Runaway horse in French capital BBC (see another video here, hat tip reader Michael T). Look for the way the gendame catches Garabaldi.

Surveillance cams help fight crime, city says Chicago Sun-Times. Big Brother is coming to the Midwest.

Check the Numbers: The Case for Due Diligence in Policy Formation Fraser Institute (hat tip Felix Salmon)

Radical revamp splits RBS in two Times Online

The Complete Biggest Losers! Clusterstock.

While Rome Burns Ed Harrison

‘Good Banks’ Are the Cost Effective Way Out of the Financial Crisis Willem Buiter Wall Street Journal

PBS Screws Up Report on Financial Crisis AlterNet

After Losses, a Move to Reclaim Executives’ Pay Gretchen Morgenson, New York Times. A good recap of why the pay of the executive ranks at a lot of firms was undeserved, and why they will get to keep it anyhow.

U.S. Bancorp CEO Davis rips TARP Twin Cities (hat tip reader Steve)

The Oligarchs’ Escape Plan Michael Hudson, CounterPunch

The US government frozen in the headlights Michael Pettis

Chocolate Covered Cotton billmon. Bilmon is back! This is a must read.

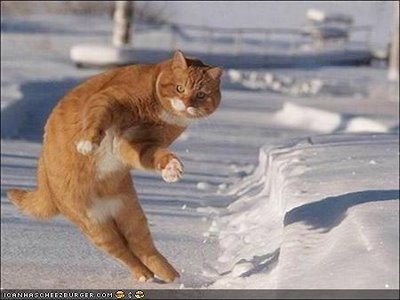

Antidote du jour:

From the same BBC video series,

Pet fox Vixen shares flat with family

http://news.bbc.co.uk/2/hi/uk_news/england/7898259.stm

It is time for the citizenry to nip the police surveillance industry in the bud.

The reason there are so many Americans in prison is the private prison industry. The situation will only get worse. IMO, this is a very big issue and a giant step toward an even more invasive police state. The only way to pay for these inneffective systems (including traffic cameras) is too write fines, fees, taxes, laws, restrictions, and police invasions. Not about increasing security. It is about control and intimidation.

And also at the Beeb

http://news.bbc.co.uk/1/hi/england/7889698.stm

How was the chocolate covered cotton post a must-read? Like the cotton itself, the post was filled with indigestible material. I tried glossing over the obligatory crudeness and slander to get at the real point of the post, but once I removed all of that, it seemed to boil down to the traditional: “My political opponents are horrible people.”

Whatever.

Billmon’s back! Wonderful.

Not to dump on all your links today, but that Counterpunch article was gibberish. Not wrong, necessarily, but I was unable to put any of his arguments into specific human language in order to evaluate them. His account of IMF restructuring made me mute for five minutes, it was so nonsensical.

Well, here’s some praise: great piece by Buiter. Very interesting, but is there any chance of it happening?

I’m curious as to why Billmon is a “must read.” I too could manufacture apparent insight by looking to, say, Spiderman comics, or Marat/Sade, to provide attractive metaphors for economic discussion. Mix with sarcasm and outrage, and voila!

Apparently, some people can’t hear Billmon’s riff on Joseph Heller’s Catch 22. I wonder what passage is causing some readers to stick their fingers in their ears and chant “la la la”?

Could it be this one:

“””

[I]t would literally be easier to square a circle, or maybe invent a perpetual motion machine, than to devise a plan that a.) lifts Big Sh*tpile off the balance sheets of the banks, while at the same time leaving them b.) solvent and c.) in the hands of private investors, without d.) constituting a flat-out transfer of wealth from taxpayers to bank shareholders.

“””

Or this one:

“””

Bottom line: great big chunks of Big Sh*tpile aren’t “impaired,” or “illiquid,” or “distressed,” they’re worthless, now and forever – unless the peak real estate values of the bubble can miraculously be restored and a whole bunch of deceased LBOs can be raised from the tomb.

“””

Or this comment, on President Kerensky and his team:

“””

One of the things that creeps me out about the political system’s response to the crisis so far – the insolvency of the banking system in particular – are the increasingly desperate attempts to maintain a phony façade of free markets and private enterprise, in an economy now utterly dependent on the federal safety net. I totally expected that from Hank Paulson and the Cheney Administration, but is Obama’s financial team really pressed from exactly the same Wall Street mold?

“””

I guess what I’m saying, really, is that a lot of the really smart and financially knowledgeable people who read this blog should pay attention to what Billmon, and people like him, are saying, because Billmon is expressing the views of a lot of people, some of whose thinking is a bit cruder. Eh? And the post is, surely, not so poorly written that it’s not worth a read — which I hope the extracts from it show.

This is from Hudson’s first paragraph, “Economies emerged from World War II relatively free of debt,…”

That was such a horrifically moronic statement, I couldn’t read any further.

Agree w K T Cat and Anon 10:35. Billmon’s rant juvenile. After all the extra insights he said he obtained from detailed study, all he can do is analogize to Catch-22, and tell us what we all know re the evils of CDOs. A little editing, Billmon, would go a long way.

And re the alleged evils of the Republicans only: Clinton pushed for the repeal of Glass-Steagall. His crowning achievement: Take that, FDR! And a Democratic Congress railroaded the TARP bailout through with no hearings, having ignored the financial crisis at least as much as the White House and the Fed did. And why didn’t they investigate corruption in Iraq?

Yves: If you are half as partisan as Billmon, that would be disappointing. The current problems go much deeper than can be blamed on one wing of the Establishment or the other.

Some commenters say Billmon’s post is “partisan.” In what way? It’s pretty tough on Geithner, and last I checked, Geithner was Treasury Secretary for a President whose party affiliation is Democrat.

“While Rome Burns” shows how P/E ratio influences long-term returns. Correct, but more dramatically shown with a scatter plot — see mine from 1995, using the same data source as Harrison’s:

http://www.incomeprofiles.com/articles/?id=12

Thanks for the billmon posting link Yves. It seems that it doesn’t resonate with some of your readership and that is interesting.

What are those same folks going to say about the news coming out of the EU where they say that they want to reign in investment banking world wide? What will the cowboy capitalists say to that?

It is time to strip the facade of Dem or Rep from responsible, law abiding moral folks and let us kill the fascism that has crept into America.

Difficult for many to get beyond their political leaning or belief in the American Dream machine, maybe they need a new draft and send them off to some far and distant land to protect the interest of the free here at home, soon they would get the message.

What is it that Billmon has written that has not been said by others more clearly and with less theatrics?

It’s just a jump to the left…

The links to CounterPunch and AlterNet are a big disappointment. These are nut sites. Didn’t the Bush Confesses to Oval Office Alcohol Relapses book ad give you, Yves?

OOPS! Fixed last sentence.

The links to CounterPunch and AlterNet are a big disappointment. These are nut sites. Didn’t the “Bush Confesses to Oval Office Alcohol Relapses” book ad give you a clue Yves?

The trade deficit caused the recession, please start to write about this, look it up, it makes 100% sense. Everything else was just a result of this.

This crisis’ root cause is NOT credit tightening, this is a result. The root cause is the trade deficit.

From Clusterstock:

LOSS: $126,417

Lucky Peter Chernin avoided getting caught in the market meltdown last fall thanks to his pitifully small News Corp. stake of 10,465 shares. Consequently, even though the company’s share price fell significantly, its COO barely saw a change in his stock portfolio.

Uh, I just got my 401k, and thats about what I LOST. BUT I don’t make nearly as much!!! Arrrrrgh!!!

Yves, Thanks for the Billmon post. It was material that most of us are probably familiar with but his slant is very humorous. I re posted Billmon on a moron crescent site and the comments were much as those above.

They continue in denial but will soon get the shock of their lives. When the shock arrives the moron crescent crowd will quickly find a bystander to point a finger at and at that point the first group will be hauled away, rinse and repeate…ala the third reich.

Notwithstanding Hudson’s sentence about debt ratios, Hudson’s piece was one of the best I read all year. Thanks, Yves. Please, everyone, read that article. If you don’t think you’re being sold down the river to the oligarchs, you’re in denial.

Take that “check the numbers” article with a very, very large grain of salt. Statistical analysis of large data sets can be done in many ways, and a well-funded skeptic can find a way to cast doubt on almost any unwelcome conclusion.

The authors are advocating time-consuming procedural requirements that could make it nearly impossible to publish science that is unwelcome to wealthy special interests.

David Michaels has written a very good book, Doubt is Their Product, giving the history of these practices.

I think that cat was thrown. I can’t see else how it could have adopted such a pose.

He’s got a look of somber resignation on his face, as if to say

‘yep, they’re throwing me into the snow-drift again!’

One of the authors of the “Check the Numbers” piece is a well known global warming “skeptic”, who has a history of falsifying data/arguments/etc (checkout the hockey stick controversy on realclimate.org, for example). A hack of the worst kind basically, who has long since given up the right to be taken seriously on any topic. His employer also does pseudo-scientific flack work for tobacco companies, to give some idea.

What’s up with these two points in the Bilmon aritcle? –

On the Obama/Geithner Public/Private plan – “what kind of market is this? One that only a banker could love – especially a REPUBLICAN banker” Huh? Which party is Obama in?

Or my favorite – “Could it be that Obama is beholden to the same Wall Street interests as Bush? Maybe it’s better to not think about that question”

Pure Daily Kos. Pure crap. Most if its readers probably came away thinking “I STILL don’t understand this, but he sounds smart and hates Republicans, so I know I must be brilliant for hating Republicans too.”

alex black, If you didn’t read bilmon when he had his own site, you have no basis for lumping him in with “Daily Kos” stuff. Yes, his post is running there, but he is an independent author with his own voice.

I can’t disagree with you more re his Republican banker point. I have said the same thing here, close to daily, as soon as Geithner showed his true colors. As far as banking and economic policy is concerned, this might as well be the third term of the Bush Administration. No arguments when I say it, but when bilmon puts is more pointedly, you get upset. Were you not paying attention?

The rest is a more general comment, not just for alex:

Apparently no one bothers reading closely, even on a Sunday when there is more time to focus, but bilmon slipped in a lot of subtle, and very well informed comments re politics and the history of the genesis of these instruments. He does know the domain, frankly better than I do. But no, if it’s longer than a browser page, and largely familiar, everyone is quick to change the channel.

I am really disappointed, I had thought better of my readers. You really are not paying attention to important detail. And if you don’t pay attention to detail, you can and will be conned.

On the “Check the Numbers” piece, I agree wholeheartedly that the examples chosen for recrimination were liberal causes. However, that does not make his general point less valid. Researchers on the right and left are refusing to disclose data. This means the polity is constructing policy on the social sciences version of junk science.

Since the right has had much more sway over economics/finance policy (doubters need to check blogs among top economists on “heterodox economics” about a year and a half ago; if you argue with me without doing your homework, I will be able to tell you are doctrinnaire idiots) they are far more vulnerable to the charge of doctoring the data than the left, hence the “best defense is a good offense” approach in the piece.

The fact that the debate has been successfully framed by the right starting in the Reagan/Thatcher era, and even more so in the 1990s, puts any contrarian/skeptic in the left camp by default. I suggest readers differentiate between ideologues and skeptics.

The Big Picture blog is now http://www.ritholz.com.

The Nattering Naybob Chronicles brings my Firefox browser to a screaming halt. I have to kill it in the task manager.

Yves –

Sorry to upset you. I have no idea who Bilmon is, but plenty of exposure to Daily Kos and its readership/commentators – I used to work for the Obama campaign, and would insert talking points into every blog imaginable, and anytime I stopped to read Daily Kos, I literally felt ill at the level of hate-talk there. Worse than Limbaugh. Enough to make me almost start rooting for McCain, even while I was working for Obama.

So when reading Bilmon’s piece, my first thought was “yeah, yeah, yeah, we already know all this…” and then I ran across the usual Republican bashing that seems to be required on Daily Kos, but it was an utter cognitive disconnect – maybe it WAS a subtle point, saying that Obama/Geithner were playing Bush/Paulson, part II, but then why didn’t Bilmon just say that, loud and clear. I read in bold letters the usual Republicans-are-evil, and then read him explicitly say that it would be a bad thing to spend any time pondering whether or not Obama was beholden to the same special interests that Bush and Paulson had catered to. Maybe you read this as a subtle damnation of Obama and Geithner – I read it as the usual Daily Kos – “nothing Obama can do is bad, if it looks bad we must be mistaken” along with a gratuitous slap-down of Republicans, who weren’t the one’s who drafted the Obama Geithner Public/Private partnership.

If it was a subtle criticism, judging by the comments I read after the article, the subtlety flew right over the heads of the Daily Kos readers. No one standing up to say “Obama is acting like Bush!” Just more Republican bashing – more echo chamber echo.

If he intended to criticize Obama’s catering to Wall Street, he failed to convey that to his audience. He dodged it, and instead turned the readers’ heads squarely in the direction that they all seem to be already frozen in at Daily Kos – Republicans evil. If he was criticizing Obama/Geithner, why didn’t he do it clearly and firmly? Why was his biggest slam on the Republicans, who didn’t draw up the plan he was criticizing?

But I respect you, so I’ll retract and give him the benefit of the doubt – this article was a damning indictment of Obama’s planned give-away to Wall Street, but designed to subversively get published on a blog that won’t print anything unless it blames all evils on Republicans.

But if he thinks his subversion will actually get the readers there to think it through and come to agree with his subtle conclusions that Obama is acting like a tool for Wall Street, I fear he’s vastly overrating the openmindedness and intelligence of the audience there. But I wish him luck! 8-)

Yves, any attempt to inject party politics into a debate on banking is in complete ignorance–innocent or deliberate–of the simple fact that there has been little different in attitudes toward banking between the two parties over the last two to three decades. Both parties have taken heavy donations from the banking industry, and both parties have prominent politicians, well-placed in various positions and on various committees, who are well known to have deep sympathies for the banking industry.

Obama supporters may have been shocked at the Geithner appointment, and may have been shocked at Geithner's behavior since his appointment, but that is a demonstration of the simple fact that they have not been paying attention. How different is Geithner's attitude toward the financial industry different from, say, Barney Frank's or Chuck Schumer's? Not much.

There are voices of independence out there, but they are on the far left and on the far right–Krugman & Co., and Mish & Co. And very few members of Congress fall into that category–Ron Paul, Denis Kucinich, not many others.

So to throw out an epithet like "Republican banker" is just sheer political hackery. Any clear-sighted review of the behavior of Congress over the last thirty years–S&L fiasco, Glass-Steagall overhaul, bankruptcy law overhaul, financial industry bailout–will reveal that the problems are very bipartisan in nature.

I don’t blame Yves for being disappointed at her readers. Ignoring who is Billmon, one of the very best writers (and thinkers) of the internets… If you don’t like to get to him through Daily Kos, you can always go through “Moon of Alabama”. Or you can check the archives of the “Whiskey Bar” here:

http://tirania.org/blog/archive/2007/Jan-06-1.html

Strongly recommended for anyone that wants to perfect their education.

Yves I don’t have a problem with the argument, I have a problem with the source. I wouldn’t trust anything that McKitrick says, nor would I trust any of the accounts in that paper, any more than I would trust Fox News. He was central to the “hockey stick” affair, and he behaved disgracefully. He lied and he refused to pay attention to any data that contradicted his thesis. And he lies in that paper also about that particular affair (others did replicate the findings, for example). One of his big claims during that affair was that the researchers didn’t release all their data/models to him; which he seemed to think meant they had something to hide. Quite why researchers would drop everything to get internal software and data ready (hardly a small task) for a complete stranger was a mystery he never answered.

Ross McKitrick also works for a “think tank” that among things takes money from tobacco companies to rubbish research into the dangers of smoking. These people are damaged goods who pollute the intellectual space and are best ignored. I am all for healthy debate, skepticism and the rest of it. However people who misrepresent and distort the data disgust me, and McKitrick falls squarely into that camp.

Billmon on the other hand is a sparkling jewel.

Yves, I am a physicist by training and one of the ways I make by living is by criticizing computer models. What you want from the authors of a report is a full, clear statement of their assumptions and the underlying equations that they are solving. A data dump (the term of art for what these people are demanding) is an enormous imposition on the authors and useless for any critic who isn’t lavishly funded by a wealthy interest group.

Anon (6:19)

Yves, Apparently no one bothers reading closely, even on a Sunday when there is more time to focus, but bilmon slipped in a lot of subtle, and very well informed comments re politics and the history of the genesis of these instruments.

So now we’re to read billmon because he slips in some subtle hints and clues amidst his standard brimstone and treacle in prose form? The thing was an indigestible mess, badly written and poorly analogized taking text from a highly overrated book.

Yves, you’re suffering from the same problem that most interesting financial sites suffers from sooner or later…There are just alot of right wing kooks that thinks they know money, just…because they do. They made the Housing Bubble Blog comments unreadable, severely degraded the quality of the comments at Calculated Risk and so forth. Immigrant bashing gets to be a pretty good symptom of when the comments are starting to go bad.

It just gets really stupid when pretend libertarian republicans pretend that they aren’t partisan and then trash someone like Billmon who, frankly, is one of those people who knows what he is talking about. His posts on the Spanish Civil War drastically influenced me.

The really *big* point I’d like to make is that Billmon was one of the first major bloggers to really do in-depth analysis on the financial system and its illogic circa 2004-2005. An early Calculated Risk, really.

-shah8

Though having only recently discovered Billmon (not to mention naked capitalism), I have to agree with Yves on the Chocolate Covered Cotton — just because Billmon’s liberal (or anti-greedmongering, against reckless destruction of the financial system, etc.) does NOT mean (s)he’s wrong. In my reading, the analysis was an indictment of the system more than any particular individual or party. Billmon seems to have a problem with shortsightedness and stupidity, regardless of political stripe.

Yes, the post was a bit rambling at times, but nevertheless explained a very complex issue in understandable terms, in considerable detail.

That being said, do tags on the various referral/review/sharing sites (digg, delicious, yahoo buzz, stumbleupon, etc.) have any real impact? If not really, nevermind, but if maybe so, then try to find Billmon’s diary (and n.c., of course) and recommend it to others.