This is Naked Capitalism’s special fundraiser, to fight a McCarthtyite attack against this site and 200 others by funding legal expenses and other site support. For more background on how the Washington Post smeared Naked Capitalism along with other established, well-regarded independent news sites, and why this is such a dangerous development, see this article by Ben Norton and Greenwald and this piece by Matt Taibbi. Our post gives more detail on how we plan to fight back. 23 donors have already supported this campaign. Please join us and participate via our Tip Jar, which shows how to give via check, credit card, debit card, or PayPal.

Yves here. By virtue of steamrolling local taxi operations in cities all over the world, combined with cultivating cheerleaders in the business press and among Silicon Valley libertarians, Uber has managed to create an image of inevitability and invincibility. How much is hype and how much is real?

As transportation industry expert Hubert Horan will demonstrate in his four-part series, Uber has greatly oversold its case. There are no grounds for believing that Uber will ever be profitable, let alone justify its lofty valuation, absent perhaps the widespread implementation of driverless cars. Lambert has started digging into that issue, and his posts on that topic have consistently found that the technology would be vastly more difficult to develop and implement that its boosters acknowledge, would require substantial upgrading in roads, may never be viable in adverse weather conditions (snow and rain) and is least likely to be implemented in cities, which present far more daunting design demands that long-distance transport on highways.

Tellingly, earlier this month, Bloomberg reported that JP Morgan and Deutsche Bank turned down the “opportunity” to sell Uber shares to high-net-worth individuals. The reason? The taxi ride company provided 290 pages of verbiage, but would not provide its net income or even annual revenues.

By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan has no financial links with any urban car service industry competitors, investors or regulators, or any firms that work on behalf of industry participants.

Uber is currently the most highly valued private company in the world. Its primarily Silicon Valley-based investors have a achieved a venture capital valuation of $69 billion based on direct investment of over $13 billion. Uber hopes to earn billions in returns for those investors out of an urban car service industry that historically had razor-thin margins producing a commodity product. Although the industry has been competitively fragmented and structurally stable for over a century, Uber has been aggressively pursuing global industry dominance, in the belief that the industry has been radically transformed into a “winner-take-all” market.

This is the first of a series of articles addressing the question of whether Uber’s pursuit of global industry dominance would actually improve the efficiency of the urban car service industry and improve overall economic welfare.

For Uber (or any other radical industry restructuring) to be welfare enhancing, it would have to clearly demonstrate:

The ability to earn sustainable profits in competitive markets large enough to provide attractive returns on its invested capital

The ability to provide service at significantly lower cost, or the ability to produce much higher quality service at similar costs

That it has created new sources of sustainable competitive advantages through major product redesigns and technology/process innovations that incumbent producers could not readily match, and

Evidence that the newly-dominant company will have strong incentive to pass on a significant share of those efficiency gains to consumers.

Unlike most startups, Uber did not enter the industry in pursuit of a significant market share, but was explicitly working to drive incumbents out of business and achieve global industry dominance. Uber’s huge valuation was always predicated on the dramatic growth towards global dominance. Thus if Uber’s valuation and industry dominance were to be welfare enhancing, Uber’s efficiency and competitive advantages would need to be overwhelming, and there would need to be clear evidence of Uber’s ability to generate large profits and consumer welfare benefits out of these advantages.

While most media coverage focused on isolated Uber product attributes, or its corporate style and image, this series will focus on the overall economics of Uber, using the approaches that outsiders examining industry competitive dynamics or investment opportunities typically would. This first article will present evidence on Uber’s profitability, while subsequent pieces will present evidence about cost efficiency, competitive advantage and the other issues critical to the larger economic welfare question.

Uber Has Operating Losses of $2 Billion a Year, More Than Any Startup in History

Published financial data shows that Uber is losing more money than any startup in history and that its ability to capture customers and drivers from incumbent operators is entirely due to $2 billion in annual investor subsidies. The vast majority of media coverage presumes Uber is following the path of prominent digitally-based startups whose large initial losses transformed into strong profits within a few years.

This presumption is contradicted by Uber’s actual financial results, which show no meaningful margin improvement through 2015 while the limited margin improvements achieved in 2016 can be entirely explained by Uber-imposed cutbacks to driver compensation. It is also contradicted by the fact that Uber lacks the major scale and network economies that allowed digitally-based startups to achieve rapid margin improvement.

As a private company, Uber is not required to publish financial statements, and financial statements disseminated privately are not required to be audited in accordance with generally accepted accounting principles (GAAP) or satisfy the SEC’s reporting standards for public companies.

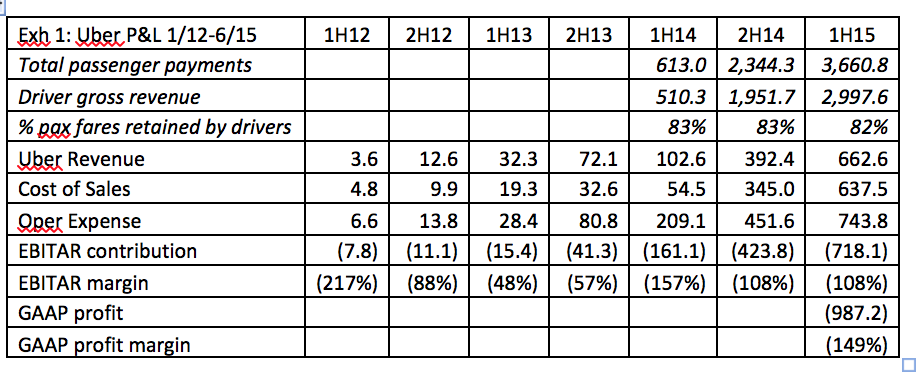

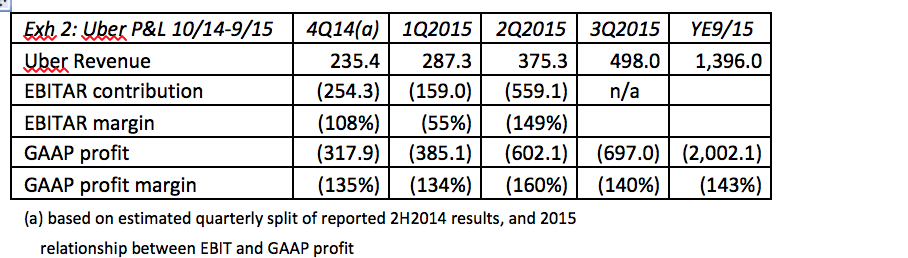

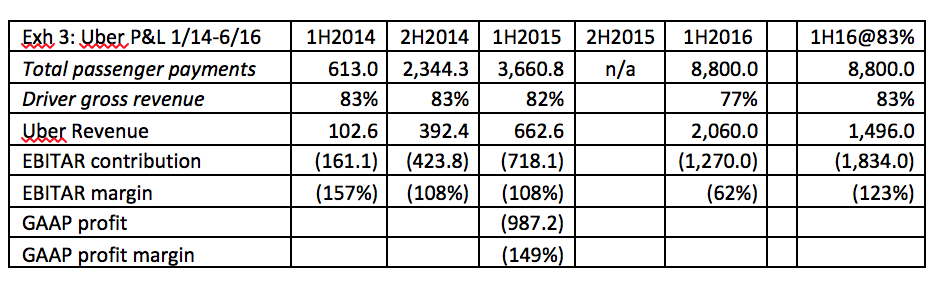

The financial tables below are based on private financial statements that Uber shared with investors that were published in the financial press on three separate occasions. The first set included data for 2012, 2013 and the first half of 2014, although only EBITAR (before interest, taxes, depreciation and amortization) contribution was shown, not the true (GAAP) profit that publically traded companies report.[1] The second set included tables of GAAP profit data for full year 2014 and the first half of 2015;[2] the third set included summary EBITAR contribution data for the first half of 2016.[3] There has been no public report of results for the fourth quarter of 2015.

Exhibit 1 summarizes data from 2013 through the first half of 2015. Drivers retained 83% of passenger payments (fares plus tips) which must cover the cost of vehicle ownership, insurance and maintenance, fuel, credit card and license fees as well as health insurance and take home pay; the balance is Uber’s total revenue. Exhibit 2 shows the GAAP results for the full year ending September 2015 based on the published numbers and an estimated quarterly split of published 2nd half 2014 results. Exhibit 3 compares first half 2016 results to 2014-15 results. There is no simple relationship between EBITAR contribution and GAAP profitability and even publically traded companies have wide leeway as to what expenses can be excluded from interim contribution measures such as EBITAR.

As shown in Exhibit 2, for the year ending September 2015, Uber had GAAP losses of $2 billion on revenue of $1.4 billion, a negative 143% profit margin. Thus Uber’s current operations depend on $2 billion in subsidies, funded out of the $13 billion in cash its investors have provided.

Uber passengers were paying only 41% of the actual cost of their trips; Uber was using these massive subsidies to undercut the fares and provide more capacity than the competitors who had to cover 100% of their costs out of passenger fares.

Many other tech startups lost money as they pursued growth and market share, but losses of this magnitude are unprecedented; in its worst-ever four quarters, in 2000, Amazon had a negative 50% margin, losing $1.4 billion on $2.8 billion in revenue, and the company responded by firing more than 15 percent of its workforce.[4] 2015 was Uber’s fifth year of operations; at that point in its history Facebook was achieving 25% profit margins.[5]

No Evidence of the Rapid Margin Improvement That Drove Other Tech Startups to Profitability

There is no evidence that Uber’s rapid growth is driving the rapid margin improvements achieved by other prominent tech startups as they “grew into profitability.”

Assuming that the unusual spike in EBITAR margin in the first half of 2014 (157%) was due to one-time events or accounting anomalies, Uber has been steadily producing EBITAR margins worse than negative 100% since 2012, and the absolute magnitude of losses has been increasing.

Uber corporate revenue for the year ending June 2015 was over 500% higher than the year ending June 2014, but the EBITAR margin barely changed, moving from negative 115% to negative 108%. Uber had a negative $1.2 billion EBITAR contribution in the first half of 2016, suggesting full year GAAP losses approaching $3 billion. Uber’s EBITAR contribution margin improved from negative 108% in the first half of 2015 to negative 62% in the first half of 2016, but this margin improvement is entirely explained by Uber imposed cuts in driver compensation. As shown in Exhibit 3, Uber only allowed drivers to retain 77% of each passenger dollar in 2016, down from 83% in 2014-15[6]. If drivers had retained 83% of 2016 passenger payments, Uber’s EBITAR contribution would have been negative $1.8 billion, and its EBITAR margin would have fallen to negative 122%. Uber’s EBITAR margin did not improve because its productive efficiency or market performance was improving; capital was simply claiming a higher share of each revenue dollar and giving less to labor.

If rapid growth could not drive major margin improvements between 2012 and 2016, there is no reason to believe that Uber will suddenly find billions in scale economies going forward. Fundamentally digital companies like Amazon, EBay, Google and Facebook had massive operating scale economies because the marginal cost of expanded operations was close to zero. Aggressive pricing fueled the growth that drove major margin improvements and also created major consumer welfare benefits.

By contrast, in the hundred years since the first motorized taxi, there has been no evidence of significant scale economies in the urban car service industry. That explains why successful operators never expanded to other cities and why there was no natural tendency towards concentration in individual markets. Drivers, vehicles and fuel account for 85% of urban car service costs. None of these costs decline significantly as companies grow. As the P&L data above demonstrates, Uber has not discovered a magical new way to drive down unit costs.

Uber Losses Not explained by Uber China and No One Can Explain How Profitability Can Be Achieved

Several of the new stories reporting Uber’s financial results quoted anonymous sources attributing a significant portion of the losses to Uber’s failed efforts in China. Uber China may have lost a lot of money but those losses are not included in (or are not material to) the losses discussed here. Uber China did not begin operating until 2014 and operated under a separate ownership structure prior to its sale to Didi Chuxing[7]. Uber Global only had a minority shareholding. Thus Uber Global could not have included Uber China results in any of its EBITAR contribution or GAAP operating profitability numbers, and could only have included the percentage of China losses assigned to its minority shareholding as a non-operating expense. The news reports of Uber’s first half 2016 losses said that Uber had not yet incorporated any Chinese losses onto its Global balance sheet, some of which will be offset by Uber’s new 17.5% shareholding in Didi, and Didi’s $1 billion investment in Uber.

The press has reported numerous unsubstantiated assertions that Uber was on the verge of profitability, or that operations in individual markets were profitable. In September 2015, Travis Kalanick said that Uber’s North American operations would be profitable by early 2016[8], but did not explain whether this meant actual (GAAP) profitability, or an artificial interim contribution measure such as EBITAR or positive cash-flow. Uber has not presented any evidence that Kalanick’s promise has been achieved.

Since Uber’s corporate expenses are almost entirely joint/overhead costs that cannot be directly linked to current operations in specific markets, it would be easy to claim positive contribution numbers despite massive actual GAAP losses. The article reporting Uber’s 2015 losses said “the company expects older markets in developed countries to generate billions of dollars in profit in the coming years.”[9] But the $4 billion profit improvement needed to convert today’s $2 billion losses into a $2 billion profit would require some combination of the most staggering efficiency gains in the history of private enterprise (total Global Uber expense in Exhibit 2 was $3.4 billion) and humongous fare increases (fares would need to have quadrupled to have produced a $2 billion profit in 2015).

Uber’s refusal to consider an IPO may best be explained by the recognition that publishing detailed, audited financial data confirming these massive losses and the complete lack of progress towards profitability could undermine public confidence about its inevitable march to industry dominance.

There have been hundreds of articles claiming that Uber has produced wonderful benefits, but none of these benefits increase consumer welfare because they depended on billions in subsidies. Uber is currently a staggeringly unprofitable company. Aside from the imposition of unilateral cuts in driver compensation, there is no evidence of any progress towards breakeven, and no one can provide a credible explanation of how Uber could achieve the billions in P&L improvements needed to achieve sustainable profits and investor returns.

Uber’s growth to date is entirely explained by its willingness to engage in predatory competition funded by Silicon Valley billionaires pursuing industry dominance. But this financial evidence, while highly suggestive, cannot completely answer the question of how an Uber-dominated industry would impact overall economic welfare.

The next articles in this series will examine the critical questions of cost competitiveness and industry dynamics. Could Uber ever produce urban car services as efficiently as the incumbent operators it has been driving out of business? Is Uber’s business model is based on the types of major product/technological/process breakthroughs that could provide sustainable competitive advantages large enough to justify the losses its investors have been subsidizing to date? Has Uber transformed urban car services into a “winner-take-all” market? Do the billions that the capital markets have invested in Uber and similar companies reflect a reallocation of resources from less productive to more productive uses? Is Uber’s pursuit of returns on the $13 billion its investors have provided consistent with the normal workings of competitive markets?

––––––––––––––––––––––––––––––––––––

[1] Newcomer, Eric, Uber Bonds Term Sheet Reveals $470 Million in Operating Losses, Bloomberg, 29 Jun 2015; see also Biddle, Sam, Here Are the Internal Documents that Prove Uber Is a Money Loser, Gawker, 15 Aug 2015; Griffith, Erin, For high-risk start-ups like Uber, big ambitions don’t make losses any less unsettling, Los Angeles Times, 11 Aug 2015;

[2] Efrati, Amir, Uber’s Losses Grow, The Information, 11 Jan 2016; Salomon, Brian, Leaked: Uber’s Financials Show Huge Growth, Even Bigger Losses, Forbes, 11 Jan 2016. ;Newcomer, Eric & Huet, Ellen, Facing a Price War, Uber Bets on Volume, Bloomberg, 21 Jan 2016

[3] Newcomer, Eric, Uber Loses at Least $1.2 Billion in First Half of 2016, Bloomberg, 25 Aug 2016; Issac, Mike, How Uber Lost More Than $1 Billion in the First Half of 2016, New York Times, 25 Aug 2016 The bottom line in the first set of reports was labeled as either “Net Loss” or EBIT (earnings with only interest and taxes excluded) but is presumed to be EBITAR the second set of reports shows that 40% of total GAAP expenses were excluded from EBIT numbers, and the third set was explicitly labeled as EBITAR.

[4] Hansell, Saul, Amazon, Facing Slowdown, Cuts 1,300 Jobs, The New York Times, 31 Jan 2001

[5] Griffith, Erin, The problem with ‘Uber for X’, Fortune, Aug 2015

[6] Uber began implementing driver compensation cutbacks in the second half of 2015. Huet, Ellen, Uber Tests Taking Even More From Its Drivers With 30% Commission, Forbes, 18 May 2015.

[7] Uber China was valued at $8.2 billion based on an investment base of $1.2 billion. Bensinger, Greg & Winkler, Rolfe, Uber-Didi Tie-Up Threatens Lyft in U.S., Wall Street Journal, 2 Aug 2016. Hook, Leslie, Uber’s battle for China, Financial Times Magazine, Jun 2016.

[8] Newcomer supra note 1

[9] Efrati supra note 2

One things that’s interesting is the idea Uber has of “replacing traditional car ownership” by making exclusive use of Uber cheaper than the costs associated with owning a car, in a big city. The problem is, somebody has to own the car (like Lambert, I’m very skeptical that there’ll ever be widespread adoption of driverless tech on the consumer/commuter level – it’s being hyped because it draws a lot of investment), but if it costs less to use Uber than to own a car, how is the owner/operator supposed to make any money by giving rides? Wouldn’t they actually be losing money every time they gave a ride? This is where the predatory financing deals Uber brokers for its drivers to get new cars come in, essentially turning them into indentured servants/debt slaves

In short, yes. One of the things Uber relies on is drivers not understanding their own economics. We had an Uber driver show up in comments and explain that his all-in compensation was OK because he had a six year old car in a part of the country with no snow, so the car has a longer expected life than in the North, and he included all the costs of car ownership, most important, insurance, maintenance, and loss of value via the wear and tear of all the extra driving (not just runs with passengers but the extra tooling about). He was highly confident that the numbers didn’t work at all for drivers with cars much newer than his. And that was before Uber imposed the cuts in driver pay discussed in the article.

lol, this may be me. It was barely worth my time using: a paid-off 6 yr-old Honda Accord w/150,000 miles (a car I’ve owned since mile 3)—ie, depreciation cost = as low as you can go; and in-sourcing half of my car’s maintenance.

Two biggest hidden expenses that drivers may not fully tally: non-revenue generating dead-head miles; trade-in depreciation costs—the IRS uses 54 cents/mile as its baseline mileage deduction costs for a reason. (as a driver using a low-depreciating car, I could micro-arbitrage as my costs were less than the standard IRS mileage deduction).

As an Uber driver myself, I’ll second the above comments.

On special event weekends in my town, when Uber is in surge pricing, it’s worth some of my spare time to drive. During non-surge time frames, not so much…

Between app issues and the behavior of some riders, Uber can be annoying.

And then there are the times where they throw out a guarantee, then tell me in my next pay statement that I didn’t qualify, due to some factor beyond my control.

When I first started Ubering, I was testing to see if it would be worthwhile to quit my job. At this time, I’m still in the job, and not Ubering every weekend.

Oh no! You are challenging the Uberlords!

Thus you are never going to be qualified to get a guarantee.

But you have an entry into the US’ most popular hobby:

Litigating Bait-and-Switch in a Class Action.

I suspect they do throw a lot of rides toward new drivers to give them a false sense of security. I don’t know if I’ve mentioned it before, but I know a veteran driver who was approached by a new driver with a question about the app. New driver had a surge, veteran did not – and they were in the same location.

I think I love you people. I’m an Uber driver (long story you don’t want to hear) and in a nutshell, you see what’s happening. I drove an investor type around once who was extolling the virtues of investing in Uber and I said I didn’t think so, based upon MY costs, etc. and he poo-pooed me.

I believe Uber will wait until they squash all competition, then raise it’s prices. It will tell the cities that have gotten rid of buses that they simply need subsidies in order to drive their poor around. It will tell people who relied on bus-level prices in 2016-17 that they simply can’t afford to charge those paltry fees, and too bad you got rid of your cars! lol

As IF the American consumer would ever get rid of their cars. As IF driver-less cars would ever work. As it is now, GPS location is very, very iffy and buggy and they don’t seem inclined to address those problems. Which tells me a great deal about their lack of commitment to really make this work beyond whatever they can scam financially out of everyone who is naive, from drivers, to riders, to investors, to governments. This should be very interesting!

We are working on a patent for a rideshare company, and have personal talked to investors who hold Uber Stock. They claim that Uber valuation needs to be cut in half, and they feel held hostage since they can’t unload the stock.

Basically, Uber is borderline running a ponzi scheme at this point.

Any ipo or government willing to work with them is probably getting paid under the table, since Uber is extremely scared of paper trails. I’ve worked with a consultant of theirs who has verified the cash for services so they can cook their books.

This series is basically a bible I have all of my investors read first before we meet. Great work, and very truly accurate.

The idea is that there will be fleet operators who save money on economies of scale. Most cars are parked something like 98% of the time, representing a huge lost opportunity cost. Car owners are generally pretty lousy about maintenance, which fleet operators could be in a much better position to handle and can presumably benefit from having lots of vehicles of the same model. In big urban centers parking (both at home and around the city) are major costs that can be reduced with on-call transport. These are the sorts of reasons you’ll see in auto manufacturers like Ford’s digressions about becoming “mobility” companies rather than vehicle manufacturers.

As someone who primarily commutes by bicycle and doesn’t own a car, I’m not wholly opposed to that line of thinking for urban areas but think that it should only be supplementary to robust public transport.

‘Most cars are parked something like 98% of the time, representing a huge lost opportunity cost’

the problem w/this line of thinking is that after you drop off a passenger in your local major downtown, you can’t just park in front of the Hilton and wait for the next fare.

So you’re left: a) driving around in circles waiting for a fare or dead-heading to a less congested neighborhood where you could park and wait for a fare (but this risks decreasing your odds of a fare as less density = less chances of a fare). Catch-22

Either way is bad for the environment :(

In short, all those articles highlighting the environmental benefits of Uber are pure bunk. Probably 40% of my miles were non-revenue generating. Don’t forget lots of idling waiting a few min. per passenger.

There’s been a bunch of University studies and simulations on this, and depending on the assumptions going into the model there are either huge savings with better route optimization or increased energy usage as you predict with lots of extra vehicle-miles driven in-between passenger pickups. There are potential savings (and reduced congestion) if you can avoid people swirling around looking for parking and reduce the total number of cars to improve urban density, but you probably need a large mass of users before it becomes significant enough to make much impact.

all models are only as good as its assumptions.

IF drivers had better/perfect knowledge of the real-time location of other drivers and better/perfect knowledge of the ratio of supply:demand, then MAYBE the system would be more efficient.

As is, it’s a form prisoners’ dilemma, every driver is acting in their own self-interest, ie burning lots and lots of petrol per actual revenue-generating mile.

In this case, the idea is as you say, react to real-time data as well as look at traffic patterns over time to optimize traffic in the same way that any public transit authority does today. It’s not too difficult of an engineering problem, but putting the infrastructure in place and making a business case to reach a critical mass of users is far from trivial. I think the author makes a compelling case that Uber isn’t doing the latter.

As someone who has driven for Uber part-time for almost a year, I can say that it very quickly became very apparent to me that Uber is using human drivers to generate data for mining: What are peak times for riders? Where do rides originate and end? What routes are drivers taking to get passengers from A to B?

Uber will use all this data for their driverless fleet (for things like locating the car corrals, and scheduling maintenance times for their driverless vehicles), because they’ve also made it very apparent they will be dumping the humans as fast as they can.

I think the ultimate question though is can they introduce a driverless fleet? And if the technology can work, and if a city allows it, then who are they competing with… Tesla? Apple/Google partnering with a BMW or someone to actually produce the cars? And won’t that be a whole new competitive battle which could lead to even further losses…how long can they sustain the story of growth, in order to ultimately create a monopoly and drive profits?

Uber does *not* understand the mentality of the masses who will absolutely trash those driverless cars because they are not being monitored and held somewhat accountable. I’m also wondering how they will account for all passengers who enter the car. As it is, one person can order an UberX and take 3 others along with them. What will the driveless car do if a non-Uber customer decides to jump in the car – and you know that will happen. It would be hilarious to watch (from a distance). Uber would eventually have to take on a bus model rather than the little car milling around scavenging for customers, more wealthy customers will revert to taxi-like rides and have to pay more for, say, clean cars, etc. while they long for the days of a $3 ride for 4 people (cheaper than the bus for door-to-door service! But Uber would be completely responsible for the bus system and how do you make that profitable? Sometimes they’re full, but often they are nearly empty and they still have to run to serve the public. They absolutely have not thought this out.

I’m not sure this is as much an issue as you think. Remember there can be cameras in the car and Uber has a log of exactly who ordered a car at any time. Trashing a driverless car would be a prosecutable offense with very good evidence.

Yes, but image the rider who is next to get in the trashed (puked in) car before Uber can act. Not good.

And in fact Google and Apple have much more data about driving routes than Uber never will have. Apple and Google are recording every iOS/Android movement. Uber will not compete with them on automated cars fleets optimization.

Uber just got another wakeup call in California when they tested their autonomous fleets without a registration.

Besides being forced to shut down, they also had to form a commercial car company to run their driverless fleet in the future.

Anytime yor read the word “taxi” or “commercial fleet” just realize that to operate it will cost $1.20 to $1.70 per mile and that’s without a driver and with insurance cut in half.

The reasoning behind this is a laundry list of commercial licensing, permits insurance, airport fees, etc that commercial fleets cost compared to tnc or personally owned cars.

That mythical unicorn Uber has spent billions on, and have paid Carnegie Mellon and BMW billions for their tech won’t mean a thing. Unless all factors of commercial ownership go down, the driver and insurance is around half of real world value, but that $0.32 a mile is complete fabrication, the federal governments write off is $0.58 a mile. So how can Uber be cheaper than car ownership, it’s not and a lie.

That model could have worked for a tnc company, but once you go commercial cost will as cheap as uber x, and nothing less.

> Most cars are parked something like 98% of the time

suggesting demand for car use is also not there for 98% of the time

car journeys are generally synchronised so will all the traffic jams, so now you will be paying for your Uber driver to queue for you while you fiddle with your phone

Not true…that personal cars aren’t used 98% of the time doesn’t mean a fleet won’t be, because instead of having 1,000 cars in a given area, they could have 100, greatly increasing the efficiency of the fleet as compared to personal ownership. It’s not likely to be quite as extreme as a 90% reduction in vehicle count, but there would definitely be a massive reduction of some amount.

Also, a road filled with automated cars theoretically would be much less likely to encounter traffic jams as they can safely drive closer together, aren’t going to be distracted leading to inefficient braking/accelerating, and should be considerably less likely to have accidents.

Not to say there aren’t significant technical hurdles still to overcome, because there obviously are at this point.

So what if a car isn’t used all the time? That’s like saying the chair in your living room is wasted because you aren’t sitting in it over 99% of the time, or the clothes in your closet are wasted because you aren’t wearing them 99% of the time. The owner owns it longer because he’s not using it all the time.

“Having a taxi makes more efficient use of a car” is patently ridiculous and I can’t believe anyone accepts this argument. When you own your car, the only miles you are putting on it are productive miles, as in taking you from point A to point B and then having the car wait at your pleasure to take you to the next place. By contrast, any taxi service has tons of wasted miles put on the car in the form all the miles put on the car going from passenger run to passenger run.

Utilization does matter for assets that (1) depreciate even when unusued and (2) cost money to own – for cars, that includes parking space, registration fees, insurance, etc. When you see something that’s getting 5% utilization there’s almost certainly major room for improvements in efficiency. If you just shared that car with another family (and could avoid conflicts in demand) you’d still only be using it 10% of the time, and your non-usage costs would effectively drop 50%. In theory, you could pool with up to 20 other families and reduce your fixed costs by 20%, save room, buy a new car more often, etc.

This is effectively what a ride share company is doing when it causes people in the city to give up privately owned cars – they’re paying higher per-miles, but they’re only paying a proportional share of the overhead of the vehicle, rather than 100% for a car they only use 5% of the time. If your mileage was already low to start with (because you don’t have a long commute) the extra cost per mile is easily outweighed by the savings on overhead.

Fleet Operators aren’t going to earn any Economies of Scale benefits. What exactly are they scaling? For each car they still need to pay the same gas, the same driver’s wage and the same car maintenance costs. And of course, they still need to pay the same for each car. The amount they get from Uber is the same regardless.

There is nothing to scale here; the only one earning any economy of scale benefit is Uber itself.

Ahem, you are apparently new here and appear to have a reading comprehension along with not having read our Site Policies.

This is not a chat board. If you read the second article in this series, which was already visible in Recent Items when you wrote your comment, explains in detail why Uber is a high cost operator and there are no mythical magical “scale economies” to be had.

Not engaging with the material provided and providing a comment that is tantamount to sticking your finger in your ears and saying “nyah nyah nyah” (more technically, “broken record”) is explicitly against our written Policies as bad faith argumentation.

I am letting this comment through despite that but if you continue in this vein, I will not approve your comments.

Scale for commercial fleets won’t be cheaper if there are caps on the number of commercial cars allowed to operate per city regulations, i.e. the medallion system.

You will only save on the driver and half of insurance. The cost per mile since Uber was forced to become a TCP company in California will around $1.20 to $1.70. This is based on the cost to run a fully viable commercial car business. The cost just covers the basics of the business operations, but for Uber and the unrealistic valuation they have will most likely have them justify increasing prices back to old taxi prices of $3.00 or more per mile if they become monopoly.

Again, anytime you hear commercial or taxi in an article there are fixed business costs to cover the operations of any commercial fleet.

Uber is a commodity, unless it creates exclusivity by capturing the potential drivers, which would make it even harder than now to argue they are independent contractors vs. employees (which would raise costs considerably).

There’s little cost of switching for users and potentially drivers. The moat Uber is trying to create is that it drives prices down so much that it kills all competition – but that is not a viable long term strategy – because it present it with two choices only – keep losing money (not viable long term – yes, I know Amazon is technically losing money, but it has IIRC positive cashflow, and the loss is mostly due to investments – it could turn itself profitable anytime it wanted w/o impact on end customers), or raise prices (which would invite competition back).

In fact, I was saying that Google/FB could kill Uber just about anytime it choose, at the cost of (ironically) potentially involving regulators (think MS bundling IE with Windoze).

Self-driving cars would not solve this, unless Uber would hold some industry critical patents, which I find unlikely at the moment.

btw, your intercept link is wrong, the right link is https://theintercept.com/2016/11/26/washington-post-disgracefully-promotes-a-mccarthyite-blacklist-from-a-new-hidden-and-very-shady-group/

Fixed, thanks.

The nicest thing I can say about Uber is that it may have spurred other taxi companies to upgrade their dispatch services, to incorporate smart phone applications. If Uber is really intent on pushing other taxi companies out of the market(s), then their push for driverless cars makes sense. If they were smart, they would give up that pipe dream, and actually become just a software company, which is that they already claim. I think that Uber has a better chance at becoming profitable if it focused on developing and licensing its software for real taxi companies.

The case here in Stockholm has been exactly that – all the major taxi companies now have apps with the same features as Uber, including showing you where the car you’re going to get into is at the moment. There is reasonable competition on price among the incumbents, and most taxis are clean and well kept. Uber has a presence here, but their lower pricing can only be due to investor subsidy, and that presence seems to be shrinking. They’ve also aggressively partnered with local companies (such as a train operator) to offer “free” first rides.

In any case, Uber has forgotten that one cannot “disrupt” the physical requirement for equipment and infrastructure if one wishes to move people about.

Same for Taxis G7 in Paris. Excellent service.

” push for driverless cars makes sense. “

but, but, if Uber driverless taxis become a thing from where will Tom Friedman get his ‘my taxi driver told me’ insights? /s

Isn’t he the type of person who would continue to pay for then-artisanal services/products?

As a software engineer by trade, Uber’s software is not that difficult to replicate. You need scale (cheap from AWS), Geographical data (cheap from Google), a payment provider (cheap from dozens of interests) and mash it all together with a decent UI. This is something that could be easily open sourced and drivers could work without a master.

Happening Now –

https://arcade.city/AC-whitepaper.pdf

There was an article in the New York Times, earlier this year, IIRC, about an Uber Driver strike during the Super Bowl or another large event.

A great deal of the article talked about driver dissatisfaction with Uber, and there was mention that certain New York Uber drivers had banded together and hired themselves a programmer to write an app to compete against Uber. Does anyone here know the status of that effort, and is it operational yet? I would be curious to see how it’s working for those drivers.

Uber is currently the most highly valued private company in the world. Its primarily Silicon Valley-based investors have a achieved a venture capital valuation of $69 billion based on direct investment of over $13 billion.

Why do economists think markets are rational? Silicon Valley-based investors prove otherwise. For every dollar invested the imagined valuation has grown by $5.60 or put into coins of the realm, for the cost of almost three Nimitz class aircraft carriers, fifteen are imagined to exist.

All the while losing billions, or again putting it into the coins of the realm, sinking a few Nimitz class aircraft carriers.

And I thought you were just joking the other day about using the Nimitz ACs as monetary units. This is awesome, carry on!

Why do economists think markets are rational?

1. Because they don’t believe in fear and greed.

2. Aircraft carries are Targets for Hyper-sonic missiles.

3. You need to “imagine” an Objective Economist – that is one who is not paid to prove some end.

Rational markets are the base case. Abstract from there. QED.

What’s to stop clever coders from creating their own Ubers, with a slightly different modus of their own to avoid copyright? Every American has the right to pick up hitchhikers, if the thing could just be automated….?

network effect. If I launch Humanity Rides LLC tomorrow, any rider using my puny network of drivers is going to likely wait 10-20 minutes for a ride. …Versus the 1 to 8 minutes for Uber.

People are a lot more impatient than you think.

And I won’t attract drivers unless I have a big pool of extant riders and/or big (and money-losing) driver incentives.

Austin has attracted a large number of Uber wanna bees (Ride Austin, Fasten, Fare, Get Me, InstaRyde and Wingz) since Uber and Lyft shutdown.

One of them, ScoopMe, is shutting down tonight.

I am sure the others will quickly follow.

I live in a city with a population of about 100,000. We’ve had Uber for about 2 years, and Lyft recently came into this market (lots of college students from larger towns, with Lyft apps already on their phones).

In my local paper, there recently was an announcement that a young man (who appears to be an immigrant) was starting his own Uber-style app. He’s offering “first ride free”, and he’s also expanding his service to several of the local medium-sized towns (populations 20-35,000), which is where he may actually be able to gain some market share. It will be curious to see how he does, and if he’s still in business in 6 months-1 year.

As the NakedCap uber driver emeritus, my hunch is that Uber’s cash hemorrhaging is driven by the ginormous driver subsidies that Uber spends to attract/retrain drivers. —as the base rate that passengers pay is 100% unsustainable given the cost structure of the majority of drivers, so Uber throws out supplemental cash as a bribe, er incentive.

Strategy being that Uber hangs in long enough to drive out its main competitors in US/globally.

Probably its an inappropriate Request but hell , I am just too curious. Will you please share your cost structure of your Uber days?

Car: 2010 Honda Accord w/130,000 miles at start, paid off

A) Revenue: 90 cents per mile, 20 cents per minute >>> typical real-world gross revenue, $10 to $20 per hour, post-Uber commissions, pre-driver expenses.

Median fare: $8.70 total revenue (pre-Uber commission), 3.99 revenue-generating miles, 13 minutes.

Average fare: $11.10 total revenue (pre-Uber commission), 4.94 revenue-generating miles, 15 minues

B) Total variable costs: 19 cents per mile.

car’s depreciation = 1.5 cents per mile per Kelley blue book

gas: 15c per mile. $2.80/gallon (pre-OPEC glut days) MPG 18 miles / gallon, lots of idling killing MPG.

Reserve fund for future car maintenance (tires, oil changes, brakes) : 2.5 cents per mile

Daily pre-shift car wash + vacuum at the el cheapo car wash: $4 per day.

Off-the-book costs: zero workers compensation, zero disability insurance, potential termination of personal car insurance in the event my insurer learns I’m a bootleg jitney driver.

C) Roughly 40% of miles driven were dead-head miles, ie non-revenue generating. Over the course of an average shift drove around 13 miles per hour (city traffic + idling).

Did you put aside a reserve for your income tax/Social Security/Medicare payments? I’ve long suspected that most Uber drivers spend all of their income, don’t report most of it and hope they won’t be audited (which may be realistic, as Congress keeps reducing funding for the IRS, resulting in reduced tax enforcement).

“Did you put aside a reserve for your income tax/Social Security/Medicare payments? I’”

Yes. I’d bet many new Uber drivers have never had to pay both sides of FICA.

“I’ve long suspected that most Uber drivers spend all of their income, ”

Anecdotally, it definitely does sound like for many Uber drivers: gross revenue minus Uber’s commissions = net income. ….i’ve long given up shaking my head and trying to show the math.

This is all fascinating for many reasons! Most of the Uber drivers I have spoken with also drive for Lyft and a direct business (package delivery, personal customers etc) that they have built up over time. They are all very adept at using whatever app comes thier way. I am wondering if Uber’s anti-labor knife will ultimately cut both ways. Both customers and drivers can and will easily switch to and among alternatives as they arise. It’s hard for me to see how Uber can raise prices or lower drive compensation substantially as there will always be alternaitves for what is essentially a commodity product.

Hi oho:

If I’m an aspiring Uber driver where can I go to get the real deal on how much, net of costs, I’m going to earn ? E.g. a web site where I can input

Costs: fuel, maintenance, depreciation, lease costs, dead/idle mile percentage, parking (?) …

Earnings: $/mile, miles driven per week, tips.

And then derives net income (before tax) => shows the difference between immediate cash flow & long term profit.

uberpeople dot net, use the search function as your question(s) have been asked. also read the city-specific forum.

1. if you’re intellectually curious enough to read nakedcap, then uber is a stop-gap/2nd, off-hours job as you’ll have some skill/potential skill that’s better paying than doing uber.

2. do not use a late model car unless you understand that you’re essentially taking out a pay-day loan that will come due when you sell your car.

3. don’t forget about opportunity costs….as in i’d argue that one is likely better off to use their time to get straight A’s or expand their skills, not drive Uber.

good luck. safety first. and buy a dashcam :)

I don’t know about that… I’ve used quite a bit of my time (and money) getting straight A’s in both a trade and business degree in accounting and haven’t had any of it pay off yet… Having skills and (especially) potential skills don’t necessarily lead to even a bottom of the barrel job these days.

On the other hand Uber is probably about as good a career choice as collecting empties for the refund or selling plasma. Since I live in Vancouver neither Uber nor selling plasma is even an option for me:-)

Didn’t someone once say that all crime eventually results in accounting control fraud? Nowadays it seems that the vast majority if business in the world is primarily accounting control fraud, or at least financial smoke and mirrors too.

Hi oho,

I had/have no intention of becoming an Uberiod, perfectly decent geek job for now. I was just curious as to whether the reality of being one has become public knowledge outside of sites like this one (or the whole WaPo list).

When I first heard of all this Uber/gig-job stuff the memory that popped into my mind from a long time ago was my (thankfully brief) stint selling Encyclopedias door-to-door (*) … go figure where that mental connection came from !?

(*) Amazing what a 19 year old guy will do when there’s a girl in the picture :-) (or is that :-( ?).

And good that you don’t ever intend to become an Uber driver.

Do people not realize that this is this equivalent of aspiring to become a taxi driver? Just because it’s all hipster doesn’t make it any more glamorous or awesome.

Now if your dream since childhood really was to become a taxi driver then more power to you. But for people who are just drinking the Kool Aid today, open your eyes and smell the coffee.

Roger on the driver churn. I’ve seen it firsthand here in Tucson.

And guess what’s driving the drivers away from Uber: It’s a combination of being badly treated (by the company and the passengers) and the lousy pay.

I’ve been an Uber driver for about a year, and I know a few other Uber drivers amongst friends/co-workers/acquaintances.

Most of us are working under the 25% commission, and most of us are not thrilled with Uber. Seems like the only happy Uber drivers I know are the ones who retained the 20% commission.

Uber will have issues retaining drivers, hence the interest in going to driverless passenger pods.

So the thesis of this series is that Uber’s business model is to:

* Raise lots of money through “the bezzle”.

* Use this funding to drive out the competition through predatory pricing.

* Extract monopoly rents once this is done.

I am inclined to agree to agree.

And a $69 billion bezzle is quite some bezzle, even today!

This is a very important story, and kudos to Hubert for his lucid explanation.

You are missing the argument. There are no monopoly rents. There are neither scale economies nor barriers to entry. It’s not hard to write an Uber-like app. Those points will be discussed in depth in the later posts in this series.

Exactly! It’s devil take the hindmost like most unicorn companies today. The early/smart guys have gotten out or will before the rest of the world figures it out.

Uber and similar stories make me think of tales of the gold rush, where the ones that were most likely to survive were those selling the picks, pans, clothes and similar items.

They also make me think of the saying attributed to Buffett and likely many others:

if you are playing cards and can’t tell who the patsy is, then it is you.

The other important thing to keep in mind is that the regulation of taxis was mostly about limiting supply and competition by requiring that drivers posess one of a limited number of medalions issued by the city. Local governments also regulated uniform fares. Even under this scenario, not many people were getting rich except those that bought and sold medallions at the right time.

As a side note, I drove a cab for a couple years back in the days. Most people don’t realize that that cab companies and drivers in most places don’t share revenue like Uber and its drivers. Taxi drivers usually rent their cabs and medallions for an eight hour shift for a fixed fee and keep 100% of the revenue. Drivers are motivated to drive the cars into the ground if needed to generate fares and taxi companies make money by making cheap cars last as long as possible and by renting or leasing medalions to drivers who own their own cars.

The old Business Model: Loose money on each unit, and make it up in volume.

And requires a monopoly position in the market.

I’ve got the solution for Uber: Use the economical Driverless Diesel cars produced by VW!! (With a Turk installed under the hood of each vehicle).

Nice, if you can pull it off. I wonder how Uber sold this to the VCs?

In most places where Taxi is deregulated neoliberal high un- and under- employment rates are high the taxi-markets already crowded and prices and profits are at rock bottom and hourly earnings for the drivers is hourly very low, Sweden doesn’t have any minimum wage. In Sweden, big cities are overcrowded with taxis driven by the huge inflow of uneducated immigrants. They sit in their cars extremely long hours waiting for customers. The system is like this, a call center that contractors drive for and have the call center logo. The main call center fee is a fixed cost so the more cars on the streets the more the call center makes and the contractors less. There is no chance in hell Uber can undercut it. The contractors are also one of the shady biz in Sweden, often immigrants that with low respect for tax laws and so on.

What’s the big deal with apps? Hardly any improvement for the customer compared to make a phone call, every call center has easy to remember phone numbers like 10 10 10, 11 11 11 and so on, its more hassle to fiddle with an app. But all of them started with apps before any Uber did show up, just hocked up with the general app trend. And everybody take credit cards.

The advantage for Uber could be that an 17-20% variable fee probably will undercut call centers fees, but they have well-known brand names and public contracts to drive disabled people.

NYT:s previous more stringent taxi regulation did came during the great depression when many unemployed tried to survive by taxi driving, the drivers did literary fight over customers on the streets. Unregulated Taxi (no expensive medallions) is a branch that expands when its high unemployment and contracts in low and the threshold to enter is low, it’s basically a shitty job with long hours. That’s what’s Uber in large tries to capitalize on.

Can’t really see that Uber is coming with any productivity improvement, the stock price is pure hysteria.

Intriguing how you say tax avoidance is widespread, but credit card payment is also. Not sure how that’s executed…

It’s simple. Folks think they can plead ignorance when the IRS or other taxing bodies come calling. You’ll make money until the tax liens start flowing…

I don’t remember now there was some trick. But isn’t foolproof, it’s a high risk game. But many is people with little to lose. Maybe there is goalkeepers involved. As in Malmö Sweden usually the cars are leased, use to be some brand that goes big on this. A couple of times whole swaths of leased cars have “disappeared” abroad. The leaser disappear to home country in Balcan or Middle East. Some call centers are almost openly attached to organized crime. Some years ago there was a shooting at a call center office with the local Bandidos boss involved.

As with ordinary cars in Malmö many of them is registred on goalkeepers, Malmö is the big immigration city. Quaite many going on welfare and/or have debts and working in the black sector and can’t own a car. Some goalkeepers have multiple millions in unpaid parking fees.

Thank You

I sent money.

Having driven Taxi for sixteen years, 77-93, I believe I can verify that the Uber numbers don’t add up, and that as Yves says;

When I left the business the charge per mile was close to what it is now, $2.50/mile.

The lease payment amounted to about $60/shift, and Gas another $40-$50.

If a driver managed to take in $200-250 in 12 hours, he/she would walk with about $90-140.

The element of chance in the Taxi industry is such that it requires long hours, but it was a flexible profession that once allowed one to keep body and soul together, with a lot of hard work.

It is easy to see that at Uber’s $1/mile charges there isn’t much left over for the driver, but it takes a while for this reality to sink in, and drivers will put in a lot of effort, only to discover that they cannot make any sort of real money as a Uber driver.

In the mean-time Uber is damaging the legacy Taxi businesses as the article outlines.

When I started driving, local regulations limited the number of Taxi licenses on the street, and closely regulated drivers. This situation changed over time, driven by the same forces of de-regulation that have done so much damage elsewhere. The result was in the end, the city through open the flood gates and allowed an unlimited number of Taxis to be licensed. (I think this was around 1995?)

The impact of unlimited licenses was immediate, and negative. Instantly, the lines at Cab stands all over town, and at the airport where filled with new cars and drivers competing for the ever smaller slice of the pie.

The point is, that market forces had already been squeezing the drivers for years before Uber showed up to put the coup-de-grace to Taxi services, and now Uber, together with it’s unwitting drivers, following the illusory promise of gainful, self-employment are destroying a legitimate business in the name of those “Markets”.

It should be easy to understand for anyone not covering their eyes and sticking their fingers in their ears, that drivers splitting $1/mile with Uber are not left with enough earnings to justify their efforts, which unfortunately does not become clear until they’ve put in enough time to verify that reality.

Also unfortunately, our collective economic insecurity provides ample motivation to try new ways to make money, and there are a nearly an unlimited number of naive people to replace the Uber drivers who have discovered the truth and left the company.

I have maintained friends who continue to drive Taxi, and they report an ever increasing anger with the unlicensed, unregulated service that is destroying their livelyhood.

In the end, should Uber win the race to the bottom, and destroy the present Taxi industry, the fares will go back up, but you can be sure the company will pocket the increase while continuing to squeeze the endless supply of naive people who think they might make a little money from the crumbs that fall off the company’s table.

Other than the militarized police currently repressing the folks out in North Dakota, I can’t think of a more brutal assault on decent working people.

Agree with you 100%. I drove a cab for a few years a couple of decades ago. I made $15-$20/hour (not bad then). I worked hard mostly because I enjoyed driving, meeting and talking to different people every day. The other successful drivers I knew felt likewise: they were working hard at doing something they enjoyed and made a reasonable living at it. The regulated taxi world with limited medalions and fixed fares worked well. As you say, things went south when cities allowed unlimited supply. This drove down revenues, drove out good drivers and put many more broken down cabs on the road making the taxi riders expereince lousy and opened the door for Uber.

I wonder why Uber adopted a revenue sharing business model with drivers as opposed to simply licensing daily access to its hailing service – similar to what cab companies did in the past. If I were a driver I would spend much of my day figuring out ways to cut Uber out of the loop – handing out business cards to passengers etc.

I think this is why Uber keeps fares low. Their drivers can’t undercut them. Another reason Uber will never work.

Wow – very well written article. Your quote “capital was simply claiming a higher share of each revenue dollar and giving less to labor” accurately describes the profit (or loss in this case) model for Uber.

A problem for Uber is their designation of drivers as low cost/no benefits Contractors instead of Employees is running up against class action legal challenges. If you have over 200,000 drivers, some will eventually challenge the fact that they have no guarantee of minimum wage, health benefits, paid leave, and have personal responsibility for vehicle lease payments, gasoline, and road tolls. Uber also has not even reached the point of regulatory challenges for labor law violations. They probably thought at some point they could generate a meaningful competitive advantage by avoiding local regulation, transferring all business costs to employees, then collect a fee for each of taxi fare. Interestingly this currently appears to have a nonprofitable result.

I wonder what portion of their high operating expense is allocated for legal and PR costs to prevent regulatory challenges and mitigate class action settlements?

Which one is Uber?

I’d guess the white phone with the orange circle, but I’m counting 17 phones and a right-hand drive vehicle, so I’m guessing this picture was not taken in the U.S.

I’m also surprised that some passenger has not reported this to Uber.

Thats Hong Kong, taxi supposed to be regulated ther. But drivers bypass it and is connected to several call centers and advertise themself on different phone numbers. Something about bypassing regulation.

Uber and a like are modern days cyber Fagins that take advantage of the precariat in the neoliberal hell hole.

This reminds me of the story during the runup to the financial crisis where potential investors met with the execs of some company issuing CDOs and asked how they were going to make money. The execs couldn’t offer an explanation in plain English at which point the investors realized the execs had no idea what they were doing and went short instead.

Time for the Uber put?

Yeah. Trouble is that Uber (& other pointy headed startups) are trying to act like quasi-public companies – selling shares in private placements – while rigidly avoiding publishing any real financial info. To short it you’d have to find one of the private investors willing to lend you their shares *and* find and even more idiotic investor to buy the borrowed shares from you.

Not gonna happen so one of the ways Mr. Market can start shouting that Emperor Kalanick is naked is not available … which is, of course, another reason Uber’s IPO will happen sometime after the heat death of the Universe … or the Clinton mob finally getting its claws pulled out of the carcass of the Dem party.

Two words: Ashton Kutcher.

And for Teddy below, I think the term is Pyramid Scheme.

So, in layman’s terms, Uber’s business model ostensibly relies on ripping off middle-class people (replacing self-employed or unionized cabbies with low-paid, precariat-like drivers), but this is actually just a ruse to con wealthy investors out of their money and only a select group of insiders is expected to make a profit? Gee, I’m too young to remember it, but apparently there was a time when capitalism was about delivering goods and services. Frank Sobotka’s line from “The Wire” really comes to mind when reading articles like this.

Yikes. This is some scary reading. You’d expect this kind of thing from penny stock territory, but to have convinced investors to pour $69 billion down this sewer is impressive. Amusingly the loss as a percentage of revenue is about the same as the percentage by which their rates undercut traditional taxi rates, which does raise the question of exactly what value they are adding.

I wonder how much the executives who preside over this almighty destruction of capital are paying themselves?

. . . to have convinced investors to pour $69 billion down this sewer is impressive

I believe you have misread the facts. The Silicon Valley-based investors have poured only $13 billion into the sewer and are now claiming it’s worth $69 billion, in the hope that when this polished turd comes out the other side enough gullible “inwestors” pay that price, or more.

I look forward to the remaining three parts of the series when the turd gets dissected and we get to see what’s inside. Get the clothes pin for the nose ready.

Yes, I noticed that after I wrote it – thanks for the correction. If all current investors decided to unload then I’m confident that the take would be a long way short of $69B.

$13 billion is still a heck of a lot, so I think the argument stands.

It takes an Economist to value a loss making private company (no market price) at $69 Billion.

I question the $69 Billion valuation – by whom? The current VCs – aka: Pump and Dump merchants?

This is a great article, and the kind of real-world information that pops the bubble of fantasy that a visionary has built a company out of a new paradigm. The thing that is frustrating about this dose of reality in 2016 is that it’s been going for several years. To make a documentary or write an expose takes years. I remember what it was like in 2011 or 2012, when everyone was still saying “we don’t even know what it is yet. Is it a taxi? It’s in a grey area. Are they 1099 or W2? They’re neither.” VCs, think tanks and attorneys who want to use companies like shock troops exploit the way that the press and would-be watchdogs are stuck scratching their heads over grey areas. The exploitation of grey areas and “early days” is a very interesting theme. Remember in Alex Gibney’s film, Jack Abramoff gravitates towards grey areas like Saipan, or with indigenous lands. Is it the U.S.? Is it not the U.S.? Does the labor law apply there? “We can use the uncertainty about status to our advantage for years, before anyone will be able to assemble real facts,” Abramoff or Norquist might say. We had to wait for these financials to come out endogenously, right? I think a lot of entrepreneurship revolves around exploiting early days, unknown zones, and this is part of what they mean by “freedom”. The freedom to tell stories that aren’t bothered by facts, because the facts take time. So it’s temporal. You’re doing things early that will not be possible under sunlight. How can we become more longitudinal and use the experience of one five-year arc with a fraudulent private company taking advantage of opacity and the dishonest business press, to hop on it earlier in the cycle when there is another tech bubble in 2020? Is there any prayer of requiring more disclosure from private capital and its projects?

As mentioned above, Google could launch Rides tomorrow and give all the money to the driver. They would use this as a local ad server with your data.

Google maps already has a price comparison tool between all the car sharing services. This like every commodity should be on an exchange and in hyper competitive market driver is lucky to cover variable costs which get really low with EVs and 2-3 mile/kwh pricing.

I’ve thought about that quite a bit: you could have an iPad in the back running ads constantly based upon a rider’s intended destination and/or other data that is known about the rider’s demographics. Say, thanks to Google, you know this person is looking into buying a home, the screen would be showing houses in their target area, etc. Plus, you could also have magnetic stick-on signs for the outside of the cars.

I’m guessing Uber has already delivered, in spades, to a relatively small number of pirates at the top. It’s a mistake, imo, to believe that these kind of internet _.0 (what are we up to now, internet 4.0?) disrupticons give a rat’s ass about investors.

The scam hasn’t changed since the first wave. I was a part of internet 1.0 posterchild marchFIRST. A few rungs back on the acquisition chain, before we became part of the laughable marchFIRST, I came into work one morning to find that our firm had been sold – again. The story was that the CEO sold us out and bought a villa in Tuscany. Message sent, loud and clear: “Hey workers – FOAD!”

Oh yes, I remember marchFIRST. At the time I was mystified as to what the strategy was – they just seemed to be rolling up a lot of unrelated loss-making companies. Eventually the money ran out and they died, just as you would expect. Now that I am older and more cynical I think I would have a better idea (and your comment confirms it).

Decentralized Open Source uber killers are in the works

https://arcade.city/AC-whitepaper.pdf

Damodaran valued Uber at $60 Billion. Are you saying that they also took high priest of valuation for a ride (pun intended)?

Do we have another Theranos on our hand?

Damodaran valued Uber at $60 Billion. Are you saying that they also took high priest of valuation for a ride (pun intended)?

Yves said:

but does this matter?

Amazon isn’t profitable and is a member of the board of directors of the rulers of the planet.

Amazon has been cash flow positive for years even though unprofitable from an accounting perspective until recently. Cash flow is the bedrock of business viability.

Uber is hemorrhaging cash with no reason to think that will change much if at all.

why not be more direct. unprofitable from a tax base perspective. The profits sit undisclosed off-shore, for now.

Huh? I have no idea what you are talking about.

$2 billion in hard dollar losses per year is an unprecedented level of losses for a startup. It’s off the charts. There are no mystery magical off-shore profits.

Amazon is a big beneficiary of the Irish Sandwich, where they have invoice out profits from Germany, UK and USA. Not sure where you’re getting the $2 Billion losses for Amazon.

Yves seems to be talking about Uber losses (2 billions) not Amazons’s.

thanks Yves. I appreciate your response. I am no expert on business viability.

I can say I hate Uber passioniately. even though I appreciate their sharing economy worker/strivers.

I live in San Francisco and I can walk within city limits faster than an Uber Share can deliver me. and that is barely, barely hyperbole.

(don’t get me started on ranting about anyone living on the west coast thinking they have anything the least bit interesting or important to say about global warming)

I do believe that Uber did have a better idea and a better way to hail a taxi. The problem is that they did not realize exactly what they had. Instead of pursuing a business model that actually would make money, they made an unfortunate decision to put everyone in the taxi profession out of business.

In the beginning, Uber was a superior product (in many locations) to a traditional taxi service. Instead of capitalizing on that superior product offering and charging what is actually needed to provide that product and make a profit, Uber squandered their incredible asset into one of no sustainability. The author correctly dissects the Uber business model to prove that it can not work on the present trajectory.

Earlier this year, I wrote a book about Uber that details much of this in an easy to understand format. The book is called, “Everybody Loves Uber”. The book is available at most libraries and wherever books are sold.

Whoa, easy there. The actual cab experience is all the cheerleading you need. Uber had nothing to do with making cabs universally unpleasant and degrading except for people who have somehow mastered the system.

This is definitely Uber’s starting advantage – the native cab company in SF Bay was absolutely terrible. There weren’t enough taxis so they just wouldn’t come if you needed them, they’d only take cash and would pretend their credit card readers were broken, the dispatchers would yell at you over the phone, and you couldn’t review them or drivers anywhere.

But that’s not enough to merit creating this attempt at a global monopoly that could easily be broken up per-city and has no actual monopoly advantage.

“Uber Global only had a minority shareholding. Thus Uber Global could not have included Uber China results in any of its EBITAR contribution or GAAP operating profitability numbers, and could only have included the percentage of China losses assigned to its minority shareholding as a non-operating expense.”

This is not correct. Uber owned > 80% of Uber China, and consolidated all of its results (despite only having an economic interest of 80%). We don’t have sufficient data on ex-China profitability, nor do we know China profitability (ex-minority interest).

Uber’s profitability can be explained by:

1) Marginal costs are borne by the drivers.

2) Uber’s commission is closer to 30% effectively.

3) Taking a 30% “tax” on transportation globally, along with Uber’s growth, is how Uber is essentially doubling its revenue every 6 months

4) Uber is offering fixed payments (guarantees) to drivers to build driver supply, and thus marketplace liquidity, which means more trips per driver, allowing Uber to lower rates and win 80+% of market. On a long-term basis, drivers aren’t paid more than the cost of the ride. Assuming so by stating GAAP profitability (which, again, includes Uber) is misleading.

5) But, let’s assume Uber had a $2 billion loss for the sake of argument. The vast majority of that is a fixed investment to recruit drivers. Yes, they have to address driver churn, but the investment is to ensure a highly liquid marketplace that enables Uber to win on fares (vis-a-vis taxis and Lyft/Gett/Ola). The operating leverage on that fixed investment is enormous. This is how Uber can go from, hypothetically, losing $2 billion in one-year to making $1 billion in a short time frame.

You are incorrect in your remarks on Uber China. Hubert will address this in his post on Tuesday on reader questions and comments. The multi-paragraph reply he sent with extensive footnotes is too long to provide here.

As to the rest of your comment, it is disingenuous and ill informed.

1. Uber is not profitable. Saying so does not make it so.

2. Item 3 is nonsense. Uber is not imposing a 30% tax on global transportation. It is keeping 30% of revenue the drivers earn in return for providing the dispatch function and branding/marketing services. “Taxes” do not cause revenue to double every six months.

Driver recruitment costs $2 billion?

3. Uber has enormous driver churn and Uber drivers work for other ride sharing platforms too. The rider subsidies are not an investment. Moreover, other readers have claimed that Uber is really a bet on driverless cars, and Uber itself, since 2015, has been pushing the driverless car meme hard. So if one were to believe that, which we don’t, that is also at odd with your dubious “investment” claim.

Correction: Uber’s commission is closer to 50% on all minimum fares. I’m not sure what the actual percentage of minimum fares is, but in my experience they are a high percentage of the rides I provide. There has been some concern among drivers that Uber is charging passengers far more than they are accounting to us, supposedly they do itemize the “safe driver fee/booking fee” in our taxes for us to turn around and write off as a business expense (this should be fun) along with the 25%. But it’s the extra $$$ that may be being charged that also concerns me, so I’m hoping the IRS would audit Uber to see what they’re really up to. Also, FYI, the surge charge is bogus: an experienced driver (anyone over 6 mos) was approached by a newbie with a question about the app. She had a surge notification on her app, but he had none, so I figured they do this to give new drivers a false sense of “security” relative to how much you actually make driving for them. Once they are satisfied that you have quit your day job (say, 2 months), they drop you from the favored role; they mess with your rating system to mentally screw you, etc. Of course, there are times when a surge is legitimate i.e. big events, but in general I believe it is Uber’s way to draw hapless drivers to areas of low coverage in order to keep up the short wait time for future riders.

This is correct. The minimum fare in my market – at the time of my last ride given – was $5. The safe rider fee was $1.80. UBER claimed 30% of the fare as their commission.

DRIVER = 70% of $5.00 = $3.50

RIDER = $5.00 plus $1.80 = $6.80

Self-driving cars have always been Uber’s endgame and that has been obvious since the beginning. If self-driving cars arrive in the timeline that Uber has predicted, they will make more money than they know what to do with. If self-driving cars don’t arrive, Uber will be one of the biggest money fires in history. Investing in Uber at this point is nearly a straight bet on self-driving car technology.

This is nonsense. From Hubert Horan:

I agree. Uber did not mention self driving cars until 2014 and it was simply a smoke and mirror attempt to “excite” investors into putting more money into this bottomless pit called Uber.

If and when self driving vehicles ever do come to the mainstream, there will be many companies (like auto manufacturers and transportation companies) that will have them.

Self Driving Vehicles will not be exclusive to Uber and they will be able to be deployed by many different companies ranging from public transportation companies, to corporations picking up and taking their employees home, to sports teams bringing fans to stadiums, to real estate agents taking customers on tours of neighborhoods, to rental car agencies, to school buses picking up and delivering children, to whatever anyone else dreams up including the post office, UPS and Fedex as well as Domino’s Pizza.

Uber is not going to have an exclusive on self driving vehicles if they can even stay in business long enough for the self driving vehicles to show up.

This cuts to the very issue I’ve mentioned before as the GPS being quite buggy. For large developments (gated), how will the driverless car enter? Will that car somehow have arms to punch in the gate code? Wait, will the car somehow call the rider and even get the gate code? If Uber was serious about this, it would be part and parcel of their current process: “rider, if you have a gate code, please text this in advance so the driver may enter your development.” But they don’t, they are running this by the seat of their pants (IMO). There is also the issue of not better instructing the riders to pinch out on their app to zero in closely on their actual location. The way it is now, if they “drop their pin” from the point that Uber initially sets, the location can be off as far as a quarter mile. The driver then arrives and the rider is nowhere to be found, has to call the rider and get the correct address, etc. That inaccuracy also comes into effect when people live near the outskirts of the development, dropping the pin will take the driver to a street to the side or behind the development. The driverless car will go there and… do what? Bump around? Call the passenger and ask them to hop the fence to get to the car? These issues tell me Uber isn’t really serious about driverless cars, because these are things you need to have ironed out sooner rather than later.

Question: Will a guess of why Operating Expenses/Cost of Sales keeps growing be explained? It this just Overhead associated with head count/R&D or does Operating Expenses include additional payouts to drivers?

In theory if you take 20% of the cut and you’re primarily a software solution, that should ‘scale’ since all you’re doing is maintaining the App and infrastructure. (As noted, all the physical costs have been shifted onto the driver for the actual ‘per-mile-of-revenue’). Basically, why are Cost of Sales and Op Ex rising with revenues? (Or did I miss this point somewhere in the article.)

Comment: Living in Los Angeles, I can attest that Lyft and Uber have had a significant impact on the availability and usability of ‘urban car services’. LA seems to have historically limited the number of medallions to the point where taking a taxi was traditionally both expensive and extremely inconvenient. (“Cash only”, long, indeterminate waits, etc.) Lyft and Uber have definitely changed that with average response times of about 3 to 4 minutes in my neighborhood and costs (investor subsidized ?) about 1/3 of what a cab would have traditionally cost. From my place to DTLA is ~$8 to $10 using lyft/uber vs $25 to $35 for taxi. (about a 12 to 15 minute ride) I’m not saying the taxi drivers were getting rich, but the medallion owners were clearly rent seeking based on limited the limited supply. Not surprisingly the value of said medallions has dramatically decreased.

https://priceonomics.com/post/47636506327/the-tyranny-of-the-taxi-medallions

Yes, you missed it. They are subsidizing driver pay to a huge degree.

This really has nothing to do with taxi medallions. Medallions are simply being used as a scapegoat, or an excuse, in order for Uber to further their program. Medallions were simply a method used by some (but not most) jurisdictions to manage a proper and adequate number of taxis for a given area. The jurisdictions wanted to make sure there were the PROPER amount of cabs in their area on a regular basis. (Not too many and not too few)

Uber simply ignores any medallion rules and sets up their business and floods the market with drivers without any regard to the actual demand. This does not change the fact that there are a finite number of customers in the designated market area.