Jerri-Lynn here: As we gallop to the end of 2016, Wolf examines the wheeze in this major stock buying force.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Companies in the S&P 500 spent about $3 trillion since 2011 to buy back their own shares, often with borrowed money. It’s part of a noble magic called financial engineering, the simplest way to goose the all-important metric of earnings per share (by lowering the number of shares outstanding). And it creates buying pressure in the stock market that drives up share prices.

With buybacks, you don’t need to sell one extra iPhone to boost your earnings per share. So the amounts have grown and grown. With ultra-cheap money available to borrow endlessly, companies take on debt and hollow out shareholder equity. It has worked like a charm. Stock prices have soared. Declining revenues and earnings, no problem. But something is happening that hasn’t happened since the Financial Crisis.

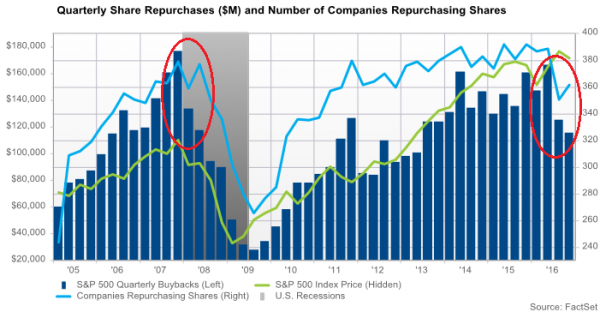

Share buybacks in the third quarter plunged 28% year-over-year, to $115.6 billion, the biggest year-over-year dive since Q3 2009, according to FactSet. It was the second quarter in a row of declines, from the glorious Q1 this year, when buybacks had reached $168 billion, behind only Q3 2007 before it all came apart.

From that great Q1 2016 to Q3, buybacks plunged 31%, or by $52 billion.

“Only” 362 of the S&P 500 companies bought back shares in Q3, the second lowest number in three years, with Q2 having been the lowest number (blue line in the chart below).

However, the third quarter has historically produced the most buybacks as companies are feverishly trying to put some lip gloss on their annual earnings per share. But not this time.

In this chart by FactSet, I circled the phenomenon of that $52-billion two-quarter plunge (blue bars). Only the $58-billion two-quarter plunge in 2007/8 was bigger:

Even the near-record share buybacks in Q1 could not overcome the plunge in Q2 and Q3 and pull out the tally for the trailing 12 months, which declined 2.6% from a year ago to $556.6 billion. That’s still a lot of moolah dedicated to nothing but propping up their shares.

The number of S&P 500 companies making buybacks of $1 billion or more dropped from 43 a year ago to 33 in Q3.

Apple retained its crown in this elect field with $7.2 billion in buybacks in Q3, followed by GE, distantly, with $4.3 billion. Over the past 12 months Apple repurchased 31.1 billion of its shares, GE $21 billion. Here are the ten biggest buyback queens:

Apple: $7.22 billion

GE: $4.29 billion

Microsoft: $3.55 billion

Allergan: $3.19 billion

McDonald’s: $2.77 billion

Citigroup: $2.53 billion

JP Morgan: $2.29 billion

AIG: $2.26 billion

Home Depot: $2.14 billion

Yum! Brands: $2.09 billion

Tech, thanks to Apple and Microsoft, remained the largest “buyback sector” – this sort of financial engineering lingo grows on you after a while – with $27 billion, or 23.4% of total buybacks. Financials are in second place with $25 billion, or 21.7% of total buybacks.

But buybacks by all major “buyback sectors” declined. Major excludes the Real Estate, Telecom, and Utility sectors, which averaged less than $2 billion a quarter in buybacks. Buybacks among Financials declined only 3.6%. The remaining “buyback sectors” experienced double-digit plunges. There are the most magnificent “buyback sector” dives, in Q3, year-over-year:

Energy: -62%

Materials: -55%

Information technology: -41%, dragged down by new-found stinginess at Oracle, Intuit, Motorola, and Apple.

Industrials -36%, dragged down by Honeywell, Quanta Services, and Caterpillar.

Despite the decline, buybacks remained a huge buying force in the market. At the end of Q3, trailing 12-month buybacks ate up 66% of net income, about the same as a year ago, with 119 companies in the S&P 500 blowing more on buybacks than they generated in earnings. And 109 companies blew more on buybacks than they generated in free cash flow. As ludicrously high as this sounds, it’s the lowest count since Q2 2013.

And much of it is funded with debt. Over the past three years, aggregate debt of the S&P 500 companies has grown 1.7 times faster than aggregate cash and short-term investments, according to FactSet.

Even Apple, which is swimming in cash, has borrowed megatons because much of its cash is registered “overseas” and represents profits that have been sheltered from US corporate income taxes by being registered “overseas” though much of the “cash” is already invested in US securities but it can’t be used for buybacks [read… Come on Moody’s, Spare us these Falsehoods: That $1.3 Trillion “Overseas Cash” is Already in the US].

This is a nasty wrinkle in the buyback scenario. But there’s hope. Trump has pledged to change the corporate tax code, and/or give corporations a tax holiday on this “overseas” cash so that they can “repatriate” it, by selling their US Treasurys and other investments and using the proceeds to buy back their own shares. That’s what happened last time the government granted this kind of tax holiday in 2004. And everyone is hoping that it will happen again. I suspect that’s one of the reasons for the surge in stock prices since the election.

If not, and if this major stock-buying force continues to wheeze like this, our eternally wondrous stock market might be in serious trouble.

GM has been reacting to its fabulously ballooning inventory glut by piling incentives on its vehicles. But that hasn’t worked all that well. Now it’s time to get serious. Read… “Car Recession” Bites GM: Inventory Glut, Layoffs, Plant Shutdowns

Interesting post, no wonder Wall St is talking up the opposite? http://blogs.wsj.com/moneybeat/2016/11/21/goldman-sees-30-buyback-surge-in-2017/

One of the advantages of reading Naked Capitalism: I finally understood what stock buybacks are about. So when proxy seasons arrives, and I get to vote my 12.5 shares in the old SEP and IRA, I vote against the proposals. Not that I expect to have much influence.

I suspect Q4 2016 will show a resurgence in corporate share buybacks. Having the corporations they control borrow money and expend the cash to buy their shares back at high prices maximizes personal financial gains for CEOs from their stock option grants, and many corporate board members who are in a position to approve these buybacks also benefit. Very few of these individuals founded the companies they lead or have significantly contributed to the organic growth of their organizations. In fact, in many cases the reverse is true.

This practice merely appears to be another form of control looting to me. I find it particularly troublesome when the corporations engaged in this practice enjoy large government contracts, large numbers of employees are subsequently laid off during economic downturns as an inevitable result of the decline in corporations’ financial resilience, and corporations seek various forms of government assistance, including tax forbearances at the state and local level.

There are ways to address this damaging practice. One way is to aggressively raise taxes on executive stock option income. Another way is to simply outlaw the practice.

If rates on long term bonds go up, then all this corporate debt will eventually have to be rolled into something that causes pain.

And that’s what is beginning to happen. Presumably because of Trump being in office and the fiscal spigots being turned on.

I’m beginning to wonder if this is why Yellen is jawboning against fiscal stimulus by Trump. It’s not that her target is fiscal spending per se. [Afterall, I don’t think she really believes that the national debt really matters; she knows better than that and if she doesn’t she doesn’t deserve to be in the Fed Reserve.] Rather, I’m thinking her real target is long term bonds and trying to keep the rates down. To protect the debt load taken on by the corporations.

Which would make Yellen even more evil of course. Because when it comes down to cash flow to people vs asset inflation to corporations and the wealthy, it would mean she’s landing squarely on the latter.

More on Yellen vs Trump: http://www.businessinsider.com/fed-yellen-call-ruin-trump-fiscal-stimulus-2016-12 . Which is why I voted for Trump and not Yellen, lol.

Anyways, in theory the only weapon she’s got really is the Fed Funds rate which drives the short end of the curve. However, she could invert the yield curve, which is the normal tell to market participants to get out of the market in anticipation of a significant down-turn. So her weapon vis-a-vis Trump is that she can tank the market. My advice to Trump would be to call her on this and to use his bully pulpit to let his constituency know the lengths that the Fed Reserve is willing to go to (tank the market) to fight him on infrastructure spending.

If Trump really wants to go Full Monty and amp it up a notch, declare that the Fed Reserve’s primary interest is to protect the “wealth effect”. Such that the common bloke must be thrown under the bus. “becuz inflation don’t you know”. Man how I would love to see Trump play this hand.

[The above said, I’m still not sure that the Fed Reserve controls the Fed Funds rate. For the last so many decades the Fed Funds rate has followed the 13 week treasury market. Even the rate hike this last week was consistent with this. Which begs the question. Is the 13 week treasury anticipating the Fed rate hike? If so, the 13 week treasury seems to know when the Fed will blink. The easier explanation is that the Fed Reserve is simply tacking on their profit margin on top of the 13 week treasury. In which case, Trump’s enemy isn’t the Fed Reserve. Rather it’s bond vigilantes on the short-end of the curve. Still if bond vigilantes really are the controlling influence, they were certainly slow to respond during the last two bubbles.]

“And much of it is funded with debt” – and that has been getting more expensive. The Trump rally is likely due to an expectation of plus laissez faire, whether it be intent or negligence, it matters not.

I’d like to see share buybacks on the same graph as relevant interest rates, to get an idea of you much potential causation is there between interest rates and share buybacks

Trump is not a fan of the stock market and will to nothing to protect it. He has said repeatedly that the market is in a bubble. When it crashes, he’ll say he was right. This Trump rally is not his idea and investors will be shocked when they finally realize stock prices mean absolutely nothing to him. This is not the metric he will use to measure his success, unlike every President before him for the last 20 years.

It certainly makes good sense to buy back shares for maximizing total return if the shares repurchased earn more or perhaps even pay bigger dividends than the cost of borrowing. An analogy would be an investor who makes 10% a year on investments likely is better off holding a 3% mortgage on his home, not paying it off with available funds. Balance sheets are often strengthened by debt.

My point is a buy back can have a legitimate purpose . . . more than just the denominator effect on EPS to make things look better.

A really good article pointing out where the cash really is; too, that we have tried a tax holiday before and what the outcome was back then.

Brad