Submitted by Leo Kolivakis, publisher of Pension Pulse.

According to Watson Wyatt, U.S. pension plan funding plunged by more than$300 billion in 2008:

As news of the economic crisis continues to unfold, the first look at actual 2008 disclosures reveals substantial investment losses for the largest U.S. corporate pension plan sponsors, according to a new analysis by Watson Wyatt, a leading global consulting firm. While many of these losses are due to equity declines, equity allocation targets for 2009 have not changed substantially.A Watson Wyatt analysis of pension disclosures for the 100 largest U.S. pension sponsors* has found that aggregate funding fell by $303 billion last year, going from an $86 billion surplus at the end of 2007 to a $217 billion deficit at the end of 2008. Overall, aggregate funding levels decreased by 30 percentage points, from 109 percent funded at the end of 2007 to 79 percent funded by the end of 2008.

“Plan sponsors were hit hard with a double whammy in 2008 with severe market declines and new funding rules coming into effect,” said David Speier, senior retirement consultant at Watson Wyatt. “This combination will require employers to make staggering pension contributions over the next couple of years, at a time when they can least afford them.”

According to the analysis, pension contributions increased slightly last year– from $17.7 billion in 2007 to $18.4 billion in 2008. However, companies are expecting to make substantially larger contributions in 2009, up to more than $27.7 billion — a 50 percent increase over 2008 cash contributions. As many firms will not need to make their required contributions until 2010, this increase can be attributed to companies’ making payments now to shore up funds in anticipation of future requirements.Pension plan assets declined by 26 percent in 2008, largely due to significant equity losses. The percentage of a plan’s portfolio invested in equities had a direct relationship with investment losses in 2008 — plans that had less than 20 percent

of their portfolio in equities lost an average of 6 percent, while those with an equity allocation of 55 percent to 59.9 percent lost 23.6 percent. Those with an equity allocation of 90 percent or more lost 32.3 percent.While stated equity targets have not declined significantly, actual equity allocations at year end were much lower. For the 83 companies that provided data, the average target equity allocation is 55 percent for 2009, compared with 58 percent for 2008. However, actual equity allocations fell over the year, to 48 percent at the end of 2008 from 59 percent the year before. Rather than a strategy shift, this reallocation was mostly due to the significant drop in the stock market — bonds significantly outperformed equities, thereby automatically shifting funds’ asset distribution. It remains to be seen whether plans will redress this imbalance.

“Many pension plan sponsors have remained committed to equity investments as they have been expected to provide the best long-term returns,” said Carl Hess, global head of investment consulting at Watson Wyatt. “However, the recent financial turmoil shows that large equity positions can create substantial risks. Companies can alleviate some of this risk by adopting liability-driven investment strategies, which utilize bond and derivative markets to better hedge their long-term pension liabilities, while at the same time making sure the overall risk level in their portfolio is one they can live with.”

Other findings include:

— The distribution of funding ratios has significantly shifted in the past year. At the end of 2007, 80 percent of plan sponsors had realized funding levels of over 90 percent. By the end of 2008, only 14 percent were more than 90 percent funded.

— The average discount rate at year-end 2008 was 6.36 percent. More than half (55 percent) of plan sponsors used a higher discount rate in 2008 compared with 2007; 19 percent used the same rate assumption; and 26 percent used a lower rate.* Editor’s note: The analysis was based on pension disclosures for the 100 largest pension plan sponsors among publicly traded companies with year-end 2008 fiscal dates, ranked by amount of plan liability at the end of 2007.

A recent report by Milliman Inc. shows that things are just as bad in 2009 as pensions experience a $33 billion decline in funded status in February:

Milliman, Inc., one of the premier global consulting and actuarial firms, today released the latest update to the Milliman 100 Pension Funding Index, which consists of 100 of the nation’s largest defined benefit pension plans. In February, pensions lost another $54billion in assets. These losses were offset by liability decreases of roughly $21 billion, resulting in a net loss of $33 billion in funding status for the month. In the last year alone, the funding ratio for these pensions has fallen from 99.6% to 71.7%.“January was a terrible month for asset values, and February was worse,” said John Ehrhardt, co-author of the Milliman 100 Pension Funding Index. “We’re not even through the first quarter yet and already funding status had declined from 77.2% to 71.7%, and that’s with asset values being offset by changes in discount rates.”

Funding status has fallen by $337 billion in the last 12 months thanks in large part to a -26% asset return. As of the end of February, the total asset value for these pensions stood at $869 billion.

In the U.K., the Financial Times reports that pensions shortfall hits record:

The shortfall in company pension schemes hit a record high in February, topping even the gap of five years ago, according to the latest data from the Pension Protection Fund, the safety net for the underfunded schemes of insolvent employers.

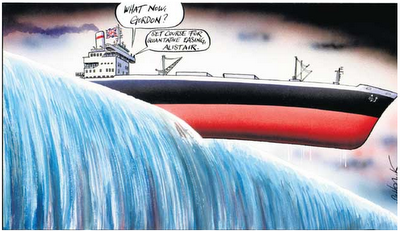

Moreover, pensions experts say, the Bank of England’s efforts to combat slumping demand in the economy through the purchase of gilts – the process known as quantitative easing – is likely to produce an even bigger deficit by the end of March as yields on long-term gilts, which form the basis for valuing liabilities, fall because of the programme.

Because pension liabilities have to be discounted many years into the future, a lower discount rate produces a higher level of liabilities when expressed in today’s money.

The PPF’s 7800 Index, which measures the gap between the benefits the fund insures and the sums each scheme has available to meet those benefits, showed that the aggregate shortfall on schemes in deficit totalled £228.1bn in February, more than 10 per cent higher than in January as stock markets fell and gilt yields eased.

QE began in the first week of March and yields on long-term gilts have fallen by 21-30 basis points. About 9 per cent of schemes insured by the PPF have a surplus, but these cannot be applied to the shortfall of any other scheme.

The PPF insures 90 per cent of promised pension benefits up to a cap of £28,000. In February, the widening of the deficit reflected a 4.7 per cent decrease in assets as UK and global stock markets fell, and a rise in liabilities as gilt yields rose.

Rash Bhabra, head of corporate consulting at Watson Wyatt, said the timing of the QE programme is acute for pension schemes because many have a scheme year-end of March 31. Also, 2009 is the first year in which many schemes will undertake a second round of triennial valuations for the purpose of calculating valuations that form the basis upon which company contributions will be based.

“The decline in the PPF level of funding is a good indicator of how the funding position of pension schemes has deteriorated,” Mr Bhabra said.

But although QE has the effect of making pension deficits larger, it may also relieve pressure on companies’ financing costs, helping profit margins and giving cash-strapped employers better odds of making it through the recession.

Nevertheless, pension experts are expressing alarm at the Government’s plans for quantitative easing.

They are worried about the impact of injection of up to £150 billion of newly created cash into the economy because of the impact this could have on annuities.

In return for a retiree’s pension pot, an annuity provides a regular income based on yields on government bonds or gilts.

Tomorrow, the Bank of England will hand over around £2 billion to banks and other investors in return for UK Government bonds and corporate paper.

However, news of the programme immediately impacted on gilt yields which have fallen to record lows.

Nigel Callaghan, of Bristol-base pension adviser, Hargreaves Lansdown, explains that annuity rates have already been falling substantially in the last four or five months.

He believes that the initial £75 billion of quantitative easing proposed will further damage prospects for those needing to purchase an annuity.

According to a BBC report, a £100,000 pension pot can currently purchase a joint-life annuity of up to £6,488 a year for a man and woman of 65 with average life expectancy.

The sum is nearly £400 lower than in 2008 and annuity rates look set to fall further as the economy falters.

With quantitative easing taking place across the world, you can bet annuity rates will be falling more in 2009. How will pension funds make up the shortfall?

What else? More alternative investments! On Tuesday, U.S. pension plans that invest more than $900 billion on behalf of their members said that they should have freedom to invest in a full range of opportunities, including alternative investments like hedge funds and private equity.

America’s largest pension funds issued their manifesto on market regulation reform that included their call for freedom to invest. The plans include America’s two largest pension funds, the California Public Employees’ Retirement System (CalPERS) and California State Teachers’ Retirement System (CalSTRS). They were joined pension funds from Los Angeles City and County, Colorado, Connecticut, Maryland, New York and Illinois.

“The ability to invest, consistent with fiduciary responsibilities, in an unconstrained investment opportunity set is critical to enable public pension funds to meet their obligations,” the statement said. “Any limitations on the universe of available investments will potentially reduce the ability of these funds to generate the needed returns and may increase the risk of the plan.”

A spokesman for CalPERS confirmed that the pension funds were including investments in hedge funds and private equity in that assertion.

“We want to have all the tools in the box at our disposal; all the tools that a smart investor uses,” the spokesman said.

With investment advisor fraud very much on the mind of Congress, including the alleged $50 billion Ponzi scheme run by broker-dealer Bernard Madoff, the pension funds want to make sure that legislators don’t move back to the old days when they could only invest in specific products.

The pension plans also want to see the Securities and Exchange Commission restored to its position as a first responder in protecting investors against fraud.

The SEC has come under intense fire because it missed the alleged $50 billion Ponzi scheme carried out by broker-dealer Bernard Madoff. There has been talk of shifting some or all of the agency’s powers to the Federal Reserve. But not only do the pension plans want the SEC to retain its policing powers, but it wants them to tailor it to fit the kind of investor and product involved.

“For example, enhanced protections for institutional investors may take the form of tools (e.g., enhanced disclosure by issuers) that such sophisticated investors may use to protect themselves,” the statement said.

A spokesman for CalPERS said, while the call for greater transparency was primarily directed at corporate issuers, transparency at hedge fund and private equity firms was an issue that might be addressed in the future.

I simply do not understand why the SEC does not consult with the FSA in the U.K. and get their act together to come up with tough new reporting standards on hedge funds and private equity funds.

Last September, I warned investors of a brutal shakeout in the hedge fund industry. How did I foresee this? Because Bridgewater Associates were right, most hedge funds are selling beta as alpha (I saw this with my own eyes investing in hedge funds). Moreover, I knew that the securitization bubble popped and that would eventually lead to the death of highly leveraged illiquid strategies.

The problems in hedge funds have eased somewhat but they have not gone away. Today, Bloomberg reports that redemptions are easing but investors still pulled out a total of $11 billion from hedge funds in February as stocks worldwide tumbled amid signs a global recession is deepening.

Furthermore, the Financial Times reports that the funds of hedge funds industry shrank by almost 30 per cent last year, with most of the losses coming in the latter part of the year as volatile markets, poor returns and the impact of the Bernie Madoff scandal took their toll.

[Note: Madoff was indicted today and faces a maximum of 150 years in prison if found guilty on all counts. Bloomberg reports that Madoff didn’t agree to a plea deal with U.S. prosecutors because of their demand that he admit to a conspiracy, a charge that would require him to say he worked with others in the largest Ponzi scheme in history.]

All this to say that if pension funds are looking at alternative investments to deal with soaring pension deficits, they’d better proceed very carefully, making sure they are paying for true alpha, not disguised beta.

As for quantitative easing and its effects on pension deficits, there is another argument you need to bear in mind. John Makin of the American Enterprise Institute for Public Policy Research is absolutely right, Inflation is Better than Deflation.

While quantitative easing might hit pension deficits in the short-run, printing money and inflating their way out of debt might lead to inflation and higher interest rates. Inflation is typically good for profits (thus good for assets) and higher interest rates bring down the present value of future pension liabilities. If quantitative easing works, pension deficits will shrink.

But that is a big “if” because as gold and silver break down, the market is betting that quantitative easing will fail miserably and we will not escape the age of deflation.

And if deflation develops, pension fund deficits will continue to deteriorate. If you’re a pension fund manager, you’d better pray that quantitative easing brings about inflation and not deflation.

But if you’re worried that quantitative easing will do nothing to restore confidence, ignore the dire warnings about a bubble in bonds and buy some government bonds to hedge yourself against deflation.

***Update (12-03-09)

Dr. Ros Altman wrote an article in the Telegraph explaining why quantitative easing is a disaster for pensions:

The Bank of England has just started implementing its new policy of ‘quantitative easing’. This is a disaster (at least in the short-term) for UK pensions. Since the Bank announced this policy measure, 10-year gilt yields have tumbled. They were already near historic lows and have now fallen even more, thus deepening pension scheme deficits as lower rates push up the value of pension liabilities.

For example, the Pension Protection Fund (PPF) has just announced that pension deficits for UK companies had risen by 10 per cent in the month of February, due to falling asset prices and interest rates. The further interest rate falls may well lead to even worse deficits in March. Unfortunately, the end of March is an important pension valuation date, since many schemes will have their triennial valuation calculated based on that date. This will lead to significant problems for employers sponsoring final salary schemes, as trustees will have to demand higher payments. It is likely to hasten the closure of schemes to both new and existing members.

But quantitative easing is not just bad news for final salary schemes. Money purchase pension scheme members will also suffer because annuity rates have been dwindling substantially too.

The aim of quantitative easing is to push interest rates down on both gilts and corporate bonds. But these are the assets which largely determine annuity pricing and the lower yields go, the worse annuity rates get. In fact, the credit crisis had helped annuity rates up to last Summer, because corporate bond yields had risen substantially, but as rates have fallen again, annuity rates have been tumbling. This means people coming up to retirement will really be suffering this year.

People retiring now face a dreadful dilemma. Consider the following example:

Someone with £30,000 in their pension fund last year could have retired with a pension of around £2,100 a year for life (using a 7 per cent annuity rate). Someone with £30,000 in their pension fund this year, would only get £1,800 a year (using a 6 per cent annuity rate), which is about 20 per cent less pension for the same money.

However, anyone with £30,000 in their pension fund last year is likely to have far less than that this year, as the markets have plunged. Most funds have lost over a quarter of their value, so the £30,000 fund value last year could be worth only around £22,500 this year. That would now buy an annuity worth just £1,350 a year now – a loss of £750 a year or nearly 35 per cent of the pension. This year nearly half a million people will buy an annuity and all of them will suffer lower pension income for the rest of their lives as a direct result of artificially depressed interest rates following quantitative easing.

Not only this, but I believe that buying gilts is the wrong way to pursue quantitative easing. The aim is to get institutions to switch money from gilts into corporate bonds, but institutions are more likely to switch the money into overseas government bonds, overseas corporate debt or top rated UK company bonds, rather than buying lower-grade corporate bonds issued by smaller and medium sized UK companies who are the ones desperately needing money. Therefore, pensions will be damaged and the policy may not even work!

Leo was doing so well until the end of the writeup. Facts and figures are hard to dispute.

It’s not possible to continue having inflation forever. After hyper-inflation you go directly to liquidation, deflation is just a side road while you are waiting to meltdown entirely in this banking system.

Gold (silver still acting like an industrial metal) is only pointing out the lack of confidence in paper currency (to much coming into the system) which includes debt, credit and cash.

If you buy US Treasury paper, good luck. Canadian paper and a few others stand a better chance of survival.

Farming commodities look good here.

I have thought for a long time that the balance between interest rates and other investments was off kilter. But everybody believes that low interest rates are the booze at the party, and more (i.e., lower interest rates) is better. As equities disappoint, pensions funds will be forced to trim their equity allocations. The low return on bond interest will also hurt pensions. Just as the belief that we can make ourselves rich with low interest rates, the belief that we can inflate away our problems will fall by the wayside. Finance doesn’t make you rich – being rich means you have options due to finance.

In other words the looting continues as the government steels from the tax payers pensions in a last ditch attempt to restart the leverage and debt party which has been so good for those at the top. Every penny that the consumer gains from lower mortgages they loose in having to boost their pensions, or face up to the fact that they are going to die very poor. They have already raided the interest on savings or the retired, so I guess next it will have to target kids. Every twist and turn the authorities make costs the consumer money and yes you might just save that over leveraged company as a result, but ultimately the economy depends on the amount of money the consumer has in his pocket.

As a 35 year old American who has spent his entire career in the private sector (in a non-smokestack industry), I find all of this talk about “pensions” to be somewhat quaint.

Will quantitative easing bring pensions to the brink?

Of course they will you silly man!

Over the falls and down to the bottom,

Its part of the golden collar plan.

And no ifs about deflation,

You can bet its here to stay,

This is an intentional financial coup,

Inflation will be controlled in the fray …

The many will soon be worth less,

The few will soon be worth more,

As billions with bellies deflated,

Are forced to pass through death’s door …

Hail the great scamerican ponzi,

It is the finest of devious schemes,

It fulfills the elite desires,

Their ruler and ruled dreams …

Deception is the strongest political force on the planet.

i on the ball patriot

rue the day said – “As a 35 year old American who has spent his entire career in the private sector (in a non-smokestack industry), I find all of this talk about “pensions” to be somewhat quaint.”

I’ll bet you find child molestation, ripping the wings off of flies and burning kittens “quaint”. Your aloofness is so charmingly compassionate …

Deception is the strongest political force on the planet.

i on the ball patriot

Inflation is not better than deflation, although it always looks that way to desperate authorities. Deflation is grim and unpleasant, but nations routinely recover from it, albeit after years of negative growth.

Hyper-inflation, on the other hand, can lead to a collapse in the currency, which is checkmate for virtually any government, with a total economic collapse and the rise of a totalitarian government being a typical outcome. Again, runaway inflation risks the endgame for Western democracy, and must be avoided at all costs, even at the cost of a deflationist depression.

I think Anonymous misinterprets me.

Most Americans under the age of 50 or so, working in the private sector, in non-smokestack industries, do not have and never had and never will have a “pension”, defined as a defined benefit retirement plan. We have defined contribution plans (401k’s), most of which have seen their values halved over the past year, and no “guarantee” on anything. Don’t misinterpret my cynicism as schadenfreude.

Leo believes that inflation is the right policy, AND that we should run out and buy bonds. This left me troubled. Surely both halves of the statement cannot be true. Then I read Buiter (FT) today, and it all made sense:

“So the US Treasury and the other members of the US macropolicy chorus plus the Fed have to simultaneously convince the holders of US Treasury debt that the real value of their investment is safe, and prepare to inflate that real value away if and when the need arises.”

Hi David,

Yes, I prefer to see "mild" inflation than a deep cycle of debt deflation.

The problem is that the Fed and other monetary authorities are going to bungle this up. They can try to reflate the bubble, but it simply won't work.

I am deeply skeptical of "quantitative easing" and as far as I can tell, all the goodies are going to hedge funds and private equity funds who are suppose to buy "toxic assets" on the cheap to then sell it to greater fools so they can collect 2&20.

I see quantitative easing as pushing on a string. You can increase the supply of credit all you want but if people are scared to death, losing their jobs, and putting off spending, where is the demand for credit going to come from?

The same goes for companies putting off their investment plans because they see no end to this economic mess.

If quantitative easing fails, a long cycle of debt deflation will develop.

Monetary authorities know this and this is why they are throwing everything they can to reflate the global economy.

I hope I am dead wrong, but I remain skeptical of these efforts and that is why government bonds might be the asset class that outperforms all others in our upcoming lost decade (or decades!).

cheers,

Leo

Leo, investments in govt. bonds are among all of those other traditional liquid capital markets investments which have been under-priced for risk. I might extend that to anything denominated solely as fiat currency. Inflation and deflation are pertinent only as to the color of the economic contraction we are to experience until we learn how to make productive investments.

Unfortunately, we do not have the infrastructure to be making those investments. We rely on bright young men with theoretical educations who find it easier to appraise collateral than to analyze productive potential.

Meanwhile, yes. I think we can count on govts. to try to prop these failed investments up. And we can count on it not working. Agricultural commodities were mentioned up-stream. In the end investments will be measured in tonnes as well as $.

http://mpegmedia.abc.net.au/rn/podcast/2009/03/lnl_20090310_2240.mp3

Say there Leo, sorry I didn’t comment on this yesterday, and thanks for putting flesh (rotting) on this skeleton in the closet. This has been a major concern of mine for some time. If we truly ease quantitatively, we wipe out much, even most, of the existing pension base. That is the historical result as well. *Poof* Done. Flat. The social costs of this will be steep, and will be unwinding for years after the immediate financial crisis passes. To the extent to which lost pension vestings are compensated, this will be done by the public if at all. It is not beyond the realm of possibility that this will be the _most_ contentious problem left by the crisis on a domestic basis for many countries.

Please stay on it, and keep us posted.

Regarding pushing on a string, Leo, I tend to think of it as forcing water into a cracked pot. The critical thing is to get the crackpots—zombie banks by another metaphor—out of the credit pool so that the base financial system is functioning. Stimulating demand can only work where credit intermediation functions in relation to demand. This is why our present approach in US/UK strikes me as so deeply dysfunctional, a bungle as you say. We are stimulating without having really done anything adequate to fix the ‘intermediation system’ so much of our impetus will just flow out through the cracks to the rats and worms. It’s madness.

I’m skeptical of the concept of quantitative easing as well, insofar as it is advanced. The way this is being done, we are doing little to support _production_ but rather jamming huge amounts of money into inherently speculative swapshops. This is completely wrongheaded. Easing quantitativel to keep GM going for another few years might be ugly and a long-term failure, but it might support production and demand for a few years. Maybe yes, maybe no. Keeping state and local services funded, and so getting their local multipliers to a level stable beyond the fluctuations of local tax bases might yield some real jolt for the buck. Giving Citi and Hedgistant more Funimoney to play with is going to do nothing but push us to quasi-default.

We are governed by timid idiots. —So what does that say about all of us mugs, hey?