I don’t see a story yet on Bloomberg, but commodity prices, even gold, have fallen despite the dollar’s fall. There is a story about oil falling $6 a barrel (!) but not about the commodity price decline generally. There has been only slight recovery of the dollar relative to the yen (97.2) so this was provoked by recession worries, not improvement in the dollar.

From the story about oil:

Crude oil fell more than $6 a barrel, retreating from a record, as signs that the economy is in recession overcame concern of a weakening dollar.

U.S. industrial production dropped more than forecast in February as the economic slump deepened, the Federal Reserve said today. Stock markets and the dollar tumbled after the Fed cut rates. A “buying orgy” in commodities inflated prices and increased risks of a collapse, said Paul Touradji, founder of the $3.5 billion hedge fund Touradji Capital Management LP.

“The roiled financial markets are pushing energy prices lower as investors seek cash and pure-cash equivalents,” said John Kilduff, senior vice president of energy at MF Global Ltd. in New York. “The deteriorating economic outlook is outweighing otherwise supportive aspects of the further decline of the dollar.”

Crude oil for April delivery fell $6.22, or 5.6 percent, to $103.99 a barrel at 1:35 p.m. on the New York Mercantile Exchange. Futures climbed to $111.80 a barrel today, the highest since trading began in 1983. Prices rose as much as $1.59 and dropped as much as $6.34 today.

Brent crude for May settlement declined $5.09, or 4.8 percent, to $101.11 a barrel on London’s ICE Futures Europe exchange. Futures reached a record $107.97 a barrel today.

“The volatility of the market today makes a good argument for cash being a nice place to keep your funds,” said Tim Evans, an energy analyst at Citigroup Global Markets Inc. in New York.

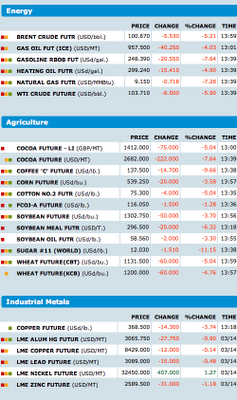

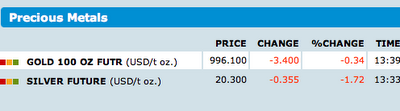

Some screenshots (click to enlarge):

Ooooh, oil *crashes* to $105 a barrel. And gold *crashes* to $999 an ounce. That is too funny.

Leveraged parties selling their winners to scrape some pennies out of the barcolounger? You bet.

The most interesting article on Bloomberg today was the story about UAE keeping it’s dollar peg. Money quote is “The U.S. has always been the guarantor of U.A.E. military security,” Marashlian said. “The U.A.E. wouldn’t do anything to compromise that relationship.” Are we strong arming dollar holders by threatening them militarily? Desperation.

Mike

I noticed the drop in commodities too. Natural gas, especially, is off nearly 8%. Silver has given some of its recent gains back. Corn and soybeans are off about 4%.

Is this a crash? No, obviously. BSC, now that’s a crash. But it’s weird to see these commodities pulling back on a day when the dollar index has spiraled farther down the toilet.

I suspect it is forced unwinding of hedge fund positions. That would be consistent with stronger Yen forcing an unwind of the carry trade. I think there are a lot of hedge funds on the ropes.

http://inflationusa.blogspot.com/2008/02/long-term-trends-in-consumer-price.html

I think a crash is a little too strong a word. After all, a $6 decline is barely outside of the daily margin requirements set by the NYMEX. Commodities are volatile. The only people surprised by a $6 price move are newbies coming over from the equities side.

The real question is why didn’t the Dow decline today? After all, just about every other equities market, every forex market, and most commodities went down. All from the fallout of news about American companies that curiously left American equities intact. Strange…

The YEN clearly shows the Hedge Fund and related parties unwinding positions, the commodity would be a nature location to sell some winning positions and also unwind even more leverage.

I been wondering why margin requirements have not been raise for commodity in particuliar AG, maybe the bubble makers always need somewhere to go.

Folks,

The word “crash” appears nowhere in this post. But per Lune and in the intro to the Bloomberg material, a price fall of this magnitude on a day when the dollar was down sharply is the converse of what you’d expect.

And per Lune, the Dow being up is weirdest of all. although it spend most of the day in pretty serious negative territory. The foreign markets consistently have taken the credit mess more seriously that we have (there have been lots of days when 2%+ falls in the rest of the world have been followed either by a vastly smaller decline here or even a modestly up day). I’d like to understand that too.

A hedgie who writes sometime said he was expecting a double digit down week and mentioned some others who shared his views.

I got in an argument in the gym yesterday (never a good idea, on a par with trying to teach pigs to fly) with a guy no older than 35 who was telling a buddy that now was the time to buy stocks. Thanks to the blogging, I had all the facts (typical bear market pattern, the Reinhart/Rogoff stuff about GDP performance in housing market declines, our balance of trade deficit). He disputed my facts and argued that the consensus was that the market was going to go lower, ergo, there is a buying opportunity (and then started on an ad hominem attack, that if I was so down on the economy, I should go live in Singapore…it went on from there).

That says to me that one factor may be that the Greenspan conditioning to buy on dips is still alive and well. When people get angry in the way he did, it’s usually because you’ve somehow threatened their value system. There are those out there with a near religious belief in stocks as an investment.

I’m old enough to remember that stocks were once regarded as speculative. Peter Lynch in one of his book said when stocks were regarded as safe was when they were the most risky, and when they were seen as dubious was the time to buy. I don’t think people have doubted the merit of stocks since the mid 1980s.

I’d love to hear other views.

Asia is opening up based on the US being up even though most stocks in fact closed down.

If you want to get into conspiracy theory mode. I heard in 2000 from someone I consider credible that the Fed (aka “The Turk”) would trade the S&P…..

Re: Peter Lynch comment. It’s an age thing. Those of us who lived through the 1973-1982 period have actually seen the market go nowhere for 10 years. Especially if we had money on the line at that time.

But that was a generation ago. And the money management business has exploded in the last 25 years. Which means an awful lot of people managing money can’t conceive what can happen over a 10-year period. They might see it on a long-term chart, and they might have heard us old farts talk about it, but they haven’t experienced it themselves. So not real at a deep visceral, intuitive level, like it is with us.

Since 1987 it’s been the same refrain with the stock market. A crisis from somewhere shakes the market. The fed acts. The market rallies to new highs. That “reality” won’t change until one or two instances where the fed acts and people lose money in the market.

That’s going to take some time. Hence, a great trader’s market lies dead ahead for at least a year or two.

TomD

The Fed was not trading the S&P today. My well diversified equity portfolio took a beating today. Only the Dow shows green. I don’t own the Dow, almost no one does. Also, inflation expectations took a dive today. Is recession now taken seriously?

Anon of 8:44 PM,

I was kidding, and it was an excuse to get that tidbit out to see if anyone had heard anything similar either back then or more recently.

JPM is part of the Dow and was up big today. It could have offset any downside that pinched other financials that make up the Dow.

I’ve been hearing all day about the PPT keeping the Dow up just so that Joe 6pack would overlook the Fed bailing out a major investment bank. Most average joes pay attention to the Dow, and they certainly don’t care what happens intraday.

BTW, Yves, my comment about crashing was in response to the the first comment, not your post. Keep up the good work.

Yves,

I had a similar discussion (although much more civilized than yours, it sounds like :-) with a friend who just last month was thinking about putting some money in a hedge fund. He literally stopped me in my tracks when he said this. He said he had been talking to some person who was working in a hedge fund who was talking about consistent 30% gains, etc. etc.

I told him the data shows that hedge funds rarely beat the S&P (especially given their high expenses) even before you take into account the high degree of survivorship bias and unreliable reporting.

What’s interesting though is that I turned the question around and said he should decide on an asset class not based on expected return, but how much risk he could stomach. I asked him if he could stomach losing 50% of his lifesavings at one point, even if in the end things worked out okay? He said sure, and I replied “Congratulations. You have the risk tolerance to be investing in plain old stocks and index funds. And nothing more.” People forget that the definition of a bear market is at least a 20% decline. You’ll experience at least several of these over a lifetime of investing. The 1987 crash saw a 22% decline in one day. The 2002 tech bubble bursting saw the NASDAQ lose 78% percent of its value. We’re closing in on a 20% decline right now, with no end in sight just yet.

While 20% sounds like a middling number, people (like my friend) who haven’t seen 20% of their life savings go up in flames don’t understand what it does to you viscerally and emotionally. Indeed, I recently saw a study that while the aggregate returns of the S&P over the past 40 years is >10%/yr, the return of the average investor was something like 4%/yr (barely beating treasuries). The difference is that retail investors don’t have the stomach to tolerate big declines, and so they get out during bear markets, losing out on the recovery (before coming in just at the peak again…)

At any rate, my friend is holding off on hedge funds for right now. But I’m sure he’s itching to get into commodities right about now :-)

Sorry, I left the first comment and used the word *crashes* (twice) but I used it in stars which was meant to convey that I didn’t actually mean it… the thread was, after all, about a price break. My intent was to say, hey this is normal, some leveraged parties are in need of funds, so they are selling some winners. Y’all didn’t get that from my comment?

Lune,

I was asking to get whacked. I stuck my nose in someone else’s conversation. And even though the guy looked like a trainer, he talked like an equity saleman (the retail, not institutional variety) which may have explained the reaction. (I do have a bad tendency to give people form pointers if I see them doing things that are likely to lead to injuries, but I’ve mastered how and when to do that without looking out of line, and people are usually appreciative. So the gym injury prevention mission got extended to the wrong context. But it was instructive nevertheless).

That’s a very persuasive line of argument. I’ll have to remember that if I ever need to dissuade someone who has taken a shine to a risky opportunity.

Anon of 11:59 PM,

I’ve found my attempts at humor or irony on line are sometimes misunderstood. It is easy to misread tone. Apologies.

“people (like my friend) who haven’t seen 20% of their life savings go up in flames don’t understand what it does to you viscerally and emotionally”

Reminds me of this:

http://news.bbc.co.uk/2/hi/health/7263476.stm

“The report, which examines how banking crises have affected health in the last 40 years, is one of the first to look at the relationship between the two. When a financial crisis hit a developed country, heart attacks rose by 6.4%. This figure was even higher in the developing world, the Globalization and Health journal study suggested.”