When you think you’ve read everything worth considering on a given topic, once in a while something comes along to prove you wrong. A case in point is this post by Charles Calomiris at VoxEu on the subprime mess.

It is longer than the standard VoxEU offering, but well worth your attention. Calomiris not only does a nice job of recapping the various failures that led to this crisis, but also teases out some elements that have heretofore not gotten much attention.

First is the role of agency failure. Calomiris doesn’t say it quite so bluntly, but agents (meaning institutional investors) wanted a free lunch. The low interest rate environment made reasonable real returns look shabby, and they went on a hunt for yield. They didn’t dig too deeply when paper that should have raised eyebrows (supposed AAA with yields well above that on corporate AAA paper) was offered to them. Competitive performance pressure, “plausible deniability” and unwitting regulatory collusion all enabled reckless practices.

The second is how the rating agencies’ unreasonably low loss assumption for subprime, key to those unrealistic ratings that made the paper attractive, came to be. Based on what I had read, I thought the main issue was a deterioration in lending standards, that the subprime market in 2001-2003 was small (true) and the underwriting procedures were more rigorous. While procedures worsen post 2004 (markedly so in the second half of 2005 and 2006), the pattern is more complicated.

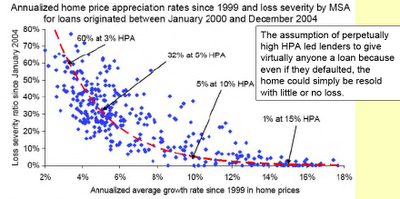

That 2001-2003 paper that formed the basis for the forecasts, actually had high default rates, But because home prices were rising, banks didn’t show much in the way of losses. Readers may recall this chart which shows how central home price appreciation is in mortgage losses (click to enlarge):

So the fatal flaw in the rating agency analysis was to project that trees would grow to the sky, that housing prices would continue to ramp up as rapidly as they did from 2000 onward.

From VoxEU:

The subprime crisis is the joint product of perverse incentives and historical flukes. This column explains why market actors made unrealistic assumptions about mortgage-backed securities and how various regulatory policies exacerbated the problem. The crisis will necessitate changes in monetary policy, regulation, and the structure of financial intermediation.

…..There are both old and new components in the origins of the subprime shock. The primary novelty is the central role of “agency problems” in asset management.

In previous real estate-related financial shocks, government financial subsidies for bearing risk seem to have been key triggering factors, along with accommodative monetary policy, and government subsidies played key roles in the most severe real estate-related financial crises. While the subsidisation of borrowing also played a role in the current US housing cycle, the subprime boom and bust occurred largely outside the realm of government-sponsored programmes.

Investors in subprime-related financial claims made ex ante unwise investments, which seem to be best understood as the result of a conflict of interest between asset managers and their clients. In that sense, sponsors of subprime securitisations and the rating agencies – whose unrealistic assumptions about subprime risk were known to investors prior to the run up in subprime investments – were providing the market with investments that asset managers demanded in spite of the obvious understatements of risk in those investments.

The subprime debacle is best understood as the result of a particular confluence of circumstances in which longstanding incentive problems combined with unusual historical circumstances. The longstanding problems were (1) asset management agency problems of institutional investors and (2) government distortions in real estate finance that encouraged borrowers to accept high leverage when it was offered. But these problems by themselves do not explain the timing or severity of the subprime debacle. The specific historical circumstances of (1) loose monetary policy, which generated a global savings glut, and (2) the historical accident of a very low loss rate during the early history of subprime mortgage foreclosures in 2001-2002 were crucial in triggering extreme excessive risk taking by institutional investors. The savings glut provided an influx of investable funds, and the historically low loss rate gave incentive-conflicted asset managers, rating agencies, and securitisation sponsors a basis of “plausible deniability” on which to base unreasonably low projections of default risk.

What is the evidence for this? How do we know that asset managers willingly over-invested their clients’ money in risky assets that did not adequately compensate investors for risk?

Detailed analyses by Joseph Mason and Joshua Rosner, by the IMF, and by others describe in detail why the assumptions that underlay the securitisation of subprime mortgages and related collateralised debt obligation (CDOs) were too optimistic. These facts were known to sophisticated market participants long before the subprime collapse.

Consider, for example, rating agencies assumptions about the underlying expected losses on a subprime mortgage pool. They assumed a 6% expected loss on subprime mortgage-backed securities pools in 2006 – a number that is indefensibly low. Expected losses prior to 2006 were even lower. Independent observers criticised low loss assumptions far in advance of the summer of 2007.

The 6% assumption is not a minor technical issue. It was hugely important to the growth of subprime mortgage-backed securities in the four years leading up to the crisis. It goes a long way toward explaining how subprime mortgages were able to finance themselves more than 80% in the form of AAA debts, and more than 95% in the form of A, AA, or AAA debts, issued by subprime mortgage-backed securities conduits.

So long as institutional investors buying these debts accepted the ratings agencies’ opinions as reasonable, subprime conduit sponsors and ratings agencies stood to earn, and did earn, huge fees from packaging loans with no pretence of screening borrowers.

Where did expected loss estimates come from?

How were the low loss assumptions justified, and why did institutional investors accept numbers ranging from 4.5% to 6% as reasonable forward-looking estimates of expected pool losses?

Recall that subprime mortgages were a relatively new product, which grew from humble beginnings in the early 1990s, and remained small even as recently as several years ago; not until the last three years did subprime origination take off. Given the recent origins of the subprime market, which postdates the last housing cycle downturn in the US (1989-1991), how were ratings agencies able to ascertain what expected losses would be on a subprime mortgage pool? A significant proportion of subprime mortgages defaulted in the wake of the 2001 recession. Although the volume of outstanding subprime mortgages was small, a very high proportion of them defaulted; in fact, only in the last quarter has the default rate on subprime mortgages exceeded its 2002 level. The existence of defaults from 2001-2003 created a record of default loss experience, which provided a basis for the 6% expected loss number.

Of course, this was a very unrepresentative period on which to base loss forecasts. Low realised losses reflected the fact that housing prices grew dramatically from 2000 to 2005. In a flat or declining housing market – the more reasonable forward-looking assumption for a high-foreclosure state of the world – both the probability of default and the severity of loss in the event of default would be much greater (as today’s experience demonstrates). The probability of default would be greater in a declining housing market because borrowers would be less willing to make payments when they have little equity at stake in their homes. Loss severity would be greater in a declining housing market because of the effect of home price appreciation on lenders’ recoveries in foreclosure.

This error was forecastable. For the most part, the housing cycle and the business cycle coincide very closely. Most of the time in the past (and presumably, in the future) when recession-induced defaults would be occurring on subprime mortgages, house prices would be not be appreciating. This implies that the loss experience of 2001-2003 (when house prices rose) was not a good indicator either of the probability of foreclosure or of the severity of loss for subprime mortgage pools on a forward-looking basis. Anyone estimating future losses sensibly should have arrived at a much higher expected loss number than the 4.5%-6% numbers used during the period 2003-2006.

Another reason that the expected losses were unrealistically low relates to the changing composition of loans. Even if 6% had been reasonable as a forward-looking assumption for the performance of the pre-2005 cohorts of subprime borrowers, the growth in subprime originations from 2004 to 2007 was meteoric, and was accompanied by a significant deterioration in borrower quality. Was it reasonable to assume that these changes would have no effect on the expected loss of the mortgage pool? The average characteristics of borrowers changed dramatically, resulting in substantial increases in the probability of default, which were clearly visible by 2006 even for the 2005 cohort.

Of course, investors could have balked at these assumptions as unrealistic, precisely because they were based on a brief and unrepresentative period. Why didn’t they? Because they were investing someone else’s money and earning huge salaries, bonuses, and management fees for being willing to pretend that these were reasonable investments. And furthermore, they knew that other competing asset managers were behaving similarly and that they would be able to blame the collapse (when it inevitably came) on a surprising shock. The script would be clear, and would give “plausible deniability” to all involved. “Who knew? We all thought that 6% was the right loss assumption! That was what experience suggested and what the rating agencies used.” Plausible deniability was a coordinating device for allowing asset managers to participate in the feeding frenzy at little risk of losing customers (precisely because so many participated). Because asset managers can point to market-based data and ratings at the time as confirming the prudence of their actions on a forward-looking basis, they are likely to bear little cost as the result of investor losses.

Official input and managerial incentive problems

Various regulatory policies unwittingly encouraged this “plausible deniability” equilibrium. Regulation contributed in at least four ways.

1. Insurance companies, pension funds, mutual funds, and banks all face regulations that limit their ability to hold low-rated debts, and the Basel I and II capital requirements for banks place a great deal of weight on rating agency ratings.

By granting enormous regulatory power to rating agencies, the government encouraged rating agencies to compete in relaxing the cost of regulation (through lax standards). Rating agencies that (in absence of regulatory reliance on ratings) saw their job as providing conservative and consistent opinions for investors changed their behaviour as the result of the regulatory use of ratings, and realised huge profits from the fees that they could earn from underestimating risk (and in the process provided institutional investors with plausible deniability).

2, Unbelievably, Congress and the Securities and Exchange Commission (SEC) were sending strong signals to the rating agencies in 2005 and 2006 to encourage greater ratings inflation in subprime-related collateralised debt obligations!

In a little known subplot to the ratings-inflation story, the SEC proposed “anti-notching” regulations to implement Congress’s mandate to avoid anti-competitive behaviour in the ratings industry. The proposed prohibitions of notching were directed primarily at the rating of CDOs and reflected lobbying pressure from ratings agencies that catered most to ratings shoppers.

Notching arose when collateralised debt obligation sponsors brought a pool of securities to a rating agency to be rated that included debts not previously rated by that rating agency. For example, suppose that ratings shopping in the first generation of subprime securitisation had resulted in some mortgage-backed securities that were rated by Fitch but not Moody’s (i.e., perhaps Fitch had been willing to bless a higher proportion of AAA debt relative to subprime mortgages than Moody’s). When asked to rate the CDO that contained those debts issued by that subprime mortgage-backed securities conduit, Moody’s would offer either to rate the underlying MBS from scratch, or to notch (adjust by a ratings downgrade) the ratings of those securities that had been given by Fitch.3. Changes in bank capital regulation introduced several years ago relating to securitisation discouraged banks from retaining junior tranches in securitisations that they originated and gave them an excuse for doing so.

This exacerbated agency problems by reducing sponsors’ loss exposures. The reforms raised minimum capital requirements for originators retaining junior stakes in securitisations. Sponsors switched from retaining junior stakes to supporting conduits through external credit enhancement (typically lines of credit of less than one year), which implied much lower capital requirements. Sponsors that used to retain large junior positions (which helped to align origination incentives) no longer had to worry about losses from following the earlier practice of retaining junior stakes. Indeed, one can imagine sponsors explaining to potential buyers of those junior claims that the desire to sell them was driven not by any change in credit standards or higher prospective losses, but rather by a change in regulatory practice – a change that offered sponsors a plausible explanation for reducing their pool exposures.1

4. The regulation of compensation practices in asset management likely played an important role in the willingness of institutional investors to invest their clients’ money so imprudently in subprime mortgage-related securities.

Casual empiricism suggests that hedge funds (where bonus compensation helps to align incentives and mitigate agency) have fared relatively well during the turmoil, compared to other institutional investors, and this likely reflects differences in incentives of hedge fund managers, whose incentives are much more closely aligned with their clients.

The standard hedge fund fee arrangement balances two considerations: the importance of incentive alignment (which encourages profit sharing by managers), and the risk aversion of asset managers (which encourages limiting the downside risk exposure for managers). The result is that hedge fund managers share the upside of long-term portfolio gains but have limited losses on the downside. Because hedge fund compensation structure is not regulated, and because both investors and managers are typically highly sophisticated people, it is reasonable to expect that the hedge fund financing structure has evolved as an “efficient” financial contract, which may explain the superior performance of hedge funds.

The typical hedge fund compensation structure is not permissible for other, regulated asset managers. Other asset managers must share symmetrically in portfolio gains and losses; if they were to keep 20% of the upside, they would have to also absorb 20% of the downside. Since risk-averse fund managers would not be willing to expose themselves to such loss, regulated institutional investors typically charge fees as a proportion of assets managed and do not share in profits. This is a direct consequence of the regulation of compensation, and arguably has been a source of great harm to investors, since it encourages asset managers to maximise the size of the funds that they manage, rather than the value of those funds. Managers who gain from the size of their portfolios rather than the profitability of their investments will face strong incentives not to inform investors of deteriorating opportunities in the marketplace and not to return funds to investors when the return relative to risk of their asset class deteriorates.

…

Near-term implications: monetary policy, regulation, and restructuring

Dire forecasts of the near-term outlook for house prices and attendant macroeconomic consequences of subprime foreclosures for bank net worth and consumption reflect an exaggerated view of downside risk. Inflation and long-term inflation expectations have risen substantially and pose an immediate threat. Monetary policy should focus on maintaining a credible commitment to price stability, which would ensure the continuing stability of the dollar, encourage stock market recovery, and therefore assist the process of financial institution recapitalisation.

Readers probably know we do not share this sunny view. Chris Whalen of Institutional Risk Analytics (who has a sophisticated clientele of big money institutional investors and is known for his thorough, detailed, bottoms-up work) has said

When the presidential transition team meets to go over the issues, the need to provide massive new financial support for the FDIC will be among the chief topics of discussion. Add a zero to the $50 billion in spending by the RFC under Jesse Jones….and you get an idea of the magnitude of liquidity that may be required in the near term to make good the FDIC promise to insured depositors.

Back to Calomiris:

Regulatory policy changes that should result from the subprime turmoil are numerous, and they include reforms of prudential regulation for banks, an end to the longstanding abuse of taxpayer resources by Fannie Mae and Freddie Mac, the reform of the regulatory use of rating agencies’ opinions, and the reform of the regulation of asset managers’ fee structures to improve managers’ incentives. It would also be desirable to restructure government programmes to encourage homeownership in a more systemically stable way, in the form of down payment matching assistance for new homeowners, rather than the myriad policies that subsidise housing by encouraging high mortgage leverage.

What long-term structural changes in financial intermediation will result from the subprime turmoil? One likely outcome is the conversion of some or all standalone investment banks to become commercial (depository) banks under Gramm-Leach-Bliley. The perceived advantages of remaining as a standalone investment bank – the avoidance of safety net regulation and access to a ready substitute for deposit funding in the form of repos – have diminished as the result of the turmoil. The long-term consequences for securitisation will likely be mixed. In some product areas with long histories of favourable experiences – like credit cards – securitisation is likely to persist and may even thrive from the demise of subprime securitisation, which is a competing consumer finance mechanism. In less-time tested areas, particularly those related to real estate, simpler structures, including on-balance sheet funding through covered bonds, will substitute for discredited securitisation in the near term and perhaps for many years to come.

Unwittingly? Unbelievably?

The idea that the governments involvement in this catastrophe is accidental, or unintended, or ‘a surprise’ is naivete of the highest order. Or it’s spin. More likely spin.

Sure, an anti-regulatory, pro-business, fact-free, crony capitalist takeover has nothing whatsoever to do with a crisis of capitalist society. Nobody could have ever possibly seen that coming. Nobody.

The solution obviously is to take whatever money is left in social security, and give it to the investment banks, and stock brockerages, as well as all future revenues intended for peoples retirement. Clearly, the problem we have had in the last few years is that we have not gone far enough in deregulating the economy, and not thrown enough money at investment banks. Sell Social Security! That should fix the problem.

What’s really funny is most americans have no idea how stupid what I just said is.

Does he mean to imply that the rich and powerful set up the system in such a way that they and their friends could extract wealth from the masses on a false premise and then deny all responsibility later? That’s just too much for me to believe. That the honest and conscientious stewards of our republic would keep policies in place that exploit those without power (in our country, banana republics and others)? I have to say…this is shocking, just shocking.

300 million indentured servants, whos’ ethical values provide the wealthy few with the safest heaven on the planet to protect their fortunes. Draft them to die in the wars. I’ve done my part.

Three tangential thoughts from Calomaris’ detailed summation:

1) There was no global savings glut: there was a global _credit_ glut. Those two things are really very different in their implications. Gluttons got thalers to play with either way, but the way the fallout lays out is very different in a world with little ACTUAL savings by anyone at this point. I don’t mean that there are no savings, as in the US, but that global savings are not in any way sufficient to back the volume of global credit being issued. Everyone is betting the farm that growth will ramp up to pay off that credit, that’s the game; like pulling ourselves up by our sandal straps, natch. I’m insufficiently visionary to see how this will all end, but let’s say that borrowing and productivity do not seem commensurate trajectories at this point, and are wildly out of balance in some economies, most especially our Lil Pea Patch.

2) Soooo privitizing soft ‘regulatory oversight’ to the bond rating agencies has worked out other than well, hummmm?? It wasnt’ supposed to work at all and didn’t, as is mentioned elsewhere in this article from VoxEU, so where’s the surprise, no? And this is the real goal with ‘privitazation’ period: it isn’t supposed to work, it’s supposed to direct revenue streams to favored cronies, ideally public revenue streams. Privitazation has always been a con. That’s not to say that public administration or regulation is notably efficient or efficatious; sometimes yes, sometimes not yes. But privitazation is, by definition, a scamfest wherever it’s tried. Sez me.

3) Public matching funds for mortgage downpayment to moderate income borrowers is a good idea from Calomaris, and I hope that it does not get lost in the shuffle. I would, for example, have bought residence equity sometime _before_ this mess if I had the DP, but my cash flow just doesn’t get that far.

Privatization transfers wealth to the connected few. If Fannie and Freddie were doomed either private or public, only if private could top managers skim tens of millions in a few years.

Regardless of what the facts are, the typical ignorant American peasant (the voter) is still going to be “convinced” all these “financial problems” are the result of:

1) “Those people”, and those liberals who like “those people”, and want to over-reg’late the honest hard workin’ `merican bidness man.

2) god’s displeasure with the “fornicating harlots”.

The system is working perfectly. The people with brains are draining the country of it’s wealth, and they’re leaving. What’s going to be left is patriotic dumb-asses armed with “nuclear” weapons.

This situation isn’t fixable. The country is getting a government that EXACTLY matches the intellect of the peasant voters.

Get out now, before it’s too late. Save your children!

Wow, I hadn’t seen that loss severity chart before. Good Lord, if loss severity rises to 60% at 3% HPA, what should loss severity come out to with our current HPA of roughly -10%?

Or does that chart only cover subprime paper? Either way, it’s pretty clear to me that loss severities are going to keep ramping up and up for some time in our current environment.