By Raúl Ilargi Meijer, editor of Automatic Earth. Originally published at Automatic Earth

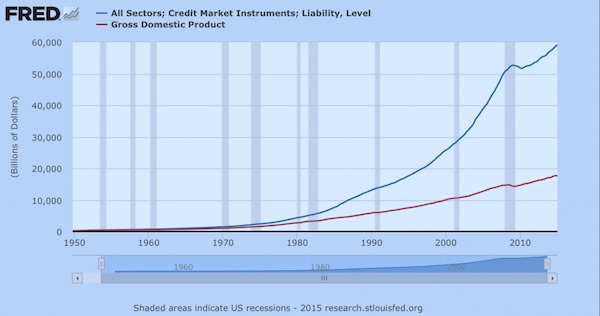

We are witnessing the demise of the world’s two largest economic power blocks, the US and EU. Given deteriorating economic conditions on both sides of the Atlantic, which have been playing out for many years but were so far largely kept hidden from view by unprecedented issuance of debt, the demise should come as no surprise.

The debt levels are not just unprecedented, they would until recently have been unimaginable. When the conditions for today’s debt orgasm were first created in the second half of the 20th century, people had yet to wrap their minds around the opportunities and possibilities that were coming on offer. Once they did, they ran with it like so many lemmings.

The reason why economies are now faltering invites an interesting discussion. Energy availability certainly plays a role, or rather the energy cost of energy, but we might want to reserve a relatively larger role for the idea, and the subsequent practice, of trying to run entire societies on debt (instead of labor and resources).

It almost looks as if the cost of energy, or of anything at all really, doesn’t play a role anymore, if and when you can borrow basically any sum of money at ultra low rates. Sometimes you wonder why people didn’t think of that before; how rich could former generations have been, or at least felt?

The reason why is that there was no need for it; things were already getting better all the time, albeit for a briefer period of time than most assume, and there was less ‘want’. Not that people wouldn’t have wanted as much as we do today, they just didn’t know yet what it was they should want. The things to want were as unimaginable as the debt that could have bought them.

It’s when things ceased getting better that ideas started being floated to create the illusion that they still were, and until recently very few people were not fooled by this. While this will seem incredible in hindsight, it still is not that hard to explain. Because when things happen over a period of decades, step by step, you walk headfirst into the boiling frog analogy: slowly but surely.

At first, women needed to start working to pay the bills, health care and education costs started rising, taxes began to rise. But everyone was too busy enjoying the nice slowly warming water to notice. A shiny car -or two, three-, a home in the burbs with a white picket fence, the American -and German and British etc.- Dream seemed to continue.

Nobody bothered to think about the price to pay, because it was far enough away: the frog could pay in installments. In the beginning only for housing, later also for cars, credit card debt and then just about anything.

Nobody bothered to look at external costs either. Damage to one’s own living environment through a huge increase in the number of roads and cars and the demise of town- and city cores, of mom and pop stores, of forest land and meadows, basically anything green, it was all perceived as inevitable and somehow ‘natural’ (yes, that is ironic).

Damage to the world beyond one’s own town, for instance through the exploitation of domestic natural resources and the wars fought abroad for access to other nations’ resources, only a very precious few ever cared to ponder these things, certainly after the Vietnam war was no longer broadcast and government control of -or cooperation with- the media grew exponentially.

Looking at today’s world in a sufficiently superficial fashion -the way most people look at it-, one might be forgiven for thinking that debt, made cheap enough, tapers over all other factors, economic and otherwise, including thermodynamics and physics in general. Except it doesn’t, it only looks that way, and for a limited time at that. In the end, thermodynamics always beats ‘financial innovation’. In the end, thermodynamics sets the limits, even those of economics.

That leads us into another discussion. If not for the constraints, whether they emanate from energy and/or finance, would growth have been able to continue at prior levels? Both the energy and the finance/political camps mostly seem to think so.

The energy crowd -peak oilers- appear to assume that if energy would have been more readily available, economic growth could have continued pretty much unabated. Or they at least seem to assume that it’s the limits of energy that are responsible for the limits to economic growth.

The finance crowd mostly seems to think that if we would have followed different economic models, growth would have been for the taking. They tend to blame the Fed, or politics, loose regulation, the banking system.

Are either of them right? If they are, that would mean growth can continue de facto indefinitely if only we were smart enough to either make the right economic and political decisions, or to find or invent new sources of energy.

But what kind of growth do both ‘fields’ envision? Growth to what end, and growth into what? 4 years ago, I wrote What Do We Want To Grow Into? I have still never seen anyone else ask that question, before or since, let alone answer it.

We want growth by default, we want growth for growth’s sake, without caring much where it will lead us. Maybe we think unconsciously that as long as we can secure growth, we can figure out what to do with it later.

But it doesn’t work that way: growth changes the entire playing field on a constant basis, and we can’t keep up with the changes it brings, we’re always behind because we don’t care to answer that question: what do we want to grow into. Growth leads us, we don’t lead it. Next question then: if growth stops, what will lead us?

Because we don’t know where we want growth to lead us, we can’t define it. The growth we chase is therefore per definition blind. Which of necessity means that growth is about quantity, not quality. And that in turn means that the -presupposed- link between growth and progress falls apart: we can’t know if -the next batch of- growth will make us better off, or make our lives easier, more fulfilling. It could do the exact opposite.

And that’s not the only consequence of our blind growth chase. We have become so obsessed with growth that we have turned to creative accounting, in myriad ways, to produce the illusion of growth where there is none. We have trained ourselves and each other to such an extent to desire growth that we’re all, individually and collectively, scared to death of the moment when there might not be any. Blind fear brought on by a blind desire.

As we’ve also seen, we’ve been plunging ourselves into ever higher debt levels to create the illusion of growth. Now, money (debt) is created not by governments, as many people still think, but by -private- banks. Banks therefore need people to borrow. What people borrow most money for is housing. When they sign up for a mortgage, the bank creates a large amount of money out of nothing.

So if the bank gets itself into trouble, for instance because they lose money speculating, or because people can’t pay their mortgages anymore that they never could afford in the first place, the only way out for that bank, other than bailouts, is to sign more people up for mortgages -or car loans-, preferably bigger ones all the time.

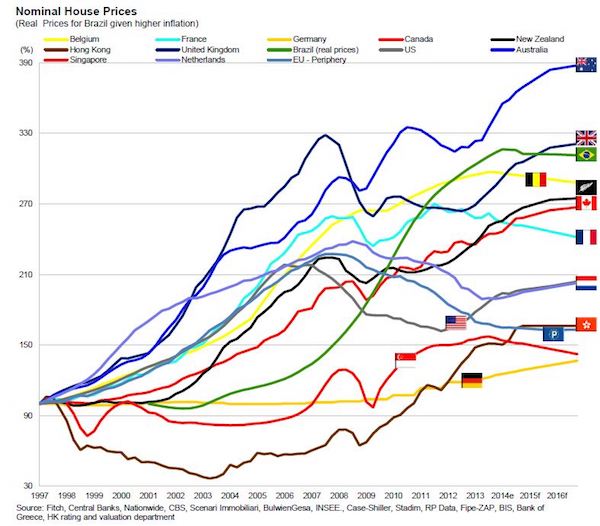

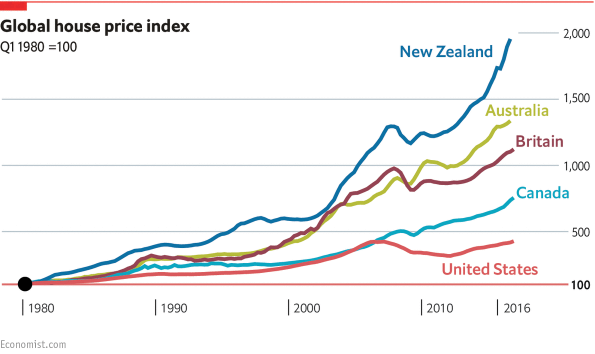

What we have invented to keep big banks afloat for a while longer is ultra low interest rates, NIRP, ZIRP etc. They create the illusion of not only growth, but also of wealth. They make people think a home they couldn’t have dreamt of buying not long ago now fits in their ‘budget’. That is how we get them to sign up for ever bigger mortgages. And those in turn keep our banks from falling over.

Record low interest rates have become the only way that private banks can create new money, and stay alive (because at higher rates hardly anybody can afford a mortgage). It’s of course not just the banks that are kept alive, it’s the entire economy. Without the ZIRP rates, the mortgages they lure people into, and the housing bubbles this creates, the amount of money circulating in our economies would shrink so much and so fast the whole shebang would fall to bits.

That’s right: the survival of our economies today depends one on one on the existence of housing bubbles. No bubble means no money creation means no functioning economy.

What we should do in the short term is lower private debt levels (drastically, jubilee style), and temporarily raise public debt to encourage economic activity, aim for more and better jobs. But we’re doing the exact opposite: austerity measures are geared towards lowering public debt, while they cut the consumer spending power that makes up 60-70% of our economies. Meanwhile, housing bubbles raise private debt through the -grossly overpriced- roof.

This is today’s general economic dynamic. It’s exclusively controlled by the price of debt. However, as low interest rates make the price of debt look very low, the real price (there always is one, it’s just like thermodynamics) is paid beyond interest rates, beyond the financial markets even, it’s paid on Main Street, in the real economy. Where the quality of jobs, if not the quantity, has fallen dramatically, and people can only survive by descending ever deeper into ever more debt.

Do we need growth? Is that even a question we can answer if we don’t know what we would need or use it for? Is there perhaps a point, both from an energy and from a financial point of view, where growth simply levels off no matter what we do, in the same way that our physical bodies stop growing at 6 feet or so? And that after that the demand for economic growth must necessarily lead to The Only Thing That Grows Is Debt?

It’s perhaps ironic that the US doesn’t appear to be either first or most at risk this time around. There are plenty other housing markets today with what at least look to be much bigger bubbles, from London to China and from Sydney to Stockholm. Auckland’s bubble already looks to be popping. The potential consequences of such -inevitable- developments are difficult to overestimate. Because, as I said, the various banking systems and indeed entire economies depend on these bubbles.

The aftermath will be chaotic and it’s little use to try and predict it too finely, but it’ll be ‘interesting’ to see what happens to the banks in all these countries where bubbles have been engineered, once prices start dropping. It’s not a healthy thing for an economy to depend on blowing bubbles. It’s also not healthy to depend on private banks for the creation of a society’s money. It’s unhealthy, unnecessary and unethical. We’re about to see why.

This is one of the most succinct analyses of what we are doing and what we are in for. It answers my question about why each new subdivision where I live has bigger and bigger houses built on it. I think it is preposterous that a family of two or maybe four roams around in a three-story house with three bathrooms and four bedrooms in a highly priced home.

Growth is really destruction when you think about it: destruction of the trees cut down to build homes; destruction of the earth beneath the house that can no longer grow crops; destruction of bird’s nests (by the thousands) when the trees are cut down; destruction of the water polluted by runoff; destruction and erosion from other plant removal, etc. And my example is just the building of one house–multiply that by many hundreds of thousands and the destruction becomes world wide. This is mind-boggling!

New builds keep on getting bigger here too… it gives people the idea that resources and energy are plentiful. Many don’t seem to realize that this growth is based on short-termism and externalities.

It’s ironic that houses are getting ever bigger when environmental and infrastructural problems are ballooning.

On a similar vein, a heavily wooded lot near my home was clearcut about a year ago and an office building was constructed. It sits vacant to this day. I have no idea what the speculative motivation for constructing the building was, but the entire character of the area was irrevocably changed for the worst. Where once a beautiful natural environment soothed the soul and offered habitat for numerous creatures, an unsightly building now stands- unused. Concrete, asphalt, and minimal landscaping. It is really a hole in the world. An unused hole.

The building is currently maintained though unoccupied, no doubt the investors still hoping to unload the property. With a downturn in the economy, the building is headed for abandonment. The only bright spot is that the forest will eventually reclaim the land- in only a few hundred years.

Is it owned by a private equity fund?

Here in Ottawa, every time a building goes against the welfare of the community, it seems to be owned by a private equity fund.

Out in the burbs, one building owner charges peanuts for parking… just to be annoying? Private equity.

Gym cutting costs… not enough towels with bad ventilation… private equity owns building and gym debt financed by private equity firm.

The list goes on… then when I mention that pension plans are destroying our economy all hell breaks loose.

Also the sand of waterways and coastal beaches worldwide shrinks fast; to be used in concrete and other building materials.

The mining of sand, a non-renewable resource

SAND MINING

Beach sand can not be used for making concrete.

https://www.quora.com/Why-is-sea-sand-not-used-for-construction-purposes-1

sand is renewable, sort of. parrotfish and certain other animals that feed on corals create sand through defecation. of course, the supply of coral is disappearing.

Top article! Banks rent-seeking like there’s no tomorrow have ensured for many borrowers there will be no tomorrow. But the banks will be OK: they’ll be bailed out for their excesses. As Michael Hudson says, the FIRE sector (finance, insurance and real estate) is running rampant at enormous cost to the real economy.

“We want growth by default, we want growth for growth’s sake, without caring much where it will lead us.”

We are cancer.

http://www.steadystate.org

“It’s also not healthy to depend on private banks for the creation of a society’s money. It’s unhealthy, unnecessary and unethical.”

Altogether, a great post — Thank you, Ilargi and Yves!

Extending this line of thought, the article (and your link) makes it very clear why economic growth, especially growth with no goal is unsustainable and damaging.

The same is true for population. Overpopulation leads to increased exploitation, increased ecological destruction, a decreasing standard of living and increased suffering for billions.

Population growth for the sake of growth leads to the same unmanageable and unjust state of affairs that we see in unsustainable economic growth.

Overpopulation is also a driver for that economic instability as resources and energy to keep that keep real-econ growth going become thinner and thinner and more capital is funneled into speculative bubbles, less real resource dependent.

Population growth can either be managed, stabilized and slowly reduced, just as unfocused and exploitative economic growth should be, or we have 2 other choices.

The entire world population lives at the same standard in terms of energy and caloric intake as rural Nigeria or we continue to blow a giant population bubble that will pop with truly disastrous effects that we may never come back from.

Indeed a great post. The focus on thermodynamics is why.

When we look at biological systems, “growth” is balanced by “consumption”; or more technically, photosynthesis is balanced by respiration. Hence even though the biosphere is very active, it consumes as much as it creates, so it is in steady state. So the grass grows every year, then is eaten every year, and life goes on at a placid rate. Can humans learn to live like this?

This society encourages the opposite behavior – accumulate, accumulate, accumulate. One small house? Get a bigger house. Get a vacation home. Get two vacation homes. Put two cars and a truck in each home. Buy a boat and an airplane. Put expensive electronics in every home. Buy food imported from all over the world. Fly all over the world for expensive vacations. That’s the dream. Of course everyone can’t live like this so there has to be a large servant class to take care of the elite class. But they are encouraged to consume as much as possible, too. One house, maybe, but lots of electronics. Garages stuffed with exercise machines and stuff they bought on sale but never use. Closests full of clothes they never wear, huge racks of shoes. And huge credit bills to pay for all the stuff. Let alone all the addictive substances to blow money on, from alcohol to opiates to tobacco, more money down the rat hole.

I don’t get it. I’d rather have a tiny cottage on a huge lot with a garden and a hedgerow than a huge house covering the whole lot. I could grow a lot of my own food, I’d have space outside, I’d never buy any processed food, I’d rarely eat out, I could invest in solar panels and cut down on energy use and be perfectly happy. And if everyone did this, they’d call it an economic recession because nobody would be buying all the cheap plastic crap imported from China.

What kind of screwed-up system have we invented? A system that deliberately produces greed, envy, anxiety, depression, misery, so go buy more useless shit to make yourself feel better, that’s the essence of this society. It’s everywhere, you can’t get away from it – everyday interactions with people consumed by this mentality, it’s like living with a pack of crazed idiot monkeys high on consumerism. Alienation is a sign of sanity.

“The focus on thermodynamics is why.”

There is no reason to believe that thermodynamics applies to anything but thermodynamics. Why not apply the “law of gravity” to economics?

It’s just another attempt to apply “science” or sciency sounding words and “laws” to stuff that science has never been able to model, let alone predict in any reliable way. Which, seems very un-sciency.

It does. What goes up must come down.

Congratulations. You just proved his point.

Economics is an ecological system by extension. Living organisms (us) are using energy resources from the environment (our food is oil) to generate a “civilizational free energy” that allows us to do things and increase our population.

This is exactly the kind of system that is bound by laws of thermodynamics (maximum efficiency, inevitable loss, etc).

We create mighty illusions that humans are somehow divorced from the laws of physics. We print trillions and call ourselves rich.

Self deception only lasts for so long. People will realize that the perpetual motion machine they have been sold (the economic model of eternal growth as the basis for our entire civilization) only in a time of it’s-to-late-now-mega-crisis.

My parents were both classical musicians. I am so lucky! In our home there was never money for the latest gizmo, but always enough to pay for piano lessons. My mother cut everybody’s hair, but opened bank accounts in my sister’s and my names when we were born — our “college accounts.” We had very nice home-cooked meals, but never ate out. I remain profoundly grateful to my parents for the example they gave us: that neither money nor material goods could constitute a worthy aim in life.

Debt and printing has permitted us to keep on getting the resources and energy to keep the game going.

Over the last 5 decades, the number of people enjoying developed world creature comforts has gone from maybe 500 million to maybe 2 billion. But those not enjoying this have gone from 3 billion to 5 billion.

There is a limit to this materialism and this fact has been creeping up on us in developed countries. Most think it’s only the 1% not sharing when instead we are probably facing a global redistribution of resources. IMO, most in developed countries are confusing past wealth and future wealth… infra and a structure of society that needs mega energy and resources might just be wealth destroying.

Who needs MONEY when one can have debt to infinity?

Ten years ago I wondered how people could afford the big homes, cars and all of the consumer products they were buying. 45 years ago I bought a home. I thought I got a deal at 7 3/4% interest. At that time a car loan was a good deal at 10% or less. Knowing this I wondered how people could be buying so much stuff when real wages were not any better than when I joined the work force in 1963. Then it hit me like a brick thrown into my face. It was because of so called cheap money. This leads people to borrow more than they really should because as long as they could make the payment everything would be fine. That is as long as they don’t experience a crises like becoming unemployed , their job disappearing ,or having to take a job at a lower wage. Also they may become sick or disabled and not able to work. Neoliberal economics created the false economy. Then came the great recession that is still effecting the majority of the population. It happened gradually so most people dind’t see it coming. Not mentioned that I believe is important is the creation of the student debt bubble. These college graduates, who were prime candidates to buy homes and consumer goods, found out they had no extra money after they paid their student debt. In fact many were forced to live with their parents. This removed an entire generation from the housing market and excess consumption. Until we have a drastic overhaul of how the economy functions things will only get worse for the majority of people. A major crises is in the making when present day working people reach retirement age. Since the vast majority of them lack enough resources they will retire in poverty or be forced to work until the die. The future looks very grim for the majority of todays working population.

Over the last few decades, stats show that something like 40% of 55+ are forced into early retirement due to sickness or restructuring…

Since debt has grown drastically in the older group over over the last few decades, we are definitely facing a crisis.

The old could always just file bankruptcy, and zero out all that unplayable student-loan and consumer-credit and mortgage debt… oh wait, I forget a fresh star is only for corporate persons…

Or we olds could do what heedless youngs and the neolibs advise: Just Die!

Thank Joe Biden for that.

Yah, that jovial bustards name was in mind at the moment.

Of course, he didn’t do it all by himself…

No . . . but he was happy to help. In fact, he was happy to lead and take some of the credit for it.

There was a TV commercial several years ago with a crisply dressed, smiling man mowing the immaculate lawn of his McMansion, with a new SUV in the driveway, seemingly living the American Dream.

The narration asked ‘How do they do it?’ with the answer being ‘They’re up to their eyeballs in debt’. As someone brought up to be extremely debt averse, that commercial really hit home.

I tried to make do with what my paycheck would allow and yet I’d see others who I knew made about the same salary as me living much better and I never could figure out how they managed. Fast forward several years and my wife is out for a ‘ladies night’ with 3-4 other moms who all have larger homes, more cars, and go on more expensive vacations than we do. They started talking about pooling some money to start an investment club. As they got to talking about their financial situations, ALL of them except us had declared bankruptcy in recent years to get out from under their debt burdens.

This seems to be the dirty little secret of life in the US – if you’re not in the 1%, the only way to ‘keep up with the Joneses’ is to take on unsustainable debt.

What does “living much better” actually mean, I wonder?

Rich folks apparently display very pointedly a flaw in human wiring: an infinite capacity to absorb self-pleasing “getting and spending.” Hardly a new observation, cf. Wordsworth, 1888: http://www.bartleby.com/145/ww317.html

“We” have no idea of “enough,” not a clue about eating to a reasonably hunger and stopping with the satisfaction of a reasonable thirst. And of course zero agreement on what is “reasonable:” how dare “we” deny the agile and corrupt, or the desperate and oppressed, their shot at yuuuuge consumption and destruction?

I’m not likely to live to see it, but it sure seems like there’s a big die-off coming — and once again, the Few who promote and profit from it, who serve up the cultural corpse that “we” have been trained to recognize as “good,” with a heaping helping of Bernays sauce ™…

So some of “:us” recognize the problem. Next question is, what is ?(or is there) a solution?

That wasn’t the best choice of words on my part – living more expensively would have been better.

But you’re right and it does get to the heart of the problem – how much is enough? Running an economy based on financialization is not going to end well.

And about the die-off, it’s already here. It just hasn’t affected humans yet so we pretend not to notice. Everything will be OK though – until suddenly it isn’t.

Thank You for the Wordsworth! This one is often running in my mind:

The Second Coming

By William Butler Yeats

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Surely some revelation is at hand;

Surely the Second Coming is at hand.

The Second Coming! Hardly are those words out

When a vast image out of Spiritus Mundi

Troubles my sight: somewhere in sands of the desert

A shape with lion body and the head of a man,

A gaze blank and pitiless as the sun,

Is moving its slow thighs, while all about it

Reel shadows of the indignant desert birds.

The darkness drops again; but now I know

That twenty centuries of stony sleep

Were vexed to nightmare by a rocking cradle,

And what rough beast, its hour come round at last,

Slouches towards Bethlehem to be born?

Apparently the great “die-off” has already started in the U.S., and white Usian’s are leading the way.

https://www.nytimes.com/2016/06/01/health/american-death-rate-rises-for-first-time-in-a-decade.html?_r=0

Just 72 myself; so I don’t expect to see the worst of it…

The ‘rich folks’ I know are remarkable for their lack of spending. It’s not that they make more money than others, though some do. It’s that they consume less and invest their savings. Nobody wants to hear that.

‘The Millionaire Next Door’ was a popular book with an unpopular message: as far as becoming wealthy goes, playing defense is more important than playing offense. A frugal wife is very helpful. Planning is important. Some of the millionaires in the book never earned more than $75,000 a year.

Nobody wants to hear those messages of self sacrifice. Too bad. They work.

A more equitable society isn’t just a Lefty’s wet dream or a thinly veiled disguise for the politics of envy.

Constantly striving to aspire to it, which can only be achieved by ‘good’ government incidentally rather than relying on the largely pointless symbolic acts of often well meaning individuals, actually makes sound economic sense as well as social.

I’ve always believed that the sole justification for current warped status quo, for those who make their money largely in their sleep, is that maybe they like to see themselves as closet environmentalists, albeit self-serving eco-warriors, whose very actions effectively amount to the suppression of consumption through controlled impoverishment by debt.

I believe we should all be more frugal when it comes to goods and services that are resource and energy intensive.

However, those millionaires next door getting rich on 70k incomes needed the market returns to get them their million or 2. So their wealth depended on the masses’ overconsumption.

Yes indeed, I agree, and the power that accruing wealth allows them to exercise ever more control of course. The environmental ‘upside’ is clearly an unintended, if arguably positive, consequence.

Thanks to the close to tested to destruction debt based money system the ‘masses’ are merely one component of demand. Their sheer numbers ensure a ready supply of consumers, thus rendering them expendable to those best placed to exploit them.

They are sustained increasingly at subsistence levels because, as you rightly say, they are vital to sustaining the wealth advantage of those who need them, but in their eyes, to coin a phrase, ‘there’s one born every minute.’

Moneta: I certainly agree that the Millonaire Next Door who got their on $70K or less probably needed the stock market to get there. However, I think the more typical MND got there by being thrifty while building a business, often a not very sexy business having to do with some obscure service that one would never think of when describing a millionaire.

We all need each other in some way. What many of the utopians writing on this page miss–I don’t consider you among them, I might add–is how many services and goods would stop being produced, and how many jobs would disappear, if income and property were suddenly taxed at the levels they prefer.

I tried to make do with what my paycheck would allow and yet I’d see others who I knew made about the same salary as me living much better and I never could figure out how they managed.

Sounds like you still have dry powder! I think you should put on your Altruism Hat and start buying down your neighbors debts!

Maybe park your beater on the driveway so there room to fix their fking jetskiis in your garage while you store them??

Perhaps ‘letting the Joneses pull ahead’ is a viable behavioral alternative. At least for some.

Housing is really raging again. Who thought it was possible to have a second bubble in a decade? We’re looking at a 6% rise in the last six months around here!

This is a terrible way to run a society.

We’ve got a huge cohort hitting retirement years. According to the pension structure that was determined decades ago, this retirement needs to be financed with either markets and/or real estate.

Since something like 75% of our leaders are part of that cohort which needs high valuations, can we expect anything different?

We know when and where we’re born, but know not when and where we’ll die.

“Contributions” is a euphemism for taxes, implying that the difference between “pre-funding” and “pay-as-you-go” seems one of perception and deception…

Funding implies using capital markets to exploit the planet.

Pay as you go would mean taking from the workers’ pay to give to retirees… nobody wants to pay taxes so markets are used…

Huh? Not sure how you got to ” exploit the planet” from my comment, but it mostly seems that when using the word “capital”, the distinction between the nominal and the real always seems blurred, whether willingly or unwittingly.

Interesting that you would use a phrase like ” taking from the workers’ pay” and use the word “retirees” as opposed to retired workers, while never considering a LVT and a TFRT…taxes have never been voluntary, and tax-cuts ARE debt write-downs, implying that an ISSUER of a currency CAN write-down a USERS “private” debt much more readily than a USER-as-creditor will…

Let’s say the retiree needs to buy groceries and then you tax the land value of the rich retiree to pay for the poor retiree’s grocery bill… the rich retiree is still not working. It’s the worker who still gets to produce the food and the retiree who gets to eat it. Great… the worker gets to work for the benefit of others.

At the end of the day, the real world trumps the money world. It’s the workers who produce the goods and services no matter how many dollars you print. So if you print and tax in a way where the workers stop working or become less productive, you are in trouble.

It’s like the Spaniards thinking that coming back with shiploads of gold from the new world will make them rich while their economy has not changed. Just huge inflation or loss of purchasing power.

Just as a reminder, the constraints on a USER of a currency are not the same constraints on an ISSUER…and in this context, taxes do NOT fund spending. However taxes can AND do modify behavior.

>” Great… the worker gets to work for the benefit of others.”

This is a wedge and phatic half-statement…”we” “all work for the benefit of others”, so why shouldn’t “we” also benefit from the work of others via a living wage? In the context of social security, why should age, disability, sickness, unemployment etc. translate into a death sentence?

In the context of inequality, a TFRT (Too F*cking Rich Tax) would not be needed to “fund” anything but could mitigate the effects of the contempt that the “haves” have with the “have-nots”.

Retirees would be buying food from the foodmaker-worker, which would keep the foodmaker-worker working and buying other things from other thingmakers.

The retirees’ spent money is actively mediating exchanges, not passively storing value.

It does not change the fact that there are people producing goods and services and people not producing them.

For a producer it makes more sense to give part of his labor to someone who can offer something in return.

When you have a huge boomer cohort trying to get the baby bust to transfer the fruits of their labor, you know you’re heading for a problem.

I think that plenty of that boomer cohort, those that haven’t saved enough for their retirements, would be happy to have and willing to work at living wage jobs and forgo retirement.

That problem, lack of living wage jobs, cuts across age demographics.

I guess if you believe the economy is a perpetual motion machine and that all we need is redistribution, your argument makes sense.

But what I see is a planet with physical limits and those retiring in the developed world clinging to a high energy/resource way of life.

IMO, the vast majority of those about to retire have already consumed more than their fair share of the world’s resources and want the young’s help to keep it going in retirement.

I believe our humanity requires us to help the elderly but the question for me is how do we distributes those joules? Everyone focuses on dollars when the treasure is the joules

My house has appreciated 23.5% in price since I bought it three years ago. I was talking with my neighbors about this just last week. We are concerned because what appears to be happening in our sub is that houses are being bought by investment companies and then being put up for rent (there are real estate agents knocking on doors weekly in my sub asking to list our houses). When someone in our area puts up a house for sale, it is rarely on the market for more than a couple of weeks. What scares us even more is that these investment companies are renting them out for extremely low prices – far lower than what someone would pay for a mortgage, even with a 20% + down. It just doesn’t make sense……

Out here where I live, homes have appreciated in value ~20% per year for many years now.

I’m in the process of house hunting now in an area south of Seattle. Crappy starter track homes with zero character or view run for $450-500k, and the national home builders are throwing these places up as fast as they can. There are vast subdivisions of these places under construction now, and many of the empty lots already have “sold” signs out front. Better construction that looks like it will still be in good shape in 10-15 years will run in the $650-700k range, minimum.

Also, when I drive around and see the people buying these places are they do not strike me as the kinds of people who can afford a half-million dollar starter home – beater pickups parked in the driveways, obese people smoking cigarettes on the porches, etc. They’ve got to be just on the edge of what they can afford. I predict eventually this is going to end very badly…

Quick! Take out a home equity loan before they change their minds!

it’s a real eye opener to look at the price escalation of Chicago lakefront condos on Zillow

House across the street just sold for $649,000. It is 684 sf.

Seattle Bubble intact, ready for popping.

Why do we need growth?

The monetary system depends on it; the monetary system requires growth to pay off the interest.

The banks create money through loans but they only create the principal and not the money to pay the interest. There is never enough money in existence to pay off all the debt plus all the interest.

Government issued money that is not based on debt can be used in a static system, but people who propose this tend to get assassinated, e.g. Lincoln and Kennedy.

Why did debt explode?

Debt = money

When the world came off the gold standard in 1971, there were no hard anchors on the monetary system and debt and money creation were now unlimited.

One nation couldn’t go crazy on its own as their currency would depreciate against everyone elses, the West when crazy together.

Housing booms create lots of money from new debt, which feeds back into the economy and gives rise to a more general boom throughout the economy.

House prices peak and the capital gain possibilities disappear, the speculators run and the housing boom turns to bust, usually caused by rising interest rates.

The repayments start to overtake the new debt and now the opposite effect takes hold, the money supply contracts into debt deflation, money is sucked out of the general economy and a very dangerous doom loop can easily form.

What is the problem with the explosion of debt?

It is all money borrowed from an impoverished future.

Hardly any of the lending has been productive lending into business and industry that generates the money to pay off the debt.

It has nearly all been lending intro financial speculation of all kinds, including housing.

Why are Western economies stagnating?

All the wealth has concentrated at the top subduing demand.

This is the US ….

http://static5.businessinsider.com/image/557ef766ecad04fe50a257cd-960/screen shot 2015-06-15 at 11.28.56 am.png

Debt based consumption maxes. out.

We used neoclassical economics in the 1920s and maintained consumption with debt and allowed debt fuelled speculation in the US stock market. The stock market crashed and the debt deflation of the 1930s Great Depression followed. The impoverished future, set up by the preceding debt binge.

Keynes realized redistribution was needed to make capitalism sustainable, progressive taxation funding subsidized housing, education and services.

Income was just as important as profit, income looked after the demand side and profit the supply side.

We went back to neoclassical economics to find it still has all the old problems.

What we humans perceive as wealth is not wealth in Mother Nature’s eyes. Rien ne se perd, rien ne se crée. It’s a transformation of matter pure and simple.

This means that most of the wealth we create depreciates and needs to be maintained or replaced for wealth to keep its value over the long term. So most of it is a reflection of past wealth not future wealth.

Over the last 5 decades, our profitability and productivity has depended on exploiting the investments we made in the decades before. Many of those assets are reaching their end of life and will need to be replaced.

However our system is mainly set up for growth and exploitation of existing assets/minimal maintenance not for replacing assets.

And the US with the reserve currency has forced everyone to play the same game.

I don’t see how we can avoid a shock when all at the same time, we all start rebuilding the assets reaching their end of life…

We have probably gone back to raw capitalism at the worse possible time, some of those resource limits are already over the horizon and coming towards us.

The neo-liberal, new world order is disintegrating and it has left many problems behind to keep our minds off what should be the most pressing issues.

The main pre-occupation of our elites is getting one over on everyone else, not a good place to be.

When they start squabbling among themselves, this is when wars start, and with the existing order falling apart there is going to be some squabbling, they hate to lose anything.

Not exactly. The problem is you are officially bankrupt when no one will lend you the money to pay off the compounding interest. The secret is to perpetually roll over the principal. This can go on a surprisingly long time – which explains why we have boiling frog syndrome.

That happens to be almost were we are. Now economists like to believe if you are a government, you can eternally run a 3% deficit. But the math still says someday the interest payment will balloon beyond this. Another popular fix is “inflate the debt away”. But this means you need to be able to borrow forever at interest rates below the general inflation level. Some countries have been borrowing at negative interest rates very recently, but that is an anomaly in the history of the world.

None of these things work for consumer borrowers, so they are the weak point, and need real income growth to get ahead of the game.

The only thing that fixes this scenario is real growth. So we got our self addicted to growth, at both personal and state and federal guv level, and withdrawal may be fatal. Generally, corporate and bank leverage is also too high to withstand any shocks to the economy.

South America being a good example, they kept rolling over the debt until it eventually got out of control.

The neo-liberal ideology assumes the trading world will naturally come to a stable equilibrium and the mainstream complain about Trump’s protectionism.

Like you say you can’t run a deficit forever and the fault lines in the global economy are just widening not converging.

The Greek’s liked German products until they reached max. debt and collapsed.

Debt based consumption is only ever a short term solution, it maxes. out.

Time for a Grand Jubilee, maybe? At least for the Mope Class?

I’m still of a mind that there is no fixing any of it in any survivable way.

Several million words ago, commenter Guy Fawkes Lives wrote a comment about how those relatively few people who “own” their houses and yards after finishing paying off the mortgage may, in some cases, be able to force the “proof” of ownership down out of the digital Cloud ( MERS) and back to analog Earth ( a legally unassailable Deed or whatever that thing is called) in a County Courthouse Registry of Deeds.

But that was several million words ago. Who has the time to go back and find it now?

If it is actually realistically possible for some house-and-yard owners to really do this the way I think I remember Guy Fawkes Lives writing about it in a comment, it would be nice if someone could re-write about it in a way totally understandable to the intelligent layman. If it were written well enough to be a Post, perhaps our Blogmasters might even decide to hoist it up out of Comments and make it a Post of its Own.

Perhaps it could even be the first Post to begin a new category which could be called Airgapping. As in persons or even communities airgapping themselves against one or another part of the Greater System.

This is not “setting an assignment”. This is “voicing a wishful dream.” Perhaps if enough “Airgapping” posts showed up over time, from devoted Commenters doing their best to write Postworthy comments, the accumulating buildup of “Airgap” -categorizable posts might grow big enough to earn itself an Airgap category just as so many Permaculture Posts were posted that it was decided that they had earned the right to the category-title Permaculture.

The banks are doing a nice dance called the “Deed of Satisfaction.” That way, they get to robosign that you’re done paying them. But wait—- don’t they still retain the promissory note? Why arent you getting that back when you finish paying? Because the thieves continue to rehypothecate it into eternity. Ask for the promissory note back. It will be a battle you lose.

I won’t ever be playing this debt game again. No loans. No taxes. Nothing to fuel their fake economy. I’m done. It’s all a big circle jerk.

“Jubilee” means “party”, I think, so that’s not a very descriptive plan in my mind. I think about what it may mean in terms of specific actions, then decide I don’t wanna think about it anymore. Depending on scope, it can lead to international wars, civil wars, assassin wars, or collapse of all our institutions that make things sorta an intelligent civilization instead of having 7 billion lone wolves roaming the planet and surviving however they can manage.

But without making too big a deal of things, they really blew it when they decided to go with what we hear described as “Socialism for the Rich and capitalism for the poor”. That’s just a nice way of saying the government aligned the legal system and other government powers with banks, capitalism, and the rich to protect their paper wealth and become an all powerful predator class aligned against, say, the 90%.

Allowing the bankruptcy system to function as it should – eliminating bad debt and making holders of bad debt take losses, would have purged the worst cases in the system. If additional safety net programs are required, or maybe you find out you have a surplus of empty houses, then devise equitable solutions once you understand what’s needed.

Then some obviously grossly unfair things like student loans at 8% during 10 years of a ZIRP economy – restructure these w/ new terms, or if that’s not legally possible, re-fi at what mortgages go for – 3.5%. That would cut payments nearly in half.

Then the Fed goes and blows the next bubble economy by blowing assets bubbles in order to fix up everyone’s net worth. Except, IIRC, the 3% own 90% of the assets. So home prices never stay affordable relative to incomes, and we are back to the game of taking out home equity loans to finance your cost of living.

So that’s as much thought as I care to give it, then I get tired and give up.

Jubilee in the biblical sense only means a reversion of contracts to null and void, money and asset evaluations had nothing to do with it because they had no stock exchanges, nor the effects such concentration of trading creates.

BTW the Fed does not blow bubbles, that distinction is the result of industry leverage applied to the political system, by all and sundry, too include the decades of funding wonky economics to facilitate some quasi religious ideological agenda.

disheveled…. how many years have you been reading this blog – ?????

As long as it’s been around, and yes, the Fed does indeed blow bubbles.

I’ve been reading financial news, working in biz, investing, and watching the Fed since the 70s, and a few NC bloggers and commenters don’t have a monopoly on the Truth in these areas. Often, very much not.

Fiddling around with IR does not have distributional vectors, nor does the Fed dictate what ADI’s do.

Industries and their lobbyists [see Hudson] have a much more distributional effect on asset prices [see Gates frictionless capitalism and the Dot.com bubble].

disheveled…. Wall St. is the distribution mechanism imo…

See “Search for yield” when the Fed floods the system with liquidity and drives the Fed Funds Rate to zero. Then also claims they are not a “regulator” in the financial system.

Out of the plethora of data points and historical back drop you pick one – yield…. sigh….

The end of Bretton Woods was an effect of the inflation of the 1960s, which in turn was due to the refusal of the Johnson Administration to raise taxes to pay for the war in Vietnam, the war on poverty, and the space race. Running fiscal deficits when the economy was already at full employment was bound to end badly. That inflation in turn was a major impetus to bank deregulation, as the old regime of simple products and fixed rates broke down as interest rates increased and became volatile.

http://www.nakedcapitalism.com/2014/06/metaphysics-money.html

disheveled…. were talking decades here craazyboy… and not quasi monetarist experiments like ZIRP….

ha. decades. so, yer say’n we have a country too, and it takes two to tango?

“Burns thought the country was not willing to accept rates of unemployment in the range of six percent as a means of quelling inflation. From the Board of Governors meeting minutes of November 1970, Burns believed that:

…prospects were dim for any easing of the cost-push inflation generated by union demands. However, the Federal Reserve could not do anything about those influences except to impose monetary restraint, and he did not believe the country was willing to accept for any long period an unemployment rate in the area of 6 percent. Therefore, he believed that the Federal Reserve should not take on the responsibility for attempting to accomplish by itself, under its existing powers, a reduction in the rate of inflation to, say, 2 percent… he did not believe that the Federal Reserve should be expected to cope with inflation single-handedly. The only effective answer, in his opinion, lay in some form of incomes policy.[10]”

https://en.wikipedia.org/wiki/Arthur_F._Burns

“Not exactly. The problem is you are officially bankrupt when no one will lend you the money to pay off the compounding interest. The secret is to perpetually roll over the principal. ”

Or (instead of denying a new loan):

The new and higher interest rate to lend you money to roll over your debt is beyond your ability to pay.

‘The new and higher interest rate to lend you money to roll over your debt is beyond your ability to pay.

This what happening in Auto loans in new and used/leased car markets! But who cares?

the new money is DEBT to perpetuity! CBers will back you up!

What is this “The Economy” that has been foisted on us? We treat it as this nebulous, yet fearsome god that must be appeased. Was there an Economy before ’71? 1933? 1913? What is a “functioning economy”?

To re-purpose Arthur Silbers’ “The Tale That Might Be Told” (powerofnarrative.blogspot.com/2008/02/tale-that-might-be-told.html): What would happen to ordinary folk if we began to avoid the multi-nationals as best we could and increased our cash spending on Main St? Would we still be at the mercy of The Economy? How long? Is there a tipping point? How do we get the word out?

How do we demand local, public banking? Not to mention local public health-care and indigent relief, retirement security, and better funded local education.

Starve the beast.

Please do. All of you, please do what the human tells you to do. The rest of us, who know what happens to prices when the demand curve sinks, promise to cooperate. At first. We promise not to go shopping! Not, at least, until your virtuous self-denial has had its predictable effect on the prices at the Big Box stores, as manifested during this year’s inventory clearance sale.

If just enough grouploads of people do this in a purposeful way, they might build little Lifeboat Fortresses of Conviviality Economics. Here is a groupload of people doing and researching some of that in their own little area of expertise.

https://slowmoney.org/

Your suggestion is just as good a theory as anyone else’s. Actions based upon it would be Theory-Action. If enough people joined together to do this in the same time and place to be called a Group, then you would have a Theory Action Group . . . a TAG, if you will.

Someone else who has spent years working out a Theory-Action theory of this approach is named Catherine Austin Fitts. It has been years since I thought about Catherine Austin Fitts. She calls her concept “Solari”. Some of it that I read begins to feel ever so slightly cultish, and she keeps referrencing God over and over. But could the concepts be cooled off to a less-than-cultish temperature? Could it be merely secular and not God-invoking? I don’t know. Perhaps it is worth study.

https://solari.com/blog/

And there is Richard Heinberg with his Power Down, and there is the Transition Town movement, and other such groups.

Terrific post- you’ve articulated the current scenario as I see it quite well. I’ve been saying this verbally for about five years, that the global dominance of capitalism depends upon constant expansion, which we cannot continue with the parameters we have established. I’ve been deriding capitalism since the mid nineties for the inherent exploitation on which it depends. So you’re not alone in this view, you’ve simply taken the lead in writing it all out.

“Growth to what end, and growth into what? 4 years ago, I wrote What Do We Want To Grow Into? I have still never seen anyone else ask that question, before or since, let alone answer it.”

I’m comfortable with less, a lot less, and a much more ethically based, spiritual existence. My community, as in the people who share and live my values who I commune with, has shrunk commensurate with my ambitions. My relationships feel more genuine, though, and my quality of life and mental/emotional/spiritual well being has improved considerably.

Thank you for offering solutions. I fear the likelihood of our collective ability to restructure our economies around production is slim, at best. We’d have to get the banksters to release their strangle hold on the rest of us, and we’d have to get all the bubble participants to wake up and completely re arrange their lives incorporating sustainable models. Convert all those trophy homes into cooperative living arrangements, reduce our environmental footprint to a limited amount per person, etc. It’s such a radically different model than what we have here in the US, I’m tempted to look for it elsewhere and emigrate. As if that were an easy option.

“It’s not a healthy thing for an economy to depend on blowing bubbles.” –Great line. Sadly, a great line and image for us to savor as we collectively implode.

“And that’s not the only consequence of our blind growth chase. We have become so obsessed with growth that we have turned to creative accounting, in myriad ways, to produce the illusion of growth where there is none. We have trained ourselves and each other to such an extent to desire growth that we’re all, individually and collectively, scared to death of the moment when there might not be any. Blind fear brought on by a blind desire.”

Wasn’t that the story of Enron? Does everyone think it will be “different this time”, for them?

Indeed.

And as for housing, do people really think the issue about public records of deeds and all the disasters of robo signing were resolved after 08?

It must be nice living in American Dream sugar plum fairy optimism alt reality.

Not sure I understand the implications of your “solution”, a debt jubilee.

Whose debt, specifically, will be relieved? Owners of debt on multimillion dollar properties and Range Rovers or students?

The developed world wants a debt jubilee so it can keep on consuming at the expense of the 5 billion in the developing world…. “but it’s no fair, we were promised the American dream!”

Time will tell us who wins the tug of war…

‘Time will tell us who wins the tug of war…’

This has been going on since late 80s but accelerated since 2009 with more credit explosion!

No one worried about DEFICIT spending, National DEBT or MKTS bubble built on debt on debt with leverage!

Those who lived or trying to live prudently WITHOUT debt appear FOOLS!

Until you reach 55+, get sick or restructured out of your job.

It’s a game of musical chairs where one chair after the other is taken away.

The funny thing about debt is that if Goldman Sachs loses a trillion dollars, the government lickety split creates a trillion dollars at 0 interest for them (and to add insult to injury, the government pays interest to the banks for holding money that the government just loaned to the banks for free…) If millions of homeowners lose a trillion dollars, they are tossed into the streets….Paying your debts is important when your poor, but not at all when your rich…

And inflation as a cure???? Inflation in health care, inflation in education, inflation in housing…..yet no inflation in wages.

And the worst thing is that the CARNAGE is not spoken of, lest the fact that the system works for the few and against the many becomes apparent.

Let’s look forward, not back. /s

If one knows one is going to be unfairly driven out of one’s home with nothing to show for it, might there be slow motion ways to sabotage the property so that no-one else can reap any underserved-by-definition gains from it?

Filling the toilet, bathtub, furnace, water heater and all lines and pipes with cement? Opening small strategically placed holes in the roof so that water can seep in slowly and slo-mo destructively? removing electrical socket plates and hiding small pieces of ultra-stenchy-when-rotted food in the revealed spaces and then carefully replacing the socket plates? Etc. etc. etc.?

It certainly seems as if our country was much better off with 150 million people in it rather than

the current 330 million.

Yeah! Almost seems like 180 million aren’t doin’ anything except borrowing boatloads of money and blowing it on German cars, overpriced houses, and Chinese stuff.

Weird. hahaha. Pass the bong, please. Just picked up an ounce of pot for $300. For only $200, went to an ophthalmologist who told me I’m going blind and wrote me a ‘script. Feel like I beat the system! At least until the OZ is gone and gotta get another. haha.

Actually I made that up. I’m not an idiot. craazyman wouldn’t even do that. He goes for sensible shoes, red wine and xanex.

The shoes might be sensible, but the xanax isn’t: it’s

vicious addictive.

Kurt Saxon the survivalist author once wrote an article about how to grow your own marijuana cheaply in money and electricity. I haven’t been able to re-find it anywhere.

It most basically involved getting one of those U-Haul type long-distance-moving garment boxes.

Paint the inside totally white with flat white latex paint. Hang a fluorescent bulb shop-light from the hanger bar with long small link hardware chains. Adjust the free-hanging chain length so that the lights are about 6 inches above the growing plants. As the plants grow taller, adjust the chains so as to keep the lights always 6 inches above the growing plants. That’s your grow chamber.

And tell nobody. The way he put it was . . . ” tell nobody. Don’t tell your future ex-boyfriend. Don’t tell your future ex-wife. Tell NOOOOO – body.”

Bravo and amen! Ever since I discovered the true nature of our money supply twenty some years ago in my college-aged youth the realization has plagued me and alienated me from the rest of our consumption based, debt crazed, materialistic society. Just thinking of thirty year mortgage on a unbelievably inflated house just so I can make some idiot, drop-out house flipper a multimillionaire, and prop up the lavish lifestyles and elaborate schemes of Wall Street bankers is enough to make me want to wretch because I know bank money (Federal Reserve Notes) is fake, but the debt and obligation involved with taking a mortgage for hundreds of thousands of dollars, for me as a peon, is extremely real. It’s wonderful that places like Naked Capitalism exist, as I remember a time when Monetary reform and even the mere talk of the workings of our monetary system was the domain of gold bugs, right-wing, tin foil hatters and musty old alternative press bookstores. It’s amazing though, even post MMT, post derivative meltdown 2008 financial crisis, post Naked Capitalism/left/wing financial blogs, 99% of the populace still thinks you’re a tin foil hat fool if you tell them money is created out of thin air when they take a loan from a bank. The eye-roll and the accompanying condescending response is guaranteed to increase proportionally with education and income level. The most vitriolic reactions almost always come from finance guys, but maybe one out of twenty already know the truth, enlighten you with some interesting insider tidbit and admit they just want to loot a little more for themselves and then they will retire to a nice comfortable and simple life far away from the casino.

“Grow into what?” A fantastic question that every elected official and government economist should be forced to answer for the public record. The next question every citizen/consumer should ask before their next purchase is does this new “x” really make me happy and do I need it? Can I be simpler? What are the impacts of me enjoying this new consumer thing and who really pays the costs associated with creation, transportation and eventual discarding of this thing? Is there a better way or a way for me to go without this? Simple questions that could go a long way towards solving our problems.

Good post, mate. Yes, who’d have thought this. The govt has told us they manage the supply of money. They even issue bonds, which they must repay!!!

Yet, private banks create money when we borrow from them, without much regulation on how much they do it.

Funny, I thought the supply of money was something that the govt did and should control.

The problem is using GDP as a goal. As the old maxim says “What gets measured gets done”. If the goal is stupid the result will be as well.

Consider a simple service economy where everyone is a hair cutter. In order to get growth you have to cut hair more often. You may start with everyone getting a hair cut every 2 months, but if you want a growth in GDP you need to gradually increase the frequency of hair cuts (otherwise you have no growth). Soon you have everyone getting hair cuts every day. So you have gotten growth, but where is the “wealth”. It only comes from whether or not you see a daily hair cut as some kind of gain. It definitely is not permanent!

Our current economy is similar especially as we move to a more and more service based economy. Most new jobs are in restaurants and bars (almost now equal to manufacturing jobs in total) and old aged homes. Basically looking after people. This by its nature limits the kind and amount of growth you can get under the current goals (GDP). I mean once you get to where somebody cooks your three meals a day how much more upside is there.

The solution is obvious, but hard to get to. A different metric, that is quality based. Change the goal and behaviour will follow. The problem … finding a goal that is acceptable … and that will not happen until we have a crisis.

++ Bhutan measures “GNH” – Gross National Happiness instead of GDP. Let the thoughtful Buddhists lead the way perhaps?

We haven’t had real economic growth since the 1970’s. Once the reconstruction of Europe and Japan in the postwar era finished, the global manufacturing sector became stymied in a crisis of overproduction/under-utilization of capacity that only continuously worsens as profit rates continue their decline. The only growth the first world countries have had since then has been from asset bubbles (Japanese real estate in the 80’s, US stock market in the 90’s, US real estate in the 00’s, euro bubbles in the 00’s).

Capitalism cannot provide 3% growth rates ad infinitum. There is a finite amount of space and resources, and because of the math behind compound interest, to grow at 3% per year the economy would need to double by 2060 and double again by 2100 (with the pace only increasing). What drives economic growth is industrialization and urbanization, and after those processes are finished, only asset bubbles or external demand can do the trick (this is the same reason that growth rates during the 17th century were anemic).

These are structural problems that remodeling a few old train stations will not solve. The Keynesian solution may temporarily boost demand in the short term, but eventually you run out of infrastructure to repair. (And in the US nowadays, more than anything else, fiscal stimulus simply subsidize Chinese manufacturing and pollute the planet). The best case scenario is that we’ll be stuck with low growth indefinitely–unless a war destroys most of civilization and we get to rebuild again.

This article misses the root of the problems we face. Economic growth does not require environmental destruction, or increases of private debt. If you check Michael Hudson’s article published earlier this week at NC, you will have much better understanding of how the economy works:

http://www.nakedcapitalism.com/2017/03/michael-hudson-democracy-collaborative.html

The author addresses the symptoms, not the disease.

Growth is demanded by capitalism, which is the root of the problem. Who will invest capital unless there is a reasonable expectation for a return on the investment – i.e. growth of capital? Macro-scale capitalism requires macro-scale growth in the national and/or global real economy. The fake financial economy, which is just rentier extraction for the leisure class, is merely an accelerant to inequality that capitalism creates. Macro-scale real growth requires more physical resources – more people, more energy, more materials, more land – so population growth and expanding resource exploitation are necessary requirements for capitalism to flourish. Capitalism was never going to last. The energy resources were banked over millions of years, but are being used up in mere hundreds of years – therefore not sustainable. Overpopulation is causing wars and migrations – we are running out of land to support an expanding population – therefore not sustainable. CO2 levels in the ocean are killing off ecosystems, and CO2 in the air is changing the climate – a finale to the man-made 6th extinction.

Since growth is not sustainable, capitalism is not sustainable. As Naomi Klein clearly outlined in “This Changes Everything” – capitalism is the root cause of all the coming crises – economic, climate, migrations, and war. Time to create a sustainable economic system – and it can’t be capitalism. Fortunately there are an infinite set of choices. Economies are merely sets of rules governing how goods and wealth are distributed, and how exchanges of goods are made. How do we fix the economy? Easy – change the rules so they penalize unsustainable exploitation and so they are not designed to just benefit the 1% (no more trickle-down economics). How do we solve the debt crisis? Easy – we forgive the debt – after all it is just money owed to ourselves. “the debts that can’t be repaid won’t be repaid. And … all you have to work at is how you’re not going to repay them.” (Steve Keen partly paraphrasing Michael Hudson). How do we solve overpopulation? Easy – education and birth control, create a global economy where the next generation does not require population growth to survive. How do we solve wars and migrations? Easy – stop manufacturing the crises through corporate resource exploitation and theft, and stop funding the military-industrial complex. How do we solve the climate crisis? Easy – heavily tax fossil fuels and fund clean energy (solar and wind) – it will cost no more than the bank bailout.

How do we do all this politically? Hard – very hard – because we have a 1% that is more interested in protecting their unearned wealth, protecting their profit margins, then in saving the human race from catastrophe. We won’t be able to convince them to change their ways – they believe they are “doing God’s work” (Blankfein) – their indoctrination is too complete. “It is difficult to get a man to understand something when his salary depends upon his not understanding it.” (Upton Sinclair) That 1% is the most ruthless 1% of the population – they would kill billions of us to protect their wealth – and they are currently killing millions. They use that wealth to manipulate us and to control the political system by buying the politicians. They rely on “the pounding twin impulses that drive modern America: burning hatred of all losers and the poor, and breathless, abject worship of the rich, even the talentless and undeserving rich.” (Taibbi) They use a “complex system of public-private bureaucracies that constitutes our modern politics … a giant, brainless machine for creating social inequity. It mechanically, automatically keeps the poor poor, devours money from the middle class, and sends it upward. And because it’s fueled by the irrepressibly rising vapor of our darkest hidden values, it attacks people without money, particularly nonwhite people, with a weirdly venomous kind of hatred, treating them like they’re already guilty of something, which of course they are – namely, being that which we’re all afraid of becoming.” (Matt Taibbi)

So what do we do? We look to the past for what worked – movements and unions addressed slavery, suffrage, inequality, child labor, jim crow – they created the progressive long-lasting changes in our social structures. We abandon what doesn’t work – the delegating of the struggle to NGOs and advocates who ask for our donations and merely call on small groups of us to mobilize and shout on a warm sunny afternoon. We look at those groups that have the power elite concerned – BLM, DAPL, Occupy, Whistleblowers, minimum wage movement – and consider what they could become if only they had the rest of us onboard. We educate ourselves and each other – and we inoculate ourselves against manipulation by understanding how propaganda and manipulation works. (study Bernays, watch “The Brainwashing of my Dad”) We do deep organizing into networks of support groups (Jane McAlevey – “No Shortcuts”) and form a movement. We abandon the major political parties and create new ones (the first thing to do is re-register to a 3rd party, preferably the Greens, then take over the party and make it your own. The major parties are too entrenched with corporate money for this inside strategy to work). And we grab the reins of power from the 1% – which will likely cost many lives because the 1% are ruthless – but as with most bullies, they will eventually back down – but our window of opportunity is short.

Or we do nothing and let the crises continue until the collapse. Do we allow billions of people to suffer and die in the crises because we were too lazy to get off our butts? Was Cornel West correct when he said: “The oppressive effect of the prevailing market moralities leads to a form of sleepwalking from womb to tomb, with the majority of citizens content to focus on private careers and be distracted with stimulating amusements. They have given up any real hope of shaping the collective destiny of the nation. Sour cynicism, political apathy, and cultural escapism become the pervasive options.” Will we allow the insanity that Arundhati Roy describes to continue: “While one arm is busy selling off the nation’s assets in chunks, the other, to divert attention, is arranging a baying, howling, deranged chorus of cultural nationalism. The inexorable ruthlessness of one process feeds directly into the insanity of the other.” Will we be like the Jews and Armenians and wait too long – “And when they came for me, there was no one left to speak out for me.” (Martin Niemoller) Or like Chris Hedges, do we believe that some things are worth fighting for: “I do not fight fascists because I will win. I fight fascists because they are fascists.”

“Growth is demanded by capitalism, which is the root of the problem. ”

Actually, this is another half truth created by the neolib folks back in the 60s-70s era.

Taking the case of publically held corporations whose common stock traded on Wall Street, we used to have two basic types of companies to buy stock in. One was the “growth company” and the other was one which paid out most free cash flow in the form of regular dividends. Electric utilities and telecom stocks were examples of this type, some are still around today, but they are known as being “slow growth”. The investor expectation is the stock price will only grow fast enough to keep up with inflation.

Any kind of company could adopt the high dividend approach to provide a return to investors. But for many reasons, like growth stock actually costing companies nothing, and tax deferment by not taking dividends and getting long term capital gains instead being preferred by most investors, most companies decided to aspire to being growth(stock) companies.

Where the problem came in was some companies, mostly in emerging growth fields, really could mange 15% growth or more, investors came to expect growth like that from most of the market. Then Wall Street figured out if they could load up upper management with lots of company stock or stock options, this would “align management’s interests with the shareholders”. Oh man, did that work. Good biz sense was no longer an impediment to looting the company anyway they could think of as long as they could justify it as short term benefit to the shareholders.

So we got massive mergers, leveraged buyouts financed by junk bonds, disappearing pension plans, off shoring, mega sizing of factories – they ship to the whole world now – my bet is eventually from Bangladesh, H1-Bs and green cards, outsourcing and related consolidation there, and a bunch of stuff I’m probably forgetting. Oh yeah, a “Cloud” and accounting firms in India. And here we are.

Apparently craazyboy fails to understand the difference between a rentier economy (or feudal system) and capitalism. Such rentier drains on the economy are exactly what the capitalists were trying to end when they attacked the feudal system several centuries ago. A rentier economy is not capitalism – just pure wealth extraction – a parasitical relationship as Michael Hudson so eloquently describes in “Killing the Host.” And it appears that the capitalists, now that they own practically everything, want to bring back good old fashioned feudalism using financialization to place us all in their debt — accelerating the process by using their purchased politicians to privatize the profits and socialize the losses. When capitalism fails and the key goal is protecting the unearned wealth of the 1%, I guess feudalism is their next best choice. Perhaps Blankfein’s message of “doing God’s work” will morph into “Wall Street was ordained by God” to own everything. That way the 1% can justify charging us rents for everything — even the soon-to-be privatized water we drink – the same reason the Nobles and Kings used to justify the theft from the peasants.

???

I don’t think either of you see the problem.

It’s not that the ‘rentier economy’ is inefficient or that investors are addicted to high returns (although both are true). The problem is the rate of profit in manufacturing (the lifeblood of a modern economy) has been in steady decline since the 1970s because of the crisis of overproduction/under-utilization of capacity that resulted from the rise of European and Japanese competition.

Yes, space and resources on a planet are finite, but more importantly, at 3% growth the global economy would have to double by 2060 and then double again by the end of the century (and that pace will only increase ad infinitum). I’m sorry but there’s just no way that that’s going to happen. What drives robust economic growth in a capitalist economy is industrialization and urbanization (this is why growth rates were anemic in the 17th century), and once those processes have been completed, growth can only come from external demand, “urban renewal,” or asset bubbles. This has been the case for the developed world since the 70’s, and why our future, at best, is looking like post-1990 Japan.

Unless a big war blows the heck out of everything and we get to rebuild, just like we did in the post-WWII era. But if not, remodeling a few old train stations won’t get us out of this crisis, as eventually you run out of infrastructure to repair.

It’s more like why would the developed world get to write off its debt so as to get a clean slate so it can keep on buying resources to replace its infra when many parts of the world still have not gotten its own share?

Many here seem to think that the only problem we face is redistribution not realizing that a fair redistribution on a global basis would mean a drastic drop in their material lives.

Completely. And of course the dynamics of the global economy benefit the first world countries at the expense of the third world countries. And even Keynesian stimulus is unjust: it subsidizes the wealthy economies in ways that poorer countries cannot enjoy (if they did the same, they’d face a public debt/currency crisis). Although I guess nowadays in the US, Keynesian economics means subsidizing Chinese manufacturing firms–at the expense of US workers and the environment.

Everyone talks about how we want a more equitable distribution of wealth: tax the rich to provide social programs for the poor, use government spending to create more middle class jobs, etc. But if we actually wanted to redistribute wealth, it’d mean all of us would have to see a huge drop in the standard of living in order to help the poor in other countries live a little more like we do.

Of course all of this is ecologically unsustainable. A capitalist economy (and especially Keynesian economics) is entirely dependent upon consumption ad infinitum, and that is impossible for our planet. We have a finite amount of space and resources, and our ecological footprint is far greater than what the earth can produce.

If you define “standard of living” by the current capitalist metric, then yes, all our “living” standards will go down. We will all have less disposable stuff for our individual consumption.

But what if you imagined society based on the satisfaction of human needs instead of infinite wants- which is the pathology of the extreamely rich and is needed to maintain the current system.

Society has lost the larger motivating vision. The elite offer a paltry vision that is unsatisfactory to the human soul.