By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Last year, Boston Fed President Eric Rosengren — considered a “dove” on the Fed’s policy-setting committee — started warning about the commercial real-estate bubble in the US and what its demise could do to banks. But in his speech on Financial Stability on March 22 in Indonesia, he added what I’ve come to call “Housing Bubble 2” to his ever more emphatic concerns.

Like all central bankers, he can’t warn publicly about an approaching problem because it could trigger the very problem he’d be warning about. In this manner, no one at the Fed saw the last bust coming. So Rosengren started out his presentation, “Financial Stability: The Role of Real Estate Values” – by clarifying this: “First, I am not here today to predict problems, but rather to suggest we continue working to head them off.

The phrase, “continue working to head them off,” is ironic because he also pointed out what has caused these problems: “very low interest rates” that were “wholly necessary” and that he “strongly supported.”

But the Risks Are Massive.

Rosengren finds that “the root cause of the financial crisis was a significant decline in collateral values of residential and commercial real estate” and “exposures across the banking system that are correlated and sizeable.”

Real estate becomes a trigger for a financial crisis because of its high leverage. For banks, these properties are collateral. When property values tank, the collateral is impaired. Defaults rise. Then broader problems spread into the economy. Property owners experience a reduction in income. Homeowners see their paper wealth evaporate and financial stress rises. At some point, banks begin to fail.

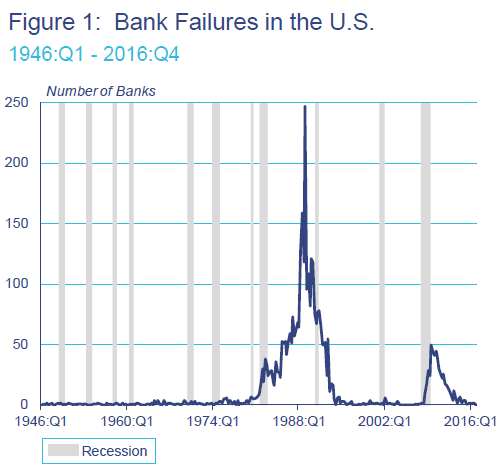

This chart shows the number of bank failures, regardless of size. In the decade before the Financial Crisis, the banks had become huge. Thus, fewer but huge banks failed:

The data includes failures and assistance transactions of commercial banks, savings banks, and savings and loan associations. S&Ls are included beginning in 1980 (source: FDIC, NBER, Haver Analytics).

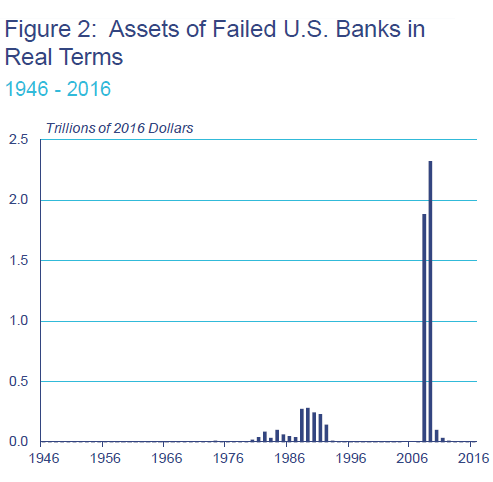

But when these fewer huge banks failed, all heck broke loose. This chart shows the asset values of the failed banks, adjusted for inflation:

As property prices plunged during the Financial Crisis, the balance of CRE loans that were 90+ days delinquent soared to over 7% of outstanding balances; and delinquent home mortgages soared to over 8% of outstanding balances.

Real estate has a significant financial stability implication because real estate tends to be leveraged by the owners, and those loans represent a significant exposure for financial institutions that are themselves highly leveraged.

As losses from these assets (the loans) hit banks’ capital, the banks shrink their lending, which crushes economic activity and also makes it harder to sell properties as potential buyers cannot find banks willing to lend even at depressed prices. Liquidity in the property market dries up.

And the Magnitude Today?

Financial institutions hold $3.8 trillion of CRE loans (including multi-family residential) and $10.3 trillion of home mortgages. So this is a $14-trillion problem. The $3.8 trillion of CRE loans are primarily held by:

- Banks: $2.02 trillion or 53% of total

- Life insurers: $460 billion or 12% of total

- Government Sponsored Enterprises (GSEs, which include Agencies such as Fanny Mae) & Agency commercial mortgage-backed securities: $521 billion or 14% of total

- Non-Agency commercial mortgage-backed securities: $544 billion or 14% of total

Among the banks, smaller banks (less than $50 billion in assets) hold the lion’s share of these CRE loans: $1.2 trillion. Larger banks, with over $50 billion in assets, hold $767 billion. In other words, the smaller banks are terribly exposed to CRE.

This comes on top of $10.3 trillion in home mortgages, of which taxpayers, via the GSEs, are on the hook for $6.3 trillion, smaller banks for $1 trillion, and larger banks for $1.6 trillion.

That $14 trillion of real-estate debt is why real estate can trigger financial crises, and why real estate bubbles, when they implode, are so pernicious.

And CRE lending has continued to surge. For Rosegren, the numbers are worrisome:

Over the past year, holdings of commercial mortgages by the banking sector have increased 8.9%, while bank holdings of multifamily mortgages have increased 12.0%.

This growth has occurred while bank supervisors have been cautioning about the potential risks emanating from the high valuations in some sectors of the real estate market.

But the impact of the guidance from regulators over the past two years about the risks of lending to a sector in a full-blown bubble has been “modest,” he said, as lenders continued to support soaring prices, particularly in the apartment sector.

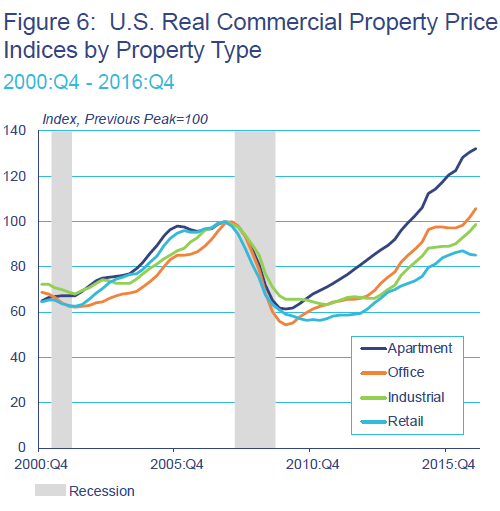

This chart shows the price increases by sector, adjusted for inflation. Prices of apartment and office buildings have soared above the crazy peak of the prior bubble. Note that retail (light blue line) is starting to strain under the collapse of brick-and-mortar retailers:

The indices, adjusted for inflation via the GDP deflator, are based on repeat-sales of properties of $2.5 million or more (Source: Real Capital Analytics, BEA, NBER, Haver Analytics).

The problem with apartments is that rental income faces the reality of maxed-out consumers and of a lot of new supply coming on the market. Though rents have soared over the past years, they have not soared nearly enough to keep up with the price increases of apartment buildings. As a consequence, “cap” rates (net operating income divided by the price of the property) have reached the lowest level in 16 years.

So what can be done about it? Raising rates significantly would stop the price increase and reverse the whole thing. But rates won’t rise enough. According to Rosengren, “there is the possibility that equilibrium interest rates may remain relatively low.”

This would require a greater emphasis on macroprudential tools if valuations became a source of concern. However, with limited macroprudential tools available and only a modest price response to date to guidance, it is prudent to keep a healthy, ongoing focus on the sufficiency of these tools and their ongoing enhancement.

In other words, rate increases may not be enough at the “equilibrium interest rate” to deal with this bubble, “guidance” hasn’t really worked so far, and macroprudential tools are too “limited.”

Reading between the lines, it appears the real-estate bubble is once again putting financial stability at risk, but the Fed, which caused this bubble via low rates and QE, is now nudging up interest rates too slowly and too late to an “equilibrium rate” that it knows is too low. And as this bubble runs its course toward a crisis, the Fed will once again pretend it isn’t happening.

Let’s hope that the problems piling up in the used vehicle market — and their impact on new vehicle sales, automakers, $1.1 trillion in auto loans, and auto lenders — is just a blip. Read… Is this the Sound of the Bottom Falling Out of the Auto Industry?

Thank you, Yves.

It’s not just the US at risk, but good old Blighty and some of its former colonies (the settler states) and, from my observation of the property pornography on French, Belgian and Swiss (francophone) TV, perhaps this trio, too. There appears to be a correlation between property pornography and real estate bubbles.

I wonder about Mauritius, too, where some developers have gone bust and left abandoned buildings, but have not caused the banks much problem yet.

Yes, Colonel, and thanks to NC, here too:

see, for example, http://www.macrobusiness.com.au/2017/03/australias-lost-decade-worse-japan-us/

In Australia, I reckon the situation potentially much worse (we never had the crash/recession that everyone else had).

Now the bubble is so large, our own Fed, the Reserve Bank of Australia can’t go anywhere. Raise rates, crash the market. Lower rates, encourage the ponzi scheme even more.

It’s going to be ugly. No toss the keys to the bank and walk away here

Banks and bond holders, or people – which will be made whole when the debt becomes worthless?

Rhetorical, I know…

Thank you, Dead Dog.

I have cousins in Sydney, so hear about it.

I have worked with Australian banks and their (prudential) regulators (APRA). I know how concentrated the market is, dominated by a handful of banks, so the risks have not been spread. I doubt that their capital bases are strong enough to absorb the coming shock.

It’s interesting that the RBA’s Glenn Stevens, the RBNZ’s Alan Bollard and Canada’s Carnage were considered for the succession to Mervyn King at the Bank of England. All three governors presided over housing bubbles, just what is required for the mother country.

Cheers Colonel for reply. Yes, APRA, has been a bit asleep.

The capital base is fine, unless there is a big correction.

Thing is, Sydney has never had a big correction in the 40+ years I’ve been here. So, there are many who still think that its market is independent of shit happening elsewhere.

Already seeing investors in Adelaide, Brisbane and Perth taking a loss after several years of ownership, but this has been structural and unique to those local economies. Has to happen to Sydney, Melbourne and Canberra, just waiting for that external shock, sudden rise in unemployment, big drop in demand or confidence and poof

I would lump Canada into that sphere as well. Vancouver actually implemented special taxes to stop hot money from foreign countries pouring into their market and pricing real estate far outside of the citizens over leveraged reaches. And Toronto is a cottage industry of shock over the price of detached and semi detached homes, though it seems that maybe the market has just crested the peak.

https://themash.ca/realestategossip/2017/3/and-it-went-for-662-dundas-street-west-kensington

Re: Vancouver, I think that horse had left the barn some time ago.

Its heating up in Ireland too – the notorious ghost estates are almost gone and there are signs of overheating in the construction industry as its lost too much capacity, so construction costs are rocketing.

Residential property prices and rents are rising very fast, although this doesn’t seem to be quite as bad in the office/retail market. I’ve not seen any signs of property craziness yet – I think the banks simply don’t have the scope to shove too much money into the market, but it has the potential to rapidly go out of control. There are signs of foreign investors looking to put big money into developments in smaller Irish towns, which is I think a sure sign of too much money chasing returns turning to peripheral markets. I think this boom is likely to be driven by foreign investor money chasing returns, not bank lunacy.

Thank you, PK.

Is there any interest sparked by Brexit?

Your comment about foreign money going into smaller towns does suggest the start of a search for yield. They soon spin out of control.

I have noticed the arrival of upscale / London estate agents in the provinces. They were always a presence in places like the Costwolds, Oxford and Cambridge, but are now in what were not fashionable parts of the Home Counties (the commuter / dormitory regions around London for readers outside the British Isles).

It’s the same in Mauritius with US and European realtors muscling in on luxury developments once marketed by (well connected) locals.

There is plenty of interest in Ireland, especially smaller insurance companies, but I think the lack of available office space is a big issue which means the big players are looking elsewhere. Its seriously bad timing for Dublin, because there is a big existing bottleneck in residential and office space, and the construction industry is stretched to the limit, so its not a case of money or land – its just not possible at the moment to deliver the poured concrete the industry wants.

I’ve heard numerous stories of ‘scouting parties’ from London, but its hard to know how serious these are. I’ve also heard through the grapevine that US and possibly Asian institutions are searching for space to expand existing operations in the Dublin Docklands area. US companies like Ireland in particular because of language and cultural issues – schooling too.

I think many financial institutions are now in the game of trying to play off one city against another – certainly Luxembourg looks the big winner so far, at least with insurance. But I don’t think anyone will know for a year or so, when they will have to actually put down deposits on office space.

As for the issue of money chasing yields, that article about a big development in Waterford caught my eye because Waterford City is very economically depressed at the moment and I don’t see any evidence of a shortfall in space there. The fact that SA money is looking to invest strongly suggests to me sucker money seeking a black hole, exactly what you expect to see when there is more cash than investment opportunities.

Thank you, PK.

Speaking of middle eastern suckers, the governments there and other donors often give money for the construction of mosques. Said mosque rarely appears. There was a recent case in Mauritius.

Bubble, Bust, Rinse, Repeat. That’s what the Fed knows best. That, and of course helping out their cronies with a “wealth effect”. While this bubble is not exactly the same as the last one, it certainly seems more comprehensive in the wide array of asset classes. It’s no too hard to read between the lines and see that you have marginal players floating some pretty sketchy plans on brick and mortar dreams.

At the same time you have smaller players picking up the slack of institutional investors who want to get rich being landlords, this at a time when those cap rates are compressing as fast as your local CAD (central appraisal district) can ratchet up your property taxes to pay for all of that “progress”.

http://aaronlayman.com/2017/01/reign-economic-error-housing-market/

Thank you.

Your post and Wolf’s base, San Francisco, remind me of a colleague from HSBC. She was French and emigrated from London to San Francisco to become a realtor and, eventually, an investor in 2003. I mention her French nationality as London has attracted realtors of French (and Italian) backgrounds, mainly catering at the higher end of the market and often largely for their own ethnic community.

A couple of years ago, it was estimated that there are more realtors in the UK than army personnel.

You have huge pools of pension plan money that needs 7-8% returns so if they reduce their weight in plain vanilla bonds, they are increasing the weight into alternatives (i.e. real estate, private equity…)

Our current pension system (led by large to be funded DB plans) begs our retired/retiring cohort to squeeze the young and destroy our economy by maximizing equity returns and using all kinds of financial engineering to get their returns.

Thank you, Moneta.

I had observed when working for a buy side trade association (2012 – 4) in London.

In Oregon, commercial real estate developers have the law on their side. Property taxes are tied to 1996 valuations, with only a 3% increase per year. That means they don’t have to fill the ever-growing number of potholes in Portland and well… why educate kids when outsourcing, software and robots work so much better!

It also helps that we are the “Delaware of the West.” In 2006, the U.S. Treasury’s Financial Crimes Enforcement Network concluded Oregon is one of four states “attractive to those persons seeking to hide illicit activity within the framework of shell companies.” We have to worry about the “licit” companies that use tax shelters too.

Recently, some of Oregon’s iconic buildings (like the Big Pink) have sold and even flipped.

That includes the Regence BlueCross BlueShield headquarters, which doubled in price in less than 3 years, having been sold by CalSTRS to German company, WealthCap L.P. on Halloween last year.

Highyon Accredited Realty Partners LP says “Real Estate Limited Partnership units are a proven method for investors wishing to reduce their taxable income. Participants enjoy the flow-through benefits of tax deductible partnership losses during the lifetime of the partnership. When the underlying asset property is sold, the proceeds to investors are taxed favourably as capital gains.”

The biggest developers and commercial businesses have, no doubt, taken the money and run. They all use Delaware-based Corporation Service Company and CT Corporation System as registered agents. Who needs the Cayman Islands for a tax shelter? After all, it will probably be swallowed up the rising oceans soon.

The potentially distressed bank assets in both CRE and home mortgages presumably doesn’t include repossessions that have still not been sold off, right? (While I assume that some were eventually sold off, since the current bubbles might be concentrated in certain locations, I’m guessing that many banks might still have repossessed properties on their books, deliberately not sold as it would force recognition of losses on their balance sheets.)

If this is the case, bank balance sheets are even more vulnerable to serious undercapitalization than”just” the huge new bubbles forming.

IOW I suspect bank balance sheets do not yet reflect the full losses from the 2008 collapse, which will only magnify the speed and force of the next implosion.

Thank you.

Very true. The speed and force in the UK will be enhanced by car and credit card loans no longer performing.

Mum works in Social Services (admin’ side) in Buckinghamshire and, as we walked to the railway station this morning, told me how she had seen evidence of credit card loans being more prevalent and bigger than housing loans. I was telling her about the big and shiny cars found in unlikely parts of the area and how they are more than likely to be leased.

On banks hiding the full extent of losses: consider the pooling and selling of non-performing loans and the role of 501C3’s as newer blinds for hiding residential mortgage-loan losses. HUD started this in 2010, Freddie Mac and Fannie Mae followed suit and by now numerous such pools have been offered at auction and snapped up. The govt agencies bleated that they really, really hoped that these pools would land in the hands of 501C3’s and women-and-minority-owned entities, ostensibly so that such entities would help homeowners and neighborhoods blighted by foreclosures, but actually in order to enable “charitable”, “community minded” organizations to foreclose and cash in big. At any rate, in fact not many of these pools have been bought by not-for-profits. Instead the winning bidder time and again has been a big bank, with Goldman leading the way. Turns out that the banks get a write-down under the terms of the 2012 Mortgage Settlement Act on these losses, then they get the payoff by foreclosing as well. Or by further packaging and selling the non-performers. In some cases it appears that the banks create a subsidiary 501C3, pool their portfolio non-performers and proceed to sell the pools to themselves, Losses are again hidden in the 501C3, which then proceeds with foreclosure, etc. etc. (I have now reached the limit on how much of these machinations I can comprehend.)

Called creative accounting condoned by the regulators to facilitate and continue the fraud!

Takes default of several mega Lending institutions, to ovrcome and crash through this BS!

Until then business as usual!

@EyeRound: “In some cases it appears that the banks create a subsidiary 501C3, pool their portfolio non-performers and proceed to sell the pools to themselves, Losses are again hidden in the 501C3, which then proceeds with foreclosure, etc. etc.”

That reminds me of the RBS scams in which they’d close down a business with desirable RE or other assets. All under bogus pretenses; they’d first artificially create a situation to cause financial pressure, and then close the business down and sell the assets at bargain prices to their secret “independent” subsidiary which would then make money from flipping them.

Is there something particularly anglophone about real estate bubbles? I did not say Anglo-Saxon as Ireland is not and the former colonies ceased to be or are fast ceasing to be.

Here in our town the triennial property tax reassessments came out. Almost universally in our neighborhood

the assessor thinks each property has gone up in value by $100,000.00 in three years. Now all the taxing bodies want to levy at higher rates, It was almost unaffordable before, now it’s ridiculously unaffordable. Without corporations and the wealthy paying taxes the burden is falling on the local property tax base.

Thank you, McWatt.

In the UK, the property tax in wealthy central London is about a third of what the rest of the country pays. Many properties in central London are owned / occupied by foreigners and empty for much of the year.

In my home town, the only retailer of note left on the High Street (Main Street) in the US is Marks & Spencer, a bit of a national institution. Marks has been able to reduce its local tax bill, blackmailing the local council with a threat to leave, so the rest of the retailers have to make up the difference.

Apart from the public sector, the only employer of note is the insurance arm of Lloyds Bank.

Clearly, we need to have David Lereah explain all this away.

Yeah, whatever happened to him?

Macro-prudential regulation application seems counter-cyclical in a bad way. It gets watered down, or reduced in focus, when there is any potential profit left to squeeze out through lower loss reserves. Then the asset bubble pops, banks are under-reserved and their viability is once again called into question.

When a phrase like the Greenspan Put or Bernanke Put enters the lexicon, then that should be a sign of likely trouble down the way. That sign gets muted through a combination of short-term thinking and actions, amply rewarded on the Street as well as in the board room, with rare interventions. One of those rare events was the recent spanking of Wells Fargo due to its multiple accounts scandal, which continues to unfold and influence current and potential customers.

Interestingly regulators might be responsible for popping these bubbles of inflated asset prices.

This is because SEC Regulation RR, which was mandated by Dodd-Frank, became effective on December 24, 2016. It impacts an important source of funding for risky Commercial Real Estate and subprime auto loans. The rule states that issuers of ‘securitized’ bonds ( MBS, ABS, CMBS ) are required to retain a 5% interest ( in all or the lowest tranches ) of every new asset-backed security they originate.

https://www.sec.gov/rules/final/2014/34-73407.pdf

This means at least 5% of the risk in securitized real estate, and auto loans must now be retained by the companies responsible for pooling and packaging their loans into securities for investors. My guess is new issuance of CMBS securities ( used to finance retail stores, malls, hotels, rental apartment complexes ), and ABS securities ( providing loans to auto finance, and credit card companies ) will slow. Most of the companies securitizing these deals use high leverage, and target a high volume of new issuance to make money. I doubt they have the equity to meet this new SEC requirement, so the portion of bond deals they retain will likely be financed by debt. This is pretty risky in light of accelerating delinquencies for commercial real estate, and auto loans. For this reason new financing in these sectors should meaningfully slow, and if not the issuers of these bonds are building balance sheet risk that is unsustainable. A slowing of new financing is particularly problematic for commercial real estate because CMBS bonds typically pay only interest, and roll over ( are refinanced ) into new bonds at maturity to avoid paying the principal due.

Not sure. Haven’t done more than skim the new reg, but the “securitizer” seems to be the sponsor of a securitization, not the originator of the securitized loans. IOW, a minimally capitalized special-purpose entity that buys the loans from the originator (or yet another intermediary) on a non-recourse basis. Also, it looks like the 5% won’t be calculated on market value, but instead on nominal value. So I doubt that will impede the originators.

Who do you think provided all the comments? Not the consumers/borrowers.

We are where we are by design, not unhappy accident.

Developed consumer economies could and should be able to thrive on stable, thoughtful debt creation, but maybe it has proved too tempting too often for those uniquely placed to abuse it?

It is potentially the lifeblood of genuine future creativity and productivity that sustains our societies. In the right hands, a genuine investment ideally reflecting and balancing risk, skill, effort and resultant reward.

The continual and continuing self serving abuses of credit creation we see today are the expedient wilful acts of long-term wealth destruction, rather than the wealth creation its beneficiaries, in spite of overwhelming evidence to the contrary, would still have us all believe.

People have to believe that there are rules, albeit often harsh, governing outcomes, but once a critical mass cease to believe that there are any or that they only apply to them and not a select few, then you start to have a big problem on your hands.

Creative accounting along with suspension of Mkt to Mkt accounting standard sin March has enabled the top 10 mega Banks to hide their losses. ISDA decides when and when NOT to declare the the default of loans under derivative/SWAP contracts! Durging Grrek crisis it declared no such default occurred and it went unchallenged!

CBers won’t admit their mistake in creating the 3rd largest bubble. Regulators will try to ignore the reality just like in 2007. Everything is hunky-dory per MSM!

This charade will go on, more than any one’s guess! The creators of the these problems are in charge of the solutions, again!