I was in Kansas City at a econbloggers conference hosted by the Kauffman Foundation, and one of the breakout discussions was on the fate of finance.

One participant who claimed to be have a basis for his view (it could be based on private polling or focus group research, or less scientific methods) said that Americans don’t want more regulation of financial firms, “they just want some public hangings.” Perhaps more important, he said that was what policymakers believed, that Americans were not in favor of regulation.

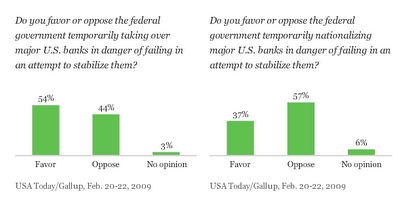

A recent Gallup poll served to illustrate how susceptible poll results are to how the survey question is phrased:

Would you be satisfied if some of the executives at financial firms who helped bring them and the economy to the brink were brought to justice, or do you think additional measures are necessary? Have any friends, family, or co-workers given their views on this question? If so, where do they stand?

sigh….you can’t hang anyone for hubris, being plagued with cognitive dissonance or innumeracy.

further sigh….American doesn’t have the same concept of personal shame as Japan. I doubt Stan O’Neal or Fuld are too guilty ridden over their tenures.

Nationalization and regulaton as well as liberal have all become dirty words. They have become slurs.

I tend to be ambivalent on everything. I get called a liberal in a lot of arguments, especially with supposed right wingers. Just cut the shit and call me an asshole, it would be more honest, and waste less of my time.

It’s just the level of discourse that has been reached. Hardly the starting point for an argument.

The hate for regulation, and all things “government” is crazy, although rightfully so in the instance of the last 20 years.

That just brings up a guy like Bolton at the UN? He has crusaded against it and anything like it for so long….

How can you run it if you disagree that it should even exist? How do you possibly measure job performance? Number of new wars? This is an honest question.

This is the starting point, where can it possibly go?

Call it what ever you want. The government has just signed the bill for 9.7 trillion dollars, enough for 90% of all mortgages. We still have record foreclosure numbers, and the banks are still very shaky, and the same people are in charge.

Something is not adding up.

I agree with your compatriots view. In my workplace polling, it is hard to find anyone who thinks that government won’t do worse than wall street has. In fact there are a fair number who think that government screwed it up.

It will take education to undo a generation of beliefs about government. Most people still believe in the efficient market hypothesis, and so it must have been Greenspan (or some such) that screwed the global economy.

Few people really grok that Fuld (for example) was more like Madoff than he was like J.P.Morgan.

There will be public hangings, but it will be done to justify the ruling class, not to satisfy mob rage.

On the other hand, people are also easily pursuaded. I have a group of Ayn Rand/Neocon types I hang with who are unsettled by the happenings in the world – and are ready to learn what should be done (not that anyone really knows).

I’m looking at the puzzle from Sweden tonight for some reason and it almost seems on topic, although a year old: US learns lessons from Swedish banking crisis

"I have been in the USA several times this year to explain what we did," said Bo Lundgren at the Swedish National Debt Office.

"The sums that we had to cover amounted to 60 billion kronor ($9.83 billion). But together with the resurrection of Nordbanken meant that by 1997 the outlay had been more than halved by reclamations," said Lundgren.

>> Then later in Sept, 2008: "In principle (the United States) is following approximately the same route we did, but the (slightly different) model chosen, I'm afraid, could cause problems," Bo Lundgren, head of the Swedish National Debt Office and who recently briefed US authorities on Sweden's experience, told AFP.

Once the crisis was over, the Swedish state sold off nearly all of the nationalized bank investments, getting back most of the money that had been pumped into the sector.

The US rescue package "will certainly lead to more stability and will ensure that things will work better, but there's a risk that the cost for tax payers will be steeper than it would have needed to be," Lundgren said.

"When you reach a certain situation you have to go in and do something that re-establishes confidence. We introduced a guarantee for all creditors but not for stock holders. That guarantee made it possible for everyone to do business with the banks without risk," Lundgren said.

"If a bank was to receive help, we took over a corresponding amount of influence in the bank so we could ensure that we could get the money back," he added.

The Swedish state took over insecure loans during the crisis worth around 65 billion kronor ($9.9 billion) of taxpayer money, but eventually got most of it back through dividends and later reselling the nationalized bank assets.

In contrast, Lundgren said, Washington's rescue package appears to favour stock holders without much prospect of the tax payer-spent money ever being reimbursed.

"What's happening in the United States now entails a big risk that stock holders will win. If the banks survive, the stock holders' holdings will still be there but the tax payers will have to foot the bill," he said.

"I would rather have seen them choose a route where they — with the cash injection — offer to go in as an owner of the banks, giving them influence, and then sell when the crisis is over," he added.

Also pondering: Catharina Lagerstam (1962). She was also previously CFO of Hufvudstaden and head of financial analysis at Swedbank. She was also responsible for the valuation process at Bankstodsnamnden in connection with the banking crisis in the 1990s.

> I think it's worth taking another look at that valuation process, because it will be like the equivalent metaphor of turning crude oil oil into inflationary jet fuel! So yes, what to do next?

Hanging some bankers is a START.

Throw in some politicians and you’ll be talking.

The few people that I’ve talked to about the subject seem to approach the situation like this:

IF (substantial taxpayer funds are at risk)

THEN nationalize (or equivalent)

The reasoning seems less based on “what’s the best action”, or “what will get us quickest out of the mess” (although nationalization my indeed be the best course), and more based on “you’re putting me, my kids, and my grand kids on the hook to pay this enormous potential loss, so stockholders should get nothing and debt holders should have to take a loss as well”. They aren’t thinking of it on quite those terms, but that is the gist of it.

In other words, “if I’m being forced to be on the hook/take the pain for this, the ones that helped get us in this mess should be on the hook as well, and under no circumstances should they benefit from my fellow taxpayers and I being on the hook.”

The few people that I’ve talked to about the subject seem to approach the situation like this:

IF (substantial taxpayer funds are at risk)

THEN nationalize (or equivalent)

The reasoning seems less based on “what’s the best action”, or “what will get us quickest out of the mess” (although nationalization my indeed be the best course), and more based on “you’re putting me, my kids, and my grand kids on the hook to pay this enormous potential loss, so stockholders should get nothing and debt holders should have to take a loss as well”. They aren’t thinking of it on quite those terms, but that is the gist of it.

In other words, “if I’m being forced to be on the hook/take the pain for this, the ones that helped get us in this mess should be on the hook as well, and under no circumstances should they benefit from my fellow taxpayers and I being on the hook.”

Its the worst of all worlds. People in charge who disclaim any responsibility, and who continue to pay for other people to fix their problems.

Some things you just can’t contract out.

Why is this an either-or? What’s the binary relation between investigating possible legal infractions in the past and deciding what to do about an unfolding economic catastrophe? The conference participant doesn’t happen to blog for Liberty Fund or the von Mises people, does s/he?

Well, for banks like Citibank and Bank of America (ie, banks that are insolvent) the existing shareholders should be wiped out (completely), and the bondholders given common stock in exchange for their bond holdings, that is to say, the companies should be forced into bankruptcy. Furthermore, as a part of the reorganization, the US government should FORCE them to be broken up into a number of smaller companies. If they are too big to fail, they are too big to exist.

And then everyone at the FDIC who had anything to do with monitoring these banks should be fired.

In the early 1970s, average Americans assumed Keynesianism was a basically good model for running the economy. They didn’t have a sophisticated understanding of it, but they associated it with the good years of the 1950s and 1960s, so they liked it.

A decade later, thanks to the economic troubles of the 70s and a heaping helping of conservative rhetoric, those same Americans had begun to accept rational market theories and the belief that government can’t possibly do anything right (except, of course, create Jeffersonian democracies in the Middle East). Again, they didn’t have a sophisticated understanding of conservative ideas, and God knows they weren’t about to get one from talk radio, but they associated conservatism with good times, so it was OK.

Until it wasn’t. Now we get to watch neoclassicism die as hard as the New Deal.

The other night when my mutiny failed, I posted this (first part below) and wasn’t sure if anyone saw it, so I’m re-posting along with two other puzzle pieces that are starting to form a very bad image somewhere within my cerebral cortex.

1. Steve Hanke, Professor – Applied Economics, John Hopkins University, and an economist with the Cato Institute:

Prof Hanke said the fiscal stimulus packages would not be able to turn around the economy fiscal packages have no history of working, he said. The economy, even without the stimulus package, will probably start recovering by the middle of this year simply due to the monetary stimulation by the Federal Reserve.

He added that the current recession does not have anything in common with the Great Depression. There has never been a case in history where we had deflation and a slumping economy when the central bank is increasing the money supply at enormous rates like the Fed is doing, he said.

Prof Hanke, however, said he foresees another recession raising its head after the economy turns around this time due to the Fed stretching the size of its balance sheet.

There will be danger right around the corner [after things stabilize] because the Fed has had this huge expansion of its balance sheet and then fine-tuning and shrinking it again will be difficult and we could be back into a recession again.

2. Estimating Default Probabilities Using Stock Prices

In the early 1990s the Swedish financial system was under severe strain due to one of the worst banking crisis that had struck an industrial nation since the 1930s. What made the banking crisis particularly critical was the simultaneous macroeconomic weaknesses and an unfolding currency crisis. The crisis led to a general recession, and between 1990 and 1993 GDP fell witha total of 6 % and total unemployment rose from 3% to 12% (Bäckström (1998)).

3. That old news, echos this: The current rescue plans, which will force governments to issue more debt, print money and flood the markets with liquidity, will flare up inflation after the crisis is over and will create worse problems, Rogers warned.

“We’re setting the stage for when we come out of this of a massive ‘Inflation Holocaust’t," he said.

And the plans are unlikely to fend off a severe economic downturn, as the crisis starts affecting all walks of life.

>> So what do you do with the banks … huh, huh, you MUST force them to not increase fees, and then find new ways to make the taxpayers pay for their losses. The future I see is a matter of banks being bailed out from accounting fraud, with tax payer revenues and then the banks, wall street and The Fed ramping up inflation as fast as they can and then choking the living shit of America! That will happen and it will cause a systemic disturbance that will destroy the fabric of our culture.

King Dick ll: Act 5, Scene 1

KING RICHARD II We make woe wanton with this fond delay:

Once more, adieu; the rest let sorrow say.

They should have left all of them fail, just like Lehman. Did anyone notice how the independent Federal Reserve is not so independent anymore. How long they last?

I’m a California liberal, old-style, so naturally my comments don’t count. That said,

1. Hang them all.

2. Regulate everything.

3. Do not underestimate the stupidity of the younger generation – the evil spawn of Reagan.

I agree there is a little truth to this. That people think in terms of punishment. Even Obama in his speech sounded punitive; he’s going to hold people responsible — he mentioned the jets, I recall. The discussion of whether bondholders or stockholders or whoever wins or loses is less important than just ‘punishing Wall Street’ mostly symbolized by executives.

There is a vague and nebulous idea that banks need more ‘regulation’ — but there’s not a whole lot of specifics about what to do exactly to stop banks, or anyone for that matter, from making bad investments. With hindsight this is an easier problem.

I do believe average people are totally aware of how absurd lending was to homeowners. I had some friends describe how they were offered $1M even though they weren’t even close to being able to make payments on this (They borrowed much less.)

I wonder what people think when they hear ‘nationalization’ — to me it sounds kind of South American, or a little bit Hugo Chavez. It implies permanent government ownership even if you say it’s temporary. Naming the thing ‘restructuring’ or something like this, even if it’s exactly the same process would digest a little better, politically, I suspect.

Those who run a large book of business and who engage in frequent telephonic sessions with key players @ Treasury for the purpose of shifting policy should be shown the noose.

I am thinking of one William Gross and the recent “cut” between the simple preferreds and the trust preferreds in C.

His shyte just runs on and on.

(And on)

before we start hanging bankers perhaps we should think of hanging a few politicians. While it is not fashionable to defend bankers I think it is worth noting that they acted exactly as the "free market" theory would have us behave- each person acting in their own self interest generates the maximum wealth. It is the politicians (and in a democracy that is ultimately us) who set the rules that they bankers used to their benefit.

I think we will find the same thing that we found in the S &L crisis- very little criminality but massive amounts of stupidity.

I remember some weaks back stating in comments here that a solid plurality of Americans would, as of right now, favor taking over the banks, and that this would grow to a solid majority, with only a hard nut core being intractably opposed. There was a response in comments at that time citing the 37% ‘for nationalization’ or some comparable number. I did not reply to that at the time because I had no hard data for my response: that that low number had everything to do with ‘question bias,’ how the question was asked. Now, we see the data in the above comparison. I have seen ‘polls’ manipulated for decades, never more than in the last ten years in America in exactly this way. We only get the reponses to the massaged questions asked, not to any real back and forth or perspective. I reiterate my view as first stated: taking over the Big Zombies would go down very, very easy with the public. No marches; no phone bank barrages; usual far right noise machine drivel but no popular opposition that counted.

But in (apparent rather than real) contradistinction to that, I completely endorse the perspective of your unnamed informant at the conference on this, Yves. I think that, yes, most Americans would far, far rather see a few summary hangings than any serious reform. There is no stomach for reform; no push in the streets. Everyone wants to get back to ‘The Way We Were.’ This is Enron/WorldCon all over again writ large. What most Americans want is a good day at the mall with their kids, preferably with someone else picking up the tab: any real civic spirit in this country is moribund outside of political liberals who are committed to electoral politics in lieu of the religions they have all moved on from, and they are no majority on their own.

The contingent which is really, REALLY opposed to nationalization is, natch, the wealtholders at the apex of the extractive apparatus, specifically those tied into the financial industry. They still, quite obviously, have an headlock on anything and everything in the District that counts. To the extent to which Congressfactors care about what comes next, they are of course concerned with constituent ire over Who Is to Blame, but very few of them seem genuinely concerned with where the country is going or how to get it going somewhere better, or at least more interesting. These types did not get the offices they have by questioning the system in which they operate: they _are_ the System, so any questions start with their culpability and intentions. Right; “No questions, gentlemen.” With Geither and Summers having Bo Prez by the gonads and earlobes respectively, he’s going nowhere. —Nor ever intended to: he believes in ‘the Market’ according to his public remarks and record. The fact that it was corrupt, skewed, overrated, and has more holes in the gut than Dillinger has not gotten through to the inner suites where he is now ensconced.

. . . We will do everything wrong regarding the banks before we do anything right. . . . Maybe I’ll write a novel to wile away the next seven years . . . .

So doc holiday, I do not regard anyone affiliated with the Cato Institute as having even the tiniest shred of intellectual credibility. None. Now, that is perhaps marginally unfair as some of those who show up there have, at other times in their life, done some scholarship of reasonable substance. That was then: The Cato Institute is flatly an ideological quote machine for the wealthy Right in America. That is why it was created. That is by whom it is funded. Carefully selected Names are given well-paying fellowships there to lend their [slender but media-boosted] credibility to that agenda, and by so doing completely discredit themselves from the first check they cash. The only reason to listen to anything over a Cato Institute byline is to know what the Wealthy Right wants you to think as of today.

—And so we no: “No stimulus ever works. Ergo, those who back stimulus are ignorant proponents of failure on the public’s dime.” Totally political swill. The efficacy of stimulus is debatable, the moreso in the present macroeconomical context of the US. But this isn’t intellectual debate: it’s pure spin.

During Vietnam, didn’t our government send 55,000+ men to their deaths to prevent the spread of socialism/communism???????

WAKE UP AMERICA!!!!!

Do I now live in a nation of mindless idiots?!?

God help us.

UK perspective:

– Whole MSM up in arms over Sir Fred’s huge pension, valued at £16M. Calls to claw it back. Front page.

– (same day) RBS £325BN asset inurance scheme announced. Potential losses of £100Bn to hit the tax payer. Business page.

@BG said “It will take education to undo a generation of beliefs about government.”

True and I believe the root cause of this is the constant drumbeat that the “best” people go to industry, that the 2nd or 3rd string gravitates to government work. That government workers make less $$ than industry not because government might be more efficient but because workers there are inefficient and don’t deserve to paid the same as industry. Until this meme stops being reinforced, people will not have any trust in government.

I believe that the brouhaha about “nationalization” is being raised mainly by people who own common stock in the companies presumed to be targets, being more afraid of losing everything when a company is “nationalized” and the stock is zeroed out than of the government actually running the entities.

As to hangings, yes, I am all for punishing the guilty. You SHOULD be held responsible for the damage you do. But it must be more than a soft fine and a few years in a white collar prison. We need to try and discourage others from following their path in the future. To do so, we must take ALL their assets, including retirement funds and send them to a regular prison. If they try to hide assets, like I think Fuld did by selling his Florida mansion to his wife for $10, then we need to recover these also. Unfortunately, this will never happen as long as the “same old boys network” remain in power. And thus the seeds of class warfare will be sown. I will not be surprised if some people take matters into their own hands as the economy worsens in a quest for punishing those perceived to the bad guys.

See, for instance:

=========================

Bloomberg

Arsonists Torch Berlin Porsches, BMWs on Economic Woe

By Brett Neely

Feb. 27 (Bloomberg) — When Berlin resident Simone Klostermann returned from vacation and couldn’t find her Mercedes SLK, she thought it had been towed. Police told her the 35,000- euro ($45,000) car had been torched.

“They’d squirted something flammable into the car’s engine block in the gap between the windshield and the hood,” said Klostermann. “The engine was completely destroyed.”

The 34-year-old’s experience isn’t unique in the German capital. At least 29 vehicles were destroyed in arson attacks this year, most of them luxury cars, according to police. The number is already about 30 percent of the total for 2008. The latest to go up in flames was a Porsche, on Feb. 14, two days after a Mercedes was set alight in a public car park.

While youths in Athens protest by throwing Molotov cocktails, in Paris by toppling barricades, and in Budapest by hurling eggs at politicians, protesters in Berlin rage at their economic plight by targeting the most expensive cars — symbols of German wealth and power.

…

Link

=======================

It keeps coming back to the same bottom line. The american people in the main are just to stupid and/or ignorant and/or brain washed to save themselves.

Trying this again…apparently it didn't take:

I agree with Anon at 1:30 and his comment about the broader populace making vague associations…

…I would expand on that to say that I think those upper-middle/lower-upper class people in their late '50s & '60s now share something with the average person who does not have an MBA: they're completely blitzed. They are so confused and bewildered by this, they have no idea what to think anymore. From anecdotal evidence of friends, family, and coworkers, I can state that the ideological among them are confused and angry, the uneducated are just confused. In their minds, it's as if the world was going on as it always had been, and then one morning early last fall the whole thing just turned upside down, and has gotten a little stranger every day since. Theirs is a very visceral experience.

On the other hand, among those who are in their 20s, 30s, early 40s and tend to have an educational bent…for them this is much more of an intellectual experience. Regardless of what philosophy they started out with, they never had the blind devotion that tends to come with age. Regardless of what they were force-fed in business school, they picked up enough general knowledge to give them a far better grasp of the whole dilemna than the rest of society (which is really a first, if you think about it: in the '30s, 95% of the population would have easily fit into the first category above. However, now you have a large demographic of highly educated young(er) people-across all ideological stripes-who completely get what is going on, every step of the way). This is the group where the real discussion is taking place; if any real change is to come from this crisis, it will be instigated from this group.

Those I’ve quizzed on this do not understand any aspect of what’s happening. They’d like to be angry at someone, but they don’t know where blame should be placed.

Nonetheless, they’re certain to resist any increase in personal tax liabilities. The view seems to be, “Can’t say who created this mess, but I’m sure it wasn’t me. Don’t get any ideas about sending me the bill if you plan on remaining in office.” There’s no basis for discussing regulatory changes with them. View seems to be that decent regulation was in place, but not enforced. A little difficult to argue with that.

I note every one of them is repairing their family balance sheet, and none expects conditions to improve any time soon. So far I don’t think many recognize how bad this may become.

The “public hangings” (not literally hangings but humiliation including real punishment and personal devastation) are important to show that the higher-ups are subject to the risks of economics, not just the common folk. This is important to healing. The job losses in the finance sector and associated downward mobility are valuable in that regard, as they empower those who have been trampled on.

I say this as someone who earned more in the FIRE sector than I earn this year. But I’ve been relatively lucky, not having been as overpaid to begin with in my opinion.

The most important form of “public hanging” is to claw back the money from the people who may be susceptible to it for legal reasons, preferably to the extent that they are not financially comfortable and have worries about food and roof-over-head, the same as everyone else. Jail isn’t the main thing. Seeing them worrying to hold onto their job without guarantees actual or implicit, forced to have the same concerns we must live with, is what we all need to see.

I’ve suggested, tongue in cheek, that the NYSE needs its own electric chair, and, on occasion, a Bernie Madoff type be placed in it but in New York you can’t even execute a Son of Sam so its all fantasy.

Despite Mr. Kline’s view, it would appear that the nays have it in terms of bank ‘nationalization’. Even the more benign poll question shows 44% opposed and 57% when you use the more draconian term.

Some probably want the insolvent banks to go bust and others imagine

the government couldn’t run them any better but could run them a lot worse.

I agree with both POV, and thus, reluctantly, have come to oppose any government involvement other than protecting depositors.

One of the more amusing aspects of this financial crisis has been watching the Ayn Randians beg for exemptions from current bankruptcy laws and for unfettered, free taxpayer money to big banks, while reverting to ideological form for policies concerning everyone else.

We still have from none of these institutions a quantified viability plan or a quantifiable policy argument for their continued existence outside of receivership/Chapter 11. Whatever GM’s failings, it has at least provided both of these. The big banks just continue as they have with no justification for their existence whatsoever. And, the “free market” ideologues lead the parade on their behalf, complaining incessantly all the while about government interference.

Get on with it. Let ’em fail. I can’t take the begging and whining anymore.

The Girl Friend thinks “they should have to flip burgers for minimum wage till they’re 70”

“Do I now live in a nation of mindless idiots?!?”

YES.

I find it amazing that people have somehow decided that the banks are to blame for this financial crisis when there is clear evidence who the real villains were. If you must punish someone regardless of whether they are guilty or not, the banks will do. This is just the modern equivalent of throwing a virgin into a volcano to appease the gods.

If the volcano keeps rumbling, find more virgins.

This whole debate over the term “nationalization” is worthless. The common use of the term is government seizing valuable assets without fair compensation for state ownership. Very few people want that. Anyone who uses the term “nationalization” in proposing a solution to the banking crisis is either a bad salesman of receivership / bankruptcy or is trying to help the big banks by undercutting support for receivership / c11 / c7.

For the life of me, I cannot understand why someone as smart as Yves continues to use the word “nationalization” in proposing a solution. The majority will never support a solution that fits the general definition of “nationalization”. Never. It means government ownership and government operation.

People want to fix the banks without costing the taxpayers any money. That means bringing the big 6 banks (c, gs, ms, jpm, wfc, bac) back into line by forcibly wiping out equity (common and preferred) and giving equity to the creditors in exchange for haircutting their debt claims.

This can be done in bankruptcy, and this can be done under FDIC authority in a receivership. FDIC has legal authority to do this, right now. However, Summers/Bernanke/Geithner will not allow the FDIC to comply with its legal mandate to seize insolvent banks because they are puppets of the big 6 banks.

Anymore, the comments sections of these blogs are as important to read as the blog posts themselves.

The Interwebs are truly a wonderful place.

I’ll cop to being a ‘neo conservative’, not that most folks really understand what that means in the aftermath of Bushcheneyhitlerhalliburton. Be that as it may, the comment by the individuals who were ‘liberal’ and used to having the term used as a perjorative, and the comments of the poster who claimed that today’s generation were an evil spawn of Reagan hit a nerve.

We all want to blame someone. Which is fair enough. There were certainly a lot of people who saw this coming, while there were certainly even more people who did not. Unfortunately, the ones who did not controlled both the finances and the politics of the country. The were ‘liberals’ and they were ‘neo cons’, and they both shared the political capital from a rising eonconomy. Until it collapsed.

I can offer no sage advice regarding nationalizing banks or stimulus spending or containing the coming inflation brought about by the fiscal policy of the Fed.

What I can shed light on is who is to blame.

Me. The people I work with. The companies that we competed against. The idea that nothing that we had aquired was worth as much as the things we had yet to buy.

My son goes to a very high end college with a top flight B school. His comments to me are that prior to the crash all that the B school majors cared about was making those 100mill bonuses. Those are our children, and they embody our values.

Our economy is not the only thing that needs to reset.

Kaufman Foundation. YUK! Talk about stigmatizing poll results (they are in a league with the Cato institute – just a tad more guileful).

Sorry, but I can’t help but think it was a ‘co-opting conference’ rather than an ‘econbloggers conference’ you attended and it speaks to the real problem; aggregate generational corruption and the brainwashing that it has produced in the ruled.

Scamerica, the world’s greatest Ponzi scheme, is now owned lock, stock, and barrel by the ruling elite. No equality in the scam rule of law and a totally unresponsive electoral process have set the stage for our current predicament and its latest devious goal – to eliminate the middle class globally and engage them in a perpetual conflict with each other … my, my, how readily we comply with the program … scamerica is not a failed state – as someone said in the previous post comment box – it is rather a very slick and incrementally successful gangster exploitation of the gullible …

The bank mess is only a symptom. Perhaps a reader sanity check on gullibility might better serve us all.

More skepticism please.

Deception is the strongest political force on the planet.

i on the ball patriot

I think the difference between the two polls is that people, rightly or wrongly, think that “nationalization” means that the banks would be run for the country’s benefit, like, say, the Post Office, instead of being run for the banksters benefit, as now.

In my small town, the idea of running the banks like regulated public utilities has gotten a little traction, since, when you think about it, the small banks and the credit unions that didn’t loot the country run themselves with that kind of feel anyhow.

As far as who to string up:

Basically, I’d make a list of whoever developed or signed off on the financial instruments, all the way up to the top of the corporate food chain. That includes the software engineers in the creative class who developed the models that didn’t account for prices going down, the managers who signed off on them, the salesmen who sold them, the middlemen who bundled them and passed them on to the next guy, and the CEOS and partners who collected the bonuses. String up the CEOs. String up anybody who collected a big bonus. And use the small fry to get the testimony on the big ones. Like Nuremberg. The whole system is a cancer that needs to be cut out, and the penalties need to be memorable, so the next generation doesn’t need to forget. Maybe the trials could be telecast?

NOTE I do mean “string up” metaphorically.

Yup, survey results are affected by phrasing. Another new discovery.

The problem is exacerbated here by the fact that “nationalization” is a term that means different things to different people. People who appear to agree that the banks should be nationalized may have very different ideas — or perhaps no ideas at all, not seeing the issue — about what this means for the creditors.

The key question is not: nationalization, pro or con? It is: who should bear the losses of the banks’ creditors?

Anonymous writes:

“””

burnside, is that across all ages, or is that people in their late ’50s and ’60s? Because that sounds a lot like what I hear from the older folks. …

To them (and I’m not trying to be snide here, but this is just an objectively discernible behavior of that age group)

“””

Wow. Please don’t make false claims about an entire generation.

We’re dealing with the end game of 30 years of conservative dominance, starting in the mid-70s, and some of us fought that every step of the way. You”re just talking to the wrong “old folks.” “Objectively discernible” my sweet Aunt Fanny.

Anon 7:49 — very well said. I agree.

It is a bit early for much of a groundswell in support of substantive reform.

For example, how much had the national zeitgeist changed between, say, October 1929 and March 1930 on the one hand, and October 1929 and 1935 on the other hand? We’ll get there, but let’s face it — Murdochland shapes opinion but also holds up a mirror to this nation, and it is not going to change its tune until its remaining advertisers respond to general sentiment and demand it.

And funnily, by coincidence of the sort history seems to relish, the presumably-quite-honest mayor presiding over the crime scene made and still makes his own $billions supplying the tubes and pipes of the financial interweb, so until his ever-extensible reign concludes it is reasonable to presume there is substantial inertia opposing a real reform of America’s “trading culture.”

In the meantime, pretty much everyone can agree on the value of enforcing laws now on the books — including those dusty SEC regs and Sarbanes-Oxley for all those overpaid execs who signed off on demonstrably false 10-Qs and Ks.

Frankly I’m a bit surprised Mr. Cuomo has not already jumped out in front on this one in NY state. All he has to do is chase the guys at the top since they exposed themselves to criminal prosecution when they signed off on the fake financials, and they in turn will try to cut deals by squealing on their sometimes even more egregiously overpaid underlings in the capital markets and real estate divisions. This will be a new twist on trickle-down economics.

Mr. Cuomo, while we wait for reform, I stand ready to help for the necessary project at hand…Ferdinand Pecora calls to you.

YS:

I say force all the big banks into bankruptcy. Indict their senior managers for securities fraud as well as the lawyers, SEC employees, rating agencies and CPAs who shilled for them. Remember Eisenhower’s 18 January 1961 warning about the “military-industrial complex”? We now have a bank-NYBigLaw-SEC-DOJ-Fed complex. Repeal the Federal Reserve Act. Investigate the SDNY US Attorney’s office. Bring back the guillotine. End fractional reserve banking. While we’re at it, replace our Supremes who have not overturned the “gold clause” cases of the 1930s.

If this crisis goes on for much longer without any accountability I think it is very likely that there will be some kind of vigilante justice.

I’m not involved in finance in any way except that I have a modest bank account which never holds more than my paycheck, but it appears to me that there has been a lot of fraud and rampant criminal behavior in the FIRE sector, with the SEC standing by twiddling their thumbs.

I probably fit the profile of someone who has been intellectually curious about the crisis for the last year or so, although I have recently suffered collateral damage.

I do want to see hangings and public trials and I want to see big heads roll, not scapegoat heads.

I also want some assurance that this will not happen again, which would mean not just regulation but the knowledge that it is actually being enforced.

On the issue of “Public Hangings”:

It is incumbent upon a society of laws to enforce those laws else loose credibility and embolden detractors as well as further subversion from within.

As of this moment, our financial system appears to the world like a case of “The Patients Running The Assylum”. But it can’t be allowed to degenerate one step further into the nightmare vision our foreign detractors love: “The Wild, Wild West”.

We may have gotten cocky but the reason the US has succeeded as the capitalist center of the world is because people around the world felt above all that their money was safer here than elsewhere.

If we erode that basic bargain, someone else is bound to step into the breech. Money talks, but it can also walk.

In addition there’s our own issues with authority (which has been a curse word in this country for 40 years) and justice. If justice is not blind in such a public manner as with Madoff, Thain and others, then much of the efforts to restore trust in the financial system are undermined.

Even if the system failed to detect and detract the criminals, then there must be recourse or else faith erodes fast.

Soon I’ll be asked to trust my money to a partially bailed out bank with Madoff as CFO.

Funny to see some free market believers renounce their faith? Funnier to see Sweden being more hardcore free market than the US. And a bit sad.

A recorded focus group with lots of open-ended questions is a better way to research this subject. How do we fix the banks? How do we protect taxpayers? How do we protect savers? How do we protect investors? How do we protect clients? How do we protect the economy?

“A recorded focus group with lots of open-ended questions is a better way to research this subject. How do we fix the banks? How do we protect taxpayers? How do we protect savers? How do we protect investors? How do we protect clients? How do we protect the economy?”

Bush/Obama/Reid/Dodd/Pelosi want to bail out rich people. They want to bailout bondholders by taxing the middle class and by inflation. Most bonds are owned by people with a net worth over 2M. The 90 percent of households have a net wealth below 900,000.

Bush/Obama/Reid/Dodd/Pelosi need to get the message that people making less than 100k a year don’t want to pay taxes to bail out bondholders worth over 2M. Screw the bondholders of C, JPM, MS, GS, BAC, and WFC. Let them take a haircut. If their bonds are worth 60 cents on the dollar, so what. They are still rich. They have no right to be bailed out by the middle class folks making less than 100k.

Apologies if this is a duplicate, but I think the internet ate my first post:

From the Hudson article in the links of 3/1:

http://counterpunch.org/hudson02232009.html

” … [T]he rhetoric of “free markets,” “nationalization” and even “socialism” (as in “socializing the losses”) has been turned into the language of deception to help the financial sector mobilize government power to support its own special privileges. Having undermined the economy at large, Wall Street’s public relations think tanks are now dismantling the language itself.”

…

“Today’s clash of civilization … is with our own past, with the Enlightenment itself and its evolution into classical political economy and Progressive Era social reforms aimed at freeing society from the surviving trammels of European feudalism. What we are seeing is propaganda designed to deceive, to distract attention from economic reality so as to promote the property and financial interests from whose predatory grasp classical economists set out to free the world. What is being attempted is nothing less than an attempt to destroy the intellectual and moral edifice of what took Western civilization eight centuries to develop, from the 12th century Schoolmen discussing Just Price through 19th and 20th century classical economic value theory.”

All that is accessible to anyone who takes the time and effort to get there; but the fact is, and I intend nothing “elitist” by saying it but only observing to what most people give their attention daily, most Americans just are not going to the point Hudson makes here:

“The economic fallacy at work is that bank credit is a veritable factor of production, an almost Physiocratic source of fertility without which growth could not occur. The reality is that the monopoly right to create interest-bearing bank credit is a free transfer from society to a privileged elite. The moral is that when we see a “factor of production” that has no actual labor-cost of production, it is simply an institutional privilege.”

As an earlier commentor observed, Americans have (and I think it is mostly unawares) cognitive dissonance, and that stymies decisions. Nobody likes to admit they’ve been taken as chumps – it is embarrassing. People will instead pray to the god which has not abandonded them but is testing them, and on their downwardly mobile glide, wave goodbye to their friends (yes, the Luo article) …. though perhaps to be reacquainted as times come by, grimmer …

“Takeover” and “nationalization” (to me) are not just differences in phrasing, but differences in meaning. Nationalization means confiscation of ownership. Takeover means asserting control. I can (and do) favor ousting Vikram Pandit without wanting to irrevocably seize the ownership rights held by C shareholders. It is important for our capital markets and for our economy that we respect the rights of equity holders (and creditors) and not become a nation that willy-nilly seizes companies without due process or compensation.

I am less concerned with prosecuting the CEOs (who always have, and always will, push the limits of risk-taking to produce quarterly results) but with the failure of the checks in the system, namely the outside auditors, regulators, rating agencies and CFOs and controllers of the banks who knew or should have known that valuations were unrealistic, or even fraudulent. It is their collective failure that allowed the problem to metastasize. Once one player in the marketplace is allowed to post results based on unrealistic valuation , competitive pressures will incentivize or even force the other players to follow suit.

I agree with Independent Accountant that there are already laws on the books that just need to be enforced; Sarbanes Oxley would be a start. If this wasn’t a Sarbanes-Oxley violation, what on earth do we need it for?

For justice to prevail in the long-term there needs to be claw-back of bonuses paid on the basis of fraudulent financial statements. In the absence of claw-back we will have privatized the gains and socialized the losses. Is anyone comfortable with that legacy?

Goes without saying that equity holders get wiped and bondholders take a haircut. Why we aren’t there yet is a mystery, and a blemish on the otherwise admirable performance of Team Obama so far.

Public hanging would help the economics of the farming communities at least. There wouldn’t be enough popcorn to go around…

Personally, I don’t want to see *more* regulation. Doesn’t do a damn bit of good if we have 1000 new laws/regs on the books if no one is going to ENFORCE them. The tools to regulate the industry are already in place, for the most part. The problem is, and has been for a looong time, that no one wanted to enforce the regs. It’s funny how the threat of criminal prosecution can act as a deterrent. Certainly the LACK of prosecution/enforcement gives incentive to bad behavior.

Just look at FTC v. EMC/Bear. With all of the media coverage and backslapping that took place back in 2004 when USA/Curry v. Fairbanks was settled there should have been no need to even consider FTC v. EMC/Bear. But for the four years after USA/Curry no one saw any enforcement of the settlement so there was no DISincentive for servicers to change their business platforms. Hell, even today, despite USA/Curry, Fairbanks/SPS has refused to change the manner in which they conduct business so why should anyone else?

If there is no law in the asylum what other outcome could there possibly be?

I would like to see the “justice” of Capitalism. If you’re really smart, and you study and work very hard, and your investment bank creates billions of dollars in profit, then you should get your share of those profits. You’ve earned them and I have no problem with that. If it’s true that you’ve been overpaid for your work, then your shareholders should take issue with your compensation.

But if you run your bank into the ground, then you (and your shareholders) should lose all your money.

By bailing out shareholders, there will be no motive, ever, for them to tackle the problem of executive compensation.

By bailing out the bankers, we reward and entrench their economic failure. This makes for a very inefficient marketplace and that cannot possibly be good for anyone in this country.

Nationalization:

As Yves has pointed out, there is no agreement as to what this means. What I favor for insolvent banks is Bankruptcy. The size of the problem makes it necessary for the government to step in and conduct the process in an orderly fashion. I don’t know what this looks like because I’m not an economist. And I don’t CARE what you call it.

If the government doesn’t allow the market to punish these institutions and the bankers who ran them, the social contract in this country will have been broken.

We underestimate the consequences of this in terms of social unrest at our peril.

“What I favor for insolvent banks is Bankruptcy. The size of the problem makes it necessary for the government to step in and conduct the process in an orderly fashion. I don’t know what this looks like because I’m not an economist. And I don’t CARE what you call it.”

You want receivership. That is “bankruptcy” for a bank, overseen by the FDIC instead of a bankruptcy judge.

Overything else is a scheme to bail out the rich shareholders, bondholders, and counterparties of the big banks. If their banks can survive without government support, they are insolvent, and need to be restructured in bankruptcy overseen by a judge or receivership overseen by the FDIC.

And the foreign investors have no legitimate right to complain of the rich US bondholders and shareholders are denied a bailout/handout.

What’s never been really explained to me, is that okay, say we nationalize banks and mark everything down and sell of the bad mortgages. Where does the money to recapitalize actually come from? Does it just print up ‘billion dollar federal reserve notes’ and hand them over, or does the USA sell bonds to recap these banks, and. Iff it’s recapitalizing all the banks, does it need a massive quantity of cash all at once. How does this work exactly?

Both poll questions were framed, and interpreted, by the framers to illicit a certain response. IMO, Americans reponded correctly to both questions when interpreted correctly.

The financial industry needs to be retructured, regulated, and returned to the function that enhances it’s usefulness to our democratic society. So yes, take them over, get rid of the cancer, defang tham, and restore the depression era regulation.

The radical business/republican government model has reached dangerous proportions to the point where the institutions of government cannot be trusted to faithfully enforce our laws or secure the common good. Therefore, nationalization will allow the financial industry to restructure itself through continued manipulation of the government that has been corrupted by them. So no, don’t nationalize them.

The sum : Restructure both government and the financial services industry for the greater good of the long term health and success of our country and constitution.

That’s what the last two elections have been about. It will take more than five weeks. More time will allow more public debate, healing, disclosure, and structure. Patience and transparency are our friend; Secrecy and haste, our enemy. In the meantime, reregulate and supervise.

I just read that this will be part of a stress test for Citi, BAC and also Buffett; guess Bernanke published a lengthy paper on accounting irregularities

>> Formerly called bio-PK, "direct mental interactions with living systems" (DMILS) studies the effects of one person's intentions on a distant person's psychophysiological state.[40] One type of DMILS experiment looks at the commonly reported "feeling of being stared at." The "starer" and the "staree" are isolated in different locations, and the starer is periodically asked to simply gaze at the staree via closed circuit video links. Meanwhile, the staree's nervous system activity is automatically and continuously monitored.

“demonstrate how susceptible the poll results are to how the question is phrased”

Either that, or the total ignorance of the American voter to substantive issues – “nationalization” being the operative buzzword that triggers the pavlovian anti-socialist response

I want to thank and salute yves for engendering this spirited and insightful discussion.

Naked Capitalism is the crucible of our national discourse.

Here in Silicon Valley, denial about the situation is so wide spread that it is creepy. The gas shocks of last summer had people reeling, but the financial crisis is just noise. I think that many here endured the DotComBomb personally, and all the outsourcing, and start-ups going bust all the time, and having survived that they are prepared to hunker down and tough it out again.

Seems like a bad idea to me, but what can we do? NY and Wall Street are a long ways off, and those society snobs are like French royalty. And DC doesn’t even exist on the same planet. We elect people to do the right thing for the voters, but then we lose track of them for the next 2 or 4 years while they butter their bread, only coming back to ask how we are doing when they want to get reelected.

It sounds like it would be fun to hang a bunch of these ass-clowns. But that wouldn’t bring back our economy, our lost small towns, our local merchants, our local industries and services. Those are gone forever, and our industries were sent overseas where cheap labor and lax environmental regulations meant ready profits.

So let it burn I guess. The banker class will probably come out fine, so long as they put up big enough walls to protect their ill-gotten gains. But in the end they’ll need food like the rest of us; when they crack open the gates, the balance of humanity will be there to eat them.

Richard Klein said:

“I think that, yes, most Americans would far, far rather see a few summary hangings than any serious reform. There is no stomach for reform; no push in the streets. Everyone wants to get back to ‘The Way We Were.’ This is Enron/WorldCon all over again writ large. What most Americans want is a good day at the mall with their kids, preferably with someone else picking up the tab: any real civic spirit in this country is moribund…”

Sadly, I agree.

There is no fighting spirit because the system has coddled so many. Call it vapid, empty or soulless, prosperity is truely the opioid of the masses. We got quite a fix over the last 30 years, but the money is running low for another.

The banks will get a pass for now and the big players will be sheltered from the storm at taxpayer expense. But there is an accounting going on and that can last for just so long.

People will stand up and be counted only once they are forced to give up the status they once had. It will take time if only because the bubble economy was so good for so many for so long. The 2010 mid-terms will be a great national anger barometer. In a surprise, instead of a Republican ascendancy we may get more radicals elected.

True calls for reform and meaningful political assault will only happen when and if significant numbers of people realize they have nothing left to lose or if they get terrified by tubulence that threatens the US. That’s way off, but not an impossible scenario.

I think that there has been a small dose of anger already expressed through the 2008 campaign and election, which repudiated the elites of both parties and repudiated complacency. There is a tone of anger toward elites in the financial sector, but just a tone and posturing so far. We’ll see how it evolves, but I think the tone gets sharper as we enter the second, darker phase of the crisis.

reading and listening to talking heads (cnbc etc) it is clear that the ‘private enterprise’ folks want it both ways: NO nationalization/receivership AND bail out the banks with direct cash or purchase at overprice the toxic assests……BOTH. otherwise, they don’t seem to offer an alternative to receivership (except private money should step in but it won’t…so???)

in canada we see more regulation is needed because as greenspan said clearly..there is too much greed and workarounds for what is on the books now. without more regs in USA we do not feel safe as from here..the bankers seem to rule. from here..too big to fail means too big to exist!

and then there is the rant on cnbc against mortgage help…”those poor people made bad choices and should have to live with those bad choices” BUT NOT THE BANKS

the idea that banks and brokerages houses are one and the same seems blantantly unethical.

that the same can sell california bond for a commission then sell CDSs to same customers using inside info that the bonds are gonna be bad and then turn around again and create a market in those CDSs is really really strange.

clearly, without regulation how will this stop? even now, they continue to sell CDSs against sovereign issue and no one knows if the seller will be able to pay out…assuming i guess (AIG eg) that the Gov’t will pay out becuase the ripple affect will be too great.

follow the money. the rich have gotten richer, the poor poorer. those who want less regulation have gotten richer and basically have brought downthe whole system with their unregulated greed.

the question about whether or not the gov’t can do better is a STRAW MAN…no one is talking about gov’t control for any length of time beyond what is needed to rescue

all are dead who might remember the day when corporations had to get license renewed every few years and prove they were acting in th public good!!

Isn’t it ironic, how the “conservatives” are against “big government” only when it comes to things like affordable education, universal health insurance, and a responsible business environment (i.e., regulation), but they don’t consider a hugely overblown defense spending as “big government” simply because they profit from it.

These conservatives have so badly discredited capitalism, if, at the end of this recession, the US will be a communist or fascist nation, they only have themselves to blame for it.

Vinny

How many Caterpillar 797B heavy hauler SUPER-TRUCKS will it take to deliver tax payer TARP funds to all the wall street crooks?

We need to use trucks like this to cart away these crooks to guillotines and not re-supply these same crooks with more fun money! Where is accountability? NOT ONE FUC-ING word so far by Obama — let me make that as plain as possible, because he is sounding like a crook, more and more every day! Where is the accountability for accounting fraud?????????????????

Vinny,

Have you read the Shock Doctrine by Naiomi Kline?

It’s funny that you don’t see the conservative pitbulls go after her the way they do a Michael Moore. I’m pretty sure they wish her name is never mentioned.

The one thing the Chicago and especially the Austrian schools never account for in any realistic way is power.

Power is bought, sold, stolen, and traded on a not-so-open market every bit as large as the open markets – at least influentially.

When you break down the individual trades in this market, they all seek unfair advantage. The “free market” is a joke told by these schools over and over again.

The government is infested with free marketers looking to pollute, protect, collude, and divert public funds.

How absurd is it that we allow campaigns to be financed privately?

Anon: 9:45 The key question is not: nationalization, pro or con? It is: who should bear the losses of the banks’ creditors?

The answer is, “Who stood to pocket the creditors’ gains?”

tut tut.

and whooooo has been using the word nationalization repeatedly and suggesting we don’t do “that” in our culture. and whoooo has definitely NOT used words like “temporary” or “limited time”?

hint, he was recently elected president.

its studies of poll questions like this that make propaganda obvious, and undeniable by even the faithful… which is why the faithful have mostly moved onto believing in a “secret” unspoken plan.

also what DanyBoy said.

I talked to my Mom and Sister in Wisconsin for awhile last night. 10 years ago they bought a beautiful house in a sub-division near Lake Michigan built around a wet lands area. There are about 20 homes whose backyards slope down to the wet lands. Lots of bird – beautiful. There was one lot that was undeveloped. Word was that you couldn't build on it without impacting the wetlands. Then a couple of years ago someone started building, and building and building. Huge house all stone with 3 car garage. Then another building with another 3 car garage. It was a retired M&I Bank exec. building it and living in it. My Mom & Sister watched it go up as their M&I Bank stock went down, down down. Now that it's completed the guy has over 100 outside lights going all night long. My Sister wants to buy a .22 rifle and learn how to shoot out lights and 200 yards.

Anonymous @ 1:36 said:

“You want receivership …”

Thanks for that. Yes. Receivership sounds right to me. If the large uber-banks were in receivership (ditto AIG), then there would be no public discussion about finance players continuing to get huge bonuses and such.

(BTW, does Receivership in this context mean the same thing to all people? I ask in earnest. I really don’t know.)

I don’t want receivership for insolvent banks as a way to punish them. I respect the fact that those who work harder and smarter than me are paid much more money. I respect this because I respect the principles of Capitalism.

If Wall Street titans don’t believe in Capitalism then let them say so.

Sadly, money in its electronic form specially is the manifestation of absolute power.

Power corrupts, and absolute power corrupts absolutely.

And interestingly for us, or sadly for our children, we will see what absolute corruption means.

Bank equity should be wiped to zero. Let’s accept they are insolvent.

At the same time convert a big chunk of the outstanding debt back into equity.

Bond holders recapitalise the company.

Hard to add to an excellent debate.

I talked to a couple of younger (than me) intellectuals with a free market bent today about bank regulation today.

The upshot: “We had bank regulation, yes. Did it work? No. If the alternative to more regulation is to leave the system unchanged, then that is unacceptable.”

Sentiment is quite pliable, and will get more so as unemployment tops 10%.

Anon @ 5:34 am, no, not at all. They cut across several demographics – social, economical, chronological and educational.

I found little or no understanding of events, no idea of having participated in any sense ‘wrongly’, a general idea that various institutions were going to have to sort it all out on their own. They suspect they’re going to get the bill, though.