This program on RTEOne from the Ides of March gives a window on how the prospect of default looks from Irish perspective (hat tip Richard Smith). Note that it is the chairman of Goldman Sachs International who argues against debt repudiation.

We’ve argued that it’s rational for the Irish to threaten default and if the debt is not restructured, to act on its promise. The EU has more to lose, since one country rebelling against austerity demands will embolden others, and also brings the real underlying problem, that of Eurobank undercapitalization, to the fore.

You can view the program here. The relevant segment starts at the ten minute mark. The debate at the end of the show is quite illuminating.

The one issue that is not stated clearly enough on this program is that investors are delighted to lend to companies and countries post default/restructuring because they have a much better balance sheet. The “credibility” issue is a canard. Ireland is not a credible borrower now because the debt burden is obviously unsustainable. The impediment is not the Ireland won’t be able to borrow post default, but how ugly and protracted a default/restructuring process might be.

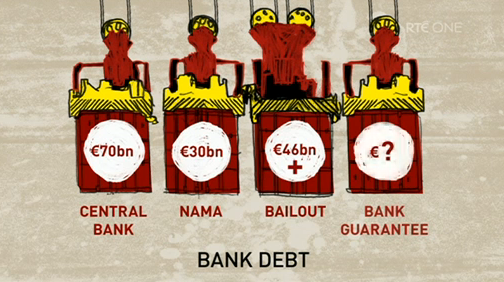

good video! it seems like the 22B Euro non-guaranteed bank debt will be defaulted upon, but the 90B Euro guaranteed Euro debt is likely to re-structured…still seems like a terrible burden.

David McWilliams and a bunch of other Irish economists have created an online primer to the Irish situation here: http://thepeopleseconomy.com/

Vincent Browne solicits enlightening political and economic commentary five nights a week on TV3:

http://www.tv3.ie/shows.php?request=tonightwithvincentbrowne

And Colm McCarthy’s columns at The Independent are spot on: http://j.mp/h4rzou

Pity the nation where economists are celebrities.

Excellent video presentation

The arrogance of the Goldman International Chairman, Peter Sutherland (14:10 in) is simply jaw dropping.

He finds it not conceivable that senior bondholders (mostly GS and other European banksters) whould be “burned” and be required to take haircuts simialar to those experienced by the shareholders and the other junior debt holders.

What I find very conceviable – if the banking cartel insists on keeping their boot on the necks of the middle and working class – is a resurgence of a militant IRA-type resistance. The financial elites are treading on thin ice and they seem absolutely oblivious to the devastaion and hardship they have created.

Perhaps Mr. Sutherland should stop feeding his dobermans, as the great unwashed masses may soon be breaching the walls of his estate.

Why do sovereign governments borrow their ‘own’ currencies from private corporations (in the US – the Fed and the fractional reserve banks)?

Why would a government – that is supposed to be representing the people – pay interest on debt to the bankers/elites?

Of course, the reason is because it siphons all of the wealth from the bottom & middle to the top. It’s the scam of the century.

I’m a bit surprised that an MMT-leaning crowd doesn’t bring this up more often….

I am surprised any decent person in Ireland is even talking about this. All you need to do is look at Iceland. Perhaps Iceland has some extra lesbians that Ireland could borrow to run their country until they get back on their feet. Default!