Yves here. We’ve been making asides in Links and in posts about how frothy markets are. Investors seem to show no sign of fear, which historically has been a precursor to bad outcomes. Wolf does note a few exceptions, to which one should add private equity fundraising.

Wolf’s big point is in the headline: the Fed may regard its rates as restrictive for the real economy, but as far as many leveraged speculators are concerned, they see them at attractive.

One could argue that the margin debt level is not out of line with the recent runup in US market averages. See this chart from Advisor Perspectives:

One can take the point of view that during sustained periods of normal market appreciation (as in excluding the dot-com mania), margin debt levels relative to S&P total market cap are more moderate than they have been of late.

By Wolf Richter, editor at Wolf Street. Originally published by Wolf Street

There are exceptions: Parts of commercial real estate are in a depression, and the housing resale market has frozen.

At the Fed’s post-meeting press conference on Wednesday, Powell will likely re-point out for the nth time that policy rates are mildly or moderately “restrictive,” with the midpoint of the Fed’s policy rates (4.33%) still being substantially higher than inflation rates. Overall CPI inflation accelerated to 2.7%, and core CPI to 2.9% in June, driven by reaccelerating inflation in services, especially non-housing services, and services matter because they’re two-thirds of consumer spending.

The Fed’s policy rates being substantially higher than any of the inflation rates in theory means that these policy rates turn financial conditions “restrictive,” which would then filter via the financial markets, especially via the credit markets, into the economy and restrict demand in the economy, which would allow inflation to cool.

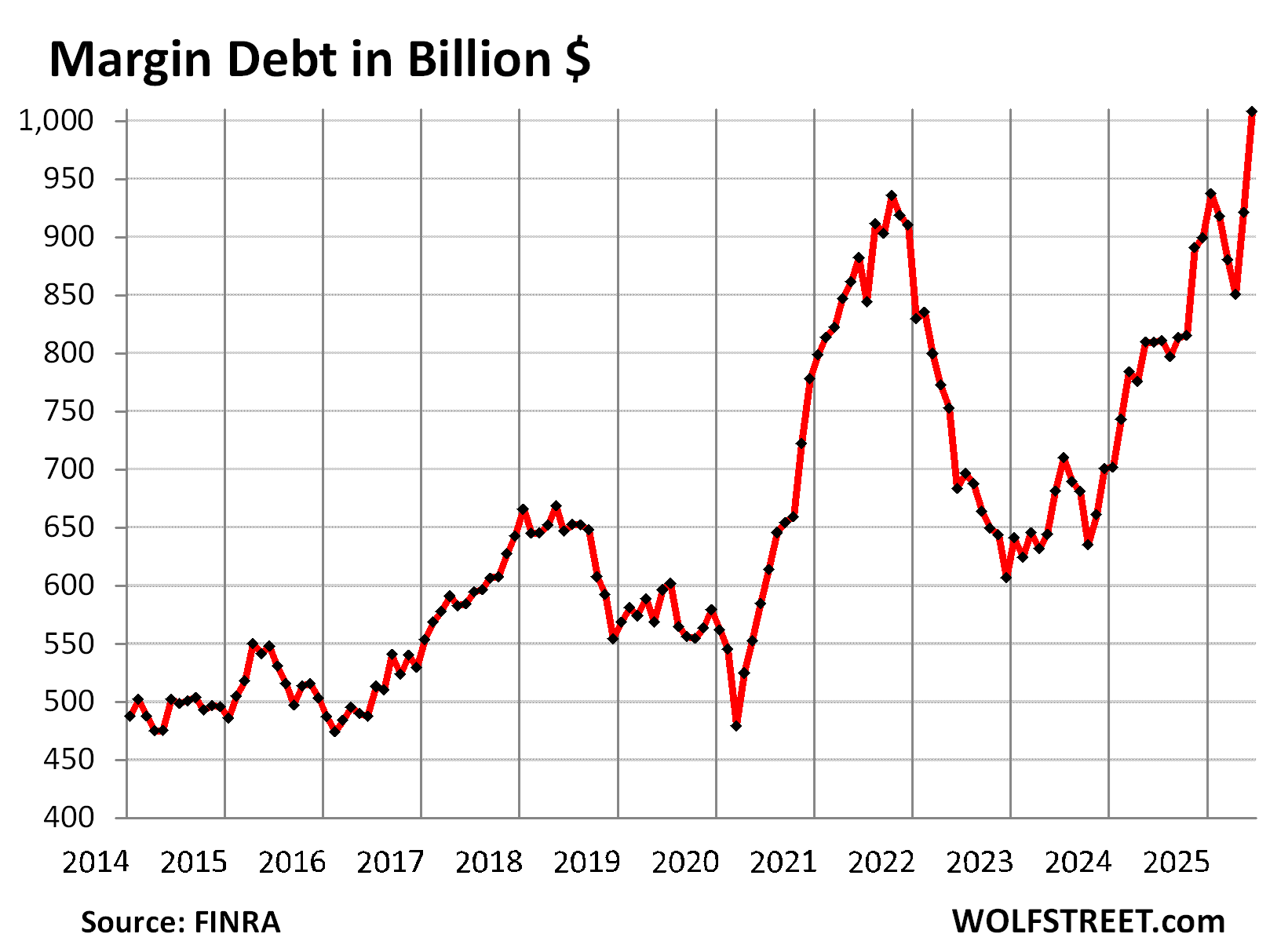

But financial markets have blown this theory beautifully out of the water, they’re practically ridiculing it: Stocks have risen from record to record and are immensely expensive by just about every measure. The meme-stock mania has massively flared up again, where people gang up in the social media with leveraged bets on the most shorted stocks – GoPro, Kohl’s, Opendoor, Krispy Kreme, etc. – causing these stocks to briefly spike by silly percentages. There are signs everywhere that people are taking huge risks with a this-is-so-much-fun attitude, including with cryptos where another mania is in full swing. And margin debt blew out by a record amount, to a record, and is Exhibit A of loosey-goosey financial conditions.

Amid manias left and right, Goldman Sachs reported a 36% year-over-year spike in equities trading volume in Q2, Charles Schwab reported a 38% year-over-year spike, Morgan Stanley a jump of 23%.

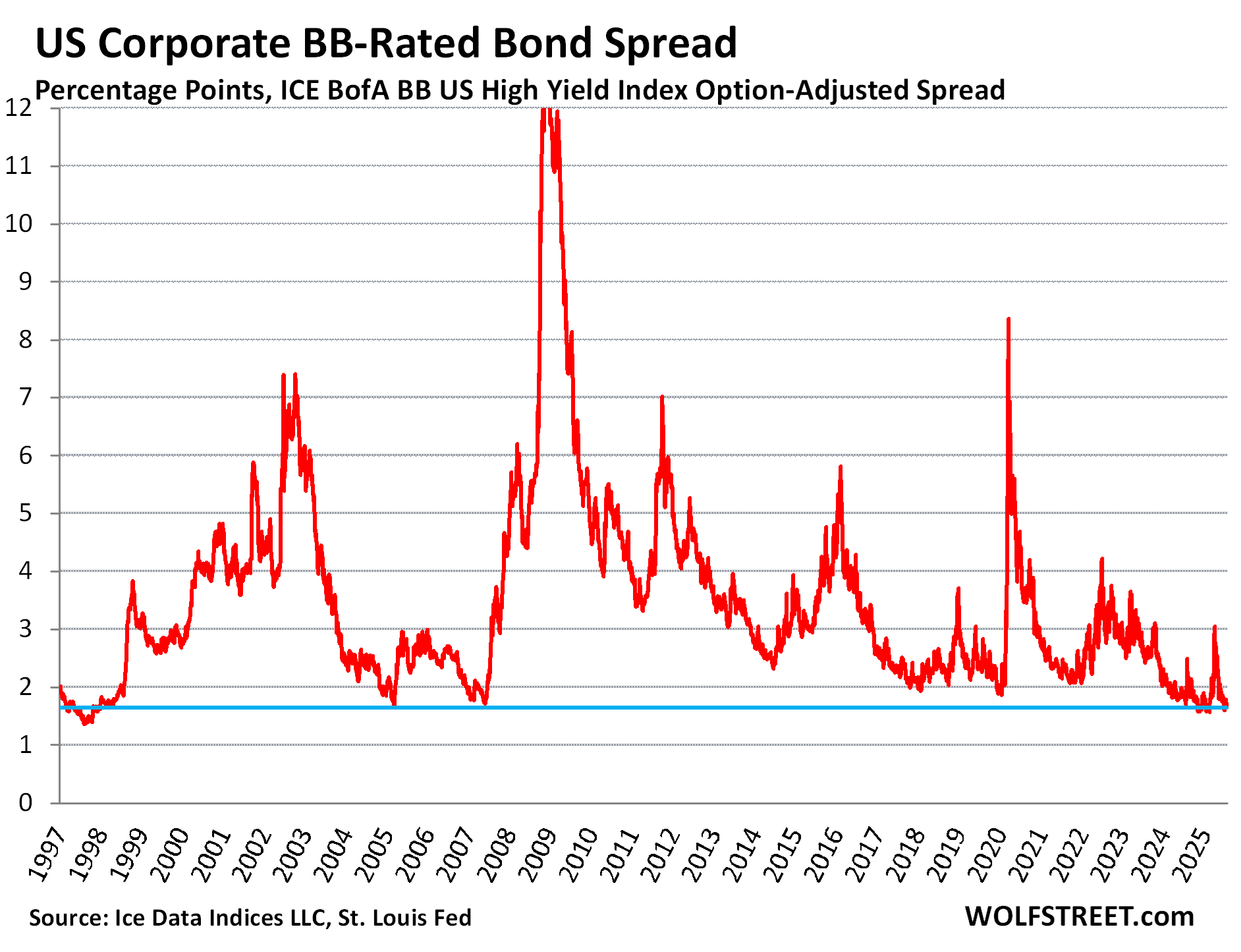

And in the credit markets, spreads between high-risk junk bonds and Treasury securities are historically narrow – and that’s going to be Exhibit B of loosey-goosey financial conditions.

Sure, there are some exceptions. Powell cited real estate as an example where financial conditions are restrictive. He cited both commercial real estate, segments of which are in a depression, such as the office sector with record default rates, and residential real estate, where the resale market has frozen largely as a result of home prices having spiked by 50% and more in a two-year period through mid-2022, from already very lofty levels, and those prices don’t make any economic sense. But that hasn’t impacted the overall economy enough to make a dent.

Exhibit A of loosey-goosey financial conditions: Margin debt blew out, spiking by 8.3% in May and by 9.4% in June, to a record $1.01 trillion. In dollar-terms, June was the biggest month-to-month spike ever (+$87 billion). Combine margin debt with meme stocks, and it’s magic.

In percentage terms, there were bigger spikes, such as in November and December 1999, just before the Dotcom Bubble imploded – less than three years later, the Nasdaq Composite was down by 78% – and in May 2007 just before the simmering Financial Crisis broke out into the open for all to see.

Exhibit B of loosey-goosey financial conditions: Junk bonds are completely in la-la-land. The spread between BB-rated junk bonds and Treasury securities has narrowed to 1.64 percentage points, according to the Option-Adjusted Spread of the ICE BofA US Corporate BB Index. These BB-rated junk bonds yield only 5.64% on average (the WOLF STREET cheat sheet of corporate bond credit ratings by ratings agency).

A narrow spread between BB-rated junk bonds and Treasury securities means that investors are bidding up prices of these bonds despite their substantial risk of default, and thereby investors are not getting paid to take those risks, and investors just don’t care. They’re eager to take big risks to get a little more yield.

There were a few other times with an even narrower spread after the Dotcom Bubble:

On Mar 9, 2005, spreads narrowed to 1.65 percentage points. And in June 2007, just before nearly everything blew up, they narrowed to 1.71 percentage points.

And then from November 2024 off-and-on through February 2025, the spread was as narrow or slightly narrower than now, despite the supposedly restrictive financial conditions. During the lead-up to, and for a few days after, the Liberation-Day parade of horribles, the BB-spread widened sharply and peaked on April 7 at 3.06 percentage points. But that has now also gone away, and by July 25, the spread was back to 1.64 percentage points.

All of this clearly shows that the Fed’s policy interest rates are not restrictive – however Powell wants to phrase this. Financial conditions in the financial markets are amid the loosest ever. There is no tight liquidity anywhere. Markets are still awash in liquidity. Nothing is restrictive.

If you ask Warren Mosler he will observe that higher interest rates also increase a sort of government stimulus via the interest income channel. Of course this is terribly regressive, since it distributes the funds to those holding government debt instruments. I once heard him describe it as “welfare for rich people.”

A close friend of mine is a successful entrepreneur and is a neophyte low double-digit millionaire. He’s raised several hundred million for companies he’s founded in his career.

His personal stash is 90% laddered treasuries and the other 10% he gambles on private companies in his field of expertise.

I often encourage him to invest more of his money in other assets. His reply is something to the effect of he’s happy enough to lose the 10% completely as long as the 90% keeps making 4-5% indefinitely.

This coming from a person who is a natural born risk taker and career entrepreneur. I’m sure there are many more like him.

Had I that much money, you better believe I’d have almost all of it in US 4-week treasury bills at today’s rates! You can live very well by most standards with low double digit millions and your primary residency paid for.

Yes, Mosler: given the Federal deficit is so high relative to gdp, then the consequent amount of treasuries being bought by savers of this prior Fed spending simply puts even more net interest earnings into the hands of those who have the luxury of saving their money in this way, i.e. those with high net worth. As interest rates have risen since 2023, these interest payments get even higher, flooding these savers with more money which, at least so far, is being spent ‘enough’, despite the rich having a lower marginal propensity to consume. So if interest rates go up, spending of the resultant higher interest payments will go up, all other things remaining equal. If the Marginal Propensity to Consume (MPC) of this wealthy Treasury owning cohort goes up as well, that means spending goes up even more. In the same way, if interest rates go down, interest income based spending will go down. And if the MPC of this wealthy Treasury owning cohort goes down, spending goes down. Sort of a 2×2 grid. Of course, he says this is only in effect if the annual deficit spending remains at its recent (last 15 years!) high levels whereby more bonds would continue to be issued relative to gdp, and also as long as inflation doesn’t push the real, inflation adjusted, debt and gdp ratios into reverse. In which case spending and deficits may still increase, but they start slowing down, or go negative in real terms. One indication that the rich are spending more is the robustness of the service and luxury sectors, and, well, the financial speculation described in this article. I think Mosler advocates cutting off risk free interest payments to the wealthy, by lowering the rate to 0, and that would actually slow the economy over time, and lower inflation over all, but that there would be winners (housing, existing bond holders) and losers (luxury, service sector) in the short run as adjustments are made. Not sure how the risk takers would react. Probably a euphoric artificial high at first, and then a reckoning of winners and losers over time.

Thank you, Yves.

My employer, an EU bank, is increasing exposure to private equity and real estate in its core north west Europe market and trying to in the US. The British bank and insurer around the corner are emulating here and in the US.

My employer is no longer too big to fail and has limited risk appetite and balance sheet. It teams up with other banks and even an insurer from the same country to make up for the lack of appetite and capacity.

Two, what I think are important, comments.

First, in April 2007 I was in a relatively senior position at a systematically important financial institution. We were a nameplate sponsor of the Milken Global Conference. At the time I carried around a graph, folded in my pocket, that had three lines and a point estimate. I showed the graph, in a private meeting, to Myron Scholes (as in that Myron Scholes) and asked what he thought would happen.

The lines were riskier credit spreads to treasuries — 5-year CDS spreads, emerging market yields and hi-yield. The point was the implied equity risk premium from Bloomberg (solving for the ERP that made the equity market fairly valued in a DDM). The spreads were compressing to historically low levels. The ERP was very high. So, either the ERP was coming down and we were set up for a massive bull market, or the spreads were way to narrow and a credit event was on the horizon. He picked the latter, as did I.

To me, as I have seen so often in career, that when you aren’t being paid for the risk you’re taking bad things are almost always certain.

The second point, is that all the talk relative interest rates, that at least I see, centers around Wall Street not Main Street. Until this shifts to the real economy from the financial economy these boom-bust cycles, and the inevitable bailouts, will continue.

Cool, Black–Scholes seems to be the most popular/common option contract pricing model, or at least the most well known.

I remember the DotCom years and the markets had been hot for some time, but the NASDQ began a screaming run in late 1998 just as the FED started to raise rates in Jan 1999. The FED kept raising rated right along into 2000, albeit slowly, they were going up and the market just blew it off until it didn’t. The market is behaving the same way now – ignoring the fundamentals. GM just reported what, a $1.3B hit to its bottom line from tariffs? Companies can’t keep absorbing those costs indefinitely, they either have to pass them on to consumers or cut production which means unemployed workers.

The other thing I’m waiting to watch is Q3 Tesla results. I finally figured out what the real thing that killed Elon and Trump via the Big Beautiful Bill… they did away with the penalties for auto manufacturers who exceed their emissions limits so who buy those credits from Tesla!?!? Tesla is basically not profitable without that emissions credit income, it sold somewhere around $5B in credits in 2024. Tesla is WAY overvalued to begin with and it only needs a nudge to implode back to reality. Will it be the stone that starts the avalanche?

All this number crunching makes no sense whatever unless one agrees that the inflation rate is at, or near, what the CPI says it is and people like John Willliams are nut jobs. If real inflation is north of 7% as opposed to less than 3% then the whole conversation has no bearing on anything real.

Today the Fed sold $170B in reverse repo. That is excess bank reserves the Fed took in. To keep 4.25%!

M2 is north of $20 Trillion

Last H4-1 the balance sheet still over $6.2 Trillion.

What is high is money.

Would lower rates suck more cash into speculating on Nvda?

Is VIX at 16 not speculative?

Not an expert on this, but the FED still seems to be much tighter than a year ago when overnight reverse repo was around $400B.

M2 seems not to have gone up much

The consensus on NC (if memory serves) was that it was flow rate that was important for QE and therefore QT. The cumulative Balance sheet figure (which is lowest its been in around 4years) is not important, only the rate of change is important.

VIX below 20 is a “pretty chilled market”

When might Elizabeth Warren, to pick a random name, look at those graphs and notice that margin debt downturns precede recessions, then propose legislation to loosen margin debt requirements to ensure future no recessions?

Asking for a friend. ;)

Maybe another sign of froth? Option trading has become more and more popular over the years, and now we have zero day (0DTE) options.

Retail traders just can’t quit risky zero-day options as trading volume booms

And it is mostly retail

If you sell an option contract, you get immediate “income”, the premium, which is what you’re paid to take on the risk that the counterparty exercises the contract, which obligates you to either buy or sell a security at the fixed contract price.

It’s all fun and games until the SPY moves against you, and your losses can easily be many 100s or 1000s of percent. Meanwhile, your upside is the premium collected only. You can have a high win rate, but a single loss can nuke your entire account from orbit.

And retail is frolicking in this space like it’s free money.