The Wall Street Journal published an important story on how states and communities throw money at companies via tax incentives and other gimmies in a desperate effort to win or hold jobs. These subsidies are a big drain on government budgets:

Economic-development tax incentives more than tripled over the past 25 years, offsetting about 30% of the taxes the companies receiving incentives would have otherwise paid in 2015, compared with about 9% offset in 1990, according to an analysis of incentives covering more than 90% of the U.S. economy.

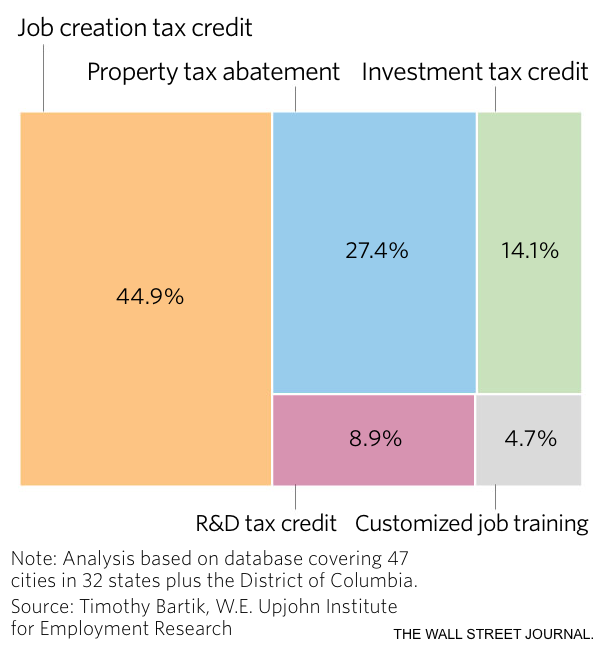

By 2015, the total annual cost of these incentives was $45 billion, according to the analysis, by Timothy Bartik, a senior economist at the W.E. Upjohn Institute for Employment Research in Kalamazoo, Mich. The study looked at 47 cities in 32 states plus the District of Columbia.

Bear in mind these incentives drain budgets. Even though property tax rebates are only the second largest incentive, and property taxes are the foundation of school budgets, it’s hard to imagine that the biggest items listed below, “job creation tax incentives,” does not also come substantially from property tax revenues.

Yet one of the complaints of American employers is that prospective worker are weak in basic capabilities like reading, writing, and mathematics. While this is often the result of companies getting what they pay for, that is, if you offer rock bottom wages you should expect only minimally skilled workers to respond, clearly another factor is the ongoing starvation of public school budgets.1

Moreover, the $45 billion is almost certainly low because it excluded some types of incentives, like city income tax rebates. And of course these expenditures aren’t equally distributed. Areas of the country that are seeing an influx of people, due to weather, proximity to universities, or a spurt for area businesses (think North Dakota in the oil boom years) aren’t as aggressive as throwing dollars at prospective employers, since the competition can become so fierce that the city doesn’t come out ahead on a net basis. As author Ruth Simon points out:

Critics say tax incentives do little to spur job creation or economic growth. Most incentives are “redundant,” meaning, “they have no impact on behavior,” said Nathan Jensen, a professor of government at the University of Texas, Austin, who compared job creation numbers for firms in four states that received tax incentives to similar firms that didn’t receive the benefits.

The Florida House of Representatives this month approved legislation to eliminate the state’s main provider of tax incentives and other development assistance. Florida has attractions such as a good climate and no income tax, said Paul Renner, a Republican who sponsored the bill, and would be better off focusing on other forms of economic development, such as education and infrastructure.

If you read closely, consultants are an important source of information for the article. It should come as no surprise that government bodies hire outside help to try to structure and pitch their “Come hither” schemes. But the consultants have every incentive to encourage the idea that winning one of these contests is a good idea.

One correspondent, who sits on the city planning commission of a small shrinking rust belt town that lost the smaller of the two manufacturing plants that had been its main employers, has remarked over the years how his town has over time paid a hefty amount in fees to consultants trying to give them a path out of their predicament. In their case, the big beneficiaries have been development experts. This town does have some assets: it’s on one of the Great Lakes and so could be a waterfront play. But the flip side is that some of the best area is tied up in unsightly ore docks, and the contract to the dock operator would prohibitively expensive to exit or to pay him to relocate a mile or two away. Another impediment is that unless you are outdoorsy, say a sailor, hunter, or hiker, there’s not a lot happening in the area.

Yet the town has hired a series of experts, and they all come up with variants of the same idea: high end condo development targeting upper middle income buyers. This is even less likely to get off the ground there than elsewhere since a university town with much better amenities 60 miles away already has gone down that path. He’s suggested other ideas to help rebuild the town that would be lower cost and could attract more tourists, such as an aquarium (there are none within 500 miles), but the consultants are all wedded to their pet models and don’t even seem equipped to consider ideas that aren’t based on subsidizing speculative residential development.

The article includes the efforts of number of Midwestern cities, such as St. Louis, which is becoming more stringent about its programs, versus ones that are more desperate, like Lansing, Michigan, and Elyria, Ohio, whose mayors believe they have to offer whatever it takes as a matter of survival.

Having said that, some approaches are more clever than others. For instance, while Elyria, which is near Cleveland, has employed standard approaches like tax breaks and real estate assemblages that might appeal to manufacturers, has tried to create jobs more directly:

The city’s Lorain County Community College operates a startup incubator with the help of state and county funding. Over the past decade, the incubator’s startups have created more than 1,200 jobs, mostly in biotech and software, said Cliff Reynolds, co-director of the program. But only about a third of those jobs have remained in Elyria, he estimated. Often ventures move to nearby Cuyahoga County to get closer to programming talent and funding in the Cleveland area, he said.

And the other incentive programs haven’t halted manufacturer exits:

The latest blow to Elyria’s manufacturing base came in November, when 3M Co. announced it would close a plant that employs 150 to make cellulose block used in sponge production. The company, which says it wants to get out of the cellulose block business, plans to shift the work to a larger and more efficient plant in western New York where the product is also made, a company spokeswoman said.

Bendix Commercial Vehicle Systems LLC, a supplier of safety and braking systems for commercial vehicles that had been headquartered in Elyria since 1941, in 2015 turned down an offer worth as much as $17 million to stay. It is moving its headquarters and roughly 460 jobs to a new site 10 miles away in Avon, Ohio, also in Lorain County.

Ten miles isn’t much of a commute, so Elyria might not wind up suffering that much. But a vacant plant is a powerful image of a community in decline. Mind you, this is only a small slice of the approaches the city has tried, and the article discusses recent and current negotiations, including another loss:

Riddell, a unit of BRG Sports Inc., determined it needed more space in early 2015 and started exploring location options. It liked Elyria, but “the geometry and size of that lot could not accommodate our plans,” said Allison Boersma, BRG and Riddell’s chief operating officer. Parking space was also a problem.

The company hired a site selection firm that brought in Incentis to consult on tax incentives. Riddell looked at 17 sites in Ohio, plus options in Illinois and Texas, weighing 30 criteria including access to and visibility from the interstate, quick movement on permits, services such as roads, sewage and electric, and the possibility of future expansion. It also said it valued moving quickly into a new facility and retaining its existing workforce.

Ms. Brinda, Elyria’s mayor, said Riddell’s decision to hire a site selection firm was a red flag, because it meant the company was seriously considering other options. In November 2015, Elyria offered Riddell the best alternate locations it could find, including one that straddled the Elyria-North Ridgeville line. The mayor said she also asked county officials for assistance.

The deal, the city said, would reduce the costs of expanding the existing facility or building a new one by as much as 50%.

In the meantime, Riddell’s representatives had approached North Ridgeville about a company “engaged in light manufacturing,” without naming the company, according to North Ridgeville’s mayor, G. David Gillock. “They asked what incentives could we put on the table,” he said.

The community had an undeveloped site that could be built to company specifications and offered up to $7 million in tax incentives.

Ms. Boersma said the company saw it as the best option, and Riddell will make the move across the railroad tracks to the new site next month. Riddell said it is adding about 50 new positions, which will increase its workforce by roughly 15%….

“If we had said we don’t have any incentives, but we have a low income-tax rate and we would love to have you, they would not be here,” said North Ridgeville’s Mr. Gillock. “If you don’t have something on the table, you are going to lose.”

The point the article fails to make is that the ability of companies to play towns off against one another is yet another proof of inadequate demand in the economy. If labor markets were tight, employers would need to be more attentive to workers, and that alone would create incentives for them to expand in place rather than look for places where the need to retain or generate jobs gives them the upper hand.

Yet the Fed raising rates, based on its claim on its view some signs of life in the labor market means the economy needs cooling off. In reality, the big driver of the central bank’s eagerness to tighten is super-low rates are a failed experiment and banks, who first benefitted enormously but are now suffering a hangover, are pushing the Fed for higher interest rates. But the odds are that we are in “two wrongs don’t make a right” category. The US needs more deficit spending but the Fed and mainstream economists continue to double down on the failed orthodoxy that created this mess. Just as using interest rates to goose asset prices prevented debt restructuring, produced only a spotty recovery, and by increasing inequality, helped usher in Trump and with him, political instability, so to will increasing interest rates for the wrong reasons do more harm than good.

____

1 International studies show a high correlation between how countries rank in skill measures of public school students and the pay and status level of teachers.

Walmartification…..

http://grist.org/living/map-walmart-stores-america/

disheveled….. Capitalism – !!!!!!!

It looks like cancer spreading. Walmart is the biggest destroyer of manufacturing work in the US and now the results of globalization are in. A total disaster.

What now? Amazon, the super predator, has received hundreds of millions to defray costs associated with their soul crushing warehouses, and being the super predator they are, no doubt demand and get all sorts of back door subsidies like no or reduced property taxes for years to come. They eat anything that get’s near them, and the politicians are giving away money they never sweated for.

This isn’t capitalism any more. If it were, Goldman Sachs would be dead, and Amazon would be told to pound sand, and fund it’s warehouses from it’s own profits.

Its not just Walmart and Amazon, there is I think a strong incentive for local governments to want to see something done, even if its not in any way productive.

Back in the 1990’s I was working in the West Midlands in England. There was a major government owned development corporation there charged with redeveloping a wide swathe of industrial dereliction through the old urban area. The centrepiece was a new link road, along with a major program of land consolidation, reclamation, and general beautification. A friend of mine was involved in doing the Cost Benefit Analysis for the project.

The problem he found doing the CBA was that when they surveyed the derelict area, they found there were still a surprising number of small metal bashing industries still surviving, and providing employment. But when they surveyed the commercial sector to see who would move into the newly consolidated and reclaimed land, it was overwhelmingly warehouse distribution and big box retailing, attracted by the excellent new road put in at public expense. No matter how hard he worked on the figures he couldn’t get them to cough up a positive job impact, let alone a positive economic benefit.

But it was ‘policy’, so it happened anyway, with the public sector absorbing the loss (the CBA was quietly filed away, never to see sunlight). They area now looks much better than it did – acre upon acre of nice new warehouses and nicely landscaped roads, replacing scrapyards and smokestacks. But I’ve not seen any evidence of any net job or economic benefit to the local residents.

Walmart and Amazon offer lower prices, if not better quality products.

And this is how we get to where we are today; the movie goes like this:

Cheaper imports = lower prices —-> fewer good paying jobs and fewer jobs period —-> Need for lower priced products, or die —–> fewer jobs —-> need ever lower prices, etc.

Now, there are several paths to get back to where, when there was a time we didn’t complain so much before (then, it was not perfect, here we distinguish that from Nirvana or paradise). One of the paths is to run the movie backwards:

More expensive imports (border adjustment tax) —-> higher prices, but made here —-> more jobs —-> less need to buy cheaper products (i.e. can afford higher priced, and hopefully and likely, better quality products) —-> more jobs here —–> etc

I also think that if the products are manufactured here with higher quality (it used to be that way) even with higher prices needed to cover higher wages, there is a need for the manufacturer to lower profit margins to sell at lower prices (vis a vis those he manufactures abroad at cheaper wage rates, and enjoy are fat profit margins and price them at prices not quite on par with quality).

I might be mistaken because manufacturers (importers) are greedier and go to great lengths to make changes to product quality (such as Levis who cut out one belt loop or an expensive sportswear manufacturer who imprint the label on the fabric rather than a sewed one.

Yet these C-corps now are sacred cows because of their GDP inputs and how it effects equity and bond markets…. not to mention a whole service and distribution network has been made just to service this currant enviroment.

disheveled…. same as many bio systems, once diminished, it – never – recovers to its previous status…..

And the union pension funds have long since invested in private equity funds when then use said funds to destroy the unions in various ways.

When only the micro level is looked out (how can we “get-over-guys” profit) instead of viewing things from the macro level (how are we dismantling our economy), the only outcome is depressing!

What sticks out to me is how clearly that map shows Walmart started to aggressively metastasize in synch with the rise in prominence of neoliberalism.

I think it is a story about: “We have to do (or more accurately, be seen doing) something” & that desperation makes them to be easily duped into doing something that might not be sensible.

I often admire the doer more than the ones who do nothing about the situation (Brexit etc), the big difference (to me) is that in this case the ones deciding will not be the ones who’ll have the benefit/consequence of the action.

Existing customers do tend to be pissed off if introductory offers for new customers are too good, they feel their loyalty isn’t being rewarded and their business being taken for granted. I’m guessing that existing business in the areas can’t complain about these rather harebrained schemes on pain of being labeled begrudgers or similar. So maybe, the existing customers will shop around for introductory offers elsewhere?

& lest not forget about the possibility of kickbacks in the back-room deals…. However, it would be fun if the deals were done by public auction – politicians would in public be competing about who could give the biggest welfare-check to profitable businesses :-)

I wrote my senior thesis on TIFs — Tax Increment Finance Districts — 11 years ago in South Bend, IN. It seems nothing has changed, except of course the obligatory sliding further down the rotten road. TIFs are a total welfare boon to large corporations and should be resisted outright, but two of the biggest problems from my viewpoint:

1- I have never seen any enforceable rules. Say you give a $5mm break to some company who promises to bring 100 jobs but they only bring 50. States and cities rarely monitor the outcomes after the big announcement, and readers will be shocked to learned that not one of the companies in South Bend who benefited from the TIF actually brought the number of workers promised. And of course what was the punishment for not living up to the contract? Nothing, of course.

2- Wages. My thesis was all about TIFs being offered in exchange for living wage jobs. Mind you, back then in one of the poorer places in the country the living wage I calculated with my professor was $12.50 for a family of 4 with 2 working parents. Most TIF-generated jobs in South Bend paid out $7-8/hour. As an aside, this makes me roll my eyes when we see the DNC being dragged kicking and screaming to support $15 national minimum wage phased in over a series of years. That would have barely cut it a decade ago in a very poor area – what say you of large/expensive urban areas?

Excellent observation: why aren’t states/counties/cities auditing TIF and other giveaway programs? Even better, why aren’t citizens asking for accountability–it is their tax money, after all.

On the other hand, can you think of any government programs that are audited, are proven effective, and yet are frequently targets of budget-cutters?

In Chicago there has been such a citizen-driven effort — the TIF Illumination Project — going on for some time. But it takes a lot of concerted effort to delve into TIFs, which are kept deliberately obscure, complex and arcane, and most citizens have no idea even that they exist, let alone how they operate. Politicians benefit from this chicanery (Rahm Emanuel being case in point) and so have no incentive to call attention to them, let alone audit them or objectively evaluate their effectiveness. The TIF Illumination Project here has had to rely on a small army of volunteers putting in many hours to do the research for their reports and in many instances has been obliged to put in FOIA requests to get what should be easily accessible public info. The Chicago Teachers Union has been out front as well in calling TIFS just what they are — a giant, and mostly secret, slush fund.

It is against federal regulation to audit the visa worker programs, and they did that for a reason (specific congress critters, that is).

Which goes a long ways towards explaining why the consultants push for high-end condos so much as a way of “revitalizing.” You roll the dice, maybe the area takes off, some big employer moves in or the town becomes a long-distance commuter sleeper suburb, prices take off and the developers and owners make a pretty penny. If it doesn’t, well the construction is simpler, cheaper, more “modular” than a specialized building, such as the aquarium idea, and the city shelled out so much in abatements, rebates, etc., that they end up stuck with the majority of the bill, as it were.

Thanks for that information! It’s helpful to know that you actually did that level of research into these very dubious (at best) practices. That’s always been one of my questions: when the city/county/state provides all of these tax benefits to a corporation to locate there, what is the follow through to check on what they actually did in terms of jobs provided? I suspected what you discovered, which is: Not so Much.

Yet we’re constantly adjured about how poor people are simply ruining the economy with their greedy grubbing ways of “expecting” some benefits.

The real welfare, of course, is hoovered up by the Fat Cats at the top. Yet citizens fail to see that and/or somehow come to accept/believe that this is the only way to do business anymore. Very frustrating.

“The real welfare, of course, is hoovered up by the Fat Cats at the top. Yet citizens fail to see that and/or somehow come to accept/believe that this is the only way to do business anymore. Very frustrating.”

Indeed. #Concur

JFYI, David Cay Johnston reports that big box sporting goods store Cabelas can attribute all of its profits to tax incentives. So it gets to con local governments out of tax breaks unavailable to the local sporting goods stores…then undersell them. Sweet

I think this will be the model for Trump’s public/private infrastructure plan. States and cities will need to pony up land and tax breaks to get private developers to build roads and airports that they will then lease back to those same states and cities. After 40 years, the public entities will own the crumbling and obsolete remains. The sports stadium model if you will. Very sad.

And the cycle starts over again…with the cry of ‘more jobs’.

I remember reading in the late 90’s or early aughts how one of the Japanese car manufacturers decided to open a new plant in Canada rather than Georgia (state, not country). Georgia offered much greater tax incentives, but the company found the Canadian workers to be so much more competent, that they figured they’d lose more from the errors of the Georgian workers than they’d gain from the incentives. If companies decided where to do business purely on the tax cost basis, New York City would be a ghost town.

Yes, there is lots of research to point to companies considering locational and labour aspects to be far more important than local taxes or incentives when finding places for new factories or offices. In reality, getting a tax break or grant is a welcome bonus, not a key variable in their decision (unless, as with some companies, extracting subsidies is a key part of their business plan), but its in their interest to encourage competition between localities.

This is, incidentally, a very good argument for centralised taxation and grant schemes. In Europe there is a lot of competition between countries, but relatively little within countries as they are usually more centralised and local regions or counties simply aren’t allowed discount taxes. This makes it significantly harder for companies to play off regions, so local cities are more likely to compete on infrastructure, availability of good staff, etc., which is much healthier. It also allows for a more focused approach to regional development – for example, some countries will encourage companies in a particular sector to cluster in order to provide agglomeration benefits.

Playing off workers against each other, using racial, ethnic, gender and immigration status identities and playing off states, cities and regions against each other, making them bend over and hand over tax incentives, as well as their dignity … it’s a game that the elite corporate managers have honed into a pure rent extraction extravaganza.

And, after only 10 minutes reading NC this morning, I have already learned a new term and concept: Tax Increment Finance District (TIF). Thank you all!

One of the factors leading many companies to move to Canada rather than the southern US has been the Canada Health Plan, aka single-payer health.

Isn’t it less of a demand issue, and more of who has the upper hand?

If we ask some basic questions about community, who’s in charge and who should really be in charge, it seems to me to be a case of value and power being stolen from those who create it in the first place – workers.

My life and community doesn’t suffer from inadequate demand. Showering capitalists with incentives is about workers being owned. What we need and want – that’s always off the table.

It’s not the whole answer, but anyplace worthwhile must have really good communications; telephone, internet (especially), everything; but idiot politicians continue to sing the same hymns:

Free(?) enterprise will do it, all we have to do is wait for TinEar&Swindle and everything will be OK.

So rather than taking control like Places such as Chatanooga, TN and Bristol, VA, and many others, and watching firms and people thrive, TinEar&Swindle and their politician bu**kissers stand by while the tombstone factories multiply and die!

You really can’t make this stuff up!

Don’t forget payroll tax withholding credits and for those engaged in retail trade

the ever completely misunderstood Sales Tax Rebate Program.

A new bar/brew pub wants to open in our town. This week they received a $50,000.00 cash gift from the village, plus a Sales Tax Rebate credit of up to $385,000.00 over seven years.

Our town is the second most indebted town in the county, our county is the most indebted county in the state and our state is the most indebted state in the nation. What could go wrong?

I’ve been out of it for a while and so missed this angle. Would someone please provide an elaborating link?

I’ve been hearing this privately from well-placed people for at least a year.

After the Greenspan Put what will history call this hugely reckless, self-serving, socially divisive failed monetary experiment to prop up vested interests I wonder?

The screamingly obvious would be The Bernanke Bust or the less obvious, but deliciously homonymic, The Paulson Crap Shoot maybe?

It’s highly ironic that they compete for jobs as their infrastructure crumbles beneath them.

There’s plenty of work to do, but nobody seems to be able to do any of it.

I remember the two USA start up automobile companies who shared some characteristics, gull wing doors, a non standard surface finish (a thin layer of colored plexiglass for one, brushed stainless steel for the other). were named for the founders, and both found non-USA assembly plants with financial incentives by foreign governments..

Malcolm Bricklin developed the Bricklin, which was assembled in New Brunswick Canada in 1974-1975

https://en.wikipedia.org/wiki/Bricklin_SV-1

And then there was John Delorean’s the Delorean, produced in 1981 to 1983 in Northern Ireland.

https://en.wikipedia.org/wiki/DeLorean_DMC-12

Both companies went to areas desperate for new employment and most likely left the areas in even worse economic shape after they failed.

Yeah, regional policy in the 1960’s and 70’s was marked by a large number of disasters like that, as governments desperate for regional development bought sharp sales talk. But to a large degree they have learned their lesson – usually most development agencies focus on established companies now, start ups are just too risky for everyone.

Its a difficult issue, as governments can have a major role in promoting new industries and sectors – solar and wind energy for example were largely developed through being protected and promoted by European and Asian countries. But its a high risk strategy which can be a political minefield if they go wrong (just look at Solandra). I think for it to work it has to be part of an integrated strategy – for example, the way the Germans promoted solar research along with incentives for installations, creating both production capacity and a sheltered initial market.

All of Atlantic Canada has been “desperate” for manufacturing for close to 100 years, once manufacturing moved to Ontario and Quebec. New Brunswick, in particular, has been in a death grip executed by one powerful and wealthy family, the Irvings (shipbuilding, oil, forestry, food, transportation and journalism), skilled at removing wealth from the commonweal into private hands and into tax havens.

Another company that thrives off tax credits (to consumers and therefore spurs on sales) is Tesla which has always gone after corporate welfare in one form or the other.

I hear they’re coming out with a gull winged model. Hopefully, Tesla will follow the fate of the other gull wing manufacturers.

I think an obvious question that needs to be asked is why don’t these cities and towns start businesses, themselves and keep them community owned?

I realize they don’t have the skill set, but if they’ve tried throwing tax incentives at manufacturing plants and that’s not working….they’ve tried building high-end condos and that’s not working….they’re wasting money helping start-ups that wander off as soon as they reach a critical mass….I think maybe it’s time to go one step further and just start up some publicly owned companies that provide goods/services that people in the area want that aren’t being adequately provided for by the private sector.

The article mentions 3M not wanting to make sponges. How hard can it be to take existing facilities, hire some of the old staff and make your own sponges? I’m not saying it’s easy, because it’s not, but it’s gotta be doable. This isn’t aerospace parts or semi-conductors.

It’s a good idea and it could probably work great in some very niche markets but in most cases the town would lack the resources.

In the 3M example the local market is not large enough, they won’t be able to reach the scale of 3M meaning inputs are more expensive, driving up the price, and how are they going to be able to reach a distribution and sales agreement with retailers.

They would need more than just the factory and workers to get started they would need to recreate on a smaller scale all the administration, sales, distribution, and supply mechanisms (among many other functions) that 3M used to support the functions of that product line.

If we get some global scale teddy Roosevelt trust busting and monopoly stomping on steroids and the competive field is leveled, then community owned and operated becomes theoretically practical and feasible almost across the board for all Industries, as it sits this only works in very niche markets serving a unique but consistent demand in my view.

Fair point about the obstacles that would need to be overcome with suppliers and retailers.

Competing with a division of a company like 3M is probably among the most difficult to re-create as it’s a dominant player in a large number of product markets globally.

Also good point about trust-busting. If you’re taking on giant monster companies, it’s much harder than smaller players.

Singapore government businesses compete with private businesses in many sectors of the economy (GLC = government linked, ie, owned):

OECD Guidelines on Corporate Governance of SOEs

As of the end of February 2016, the top four Singapore-listed GLCs accounted for about 13.7 percent of total capitalization of the Singapore Exchange (SGX). Some observers have criticized the dominant role of GLCs in the domestic economy, arguing that it has displaced or suppressed private sector entrepreneurship and investment. GLCs funding decisions are often driven by goals emanating from the central government.

Local government could begin to buy stock in companies with the goal of taking them over or controlling them. Or buy them outright with borrowed money. Or set up a coop bank to fund local coops. The public banking movement to replicate

North Dakota’s public bank has been growing. A lot of vested interests are alert

to the dangers of such possibilities and thus keep them out of general discussion.

Here is one reason: this direct intervention in the market via a commercial venture would amount to distortion of competition — and is prohibited by law (at least in the EU).

I suspect most of the trade agreements might prohibit it.

I think it’s a great idea, but getting it to fly in the face of all those vested interests out there would be a tough one, let alone their trusty ideological ‘trump (small ‘t’) card that government is simply incapable of or very bad at running ‘businesses’ period.

Remember the neoliberals’ rationale for privatisation and deregulation? Big government always, always baaad, smaller and smaller government gooood….exactly for whom Isn’t even up for debate anymore sadly.

Government is by default and definition inefficient, wasteful, flabby etc and should stick to what it does best ie ‘governing’ and procuring and paying for the services of nimble, lithe, super efficient private providers in a ‘competitive’ presumably cut-throat market thus delivering unique VFM to taxpayers or chucking ever bigger bungs to big businesses at taxpayer expense and finding new and exciting euphemisms for them.

The other ‘problem’ I foresee is that in the UK, and I assume it’s the same in the US, most monies essentially come from central government, albeit often in a convoluted fashion, and there are currently pretty strict rules from central government dictating how, when and where they are spent. That even applies to monies raised directly by the local authorities themselves.

Still think it’s a positive idea though.

There’s a story here linking economic incentives with a “deskilling” of the political class producing the general lack of faith in that class. Not sure which is cause and which is effect.

They should ban companies from playing different regions of the US against each other. I believe that there may be such a law in Canada against other Canadian provinces (would have to check).

Net though, nobody but the corporations wins when corporations can play counties against each other. It leads to fewer budgets for everything else … like education.

What corporations want is something for nothing. They don’t want to pay taxes, but want good infrastructure and a highly educated workforce. Then when that workforce joins them, they don’t want to give them good wages or job stability. That’s what this is about.

When they talk of worker shortage … there’s no shortage of workers. Only a shortage of employers willing to pay a good salary and benefits to workers.

Sorry, happens all the time in Canada too, one province against the other, one city against the other, one village against the other, and town against unincorporated rural acreage.

Tax incentives for filming still fly under the radar. They include rebates, grants, and transferable tax credits (Louisiana filmmakers sold their credits to the oil industry) And when the incentives dry up, the filming goes away. New jobs are never created, they just move around from one state to the next or one country to the next as film crews chase work.

A friend of mine who works for the MPAA says that they think a multiplier effect of about 2.5 is conservative, with additional tourism being hard to quantify.

MPAA serves the producers – the recipients of the incentives. Again, that multiplier takes from one state and transfers to the next. No new jobs are created when observed at the national level. 4500 new jobs in one state is 4500 fewer jobs in another. The jobs are simply moved from one state to the next. Yes, it’s a new golden age and lots of tv shows are being filmed simultaneously, fewer movies are being made.

Look at the big picture not just the local level.

Just another neoliberal sleight of hand conducted in the name of mythical free markets then.

Cynically blurring the lines between the private and public sector (and most importantly its unique direct access to taxpayers money) has become the standard modus operandi for expectant, nomadic, fleet footed, tax averse mercurial ‘private’ big businesses.

Corporate welfare scroungers sniffing out the best deal under the premise of fiduciary duty and with more and more politicians either only too willing or desperate to oblige.

Forty years ago, one national NDP campaign (NDP, Canada’s version of a Labour Party, now “neo-labour”) flipped the language,that the Liberal and conservative parties were using, referring to homeless, unemployed, and hitchhiking hobos as welfare bums. They used a campaign slogan against “corporate welfare bums,” and in that election gained considerable increases in seats in Parliament.

Further, these tax forbearances and other subsidies have cumulatively been used to fund massive corporate stock buybacks and dividend payouts to the benefit of the usual suspects at public expense. There has been little or no reciprocal accountability required by the politicians. It’s like being invited to dinner at Le Bernardin, but your presumed host says he has to use the restroom, quietly departs, and leaves you stuck with the tab.

Here in Tucson, poor starving Caterpillar got more than just a tax break. It got free utilities.

And what a fool am I. Paying that Tucson Electric Power bill every month.

Link: http://www.tucsonsentinel.com/local/report/071216_caterpillar_lease/hidden-perk-caterpillar-lease-pima-county-building-free-utilities/

Funny you should mention consultants who got paid good money by municipalities despite failing to improve the situation.

Just this morning I checked despair.com to see if they had any new ‘Demotivator’ posters with their cynical slogans and ran across this one –

Consulting: If you’re not a part of the solution, there’s good money to be made in prolonging the problem.

It would be funny, if it wasn’t so achingly sad.

UK Guardian journalist Jacques Perretti did a rather good exposé on consultants PwC who basically charged credulous local government top, top dollar for hard sold, cut and paste ‘tailored solutions’ for ‘efficiency savings.’

‘Savings’ which councils were obviously incapable of spotting themselves plus I believe they negotiated a percentage of savings made, and which mostly amounted to little more than wholesale swingeing cuts in public jobs and services.

https://cymru-wales.unison.org.uk/news/press-release/2016/10/management-consultant-milks-public-purse/

Thx for the link.

I have a relative who is a consultant to private companies rather than governments, but generally works for large Fortune 500 companies. Asked him one day why the CEOs, who presumably know lots about their own company, need to hire consultants so often in the first place and what it is he does for them. He said he goes to talk to the lower level employees to find out what the problems with the company are and then reports back to the CEO and offers solutions. Seems the CEOs can’t be bothered to just talk to their own employees and don’t know nearly as much as they should about the companies they are supposedly in charge of.

You’re welcome and thanks for the reply.

I think it’s far more insidious than they can’t be bothered.

It’s partly down to an innate mistrust of the minions, the ‘them and us’ culture and the presumption that they couldn’t possibly contribute anything positive or insightful to an organisation outside of their own self-interests, which is kind of ironic when you think about it.

Also when austerity, job cuts etc is clearly the sole, yet unspoken aim there has to be this charade that every avenue has been explored and exhausted and if there’s some external professional ‘objective’ agent that has also come to this same necessary but regrettable conclusion then mores the better.

This is why Fidel Castro and Hugo Chavez used to joke about “comrade Bush”.

I can imagine a scenario where these handouts are illusionary. The Federal government can create money out of thin air by pressing a button. Suppose they do this and give some money to corporations as incentives but at the same time give money to the community. Then everyone could come out even. Yes, I know– that isn’t what is going on here.

Bernie thinks that we should promote co-ops, and I agree

https://medium.com/@PrestoVivace/bernie-sanders-on-building-co-ops-e821c053b07f#.1gmuyyupy

Argentina had a successful experiment in taking over closed factories.

These public-private partnerships are a mess here in Louisville, KY. First we had 4th Street Live (owned by Cordish and stained with a history of racial profiling) which has shown to not work out in the city’s favor after over 10 years, but we are doing it again. The recent one being Omni Hotel, a luxury hotel we have zero need for that is going to cost the state/city $139 million in lost tax revenue since we have to foot the bill to “attract” the developers. The justification for this bill being placed on the tax payers, 765 construction jobs (good for about 3 years max) and 320 permanent jobs (maybe). That is over $430000 of lost tax revenue per permanent job. Do you think those workers will make that kind of money over the lifetime of the hotel? I doubt it. Maybe someone in Omni management but definitely not the regular staff. Doesn’t seem like a great deal to me. Particularly since it serves such a niche market and the jobs are mostly service. Ask the state/city to devote this kind of money to a University of Louisville satellite campus in the West end (mostly black working poor) or South end (mixed demographics working poor) and they deliver a litany of excuses. Similar can be said for an affordable housing trust fund. If it serves the broadest social good it gets the least support.

There is a federal program offering more than $3 billion of tax credits annually, put in place in by the Clinton administration that upon first hearing about people think it is a scam. It is called the New Markets Tax Credit program and it provides “free money” to developments. The documentation is so complex and convoluted that only a limited number of law firms document these deals. As a consequence the fees are huge. Because of the structure of these deals they need to succeed for 7 years. So while they may have a noble sounding mission, the actual winners in receiving tax credits to their projects don’t really need the funds for their project to work. The entities involved talk up their “community benefits”, but in most cases the project was going to be done anyway. This is crony capitalism and the abuse is well below the radar of virtually all.

https://www.cdfifund.gov/programs-training/Programs/new-markets-tax-credit/Pages/default.aspx?utm_source=HUD+Exchange+Mailing+List&utm_campaign=b64b94e191-Promise_Zones_Update_10_27_2015&utm_medium=email&utm_term=0_f32b935a5f-b64b94e191-19340809

I did a search for “broadband” in the article and the comments (I read the article, too), and concluded that as far as those consultants are concerned, community broadband is not an option to consider when helping cities to fix their ailing economies. In other words, they seem to think that direct subsidies to business is better than creating public infrastructure that everyone can use.

I offer the use of community broadband and the city of Ammon, Idaho as a case in point, and in contrast to typical ideas suggested by those consultants. In Ammon, they found a way to build community broadband by building infrastructure with a clearly defined public use and selling excess capacity to customers who happen to be on the route for the cable they laid.

In this video, they show a shot from the air, of the border between Ammon and Idaho Falls, a neighboring city to demonstrate the growth inspired by community broadband. Community broadband is a very powerful “come hither” message that has worked in places like Chattanooga, Tennessee and Cedar Rapids, Idaho and even Wilson, North Carolina.

I really admire your work here on Naked Capitalism and suggest that you interview Christopher Mitchell, director of Community Broadband Networks (https://muninetworks.org/) to investigate the economic benefits of community broadband. I think it’s time that cities and states consider building community networks before building another stadium to grow the local economy.

Due to NAFTA the rust belt has been forced to compete with Mexico’s incentives — which are LARGE.

The only prospective force to stop this trend is Trumpian economics.

The President is attacking Mexico’s incentives… for now just using the Bully Pulpit.

Not to worry. Trump will change his tune once the big boys have a talk with him.