As I wrote Monday:

In really bad times, people who are evicted from their houses will not rent. Instead, they will move in with friends or family for some time.

As the Wall Street Journal explained last October:

Driving the change [i.e. large numbers of rental vacancies and lower rents] is the troubled employment market, which is closely tied to rentals. With unemployment at 9.8% — a 26-year high — more would-be renters are doubling up or moving in with family and friends during periods of job loss. Landlords have been particularly battered because unemployment has been higher among workers under 35 years old, who are more likely to rent. Nationally, effective rents have fallen by 2.7% over the past year, to around $972.

As Zack’s Investment Research writes:

A smaller percentage of Americans owned their own homes in the 4th quarter of 2009 than at any time since 2000. In the 4th quarter 67.2% of Americans owned their own home, down from 67.6% in the third quarter and two full percentage points below the peak set in the fourth quarter of 2004.

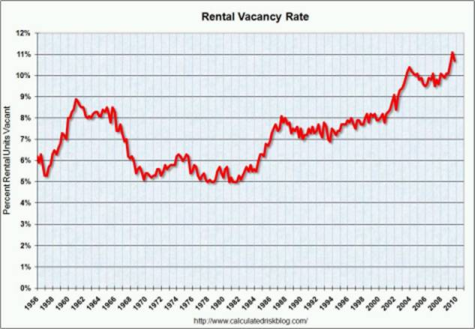

As the first graph below shows (from Calculated Risk) …:

So where have all these people gone who are no longer homeowners? It does not appear that they are moving into apartments or rental housing. As the second graph shows (also from Calculated Risk), the rental vacancy rate is now at 10.7%. While that is down from the record level of 11.1% in the third quarter, it is up from 10.1% a year ago, and the 7-8% range that was normal for most of the 1990s …

***

It thus appears that many of the people who used to own their homes, and no longer do, are doubling up with friends and family. This is probably not their first choice of living arrangements, but they are doing so because they have no other choice economically.

In other words, the correlation between falling home prices and rising defaults, on the one hand, with increasing rental demand and higher rental prices, on the other hand, doesn’t hold in a really tough economy.

Today, MSNBC adds some important details:

More than 1.2 million households [have been] lost to the recession, according to a report issued this week by the Mortgage Bankers Association that looked at data between 2005 and 2008. That number doesn’t include information from 2009, when job losses and foreclosures continued to rise.So it’s likely that the full impact of the 8.4 million jobs lost and nearly three million homes foreclosed on since the recession began has taken an even bigger toll on the number of American households.

“Given the depth of the downturn in 2009, and the ongoing weakness in the job market through the beginning of this year, this study gives no reason to expect that household formation has picked up at all,” said Gary Painter, a professor at the University of Southern California who conducted the study.

The study also shed some light on what happens to the people in those “lost” households. It’s widely assumed that many who lose a home to foreclosure become renters. But since the recession began, there has been a five-fold increase in “overcrowding” of remaining households — defined as more than one person per room, according to the study.

That doubling-up is happening as families who lose their homes move in with friends or family. In other cases, younger people have delayed moving out on their own, instead staying with their parents until the economy improves. Others who fail to find work after graduating from college move back home.

Falling homeownership levels

The decline in households is weighing on both the home buying and rental markets. Since the number of home foreclosures began surging in 2007, the national homeownership rate has been steadily falling. But renters also have been forced to double up or move in with friends or family. That’s a major reason that the vacancy rate for U.S. apartments stood at 8 percent in the first quarter, the highest level since 1986, according to a report this week from Reis, a real estate research firm.***

Homeownership levels, meanwhile, continue to decline. New foreclosures filings are running about 300,000 a month, according to RealtyTrac. There are currently some 5 million homeowners that are 90 days or more past due on their mortgages, according to Fannie Mae chief economist Doug Duncan.

***

In some cases, the loss of a house to foreclosure is leaving families homeless, though there is little national data available on how many are affected. A recent study by the Department of Housing and Urban Development found family homelessness on the rise since the recession began, with the biggest increases in suburban and rural areas.

Other groups, like the National Alliance to End Homelessness, report that a rising number of older adults are without a permanent place to live.

“The limited existing research tells a story of increasing homelessness among adults ages 50 and older,” the group said in a recent report.

The formation of new households isn’t expected to pick up again until at least 2012, according to the MBA study, even as the population continues to increase. Between 2005 and 2008, those 1.2 million households were lost even as the population grew by 3.4 million.

Could this number be inflated by speculators who let their investment properties or second homes go into foreclosure?

Yes, we had a BUBBLE in real-estate and over-priced rental properties. The BUBBLE was generated by a wave of debt financed expansion that fed back on itself. Now that the BUBBLE has popped, prices are returning to approach sanity. This means people will buy modest homes within their means and low margin business like hardware stores and machine shops won’t be displaced for chain stores selling “luxury” goods. Terrible, ain’t it?

Agree. Just plain awful. And now nothing will ever be the same; and we’ll never talk about anything other than how we are setting ourselves up for the *next bubble*. I like how the posts here put especially scary stuff in bold now. I guess, have enough bubbles, that is all anyone can think about and all anyone sees. I think it is psychological trauma perhaps.

Then I must have missed the point. I thought that this was not about people who bought a house they couldn’t afford in the first place, but was about people who bought a house they now no longer can afford through no fault of their own, e.g. because they lost their job.

If Americans are not free to but things they do not need or really even want with money that they definitely do not have, the result is worse than terrible.

it is communism.

Communism? Come on! How can this be communism? The state isn’t housing people. When your life has been depleted by job loss, you have no choice but to move in with accommodating friends and relatives or go live under a bridge.

The term communism is being batted around by people who have no concept of the true meaning of the word.

If you want to know the truth, fraud committed by capitalists caused this problem.

so much for “ownership society.”

I’ve been renting for quite some time and it is fine. The “ownership society” meme is a crock, crafted to appeal to man’s ego in order to create a class of indebted indentured servants. “Home ownership creates a stable society”. Another crock!

Hey, thanks. That’s straight-shooting and I appreciate it.

It was all a scam–nobody “really” owns anything….mz

It’s the “pwnership” society. Americans have been pwned.

Don’t forget that a lot of the folks that are going to eventually lose their houses to foreclosure are still living in their houses for many years despite not making payments. Because they are not making payments it is hard to believe that they are not saving up enough money to go get a rental especially because it is a renter’s market.

By not paying their mortgage for a few years also ruins their credit score, and since landlords check prospective tenants’ credit, it is not easy for them to rent either. But they can always move into their car…

Vinny

Well, some of these homes that were purchased were second homes and/or vacation homes that would be empty for a good period of time anyway. Also, many were empty b/c they were investment properties that were intended to be flipped and never lived in.

Despite the wit of the “pwnership” complaint, there is legitimate reason to buy a house — IF and when a sane oppoertunity presents itself.

The conditions are most favorable once you feel the bubbles have finally been wrung out of the system (this is currently being disallowed and may require a great crash beforehand) and especially if you feel a time of inflation coming upon us.

In an inflationary time, you borrow money, pay it back at a time when the money is worth less and the house is worth more. You get the benefit of equity at the expense of the bank.

Greenspan’s distortions of the interest rate/stockmarket, housing, etc. have been going on for a decade or so but things will change in time.

Save some money for a downpayment so you’ll be ready when there are cheap houses! Over the long haul inflation ALWAYS wins. Ask the oldest people you know what they paid for thier houses. The rest of the deal is: buy at a price where you have some chance of paying off a mortgage in reasonably good time, or you’re just a slave to mortgage debt. Biting off too much is a big mistake a lot of people made, and lost their investment.

If you can buy at the right time and place, your house will go up in value over the decades.

I bought a house in California in 1995.

My house turned out to be my best investment.

Um, by that logic you could buy any asset and inflation will make it seem like a winner.

It’s not homes per se which is a good investment. It’s land.

Not such a good investment during a bubble, but generally, yes. It’s why there _can_ be bubbles in land—they’re not making any more of it. As compared to things like computer chips.

Assuming that you buy your home with a loan like much of the general population you are taking a loss. How much particularly, depends on whether it is a 15 or 30 year loan. Inflation will eat some of that loss away. But not all of it, as home value appreciation typically tracks inflation according to Case-Schiller.

Evelyn Sinclair,

Yes, but in an era of declining wages, one cannot count on income keeping up with inflation anymore. As such, your formula can work only if you also have some kind of hedge against inflation in place. For example, gold. Once inflation (or hyperinflation) hits the roof, you sell some gold, pay off your mortgage with worthless dollars, and the house comes out almost free. But you need that solid hedge against inflation.

Vinny

“THE FACADE IS FALLING! THE FACADE IS FALLING!

lies, lies, everywhere lies.

oh no, mr.bill, this is the end,” said the storyteller.

“you mean there is no credit/something-for-nothing fairy; government is just a house of mirrors?” little Sally asked her mother, stunned, with a tear running down her face.

“and the Fed huffed and puffed … and clicked its heels …”

looking at his watch, “ok everyone, the museum is closing, but you can come back tomorrow. we’ll have another storytime then. don’t forget, museum prices go up tomorrow. fantasyland isn’t free you know.”

“back to your dreary, unimaginative lives,” he said to himself, as he locked the door, and glided to the cash box.

Life is a on average, a 65 year lease. Own that.

wow, like deja vu

i would pay $20 + shipping for that t-shirt.

can you put it on heavy cotton?

I don’t know, Skippy… You can’t take it with you anyway, so it might be better to borrow as much of it as you can, all your way to the check out counter… :)

Vinny

a house is a consumable, not an investment.

Concur.

The only sound investment, is to me, human potential.

Skippy…Run with it, 2 points if ye feel like it.

We have a 25% oversupply of houses, not including all the excess footage, dead inventory in McMansions, and that assumes the multi-generational family household is dead.

Hello…

The problem with status symbols, a house instead of a home, is that they lock us into behaviors and products that we do not truly want, and then we compete for more, in hopes that a bigger carrot will somehow satisfy us when the last one failed to do the job. Like the little tile game with one open spot, our non-performing assets lock us in, and our reluctance to give up our “hard-fought-gains” at a “loss” causes a system crash.

a home may be a psychological and social investment, but a house is never a financial investment; the latter is a prison, as the economy attests. If house prices fell tomorrow by 75%, a home would lose no value, and houses could be swapped at no realized loss, but the real economy would take off, because kids would have a stake in the economy again.

In a world of infinite possible futures, we always have demand to supply, and our supply triggers demand, so long as we are willing to recycle non-performing assets back into the system for renewal. Monetary expansion may continue indefinitely, so long as we create real wealth, unique adaptations that trigger effective adaptations in others, consistent with the diversity needs of the planet.

non-productive asset inflation merely discharges the system, through the increasing disparity of income, from those with productive skills to those without, until the Ponzi scheme crashes. Alice in Wonderland.

We suffer from an abundance of malnutrition. Some people view the planet as a rock, to be exploited. Some people see the planet as a living being, to be appreciated. The former wreck the car the first night out and ask daddy for another, and gets it until daddy goes bankrupt. The latter take care of what they have before asking for more, space exploration.

most of the price in a house is government, and speculation, feeding off of each other, and that doesn’t include property taxes, or the opportunity costs for young people with productive skills to invest in a particular community.

round and round it goes.

Testify!

My wife’s sister, a component of your former example, just text-ed her from out of state to ask for 2,500.00 smackaroos….wait for it….to replace a lost[?] ring her troll partner (soon to be bankrupt for the reasons you give+) gave[?] her.

Skippy…lifeguards will not let her inter the surf as the jewelry that adorns her make swinging impossible…but hell she thinks it looks great -.>

“I don’ know how much longer I can hold ‘er t’gether.”

so, we began with the equation for a circle, went through the looking glass to find “einstein’s” equation, and now we have gone through the looking glass again …

fusion and fission

tick-tock

“Just before they went into warp, I beamed the whole kit and kaboodle into their engine room, where they’ll be no tribble at all.”

from jumpstation:

True story from a Novell NetWire SysOp:

Caller:

Hello, is this Tech Support?

Tech:

Yes, it is. How may I help you?

Caller:

The cup holder on my PC is broken and I am within my warranty period. How do I go about getting that fixed?

Tech:

I’m sorry, but did you say a cup holder?

Caller:

Yes, it’s attached to the front of my computer.

Tech:

Please excuse me if I seem a bit stumped, it’s because I am. Did you receive this as part of a promotional, at a trade show? How did you get this cup holder? Does it have any trademark on it?

Caller:

It came with my computer, I don’t know anything about a promotional. It just has ‘4X’ on it.

At this point the Tech Rep had to mute the caller, because he couldn’t stand it.

The caller had been using the load drawer of the CD-ROM drive as a cup holder, and snapped it off the drive!

Sorry can’t help my self.

An individual goes to health care provider (HMO) and complains of haemorrhoid’s.

Doc has a look and reports that all is normal.

The care seeker erupts with indignation proclaiming that their partner does not like the looks of it, and needs surgery to preserve the relationship.

Skippy…K your value+

The sooner the better for a fatal credit crisis! Ben keep those bubble’s coming….

Nice posts on the rental housing market GW. These are much more informative than some of the more conspiratorial posts I’ve read from GW.

As a long time renter, I’ve been puzzled by the fact that my rent hasn’t fallen. I absorbed +5% increases in both 2008 and 2009 while living in Kalamazoo, MI – not exactly a hot bed of economic activity. I think there’s a bit of natural inflation in rentals if you live in the same place for several years. You always balance the cost and hassel of moving against the cost of the rent increase. The landlords know this and are able to extract increases from long time renters.

In any event, it’s still a no brainer to rent. I worry about renting private or bank owned homes (vs apt). There is always that threat of a sale or foreclosure hanging over your head. The maintenance and repair service for rental homes is another problem.

Guys, this is about people who lost their home because of structural unemployment: jobs that are gone and are not coming back. They couldn’t sell the house to move in the jaws of the crash, and now they can’t get a new job in the area where they used to live a middle-class life. This is the whole city of Detroit, not some soul-killing suburb in the Inland Empire. Sure – there is some of that, too. But it is wildly unfair to make cute remarks about people losing everything they have worked for because GE got too big for its britches.

I honestly believe that, in addition to poverty driving people to double up, it is the difference in school district between areas where there are apartments and those where your parents live.

One of my sisters moved in with my parents last year. She and her husband divorced, and she can’t manage the mortgage on her own. The house has been on the market for a year, and didn’t sell — she’s renting it for about 2/3 of the mortgage (about 300 miles from my parents). She’s covering the shortfall monthly, and saving up to be able to afford the first and last down to rent a place. She’s not the world’s most responsible human being, but I wouldn’t say she’s atypical. My parents are in the best elementary school pyramid in their town. There ARE no apartments zoned to that elementary school district. Now my sister is trying to find a rental house, with more savings in the mix and a higher rent, so that she can keep her kids at the school.

you’re right – plus it’s impossible to rent after losing your home, or being late on mortgage, because landlords won’t rent to low credit score; not to mention having to put down first, last, security, and application fees, how does anyone who hasn’t had $$ to pay mortgage have thousands to put down on an apt? They don’t. They have relatives.

Early in the 1980s, I latched onto a demographic trend piece that argued strongly for a sustainable bull market in equities due to the projected increase in net household formations. The study, which I no longer have and cannot quite retrieve from memory, pointed to the massive economic changes wrought by the development of the baby boom generation, predicting not only the surge in net household formations, but also of vacation properties.

Indeed, if memory serves, Jon Laing may have written such a piece in the late 1980’s showing that the preference for vacation and retirement homes was within 150 miles of a coastline.

The power of net household formation cannot be denied. New households require additional goods and services, including financial services such as insurance and often individual transportation.

A concern about the prospect of high unemployment and the particularly high level of unemployment among those 18-25 is the affect on household formation and its translation in the economy.

While I believe Buffett is correct that population growth will prove crucial in the long run, Keynes was also right about the long run.

We got into buying single family rentals in the early 2000s. While it hasn’t been exactly a cakewalk, it hasn’t been terrible either. Unlevered returns are probably in the 6-7% range, better than the stock market over the past decade. Properties can remain un-occupied for nearly a year, though.

Looking at your chart, it appears that vacancies were low during the ’70s. This was undoubtedly because the baby boom was in its early adulthood stage. How ironic that books like ‘Nothing Down’ popularized the buying of houses as investment properties just as the vacancy rate was beginning a three decade climb.

One factor in the housing/mortgage crisis that hasn’t been discussed is the role of higher long term capital gains taxes for real estate. The reality is that today more than a fourth of single family home purchases are for cash. These are mostly investors, often times smaller investors in the lowest tax brackets. If these people were selling stocks, they’d enjoy zero capital gains rates this year. If they’re selling rental housing, they pay 25% to the feds for long term capital gains, plus whatever their state’s capital gains rate is. In my state, that would be a total 32% rate. This is a lot higher than zero. If I were in a lower tax bracket and were choosing between stocks and real estate as an investment, there’s no contest. I’d choose stocks. I think this creates a vacuum where there ought to be buying power supporting the housing market.

Maybe the “lost” households are illegals going back home to wait out the recession. I call that a correction.

Sinces houses are a lot bigger today I think it is much more comfortable for adult children to keep living at home. Many houses in my neighborhood have basement kitchen mother in-law apartments. I see lots of 20s somethings using these.

Just take a look at Craigslist, Oahu, Hawaii at the rentals available and the rent required. How can anyone afford this especially if you’ve lost your job? REmember, inclusive with rent are utilities and some cases a maintenance fee. You still need food and gas. Go ahead take a look, it will blow your mind!

Nobody has mentioned that real estate taxes are way too high, and need to come down. I know people in places like Chicago and New York who are on the verge of mailing the keys to the bank not as much because of the loss of equity (i.e., negative equity in most cases), but because oftentimes while the value of their property has been going down, the taxes on the property have been going up.

High property taxes is yet another reason not to own a home anymore. Heck, renting is so much simpler.

Vinny

I wonder how many of these people are taking jobs outside the country?

My father moved to Saudi Arabia after gas hit $4 a gallon and killed what was a growing business selling his own barbecue sauce.

I finished my MJ eight months ago and can’t compete against all the laid-off reporters with more experience for the few openings that have come along… I finally moved to Korea to teach English. My girlfriend is doing the same.

I’m sure we aren’t the only Americans to consider expatriation in tough times.