We know that JPMorgan is not substantially increasing lending anytime soon. And we also know that banks are recapitalizing courtesy of a steep yield curve and near zero rates, what I would call free money. What I didn’t know is how free these funds truly were. An investor friend pointed out something curious buried deep in JPMorgan Chase’s financial report from Q1 2010, namely that they were effectively paid five basis points to borrow money.

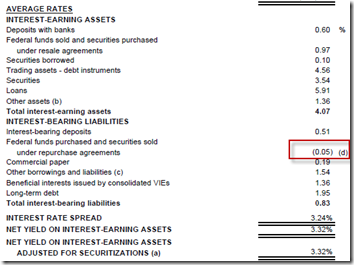

Here’s a close-up of the numbers in question.

This is on page five of the document embedded below. It shows you that JPMorgan Chase earned an average yield of 3.24% more on its assets than it paid out on its liabilities. This huge margin is in large part due to a steep yield curve and zero rates. The interesting bit is highlighted in red. That is the interest rate that JPM had to pay for Fed Funds i.e. for money borrowed from the Federal Reserve.* The number is –0.05%. That’s right, negative 0.05% for what were $271.9 billion in repo liabilities. That’s unbelievable!

*Technically, JPMorgan borrowed from other primary dealer repo counterparties; see note at bottom.

JPMorgan Chase says in the footnote that this:

Reflects a benefit from the favorable market environment for dollar-roll financings in the first quarter of 2010 and the fourth quarter of 2009.

Favorable indeed! But how favorable? Let’s take a look at past JPM filings to see.

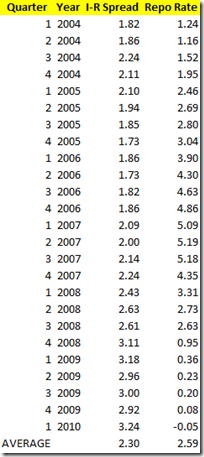

JPMorgan Chase does this earnings release financial supplement the same way every year. And it has the last five years’ worth online, which I consulted. Here’s what I found.

You can see how the yield spread has steadily increased over the past six years to where JPMorgan Chase is now making a spread that is 1 1/2% greater than it was in 2004.

Moreover, the interest it has paid on repos has plummeted. Fed Funds rates started coming down in mid-2007 when the subprime crisis blew up, but they fell off a cliff after Lehman hit the wall in September of 2008. As of Q1 2010, JPMorgan Chase was being paid to borrow $271 billion. Talk about free money! I sure wish I could get a deal like that.

Hat tip, Scott.

JPMorgan Chase 1Q2010 Supplement

Update: The point I am trying to make is that the interest carry is enormous and that banks are borrowing for next to nothing. It just so happens that JPM’s dollar-rolls made the net rate come out negative which makes this example all the more pointed.

A commenter felt my reference to borrowing "from the government" was misleading. I have stricken that reference now. Note that technically Repo counterparties are largely banks lending and borrowing excess reserves from one another. So, they are not really borrowing from the government. However, the Fed has set the Fed Funds rate at 0.00-0.25%. It controls the Fed Funds rate to within that range by making repurchase and reverse repo agreements that are collateralized loans to primary dealers of Treasury securities. The supply and demand dynamics in the repo market are largely controlled by the Fed in order to maintain the repo rate at the specified level set by the Fed.

So, while the repo market participants may be borrowing from each other, in essence they are borrowing from the Fed. The repo rate is set and controlled by the Federal Reserve. You could suspend all counterparty transactions in the market and have dealers just repo with the Fed and the net effect would be the same.

*And I know some people argue that the Federal Reserve is not a part of the Government because the U.S. Government does not own shares. But, all profits after payments are paid to the Federal Government and the Federal Reserve is acting on behalf of the Federal Treasury.

Also note that not all repo agreements are for Treasury securities. Other collateral can be used in interbank transactions, while the Federal Reserve had only accepted Treasuries before it relaxed standards in the wake of the Lehman collapse.

No wonder everyone is jealous of companies like JP Morgan and Goldman! h/t Jon Corzine.

Loan me even a fraction of that on those terms and I’ll be out of debt in no time!

Wow. This is like getting scored for a home run before you even step into the batters box. It’s incredible to me that someone can have that much talent and still be human. They must be Gods. Gods. And this is why we serve them, as supplicant beggars and washers of their feet. Now I understand it all. :)

Seriously, thanks Ed for your hard work and righteous rage reporting this stuff. I think you and Yves and others are helping to create a new collective consciousness that will slowly bear healthy and ripe fruit. I won’t go into all the details, but it’s a form of DNA radio. Better to leave that topic for after 5 or 6 beers, when it begins to make real sense.

I think this data is slightly misinterpreted. The -.05 rate is an average of Funds raised by borrowing Fed funds deposits and by borrowing cash by lending out securities(repurchase agreements). First off, “Federal funds purchased”, is a term that leads to some confusion, these are not funds borrowed from the government/Fed. Fed funds deposits are dealer-to-dealer transactions. Dealer A is short cash, it borrows this cash from Dealer B at Fed funds deposit rate. This is a derivative rate of the Fed Funds target, which is currently at .25. The value of the Fed funds rate varies over the course of the day depending on supply and demand of funds.

Secondly, because of the massive flight to safety and the low Fed funds target, repo borrowing(loaning securities for cash) is very cheap(low rate). A particular aspect of repos is that specific issues can go “SPECIAL”, that is they trade at a rate significantly lower than General collateral(generic securities). Since fed funds target is at .25 and repo is around a similar level, special issues often trade negative. The floor for negative rates is -3.00%. That means you get paid interest to borrow money.

The -.05 rate is the composite average of raising funds by JP through Fed fund deposits and repos. This is not an unrealistic market average for 2009 and q1 2010. It is also not indicative of where JP borrows funds from the Government/FED.

This is not to say that JP isn’t exploiting a generous Fed vis a vis a steep yield curve, and deposits on reserves.

I consider the repo market a government sponsored market since the Federal Reserve sets the rate. Effectively, the participants are borrowing from the government as they are using government collateral for loans of excess reserves held by counterparties at the federal reserve.

While that may not be clear to everyone reading this based on the post, it is effectively a loan from the government at negative interest. Without the Fed setting the fed funds rate and controlling it, this activity is not possible at this rate. That is the point I am conveying.

these transactions are collateralized. repo traded at negative yields. the money was borrowed from other market participants. the fed set the base rate low, true, but JPM was not alone in utilizing the low rates. the whole banking system was, as this is the transmission mechanism through which the Fed tries to reignite the economy. this article is very misleading about very normal behavior (albeit at abnormal levels of rates set by the Fed during very abnormal times)

There is nothing misleading about it. JPMorgan Chase is just benefiting from the abnormally low rates on offer in the Repo market and this points that out. What is misleading? You said it yourself.

The Fed doesn’t set the repo rate, it is a market rate that hews very close to Fed funds deposits as they are typically competing products for overnight cash depositors.

I don’t understand how you can say that the use of government debt as collateral means that “participants are borrowing from the government.” Rather, holders of government debt are lending to the government. In order to finance their government debt purchases, they have to repo out that collateral to cash lenders. Typically they pay interest, due to low rates, etc., they are charging interest to borrow cash. But this is cash they are borrowing from the market(money mkt funds, securities lenders, banks, pension funds) not the Fed(s).This is not a borrow from the Fed at a negative rate, it is a borrow from other market participants at a negative rate.

I think that the Fed policy you are looking to criticize is that of paying interest on excess reserves. borrowing from market at an average rate of -.05 and lending to fed at .25. This causes incentive not to lend to the public. I don’t have a lot of sympathy for JP or any TBTF bank, and I have a skeptical opinion of what they did to average -.05 in repo and depos. Unfortunately the JP release above doesn’t speak to that.

That’s not what I saying at all, C. It has nothing to do with excess reserves. If the Fed funds rate were not 0.00-0.25%, JPMorgan would not be able to borrow in the repo market at zero rates.

Again, the fed has set the fed Funds rate at 0.00 to 0.25% and and controls the rate to within that range. The supply and demand dynamics in the repo market are largely controlled by the Fed because of this.

So, again, they may be borrowing from counterparties but in essence they are borrowing from the Fed because the Fed, through its active participation in the market, controls the rate.

You could suspend all counterparty transactions in the market and have dealers just repo with the fed and the net effect would be the same.

I think that you are mischaracterizing these transactions with the headline the JP is borrowing at negative rates from the Govt.

The Fed can control the rate within the 25-0 range, but this is not often the case and rates can go above or below that range depending on the supply of funds in the market.

If you are making the argument that the Fed is the universal counterparty in the repo market due to its participation in it, i think you are making a large leap. Not that the Fed doesn’t make extra legal moves, but suspending all counterparty transactions would be illegal. If that occurred it would probably happen because of some force majure event. In that case the Fed would be the only source of financing for dealers, and that would fall under its role as lender of last resort. As it stands now the activities of the Open market desk within the repo market are not insignificant, but are in no way large enough to be characterized as the “controls”. This is not to say that the Fed couldn’t, through an open market operation shift rates.

I think the confusion with the data was the misinterpretation of the term “federal funds purchased.” I think this term was interpreted as funds purchased from the Fed, when in reality the lenders of these funds are other dealer banks active in the money market space. These funds are also market determined rates, and like repo can be affected by fed intervention. If counterparty transactions stopped in this market, the Fed would also be the lender of last resort.

I understand that this post has nothing to do with interest on excess reserves. I just feel that you are trying to show an example of an exploitative relationship between JP and the Fed, unfortunately this doesn’t show it. The data shows that the repo rate has moved with the Fed funds target, that is normal and to be expected. The only way to remedy this is to raise the target. I mentioned IOR because JP basically has a risk free arb thanks to that fed policy. That does strike me as exploitative.

C, I am not trying to show an exploitative relationship. I am trying to demonstrate that the interest carry is enormous and that banks are borrowing for next to nothing. It just so happens that JPM’s dollar-rolls made the net rate come out negative. Which makes this all the more pointed.

But, the average repo borrowing rate is largely the same for all the other borrowers of fed funds. There is no special treatment that JPM is getting.

The only way to remedy this is to raise the target. I mentioned IOR because JP basically has a risk free arb thanks to that fed policy. That does strike me as exploitative.

It’s a little generous to call such a blatantly obvious hand-out arbitrage, but I agree.

My favorite part of IOR is that the Fed is long a massive pile of mortgages and longer-dated T’s. It intends to fight any possible inflation by paying out higher interest on its liabilities while its assets get crushed. This, of course, is more net debt for the Federal spaghetti ball, which in a normal world is inflationary. I have a morbid curiosity about getting out of the liquidity trap just to watch what would happen.

i like how “c” like to aregus sematics…okay C you win.,

BUT THEY STILL GET TO BORROW AT NEAR ZERO!!!

show me where you and i get that option.

A question for c who seems quite familiar with the repo market

Do you have any idea what proportion of the repo market results from the tide of money flowing into it from daily automated sweep accounts and other cash management techniques?

My guess is that that tide of money somewhat reduces the effectiveness of Open Market Operations and explains many of the steps taken by the Fed, the FDIC and Treasury since Fall 2008. Things like expanding and extending FDIC coverage; penalties on fails to settle repos; opening up direct purchases of Treasuries etc.

SOCIALISM!!! Oh,it’s for a bank,that’s ok.

Everyone seems to be concerned about where .5% is made as if this is the point on which to focus. It’s lunacy. I wouldn’t have a problem with all of this if the shareholders were wiped out and the debt holders took a haircut.

One day liabilities actually have meaning, the next day they are defined out of existence. There is not a neoclassical economist worth diddly-squat. There seems to be a consensus of fools that believe in increasing structural deficits to support unethical behavior like this is good policy as long as it benefits the present generation of stock and bond holders. I was raised to judge a person not through their reputation but their words and actions, to observe if their views of this world stand with reason and for the most part without self preservation and glorification. The actions of multiple generations which include and have followed the baby boom generation attests to a collective flawed character and massive delusion.

What does it mean to squander the potential of the future to support the follies of the past and present. We live in a time where stealing from the mouth of babes is justified and passively accepted by common men and women on the precept of self preservation. Where grownups find it acceptable to apply the laws of physics to financial markets, where FASB is no longer useful, where liabilities suddenly are in fact Shrodinger’s cat. This is not a question of whether we see our actions, we see all to clearly and continue to live in cognitive dissonance. No, this is a question of whether we correct our actions so that we can live with the consequences.

Oscar Wilde: “We know the price of everything and the value of nothing.”

The weight of our actions will crush our infantile form of capitalism.

The interesting question is: If JPM – and others supposedly – is paid for borrowing, who is paying?

Let’s say JPM borrows 100 mln from GS. It does have to repay 99.95 mln only (0.05% of 100 mln are 50,000). Who is paying the differnce, Goldman Sachs?

Even if 50,000 is chump change, I don’t think the banks are paying eachother when borrowing from eachother.

The term “Dollar-roll Financing” has specific meaning. This from the JPM footnote:

Reflects a benefit from the favorable market environment for dollar-roll financings in the first quarter of 2010 and the fourth quarter of 2009.

So what is is a Dollar-Roll Financing? That is the Federal Reserve folks.

Why have there been sales from the Federal Reserve’s portfolio? This from the Fed on dollar rolls:

Why have there been sales from the Federal Reserve’s portfolio?

As the investment managers conduct dollar rolls they simultaneously buy and sell agency MBS securities for different forward settlement dates. To date all sales for the SOMA have been associated with dollar roll transactions. These transactions have not represented any outright sales of agency MBS from the SOMA.

The Fed priced these dollar rolls. They priced them so that the dealers holding the MBS inventory would get financing at -5bp. Don’t blame JPM for taking advantage of this. This is just another good example of how the Fed has been recapping the balance sheets of the banks through ZIRP.

It is heinous that they did this. It is even worse that they are continuing it today.

Whoa! Good catch.

Do the math, and you’re talking big money for JPM.