labor-costs matter are the prime determinant of a country’s international competitiveness, current account balance, and foreign indebtedness. The issue is serious: keeping alive the dangerous myth that labor costs drive “competitiveness” feeds the irrepressible urge of the orthodox mainstream to try to bring about economic recovery by reducing Eurozone unit labor costs (Gabrisch and Staehr 2014; Janssen 2015; Storm and Naastepad 2012, 2015b, 2015c). This intrinsically beggar-thy-neighbour strategy has already become codified into official Eurozone policy: in the Euro Plus Pact (adopted by the European Council in March 2011) and recently by the Informal European Council (February 2015), which both combine it with a prescription for fiscal austerity based on a tight cyclically-adjusted public budget constraint.3 It is therefore high time to look more closely at the labor cost competitiveness myth.

Progress: What the Consensus Diagnosis Gets Right

But first let me clarify that the consensus diagnosis is right in pointing out that the Eurozone crisis is not a sovereign debt crisis in its origin. Instead, it correctly holds that (i) the Eurozone crisis originated in a (banking) crisis of cross-border capital flows gone wild that led to massive intra-Eurozone (current account) imbalances; and (ii) that the crisis has been amplified by institutional flaws in the design of the Eurozone. The consensus authors rightly point to the vicious “doom loop” in which crisis-struck Eurozone governments, lacking access to a lender of last resort, were left to borrow only from their national banking systems—systems which had become increasingly insolvent and in turn had to be bailed out by the same governments. The diagnosis that the Eurozone crisis is a crisis of deregulated (too-big-to-fail) banking is consistent with earlier analyses by Lane (2012), Lane and Pels (2012), Gabrisch and Staehr (2014), Storm and Naastepad (2015c, 2015d), O’Connell (2015) and others.

It is a far cry from the orthodox diagnosis propounded by mainstream economists such Sinn (2014) and by the European Commission, which absolve TBTF banks from any responsibility for the crisis and instead blames the “victims,” arguing that profligate Southern European countries, by allowing nominal wage growth to persistently exceed labor productivity growth, let their relative unit labor costs increase and their cost competitiveness deteriorate. In this narrative, rising unit labor costs are due to fiscal profligacy and “rigid” “over-regulated” labor markets, powerful unions, and strong employment protection. Rising relative unit labor costs supposedly killed Southern Europe’s export growth, raised current account deficits, created unsustainable external debts and reduced fiscal policy space, and hence, when the crisis broke, these countries lacked the resilience to absorb the shock. It follows in this story that the only escape from recession is for the Southern European countries rebuild their cost competitiveness—cutting wage costs (because Eurozone members cannot devalue their currency) by as much as 30% (as proposed by Sinn 2014), which requires in turn that their labor markets be thoroughly deregulated.

The Flip Side: The “Unit-Labor Cost Competitiveness Matters” Myth

Bofinger is right: when it comes to individual countries, the “consensus diagnosis” one-sidedly focuses on the crisis-struck deficit countries of Southern Europe, while the role of the Eurozone surplus countries, and Germany in particular, in bringing about the imbalances is left unmentioned. This omission is even worse, because the “consensus diagnosis” promulgates the “official” party line by claiming (in a throw-away sentence) that “the rigidity of factor and product markets [in Southern Europe] made the process of restoring competitiveness slow and painful in terms of lost output.” The consensus diagnosis thus accepts the official remedy of internal devaluations and labor market deregulation imposed on the crisis-struck countries by the European Commission, the ECB and the IMF.

Bofinger and Wren-Lewis wish to set part of the record straight by highlighting Germany’s responsibility for bringing about the Eurozone crisis. They argue that Germany’s long-term policy of wage moderation (based on a deliberate voluntary tri-partite agreement between German employers, trade unions and government) undercut its Eurozone neighbours and thereby raised Germany’s labor-cost competitiveness, helping to cause the Eurozone crisis by contributing to the build-up of Eurozone (current account) imbalances. Southern Europe’s cost competitiveness problem, in other words, was created in Berlin. The result, as Bofinger (2015) argues, is that German domestic and import demand slowed down, while its increasingly more cost-competitive exports experienced fast growth; as a result, the profit share in German GDP increased simultaneously with a growing current account surplus.

Confusing “simultaneity” with “causality,” Bofinger then suggests that the higher corporate profits were used to finance the (net) outflow of German savings to the rest of world, as indicated by its current account surplus.4 German wage moderation in this story is (mostly) to blame for the weakening of Southern Europe’s cost competitiveness as well as the large capital flow from Germany to the increasingly indebted and vulnerable Eurozone periphery. Wren-Lewis calls this the “untold story of the Eurozone crisis,” which is rather remarkable, because many authors made exactly the same point earlier including Lapavitsas et al. (2011), Stockhammer (2011), Bibow (2012), Flassbeck and Lapavitsas (2013) (for a lengthy list of references see Storm and Naastepad 2015a, 2015b, 2015c). These accounts show that wage moderation is a very powerful narrative (especially in Europe’s North), probably because it resonates with Calvinism and fits seamlessly with Weber’s Protestant Ethic, centring around the notion of “delayed gratification”: first the pain of tightening your belts to improve labor-cost competitiveness in order to obtain the gain of higher export growth, higher incomes and more jobs at a later stage. But, as Tolstoy (1882) wrote in A Confession, “wrong does not cease to be wrong, because the majority share in it.”

Knocking Out Errors

Bofinger’s narrative is worrisome in two major ways. First, by exclusively focusing on the real economy (wages, corporate profits, cost competitiveness and trade), the financial sector disappears from the scene—even though Bofinger seems to agree that the Eurozone crisis is in essence a financial crisis—and it becomes almost natural to only look for solutions in the real economy. In this way, the culprits (i.e., TBTF banks) are let off the hook—which means the real origins of the imbalances and crisis are left undebated. Secondly, of course it is true that Germany and German wage moderation bear part of the responsibility for bringing about the Eurozone crisis. Bofinger and Wren-Lewis have the best intentions while making this point (alas, the road to hell is paved with good intentions ….), but their single-minded emphasis on the importance of relative unit labor cost competitiveness is misguided for at least the following three reasons.

Firstly, exports and imports are—by definition (as explained in Storm and Naastepad 2015a, 2015c)—much less responsive to changes in (relative) unit labor costs than to changes in (relative) prices for several reasons. Unit labor costs make up less than 25% of the gross output price, while a second reason is that firms in general do not pass on all (but mostly only half of) unit labor cost increases onto market prices. What it means is that (when using realistic unit-labor cost elasticities) observed changes in Germany’s relative unit labor cost statistically “explain” only a minuscule fraction of its export growth and current account surplus (Wyplosz 2013; Gabrisch and Staehr 2014). For instance, IMF economists Danninger and Joutz (2007, p. 15) find that relative cost improvements accounted for less than 2% of German export growth during 1993-2005. Germany’s superior export performance can instead be completely explained by the “income effect” (Storm and Naastepad 2015a): German firms supply mostly complex, high-tech, and high-priced goods to fast-growing markets as well as to faster-growing countries such as China, Russia and Saudi Arabia (Gabrisch and Staehr 2014; Diaz Sanchez and Varoudakis 2013; Storm and Naastepad 2015a; Schröder 2015). Germany excels in non-price (technology-based) competitiveness and does not engage (much) in price competition.

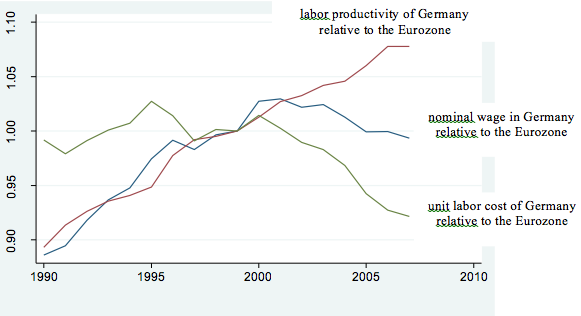

Secondly, as shown in Figure 1, there is no clear sign of a nominal wage squeeze on German workers if we compare Germany to the Eurozone as a whole (but excluding Germany). German nominal wages increased relative to the Eurozone in the 1990s and the German relative nominal wage stayed more or less flat during the period 1999-2007 (there was a negligible decline of 0.7 percentage points over these eight years). It is nevertheless true that Germany’s unit labor cost declined relative to those of the rest of the Eurozone (as Figure 1 illustrates), but this was not a result of wage restraint: It was completely due to Germany’s outstanding productivity performance: during 1999-2007 average German labor productivity (per hour worked) increased by almost 8 percentage points compared to the rest of the Eurozone, which accounts fully for the decline in Germany’s relative unit labor costs by 7.8 percentage points over the same period. It was German engineering ingenuity, not nominal wage restraint or the Hartz “reforms”, which reduced its unit labor costs. Any talk of Germany deliberately undercutting its Eurozone neighbors is therefore beside the point.

Thirdly, the increase in current account deficits in Southern Europe resulted from an increase in the trend growth of their imports, while the trend growth of their exports stayed unchanged (notwithstanding the sustained rise in their unit labor costs). There is convincing statistical evidence for the European Union (Diaz Sanchez and Varoudakis 2014; Storm and Naastepad 2015c) showing that initial increases in current account deficits were followed only later in time by increases in relative unit labor costs—which, if true, means that the current account deteriorations were not caused by higher (relative) unit labor costs. The only rational explanation for the observed time-sequence is that Southern Europe first experienced a debt-led growth boom, which then led to higher imports and higher capital inflows leading only after a lag of many quarters to lower unemployment and higher wage growth in excess of labor productivity growth (see Storm and Naastepad 2015c). This explanation is consistent with the first two statements of “consensus diagnosis” outlined above

.

Figure 1

Nominal hourly wages, hourly labor productivity and unit labor cost:

Germany vis-à-vis the rest of the Eurozone (1990-2007; 1999 = 1.00)

Authors’ calculations from EU-KLEMS Database. See Storm and Naastepad (2015a). Relative unit labor cost is defined as the ratio of the relative nominal wage and relative labor productivity.

The Unmentioned Issues

The real problem of the Eurozone is, accordingly is not that unit labor costs have not converged but that the common currency and monetary unification have not led to a convergence of member countries’ production, employment, and trade structures, but rather to a centrifugal process of structural divergence in production. In a nutshell, since the mid-1990s, Germany has become stronger and more productive in high-value-added, higher-tech manufacturing (in conjunction with outsourcing to Eastern European countries), while Southern European countries became more strongly locked into lower-tech, lower value-added and, often, non-tradable activities (Storm and Naastepad 2015c). This has reinforced the core-periphery relationship between Germany and the Southern-European countries—meaning that Southern European growth spills over into German growth (via trade and finance) but not vice versa (Janger et al. 2012; Simonazzi, Ginzburg & Nocella 2013; Botta 2014; O’Connell 2015). This centrifugal process has been fueled and strengthened not just by the surge in cross-border capital flows following the introduction of the euro, but also by the common currency itself (as argued by Wierts, van Kerkhoff and de Haan 2014) as well as by the centralized and uniform interest rate policy of the ECB which up to 2008 was perhaps appropriate for stagnant and low-inflation Germany, but was undeniably out-of-sync with inflation levels in Southern Europe (Storm and Naastepad 2015c). Cheap credit in the South created unsustainable asset bubbles and facilitated untenable debt accumulation which fed into higher growth, lower unemployment and higher wages—but all concentrated in the non-dynamic and often non-tradable sectors of their economies.

In this analysis, the role of German wage moderation is very different from conventional wisdom. It mattered a lot, not through its supposed impact on cost competitiveness, but via its negative impacts on demand or, more specifically, (wage-led) German growth and inflation, which in turn prompted the ECB to lower the interest rate excessively for the Eurozone as a whole (as is illustrated in Storm and Naastepad 2015c, by Figure 1). The real issues facing the Eurozone have nothing to do with wages, cost competitiveness or trade imbalances. They are instead how to bring about a structural convergence between member countries of a common currency area (so far lacking any meaningful supranational fiscal policy mechanisms) in terms of productive structures, productivity levels, and ultimately incomes and long-term living conditions—which certainly will not be achieved by cutting wages and deregulating labor markets? What is the appropriate interest rate for the structurally divergent “core” and “periphery” in a one-size-fits-all monetary union? And how can banks, the financial sector and capital flows be made to contribute to a process of convergence (rather than divergence)?

These are hard nuts to crack —but let us hope that it will not take another five full years to finally ditch the dangerous myth that unit labor cost competitiveness is the prime problem and come up with a more rational Eurozone macro policy than the self-destructive policies of internal devaluation” and “structural reforms” pursued so far.

- 1. http://www.voxeu.org/article/ez-crisis-consensus-narrative

- 2. http://www.socialeurope.eu/2015/12/german-wage-moderation-and-the-eurozone-crisis/ and http://www.socialeurope.eu/2015/12/was-german-wage-undercutting-deliberate/

- 3. See Costantini (2015) for a hard-hitting exegesis of cyclically-adjusted budgetary policy, which traces its evolution from an essentially Keynesian concept in the 1940s, ’50s and ’60s, to a dogmatic New-Classical and (within the Eurozone) an Ordo-Liberal concept today.

- 4. The simultaneous increases in corporate savings and net capital outflows from Germany are not directly linked. Net capital outflows are the result of gross cross-border capital flows, which in turn are determined (even “pushed”) by events in the countries (such as Germany) where the large financial institutions channeling the lending are based (O’Connell 2015). This means gross capital flows are not necessarily (or at all) related to the financing of trade. For example, Germany was Ireland’s biggest net creditor by far, but only a minor Irish trading partner. O’Connell (2015) convincingly argues that the Eurozone crisis is a creditors’ crisis.

See original article for bibliography

I think you’ll find that it’s the “Institute for New Economic Thinking” (first para.)…

Isn’t that an oxymoron?

If only it were as Yves typed it, then the skies would part.

I’ll have to read this post. It seems — just based on Yves’ description and the colorful graphs — like a promising circumnavigation of the City of the Mind that tinfoil sculptors have erected in their own honor. Every metaphor is also a metaphor. How can that be? There’s a peculiar answer to that question, but I won’t bore anybody with it now.

The continental European (led by Germany) way is beggar-thy-neighbour solution to your problems: got a problem? Export it elsewhere! xport problems (deflation) and import solutions (demand).

I wonder, with the largest trade surplus ever in the history of mankind (in absolute and probably relative terms), soon we will have to export to aliens to solve our problems.

What sort of misguided ideology can claim you have ‘competitiveness’ problems while you hold a gigantic trade surplus with the rest of the world? The one which European elites profess…

Those continental Europeans run more equal societies with a higher priority placed on policies such as social insurance, passenger rail, and renewable energy. I agree Berlin and Paris are complicit in allowing the Anglo-American empire to become what it has become, but are you suggesting USUK is doing a better job?

FD I’m a continental European.

The current reason why they are running “more equal” societies is because transfers through exports from USA and China.

Pre-2005 sure, right now all I’m saying is not sustainable. And it’s driven by “protestant” type of moral económica, so not much better.

I’m calling BS on that. Current account surpluses do not cause equality (and current account deficits do not cause inequality). That’s the very justification the neoliberals use all the time to excuse concentration of wealth and power.

And at anyrate, I note you didn’t dispute the core comparison. Paris and Berlin run more equal societies than DC. The pressure is coming from the Atlanticists, not the Continentals.

But Germany can only raise wages if the unions are strong enough to raise wages, and they aren’t – or at least they don’t think they are.

We are still stuck in national wage setting where wages only go up when unions are strong enough to make them go up. And even in Germany, that condition does not exist.

Also, the author is no doubt right that, in the aggregate, wage restraint in Germany had nothing to do with strong German economic growth. But in actual wage negotiations (which in Germany are still mostly held at the Lander level – analogous to U.S. states), that isn’t what controls. The unions can try to strike for higher wages, but the employers can take them on and, at least in the export sector, they can and do shift work to lower wage countries, or even lower wage parts of Germany.

Maybe they have been brainwashed. But talk to German autoworkers and they claim they have no hand to play.

But the issue is that economists and the politicians are supporting the wage-crushing strategy. If the unions had friends in court, their bargaining positions would be much different.

And it is really bogus to say that direct factory labor has much to do wit the competitiveness of car prices in particular. Direct factory labor is only 11-13% of the dealer price. And when you move manufacturing offshore, you offset factory labor savings with increased managerial costs and transit times, which means more financiing costs and more risk of being stuck with excessive inventory. The labor cost whinging is all about transferring income from workers to managers, not about product cost.

No argument from me. But auto unions everywhere have been making those same arguments for the last 30+ years. And yet the economists and politicians remain not only unconvinced but actively opposed. It almost seems like class warfare.

Superb and unexpected essay for which I am grateful. The analysis settles a series of questions that have been nagging me but I did not know how to approach.

We’re getting closer to the heart of the matter. Exports are becoming so important to national economies that foreign markets and international laws control domestic policy.

It’s seems to me indicative of the dementia that has gripped the mainstream of the economics discipline that supposedly serious, well-informed leaders can actually encourage every single country to pursue a strategy of export growth–i.e. the “take some business away from your neighbors” strategy–without seeing the obvious fallacy of composition problem.

The Greeks take a pay cut so they can sell more stuff in Germany (i.e. take business away from German firms) while the Germans also take a pay cut so they can sell more stuff in Greece (i.e. take business away from Greek firms). Even though Greek goods are now cheaper in Germany than before, the Germans have less money to spend overall and so don’t buy as much.

It should be apparent that every country cannot follow a strategy of lowering wages at home and taking business away from firms in other countries and expect to be successful. In fact, this way of conceiving the global economy sets things up as a zero-sum game. But no one (of importance) ever says to some country, “hey look, not everyone can win the beggar-thy-neighbor game, and you probably won’t be one of them, so why don’t you start thinking about some other strategies and tactics to accomplish your economic goals?”

The mainstream economic advice of slashing wages and increasing export revenue amounts to a suggestion that everyone ruthlessly attack their neighbors–let’s you and him fight on a global scale–all the while claiming that theirs is the way to peace. It’s absurdist, see-thru BS. Abso-f—ing-lutley astounding that anyone takes them seriously.

Not a bug, but a feature. Policy is increasingly written for corporations, not for the people. What do firms care if Greece crashes and burns? Production is practically built on wheels to chase after the cheapest labor any way so anything to push even low labor costs even lower is exactly what they are striving for.

“It should be apparent that every country cannot follow a strategy of lowering wages at home and taking business away from firms in other countries…”. Yes it SHOULD BE apparent. Unfortunately most national leaders (certainly Obama and David Cameron in the UK) promote the “lets export our way out of unemployment” drivel.

Back in the day (2005?) we had expensive seminars by a traveling circus of consultants on how to optimize our cash flow, which basically meant paying bills as late as possible, even using software tools to record the time taken after the due date for a notice to be sent, who would send late-fees, how large and when.

Of course – when *everyone* has taken the same “training”, it doesn’t work so well. The other effect was that whenever the production had a problem and, for example, needed extra parts NOW, the sub-contractors would often say (with a certain glee): “Nah, we sold that extra stock to The Competition – besides, they just pay what we ask – On Time even!”

Is this a good example of just what a blunt instrument interest rates are? Not just because each economy is different but because also each government is different. In Germany and the other former sovereign nations of the EU, their politix swings from conservative to liberal as necessary because they need to protect their interest rate, not their currency individually. A lot of this chaos which results in governments strangling labor to protect interest rates could be eliminated if labor and full employment itself backed the euro. Instead logic has been turned on its head in a circular rationale so that the value of the euro backs the euro. And the same thing is sorta happening here when labor is just another commodity.

Except the EZ crisis wasn’t diagnosed properly in that Rebooting article. How can we have a consensus narrative of events in western political economy when words like fraud, inequality, and NATO aren’t even used?

From the article:

“In a nutshell, since the mid-1990s, Germany has become stronger and more productive in high-value-added, higher-tech manufacturing (in conjunction with outsourcing to Eastern European countries), while Southern European countries became more strongly locked into lower-tech, lower value-added and, often, non-tradable activities (Storm and Naastepad 2015c).

If this is indeed the correct analysis (and I tend to agree), then its almost intractable politically. I sincerely doubt that Germany will give up its high-tech manufacturing and productivity lead any time soon.

Maybe this realization will finally abort the ill-conceived and poorly implemented monetary union. It’s never too late to roll back.

Thure:

The difference being Labor intensive work goes to countries with great amounts of Labor and Capital intensive work goes to countries with great amounts of Capital. Greece being the former and Germany being the later. Eli Heckscher and Bertil Ohlin (Stockholm). The Heckscher–Ohlin model predicts patterns of commerce and production based on the capabilities of a trading region. Countries will export products that use their abundant and cheap factor(s) of production and import products that use the countries’ scarce factor(s).

Germany will not give up its Capital enabled capability which more than likely has a lower Labor cost due to less of it being used and a much lower cost to produce. It will continue to squeeze Labor intensive countries as it has that lower level of cost. With the influx of new immigrants, it may now be able to take on more Labor intensive production.

I find this to be intriguing: “Unit labor costs make up less than 25% of the gross output price.” 25% for Direct Labor costs is too high and I suspect this includes other factors such as Overhead.

That seems a bit simplistic.

Where in this dichotomy would you place knowledge, innovation as well as the accumulated advantages due to superior managerial and creative services developed by these firms?

Its the endogenous advantages in context that matter.

Thure:

Can “knowledge, innovation as well as the accumulated advantages due to superior managerial and creative services” directly make a part?

I find this confusing. First the authors claim that German nominal wages stayed more or less in line with others in Europe, then they claim that these same ‘unsuppressed’ wages caused reduced aggregate demand in Germany. Would not some graphs to demonstrate changes in aggregate demand (relative to Europe) help to support this point? What effect did unification have on this dynamic?

The authors then claim that the negative impacts on demand from German wages (even though they were in line with European ones) prompted the ECB to set interest rates that were too low for the periphery (some evidence that the ECB set interest rates in response to the performance of the German economy would be appreciated). This promoted debt-driven growth, primarily in the south (some graphs juxtaposing ECB interest rates with European growth rates, EZ and non-EZ, would help). This, it seems, is a testable hypothesis. Would different US states not show varying rates of growth commensurate with FED interest rate policies? The FED interest rate must be too high for some states and too low for others, somewhat similar to the argument being made about Europe?

The only thing that seems clear is that “Germany’s outstanding productivity performance” contrasts with the South where there was apparently little productivity growth.

How to fix that?

1. Let the Northeners be production-slaves so that goodies can be handed out to the South (and they don’t become debt-slaves)?

2. Hamstring productivity growth in the North (the economic equivalent of a frontal lobotomy)?

3. Improve productivity growth in the South?

4. Increase aggregate demand in the north for southern goods (where the economies are often non-dynamic with lower-tech, lower value-added and non-tradable sectors…)?

5. Have southern countries leave the EZ (with their non-dynamic, lower-tech, lower value-added and non-tradable sector economies)? Leaving the EZ will make these economies dynamic, high-tech, value-added and expand the tradable sectors?

I think 3 is the only realistic option, but maybe I have overlooked one?

Although, when taken together, it seems that the problem lies with the ECB (whom the Northerners accuse of setting too low interest rates and the Southerners of too high interest rates), it really seems that the problem lies with the southerners: if they want a northern lifestyle, they must perform at northern levels. Period. This holds true whether economists shunt the problem form “unit labor costs” to “productivity levels” to “interest rates” to “Target 2 transfers” to “trade imbalances” to “the lack of a sovereign currency” to “fiscal stimulus” to “aggregate demand”. I’m sure my head is not the only one spinning, but maybe yours is less so. Then please help me out!

One is Capital Intensive and the other is Labor Intensive. Plow pulled by horses or plow pulled by steam tractor. Make sense now?

Whoa this one is good. I was going to call my comment “Nobody Would Think of This While Eating Spaghetti”, since I am eating spaghetti as I type. Well almost nobody anyway. Very few people, let us say, would even bother to read something like this — either the Post or my comment. Maybe 4 people total. But then I thought that was too abstract of a comment title. So I decided to call it:

Drum Roll Please:

Pumping Iron

Hans and Franz won’t like this one, that’s for sure. You’re not supposed to look at Hans and Franz in the weight room and say “Those muscles youze guys have. Those look like crumpled paper stuffed in wads under your sweatshirt!”

They’re here to “Pump You Up!” You’re not here to turn them into Girly Men with slender arms that can’t get competitive. That’s not what you’re supposed to do.

What is this? Did somebody make this Post up and type it out. They need to get competitive and buckle down. There’s no math in this Post! How can you tell what side of the circle is more circular without equations?

Based on this article, I’d say a “policy shift” is called for.

Of course, it one sees this as about labor and capital in all countries, and not about relative national competitiveness at all, it becomes more explicable.

The bosses are behaving as if they believed in some theory that held that labor power was a unique commodity in ways that made it the ultimate source of all surplus value.

Hans and Franz wanna Pump You Up!

If you get pumped up, you can be a Surplus Value Manly Man. But if you’re a Girly Man who can’t get competitive, you won’t be a unique commodity that produces surplus value for your boss .Girly men are not unique but the Manly Man Who Gets Pumped, he’s the Man the Boss wants

“Competitive Sucess for the Manly Man’ is a tell-alll how to to get competitive and achieve surplus value. This 100 page pamphlet will show you how to lose all your weight and disappear. When you divide yourself by zerro, you get infinity. Send $100000000 dollars to:

Manly Man Secrets in 100 Pages

Sucess is Now Publications

PO Box 8

Magonia

So Servaas Storm thinks that “….labor is a comparatively small percent of the cost of wholesale goods.” Truly hilarious. Labour actually accounts for 100% of the cost of all goods. Of course you can split the cost of producing something up into labour, capital equipment and materials. But the cost of that capital equipment and materials itself is made up of labour, capital equipment and materials. So if you go back far enough, labor accounts for 100% of the cost of everything (that’s if you count the employer’s labour, i.e. profit, as a form of labor).

Another reservation of course is that part of the cost of producing stuff in any country is accounted for by imported materials etc. Thus my above “100%” point applies to the world as a whole, not one country. Nevertheless, the idea that labour accounts for a “comparitively small” proportion of the cost of stuff is wide of the mark.

One point that should be mentioned is the way wages are supposed to behave in a currency union: Grow in line with productivity + ECB inflation target like they did in France. When Flassbeck for example talks about wage moderation then the fact that German wages stagnated instead is what he means.