By Alex Cobham. Originally published at Tax Justice Network

Last week I took up the kind invitation of the government of Cayman to speak at their conference on ‘Tax Transparency in the Global Financial Services Ecosystem’, and to meet with staff from the monetary authority, statistics office and corporate registry; and with a range of industry representatives including those from the compliance association and Cayman Finance. Above is a video of my presentation; and here a few reflections on the divergences between reputation, rhetoric and reality; and on where things now stand.

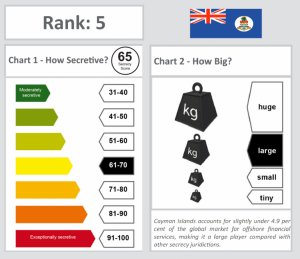

Per the most recent Financial Secrecy Index, of 2015, Cayman ranks 5th. This reflects a high degree of financial secrecy: a score of 65 out of 100, where 100 indicates total secrecy; and a significant scale: the islands account for nearly 5% of all financial services provided globally to non-residents. Full details and a narrative history of Cayman’s emergence as a secrecy jurisdiction are provided in the Financial Secrecy Index (FSI) report.

Of the four jurisdictions ranking above Cayman in the FSI, three have a similar scale but higher secrecy scores: Switzerland (ranked first), Hong Kong (2nd) and Singapore (fourth). Only the USA, ranked third, has a lower secrecy score of 60 – but a much bigger scale. On a pure ranking by secrecy, Cayman would come around 50th in the world – but the great majority of those with higher secrecy scores, like Vanuatu or the Cook Islands, provide only a negligible share of global financial services exports.

And so Cayman’s importance brings with it a greater responsibility to transparency. The monetary authority reports Cayman as the leading domicile for hedge funds; the second largest offshore captive domicile for insurance overall, and the largest for health insurance captives in particular; and with total net assets in Cayman-regulated funds of $3.575 trillion in FY 2015 (more than 5% of the value of all publicly traded shares).

The sheer scale of money passing though the Cayman Islands means that the secrecy offered in Cayman can do much greater damage internationally, by promoting tax abuses and other forms of corruption, than the higher secrecy of, say, Samoa (which ranks 51st on the FSI). Similarly, the USA ranks above Cayman on the FSI despite a slightly lower secrecy score, because of its global dominance in financial services.

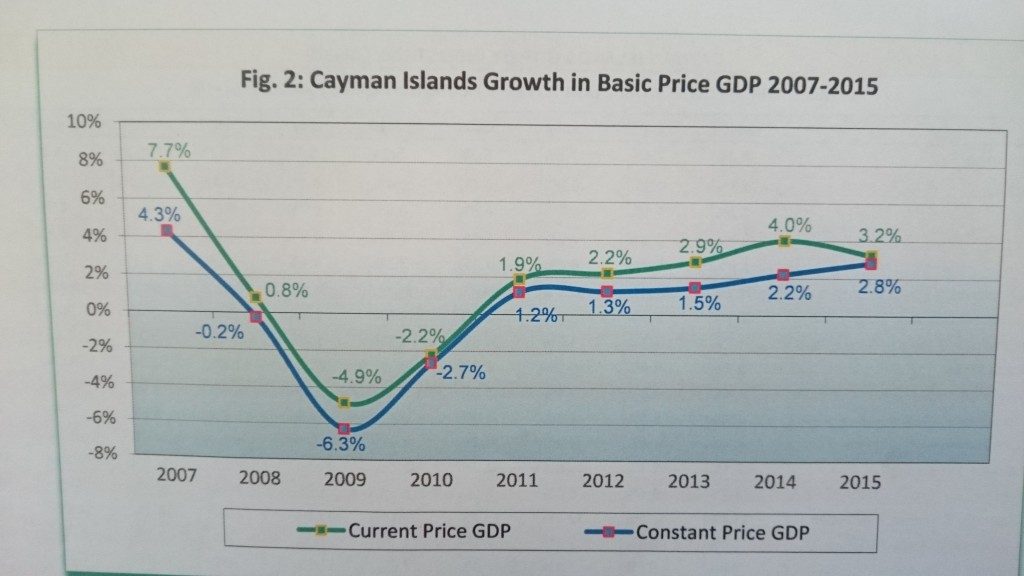

The same success in attracting financial services, of course, also represents the greatest threat to Cayman. Such is the dependence on this sector, that not only are others crowded out but the whole economy is more volatile as a result (see graph). Researchers at the IMF find as a result that economic growth suffers in countries with financial sectors in which private sector credit exceeds GDP. In Cayman, this has long been the case. And such economic assessments do not touch on the ultimately greater political costs associated with the finance curse.

The same success in attracting financial services, of course, also represents the greatest threat to Cayman. Such is the dependence on this sector, that not only are others crowded out but the whole economy is more volatile as a result (see graph). Researchers at the IMF find as a result that economic growth suffers in countries with financial sectors in which private sector credit exceeds GDP. In Cayman, this has long been the case. And such economic assessments do not touch on the ultimately greater political costs associated with the finance curse.

Reputation does not always align with the facts. There is a great sense of injustice in Cayman that it seems always to be the offshore centre named in TV and film, almost as short-hand for ‘this is a bit dodgy’. The ‘Grisham effect’ is often blamed for this, reflecting the prominent role of Cayman in the 1991 film The Firm.

Every person I spoke with from the company formation industry made a similar point: that the due diligence and customer verification processes in Cayman are significantly stricter than in many other jurisdictions where their organisations operate (examples of lax practice included other centres in the region, but also the Netherlands and the UK). ‘Well they would say that…’, perhaps; but of course this aligns with the type of evidence that Jason Sharman and colleagues have collected through mystery shopping exercises on the relative rigorousness of company formation providers in different jurisdictions.

Where the argument becomes less compelling, of course, is when superior verification is given as a reason against publication of beneficial ownership registers. On the contrary, third-party verification and open publication should be seen as complementary approaches, both likely to strengthen the ultimate quality and value of the data. The existence of bad data in the UK public register, for example, is not an argument against its continuing publication but in favour of enhanced capacity at Companies House to monitor, verify and challenge. And the existence of potentially better data held privately in Cayman provides no argument at all against publishing.

On the contrary, such quality would create an opportunity for Cayman to demonstrate real leadership among the offshore centres by becoming the first to put their verified data into a public register. The price of this might be to lose a little, less reputable business – but the benefit would come in terms of challenging the negative reputation, and of insulating the clean, higher value-added financial services from the damage that would come from a Panama Papers-type leak.

The stated position both of government (with elections pending) and industry, is that Cayman should wait until there is a strict international standard in place which requires public registers. A major part of the defence offered for this approach is the complete lack of interest in transparency from the secrecy jurisdiction to the north – that is, the USA. Many people I spoke with highlighted the ease with which criminals can establish and use anonymous structures in multiple US states – while the pressure and bad reputation remains very much with Cayman and other smaller jurisdictions.

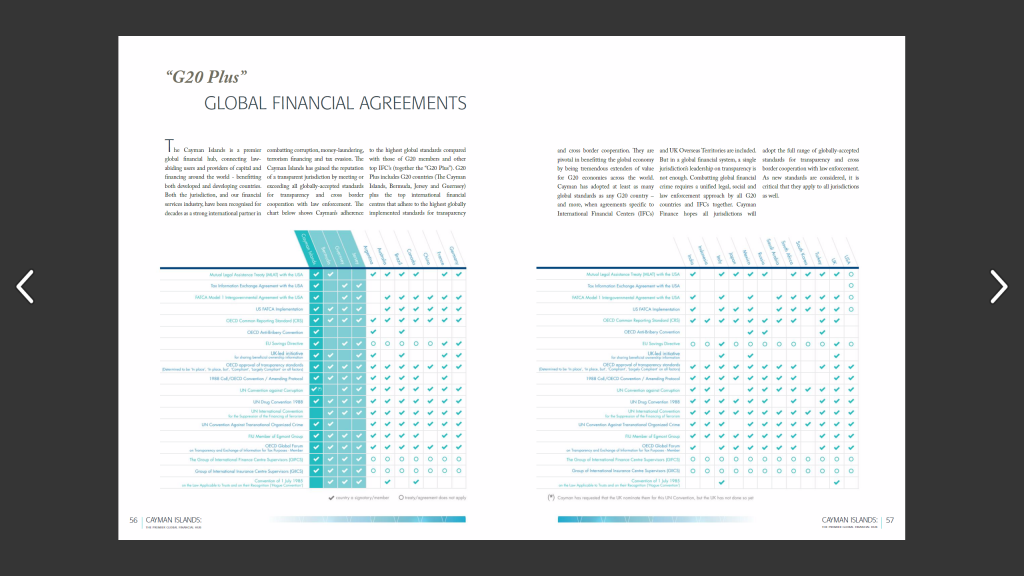

In this respect, there is common ground with the work of TJN. There is no tax justice in beating up smaller jurisdictions while the major economies continue secrecy practices, and for this reason we have long highlighted the threats of ‘tax haven USA‘ and the UK’s secrecy network, and through the Financial Secrecy Index promote the use of objectively verifiable criteria to ensure a level playing field. In a similar vein, here’s a piece from Cayman Finance (p.56) which starts to compare a few financial centres (the ‘G20 Plus’) with G20 members.

In this respect, there is common ground with the work of TJN. There is no tax justice in beating up smaller jurisdictions while the major economies continue secrecy practices, and for this reason we have long highlighted the threats of ‘tax haven USA‘ and the UK’s secrecy network, and through the Financial Secrecy Index promote the use of objectively verifiable criteria to ensure a level playing field. In a similar vein, here’s a piece from Cayman Finance (p.56) which starts to compare a few financial centres (the ‘G20 Plus’) with G20 members.

The conference focused, in effect, on our longstanding policy platform, the ABC of tax transparency:

- Automatic, multilateral exchange of tax information

- Beneficial ownership (public registers for companies, trusts and foundations); and

- Country-by-country reporting (public).

I don’t think Cayman will be signing up to the public elements in particular any time soon. But a few years ago, there would have been a comprehensive rejection of the whole thing – whereas I was able to commend the government on signing up to automatic exchange under the OECD CRS (from 2018); and on committing to introduce (private) country-by-country reporting under BEPS. Halfway to the ABC?

There may be just a little more mutual understanding after last week – a little more awareness of the extent to which we share an interest in a level playing field, and a little more clarity on the transparency demands of civil society and the basis for making them. Because we’re not going away…

My speaking notes are here, and the video at the top of the page. See also the very interesting opening presentation from Pascal Saint-Amans, and a panel including Radhanath Housden from the Global Forum among others, and the closing session.

Cobham, not Coburn.

Thanks, it’s fixed now.

If you actually go to the Caymans on a ship, you will be astounded not to say horrified, at the actual fact that they are AWASH much of the time; BRIT BS conquers all!

Actually it should be pointed out that there are 3 islands in the Caymans 2 of which have no financial centers of any significance, (Cayman Brac and Little Cayman, 60 miles east of Grand Cayman). Cayman Brac does get to an elevation of 300 feet at the east end due to uplift. I used to scuba dive and the two out islands have far better diving than the main island. Most of the financial operations are in Georgetown the Capitol on the west end of Grand Cayman where the cruise ships stop and deliver their passengers by lighter to the shore. (The cruise ships are by far the tallest things around Georgetown) The area north of Georgetown is where the big resorts are.

The US is secrecy jurisdiction numero uno. However, many in the Tax Justice community are reluctant to point this out as there are very few Democrats never mind any Republicans who are willing to change this while far more Democrats are willing to criticize the Caymans. Plus they are helped by Hollywood which has never thought to portray the US itself as a tax haven unlike the Caymans or Panama. Thus for the Tax Justice community it is far far easier to go after little fish like the Caymans instead of big fish like Delaware.

Second there is a very strong argument that the Caymans made a mistake in signing up for both A and B without the US doing so. This has been for both the Caymans and the world. Far better to make A and B conditional on the US Congress also agreeing on doing so.

“Thus for the Tax Justice community it is far far easier to go after little fish like the Caymans instead of big fish like Delaware.”

Ka-Ching!

Deleware is not a secrecy jurisdiction. Beneficial owners and company registers are listed. Tax avoidance and secrecy are two different things.

There are secrecy vehicles in the like Wyoming limited liability companies, but that is not Delaware.

Nicholas Shaxson, who is part of Tax Justice Network, has written about how the Caymans are part of the US secrecy structuring, the same way places like the Isle of Man and Gibraltar are for the City of London.

Restriction of Capital is restriction of freedom and liberty…. saith the load….

disheveled… in a mood amends…

@skippy

You are so right.