Richter’s post confirms what Matt Stoller foresaw in 2010 in A Debtcropper Society:

A lot of people forget that having debt you can’t pay back really sucks. Debt is not just a credit instrument, it is an instrument of political and economic control.

It’s actually baked into our culture. The phrase ‘the man’, as in ‘fight the man’, referred originally to creditors. ‘The man’ in the 19th century stood for ‘furnishing man’, the merchant that sold 19th century sharecroppers and Southern farmers their supplies for the year, usually on credit. Farmers, often illiterate and certainly unable to understand the arrangements into which they were entering, were charged interest rates of 80-100 percent a year, with a lien places on their crops. When approaching a furnishing agent, who could grant them credit for seeds, equipment, even food itself, a farmer would meekly look down nervously as his debts were marked down in a notebook. At the end of a year, due to deflation and usury, farmers usually owed more than they started the year owing. Their land was often forfeit, and eventually most of them became tenant farmers.

They were in hock to the man, and eventually became slaves to him. This structure, of sharecropping and usury, held together by political violence, continued into the 1960s in some areas of the South. As late as the 1960s, Kennedy would see rural poverty in Arkansas and pronounce it ’shocking’. These were the fruits of usury, a society built on unsustainable debt peonage.

Today, we are in the midst of creating a second sharecropper society….Today, the debts do not involve liens against crops. People in modern America carry student loans, credit card debt, and mortgages. All of these are hard to pay back, often bringing with them impenetrable contracts and illegal fees. Credit card debt is difficult to discharge in bankruptcy and a default on a home loan can leave you homeless. A student loan debt is literally a claim against a life — you cannot discharge it in bankruptcy, and if you die, your parents are obligated to pay it. If the banks have their way, mortgages and deficiency judgments will follow you around forever, as they do in Spain.

Young people and what only cynics might call ‘homeowners’ have no choice but to jump on the treadmill of debt, as debtcroppers. The goal is not to have them pay off their debts, but to owe forever. Whatever a debtcropper owes, a wealthy creditor owns. And as a bonus, the heavier the debt burden of American citizenry, the less able we are able to organize and claim our democratic rights as citizens. Debtcroppers don’t start companies and innovate, they don’t take chances, and they don’t claim their political rights. Think about this when you hear the calls from ex-Morgan Stanley banker and current World Bank President Robert Zoellick and his nebulous mutterings pining for the gold standard. Or when you hear Warren Buffett partner Charlie Munger talk about how the bailouts of the wealthy were patriotic, but we mustn’t bail out homeowners for fear of ‘moral hazard’. Or when you hear Pete Peterson Foundation President and former Comptroller General David Walker yearn nostalgically for debtor’s prisons.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Endless discussions of how important inflation is to the US economy, and how there hasn’t been enough of it in recent years, and how more inflation would be a godsend, has become the standard. The threat of lethal deflation is being brandished to rationalize all kinds of absurd monetary policies. And we know why: inflation is good only for debtors, in an over-indebted country.

But that’s not true either. Because a lot of debtors, particularly those who funded their education with loans, are being strangled by … inflation.

“College Tuition and Fees constitute one of the biggest threats to our economic outlook,” writes Jill Mislinski at Advisor Perspectives, which runs an excellent series of analyses and updates on the topic.

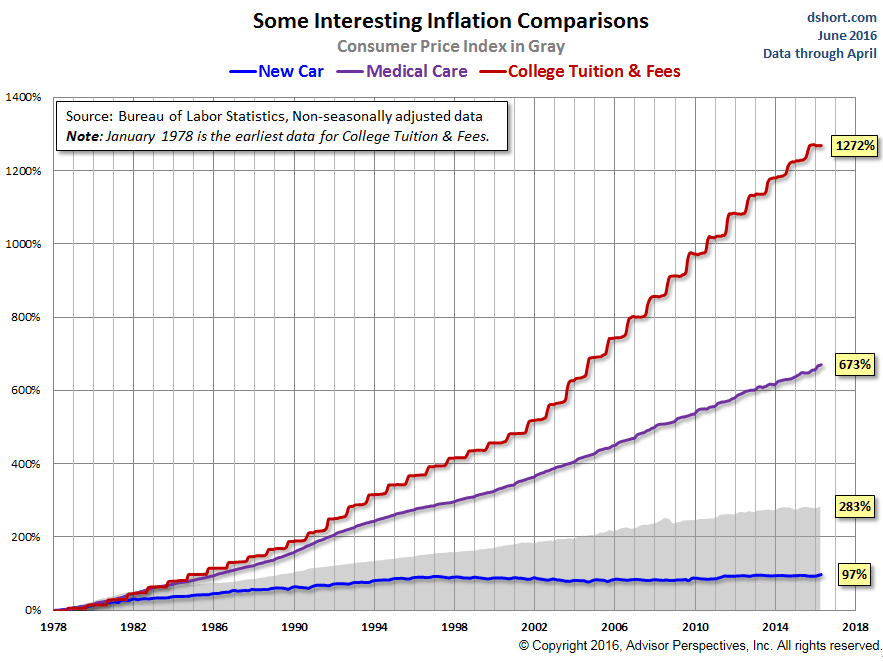

The chart below (by Advisor Perspectives) shows the Consumer Price Index sub-component for college tuition and fees (red line) going back to 1978. It also shows the price increases of autos (blue line) and medical care (purple line), “both of which pale in comparison”:

Mislinski at Advisor Perspectives:

During the decade of the 1990s, when real out-of-pocket funding declined 25%, tuition and fees rose 92%, which sounds substantial … until you compare it to the 1272% across the complete data series. For early boomers (a decade before the time frame in the chart above) paying for college was sort of like buying a car. But in recent decades, it has become more like buying a house, for which the strategy of a minimum down payment is commonplace for first-time buyers.

The annual stair-step rise in college costs seen above is probably the most dramatic visualization of inflation data we routinely produce.

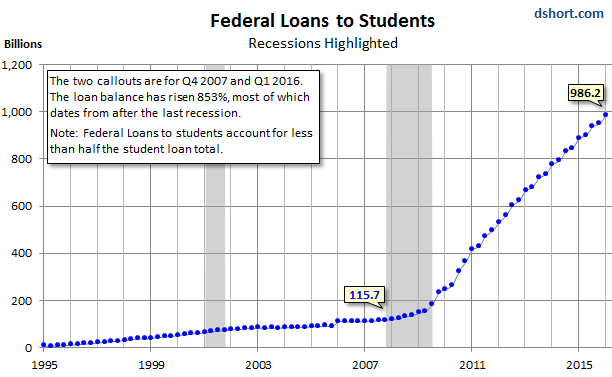

In a separate analysis, Advisor Perspectives today reported on the outstanding student loan balances for the first quarter, based on federal loans to students from the Fed’s Z.1 Financial Accounts of the United States. At $986 billion, the outstanding student loan balances have soared 853% since Q4 2007, when the Great Recession began — because there was never any recession for student loans:

But it’s even worse: This chart only shows data for federal loans to students. It does not include non-federal loans to students. No hard data exists for this. The New York Fed, which tracks household debt and credit via surveys, estimates that, based on its survey results, total student loans from federal and private lenders has reached a record $1.26 trillion. And it considers 11% of the outstanding balance in default!

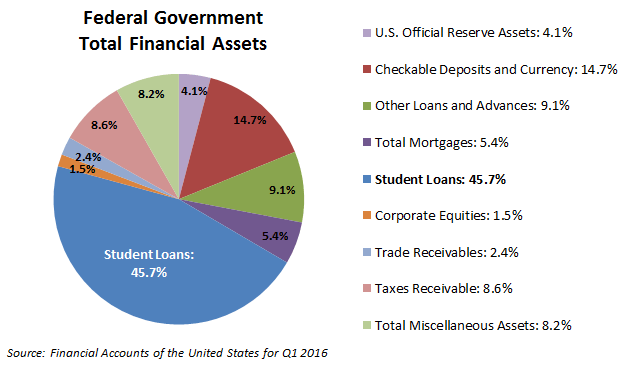

Which begs the questions, as Advisor Perspectives puts it, “What line item is the largest asset in Uncle Sam’s financial accounts?”

Student Loans. They’re a liability for students and former students, often for decades to come. They crimp their spending behavior, delay home purchases, and trigger credit problems. Even hopelessly indebted student-loan debtors cannot get their student loans discharged in bankruptcy. But these loans are an asset to the other side.

Student loans have ballooned into the largest financial asset category on the balance sheet of the federal government, accounting for 45.7% of total federal financial assets, up from around 17% before the Great Recession, and up from about 9.5% in 2000:

“The student loan bubble, the biggest slice in Uncle Sam’s asset pie, will haunt us for many years to come,” Mislinski writes.

But student loan balances are not going to stop ballooning anytime soon. Why? Because it’s structural. It’s built into the system.

In the US, the price of a college education is determined by educational institutions. The customer (the student) who buys the product generally doesn’t have the money for that product. So they cobble together a support system (the third party): help from mom & dad and other relatives, and to a large extent, financial aid including student loans.

In this system, the seller sets the price based on what third parties can pay. That third party includes the deep pockets of the federal government, which enable these enormous price increases.

Customers are told they must have an education in order to succeed in life. So they can’t easily walk away.

What is lacking is market discipline — the threat that a large number of students (say, 50%) will simply refuse to buy this product unless prices come down. Suddenly, universities would see their “revenues” collapse. They would have to compete based on the cost of tuition and fees. They would have to become more efficient. They would have to produce more with less to bring their costs down. And if they fail to lower their prices enough, year after year, as is happening with TVs and smartphones, their customers would simply not buy.

But that discipline is not built into the system. Instead, tuition and fees get inflated year after year without market resistance. Sure, there are some student protests and the like. And after the police-strength pepper spray dissipates, tuition and fees are raised again.

Universities bear none of the risks. If former students cannot find employment with enough income to pay for this debt, and if they then default, or if this debt is forgiven in some manner, then lenders (mostly the government, and therefore taxpayers) eat the losses, while the university smiles all the way to the bank — when it should be the universities that eat the losses on loans of their former students.

This is inflation of the most pernicious kind that will haunt the US economy for years, and the Fed is blissfully blind to it.

So who is the most impacted? Ah yes, the Millennials. Read… The Revolt of the Debt Slaves Has Started

Its a shame that neoliberalism destroyed the meaning of ‘public option’ because it’d be nice to have a public option for college education — you know something like excellent public universities available at low tuition points for everyone while the ‘private option’ of private universities continues for those who can afford it (whether before or after scholarships).

This, of course, existed back in the years between the late 40s and early/mid 70s. And not just for the GI Bill — for everyone.

Sanders’ call for a return to this is descried by the neoliberal media as unaffordable. Yet Wolf’s blog post shows just how unaffordable the current ‘free market without market discipline’ approach is for so many folks — and by extension for the federal government as well (that debt is NOT going to be repaid).

Instead of just having a public option and using the common sense blend of market discipline imposed by the ‘single payer’ (government at state and fed levels) plus MMT plus taxes (oh no!!) all on the way toward sane yet widely available and affordable education, we have the neoliberal hustle — students-as-cash-flow-engines to be strip mined through debt slavery so that financial assets can get created and bought/sold in casinos serving the 1%.

…government fingers the pie until it is ruined, then it’s answer is to bake more pies to be fingered…..?…..best to all………………….rs

Try looking at what other countries do. More than a few countries in Europe have university courses where the only qualification for entry is that you have the necessary subject grades. There are no college fees. Tuition is paid for out of general taxes. That’s what I’d call a very good use of taxes.

One missing piece of this story: Federal funding for higher education has declined by 55% since 1972. See! All those student protests in the ’60s did get something!

…and gosh, I wonder why tuition keeps rising!

And let’s remember: We have a sovereign, fiat currency.

I would quibble a bit with your characterization of college for everyone half a century ago. Quite the opposite, we used to have a society where college was one of many options for young adults rather than the primary social sorting mechanism we have imposed on Xers and especially Millennials. Even today, the majority of Americans do not even have undergraduate degrees, let alone graduate ones.

I do support cost-effective, government supported options for education beyond K-12, but that’s not the main ballgame. There are already public options, and they are significantly cheaper than the private ones. The problem with higher education is that even those cheaper options are still extremely expensive to provide in the current model wherein a significant portion of total student costs are for non-tuition purposes (like housing, food, healthcare, transportation, and so forth). That’s what has changed; not just tuition costs as professor and admin salaries have soared (which is a major problem itself), but also, above and beyond that, the non-tuition costs of living have also soared.

The only real cost-saving measures that would make a difference are to 1) meaningfully reduce the overall cost of living in the economy, and/ or 2) return college to more of a niche roll for those actually interested in intellectual pursuits (and who have something original to offer) rather than as a basic requirement to join adult society as a full citizen. K-12 public education is all that ought to be needed for the vast majority of civic participation, and even many ‘advanced’ professional occupations like accounting and law really only need 2-4 years of higher ed for most purposes. Advanced degrees like JDs and MBAs and so forth largely exist because of legal requirements and artificial employment constraints, not substantive value, while the number of PhDs we actually need to push the boundaries of scientific understanding of our world is a heckuva lot less than the number of PhDs our educational system churns out.

I know that runs against the current liberal mantra of college for everyone, but realistically, the issue isn’t just making college cheaper. The other component is making it so that college isn’t a requirement to participate in society. Degree inflation leaves everyone (save the professors and administrators) worse off.

Some very good points, especially the non-tuition cost inflation. Although K-12 education is essential, the “new normal” for educational attainment is two years at a community college. (They have both vocational/technical programs and pure “liberal arts” courses for the university matriculating student.

I spend much time on my local college campus and the educational and personal growth you see in students there is impressive. The exposure it gives them to new ideas and different people is important in a complex and diverse society like ours. Unfortunately, I’ve seen students acquire student debt of $11K for technical certificates. Not much, relatively, but still an anchor for an automotive tech student.

The higher education “trap” is absolutely inscrutable.

Chosing college, without even considering entering a trade, is one of my great regrets. My sole motivation was class cosciuosness.

Well said.

A side note: what has happened to Stoller? His postings here were great but I haven’t seen anything from him for quite a while.

He can still be found at http://www.mattstoller.com

Thanks. Lazy of me, should have more specifically asked why have we seen less of his work here. As in the quote above, he’s very conscientious about historical context and tracing policy change over time.

He’s a Congressional staffer again (to Bernie Sanders!) so he can’t write unless he gets approval. And he is pretty much limited to writing about safely distant history.

What’s interesting is the use of a basically un-payable “asset” by the Federal Government as a ‘financial asset’ on it’s books.

As Mr. Richter mentions, this is an un-payable debt. The ‘asset’ part of the equation is really approaching null. So, federal finances are in a lot worse shape than advertised. There are ‘work arounds’ for this at the Federal level. However, if a government is not a “Household,” and thus exempt from needing to ‘balance’ it’s budget, the other side of this equation, student households, really are households. Not only does the government move the goalposts here, it plays on a completely different pitch.

Simplified version: universities hire politicians as presidents, who then collude (exploiting their legal impunity) to crank tuition skyward, confident that generous federal financing to students will pay for their exorbitant oligopoly.

You’re not gonna learn this in no econ class taught by the GAP (gov-academia partnership): don’t want to clue in the fresh-faced marks!

This is gangsta econ, whose tenured professors (such as Chancellor Bernie Madoff) reside at Club Fed.

You no pay, we breaka you knees.

Great observation.

I read that if you take enough un-payable debt, sort it into tranches from ‘crap’ to ‘toxic shite’, build special investment vehicles to securitize them, bribe some ratings whores to stamp AAA on them, and sell them to pensions, municipalities and insurance companies, the problem just goes away.

But seriously, the collateral for these loans is only as good as the need tor the student to maintain a credit rating. This is a powerful force for economic marginalization that will eventually produce a critical mass of the excluded who can form an independent economy based on factors and assets other than those tied to an official credit rating.

From Stoller: “A student loan debt is literally a claim against a life — you cannot discharge it in bankruptcy, and if you die, your parents are obligated to pay it.” That sounds crazy. Most only be in cases where parents are co-signatories on the loan or are official collateral some how? If the person taking the loan is over 18 years old, why should there be recourse to the parents….

“If the banks have their way, mortgages and deficiency judgments will follow you around forever, as they do in Spain”…and Sweden. All mortgages are full recourse and it is virtually impossible to go into personal bankruptcy. If you do, the ramifications are severe in terms of inability to get credit cards, rental apartments etc.

“The goal is not to have them pay off their debts, but to owe forever”. Not just a US phenomenon. Some data from Sweden: average amortization rate on mortgages in Sweden is 83 years, 125 years for apartments and 71 years for villas. For new apartment loans it is 200 years. For Stockholm mortgages it is 400+ years. Data is from 2012 (BKN) so probably longer now as prices have increased c.10-15% per year since then.

It has truly become a mortgage (“death pledge”)….

It makes me wonder why banksters aren’t hanging from lamp posts with their neckties as nooses.

Really, the people are idiots for letting it get that far.

But whodathunk the NFL could be so profitable, but college football be such a money losing proposition???

Would the NFL be profitable without free stadiums and charging the military for their pregame propaganda performance?

Makes you wonder why college football teams don’t use the free stadiums? But they do have ROTC marching bands for the pre-game and halftime. Those are paid for by government already, so that’s free. Plus the ROTC guarantees a job even if you’re a liberal arts major. Doesn’t pay as much as being a NFL football player, but it’s something to fall back on, and the government pays for your re-location anywhere in the world your job may end up being. Other college grads may not be so lucky.

Well, football, especially the American variety, is, at root, a war game. The entire thing is propaganda.

I agree. What is also bizarro is the ridiculous pay college football coaches get. The media fawning and verbal fellatio given to Jim Harbaugh when he deigned to coach at Michigan was vomit inducing.

Prolly houses last 400 years in Stockholm, then you buy another one.

When will we understand banks (money changers) are and have always caused the collapse of nations. The only solution is public banking which is outlawed threw the political process. Some argue that we need banks to fund capital investment. I say we can eliminate much public debt by funding public projects threw public banking by interest free loans.

Public banking illegal?

Not in North Dakota. The Bank of North Dakota has been in business since 1919.

And there’s a growing movement toward starting public banks in other areas of the country.

It may be growing but the Bank of North Dakota is the only state-owned bank in the US, today.

My fellow Zonies are working on changing things, Anon. Link:

https://arizonapublicbanking.org/

This is capitalism, or at least its logical conclusion.

https://therulingclassobserver.wordpress.com/2016/06/15/ruling-class-axioms/

It’s not just student loans…Fed rates being so low, and possibly going lower are going to make these debts impossible to pay off. Or, more likely, that is the intent.

https://research.stlouisfed.org/fred2/graph/?g=4y1R

In Italy workers who want to anticipate their state pension will be offered a b a n k credit. An example: a worker who leaves work (or doesn’t a find a job) at 62, that is 3 years earlier than legit. His monthly pension payment of, say, 2500 € will be cut by 500 € (3% interest and part of principal) for 20 years. The whole operation is conducted by the state pension fund and financed via a personal bank credit. It goes by the name of APE.

Just wow. I wonder how long it will take for that idea to surface here?

The “debt crisis” is also a part of this. In order to force people into debt, they can’t have any assets they can spend on their own. And so the best way to do this is eliminate the very notion of sovereign currency. The smaller the government debt, the fewer dollars there are in circulation to be had for savings. Add on top of that low or even negative interest rates where saving is penalized, you now have no chosen but to barrow for all of your capital needs.

And not just for individuals either. Businesses no longer operate from reserve capital. Nearly every function operates from credit.

This puts the banks in an extremely powerful position. If the banks fail – than the very notion of money disappears from business legers. No wonder congress was stampeded into supporting the bailouts.

It will not solve the problem, but one way to at least ease the pressure is to grow the government debt. This creates more currency in circulation, and starts to allow business and families to function from reserves. We also need to kill this notion of perpetual debt.

Job-Seeking Ph.D. Holders Look to Life Outside School

[WSJ, Google the title if link doesn’t work]

Increasing debt serviced by decreasing income. What could possibly go wrong?

Someone please forward to fwd.us.

I have a student loan myself. Still worth about 1/2 of last years income. Going on 50 yrs old here. In my experience, school is worthless for career advancement, although it can be good for other things. Particularly since NAFTA, these trade agreements have all lessened the value of an education for career purposes. Therefore I think the default ratio should be 100% until Congress decides to do something about the trade deals. Either that or introduce some market discipline somehow. In other words, a debt strike until decent-paying jobs come back with a clear path to advancement.

I hope you see that this rabbit hole goes quite a bit further. Let us start with the fact that debts that cannot be repaid, won’t be repaid. Add to that the “debt for life” burden the inability to discharge student debt creates. Then let’s pepper the future with highly rated securities based on a basket of student loans (highly rated specifically because of the bankruptcy laws). Voila, we have the ingredients for political inaction on this issue. Change the bankruptcy laws you say. Pshaw, then those highly rated securities would fall in value, banks would be hurt. Oh my. Can’t have that. And don’t expect the FIRE industry to place any downward pressure on tuitions – those high tuitions force our precious darlings into their lairs. And shoot, if corporate CEOs are pulling down tens of millions, why shouldn’t the presidents of our universities make millions? Don’t you value education? The next financial crisis will involve defaults on a wide array of debts, from student loans, to car loans, to subprime home loans. With the help of under-reported inflation, the FIRE industry is looting the future – with the tacit aid of our weak government.

No, only private student loans are at risk. The overwhelming majority are government guaranteed by Sallie Mae. That is why Richter called it “the government’s biggest asset class”.

Student loans are relatively new in the UK and only in the last few years tuition fees have trebled from £3,000 to £9,000 pounds a year.

My daughter is going to University soon and in one of the talks I noticed student loans are linked to RPI.

RPI has been consistently higher than CPI for years, but CPI is the one the Bank of England targets and keeps low.

CPI is used as the guide to wages and benefits.

I thought RPI was dead and buried a decade or so ago, but up it pops for student loans to extract even more money from our youngsters.

Does the US do anything similar?

Linking student loan debt to a higher inflation figure than that targeted by the FED.

In the US direct federal student loans have a fixed interest rate based on the 10 year Treasury. This is as of legislation passed in 2013 (Thanks Obama!). Currently ranges from 4.29% for undergraduate students to 6.84% for loans taken out by parents or professional/grad students. Private student loans run quite a bit higher. Also if you took out your loans or consolidated when interest rates were higher you’re stuck and not permitted to refinance. I frequently hear from friends with student loans at 8-9% which I consider abhorrent. These people will pay more than double their loan amount in interest and fees. What a ripoff.

The author’s argument was weakened by the use of the federal loans to students chart. The student loan programs have been restructured, with the state guarantee programs eliminated and federal direct lending replacing it. While it is not impossible to figure out total student debt over time, I agree that it is not easy.

The author also doesn’t consider the pullbacks of state funding of the university systems, which has been an additional cause of spikes in tuition and fees.

I don’t disagree with the author’s points; rather, he should strengthen his supporting data to broaden the fact base of how bad it really is.

The problem is that the additions you suggest be incorporated would take a very large amount of work and render any result more assailable because it would still have gaps and also might have inconsistencies in how it was captured and categorized. If an academic did that work, it might be taken seriously, but not a financial writer.

This guy does a pretty good job on the effects of states contributing less: http://dvschroeder.blogspot.com/2015/08/why-cost-of-college-has-tripled.html

edit: following up to Laocoon

Thanks, good piece especially the examples of the mechanics of cutbacks translating to big swings in out of pocket tuition ergo increased student borrowing.

I do agree with Wolf’s point of debt slavery and the long-term implications. The government programs like student loans that started out trying to help people seem to have morphed into giant vampires, the result of a series of public policy changes over recent decades.

I’ve heard about counterparties playing a big role in the risk relatedtoUS gov’t vulnerability in relation to Social Securityobligations. I didn’t notice any mention in this post about counterparties relating to student loans. I wonder if there is counterparty risk relating to student loans hiding somewhere. . .

I wonder if there is counterparty risk relating to student loans hiding somewhere. . .

It would be ironic if some of the ‘investors’ in student loans was pension fund or university endowment money channeled through hedge funds. I can see it now. Haaarvaaard invest billions with their hedge fund partners to buy distressed student loan debt, and turns the screws to bleed the students dry. I put nothing past them as ethics are non existent at the institutions of higher learning.

Yes inflation, no inflation, loans, no loans, free, not free. How about a little less government trying to micro manage.

Anyone who reads ‘History’ as opposed to mythology or journalists would agree with the article.

It is a myth that slavery ended with the (un)Civil War. The ex holders of ‘chattel’ slaves adopted sharecropping and tenant farming. Less chance of a slave revolt and it had the legal backing of governments. Merchants and bankers also had a dog in the hunt as the article explains. Playing local historian in a rural Texas County I found that the ‘old money’ and most real property was concentrated in the decendents of merchants and bankers operating before 1950. Today slavery is completely monetized and backed by the full force of law and policy (it is pure fantasy that government will shrink and abandon the oligarchy). Even ‘income transfer’ to the lowest paid workers (‘welfare, food assistance, special tax breaks) benefit Creditors, employers paying non-living wages, as well as those receiving the ‘transfer’ (I wonder which gets the best deal). Notice many tout Education as preparation for the workforce. (employment secures an income stream for creditors, suprise, suprise)

“a free man should not live for the benefit of another” as Aristotle said in Politics — perhaps freedom in the USA is an illusion for most.

Bless you, Yves, and all those out in the NC commentariat.

I have a sci-fi film in financing, SYMBIONT. Logline: What if the Aliens were in league with the 1% to enslave MIllennials using student debt and make them work in vast underground warehouses? Based on a true story. :)

Much of the subtext and several of the plot points were inspired by posts and comments on this very site.

Thank you, guys, and keep up the great work.

Ps. Interestingly enough, people over about 30 read the script as more or less straight sci-fi, whereas Millennials get it immediately.

Many developed countries have more equitable, affordable and socially/politically appreciated arrangements, though even there costs are rising due to institutional inflation and heavy demand – and in many larger centres from foreign students of the global well-to-do.