By Arthur E. Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Originally published at OilPrice

Gasoline demand is a red herring.

A red herring is something that takes attention away from a more important subject. Gasoline demand distracts from the more important subject that there is no fundamental reason for the current oil-price rally.

U.S. Gasoline Consumption Has Fallen 2 Million Barrels Per Day Since 2005

Those who believe that gasoline demand is the fire behind oil’s recent rally confuse production with consumption. They also don’t understand that Americans increased their driving when oil prices were $100 per barrel and continued to travel more miles throughout and despite oil-price highs and lows.

A recent Bloomberg article stated, “American gasoline consumption rose to 9.25 million barrels a day in March, an all-time high for the month.”

9.25 million barrels per day is product supplied, the measure of how much gasoline is produced in U.S. refineries. Total wholesale and retail sales is the measure of U.S. consumption and that amount is only 7.76 million barrels per day.

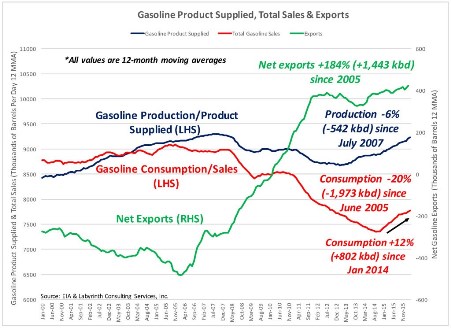

Consumption of gasoline in the U.S. has increased 802 thousand barrels per day (kbpd) since January 2014 but is 1,973 kbpd less than peak consumption in June 2005.

U.S. production of gasoline is 908 kbpd more than the post-Financial Collapse low in January 2012 but is 542 kbpd less than the peak in July 2007 (Figure 1).

(Click to enlarge)

Figure 1. Gasoline product supplied, total sales and net exports (12-month moving averages). Source: EIA and Labyrinth Consulting Services, Inc.

Meanwhile, net gasoline exports are at record high levels. Exports have increased 1,443 kbpd since June 2005.

So, consumption has increased but remains far below pre-2012 levels. Production is again approaching earlier peak levels but most of the increased volume is being exported. The belief that U.S. consumption is approaching record highs is simply not true.

Americans Are Driving More But Using A Lot Less Gasoline

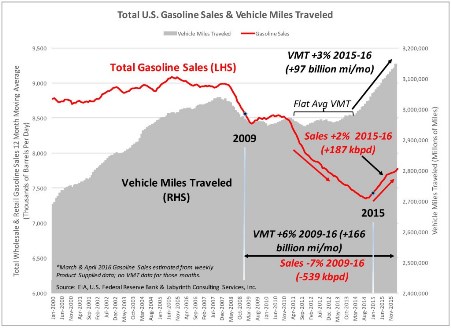

Americans are driving more than ever before. Vehicle miles traveled (VMT) reached an all-time high of 3.15 trillion miles in February 2016 (Figure 2).

VMT have increased 97 billion miles per month (3 percent) since the beginning of 2015 and gasoline sales have increased 187 kbpd (2 percent). The rates of increase are not proportional.

(Click to enlarge)

Figure 2. Total U.S. gasoline (wholesale and retail) sales (12-month moving average) and vehicle miles traveled. Source: EIA, U.S. Federal Reserve Bank and Labyrinth Consulting Services, Inc.

For example, VMT was fairly flat from mid-2011 until oil prices collapsed in September 2014 yet gasoline sales fell more than 1 million barrels per day during the same period. Americans traveled the same number of miles but used a lot less gasoline. Even with the VMT increase since 2015, sales are still 539 kbpd less than in January 2009.

Vehicle Miles Traveled Independent of Gasoline Prices

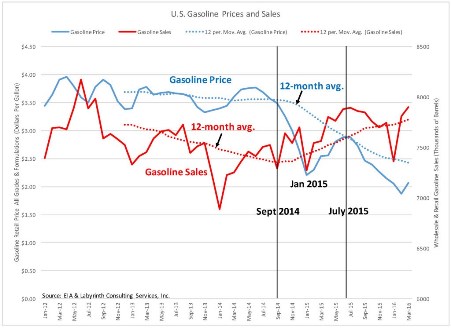

Gasoline prices fell along with oil prices in late 2014 and consumption increased (Figure 3) but the relationship between prices and consumption is not straight-forward.

(Click to enlarge)

Figure 3. Gasoline retail prices and sales. Source: EIA and Labyrinth Consulting Services, Inc.

Prices reached a low in January 2015 and then increased to a peak in July 2015. Gasoline sales increased right along with prices, not exactly the relationship we would expect. Although gasoline usage is strongly seasonal, consumption is not simply a function of price.

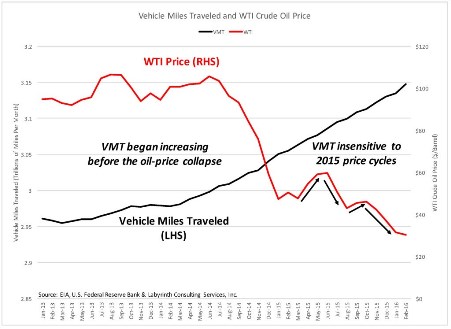

Figure 4 shows that vehicle miles traveled increased from March 2013 through September 2014 when oil prices averaged almost $100 per barrel. It is unclear why Americans began driving more but it was not because gasoline prices were cheap.

(Click to enlarge)

Figure 4. Vehicle miles traveled and WTI crude oil prices. Source: EIA, U.S. Federal Reserve Bank & Labyrinth Consulting Services, Inc.

When oil prices fell to less than $43 per barrel by January 2015, there was no change in VMT growth. Furthermore, VMT continued to increase despite cycles of high and low prices in 2015 that first rose to $60 and then fell to less than $30 per barrel.

The factors that underlie driving behavior are complex. Gasoline price is among those factors but there is no clear correlation between price and consumption.

To put gasoline consumption in context, the 187 kbpd increase in gasoline sales since January 2015 is 1.2 percent of monthly U.S. oil consumption. The increase in product supplied is 1.7 percent of monthly consumption.

Crude Oil Imports Increased As U.S. Production Declined

As U.S. crude oil production began to decline in 2015, more oil was needed to produce gasoline and other refined products so imports increased.

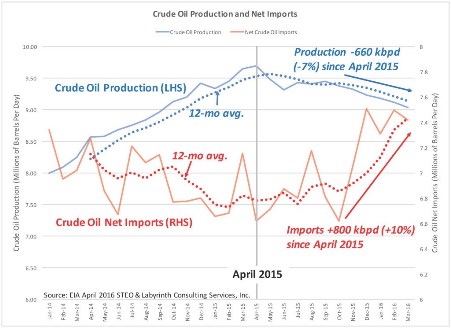

From April 2015 to March 2016, oil production decreased 660 kbpd (-7 percent) but net crude oil imports increased 800 kbpd (+10 percent) (Figure 5).

(Click to enlarge)

Figure 5. Crude oil production and net imports. Source: EIA April 2016 STEO and Labyrinth Consulting Services, Inc.

When analysts mistake gasoline production for consumption, they include gasoline made from imported oil in their celebration of increased U.S. “demand!”

Moreover, increased imports are also included in U.S. inventory volumes. If the whole situation seems complicated, that’s because it is and the lesson is to be careful about your sources of information.

Gasoline Demand Is A Red Herring

Americans are driving more than ever but using less gasoline than a decade ago. A lot of this is undoubtedly because of greater fuel efficiency. It seems unlikely that gasoline consumption will ever again reach levels seen before the Financial Collapse in 2008-2009.

The correlation between gasoline price and vehicle miles traveled is not very good. Americans started driving more when prices were very high and kept driving more despite large fluctuations in price. I cannot explain this except to observe that aspects of gasoline consumption must be somewhat inelastic. Price matters but not as much or in the same way that I imagined.

What is clear is that gasoline consumption is not a significant factor in the recent oil price rally. The collective consciousness that drives the oil market is fed up with low oil prices. It looks for and sometimes invents excuses to raise prices and ignores compelling reasons to lower them.

Gasoline demand is the most recent invention and it is a genuine red herring.

Nice take on the issues. I’ve been trying to get my head around why oil has been rising, despite nearly all indicators pointing to a continuing glut around the world with no end in sight. I think a core point is, as Berman points out, oil markets are far more complex than is usually assumed by analysts because oil products are far less fungible than the usual comments about barrels produce and barrels consumed would lead you to believe. It seems that markets are so desperate for oil prices to arrive, they have grabbed anything that resembles good news for them and have convinced themselves they have caught the bottom of the market. They are likely to be in for a very nasty surprise in the third and fourth quarter of 2016.

There seems to be considerable exposure to the latest gas and oil boom which, of course, means there likely won’t be more than two or three people telling the truth about the state of the industry or it’s finances.

The author is likely correct that, we aren’t actually paying the true market price for petro products but an inflated premium to cover some really bad market positions.

When the knock-on effects simultaneously hit the manufacturing, real estate, and financial markets the consumers will be the target in bailing out some overpaid individuals.

The click on link to enlarge function doesn’t appear to work here.

Perhaps Igor Sechin is right (Sechin is head of the Russian energy company Rosneft and a close ally of Putin). In a Telegraph article on 2/2/15, discussing Sechin and the remarks he made at an oil consortium, the author comments that, “However, the real “haymaker” punch he (meaning Sechin) aimed at the global energy system came with the accusation that oil futures markets in London and New York, which set the price of the world’s most vital energy commodity, are essentially being rigged by a feral cabal of speculators and traders.” That would explain the obvious disconnect discussed by the author here concerning the red herrings put out by the oil sector. Interesting as well, in the article mentioned above the author also notes, “Mr Sechin warned last week that the current shale boom could be another “dotcom bubble” about to burst after drillers, loaded up on risky debt, and hedge funds piled in to make a quick buck over the last five years.” Seems like he was prescient in that observation as well.

The link to that article I mentioned is here.

Berman implies as much, but puts a kinder spin on it

“The collective consciousness that drives the oil market is fed up with low oil prices”

We’re fed up, ain’t gon’ take it no mo.

June crude is up 2.5% to $44.87 today.

Celebrating Cinco de Mayo … free money, free beer, free gasoline!

The elephant in the room is cost of production which for most countries including the USA and Canada are far higher then the current prices. That means that the wave of bankruptcies and drop in the USA production will continue unabated. The total loss might be above 1 Mb/d for the 2016. Canada also lost some production (currently 0.5 Mb/d due to fires) and needs about $80 for tar sand production to be profitable. Chances that oil price will reach this level in 2016 are slim so the future of Canadian tar sand oil production is grim.

Several oil producing countries are on the verge of bankruptcy (Nigeria, Venezuela, Iraq). Saudi are losing around 100 billion a year in currency reserves while still playing a role of Trojan horse of the West in oil markets.

This situation is unsustainable and speculator/HFT driven suppression of oil prices at some point might break and will be replaced by a new price boom. It in highly probably that the price of oil will reach at least temporary the level of $55 this year.

But oil is a strategic product and high oil prices mean stagnation of Western economies. The key problem is that high oil prices threaten neoliberalism as a social system and derail neoliberal globalization.

So they will be fought tooth and nail by the US and EU elites. That’s why agreement to freeze oil production by OPEN was derailed. Another victory of western diplomacy.

Arthur Berman was a very keen observer of shale bubble in the USA until recently.

That is a very interesting article – certainly makes me appreciate the complexity of what determines the price of a commodity…

As usual, Mr Berman understands energy about as well as Nate Silver understands Donald Trump. Driving more, but less gasoline used in this increase in driving? To quote Mr Berman:

“Americans are driving more than ever but using less gasoline than a decade ago. A lot of this is undoubtedly because of greater fuel efficiency. It seems unlikely that gasoline consumption will ever again reach levels seen before the Financial Collapse in 2008-2009.”

That’s a lot of “fuel efficiency” considering that Detroit has wrung the last drop out of its gas guzzlers by dropping Gross Vehicle Weight, making the auto lighter hence requiring less fuel to push it fast onto the highways and byways of the USA. Plastic replaced metal, lighter aluminum, “military grade” according to the manliness ads for trucks, replaced heavier steel alloy. And some engineering advances here and there, most computer controlled fuel and air mixes have push MPG ratings about as high they can go. Unless you start to count the effect of Hybrid cars and pure Electric Vehicles, EV. Compressed natural gas and hydrogen Fuel Cell vehicles are even in less supply operating in the US, than Hybrids and EVs. So, I’ll stick to pointing out them as the culprits of driving more and using less gasoline.

http://electricdrive.org/index.php?ht=d/sp/i/20952/pid/20952

You can see the total sales of cars and the total sales of each category of hybrids, plug in hybrids and plug in EVs. Annual sales for the past few years hovers about 500,000/yr. These all drive demand destruction for gasoline. They remain about 2.5-3.5% of total car sales every year since they started to be widely available, meaning, more models from more manufacturers than the Toyota Prius, which is the champion of Green Cars. Over 5 million sold worldwide, many still on the road, 90%+ and they are improved every few years. Not only Prius, but now, also Ford Fusion, Hondas, Nissan and the Chevy Volt, are all MPG warriors. 40-50MPG Highway. And of course, the plug-in EVs, no gasoline at all. No oil changes, at all! No emission tests, at all. Especially for the 400,000 cash reservations for Tesla 3 EV, due to roll out by 2018. Driving no longer means using gasoline as much or in growing instances, using any at all.

In the future, in behooves the prudent analyst to try to pretend that you have taken all of the facts into consideration that are relevant. And in any discussion about gasoline consumption, the rise of hybrids and EVs needs to at least be acknowledged, certainly more than an ambiguous reference to mileage efficiency.

interesting times, imagine what would happen to those numbers if someone came up with an electric school bus. I continue to think there’s a lot of low hanging fruit in the petroleum consumption game and the pareto principle applies, 20% of oil usage is critical, 80% can be replaced by other forms of energy supplies (wind, solar) especially if the policy is consumer friendly. For instance, if gov encouraged rooftop solar and encouraged people to feed the grid, that is a lot of energy, think walking across a hot parking lot barefooted, there’s a ot of room for improvement that is stymied by the desire by TPTB that everything be an income stream for the big corps, but we could have a sea change where the income stream continues as now, but the suppliers of the energy change, each household contributes more to the grid then the utility is required to do less production and more storage and supply management.

Consumption dips may have to do with all the new vehicles on the road getting better MPG

I fear that would be offset by government failure to build more roads and vehicle lanes.

People are driving more but without an increased supply of road, they must be taking longer to get where they are going. Yet another argument for increased infrastructural spending.

yes, unfortunately as you might expect all the new roads become toll roads,

http://www.ocregister.com/articles/extension-608946-tca-road.html,

and so are the old ones under our current system

http://www.wsdot.wa.gov/Tolling/EastsideCorridor/

The oil sands on fire, and the conspiracy of stupid continues. I wonder if the Cally critters understand what that gas leak does to DNA. DuPont was obviously a piker.

“It is unclear why Americans began driving more but it was not because gasoline prices were cheap…The correlation between gasoline price and vehicle miles traveled is not very good. Americans started driving more when prices were very high and kept driving more despite large fluctuations in price. I cannot explain this except to observe that aspects of gasoline consumption must be somewhat inelastic. Price matters but not as much or in the same way that I imagined.”

VMT will increase, whatever the price of gasoline, as long as work opportunity and affordable housing do not occur within the same region. Years ago, teachers working in San Francisco couldn’t afford housing there, so they moved to Oakland. Oakland today is too expensive for said teachers, so they will move…where? Same thing in Denver. There may be jobs in the metro area, but it’s hard to access them from the opposite side of the friggin’ Continental Divide. Inelastic is the kindest possible word to describe the sheer lunacy of the fundamentals in action.

Gasoline demand a red herring? Yes, dear author, just, “not as much or in the same way” that you “imagined.”

OK, look, I spent months doing a deep dive into this market. I know *exactly* why the oil price rallied.

The oil price dropped below the cost of production for nearly every field in the world. The result is that fields are being shut in; production volume is dropping. The price *has* to rally eventually as supply dries up.

It’s not going to rally much more. It just has to stay above the prodution costs. It had dropped so low that *every* oil company was losing money, and it had to rise enough that the cheapest producers are making money.

Sales prices can stay below production costs for protracted periods of time. See the railroads in the 19th century.