Submitted by Leo Kolivakis, publisher of Pension Pulse.

Stocks tumbled on Monday and lots of people are worried that they will retest their March lows. Stop worrying so much! Let me quote the bonddad blog today: “While I am sure there are people in a panic about this, I’m not. The market needs a sell-off right now; we’ve come a long way and it’s time to drive out some weak positions.”

I agree, let the weak hands sell. This market is heading higher. Uri Landesman, who oversees about $2.5 billion as head of global growth for ING Investment Management Americas shared his thoughts on Tech Ticker today:

Landesman now faces a “quandary” of expecting a significant near-term correction but believing major averages will end the year “substantially higher” than where they are currently. His optimism is based on a belief the massive global government stimulus will boost economic growth in the second half and into 2010, and that major averages haven’t fully priced in that rebound.

Landesman believes underinvested or just generally bullish fund managers will become aggressive buyers if and as the S&P 500 falls into the 950-975 area.

Don’t underestimate the psychological effects of performance anxiety. A lot of portfolio managers are underperforming their indexes and they are looking for any dip to pull the trigger and buy stocks.

Interestingly, Bloomberg carried a story today stating that pension funds pare stocks, ignoring economic rebound:

The world’s biggest pension funds lost confidence in stocks as the best long-term investment, cutting holdings or leaving them unchanged during the steepest rally since the 1930s.

Funds overseeing money for California teachers and public workers, Dutch government retirees and South Korean private- sector employees reduced their target weightings for equities this year, data compiled by Bloomberg show. The rest of the 10 largest kept them the same. U.K. pensions have cut stock allocations to the lowest since 1974, according to Citigroup Inc. Managers handling Oxford and Cambridge University professors’ assets have been selling shares as the MSCI World Index posted a five-month, 51 percent rally.

“Given the storm in financial markets that we have seen, the name of the game is risk management,” said Dirk Popielas, head of the Pension Advisory Group at JPMorgan Chase & Co. in Frankfurt. “The majority of pension funds have not finished taking risk off their portfolios. Some have not even started.”

Losses suffered in the worst decade for stocks versus bonds since at least 1900 drove pension funds to pour more money into fixed income, commodities and derivatives just as signs the global recession is easing helped equities rebound from the MSCI World’s biggest annual drop on record.

The average return for U.S. stocks has trailed government bonds by about 8.6 percentage points annually since 1999, after outperforming by 8.2 points last century, based on data compiled by the London Business School and Zurich-based Credit Suisse Group AG.

New Century

Equities appreciated an average 12.91 percent a year from 1900 to 1999, while bonds returned 4.69 percent annually, according to the data from the London Business School and Credit Suisse. Since the start of the new century, bonds gained 6.36 percent, compared with a loss of 2.27 percent for shares.

Stock indexes retreated from Shanghai to London and New York today as foreign direct investment in China fell and Japan’s economy grew less than economists estimated. The MSCI World slid 2.5 percent at 9:35 a.m. in New York, while the Standard & Poor’s 500 Index sank 2.1 percent.

The MSCI World’s 42 percent slump last year decimated equity allocations at pensions. The largest funds oversee a total of about $3 trillion, according to data compiled by Bloomberg, magnifying the impact of their decisions on the performance of stocks worldwide.

Decade of Stagflation

Equity assets in the U.K. fell to 41 percent of holdings at the end of 2008, according to data compiled by New York-based Citigroup. The last time British pension funds held so little in equities was in 1974, after the Middle East oil embargo ushered in a decade of stagnant growth and price increases known as stagflation.

Funds aren’t returning to their previous levels, according to Andy Maguire, a senior partner at Boston-based Boston Consulting Group. The proportion of equities in U.K. pensions exceeded bonds by 1.6 percentage points in the first quarter, the smallest gap since 1962, annual data compiled by Citigroup show.

Equity losses have hit the pension industry just as liabilities increase. The number of people worldwide 65 and older may jump to 1.3 billion by 2040 from 506 million last year. Their proportion of the total population will double to 14 percent in the same period, according to a June report from the U.S. Census Bureau.

‘Right Thing’

“The real issue is they don’t want the volatility they had,” said Louise Kay, head of U.K. institutional business development at Standard Life Investments Ltd. in Edinburgh, which oversaw the equivalent of $34 billion for U.K. pension firms as of December. “Funds normally have to look whether they rebalance or not after one asset class loses value, and this time they are wondering whether this is the right thing to do.”

The FTSE 100 Index of U.K. stocks advanced 6.3 percent this year through last week, the smallest gain among the world’s 20 biggest equity markets, according to data compiled by Bloomberg.

Four of the world’s seven largest pension funds — Sacramento, California-based California State Teachers’ Retirement System and California Public Employees’ Retirement System; Heerlen, Netherlands-based Stichting Pensioenfonds ABP; and South Korea’s National Pension Service — have cut their equity target allocations, data compiled by Bloomberg show.

Calstrs, Calpers

The $119 billion California State Teachers’ Retirement System, which oversees the pensions of 833,000 members, said on July 21 that it had temporarily shifted 5 percent from equities to fixed income, real estate and private equity, and permanently moved 5 percent from stocks to “absolute return” products that target gains even as markets fall.

“The shift out of equities is still in progress,” Calstrs’ spokesman, Ricardo Duran, said in an e-mail on Aug. 12. The value of the fund’s investments slid 25 percent in the fiscal year ended in June.

The $181 billion California Public Employees’ Retirement System, which managed retirement benefits for 1.6 million current and retired public workers as of June 30, lowered its equities target to 49 percent from 56 percent on June 15. Calpers lost 23.4 percent in the fiscal year ended June 30, erasing six years of earnings.

ABP, which oversees the equivalent of $256 billion for more than 2.7 million Dutch government workers and teachers, reduced stock holdings to 29 percent from 32 percent in the first months of this year to reduce risks, according to spokesman Thijs Steger. ABP, the euro region’s biggest pension fund, said the value of investments increased 4.5 percent in the first half.

Rodgers and Hammerstein

The Dutch pension fund is turning to so-called alternative investments to boost returns. It outbid music publishers in April for the works of Richard Rodgers and Oscar Hammerstein II, including “The Sound of Music” and “Oklahoma!” The songs are managed by ABP’s Imagem Music Group, which has rights to more than 200,000 compositions, including Michael Jackson’s “You Are Not Alone.”

South Korea’s National Pension Service cut its 2009 domestic stocks allocation in June for the second time in a year as it predicted a “slow” economic rebound.

The fund posted a 0.2 percent loss on assets in 2008, according to South Korea’s Ministry for Health, Welfare and Family Affairs, even as the country’s benchmark Kospi Index of stocks slid 41 percent. The hedge-fund industry had its worst year on record in 2008, losing 18.3 percent, according to data compiled by Chicago-based Hedge Fund Research Inc.

South Korea’s National Pension, which was set up in 1988 to cover private-sector workers and people who are self-employed, posted returns of more than 5 percent a year between 2003 and 2007.

Norway Oil Fund

Norway’s sovereign wealth fund, which invests the country’s oil money abroad to avoid stoking domestic inflation, has been a buyer of stocks this year even as its target allocation held steady. The fund, which raised its equity weighting to 60 percent in 2007 from 40 percent, said in a presentation on Aug. 14 that its stock holdings stood at 60.3 percent of assets.

The sovereign fund, Europe’s biggest stock owner, said last week the value of its investments rose a record 12.7 percent in the second quarter as the MSCI World posted its biggest gain since 1998, climbing 20 percent in the April-to-June period.

Signs the global economy is rebounding from its first recession since World War II sent the MSCI World up another 10 percent this quarter through last week, while the S&P 500 of U.S. stocks extended its five-month rally to 48 percent.

The U.S. unemployment rate dropped in July for the first time since April 2008, data from the Labor Department showed this month, while the German and French economies unexpectedly grew last quarter, government figures indicated last week.

Valuations, Oxbridge Dons

European pensions reduced their weightings even after the MSCI World fell to 9.4 times the average per-share earnings of its companies in November, the cheapest valuation since at least 1995, according to weekly data compiled by Bloomberg.

“Human emotion comes into the investment-making decision process, and managers are just as prone to it as individuals,” said Neil Hennessy, who oversees $850 million as president of Hennessy Advisors Inc. in Novato, California. His Focus 30 Fund beat 99 percent of rivals in the past five years. “These managers are good, but you can see how they got whipsawed.”

Universities Superannuation Scheme Ltd., which oversees the pensions of employees at more than 400 universities and higher education institutions including Oxford and Cambridge, is shunning stocks, said Elizabeth Fernando, an adviser to the fund’s investment committee.

‘An Awakening’

The U.K.’s second-largest pension fund, which managed 23.1 billion pounds ($38.1 billion) in Liverpool at the end of 2008, is diversifying investments after trustee boards got “scared enormously” during the bear market, Fernando said. The fund is boosting its allocation to alternatives that deliver “equity- type returns” but are uncorrelated with stocks, she said in an interview Aug. 4. She declined to give more details.

A third of U.K. pension funds in an April survey by Mercer Investment Consulting said they plan to cut domestic equities. Only 2 percent planned an increase, according to Mercer, a unit of New York-based Marsh & McLennan Cos. There has been no update of the survey since then.

“The fact is there has been an awakening towards the risk of equities and the part that equities should play in the overall pension-fund strategy,” Tom Geraghty, the Dublin-based head of Mercer’s European investment consulting business, said in an interview. “Not to say that equities should not be part of a pension’s asset-allocation arrangement, but that they will have a less influential part to play.”

An awakening towards the risk of equities?!? Hello! That’s why they call it dumb money! One of the portfolio managers I used to work with told me to “always short pension funds,” adding that “they are always the last ones in and the last ones out. Even retail investors are smarter than most pension funds.”

The fact remains that there is a time to cut risk and there is a time to crank it up but most of these large pension funds cut their equity allocations at the bottom of the market and now they are stuck chasing stocks higher. And trust me, they will chase the indexes much higher or risk losing their jobs after severely underperforming their policy portfolio.

Unfortunately, this is how absurd markets have become. On one side, you have large, lethargic pension funds that have to pass investment decisions through committees and their board of directors and on the other you got large, aggressive and nimble hedge funds that are looking to capitalize on market opportunities knowing that dumb money (and I include mutual funds in this category) will follow their lead.

Bloomberg reported today that Ken Griffin’s $12 billion Citadel Investment Group LLC is trying to set up a leveraged-loan trading unit as the market for the debt has returned 42 percent from a December low:

The hedge fund sought unsuccessfully to hire four members of Barclays Capital’s loan sales and trading team for its effort, said another person, who declined to be identified because the discussions are private. It’s unclear how many people Chicago-based Citadel seeks to hire or when the group may start trading.

Citadel would join firms such as Macquarie Group Ltd. and Jefferies Group Inc. establishing operations for trading leveraged loans, often used to fund corporate buyouts. More than $57.1 billion of the debt has been underwritten this year, down from $229.7 billion in the same period of 2008, according to data compiled by Bloomberg. Some firms expanding into loan trading hired from investment banks that laid off employees when the market deteriorated, reaching an all-time low in December.

Now if you ask me, Ken Griffin doesn’t want to expand into leveraged loan trading because he is cutting risk and worried about the future. He sees an opportunity and wants to capitalize on it. True, Citadel will act as market-maker and make some nice juicy spreads in the process, but they obviously believe the leveraged loan market will expand in the coming years.

And if I were a betting man, I’d bet with Ken Griffin who has a proven track record and skin in the game and against the large pension funds who have for the most part made one huge investment blunder after another.

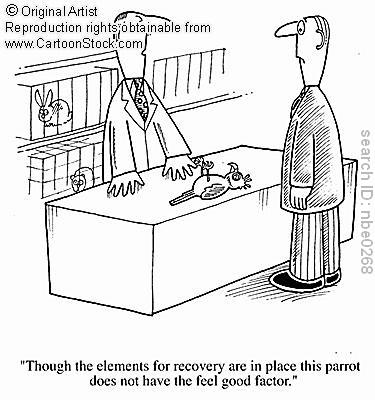

Then again, why should pension parrots care? It’s not their money they are betting with.

I have no idea what the market will do — e.g. how it will end the year, higher or lower than now.

…and that major averages haven't fully priced in that rebound.

So after a fast and furious rally of historic propoprtions, one that in some emerging markets approaches 100% over the last few months, we are expected to believe that the 'major averages have not fully priced in an economic rebound'. Sorry, but I just cannot take that seriously. And I'm not so sure that pension funds should be heavily wagered on it.

If the only thing making the markets go up is government stimulation (and more debt), wherever this ends, it will not end well.

Eh wrote:

So after a fast and furious rally of historic proportions, one that in some emerging markets approaches 100% over the last few months, we are expected to believe that the 'major averages have not fully priced in an economic rebound'. orry, but I just cannot take that seriously. And I'm not so sure that pension funds should be heavily wagered on it.

>>Pension funds are wagering on alternative investments (hedge funds, private equity, real estate, commodities and infrastructure), mostly because they can game their benchmarks in these asset classes.

But I disagree with your line of thinking. It means nothing that equities rebounded 100% or 50% from an extreme oversold position. I can show you many stocks are that are up 400% and still heading higher. Be careful because there is a lot of liquidity out there spurring stocks higher. When you add to this performance anxiety, then stocks can go much higher from these levels.

Leo

I'm not so sure that the liquidity is still out there. Look at gold prices. Oil has lost its footing. The Shanghai Composite looks like it has rolled over.

All of those rise as a result of hot money & liquidity, and just about all of them are not confirming this move. (Let's not even mention the torrent of insider selling)

The shorts have been killed, thus the short covering rallies are nearly complete. Plus, everyone is talking about getting back in to not miss the move <– if that isn't a sell signal, I don't know what is.

You may be right, as I can't predict the future, but stretching to get that last basis point is what always kills me.

Equities have not 'rebounded'; they have been driven up by a speculative bubble.

Speculation is not investment.

This Leo guy writes too much and thinks too little.

Bob,

Thanks for that great insight. Did you put a lot of thought into that before you posted it?

Go back to the Yahoo message boards.

Leo

Leo, there is no need to respond to people such as Bob. Clearly he has not jumped on the great bandwagon to the sky like the rest of us.

You and I, we understand that the stars are aligned properly, and have been aligned well ever since last November's election. Nothing can go wrong, with all the right people at the top.

I understand that President Obama has the highest IQ of any president ever. Michael Beschloss attests to that fact, and as a presidential historian he should know.

Leo, you are as well respected in your field as Michael Beschloss is in his. All of us understand the stakes involved here. Let's continue to talk this recovery up, and convince everyone who matters to get on board.

Parrot: clearly lacks "animal spirits."

Bob the Detractor: needlessly unkind, and wrong about your great insights. But I agree pithier is better. Example:

"Unfortunately, this is how absurd markets have become. On one side, you have large, lethargic pension funds that have to pass investment decisions through committees and their board of directors and on the other you got large, aggressive and nimble hedge funds that are looking to capitalize on market opportunities knowing that dumb money (and I include mutual funds in this category) will follow their lead."

Could become:

"This is the absurd dichotomy in today's markets. Hidebound pension fund boards and investment committees forever chase nimble hedgies, who use the former's lethargy against them."

That's my style, not yours, and no doubt you can say it better and more precisely. But it's 60% shorter with no loss of information. Apply this to every post, and readers will be grateful.

I still think Bob should go to charm school.

"I can show you many stocks are that are up 400% and still heading higher. Be careful because there is a lot of liquidity out there spurring stocks higher. When you add to this performance anxiety, then stocks can go much higher from these levels."

Without the pledged trillions of future taxes to back up the salesman on Wall Street this bluster about the new dawn of investment riches would seem pretty silly.

Somebody will be saved during this financial exercise but its hard to imagine that the common mans pension or investments is much of a concern.

Leo,

Sorry if I annoyed you. In answer to your question, No, I didn't put very much thought into my comment. I was just passing through and read your post. You started with a pretty confident assertion that the market is going to keep going up and then called people who disagree with this idea "weak hands"–whatever that means.

I wanted to find out whether you thought what seems to me like a strong bear market rally still has some legs or whether you think this very major economic contraction is behind us, and what your reasons were. So I spent a lot of time reading your post, hoping you would explain your prediction in some way.

Instead, you castigated pension fund managers for not agreeing with you and even suggested that these managers don't care about the welfare of the pensioners whose retirement funds they are investing. I was a little annoyed by this, so I typed in my comment. In the future, I'll just skip over your posts. No hard feelings.

–Bob

This is my first visit to Naked Capitalism in many months–since I first ran across a post by Leo Kolivakis. After a dose of Leo, I removed your site from my list of favorites. I see you're still running posts by him.

Eeeew!

Too bad. With posts by Leo, your site will remain offensive, and irrelevant.

In financial markets it is all about who sticks it to the other guy. Market is heading down you morons. This reminds me credit cards. They need to be sticked, otherwise they will stick it to you. Know how to get the score even

http://www.ira-site.com/creditcards/

On any given day, I have 600 to 800 people reading my blog, including the largest pension funds, hedge funds, investment banks, and a few central banks. I blog because I like sharing information and discussing things that most people are not aware of. If you do not like my content, PLEASE skip over it and move on. I couldn't care less. Just stop posting little snipes which offer no insight.

>>Bob, this is a bear market rally with legs and it could last a lot longer than you think. In some sectors like semis, solars and biotech and medical devices, I see a long secular bull market.

cheers,

Leo

I appreciate Leo following the pension scene so I don't have to. But I don't agree with him about stocks. His statement about a great deal of liquidity out there rather than any inherent strength in companies for me defines a bubble. It should also have us asking where this liquidity is coming from.

Hugh,

The biggest mistake everyone does is to underestimate liquidity flows. And I am talking broadly here, including flows into hedge funds, commodity funds, real estate funds and private equity funds. All that liquidity has to go somewhere, and it typically goes into financial assets first.

It was interesting to see the Fed report yesterday that US banks have not loosened their lending standards. Of course not, they are taking the money and trading it in their capital markets divisions – a huge source of profits. They do not care about small business loans when they can make a killing trading and speculating.

Having said this, investors have to think long-term here and ask themselves which sectors will outperform in the future and why. There is always a bull market somewhere…you just have to find it and invest with conviction.

cheers,

Leo

Jeez Leo, why do they always come out for you, your the least controversial guest here, old friends doing drive by comment spray?

Not to worry, in my experience they are the type to walk straight into mine fields whilst their minds are looped on some issue and not looking wear they trod. So every time one opens their gob with drivel and not addressing your statements, just imagine mentally a loud boom and body parts achieving Mach2, for a moment, till aerodynamics take over.

BTW concur with your view, some sectors will have legs, even if it seems surreal how the market moves on the smallest of good tidings.

Skippy…Liquified internal organs, of which the brain is one, anyone got a jelly mold?

Generally Leo does a very good job covering the various pension crises. I just think that with such a huge rally a lot of (largely yet to come, really) improvement in economic conditions has got to be already priced in. So much 'wealth' (ahem) has been wiped out; how can a recovery from that happen so quickly? In the end he may be right — the market feels like it wants to go higher.

I'm a little confused as to whether the argument in the article is supposed to be "Pension funds are stupid, therefore stocks are rising", or "Stocks are rising, therefore pension funds are stupid," but I think commenters are criticizing Leo for ridiculous dogmatic reasons. Fundamentals may hold the reins, but the leashes are long and the dogs are strong and will run and pull.

For the record, I worked at two of the largest pension funds in Canada as a senior investment analyst working across alternative and traditional investments. I have tremendous respect for many investment professionals at public pension funds and very little respect for some of them that managed to rise to their level of incompetency (Peter Principle).

What amazes me is that after the disaster of 2008, all of sudden pension funds discovered the importance of risk management. They cut risk at the market bottom, they started beefing up their risk management divisions, and allocating more to long-term bonds.

Now the new mantra is less stocks, more alternative investments. They still don't get it. Most hedge funds offer disguised beta and private equity and real estate is mostly illiquid leveraged beta! Sure there are some exceptions, the top funds are adding real alpha but it amazes me how myopic the large pension funds have become. Alternatives is no panacea and if you are not careful, you are going to get whacked, especially with illiquid private markets.

The other thing that I did mention in my post is that many pension funds suffer from a bureaucratic process that limits their ability to pounce on market opportunities. By the time they pass it through their investment committees and board of directors, it's too late. This is especially true in public markets where things move fast and you need to take quick and decisive actions to make money.

I am not against large pension funds but I am weary and very critical when I hear the pension parrots all singing the same song, trying to cover their backs.

Pension funds need to rethink their strategy and I have some great ideas on how they can do this. I might write on this one day.

Leo

From what I've been reading, the average stock has done far better than the major averages. I mean, how many stock do you know that have more than doubled? (http://bespokeinvest.typepad.com/bespoke/2009/07/15-sp-500-stocks-up-100-in-2009.html) How can portfolio managers who are stock pickers be underperforming?

I think this performance anxiety mumbo jumbo is a load of crap, just like the mountain of cash on the sidelines and other various fallacies.

"How can portfolio managers who are stock pickers be underperforming?"

Because they are closet indexers and rarely veer away from the major index stocks (which are not the ones you posted).

Performance anxiety is not mumbo jumbo. It is a fact of life for many portfolio managers struggling in these volatile markets.

Leo