Willem Buiter is being proven right even sooner than he probably expected. The CBO provided a simply atrocious (but I imagine not surprising if you are up on such matters) report that the Federal budget deficit will come in just shy of $1.2 trillion, and that before any stimulus related deficits are added in, which are now expected to be $775 billion.

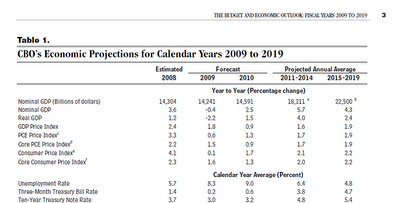

And it appears the CBO is working with pretty optimistic assumptions, so the budget gap ex Obama programs is likely to have been larger:

The budget watchdog warned that without policy changes such as a large stimulus, the economy would contract by 2.2 per cent in 2009, unemployment would peak at 9.2 per cent in 2010, house prices would fall a further 14 per cent and the economy would not return to its potential output until 2015.

That section reminds me of Paulson’s closed door threats to Congress, that if the TARP wasn’t passed, armageddon would result. We appeared to have had that anyhow in October, with (or perhaps even due to) the TARP. The market-watching crowd that corresponds with me expects unemployment to peak at 10-12% even with a stimulus program (although I think they are a tad more optimistic about economic recovery by maybe a year or two).

If they think that that is the worst that the downturn will get, I guarantee their revenue estimates are way too optimistic. The base line is too high.

Another revealing bit:

Robert Sunshine, acting CBO director, said that the subsidy cost of the $700bn bail-out fund known as the Troubled Assets Relief Programme was estimated at about $189bn. This amounts to an average subsidy of about 25 cents for each dollar spent. The cost of taking control of Fannie Mae and Freddie Mac was $238bn, he said, though this was almost entirely a one-off expense.

That Freddie/Fannie cost figure is new, and seems far higher than anything bandied anything bandied about earlier (although, in fairness, I came up blank on a quick search, so my memory could be wrong here.

Marshall Auerbach (of Prudent Bear fame) weighted in via an e-mail, “CBO Seeing Stars”:

The idea that trillion dollar deficit has already occurred starring everyone in the face.

But the “stars’ part is if they think that the deficit comes down in 2010. Indeed just yesterday Obama said that the deficit would be over a trillion for a long period of time.

The surprise will be that the deficit as percent of GDP will “only” be 4.9% in 2010 and that nominal GDP will decline less than 1% in 2009.

Remember the fiscal year starts on October 1st.

Now just how is it that Obama’s extra $750 billion spending, combined with lower tax revenues due to recession will result in lower nominal deficit for 2010 and virtually unchanged nominal GDP in 2009?

Either incremental deficit spending will have to well exceed 1 trillion for 2009-2010 which will then put the budget deficit at close to 10%, if not more of GDP or nominal GDP will decline substantially more than 5% for lack of adequate fiscal stimulus.

They can’t have it both ways; lower deficits and unchanged nominal GDP.

If they need a history lesson they should check out 1932 and 1937.

My guess is Obama spends that $750 plus, the deficit goes to close to $1.5 trillion, nominal still goes down because of the lag effect of the stimulus and, presto, the deficit as percent of GDP goes over 10%.

Yes, one and one still equal two and the sooner the folks in DC figure this out the sooner they can get their nominal GDP growing again.

Otherwise, pleas, someone, explain what is going to cause nominal GDP to go from negative 5% plus in 4thQ 2008 to almost unchanged in 2009.

Not even Bernie Madoff could get to those numbers. That is unless Ms. Romer thinks that monetary stimulus will do the trick all by itself.

It must be that CBO was just to horrified to print a deficit number that was in the double digits as percent of GDP (click to enlarge):

Missing a word in your first sentence? Honestly, if you want this blog to produce your income you need to proofread it and not post such sloppy writing. Okay, friend? Thanks!

Why oh why do you pretend that CBO are supposed to be believed?

We are going to see fiscal deficits rise above 100% of GDP, and we are about 50% now? 5 years at 10%? 3 years at 13%?

DBPepper,

There is nothing wrong with the first sentence, I suggest you read more closely before taking pot shots. “Willem Buiter” is a proper name.

I think DBPepper needs to proofread her/his posts. I think s/he means the second sentence rather than the first.

Yves: I dislike the TARP as much as you, but October 2008 was not armageddon. Without the TARP, October would have likely included Chapter 11 filings by Morgan Stanley, Goldman Sachs and Citibank which would certainly have made it closer to armageddon.

Maybe I’m dumb, but it’s gotten to the point where I have no idea how this is going to even be theoretically supported. I mean as mentioned in the recent post on Chinese outflows, they are going to have to spend desperately just to keep from falling apart…Germany had a bond offering fail and is surely going to have a huge drop in exports…the Gulf States are hemorrhaging and Japan’s exports are in nearly Depression territory already.

Am I missing something, or is there not even enough capital around to support these massive deficits even if people wanted to?

What a stupid comment, so much so, thought it was pure satire. You were far too polite in your rebuttal but one can understand why.

At this rate $9 of debt to generate $1 of GDP. If a company had to borrow $9 to generate $1 in sales, grim outcome for sure. This is simply not sustainable if the Treasury is to continue as a going concern… And these CBO figures of $1.2 Trillion are BEFORE Obama’s planned expenditures of another $800B or any of the states wanting a $1 Trillion bailout. What’s going to happen when Social Security and Medicare really kick in big in 2-3 years. Checkmate.

DBPepper,

While Yves’s post does have some typos, I’ve learned to not fault the econ bloggers for some typos here and there.

Mish, Barry, Yves, etc. have typos. They’ve also been helping me make sense of everything for more than a year now and have saved me my savings for free.

A tip of the hat to all of them.

As for you, one can be a bit more helpful when it comes to typos. Ripping into them isn’t helpful. Send an e-mail or be a bit more tactful in your language next time.

As an exercise (if not wishful thinking), what would happen if one or more of the following would occur:

1. The US failed to make its interest payments on bonds?

2. Flat out declared that its bonds, tbills, etc were no longer redeemable

3. Declare CDS, CDOs, etc illegal and irredeemable

4. Declared a debt jubilee

Would we be threatened with nukes to pay (at least China or Russia)? Would we be forced under a UN-led IMF programme? Would we be simply ostracized and cut off? How bad would it be if we were?

Anybody getting funny ideas on 10 and 30 year T-bond? Both seems to be closing in on December levels. I am itching for a good short.

Another American Non-Reality Based Wildly Optimistic Deficit Estimate. (AANRBWODE).

USA is bankrupt already and quite soon the bond market will finally collapse this clown circus.

Even US mercenary high-tech military is soon quite useless. Mercenaries must get paid or else…American high-tech weapons also require very costly and constant maintenance and without it an Apache helicopter for example is useless within few months.

$1.2 trillion alone is already about as big as any deficit run by Japan in their futile stimulus attempts. Tack on another $800b and it’s Texas sized. Or maybe California/New York sized is more apropos.

In fact, if nominal GDP shrinks slightly and those numbers are accurate, we’ll clock in around 14%. Mexico will have only posted 3 greater numbers in its tumultuous history. We’ll see when bigger’s better, when it’s functionally useless, and when it’s potentially dangerous.

These numbers begin to take us well out of the ballpark Reinhart and Rogoff were playing in, and some metrics like our current account deficit, stock prices, and house prices were already pretty high. I still suspect the Swedish plan just wasn’t feasible here due to the magnitude of our problem. The improved budget deficit will add an unprecedented experiment in debtitude.

I don’t personally anticipate a Japan-like outcome here, because of extreme differences in household savings, reserve currency status, NIIP, the trade deficit, and the state of the rest of the world, and the rest of Buiter’s mentions, but it’s in the realm of possibility. Nor do I anticipate a gradual adjustment as happened in the other big 5: our imbalances, particularly externally, were worse, and I suspect if you mapped total credit outstanding to GDP(the integral of the interesting numbers Stuart posted upthread) for the big 5 we’d see quite extraordinary numbers for the U.S. I still strongly believe we’ll see increasing real interest rates, dollar strength, and worsening economic problems, until something snaps.

Again, the really scary thing to me is that the populace and our economic leaders has been conditioned effectively into believing deficits don’t matter; American exceptionalism is, though perhaps sometimes valid, rampant; and our government believes the larger the deficit the more likely we are to recover from it.

Remember: just because you can’t see real interest rates going up, doesn’t mean they aren’t. In fact, it’s very hard to see at all now, because the markets are so contorted through intervention, zero bounds, friction, and other inefficiencies. But we know debt and higher real interest rates are deflationary, and the ensuing debt deflation is how Irving Fisher redeemed himself.

Has anyone done any sort of quantitative analysis of whether/when the US will default on its debt? I imagine one could look at scenarios representing different levels of deficit spending and GDP/tax revenue growth (or decline) to see at what point the US would be effectively insolvent (or are we already?). Developing a point estimate (e.g., the US will default on its debt on June 23, 2015) would be pointless–there are too many unknowns. But it seems to me one could investigate what assumptions about the future path of economic growth, tax revenues, goofy Keynesian multipliers, etc. one has to make to avoid insolvency. I haven’t seen such an analysis, but if anyone has, please point me toward it. Otherwise I may have a crack at it myself.

Right now, on one side of the debate are the Krugman/Reich/etc. pro-stimulus faction, who dismiss the notion of default outright or, at best, point to the fact that we were able to overcome our giant post-WWII deficits, so why worry. On the other side are people like Buiter and Marc Faber (and Timo above), who are fond of making strong normative statements about the certainty of impending default but without (as far as I’ve seen) any numbers to back them up. I think Buiter and Timo are probably right, but I’d like to see a somewhat more rigorous exploration of the issue. Does such a thing exist?

And as Timo reminds us in his own way — while I’m typing my long, blithering post — there are still a lot of very large liabilities lurking off the balance sheet. Imagine adding on the governors’ $1 trillion dollar wish. That would already easily eclipse any high water mark Mexico ever reached.

Regarding previous cost estimates for the Fannie/Fredie situation, from the Economist in Sept:

“Mr Paulson was upbeat, pointing out that since the Treasury would hold the securities to maturity it might one day reap net gains.

But the eventual cost to the public purse is unknown and potentially huge. The Treasury says it could buy as much as $100 billion of preferred stock in each of the two firms, though it deems that highly unlikely.”

http://www.economist.com/finance/displaystory.cfm?story_id=12078933

and DBPepper … please drown yourself in a polluted river.

Has anyone done any sort of quantitative analysis of whether/when the US will default on its debt? I imagine one could look at scenarios representing different levels of deficit spending and GDP/tax revenue growth (or decline) to see at what point the US would be effectively insolvent (or are we already?).

It’s a good, but extraordinarily difficult question, James. That’s because you have to look at:

1) The NPV of the assets and liabilities of the Federal Government and all that for which it’s on the hook(this is why deficits and borrowing do still matter even in a temporary liquidity trap); and

2) Intertemporal budget constraints from now until the foreseeable future, to make sure that in no period do we require more income than we have.

The assets are pretty clear: we have the amount of money the USG can tax, and we have the amount of money the USG can siphon out of the real economy with inflation (seigniorage). There are real limits to both. It’s extraordinarily difficult to suss out what those limits are.

The liabilities are even less clear and variable. Federal budgets, Federal debt, Medicare/Medicaid, municipal and state deficits, bank deposits, FNM/FRE, Fed resuscitation, AIG, GE, GM, investment banks, and the other 30 problems we haven’t come up with, minus the above variables that turn out not to be problems.

Some brave souls have tried to look at just Medicare and Social Security. There are some very good conclusions there and some rough guesses at numbers.

The world is also extraordinarily complex and always changing. If anyone could come up with a reasonable net worth estimate with less than an order of magnitude of uncertainty, I’d be awestruck.

Beyond that, there are a lot of different kinds of default. Simply proving that default seems inevitable may not be so useful for figuring out what wil happen.

@ Mikkel,

"it's gotten to the point where I have no idea how this is going to even be theoretically supported."

aren't we all wondering that? Aren't we all wondering when the fiscal crises begin here and elswhere? I mean all global policymakers throughout the world are doing is to continue to prop up the global imbalances with unsustainable trade deficits and surpluses, the status quo, the world order as we know it under the US dollar as the worlds reserve currency.

What the world needs now is a adjustment in these global imbalances and a return to something on the order of a Bretton Woods II that would put a mechanism in place to avoid these kinds of unsustainable imbalances from recurring.

@Yves,

The budget watchdog warnings do sound like the P&B fearmongering. But more worrisome is that the watchdog believes a set of assumptions that are proving to be invalid in our post housing bubble economy. And worse, the fiscal stimulus plan is really only focused on mitigation for 2009 rather than on stimulus spending on long range goals such as economic sustainability and providing engines of economic growth for the long run. A lot of spending on mistaken goals is what I worry about happening here. Not one mention since September has been made about an implementing an alternative energy grid across the spine of America. Those plans got shelved to save the old paradigm. Huh? Doesn't make sense for a new Prez that wants to usher in change.

@ James B – Krugman urged Japan to "PRINT LOTS OF MONEY" to increase the supply of money in 1997 to counter and overcome the deflationary forces. Japan listened and experimented with fairly aggressive monetarism. The BOJ governor Masaru Hayami made a few observations 5 yers later in July 2002: "The growth rate of the monetary base has been increasing at a rate close to 30% a year….it is extremely difficult to revitalize Japan's economy solely by monetary easing when it faces various structural problems…"

The BOJ also published a paper in July 2002 titled "The Effects of Moneary Policy on Firm Investment after teh Collapse of the Asset Price Bubble.

That paper revealed "that the monetary easing after the bubble burst worked therought the interest rate channel, but not through the credit channel. The credit channel was blocked because of a deterioration in balance sheet conditions.

Five years after Krugman's exhortation, monetarism wasn't working due to deterioration of balance sheet conditions after the asset bubble burst. Japan still struggles and thier fiscal conditions have only worsened.

The US housing bubble burst wide open in 2007-08, monetary easing is not doing anything to unclog the credit system for precisely the same reason, deterioration balance sheet conditions. The US is following Japan with a lag in both policy and outcomes. The outcomes of which are neither desirable nor the intended policy objective. So, perhaps it is time for a BIG RETHINK about normative policy responses that no lnoger work in a post bubble economy.

The new director of CBO is named Robert Sunshine???? How weird is that?

Oh, and I’d just like to point out that CBO’s budget numbers usually have the higher AMT tax because Congress didn’t re-up the exemption fudge in them (not because they want to, but because they produce the budget estimates based on the tax code as written–I’m not trying to suggest that CBO is attempting to hide anything.) So it could be even worse. . .

ndk,

Thanks for a more detailed and thoughtful response than my little comment deserved. And thanks for pointing me to that Kotlikoff article. I don’t know if I’ve seen that before. Reading the introduction I had a strong sense of deja vu, but maybe that’s just because it’s midnight and I’m pumped full of sudafed.

I agree that coming up with precise estimates is hopeless, but I wonder if some sort of scenario analysis might still be useful; it might, for instance, show that insanely optimistic assumptions about the future are needed to prevent default. I’ll have to give this some more thought when my brain is functioning a bit better.

As to the different kinds of default, that’s a different analysis and depends on policy choices as yet unmade. If this year has proven one thing to me it’s that I will never be able to anticipate the insane, craven things my government will do.

john b,

I think we’ll be extraordinarily lucky if we end up following Japan’s course. I suspect we’re headed for something much worse.

DBPepper,

if you want to exercise your grammar skills try this blog:

http://www.grammarblog.co.uk/

one thing is certain: as deficits rise, the dollar will ultimately tank and while the government will not default on its debt, it will de-facto default on any benefits promises and that will make things more manageable in the future. but this will send at the same time a clear message to anyone: do not expect any fixed income from the government and save on your own for retirement. this on its own will lead to ever decreasing consumption given the demographics age composition and will add further pressure on the size of the gdp. japan style economic malaise is inevitable despite the quite different state of public finances and propensity to save in each country.

be real, it is simply impossible to have at the same time 14% GDP deficits (or 30% budget deficits) indefinitely, strong currency, keep promises on past debts, economic growth, low unemployment, world’s reserve currency, low taxation, preserve social security and medicare benefits.

@james b and ndk,

I think you can benchmark max govt taxation and other “assets” that can be stripped from We The People by looking at 1943-44. Indeed there is a hard ceiling of maximum sacrifice, about 52% of GDP.

In time of crisis everybody concentrates on his/her own household situation. The same goes for global crisis.

Foreign net purchases already collapsed from usual 50-60 billion dollars down to pitiful 1.5 billion. China is losing appetite quickly for more US debt. The same with EU. Americans will be pretty much left alone just like everybody else.

It probably takes 10 dollars of new debt to create one new GDP dollar on top of the yearly pile. So even if Obama wastes 1000 billion NOW, it most likely will only equal few months worth of GDP contraction. Every sector nowadays is taking heavy losses.

Financial Times estimates $3000 billion new government bonds will be issued this year. Add to that rollover debt. Huge pile of debt waiting to be financed.

If investors simply buy bonds and not stocks, stock markets will go down even further and that begets even more panic selling. What about companies seeking for funding? Those markets too are already quite frozen all around the world. Companies are going bankrupt even because of mere short term financing difficulties.

Really bad situation, checkmate or Zugzwang (any movement now makes your situation even worse)…

Nice post, and good comments. I am really becoming a fan of “NDK” for his/?her? insights.

with regard to Yves response, “Five years after Krugman’s exhortation, monetarism wasn’t working due to deterioration of balance sheet conditions after the asset bubble burst. Japan still struggles and thier fiscal conditions have only worsened.”

At some point, everybody is going to realize its just little printed pieces of paper. And to the extent paper money is a surrogate for exchange of actual productivity, I agree too much of it is going back to activities (banking)that are domonstratibly a higher proportion of GDP than can be justified.

Yves,

Great post. And the additional commentary by Marshall does put things in perspective.

The question is: how do you see this playing out for the bond market, specifically treasuries?

I know Buiter sees this as bearish for bonds, and, indeed, we have seen a selloff there over the past week.

Cheers.

Ed

John Bougereal: Thanks for the exceptionally interesting post.

To NDK,

Thanks very much for your wonderful insights. I learn a lot from your posts.

The only minor point I might disagree with you on is why the Swedish response [as described in Reinhardt & Rogoff] was not followed in the US.

For me, it was a reluctance to do something that smacked of socialism, i.e., the nationalization of the failing banks. Bush and Paulson's philosophy would not allow that step. Added proof of that is the exceeding mild terms Citicorp and other troubled institutions received from this Republican admisistration. They don't want to do anything that will destroy friends or those with similar business philosophies.

Another possibility is that no one at the Treasury really read Reinhardt & Rogoff in the first place, as I have seen no mention of the possibility of the Swedish solution in any of their prognostications.

Just looking at the CPI numbers….given that inflation is the stated goal arent these numbers kind of low, doesnt that make the whole forecast problematic…which is fine with me since I dont think anyone knows what is going to happen beyond this quarter right now.

ndk et al,

NPV calculations for these issues are hopeless and somewhat meaningless. The eventual resolution depends on income, not asset values.

Projections of GDP share for the important variables are essential.

As per page 16 in the CBO report, showing the projected trend for federal debt held by the public as a share of GDP.

You may not agree with those numbers, but that’s the sort of analysis that’s required.

Since the Fed has clearly indicated they are willing to buy Treasuries, they may not fall as fast as people think….at least in nominal terms. Expect intervention to continue to cloudy the markets and make analysis more confounding.

I know some people don’t want to hear it because they may be caught up in prognosticating on international payments balances via-a-vis FX, or they are worried whether NOW is the time to abandon all hope and move to GOLD, but the answer to all these problems is NOT any level of deficit spending.

The answer, plain and simple, is the abandonment of the international debt-money system that got us here in the first place.

The basic problem IS fractional-reserve banking and the unsustainable debt burden this system places on the economic society.

In Friedman’s “”Monetary and Fiscal Framework for Economic Stability”, he correctly advocated for an end to private creation and destruction of money, establishment of a system of Treasury-issue of all monies, debt-free at issue, and having banks operate on a 100 percent reserve lending system.

The problem that we have is TOO MUCH DEBT.

The solution cannot be vastly increased and unprecedented additions of debt.

It just cannot be.

It’s time for Greenbacks.

Plain and simple.

…yeahh.

come on smart people. We want to see number.

1. total debt status

2. total income

3. export/import picture given top 5 our biggest trading partner most likely behavior (including exchange rate movement)

What is the state of US solvency?

Are we going Argentina? Korea? Zimbabwe?

Or is it party time still?

Show number please.

I’m confused. If the current deficit is $1.2 TT, and includes $750 BB for TARP, then the deficit, w/o TARP, is $500 BB.

Now granted, the deficit has been reported at $400-500 BB throughout Bush’s 8 years, but debt increased $10 TT, so they’ve been low balling all along. But back to my confusion…

TARP is not authorized for another $750 BB next year. Is it generally expected to be another $750 BB? If not, why are we adding Obama’s $800 BB stimulus to the $1.2 TT current deficit? Basically, the stimulus and TARP are a wash and the projected deficit for next fiscal year will be around $1.2 TT. Not $2 TT by adding $800 BB to 1.2 TT.

Now, all the arguments about revenue figures and such can be made. But that is different than counting TARP in 2009.

Why was anyone surprised by $1.2 TT when TARP was certainly not under the radar and cost $750 BB?

Newbie here, please tread lightly. Just a mom trying to educate herself more, hoping to glean a pearl here or there for my kids sake.

For anyone who cares to comment:

1. TIPS: is there a chance the US treasury might default on these inflation fighting treasuries?

2. Income Taxes: Bush’s set to expire 2010, any one see mass rising of taxes to fill government coffers and counter debt? Since I’m over 59.5, I’m seriously wondering if 2009 is time to cash in my now all cash IRA and take the money foreign. Sounds counter-American to me and I hate the idea.

Thanks.

Re: Anonymous regarding TIPS & IRA investments…

While the inflation protection component of TIPS might well lag in a high inflationary environment, it is unlikely the US would default on them. Rather, it is more likely they would also [but to a lesser degree] lose their purchasing power as bonds in general would.

It is not intutively obvious that putting ones resources in foreign currencies would be much preferable to dollars, as foreigners have many of the same problems the US has [and there seems to be a general desire to keep all currencies cheap relative to each other [obviously impossible, but that doesn't mean they won't try].

Right now there is a big battle worldwide between deflation and inflation. As long as deflation seems to be winning, keep your gov't bonds and cash, but if things tilt in favor of inflation, then gold should be the asset of choice to hold in IRA's or elsewhere.

8.1.2009

By astrology, the left-side brainer, a Gedankenexperiment. Suppose there is sufficient reason, to anticipate for the matters of physical maintenance (“element earth”):

• a BIG change (size: one in 800 Years) in 2577 according to which the paradigm Virgo will be replaced by Capricorn, suggesting, that the overall “climate” will change from a late-summer type to winter type. This late-summer-paradigm will then have lasted for minimum about 3.200 years.

• Preparing for this change we have from now about 570 Years. But the time window for finishing an old pattern and starting to “bail” a new one out of the unconscious is open only for 21 years and those are that between 1998 and 2019.

That would mean we are suffering an accommodation being far different from those dimensions, we are used to talk and think to in economical relations.

It might be due to think different about the dimensions being necessary for meaningful debt spending. We might be faced with debts, which might be those of hundreds if not thousands of years.

This would ask for conscious and credible commitments over such timeframes and would be incumbent to the debtor to accept controls by monitors, etc. Might be the only way avoiding the emperor-with-no-clothes-shame of everlasting pending default. Not primarily to avoid US- and other sovereign-defaults, but to maintain civilization might mean: international compliance, based on earth wide reshape projects, would mean, to overcome economics by mega politics.

FDR (and Churchill) reshaped political world order following the route of “Four Freedoms”-Speech of 6.1.1941, Atlantic Charta, destroying the beast, UN, in fife years for lots of coming generations.

With other words, not macroeconomics might be due but mega macroeconomics.

Could it be, that pieces like those about the medieval Fuggers and about the Yellowstone caldera refer to something like that being in the subconscious pipes?

mundanomaniac

Bah Humbug,

This crap is all unconstitutional and I’ll see all these fools in jail, I mean, they will be inside jail, and part of a new social circle, while I dance freely outside, looking in …. laughing like a spotted hyena : mooohawhahahahaha …

Also see: In her dissent, Justice O’Connor noted that Butler was the last case in which the Supreme Court struck down an Act of Congress as beyond the authority granted by the Spending Clause.

This was part of a series of cases decided by the conservative Supreme Court of the time period which declared unconstitutional parts of Franklin D. Roosevelt’s New Deal legislation.

Some history from Wiki, related to GDP:

These reforms, together with several other relief and recovery measures are called the First New Deal. New regulations and attempts at economic stimulus through a new alphabet soup of agencies set up in 1933 and 1934 and previously extant agencies such as the Reconstruction Finance Corporation brought a sharp upswing of the economy, with GDP returning to the levels of the late 1920s. By 1935, the “Second New Deal” added Social Security (which did not start making large payouts until much later), a jobs program for the unemployed (the Works Progress Administration, WPA) and, through the National Labor Relations Board, a strong stimulus to the growth of labor unions. Unemployment declined by over one-third in Roosevelt’s first term (from 25% to 14.3%, 1933 to 1937). In Roosevelt’s second term, the economy went into a short, sharp recession in 1937-38. In 1929, federal expenditures constituted only 3% of the GDP. The national debt as a proportion of GNP rose under Hoover from 20% to 40%. Roosevelt kept it at 40% until the war began, when it soared to 128%. After the Recession of 1937, conservatives were able to form a bipartisan conservative coalition to stop further expansion of the New Deal and, when unemployment dropped to 2% they abolished WPA, CCC and the PWA relief programs; Social Security, however, remained in place.

Also see: Total Global GDP is about $50 Trillion The market for Derivatives like Credit Default Swaps is over $60 Trillion

Genuine investment, production sectors, export chain, and long term jobs are part of the solution.

Emergency sessions to change the tax structure to generate genuine productive investments.

Emergency sessions to cut govt. employees(federal, state, on down) salaries, benefits, and pensions as close to 50% as possible.

And, private employers can reduce hours, pay levels, etc. to keep people employed starting with the thousands of fat media salaries.

__________________

Thoroughly disgusted. These pol. pimps are going to get this economy deeper in the hole with payoffs to state pols.

Chauncy Gardner playing a Pres.-elect was on the tube today. It’s just a sign of how bad things have bottomed out in this country and what a $750M ad campaign will get you. We will never use the same title of a Washington etc. He’s like some college kid play acting pres. surrounded by his oldsters telling him what to do. We can’t even use the moniker CEO to describe him.

The archaic governance system should have been altered years ago. The Founding titles should have been retired at least forty years ago to reflect a more business like structure that was needed. Further, we have thought for years that we should elect a team of three to run the country.

independent

not sure via a chapter XI or VII by insolvent institutions would be considered to be armageddon. Isn’t that what is supposed to happen to insolvent institutions. BTW if that would armageddon what is what is going on in Gaza? Irrespective of the merits of each side what is happening to civilians is certainly worse than a few banks going bankrupt. I think we all need to get a perspective with our language.

when a body has poison in its system to get out as quickly as possible is the best treatment. This true of an economy. Low interest the knee jerk reaction is exactly the wrong answer since it allows the poison to stay in the system longer.

In a solvency crisis lowering interest rates doesn’t help increase spending by insolvent borrowers but rather decreases spending by savers. I believe Japan’s problems would have been significantly less if they had kept interest rates up.

On another note: Kudos to NDK!

Tho’ it is not yours alone, you have come up with Word of the Year 2009. “Debtitude”

ignorantmike

That $1.2tn deficit is going to seem impossibly large in a couple of years time (and remember that this is a recurring annual deficit) – because tax receipts are literally falling off a cliff. Right now. The Treasury would struggle to meet even the original 2009m budget with a $450bn deficit.

$1.2tn looks vaguely do-able through the Fed's rose tinted glasses – because we are coming off the back of a monstrous credit boom.

When unemployment nears 10% and CRE has collapsed and MEW has vanished – the huge Government spending numbers will be seen by everyone as ridiculous. The $300bn promised to Citigroup, and similar for AIG, and similar for F&F will be shown as extravagance beyond words. Even more so when 20 states come begging for billions to meet their payrolls!

It looks like the Fed and Treasury have simply given up caring about what happens 2 years down the road. They are in survival mode – taking a month at a time.

The United States has long been the greatest nation in the world – but always worried about foreign threats – Russia, China, terrorism. How sad and ironic that the most dangerous threat, bringing it to its knees, comes from within! In fact WITHIN the government itself.

I want to be constructive.

Obama’s $775bn infrastructure plan can help – IF he takes the money from existing plans which are bailing out failed institutions. i.e. no new money.

All banks have to be divided into 2 lots. Good and bad. The bad ones are killed off (yes this includes Citi, GS, most of the big favoured names). Branches and deposits transferred to the good banks. By presidential edict or whatever. The bad debt has to be flushed out of the system. This is major surgery now – because the patient has been left in the trenches for so long severe gangrene has set in.

That is the start. Other areas include: tax reduction for small companies, shrinkage of government, market to set interest rates, regulatory overhaul, active prosecution of fraudsters detected over the last 10 years…

It is only too late when we are all dead!

@ doc darkness holiday,

Compressed metal rounds are impossible to trace forensically, so make a list for the ones going on the lamb and I’ll sort it out K. The ones that cooperate can live out the rest of their lives, in the coming to America soon, Gitmo Gray Bar Zoo. Where the genial folks of America can watch them sit in cages like the monkeys they are, Unlimited fighting (no rules) cage style on Wed and Sat. Sell the brodcast rights to pay for their rent and board.

Your Pirate in arms.

Skippy