Submitted by Rolfe Winkler, CFA, publisher of OptionARMageddon.com

Policy-makers not only misunderstand the economic crisis, they continue to underestimate it. Consequently, solutions to date have not only failed to “fix” anything, they have made the problem worse. The problem isn’t falling asset prices, it’s not rising foreclosures, it’s too much debt. With an assist from mark-to-market accounting,* too much debt inflated the asset bubble in the first place. Yves has it exactly right that the only “solution” to this crisis is price discovery, to allow asset prices to fall to whatever level they need to in order for markets to clear. This is bad news for over-levered balance sheets, but there’s nothing else to be done.

And yet American policy-makers appear convinced that more debt can rescue an economy already drowning in it. If we can just keep the leverage party going, all will be well. $787 billion to fund “stimulus,” another $9 trillion committed to guarantee bad debts, 0% interest rates and quantitative easing to drive more lending, new off balance sheet vehicles to hide from the public the toxic assets they’ve absorbed. All of it to be funded with debt, most of it the responsibility of taxpayers.

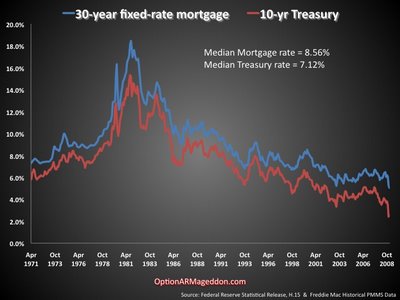

If I may offer just one reason this will all fail: rising interest rates. Interest rates need only revert to their historical median in order to hammer asset values, and balance sheets, into oblivion.

A simple present value calculation suggests that house prices could fall another 30% if mortgage rates get back to 8%.** Enough to wipe out a 20% downpayment made today and still leave the buyer upside down on his mortgage. Given the pile of Treasurys the Obama administration plans to dump on the market, it seems logical to assume interest rates are headed up.

Some might argue that deleveraging is SO violent that a couple years of “stimulus” and other debt-financed rescue measures are needed to cushion the blow. Unfortunately, any positive impact is likely to be offset by upward pressure on interest rates. Perhaps the Fed can monetize a lot more debt. But that will have its own negative consequences.

Picture it if you will: the economy stabilizes, money flows out of Treasurys, which drives interest rates back to normal. Asset values that had appeared to stabilize fall again. More writedowns ensue, more balance sheets turn up insolvent. The debt deflation conflagration ignites again, burning up what’s left of the economy.

If our experience to date has taught us anything it should be that kicking losses up to bigger balance sheets solves nothing. Losses have to be taken. The balance sheets on which they reside will end up insolvent. Why compound our problems by piling up more debt and concentrating all of it on the public’s balance sheet? Is American arrogance so great that we believe our Treasury and our currency will survive the trillions of $ worth of losses and stimulus we’ve already agreed to fund? To borrow Martin Wolf’s wonderfully evocative phrase, we are a python that has swallowed a hippopotamus.

At the end of the day, flushing more debt through the system is the only lever policy-makers know how to pull. Lower interest rates, quantitative easing, deficit spending, it’s all the same. It’s all borrowing against future income. Each time we bump up against recession, we borrow a bit more to keep the economy going. With garden variety recessions, this can work. Everyone wants the good times to continue, so no one demands debts be paid back. Creditors accept more IOUs and economic “growth” continues apace. If it sounds like Bernie Madoff’s Ponzi scheme, that’s because it is.

Each time Bernie’s scam got a few too many investor withdrawals, he’d simply plug the hole by raising more investor cash. The guys at Fairfield Greenwich were making so much in fees, they were happy to funnel more his way. But at a certain point, Ponzis get too big. There simply aren’t enough new investors to pay off older ones. In the aggregate, the same is true for Western economies. Their debt loads are now so huge, they are simply unpayable.

Naturally, policy-makers sound just like Ponzi-schemers: Just give us a little more cash to get us through this rough patch and everything will be copacetic. Ben Bernkanke at the National Press Club alluded to the famous quote by St. Augustine: “Oh Lord, give me chastity, but do not give it yet.” President Obama convened his “fiscal responsibility” summit days after passing the stimulus bill and days before proposing huge increases in health care spending.

So the question becomes, can we keep our Ponzi going? Or has it grown too large? Have we reached the moment when, like the Depression, there’s just no escaping the great unwind?

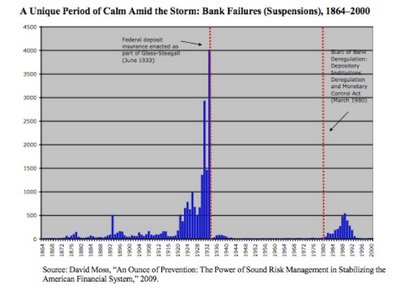

There has been much protest from economists that whatever economic funk we find ourselves in presently, it’s not as severe as the Depression. One data point suggesting otherwise is Household Debt vs. GDP. A favorite example of mine, though, was the chart at right featured in the Congressional Oversight Panel’s January report. (Click to enlarge)

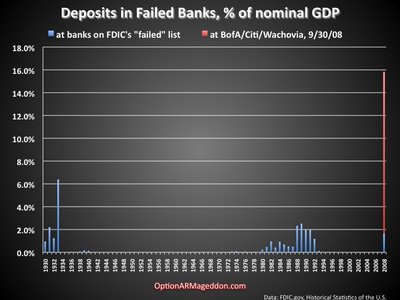

The COP’s chart downplays our current crisis by comparing the number of failed banks during the Depression with the number today. But the number of bank failures misses the point. The banking system is far more concentrated today. What makes our current banking crisis totally unprecedented is the size of bank failures relative to the overall economy. A better way to compare the two crises is to look at deposits in failed banks relative to GDP. (click to enlarge)

As you can see, I’ve taken the liberty of adjusting FDIC’s figure for 2008. This chart includes the $2.0 trillion worth of deposits at BofA, Citi, and Wachovia as of September 30, 2008.***

As you can see, I’ve taken the liberty of adjusting FDIC’s figure for 2008. This chart includes the $2.0 trillion worth of deposits at BofA, Citi, and Wachovia as of September 30, 2008.***

Last year WaMu was the only ultra-large bank that officially “failed” according to FDIC. But in the absence of government intervention, it’s likely the entire U.S. banking system would have gone under. Certainly the “failed” list would now include Citi, BofA and Wachovia.

Adding these three banks to the list still understates the scale of the crisis. Can anyone seriously argue that Chase and Wells would have survived the year in the absence of taxpayer largess?

What about non-deposit taking financials? AIG, Fannie, Freddie, Goldman Sachs, Morgan Stanley, GE and—at some point soon—a few of the Federal Home Loan Banks. Then there’s the insurance industry. With leverage worse than the banking system’s and balance sheets chock-full ‘o toxic assets, it too owes its survival to TARP cash and publicly-subsidized lending.

Also FDIC’s Deposit Insurance Fund. The $19 billion it has in reserve is but a drop in the bucket compared to the $5 trillion worth of deposits and bank debt it now “guarantees.” Naturally, the Fund needs replenishing.

Public and private pension systems are drastically underfunded. California is on the verge of bankruptcy. The unfunded liabilities for Medicare and Social Security are north of $50 trillion.

European economies face even more oppressive debt loads.

The great Ponzi scheme that is the Western World’s economy has grown so big there’s simply no “fixing” it. Flushing more debt through the system would be like giving Madoff a few billion to tide him over. Or like adding another floor to the Tower of Babel. To what end? The collapse is already here. The question is: How much do we want it to hurt?

Using the public’s purse to finance “confidence” in a system that is already kaput may delay the Day of Reckoning, sure, but at the cost of multiplying our losses. Perhaps fantastically.

Bottom line….We can bankrupt ourselves propping up a system that is collapsing anyway, or we can dig ourselves out of debt, if not with higher interest rates then certainly with fiscal austerity. That would be a hard sell to the American people, I know. But deep down, Summers and Geithner know it is the right thing to do. It is, after all, the prescription they wrote for emerging markets facing financial crises.

It’s long past time we took our own medicine. If we don’t take it voluntarily, the bond market will stuff it down our throat anyway.

———————————–

*As asset values increased, so did the value of collateral to support new lending. More lending inflated asset prices, increasing the value of collateral yet again, encouraging still more lending. Since house prices never fall, everyone imagined this cycle could continue ad infinitum. And even if they didn’t, no one was going to get in the way. Too much money was being made. I wonder: did any of the current critics of MTM’s pro-cyclicality complain on the way up?

**Imagine mortgage rates jump from 5% to 8% tomorrow, with no corresponding increase in buyers’ incomes. A representative consumer has $3,000 to spend on housing today and tomorrow. Increasing interest rates 300 bps drastically reduces the principal value of the loan he can support with that monthly payment. (Admittedly, this is a simplistic way of looking at house prices. But it serves to demonstrate asset price sensitivity to interest rates.)

- Monthly payment = $3,000, # of mortgage payments = 360 (30 years * 12 months = 360), future value of mortgage balance = $0, IntRate = 5% over 12 months or .42% per period, Present value of asset = $558k

Now increase the interest rate to 8% while holding other variables constant.

- payment = $3,000, # of payments = 360, Future Value = $0, IntRate = 8% over 12 months or .67% per period, Present Value = $409k

- 409/558 – 1 = -27%

***Caveat: to the extent government intervention allowed insolvent financials to survive the S&L crisis, they wouldn’t be included in this list.

The real question is-

What is more important for a functional society.. Jobs or Money?

Why is nobody else considering intellectual property as part of the reason why the US is trying to give the impression that it is doing all it can to protect foreign interests.

As soon as foreigners get shafted by US bank and other corporate bankruptcies, US corporations will lose all of the competitive advantages they currently hold that result from intellectual property rights being, for the most part, at least in regards to high-value products, respected.

Once these intellectual property rights are no longer honoured, US (and European/Japan) corporations lose all their competitive advantage, and their wage structure result in virtually guaranteed bankruptcy.

That’s the reset button.

The world will be a better place in the end, we just have to be honest with the people as to how we get there.

Socialism is coming America. And trust me, you’ll wonder why you waited so long.

Capitalism doesn’t work when a few own all the means of production and the many cannot afford the very goods they produce.

We have had a good run in getting China to do our slave-labour and paying them in IOU’s that we have no intention of repaying.

That is what gave most Americans the immpression that Capitalism was so amazing. It afforded them the ability to maintain their lifestyle through ever increasing debt.

Capitalism only works when everyone that is producing gets proper compensation for their labour, otherwise, it can only go so long, before it collapses on itself.

Sukh

“Given the pile of Treasurys the Obama administration plans to dump on the market, it seems logical to assume interest rates are headed up.”

Just to be fair here, most of that is due to checks the previous admin kited.

Thanks RW for this insightful post.

Why do you think that we will be paying 8% for mortgages in the medium term when the government seems to be advertising 4.5%?

There can be only three possible reasons for your supposition:

1. Heavy government borrowing coupled with a foreign capital strike will cause long interest rates to rise.

2. The mortgage spread will increase. This has happened in jumbo loans, but conforming loans seem to still be under the governments control, and their will remains.

3. Inflation kicks in, which of course will of course raise long bonds, as they are designed to predict long term inflation. When the fed starts buying treasuries this might well trigger inflation expectations.

However Inflation partially counters your argument about housing values dropping with rising interest rates. Inflation drives up wages which makes housing more affordable.

Thanks again for your insight.

Yves, just put the blog on hiatus while you work on the book, rather than fill it with dime-a-dozen diatribes like this. We’ll still be here when you get back.

Welcome to NC, Rolfe

There is no way the any Democrat is going to force people to accept the truth when their entire ideology is based on “helping the common man”; it is anti-thetical to the belief that government can solve any problem. In case you haven’t noticed, lack of government is being hailed as the problem and the current administration aims to solve that particular problem with massive deficits that make W’s budget look like careless accounting errors.

America will not be taking any medicine as long as politicians are motivated by fixing problems with money.

Asset inflation in the US took place without a general inflation in consumer prices because offshoring jobs and anti-union legislation and propaganda prevented a rise in the level of wages (except on Wall St.). Households therefore fell into debt. Now their increasing impoverishment means they can’t pay their mortgages or credit card bills.

Only a general bankruptcy of financial intermediaries can resolve this. Bankruptcy implies debt forgiveness; if you can’t pay, you’re bankrupt and the creditor must forgive the debt after seizing what assets the law allows. In the current circumstances, householders have a moral claim to remain in their houses since they were excluded from the benefits of asset inflation by a form of class warfare which was directed at them. The best way of achieving this is to bankrupt the creditor before the householder, and resolve the creditor’s (the mortgage holder) bankruptcy on terms which preserve the householder’s title.

Ok, my take from this post is that if I buy a house now at $558k, which is $3000x360month at fixed 5% it’s the same as $3000×360 for $409k at 8%.

But if the value of the $ errode over the 30 year period, which is very likely, considering the ammount of printing Ben is doing with his computer, it should be more advantagious to buy now or not ?

That is my question. Hope the author will give some general answer. Anyway thank you for a nice post, although the line of reasonning I’ve read at CR comments few days ago.

I have a big question…

1. how much debt can the US government create before it goes insolvent?

2. what’s stopping the treasury department to simply print funny money? (oh i don’t know, create new class of bond, or simply print out cash and distribute it on the street.) There is no inflation, and nobody knows M1-M3 real number anyway.

or to put it simply, how far can this ponzi scheme goes what can stop us?

I was going to write something completely different until I read one of your commenters’ query: What is more important for a functional society.. Jobs or Money? This was really interesting, because it’s kind of rhetorical but at the same time necessary to answer. Obama is using money to create jobs, right? I think that’s alright. As an entrepreneur, I know for a fact that in order to get returns, you must invest/spend… To me that’s exactly what Obama is doing. Because he knows that at the end of the day, getting people hired again will make Americans earn money again thus making the economy up and running once more.

If you have gangreen in your arm, you can cut it off with a chainsaw or a spoon. Although the chainsaw sounds horrific, the spoon in actuality is much, much worse.

Looking at this graph one can see the effect of big foreign wars on American economy. Foreign wars is a way of the Military-Industrial-Complex to extract illegal taxation on the American economy. After the end of the Vietnam war, there was a spike, and now after the Iraq-Afghan war there will be a spike.

Not to pick on Italians but if our economic model was designed by Charles Ponzi, the governments financial forecasts appear to be the work of his sister Rosie Scenario.

The socalled ‘stress test’ would seem to be a middle range outlook instead of a ‘worst case’.

With each quarter of zero or negative growth that passes the more ridiculous our situation becomes.

Government borrowing can only be considered ponzi if there is no real prospect of the debt being paid off. You would expect announcements of future tax increases and budget restraint at the same time that borrowing is increased. Both the US and Europe so far have shown a reluctance to do that perhaps understandably because it makes politicians look bad. We also should not forget that a considerable part of government income came from banking.

Outside the US I expect countries to soon run into a barrier preventing them from borrowing and forcing them to adjust. Iceland and Ireland are already going down this route and even Germany is being careful about its budget. The US on the other hand can keep borrowing as long as the flight to safety continues and Brad Setser’s analysis of the flows does not suggest any immediate problem for US funding. The borrowing if it continues at current rates will eventually be beyond the US Taxpayers ability to sort out, but that time has not arrived yet (something to look forward to).

Slowly but surely the tax payer is beginning to realise that they have been given the short straw. Its not often we see FTAlphaville comment quite so forcibly about tax payers getting shafted or advertising a save capitalism blog.

A deceit on Tax Payers

Save the system

They understand what’s going on,they just don’t have enough character to do the right thing over their own selfish interests.

As always, this analysis misses the really important bit: the enormous distributional impact, or who pays for the mess.

Notional asset values have been bubbled up for 10-15 years; now that they have to bubble down, things are not going back to 1995.

All those notional capital gains did not create new production of value, just paper wealth, a good chunk of which has been cashed by capital rentiers.

Because during the bubbling quite a number of clever people cashed in those notional capital gains, and have made a lot of money fast.

The problem is that cashed out and largely already spent money, a few trillions worth of black hole, which has largely gone to capital rentiers (and in small part to the working poor of China and India), and now debtors have to pay that back too.

So what happens? Do the suckers pay back what they owe, including that which has been cashed in by the winners, by saving, causing a depression, or do the suckers pay back with freshly produced liquidity, causing stagflation?

The winners (the rich, especially the financial sector rich) have already, thanks to the generous help of Paulson and his successor, cashed out of their losing positions, and mov ed into a mix depression and inflation hedges.

As to the losers (that is the middle class and the working class), who loses most depends on which way things go and whether they are net debtors (younger) or creditors (older).

In 1970-1980 the younger losers were more numerous and organized (unions) and stagflation was the outcome, and the loser creditors were wiped out. Currently I suspect that the older losers are more numerous and organized (AARP, republican campaign donors, citizens vs. immigrants) and the result may well be depression.

«What is more important for a functional society.. Jobs or Money?»

Depends on whether you are working or retired, a net debtor or a net creditor.

If you are retired with a good safe pension, lots of unemployment and cheap foreign imports are splendid.

However Inflation partially counters your argument about housing values dropping with rising interest rates. Inflation drives up wages which makes housing more affordable.

only if we have wage inflation along with the monetary inflation, difficult given global wage arbitrage.

it is possible however if we enact protectionist measures. I foresee protectionism in the future… at that time we MIGHT see a push for wage inflation… either that or high monetary inflation combined with low wage inflation OR combined with wage inflation and low employment… both those combos would be a killer to asset values.

monetary inflation will only “work” if it can be translated into wage inflation.

A good post.

You alluded inflation

“Perhaps the Fed can monetize a lot more debt. But that will have its own negative consequences.”

and

“or we can dig ourselves out of debt, if not with higher interest rates then certainly with fiscal austerity”

I suppose that an Argentina style debt default or several years of +10% inflation would also fix a debt problem, although each of these have their own considerable “negative consequences”. My fear is that policy makers, in a situation where all choices have “negative consequences” choose not the best policy, but the policy has no fingerprints on it. That would be the inflation policy. My hope is that the Obama administration is serious in its talk about “taking responsibility” and so we find a different path.

I guess we will all find out in the next two years.

The solution is NOT financial, the solution is POLITICAL!!!!

Policy-makers DO NOT misunderstand the economic crisis, nor do they continue to underestimate it. Their solutions to date have not been meant to “fix” anything, they have been made intentionally to make the problem worse. The problem isn’t falling asset prices, it’s not rising foreclosures, and its not too much debt. And it doesn’t have jack shit to do with mark-to-market accounting and the only “solution” to this crisis is NOT “price discovery, to allow asset prices to fall to whatever level they need to in order for markets to clear.”

The only solution to this intentionally created crisis is to realize that it is an intentionally created crisis. The solution is POLITICAL! It is NOT financial!

It should be obvious to even the most brain dead amongst us by now that ‘our leaders’ – of both flavors – are non responsive, disingenuous puppet cretins and the ‘rule of law’ is a selectively enforced scam owned and controlled by the global wealthy central banking elite.

THE BIG PICTURE …

The financial services industry has taken money – which should be limited in function to a simple utility medium for the convenient exchange of goods and services – and exceeded that basic function by charging usurious interest for its use. That enslaving function of charging interest for the use of money is immoral and was gained illegally by the banking industry through the purchase of generations of politicians who created the legislation that gave the bankers the right to enslave others through charging interest (credit). Credit is simply a replacement for the chains once worn by slaves on scamerica’s early plantations. The financial services industry, in the present day, in all of its deceptive complexity, now fulfills the role of the plantation overseer.

Through aggregate corruption over generational time the bankers illegally purchased more and more legislation that allowed the financial industry to blossom and create a range of ever more enslaving, more devious, and far more immoral ‘derivative’ ‘products’ that are in effect just more powerful chains and shackles. And, because of the outright deception used in valuing their underlying base of assets, and the off the charts leverage used in structuring the newer of them, they represent, in effect, trillions of dollars of counterfeit money that have caused a complete break down of trust in the global financial system (enslavement system).

Look back to the Strauss neocons …

In the past forty years or so, a small group of elite ideologues gained the ear of the golden collar western global central banking crowd, and, in Hitleresque fashion, appealed to the worst in them. In a well orchestrated and comprehensive plan, they have set the stage for, and implemented, an intentional and massive overdose of the credit drug, and all of its deceptive derivative products, right into the main vein of global commerce. Ouch (think small pox in the blankets)! They did this to intentionally create a global financial crisis for the purpose of effecting a global financial coup. One can argue their motives, their abilities, or that there is even a conspiracy, but one can not argue that there is not a global financial crisis and who created it. There IS a global financial crisis and it WAS created by a scamerican gangster ruling elite!

Why?

• Consolidate financial power.

• Reduce population that pressures a now more unsustainable world. The die offs are in process right now.

• Eliminate the middle class (old, expensive, high resource consuming, overseer class) globally and replace it with a law enforcement class (a cheaper to maintain overseer class).

• Geopolitical advantage. Tank competitive nation states and cause those states to expend energy and resources on dealing with domestic violence and have less for military spending.

• Create a two tier ruler and ruled world where the ruled are kept in perpetual conflict with each other.

• Etc. There are many more benefits for the ruling elite if you don’t get hung up on lost ‘profit’ and realize that CONTROL is the end game.

Some thoughts;

• Tendering remedial economic plans is a waste of valuable time. These are disingenuous gangsters. You might as well shovel shit against the tide. Better to organize peaceful street demonstrations and election boycotts.

They will not let you take; “our own medicine”. They want you to suffer in perpetual conflict.

• This is not plain old profit motivated vanilla greed. Psychopathic elite gangsters are at the helm and control of a ruler and ruled two tier global society is their end game.

• We do not need a currency reset. We need a complete government reset with a new – truly democratic – electoral process. The current electoral process is a totally non responsive to the will of the people scam that should be boycotted by sending a ‘vote of no confidence in government’ letter to your supervisor of elections stating your intention to boycott and why.

• We need to wake up and see the incremental aggregate generational corruption. It is that ever growing deception bubble – now controlled by a more pernicious and dangerous sort of gangster – that must be popped.

Deception is the most powerful political force on the planet.

i on the ball patriot

I agree with the basic critique of Geithner/Summers: that they incorrectly believe we can return to the status quo ante (say 2005).

But this seems like a desire for a return to the super status quo ante, say 1750, before the US had a banking system of any significance.

So what happens if you go back another thirty or forty years on that first chart? Well, for one thing, mortgage rates won’t look bizarrely low any more. They’ve been this low before, and they were this low for a very long time.

http://mortgage.lovetoknow.com/Mortgage_Rate_History

“In 1938, Fannie Mae was created by President Franklin D. Roosevelt to help families afford to buy homes or stay in the homes they had already purchased.

This step meant that mortgage funds became readily available nationwide and interest rates stabilized. At that point in time a consumer could get a mortgage rate as low at 3 percent. In the 1940s, rates stayed on the low side since buying a home during World War II was quite difficult.

In the 1950s and early 60s, mortgage rates continued to remain in the affordable 5-5.5 percent range.

In 1968, Fannie Mae was re-chartered under an act of Congress to become a company solely owned by shareholders. The investors came from around the world.”

Fannie and Freddie were private for about as long as they were public, before that. I guess a big question is, how long will they stay public, this time?

Mortgage rates can stay much lower than the recent median, just as long as the government is willing to do a little price fixing. The government’s willingness to meddle in this area in this specific way lasted forty years or so the last time around. Interest rates stayed low, without the kind of wild asset speculation we’ve come to accept as the norm in housing recently. Mind you, people’s willingness to go into debt was pretty low over that period, so government didn’t have to fight the market very hard.(Well, maybe not present company.)

I don’t think higher interest rates are necessary to keep people’s willingness to go into debt low are necessary right now. A horrendous job market and a once in a lifetime scale housing crash are more than enough. I hope.

Are necessary are necessary are necessary. I think I’ve got it out of my system, now.

The Federal Reserve is the world’s largest – debt kiting – Ponzi scheme

If I may offer just one reason this will all fail: rising interest rates.

While it’s possible this will be correct, I’m quite skeptical, and I have yet to see a single argument by the “rates must rise with all these bailouts” crowd as to why this did not happen in Japan. Japan saw declining interest rates over two decades despite tripling of government debt to 180% of GDP, falling consumer savings rate (ours is rising), and superior global investment opportunities.

Also, real interest rates soar in deflation, even with flat or declining nominal rates.

But what, Mr Winkler, is YOUR position on MTM? Let’s see …

You conclude only by wondering if others complained about MTM on the way up — yet FAS 157 only came fully into effect in November 2007 (months after the collapse of the Bear Stearns funds), when we were already on the way down.

Ie, I don’t see the relevance of your comment on MTM. And don’t see what you are recommending.

There was never a secondary market worthy of the name for a range of structured finance instruments, because in essence they were not “bonds” even though they were were drafted in that shell.

Thus FAS 157, a child of Free Marketeers, was inapt for this large segment of the universe, and when it hit it froze the financial system. (This is one big reason why nobody came to the MLEC party that Paulson tried to throw late in 2007 to stabilized SIVs.)

Eleven months later the FASB burped, said excuse me and passed 157-3, which in good vague language allows an institution to mark assets “to model” (the good old pre Nov 2007 way) when their markets are “not active.”

For myself, “models” set by a public utility, segment by segment — one model for all institutions — would be preferable. This “price control” regime would also require Level 3 (m-t-model) assets to be itemized in quarterly reports. Thus bringing transparency and level-playing fieldness.

But what is YOUR view, Mr Winkler, as to correct policy here? Readers are left to wonder.

And again:

You are likely right to worry that when interest rates turn up (as they must, someday) they will pressure housing prices.

But are you proposing public policy today that encourages more deflation? Let’s see …

Rereading your column, I’m more confused that before. What ARE you proposing, sir?

In general, of course I hear, you are singing for leadership that watches the city burn to the ground so the slender shoots of the Market may rise from the ashe and flourish.

This strikes me as run-of-the-mill Market Fundamentalist moralism, likely bred by too much Age of Reagan television during formative years, which I have rejected since attaining the age of reason.

But the world of finance is full of Fundamentalism; it’s a convenient approach to the world from that chair.

Malthus was correct analytically but his forecasts failed, and the pattern oft repeats. The sad fact often foiling number-crunchers is that people are sentient beings who react to mitigate disasters. And sometimes go so far as to regulate …

PS I don’t recall Yves singing the Price Discovery song by the way. Maybe I was in the john …

If debt loads are this oppressive there is a far better answer than allowing deflation to run its course: print money, and inflate a chunk of that debt away.

As for this sort of comment:

“We can bankrupt ourselves propping up a system that is collapsing anyway, or we can dig ourselves out of debt, if not with higher interest rates then certainly with fiscal austerity.”

Our spasm will not be over until this kind of lecture is generally understood to be over the top. You are talking to a population that has been losing jobs to outsourcing for years, had stagnant wages and declining benefits for decades, was sustained only by a credit bubble as the financial class made out like bandits. So: fiscal austerity for the likes of YOU. It’s called clawback!

IMHO, it makes no sense to assume interest-rates rising to 8 %, with everything else remaining constant.

Interest-rates will only rise to 8 % in response to severe inflationary pressure.

Such inflationary pressure might well occur at some point down the road as a consequence of current policies, but it would imply that disposal income will rise in nominal terms, and it is not at all clear that the overall effect would be further pressure on house prices.

The problem is private debt, not public debt. Public debt isn’t that large relative to GDP and “borrowing” to ease the pain from deleveraging of private debt won’t add to inflation concerns while deleveraging is ongoing.

Read Koo, Klugman and Roubini.

The problem is private debt, not public debt. Public debt isn’t that large relative to GDP and “borrowing” to ease the pain from deleveraging of private debt won’t add to inflation concerns while deleveraging is ongoing.

Read Koo, Klugman and Roubini.

Treasury interest rates are exogenous. The fed controls interest rates on treasury debt, not the market.

So, the FDIC’s leverage is like 250 (5 trillion potential liabilty vs. appx. 20 billion net worth). That’s worse than Goldman.

In any case, to keep it simple – we got into trouble borrowing too much, more debt will not solve the problem.

It’s like science created all the environmental problems. More science will not solve them (see my other posts elsewhere in this blog about the dangers of solar panels and green cars). On the other hand, using less of everything will.

Sukh, post more!

As for me, I’m no pencil neck, either. I’m no bean counting pale rider. I’m not afraid of no socialized debt, and I’m not afraid of no ghost!

Once we are reduced to socialism, which is the norm among the poor in America ALREADY,..and the bubble in the Jim Jones leadership cults resets to zero, Obama will have the assets to ensure that the ones who die along the way, in the alley ways and nursing home beds, will not do so in vain.

But, you dissenters, you are right,..the libertarian way is “dead and gone,” and don’t blame Obama. You have that issue of the cowboy from Texas to chew on now, trapped as you are alive, clawing at the lace and steel, six feet under inside your tomb.

Only a pathetic stooge for right-wing think-tank policy ejecta in America-Thinkstankistan would fall for the artificial presupposition that a socialist America is ALREADY a poor risk strategy for America’s future global contention.

Debt! Give me a break. Go back to you cubicle and await my next order.

Unregulated capitalism cannibalized itself.

“The problem isn’t falling asset prices, it’s not rising foreclosures, it’s too much debt. “

Rolfe, Great post! let’s not blame it on debt per se, though. The problem was and is that claims were created against unproductive ventures. Plus massive confusion of what constitutes an ASSET.

In particular a home can only be considered an asset if the lifetime expenditures of ownership would be less than rent for a similar abode.(price to rent)

Residential Real Estate in the anglo sphere recently has not passed that test……but it can and will going forward……..

Unless your work requires a new car and is tax deductible it is not an Asset….ditto with credit card debt and lines of credit.

Used for REAL wealth creation, self liquidating credit has no limits.

The fix for the current mess will be the new dollar carry trade where Bernanke will blow out their balance sheet and get the MCB’s to lend to every Tom, Dick and Harry in every rathole around the world.(hey, it’s worth a shot)

yves has repeatedly advocated price discovery, you clearly missed her rants about MLEC and all its successors.

I on the ball patriot:

I agree with much of what you wrote, and I commend you for being a well informed dude.

But don’t you think you give these neocons too much credit? Do you really think Dick Cheney, Karl Rove, and the gang are that intelligent? They’re just greedy morons unable to steal in a way that is less obvious. What’s “Vice” going to do with all his dough he stole for Halliburton when he has his next heart attack. Didn’t you see him at Oh’bama’s inauguration? The piece of pathetic shit was in a wheelchair. Hey, he may have stole a few tax bucks from me, but I still have my health, while he doesn’t. I win.

As far as the idea of enslaving people in debt, well, that may have worked 200 years ago when we still had a debtors’ prison. Nowadays, if Joe Sixpack charges his new plasma TV, gets a new Dodge Ram pickup on credit, and a mansion on subprime, and then sticks it to his creditors, there really isn’t much they can to do him.

As far as the U.S. accumulating so much debt, I’m all for that. We’ll just run a 10,000% inflation for a few years, then pay China off in cash.

Vinny

Thanks for your comments, readers.

Vinny, I certainly don’t give Dick Cheney much credit: “Reagan proved deficits don’t matter.” Did he?

Thomas, you make a good point about inflationary pressure driving interest rates. What I wonder about is capital flight. To free ourselves from the clutches of debt deflation, is it not possible we might be forced to repudiate debt? That could lead to a spike in interest rates rather quickly. Another commenter points out that the public’s debt load doesn’t appear so suffocating, not relative to the private sector’s anyway. So debt repudiation sounds crazy.

And yet….

The fact that the government is now acting as lender of last resort to, well, everyone, suggests that the line between private and public debt is a lot squishier that we’d like to admit.

The scenario that really scares me is capital flight emerging-markets style. It’s hard to contemplate, of course, ours being the world’s reserve currency. But just because there aren’t any good alternatives to the dollar doesn’t mean the world’s investors will simply ignore fundamentals forever…

This gets me to my answer for bg. Insightful thoughts….it’s scenario 1 of your 3 that worries me. That could have ruinous effects for the dollar’s purchasing power without necessarily leading to higher incomes.

“The problem isn’t falling asset prices, it’s not rising foreclosures, it’s too much debt. “

Exactly right … What the powers that be are doing is saving the owners of that debt, the well to do, pensions … at tax payer expense by placing the debt on the country’s balance sheet through bailouts and guarantees.

What should be done is nationalize the Fed and create money without borrowing it. After nationalizing insolvent banks use this money to re-capitalize the banking system while this unpayable debt is written off. Pensions will go bust and the well to do will see their portfolios sliced and diced but in this way the the country is saved from insolvency and the people are saved from a crippled social net.

why would mortgage rates ever go to 8% in this environment?? 8% would imply substantial economic growth — which would be the best thing ever for all of the government’s borrowing. Homeowners are not defaulting because they are losing equity — they are defaulting because they took on too much debt and are losing their jobs. the growth implicit in an 8% mortgage rate scenario would imply a much better employment and income growth picture — homeowners, especially those that have already refinanced, would be in great shape under that scenario, as would the government and all of its debt it acquired on the cheap.

“The scenario that really scares me is capital flight emerging-markets style. It’s hard to contemplate, of course, ours being the world’s reserve currency. But just because there aren’t any good alternatives to the dollar doesn’t mean the world’s investors will simply ignore fundamentals forever…”

RW, The quid pro quo has been set already. If you noticed when Hillary was in Beijing no mention was made about human rights issues.

What was discussed was the need for continued chinese funding during the Obama fiscal blowout.

The deal is pretty simple. China will continue to fund the US Treasury and the Treasury promises to keep the Fed’s monetization in check.

With Bernanke handcuffed, I wouldn’t expect him to remain around too much longer. I think Summer’s is itching for that job, anyway.

Bye, Bye, Benny. You’re like a candle in the wind………..