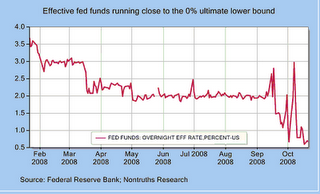

I’ve kept seeing mention of a possible 75 basis point cut by the Fed. As much as some traders seem to be lobbying for it, your humble blogger would regard Fed setting its policy rate at that level as entering the famed ZIRP (zero interest rate policy) land that has played a big part in persistent deflation/stagnation in Japan.

Now some have said that cutting rates that low would merely be the Fed endorsing the fact that the effective Fed fund rate has been below 1% for a few weeks. But that may well be the result of not having worked the bugs out of some of the Fed’s shiny new tools, particularly paying interest on reserves. As the blog News ‘N Economics noted last week (hat tip Mark Thoma):

By paying interest on excess reserves, the Fed increases the incentive for a bank to hold excess reserves with the Fed. This reduces the amount of interbank lending, and and increases the effective federal funds rate. The move, in theory, sets a lower bound on the effective federal funds rate.

Apparently the Fed was not paying enough reserve interest because the effective rate has been trading low, 0.67%, which is well-below the Fed’s target, currently 1.5%. The increased interest payments on excess reserves should increase the reserves held with the Fed, and drive up the effective federal funds rate. However, this is a new policy tool, and the correct rate still needs to be hammered out by the FOMC.

From Bloomberg:

The dollar fell for a second day against the euro on bets the Federal Reserve will lower interest rates by as much as three quarters of a percentage point today.

The U.S. currency also declined against the yen and the British pound on speculation the central bank will continue lowering borrowing costs as rising unemployment and sliding home values cause the world’s largest economy to contract. U.S. consumer confidence slumped to a record low this month as stocks plunged and banks shut off credit, a report showed yesterday.

“When the dust settles, the dollar’s fundamentals will pressure it to go lower,” said Masahiro Sato, joint general manager of the treasury division in Tokyo at Mizuho Trust & Banking Co., a unit of Japan’s second-largest publicly listed lender. “Traders will focus more on falling rates and the rising costs of fixing the U.S. economy.”

Like you, I read all of the numbers and try and make sense of them. But, I’m also a big fan of what Kedrosky calls drive by statistics.

This past Saturday I spent a wondeful day playing golf in the mountains of Northern Arizona with a group of “normal” people. School teachers, high school football coaches,a couple of UPS deliverymen and a rep for a shoe manufacturer.

The UPS guys told me that for the first time in their memory, UPS was laying off people prior to Christmas. The shoe rep said that Nordstrom’s had sent out a directive to all of their stores to cut inventory by 30% immediately and the school teachers and coaches didn’t want to talk about sports. All they had on their mind was the economy. The last time I heard that from them was in 2000 when they couldn’t quit talking about their tech investments. I sold everything the next day then.

The point is that any rate cut is spitting into the wind. The Fed needs to save its bullets. Let the whirlwind have its way and then use your policy tools. Don’t waste them now. Unfortunately, these guys are divorced from the real world.

The prospect of the markets tanking HARD if they don’t cut is I bet foremost in their minds. And with the price of oil less than half what it was in the summer, they’ve had an excuse handed to them. Also Uncle Sam has heavy borrowing coming up. You really have to wonder if kicking savers in the teeth like this is a good long term strategy.

Exactly right – artificially low interest rates punishes savers. In a narrow deflationary context you can argue that people will save anyway because cash holds or improves in real value. But hen you might as well argue the virtues of storing banknotes in your mattress.

Low rates also deter lenders from lending. None of this is the basis for a large, modern economy to function properly.

It is really annoying to see charts exaggerated for effect. I recall the saying that “there are lies, damned lies and statistics”.

Why does News’N’Economics start the y-axis as 0.5 not 0 ?

Obviously for visual impact!

We don’t need it. Their readership are intelligent people invited to interpret data for themselves.

I don’t like government interventionism in interest rates. But I also object to bias and distortion from both sides of the fence…