Lambert here: First, I apologize for a missing original post; I was “waist deep in the Big Muddy” of another worksheet on the mid-terms, when I discovered that Inside Elections had expanded the electoral map, and I hadn’t budgeted nearly enough time to handle that. And, it being Memorial Day, by the time I finished the post, you all would have gone off to throw the shrimp on the barbie, or whatever it is that you do. So here is a cross-post, in lieu.

Writing on “volatility voters” in the 2016 elctions, Chris Arnade commented: “The elites loathe volatility. Because, the upside is limited, but the downside isn’t. In option language, they are in the money.” Steve Roth shows how in the money they really are.

By Steve Roth, who serves as Publisher of Evonomics. He is a Seattle-based serial entrepreneur, and a student of economics and evolution. Originally published at Evonomics.

The shares of income going to “capital” and “labor” are vexed issues. How much is received for doing work, and how much is unearned “property income”— interest, dividends, etc.? For a long time, economists thought these relative shares stayed roughly unchanged over time. But since the 70s, and especially since 2000, the share going to owners of capital has been increasing, while labor’s share has gone down.

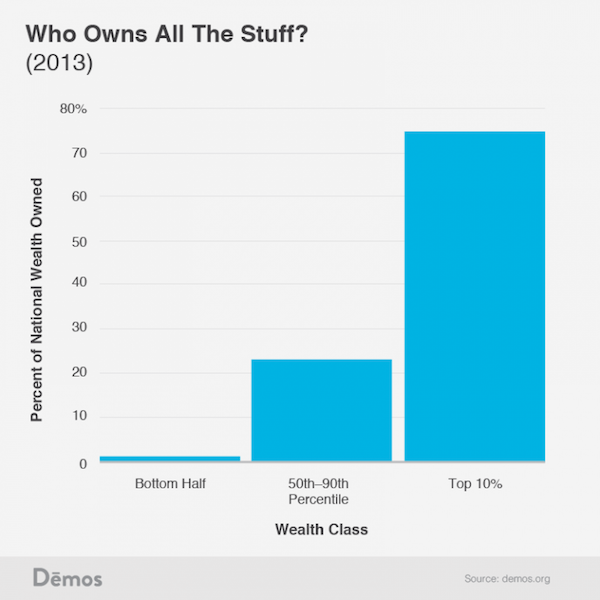

People get income for doing stuff, and they get income for owning stuff. Increasingly the latter. And the ownership share of income goes to a small slice of households that own almost all the stuff.

The labor and capital-share measures you commonly see start by measuring total labor compensation — wages, salaries, and benefits. That’s labor’s share, in dollars. Subtract labor share from GDP, and you get the share of GDP going to owners (to “capital”). Owners’ share isn’t measured, it’s just a residual: GDP minus labor compensation.

There are some gray areas. What counts as “labor compensation”? But in the big accounting scheme of things, they’re pretty small. Little of Jeff Bezos’ and Bill Gates’s wealth, for instance, came from wages, salaries, and benefits — what the IRS classifies as “earned” income. It came from owning stock. But you can still say it’s ultimately a result of their labor — their work, smarts, and effort. Even if you grant that, though, we’re talking very small numbers: their total wealth, combined, accumulated over two to four decades, is hardly a rounding error — a bit over one percent — on one year’s total household income.

Bottom line: National accountants do impressive yeoman’s work here; “labor compensation” is a pretty solid empirical measure of what workers receive for working. And the remaining income is a good measure of what people receive for owning stuff.

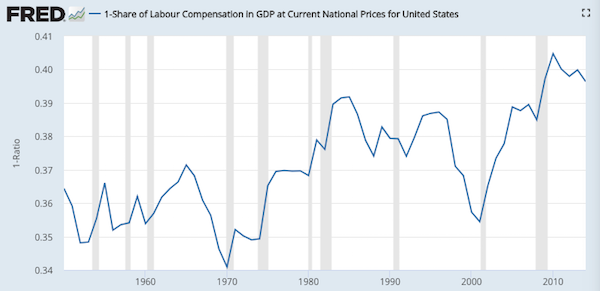

Here’s a typical measure of capital share, as a percent of GDP — here just 1 – labor share percentage. (Note that this not an official U.S. measure, from the BEA or BLS; it’s from University of Groningen researchers.)

Owners’ share has increased from roughly 36% in the fifties to 40% today, an 11% increase — significant, but not eye-popping. (If you’re interested, the New York Times just published an imperfect but very interesting look at these shares, company-by-company.)

But what’s weird about this picture right off: GDP ($19.4T in 2017) does not equal household income ($14.6T). So you’re not seeing labor income (which all goes to households) as a share of household income.

The accounting gymnastics to jump that $5T sector gap require rather heroic economic assumptions — about factor contributions to production, variously imputed “rental” payments for capital, “factorless” income, etc. It’s hard to peer through all that theory and manipulation to know what we’re actually seeing. Revealingly, you won’t find an official U.S. release of this labor-share-of-production measure in dollars or even percent on the Fred data portal — just an index showing its change over time. If you care to go down this theoretical black rabbit hole, some papers here, here, here, and here.

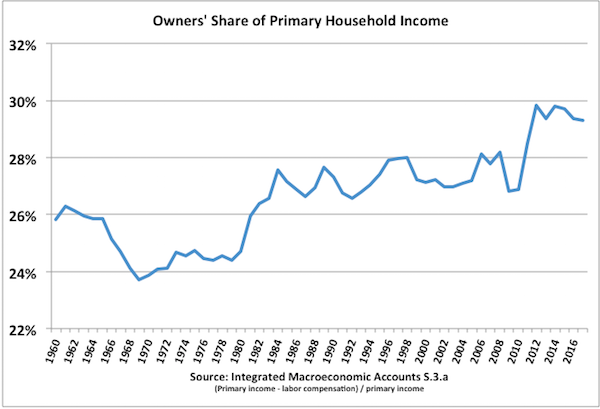

Avoiding all that, here’s a more straightforward question to start with: what percent of household income comes from doing stuff, versus owning stuff — roughly, how much goes to owners vs workers? Here it is based on “primary income” (from the Integrated Macroeconomic Accounts), a measure that seeks to depict households’ market income before taxes and transfers.

The relative jump in this picture is bigger, from 25% to 30% — a 20% increase. But owners’ income share looks smaller.

But this raises another issue. When economists talk about household income — including this “primary” income measure — they’re talking about a particular stylized accounting definition of “income” that ignores a huge part of…household income: capital gains, or holding gains — money that people, households, families, and dynasties receive and accumulate as wealth over years, decades, and generations.

The thinking is, capital gains aren’t “real” income; they haven’t been “realized,” or they “generate no cash for their owners,” or they’re merely based on “expectations.” Your stock portfolio or home value might go up this year, but go down again next year.

That’s certainly true for any given year — or even three, five, or seven years.

But over any longer period, household capital gains are very, very real income indeed. They deliver very real assets and net worth — wealth — onto household balance sheets, which individuals can easily swap for “cash” when they want to spend, in our liquid financial system. That’s what retirees with nest eggs do — swap their various assets for cash, and “spend down their assets.” (Got lifetime income hypothesis?)

In fact, capital gains are among the main ways that modest households build significant personal nest eggs for retirement and eventually long-term care and bequests to their children (mainly through owning homes), and — especially — the overwhelmingly dominant way that rich households, families, and dynasties, who own most of everything, get rich(er).

This explains why Modern Portfolio Theory investors focus quite sensibly on “total return” including capital gains when building or evaluating their ETF portfolios, not the red herring of yield from interest and dividends — the part of their returns that counts as “income” in national accountants’ and economists’ stylized and incomplete measure. Likewise real estate: how many homeowners could even begin to estimate their annual “income stream” from living in their house? But most can tell you 1. what they paid for it, and 2. what they think it’s worth now. For households, capital gains are very real income. Over years, decades, and lifetimes, they can and do spend that income.

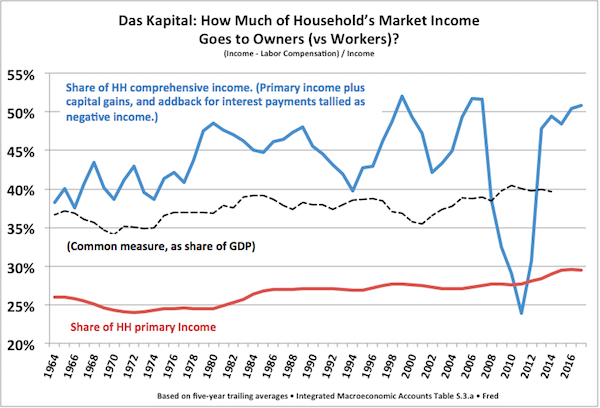

And when you look at a complete picture of comprehensive income including cap gains, you discover a much more extreme picture of income concentration.

But before we get to that, we need to make one more correction. This “primary income” measure is tallied after deducting households’ interest spending (a.k.a. “uses of property income”). Interest outlays are not counted as a use of funds — spending — but as negative income. If you add that back in — because households do receive that income before using it to pay interest — you add about $600 billion a year, roughly 5%, to household income (average, 2009–2016).

Here’s what the capital/owners’ share of income looks like with those two corrections:

Capital gains are volatile, so this picture is smoothed with simple five-year averages. The other measures are also shown for comparison. The spreadsheet, including data sources, is here.

In the worst five-year period (2007–11) over the last half-century-plus, owners got 25 percent of comprehensive income. Despite protestations about owners “risking” their “capital,” this five-year measure has never gone negative. Over recent decades they’ve often gotten more like 45 or 50 percent+.

Almost all of that ownership income is unearned income, by definition. (Otherwise it would be labor compensation.) It’s received simply for being wealthy: owning stuff like titles to land, and ETF portfolios.

And in the U. S., roughly 60% of that wealth itself — the stuff that accrues income to owners, just for existing — is earned the old-fashioned way: it’s inherited.

It’s pretty hard to square that reality with the widely held view of of prosperous, hard-working makers vs indolent, do-nothing takers. Who’s who?

The boomers were sure born at the right time, weren’t they?

Millenials are the first generation ever who have a much better chance of earning their wealth through inheritance than through work. (Well, the lucky ones. The rest are pretty much just SOL.)

“First generation ever?” Hardly. Throughout most of history, inherited wealth dwarfs earned wealth. I have come to the conclusion that it is the post-war economic expansion that is the exception to the rule that the wealthy and powerful tend to hog all the money. I really believe that the great depression and the world war that it spawned convinced a generation of 1%ers that they have to share some of their bread with the oarsmen if they want to keep off of the rocks.

Steve got a lot deeper in the weeds than i would have gone…the monthly income and outlays report breaks down the types of income each month in table 1:

https://www.bea.gov/newsreleases/national/pi/2018/pdf/pi0318.pdf

wages and salaries are just over half…employer contributions to pensions, et al are another 12%…but transfer payments like unemployment comp and social security are another 17%; is steve counting those?

I received some hysterical criticisms from my Henry-George friends saying, “That’s not ‘capital’; it’s land.” And my colleague Dirk Bessemer (from Groningen – -where the chart comes from) and I are segregating the FIRE sector as real estate, insurance monopolies and finance, not industrial capital.

It’s important to show that finance and the rest of the FIRE sector have antithetical interests to industrial capital. (See Marx, Capital, Vol. III).

Your Henry George friends are right. Not separating natural resources from artificial capital was a fundamental error of BOTH capitalist and Marxist economics.

Actually, it wasn’t an error; it was propaganda for the merchant classes vs. the landowners. Why Marx repeated it escapes me.

I’m not sure about the practical distinction between natural resources and artificial capital in the case of most actual land today. It seems to me that it’s a distinction that only makes sense in terms of say, undeveloped oil fields or the like. Most actual land in use has been worked on extensively.

I am also with your friends on that. I would add “that’s not ‘capital’; it’s money.”

Capital is created and consumed in the real economy, the FIRE brigade just insert themselves at every gateway and bottleneck in that process so as to extract a toll.

capital seems to mean financial capital these days.

You’ll have to say “real capital” when you mean old school.

Agreed. Much of the economic vocabulary has been euphemized by the financial types.

“Capital” today is no longer real capital, it’s another word for credit.

“Money” is no longer a legal claim on a real capital asset. It’s another word for credit.

“Your money is safe in the bank” actually means “you have an ownership interest in zero-interest short-term junior subordinated bank debt”.

“Bail-ins” means “your money is no longer safe in the bank”.

People no longer make loans to earn interest, they “buy bonds”. Making it seem like a purchase obscures your responsibility to lend wisely and ethically.

“Prime money market fund” means “loans to TBTF banks”.

“Corporate bond fund” means “loans to TBTF banks”. Every time I read a summary of what’s in one of these funds, I never see a significant fraction of bonds of actual production-side corporations. Why is that?

And then most issues under discussion have implicit pro-financial bias simply from the choice of terms that are in use.

The “K-Suckers” just published their “giving” figures which all went to (REpugs); the “Dimmcrats”,

even the most business friendly got squat. Read and remember, and act sccordingly!

What percentage of labor income goes to Capital Income as rent or interest?

Really glad to see this here.

For want of a nail, the battle was lost.

The ‘nail’, it now appears, being the failure to correctly diagnose and accurately analyze labor as a share (portion) of household income.

Sincerely hope that Mr Roth will be in town and able to attend the Seattle meetup on 19 July, place to be determined.