‘Big Dry’ hits Australian farmers BBC

J.K. Rowling, Lexicon and Oz Orson Scott Card

Insight: Triple A prices are out of sync Gillian Tett, Financial Times

Mortgage Aid Plan Advances in House New York Times

Risk taking, remuneration and leverage Willem Buiter. Or “What we lost by abolisihing debtors’ prison.”

U.S. Recession Probabilities Jeremy Piger (hat tip Mark Thoma)

Barron’s Panic Euphoria Model Barry Ritholtz

Party of Denial Paul Krugman

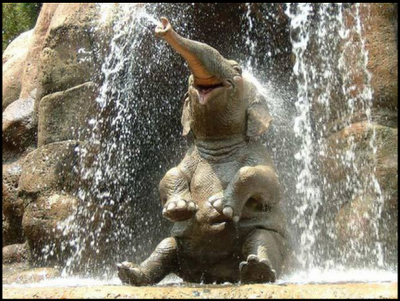

Antidote du jour:

Hi Yves.

I greatly appreciate your site: it’s a daily read. :)

I’d like to respond to the FT piece by Gillian Tett. This is something I posted elsewhere in February. I’d appreciate any thoughts you have….

When this thread began the mainstream was deep in denial. Now it is mainstream. But my God! how confusing it all is.

There is STILL an important part missing from the explanation.

Let me go back to basics….

The banks purchased mortgages and pooled them. They issued securities based on those pools (RMBS).

The same was done with commercial property, with car loans, with credit cards, with student loans.

Other banks then purchased a proportion of these RMBS and other types, and mixed up the geographic sources and types, creating another pool.

Based on THIS mixed-up pool the banks issued a new type of security called a collateralised debt obligation (CDO).

Now the logic was that by spreading thus the portfolio one reduced the overall risk.

Typically therefore 100% BBB- RMBS could be transformed into CDOs comprising 75% AAA, 20% BBB- and 5% unclassified. THAT was the “alchemy” of structured finance.

Now I could be crucified for putting it like this, but AAA debt is worth roughly twice what BBB- debt is worth.

By means of “financial alchemy” 100 units of BBB- had been transformed into 150 units of AAA (ie 75 worth double) plus 20 units of BBB- and zero of unclassified (5 worthless units).

That’s a total of 170 units.

THAT’s where Wall Street made their “profits”.

170 minus 100 is 70 “profit”.

ON TRILLIONS OF DOLLARS OF DEALS.

Do you see now why the banks were paying up to 110 percent of face value for packages of mortgages? Do you see now why it is impossible to open the mail without finding three new credit card offerings?

Not all was taken as capital. Much was taken in the form of fees and commissions and other types of skimming. Much was taken in the form of inputs into other CDOs (so called “CDO squared”). Some was taken as “enhancement” to so called “synthetic CDOs”.

The point is, that 70 units has long gone.

And now the financial alchemy has collapsed.

Spreading the risk DOES NOT WORK.

When there is a systemic downturn, a recession, then everybody has a hard time.

If homeowners are having a hard time because of a bad economy, then SO IS EVERYBODY ELSE. Or, as they say in finance, correlations move towards one. Diversification is ineffective.

Nobody wants to buy these things because nobody else will buy them. Nobody wants to get stuck (as opposed to being a conduit-for-fee) with them because forty percent has been stripped out already (seventy out of 170 is forty percent).

All that slicing and dicing adds no value.

Now at the moment everybody is focussed at the mortgage end of the chain, which is AT BEST only half of the problem. The real problem is that potential mortgage losses are forcing the CDOs to be unwound.

All that “added value” on securitisation is going into reverse.

When the CDO is unwound 170 units of value revert back to 100 units of value. Which is a capital loss of 41 percent.

THEN, out of that 100 units of value there will be the mortgage losses. Let’s say on average they lose 20 percent, so that 80 units of value is recovered.

The OVERALL loss is (170 – 80) on 170.

90 on 170 is 53 percent loss overall.

But notice only a minority, 12%, arises because of the mortgage end. The great majority, 41%, arises at the securitisation end.

IT’S THE CDO UNWINDINGS THAT WILL KILL WALL STREET.

And EVERYTHING coming out of Washington has one purpose, and one purpose alone. That is to prevent or slow down the unwinding.

Ends.

Thanks Yves

John Cleary

Yves, John Cleary – thankyou.

I hope this is picked up accross the blogosphere.

So tired of all the lies. This is easy to understand and has the ring of truth.

While a student of the George Baker school of banking, I don’t think we’ll ever go back to that.

My suggestion is to require hefty pool insurance at each step in the securitization process. The other obvious point is to make sure it’s impossible to get AAA ratings out of something originally rated at BBB

Eric