By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Bank regulators have been warning, now it’s happening.

The New York Fed, in its Household Debt and Credit Report for the fourth quarter 2016, put it this way today: “Household debt increases substantially, approaching previous peak.” It jumped by $226 billion in the quarter, or 1.8%, to the glorious level of $12.58 trillion, “only $99 billion shy of its 2008 third quarter peak.”

Yes! Almost there! Keep at it! There’s nothing like loading up consumers with debt to make central bankers outright giddy.

Auto loan balances in 2016 surged at the fastest pace in the 18-year history of the data series, the report said, driven by the highest originations of loans ever. Alas, what the auto industry has been dreading is now happening: Delinquencies have begun to surge.

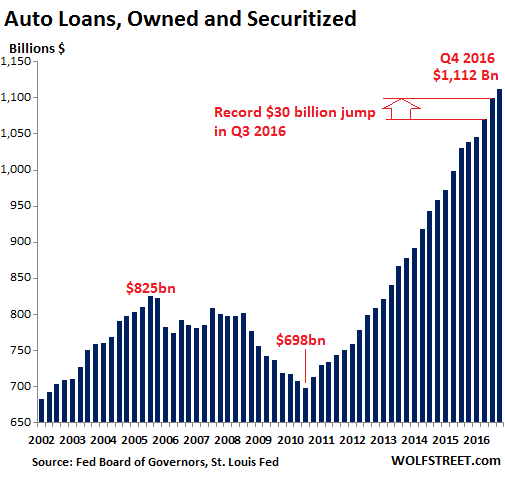

This chart – based on data from the Federal Reserve Board of Governors, which varies slightly from the New York Fed’s data – shows how rapidly auto loan balances have ballooned since the Great Recession. At $1.112 trillion (or $1.16 trillion according to the New York Fed), they’re now 35% higher than they’d been during the crazy peak of the prior bubble. Note that during the $93 billion increase in auto loan balances in 2016, new vehicle sales were essentially flat:

No way that this is an auto loan bubble. Not this time. It’s sustainable. Or at least containable when it’s not sustainable, or whatever. These ballooning loans have made the auto sales boom possible.

But despite record low interest rates, the bane of the automakers is now taking place relentlessly:

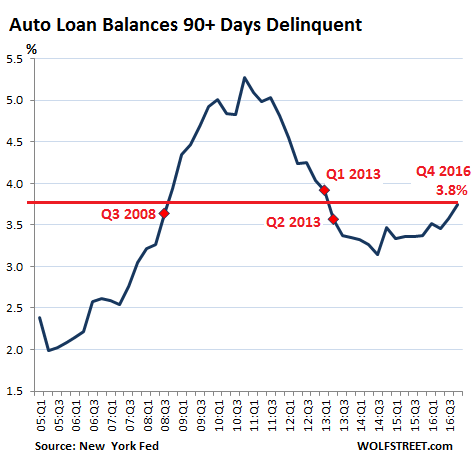

“Seriously delinquent” auto loan balances, composed of all loans that are 90+ days past due, rose in Q4 to 3.8% of total auto loan balances. That puts them right between Q1 and Q2 of 2013, as auto credit was recovering from the Financial Crisis. Last time auto loan delinquencies had surged to that level was after Q3 2008, as the Financial Crisis was tearing into the economy:

These seriously delinquent auto loans are an indication of what is next:

- Losses at auto lenders, particularly those specializing in lending to subprime borrowers, but also other lenders, including captives, such as Ford Motor Credit, which had already warned in its most recent outlook that “we continue to see credit losses increase.”

- Tightening auto credit for consumers, as those losses begin to exact their pound of flesh from the lenders.

Some specialized subprime lenders might keel over. Larger lenders with good quality loan portfolios will bleed but go on while tightening their underwriting standards in order to weather the storm. And that’s precisely what the auto industry is dreading: tightening credit.

The auto boom over the past few years was funded by historically low interest rates and loosey-goosey underwriting, with long loan terms and high loan-to-value ratios, often over 120%. They made everything possible. But they infused the $1.1 trillion in auto loans with some very big risks.

The Office of the Comptroller of the Currency (OCC), one of the federal bank regulators, has once again warned about the risk-taking by auto lenders:

Auto lending risk has been increasing for several quarters because of notable and unprecedented growth across all types of lenders.

As banks competed for market share, some banks responded with less stringent underwriting standards for direct and indirect auto loans. In addition to the eased underwriting standards, lenders also substantially layered risks (granted longer terms combined with higher advance rates resulting in higher LTV ratios).

These factors increased the credit risk in auto loan portfolios…. This embedded risk is now being reflected in lower recoveries at charge-off (higher loss severities) for both bank loans and securitized auto loans despite relative stability in used auto values.

Bank risk management practices and the ALLL [allowance for loan and lease losses] should reflect the elevated risk profile and higher probable credit loss severities.

So it’s all there – the ingredients for bigger losses among banks and investors, a few failures of smaller specialized subprime lenders, and belated credit tightening, both out of necessity and due to lower competition among lenders as some of the most aggressive ones will be busy licking their wounds.

And auto sales – not long ago the truly hot sector in the US economy – are now confronted with these tightening credit conditions as growth has already been stalling.

Despite what you might think, automakers did not “cut back” on fleet sales in January. But keep an eye on rideshare companies. Read… Car Sales Crash, But It’s Complicated

While looking at the figures showing stages of delinquency on auto loans there is no mention of what is happening in the leased vehicle market. Perhaps incorrectly, I would think that the figures on the return or default on leased vehicles might be an indicator as to when the canary dies.

As best I can determine leased vehicles are included in the figures for delivered/sold vehicles and do not see how their delinquencies/defaults are parsed out. (Probably because I do not speak/understand the nuances of the language of automobiledealerspeak)

The only references I found to leased vehicle impact in Richter’s articles was:

“Retail sales of cars are getting squeezed by a flood of off-lease vehicles that customers turn in at the end of the lease”

So how much of auto sales are being squeezed by defaulted leases? All that I see in my tiny little community bubble are giant over sized car lots of new or fairly new vehicles (which I assume are mostly returned leased vehicles not yet sold at auction or being held for re-sell)

1. I would bet this data isn’t reported. Lots of data is either not made public or not collected across sources (for instance, no one knows the number of mortgages in the US, the estimates last I looked were 51 to 55 million. Pretty big range).

2. Even if reported, the auto companies would probably muddy the data by mixing leases to the big rental companies with consumer leases.

Uber sub prime…. chortle…

Disheveled… but hay…. if it creates artificial demand in the interim to support balance sheet tropes to support some IPO payday or woefully informed ideological perspective it must be “natural”.

also there is the move to 72+ month loans .

the argument is that as cars are more reliable, it’s reasonable to stretch out payments—to 60-months is reasonable, but 72-84?

most buyers are motivated largely by the monthly payment. the biggest problem is when long amortization loans are given to buyers w/marginal credit and little down payment.

Anecdotally these buyers get hit with a quadruple whammy of long loans, higher interest rates and high transaction prices for cars with above average depreciation.

resulting in these buyers going ‘upside-down’ on their loans.

but hey since everything securitized, not my problem.

Here’s why auto dealers pump up auto debt. This happened 2 weeks ago when I bought a new 2016 Prius C:

Called 2 auto dealers on Massachusetts’ famous Rte 1. Both told me they had white 2017 Prius C cars at dealership. First one (Prime Honda) did NOT have any when I showed up. Drove down the street to Boch Toyota. Manager said he could find me a white 2017 Prius C if I wait 30 minutes, but it will cost a bit more. He was evasive when I asked where it might come from.

About 30 minutes later salesman walks towards me with a piece of paper from the Manager. It reads “New Silver 2016 Prius C $15,169, with Zero % financing $15,669.”

As I was paying cash I took the $15,169 w/o financing. That’s like a 5-6k discount because they need to get rid of 2016 models because 2017 are on there way. I’m very happy. The manager walked over and tried to get me to take the zero financing, asking me several times. Finally he asked if I’d do it as a favor because he would get a $500 bonus if I do.

his “bonus” was the “financing charge”? my head hurts

Wow …

Should have told him that you did take zero % financing, from the First Bank of Pay Cash.

This is common knowledge for those who have been around a while, but for younger readers let me contribute a little wisdom.

If and when you buy a new or used car, go in toward the end of the year or logical sales period like the end of the month or the quarter. Go at the end of the day when only the sales manager is there-alone. He wants to jack his numbers of sales up and this is his desperate last minute chance.

Get the best deal you can–don’t forget the ‘internet coupons’ or other stuff they send you.

Let him take your trade in for a test drive. He’ll offer you a dollar amount for it. Accept the deal. Final papers are drawn up, just as you are ready to sign, change your mind and tell him to add the dollar figure of your trade in to your new car price. i.e. You’ll keep your trade in.

Sell the trade in for cash on Craigslist. You probably have just doubled the value of the trade in.

The financing bonus is usually a rebate from the manufacturer.

Thanks for this post. I don’t think bad auto loans are enough to tip the economy into recession, but the overhang will definitely slow the economy and the losses might get some lenders in trouble. Reduced credit and auto sales mean rust belt pain.

One sector of private, non-government debt, the auto loans. It seems to be more telling and more of an indicator of the economy because it is based on people who have to earn money, and can’t just print it. And when those people can’t service the debt, in this case the auto loan, cue the repo man. Or you bravely walk in to the dealership and turn in the keys and surrender the title. However, to find this discussion in a greater public venue on a regular basis is tough. It would be better if nakedcapitalism could dragoon our own crackpot billionaire, or multi-millionaire at the doorstep of billionaire status to underwrite a PRIVATE DEBT CLOCK in time square or next to the HOLLYWOOD sign in the hills of LA. You know the kind of kook crusader against the dreaded federal deficit with its unfunded Social Security Mandate not even factored in!!! One of those blinking counting higher and higher neon number sets of $Trillions$ spinning out of control until we drown in government debt and then are taxed to death. Or given the death tax, or the death panels to reduce unfunded mandates for old people.

Here is an example of the Federal Government is the only entity in the world with debt, certainly not the private sector.

http://www.usgovernmentdebt.us/

————————————————————————————————-

Well, I present to you the Brandeis Brief of Debt Clocks. The Universal Set of All Possible Indebtedness, public and private. And it includes a planetary overview of most nations as well. I mean, you need to realized that private debt is 2-3 times the amount of the federal deficit. Think about it. Not only these auto loans, but student loans, unsecured credit card debt, pay day loans, auto title loans, pawn shops, cash for gold and the Moby Dick of Debt, home mortgages, home equity lines of credit and 2nd mortgages, home improvement loans for pools, windows etc. Don’t forget corporate America with all of the commercial paper out there in the bond market as well as real estate backed loans. SBA 3rd position liens on private residences. You get the idea, outside of the government, there are all kinds of indebtedness, and last but not least, medical bills!!

Without Further Ado, feast your eyes upon Debt Leviathan!

http://www.usdebtclock.org/index.html

To which I respond Modern Monetary Theory.

As the issuer of money, the US Gov has not debt. The deposits in interest bearing accounts would be settled by issuing money, if the account holder were so foolish as to pass up guaranteed income.

Please, add some cussing, a few anti-semitic remarks, and post your drivel on Zero Hedge.

Tioxon is ridiculing the exact position you are attempting to criticize:

Please try to read other comments carefully before responding. In any case, it isn’t your job to tell people where to post their comments.

It kind of like the old McDonald’s sign with the Millions, the Billions, the Gazillions of burgers sold.

Then they dropped the sign altogether, not necessary any more, I guess.

But we haven’t run out of cows … strange.

I am a prime contributor to: finding alpha zulu moolah on the dark web, far superior to Zero Hedge. Holy Moses, Jumping Joseph’s get with the program.

The current automobile manufacturing rate is not sustainable, not unless we start junking cars that are still in good working order, A typical vehicles is driven something like 12,000 miles a year and with proper maintenance is good fro close to 200,000 miles (some makes are better). That’s 15 years. There are something like 240,000,000 drivers in the country each with one vehicle, They need 16million vehicles a year to be produced, and that number is reduced by imports. We are actually, I read, producing over 17 million a year. You can keep the number up by persuading people who would have been wiser to buy a used car for much less, but then you get the escalation in delinquencies because they bought cars they cannot afford.

If my memory is correct, Congress exempted the auto industry from scrutiny by Consumer Financial Protection Board clearly envisioning sharp growth in subprime loans. A flood of used cars from repossessions can hold down prices of new cars. I wonder if we are talking about auto sales peaking?

The 900 pound gorilla in the automobile “remarketing” industry (at least in the USA) is Manheim. This is the auctioneer where the manufacturers take their off-lease vehicles to sell to dealers. Manheim also handles a huge chunk of the more traditional wholesale used car market, being sold to “Buy Here Pay Here” used car lots. They also handle the remarketing of used vehicles to exporters, who then ship them overseas for resale. Manheim’s primary competitor is Adesa.

You can access Manheim’s annual state of the North American used car industry report here (for 2015) –> Manheim 2016 Used Car Market Report. (for 2016) https://publish.manheim.com/content/dam/consulting/2017-Manheim-Used-Car-Market-Report.pdf I am not aware of quarterly or shorter term reports. Unfortunately, most of Manheim’s data is behind a paywall only accessible to car dealers.

To a lesser degree, CarMax — KMX — functions as a proxy for the used car industry. Their most recent results and conference call can be informative.

does anyone know how prevalent securitization is in the world of auto loans (like the percentage of loans, say, that are securitized)?

I worked at one of the media properties of Cox Media Group (Manheim is part of the Cox empire). During one of our “Ask the Publisher” meetings I pointed out the sub-prime loan issue and asked what will happen to us when it all blows up. I got the nothing to see here answer. I guess they are going to find out soon.

Money, or more precisely debt or credit, makes the world go around.

Credit is both a blessing and a curse depending primarily on the disposition of the lender. After all willing borrowers are rarely hard to find.

The higher the item or service value, be it a house, a car or even an education the more likely your average earning Joe is going to need credit in some form or another to finance it.

Debt/credit, ideally secured against an asset (or the promise of future labour), expands the money supply and feeds into the wider economy whilst keeping the borrowers occupied on self-improvement or enjoying their newly acquired objects of desire and focused on labouring to make the payments. All the while enriching the lenders (or blessed custodians of the sovereign backed sacred magic money tree) and their stakeholders in their sleep.

Credit expansion doesn’t take any particular genius or self-control, but regulating it clearly does. Hence expedient,vote hungry, venal politicians working on a 4/5 yearly electoral cycle and bankers paid ever burgeoning bonuses based on their propensity to lend or ‘invest’ money at no personal risk to themselves probably ain’t exactly a recipe for wider long-term success and stability for the greater good.

The Reagan and Thatcher years were characterised by the loosening of hitherto pent up credit availability to the consuming masses. That new found creditworthiness came courtesy of the sovereign states’ unique money creation powers that underwrote it, was executed primarily by newly deregulated banks and seemed to perform miracles in the short term at least.

Fast forward 30 years or so and many developed economies are increasingly indebted, tax bases are constantly and consistently being eroded and most, if not all, are over reliant on ever more debt fuelled consumer spending in a desperate attempt to keep the wobbly plate spinning.

Is this bad? At least the economy is, um, limping along.

If the crash of a bubble doesn’t manage to take down the system, do you think we would be better off trying to “manage” the credit creation cycle, vs letting it play out?

The GFC was one of the most obvious negative manifestations of letting barely managed credit creation play out (of control) in no small part thanks to Alan Greenspan’s sustained reckless criminally low interest rate policy.

I find your use of the word ‘cycle’ here particularly pertinent in this case as it suggests a reset or a return to some sort of equilibrium via a combination of paying down, defaults, asset writedowns and crucially haircuts for creditors in order to achieve this.

However, as we all now know these credit induced losses were effectively socialised in order to preserve the status quo, and the brunt of the costs, both social and financial, borne by the very people who required credit on a day to day basis and still continue to do so.

Many borrowers lost their shirts, their jobs and their homes while lenders, for the most part, kept theirs, got to pretty much carry on as usual and even managed to snap up a few bargains in this newly auspicious climate. One person’s plane crash was another’s bit of uncomfortable inflight turbulence during the Champagne service you might say.

In addition, post crash, some lenders had the added bonus of swapping their own ill-judged crappy ‘non-performing assets and loans’ for near as damned free central bank funny money in the hope they would start lending again to the poor saps who’d lost everything the first time round, but why would they when there’s far easier, apparently less risky money to be made elsewhere

other than the genuinely productive, boring old ‘real’ economy? After all they have a duty to their shareholders to get the best returns…don’t they?

So, back to your original questions, ‘is it bad?’ and, ‘shouldn’t we just just let it play out?’ I think the answers are yes it is if we want to see vibrant economies and more equitable, just, content societies, and secondly, it’s now probably too late as we are now in the midst of a massive logic defying global stock market bubble thanks to our abject failure to manage the ‘credit creation cycle’ in the first place or let it ‘play out’ properly in 2008.