Are the Germans plotting to beat Marine Le Pen to the punch in her “destroy the Eurozone” plot? Not that that is Le Pen’s main goal, but executing her plan to have France leave the currency union would do just that.

However, even before we get to the scheme of the day, it’s important to recall that Germany has imposed boundary conditions that make it impossible for the Eurozone to survive, such as insisting on retaining its trade surpluses with other countries in the currency bloc, yet refusing to finance their purchases, and also stymieing other measures that could finesse the problem, namely, fiscal transfers, like large-scale infrastructure spending in periphery countries financed by an ECB infrastructure bank (one of the mechanisms in Jamie Galbraith’s and Yanis Varoufakis’ Modest Proposal). If Germany and its allies in the creditor nations don’t relax these constraints, the Eurozone is destined to founder. It’s just a matter of time.

And the Germans may be accelerating that time of reckoning. Ambrose Evans-Pritchard has a new story on a German sovereign bond bail in scheme that is obviously hair-brained, in that it is guaranteed to blow periphery bond yields sky-high, which was the very problem the Eurozone was struggling to contain through 2012. That meant periphery countries could not finance their budgets or even roll over maturing debt at reasonable prices. It also meant that banks were imperiled, since they were stuffed to the gills with sovereign debt that Mr. Market said was worth a lot less than they’d paid for it.

The one big caveat regarding the Evans-Pritchard piece is that my contacts who read German don’t recall seeing any reporting on it, nor did they see any news about it in today’s papers. Evans-Pritchard’s story appears to have been placed by Peter Bofinger, who is apparently a lone and loud dissenter on the five-member German Council of Economic Advisers to the sovereign bail-in plan.

From the Telegraph:

A new German plan to impose “haircuts” on holders of eurozone sovereign debt risks igniting an unstoppable European bond crisis and could force Italy and Spain to restore their own currencies, a top adviser to the German government has warned….

The German Council has called for a “sovereign insolvency mechanism” even though this overturns the financial principles of the post-war order in Europe, deeming such a move necessary to restore the credibility of the “no-bailout” clause in the Maastricht Treaty….

Under the scheme, bondholders would suffer losses in any future sovereign debt crisis before there can be any rescue by the eurozone bail-out fund (ESM). “It is asking for trouble,” said Lorenzo Codogno, former chief economist for the Italian Treasury and now at LC Macro Advisors.

This sovereign “bail-in” matches the contentious “bail-in” rule for bank bondholders, which came into force in January and has contributed to the drastic sell-off in eurozone bank assets this year.

Prof Bofinger wrote a separate opinion warning that the plan could become self-fulfilling all too quickly, setting off a “bond run” as investors dump their holdings to avoid a haircut.

Italy, Portugal and Spain would be powerless to defend themselves since they no longer have their own monetary instruments. “These countries risk being hit by a dangerous confidence crisis,” he said.

Yves here. Bofinger’s warning was based on the assumption that the next move would be for countries like Italy and Portugal to introduce their own currencies pronto. But as we discussed at length (see here, here, and here for some examples), it will take years to convert to a new currency, thanks to systems requirements, most of which are not under the control of the government wanting to make the conversion. In the case of Greece, as we saw in its two-week bank holiday, the lack of access to international payments systems hit key imports – tourism, food and pharmaceuticals – hard and would have soon started affecting fuel imports. Greece is not self-sufficient in food. Italy may be, but does it have the staying power to function as an autarky for 3+ years? (Yes, IT experts who know the relevant systems estimated three years was the minimum amount of time to execute a conversion smoothly. No planning, meaning trying to manage an emergency while you are also trying to deal with the systems issues, would almost certainly be worse).

So the fact that the Eurozone is a roach motel may be why the Germans think they can push their plan through. But in tightly-coupled systems, measures to reduce risk actually wind up increasing it. And bail-ins don’t just fail to reduce risk, because they shift it from taxpayers to investors. They increase it by putting in place an automatic procedure. Now that procedure may wind up being suspended in practice. But if it is believed to operate in an automated manner, parties will move to get out of its way when it is in danger of kicking in, creating runs. In this case, unlike Bofinger, I don’t think this will cause exits. It will cause funding crises at Eurozone states and bank runs, since bank guarantees are primarily at the national level and the second-level of Eurozone-wide guarantees is thin and only in the process of being funded.

And that’s before you get to the immediate tight-coupling factor: this mechanism would lead to haircuts of sovereign debt sitting on bank balance sheets. Worse, imposing losses on banks is a feature, not a bug. Evans-Pritchard again:

The German Council says the first step would be a higher “risk-weighting” for sovereign debt held by banks, and a limit on how much they can buy, with the explicit aim of forcing banks to divest €604bn. They would have to raise €35bn in fresh capital, deemed “manageable”.

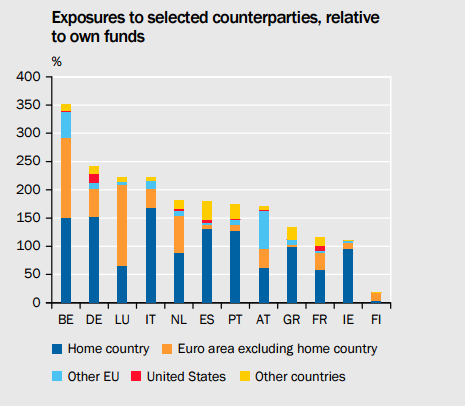

Sovereign exposures of banks in selected euro area member statesIt is a neuralgic issue in Italy, where the banks own €400bn of government debt and have effectively used cheap finds from the European Central Bank to prop up the Italian treasury.

Raising €35 billion in equity was well nigh impossible even before this scheme was well known. It’s hard to see how anyone with an operating brain cell would want to be a shareholder or depositor in anything but the most solid banks in one of the periphery countries. The smarter move is to go to a solid bank in one of the creditor countries. That slow-motion bank run is already under way in Italy and if this plan moves forward, it is sure to accelerate.

Germany is burning the village to save it. This Gotterdammerung is set to be quite the spectacle. But plenty of bystanders will be torched too.

maybe I am becoming parnoid, but I am wondering how much of this is driven by the shambles german banks are in. if db or commerzbank or someone like that pops on its own, it would be hard for any german government to sell a bailout (and keep any senblance of electability). otho, if tou blow up eurozone, and can sell it to your electorate that it wasn’t you – adter all, you were just putting in safeguards… – bailing out your national banks becomes much easier.

It looks to me like Schauble and co will continue to put presure on eurozone with the agenda that they will either get their ridiculous demands, or blow eu up but look innnocent..

Being paranoid does not mean you are wrong.

All eurozone members are i) to different degrees insolvent, and so are their banks and ii) they are playing musical chairs with the question who is to be blamed for blowing the euro.

I have not heard of the story other than by AEP, the German press is busy reporting what a welcome edition every refugee is, and the ongoing hearing in high constitutional court re: legality of the ECB OMT programme (FAZ only) – and thus the relationship between the highest German Court and its European counterpart. But then, the German press is a long way from reporting anything relevant to Germany in general and more recently, obfuscation and divergence from the real issues seem to be the mainstay.

At some point it may occur to some of the victim governments, either as a national defense measure or as a bank regulatory requirement, to pay or require banks to have the needed software, etc. in place, and to have the needed stock of currency in place, so that a changeover becomes manageable. The Greeks had a considerable time to prepare, but failed to do so.

My sentiments exactly. A backup currency infrastructure makes a lot more strategic sense than a COG (Continuity of Government) bunker buried under a mountain.

I wonder if some (as in Scandinavia) who are moving away from cash are making a Euro exit easier to accomplish?

It’s also easier when we did not join the EUR in the first place ;).

Denmark – I am embarrassed to say – did join the ESRF.

Didn’t need to but Danish politicians have this terrible phobia about not “being at the main table”.

“Italy, Portugal and Spain would be powerless to defend themselves since they no longer have their own monetary instruments. “These countries risk being hit by a dangerous confidence crisis,” he said. ”

If Italy switches to the Italian Peso, there will be a crisis of confidence and bond yields will spike just as surly as if there was a bond haircut. And if the trade deficit doesn’t tank the iPeso, currency flight will.

I guess the real problem was they shouldn’t have made bond holders believe any level of sovereign debt is somehow guaranteed as being good [as gold?]. It’s all AAA and in a reserve currency to boot. Just cross your fingers and believe.

Can’t help looking forward to a surly spike. Will those of us currently sitting on huge unused reserves of surliness get rich?

Nope. You make 20% iPesos first year, then lose 100% of your principal the next year.

I tend to view AEP as neurotic especially with regard to Germany. I have seen nothing of this, and I should have expected Handelsblatt to have commented on it, and I have not found anything.

Germany is not itself especially solvent now that Merkel has added huge social costs onto the welfare budget just as German business tanks and Deutsche Bank goes the way of Kreditanstalt Wien. There is some peculiar Anglo-Saxon belief that Germany has a sound economy. It has corroding infrastructure, terrible school buildings, awful university facilities, and has failed to invest in infrastructure for decades.

There has been more investment (low quality) in school buildings, clinics, university accommodation, in the UK since 2000 which makes Germany look shabby. Then look at private houses in say Taunus, wealthy area decaying as pensioners cannot afford maintenance and their houses will be toxic inheritances.

Germany has lived high on the hog – not Otto Normalverbraucher – but the SME owners and Corporate Elites. They used the Euro to shift GDP from Consumers to Capitalists and then Hartz IV to shift social costs to employees and away from employers.

Germany is technically insolvent but the myth-making machines in London and New York think Germany is somehow a paragon of conservative accounting. Merkel has squandered Germany’s future.

All the UK “investment” is built with private debt. The uni accommodation is low quality and predicated on young people being saturated in debt to pay for it. Hospitals are financed with PFI to keep it off the books. Not a good example IMHO.

Example or not, it is better than the crumbling buildings in Germany and schools that look like factories

AEP has on the record quotes from Bofinger, and Bofinger has also provide a written report. AEP is not making this up. You can disagree with his interpretations but he’s not in the creative writing business.

I can tell you there was also nada re subprime in the WSJ and New York Times about subprime or that credit spreads were insanely compressed across all debt instruments in 2006. You had to read the FT (or Bloomberg attentively) to have a clue. That’s why I started blogging.

Incidentally, if Erdogan puts his neck on Putin’s chopping block, all this becomes academic. Obama has probably washed his hands of Erdogan and Salman and the dismemberment of Turkey and Saudi Arabia lie ahead. The cancellation of Saudi holdings of US Treasuries and other assets will be a likely consequence

That would be unduly sensible of the Obama regime if so, but let’s hope you’re right. I sort of doubt that Obama has gotten that tight of a leash on the crazed neocons in his regime though. My opinion is that even if he wants to something reasonable and non-suicidal the resistance will be nigh insurmountable.

Let’s also acknowledge that destruction of Saudi Arabia (which is inevitable in any case) will swiftly accelerate the demise of the current world monetary regime as well as the decline of the US empire. Even the non-neocons in the regime might not be willing to see that happen.

Hmmm. Ashton Carter directed the 101st Airborne Division last month to prepare one brigade to go to Iraq to train and lead Iraqi forces against ISIS. This month there is word that has been upped to two brigades. Now I’ve been retired for a long time, but when I was still on active duty a brigade had about 3,500 men, and usually had to be accompanied by attached artillery and support units bringing it to over 5,000. There is word that the Turkish 2nd Army is currently lined up to invade Syria, probably to attack the Kurds there and in northern Iraq. Other players are making noises like they are ready to invade, mostly in order to prevent Russia and Assad from “winning.” Russia has warned Turkey they will face retaliation if they invade. From the conflicting and self-defeating actions we’ve seen the U.S. performing in the last two years, it may be there is a civil war going on in the “national security” community. I’m usually optimistic, but not this year.

Turkey is sabre-rattling on the Azerbijani border which is where it has its Leopard tanks. The Treaty of Kars 1921 is up for repudiation by Russia and Armenia. I can see Iran and other forces invading Turkey from the east and slicing off that area with Kurdish front-runners and NATO can only invoke Art 6 not Art 5 since an Uprising in Turkey would require NATO to invade under Art 6 and fight in a Turkish Civil War

“Germany is not Germany anymore”

The resigned verdict from a berlin airport worker when I missed a flight due to a train breakdown last week.

Exiting the euro.

Yes it is a systems problem.

There are other countries who are not in the Euro.

Could they provide the system infrastructure as a service to countries which are in the Euro?

Every problem is simultaneously an opportunity.

I suggest that Russia step in with its currency, offering all crashed then-former EU nations an extant currency. No need for 3 years to rebuild a currency from zero.

Imbalances are the main problem of the euro zone. Any country changing from the euro zone to the (hypothetical) rubel zone will find itself in similar imbalances.

Fixing the imbalances between the countries of a currency union will need a transfer union (at least for the time needed to fix the imbalances), and this simply will not happen, neither in the euro zone nor outside (UK? No. Denmark? No. Turkey? No. Russia? No).

Regards, Uwe

Doesn’t solve the problem. You need to monetarily sovereign. Russia is not going to cede control of the ruble and let Italy print it.

And the IT issues would be identical. Italian banks and point of sales terminals would need to be redenominated/retrofit to the ruble.

Your solution would be worse than trying to reintroduce the lira on an emergency basis.

interesting idea, think Switzerland,

Given the incredible difficulty in re-establishing currencies it seems unavoidable that a eurozone collapse would be a catastrophe of proportions not seen since 1945. And increasingly it seems that the euro is on borrowed time. I hate to sound like a paranoid survivalist, but as a eurozone dweller i can’t help wondering if I should start stocking up on gold and guns (and canned beans).

having a bean stash is never a bad idea !

Try getting guns in Germany unless you are Arab

Or…you know…you could stock up on a currency that is not likely to be squashed. Euros issuers do not have an inherent taxing authority–so…how do you get more Euros (net–note that bank loans are zero sum since they also create liability) into the economy to account for any possible expansion?

How widely do countries in the Eurozone accept that it has to be preserved? The people who run it are intelligent and capable, and they’ve read many of the articles criticizing the Euro and the institutions that support it; how many of them have accepted the conclusions that it’s unsustainable, or perhaps that it’s unsustainable with the institutions that have developed around it? Or if they haven’t, what is their level of trust with their partners? Is Germany certain that Italy won’t prepare a move to exit suddenly? Is Italy certain that Germany won’t blow up the currency union in such a way as to benefit Germany? Or maybe Italy doesn’t want to leave, but suspects that Portugal is going to sneak out first . . .

I honestly wouldn’t be surprised if Germany has looked at these issues, and considered the problems of maintaining trust throughout the zone while at the same time maintaining the punitive policies that it feels are moral necessities, and decided that the Euro should be exploded earlier — and in a way that benefits Germany both in the build-up and the aftermath.

There are economists who criticize the Eurozone.

I don’t see any of the technocrats who are running the system (as in in positions of power) as skeptics/critics; they’ve all drunk the Kool-Aid. The guys at the ECB are the worst. The problem is all those bad debtors, not the system.

As Upton Sinclair said, “It is difficult to get a man to understand something if his salary depends on him not understanding it.”

It is astonishing how effectively critics of the euro have been sidelined. I’m not privy to private conversations among senior level officials anywhere, but if they are having any doubts about it they are keeping it very well hidden. There is a lot of classic groupthink going on, which makes me think that even basic precautions are not being taken behind the scenes for any type of a break-up, except possibly for Italy or Spain.

I suspect that those who are aware of the unsustainability of the Euro have it in mind that it could be split into a ‘north’ and ‘south’ Euro, or that weaker southern countries could be prized out of the euro one by one if needed. Its not impossible that somewhere there are plans for this eventuality. But I’m pretty certain that there are no contingencies whatever for a complete breakup.

Without a complete union of Eurozone countries into something akin to the US, Europe has virtually no hope. They did not listen when they were told that if they joined a common currency, they would be like states–unable to run deficits. Since they can not print Euros out to deal with deficits, there is very little chance that EZ countries can stimulate their economies. There is simply no way for the currency to expand (other than bank loans, which, when paid back, actually take money out of the system or at best leave it in a zero-sum situation).

They thought they would force nations to submit with the Euro, but they have simply blown everything apart

Currently working on this exact problem. The attempt at asymmetrical regulatory federalism (economic but not social) seems to have failed. Without fiscal stabilizers and effective transfers to ‘have not’ members, it seems likely that sooner later the EU must equalize conditions or abandon the project altogether.

It cannot equalise conditions when social security in Germany or France exceeds the average income in Bulgaria and when tomatoes cost more in Greece than in the Netherlands.

The only way to do that is the way A Hitler did it because you need to break monopolies, restructure finance, smash restrictive practices. Even the USA has not equalised living standards between Northern California and Louisiana

Let the disintegration begin… Euro is past its sell by date.

and watch the global financial tsunami wash away the eastern seaboard of the USA

Psychology of War: Frankenstein Information Systems

Frankenstein is in the genetics lab, working for feudal industry just like the rest, for rent subsidized by others. All empires are tightly bound by arbitrary knowledge; that’s what makes them efficient counterweights. If you go to that hospital to have your baby, tell the lab rats running the program that you don’t trust your spouse and you are afraid of children, and you’ll sail right through, confirming them as the experts.

From a genetic perspective, females are far easier to replace because their eggs come prepackaged, and now Frankenstein is ready to scale up the mitochondria, with an egg bank. With AI and automation, he can also replace most males, except the ones he needs. Relative to this iteration of fascism, the knowledge crowdsourcers analyzing the past are just getting further behind.

Shuffling the DNA deck, the dead weight of feudal infrastructure relative to Frankenstein, is the process, but he has two problems. Timing is everything, and he may as well be throwing darts blindfolded, in the wrong direction, at the wrong time. Nature protects itself by not knowing, but Frankenstein must know, which is why automatic mutation meltdown persists, to protect against MAD genes and their derivative, Frankenstein.

All supply-side developed economies are in terminal demographic meltdown, and with financial replication, the predisposed emerging economies have resumed meltdown as well. Merkel will accept the cost of morons raping her girls in hopes that some will have sex with the required males, which isn’t going to happen, due to the gap. The make-work problems of finance, war and infrastructure are just the derivatives.

Let’s assume a curiosity to explore space, to seek the unexpected, rather than extending natural resource exploitation. Frankenstein looks into a telescope and orders the space administration, bred from a petri dish under a microscope, to plan a path, to the past. Now, not everyone is quite so myopic, but the collective bred on RE control is, trapped in prisoners dilemma accordingly.

Due to functional abstraction, the self-obsessed brain, heart and all the rest, like most of your bosses, assume they are directing a top-down organization to fulfill the mythology, ignoring the fact that they are receiving and acting upon external input. O/I/O becomes I/O with a double-sided mirror at the synapse serving as the couple. The fetus commandeers the hormonal system and the unsuspecting mother seeks an expert in certainty, a false promise, completing the short from I/O to O.

Genetically, babies come pre-tuned to nature and their parents, two points approximating a curve. A lab rat contained in a cubicle in its mind, contained in a cubicle called empire, desperately trying to create its own demand, is not going to keep you on that curve. The Obamacare Information System isn’t gobbling up the economy at the margin, backwards, destroying the nation’s health by accident.

Labor seeks a complimentary spouse on the other side of the curve, effectively opening up a sail, and the children dial in the wave. Spatial recognition is about connections in the fulcrum of fulcrums, the power amp relative to the preamp, not the spacetime across the insulator. Empire replicates through competition to build a media amplifier; labor cooperates implicitly with unique frequencies to form a flexible composite, separated by the noise.

The single life is great; all you have to do is choose a channel on the empire broadband and get paid in credit, debt assigned to others, for compliance. Political marriage is a bit trickier, because enemy families merge in marriage to control everyone else. And political children are a threat, because they may comply more efficiently, or add sufficient resistance to blow the subunit sky high.

Choice is a trade-off. Choice A is to comply for a prize in the short-term at the long term cost of redundancy, until there are no more prizes and you are going over a cliff, failing to expect the unexpected, followed by choice B. The buck chooses a doe and changes the focus of the predator, while the herd moves to the next field, and regardless, the predator goes over the cliff, sooner or later.

Who do you suppose has the advantage, the people doing the work, or the people watching and telling others how to do it more efficiently, as a means of providing for themselves? Labor doesn’t need anyone to tell it what to do, how to do it, or when to do it, regardless of arbitrary, proprietary system. A political state on drugs goes nowhere, which is why its infrastructure collapses, finance implodes and the threat of war is always imminent.

If UTC can pick up and ship its control experts to hedge-haven Mexico, what is UTC worth, in gold, petrodollars, or anything else? Because my hands consume far more processing power than most doesn’t mean that my cortex is so occupied with noise as to fail to pay attention to what is not noise. Working with all those wires in a controller is just an occupation, no better and no worse than any other.

Most learn linearly, like a collection of books in a library added over time. Labor parses each book into subprocesses and adds each sub-parse to existing processes, with only one book, on empire. Like anything else, there are trade-offs. Efficiency prevails in the short-term, effectiveness prevails in the long term, and viral parasites are thrown in the mix for good measure.

For me. Artificial Intelligence is fascinating, but completely counterproductive, so I am not saddled by the biases limiting others in the field, and I can always roll out a far superior product to empire groupthink. No matter how you look at AI, it’s just an extension of the counterweight. In the meantime, I fix a lot of crap in the crapification machine.

There isn’t any bullsh- going on in any hospital that I haven’t heard and seen. “Any jackass can kick a barn down, but it takes a carpenter to build one.” There’s always an angry posse chasing you to the edge of the cliff, so before you start kicking barns down and pissing a lot of people off, best to learn something about building barns for yourself, the point.

Experts are six of one, half dozen of the other, and a dime a dozen, which you no doubt see in your daily life. You were collected from this planet, and you will be redistributed across this planet, like everything and everyone else. Who’s to say that a planet is not a lifeform, or that any human is superior to any other lifeform, and why would you limit yourself to the definition of others accordingly, by majority vote or not?

Why do suppose formula / cardboard food in a coffin makes babies listless and self-obsessed, like their geriatric counterparts, along with all those derivative surgeries, consuming all those 1s and 0s, and what does that have to do with a certified lactation expert and socialized sick-drugs? Incidentally, if you were going to design a material that could adjust atmospheric friction …/solar/cell/atom…, what would its effect be on the universe above and below, and what does that have to do with water?

I just happen to be a german carpenter specializing in German cherry trees, but what is the function of oil in the earth’s crust? Fiscal spending would be great, if unicorn money issued by social engineers was worth anything outside of the prison they create. Empire is just the psychological downdraft of misery seeking company, selling whatever drug the volunteers want to buy.

The scientific community is like going to a gala with multidimensional intrigue, where everyone has a knife and the experience to use it, and you don’t know how many times you have been cut until your dead, when it doesn’t do you any good. And the psychologists are the best. If you want to expose the psychologist, just cut down that cherry tree, and keep cutting down cherry trees, if you want to see Frankenstein.

oh man…I want some of what ever your taking…..and, no, I do not discounting a bit of which you speak…..I just want more clarity, without all the dross.

so maybe, finally, all this marks the end of WW2

A) hare-brained not hair-brained. No need to be an egg-head to have good ideas…

B) countries with a postal bank have an advantage to exit the euro. One could open an account for every citizen, force payment of salaries there and then use its existing smartphone real time payment app in the absence of banknotes. The infrastructure is already there and is tailored for high volume. Private banks would cry for murder, and it would definitely be one, but they deserve to be butchered anyway.

“it’s important to recall that Germany has imposed boundary conditions that make it impossible for the Eurozone to survive, such as insisting on retaining its trade surpluses with other countries in the currency bloc”

Germany’s trade surplus with the eurozone was 8.5 billion EUR last year (435b exports, 426.5b imports) . That’s not really worth mentioning.

The German bank cartel is attempting to fulfill Mundell’s dream of liquidating the labor market in Europe. Germany, the birthplace of social security, is attempting to use the next banking crisis to liquidate pensioners. The same way they defrauded simple depositors by pushing them into coco bonds, look for now non-sovereign states to get that extra capital by “allowing” the pension system to invest directly in banks (on top of what they’ve already poured in). When the sovereign bonds default, the bond-holders and the depositors will be bailed in – including all future pension obligations.

Talk about a recipe for more deflation. The money supply is going to contract considerably.

Lacking a mature corporate bond market, most European business lending is done through their banks. This will destroy the velocity of money through the economy, not to mention what it will do to the repo chains once lending collateral vaporizes. It’ll create immense demand for U.S. debt – at a time when our Congress is driven by a cataclysmic Calvin Coolidge-esque obessession with reducing the deficit.

Which leads me to my next point and the solution that’s been hanging out there from the start: a U.S. Fed bailout. We appear to have the only functioning central bank in NATO capable of getting the job done. The Italians can always dollarize. Of course, that presupposes a cosmopolitan, forward-looking elite in a Washington populated by neoliberals.

What do we actually have in the arsenal?

Could it be that TISA is a backup plan for Germany’s imminent imperial implosion?

I’ve met the Marshall Plan. I knew the Marshall Plan. The Marshall Plan was my friend. You, sir, are no Marshall Plan.

I doubt this is going to have the effect you think it will on Deutsche bank. If this change will send money into creditor country banks, why is Deutsche bank plunging?

This destabilizes the entire banking system and it ties the hands even of the Germans when they have to bail out their own banks over their considerable derivatives exposure. It might also give someone like Tsipras the leverage to pull the plug on the entire banking system with one carefully calculated blow. I don’t think the Germans are prepared for that.