As much as the dot com era conditioned US individual investors to focus on stock market movements, credit markets are where the real action lies. Deterioration in the bond markets almost without exception precedes stock market declines (although debt instruments can also send out false positives). In the stone ages of my youth, the rule of thumb was a four-month lag. In 2007, that guide was not at all bad. The bond market turn began in June 2007 (yours truly took note of it then, see here for the critical development, but was not convinced it was the Big One until corroborating data came in in July). The stock market obligingly peaked in October 2007.

Now given the extraordinary degree of government interventions, turns are not as obvious, market upheavals have repeatedly been beaten back, and relationships between stock and bond market price movements are likely to be less reliable than in the past. But one thing that is a clear danger signal is liquidity leaving the banking system. It’s like the preternatural calm when the water leaves the beach, revealing much more shore than usual, before the tsunami rolls in.

A very good overview at the end of last week by the International Financing Review highlighted one clear danger sign: many mid tier banks in Europe are unable to get funding in interbank markets and are increasingly dependent on the ECB. The whole piece is very much worth reading. Key extracts:

Bankers who once ran the now-defunct repo facilities for medium-sized European banks say the credit lines were withdrawn after risk managers became concerned about their own exposure to the unfolding sovereign debt crisis, leaving some clients now solely reliant on central banks for cash….

The closure of traditional credit lines is a clear sign that concern about European sovereign debt has infected the region’s banks. Many in the region are big holders of the debt of their respective governments. According to the EBA stress tests published in July, the 90 banks it surveyed held a total of €326bn in Italian government debt, €287bn of Spanish public debt, and €215bn of French debt.

“Everyone has been cutting their exposure,” said the head of another European investment bank. “It started with Greece, then Spain and now Italy. People don’t want to do business with these banks. Many of them have good underlying businesses, but they are stuffed.”…

For many, the European Central Bank is now the last remaining source of liquidity. Under its open market operations – brought in during the depths of the crisis to pump liquidity into the region’s banks – its member central banks provide unlimited repo financing against certain eligible assets.

Demand for that money has been picking up of late, as banks feel the squeeze of dry private credit lines. Earlier this week, the Italian central bank said lenders asked for €80.5bn of liquidity during July, almost double what it had provided only a month earlier, in a sign of banks’ deteriorating finances.

Total use of the ECB’s main refinancing and long-term refinancing facilities – both part of the open market operations – are now close to €500bn, up from about €400bn in the spring.

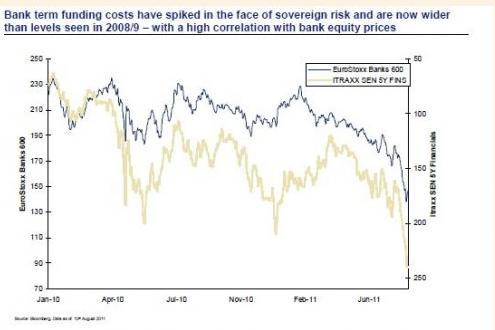

FT Alphaville also took up the theme of Eurobank financing stress, citing Morgan Stanley analyst Huw van Steenis, who points out that the 5 year CDS of Eurobanks are trading wider than they did in 2008 and provided this cheery chart:

And the journalist from (Graham) Greeneland, John Dizard, also points that the system is close to going into a critical state:

Not that there’s a European banking crisis just yet. We can see how close we are coming, though. As US money market funds cut back on their European exposures, even the best European banks have to fill the gap by borrowing euros short term from the ECB, and swapping those into dollars. Last week the cost of that process for large banks reached between 80 and 85 basis points. Measuring that against the 100 basis point penalty rate for the Federal Reserve dollar swap facility with the ECB, the system was about 15 or 20 one hundredths of 1 per cent away from a crisis.

Dizard also points out that the Eurozone isn’t prepared to enter into broad scale bank recapitalization programs; they’ll have to take place on a country by country basis. Yet he argues that the concerns are still overdone, for the Fed would ride to the rescue with swap facilities in a crisis, so US money market funds can keep their funding of Eurobanks (via repos) in place.

Yet it does not appear that money market funds are all that sanguine. They’ve been pulling back from European banks for a while; the dry up of funding to medium-sized banks described in the IFR article is in part due to their newfound caution. And one can’t forget how public hostility can impede action. The reason the authorities didn’t bail out Lehman was that it was politically unacceptable to do so. And I’m not saying a rescue was the right answer, but relying solely on a private sector solution and not considering a resolution or a good bank/bad bank structure was remarkably short-sighted. Here again, a failure to appreciate the downside may again lead to sluggish responses and tactical rigidity that could prove deadly in a crunch.

Doesn’t the issue of “broad scale bank recapitalization programs” make it a solvency issue versus a liquidity issue. I suppose that a lack of liquidity goes with a lack of solvency, but it was my (possibly feable) understanding that a “sovency” crises was not about going broke because you lost all your money, but going broke because the incoming flow of spending/trade/whatever was too low to match your current output.

Supporting Yves’ thesis, from the Globe & Mail:

Europe’s corporate bonds send an ominous signal

Who are you going to believe about the prospects for a fix in Europe?

As German and French leaders head into yet another meeting seeking a magic bullet, the signals from share prices and corporate bond prices are very different.

Is your money on stocks, which are on the rise again, and a government bond market where the European Central Bank is papering over problems with a buying binge, or a corporate bond market that’s in increasingly bad shape? ….

http://www.theglobeandmail.com/globe-investor/investment-ideas/streetwise/europes-corporate-bonds-send-an-ominous-signal/article2130419/

“The reason the authorities didn’t bail out Lehman was that it was politically unacceptable to do so”

Really? For whom? Was it less unacceptable to blow up the system and have everybody running for the exits? I remember the wave that came after unsecured LEH creditors got a first climps of the damage.

Hank Paulsen decided what was politically acceptable or not. TARP apparently was. And stuffing unsecured LEH creditors while derivative counterparties and secured creditors (= Wall Street) made out like bandits apparently was good business too.

Next station: EURO-TARP ?

You have to remember that Paulson acted to save Goldman because he had $700 million on the line to lose if he allowed their failure.

It was politically unacceptable. There was a really big backlash after the Bear subsidized sale.

I called this on my blog, it was crystal clear there would be no Lehman bailout. That is not because I had any insight, it was simply bloomin’ obvious.

“Yet it does not appear that money market funds are all that sanguine. They’ve been pulling back from European banks for a while . . . ”

That’s the key issue.

The difference between the money market funds and the ECB is the dollar versus the euro; and it is the latter that is the scarce commodity in Europe right now. European banks need dollars to fund their dollar-denominated operations, and without MMF support, they’re in serious trouble.

At the height of the crisis, the Fed stepped in with a huge dollar repo backstop for the eurozone, but I seriously doubt they will be able and willing to do the same again; particularly with Congress taking a much more critical view of Bernanke’s approach, and particularly since it is not at all clear that such a move would provide more benefit than risk to the U.S.

In hindsight (it is always easier in this case) I might have found it ok to have bail outs in 2008 IF the concerned people (bankers) who produced the mess in the first place, would later have shown remorse and accepted some responsibility by returning their compensations of the previous few years and would have shown the related humbleness and stepped down from their perky positions and would have supported that the compensation schemes would have been completely revised to a much much lower level. Yes in that case I might have agreed to the bail outs. But what really happened was exactly the opposite. I rather have a system collapse than a system of theft and deceipt.

What is going on in Europe is again the same old tricks being played. The threat of the system breaking down – WOW. We are so afraid. BS. Let the shit hit the fan and let us sort out the mess afterwards and let us not forget those guy who were responsible for it in the first place.

BUT DO NOT transfer again the costs of failed investments over to the tax payer. No, really no more of this.

I know politicians and guys like Trichet try hard to do it again (partially did it already); they try to muddy the water with communication strategies and complex arrangements so that no one should realize what is going on. The problem they have, that the spectators are not that gullible anymore.

And of course the media continues to praise the idea of EURO bonds and other arrangements. Just get back to the principle of the RULE OF LAW that clearly states that who makes an error when investing and is loosing as a result, has to take the hit himself and should not be “saved” by any organization. Let’s stop this BS and get real. Grow up!

Adding to the liquidity concerns is lack of economic growth. The 2nd quarter GDP figures are in, and they’re freaking dismal:

Eurozone — +0.2%

Germany — +0.1% [vs. +0.5% expected}

France — +0.0%

http://www.bloomberg.com/news/2011-08-16/u-s-stock-futures-slide-after-german-economy-almost-stalled-last-quarter.html

Jesus H. Christ on a titanium crutch! ‘Everybody’ believed that Germany was Europe’s mighty locomotive – thus the expected quarterly GDP growth of +0.5% (+2.0% annualized, to match the way US figures are presented).

Instead it turns out that growth in Europe’s French-German core is even slower than in the euro zone as a whole. Hello, wake-up call!

If anything, the accumulating evidence of a gathering global recession may lower borrowing rates even further for Germany. But a fresh plunge in growth simply blows away the austerian thesis that peripheral Europe can grow its way out of its debt burden. Under no-growth conditions, its debt burden will spiral up faster than before.

Likewise, under no-growth conditions, piling heavier EFSF guarantee obligations onto France and Germany is a good way to push both into a de facto, if not de jure, ratings downgrade.

Fixing a debt crisis with more debt has worked ever since Oil Shock I. But this time the poor rabbit suffocated in the hat, so there’s no use pulling it out. How do you spell relief? R-E-S-T-R-U-C-T-U-R-E!!

With flames licking at the European horizon, the prudent will rusticate themselves to Graham Greeneland for the time being.

These figures are SO subject to revision and correction as the data gets refined over time that any action at all based upon them now would be ill-advised indeed.

I mean, the numbers from 2001 are just now getting into the history books….

“Only last month did the U.S. Bureau of Economic Analysis release its revised GDP data for 2001. “These data are the ones that will be likely to enter history,” says economist Gail Makinen, who penned a one-year economic retrospective for Congress during his tenure as a co-ordinator for the Congressional Research Service. Only now do we learn that what was reported to be U.S. GDP growth of 1.3 per cent in the first quarter of 2001 was, in fact, a contraction of 1.3 per cent. As Makinen notes dryly, a change of 2.6 per cent “is a pretty large revision.”

From:

http://www.thestar.com/news/insight/article/1038829–greed-not-osama-took-down-the-economy

It’s an art, not a science.

Don’t delude yourself.

Art?…

That the art of the con-artists.

Voodoo art is still art.

‘Smart’ collectors are favoring those these day.

I agree. “Real GDP” numbering takes years. Like the big growth of the Clinton years wasn’t really realized to years afterwords, though the economy was booooooooooming.

Ever since, US GDP has been overdone, including the flawed Bush era expansion.

So what are you suggesting? That one wait 10 years for the numbers to firm up before taking action?

Silly, silly, silly.

Although I’d prefer that central bankers not take any action at all—ever—making them wait 10 years is not a bad idea. Meanwhile, economists can have fun playing with the numbers and discussing their quacky remedies amongst themselves.

What happens when the credit crisis strikes?

No rescue ahead of a credit shutdown in Europe appears likely or even possible given political conditions in Germany.

A credit shutdown will give the German, French and ECB leaders room for quick maneuver. Won’t the ECB have to ride to the rescue? Won’t laws have to be ignored? What will German leaders want to achieve in that window of opportunity? Will the French agree?

Isn’t this the likely focus of planning at high level talks now?

That is the analysis I’d like to read.

High level talks? That’s so one hour ago.

The Sarkel-Merkozy presser served up great thumping helpings of pie in the sky. But punters have nothing to eat.

Ergo, SELL!!!

@Jay B: I’ve been wondering the same things. Perusing the various financial websites, I have encountered a significant minority of pundits who say that it will indeed take a major outbreak of the Euro crisis to galvanize the ECB into mimicking Bernanke’s money-printing, aka “expanding the balance sheet of the central bank.” But the stress was on “major outbreak”; which leaves plenty of room for disaster, anticipated and unanticipated. None of the articles was sanguine about anything but more “kick the can down the road” in the near term. (Incidentally: Where are all the MMT advocates now? You’d think they’d be all over this thread, esp. after the discussion aired on this website in the last few days.)

Hemingway once wrote that a man goes broke “slowly, then all at once.”

Europe is looking to be going that way.

You know what I’m starting to notice? Well, that those against the bailouts are gradually coming to see them as ‘the only game in town’.

Consider the FT article cited in the above post (which is very good) as an example. The author is clearly somewhat anti-establishment — using terms like ‘eurocrats’ and ironically shooting down Paulson. And yet, in a somewhat confused manner — at least given the overall thrust of the article — the author writes this:

“The key lesson the eurocracy should have learnt from the Tarp episode is that a bailout facility really needs a funding mechanism, or readily available pot of cash. The EFSF has attracted populist outrage in both creditor and debtor countries without getting that pot, and consequent ability to act fast. Once secretary Paulson got his hands on the Tarp law, populists could do nothing to stop him or his successor from spending hundreds of billions buying bank core capital securities.”

Do you see how ambivalent that paragraph is? Is the author implicitly arguing against populist anger at the TARP bailouts? It appears to me that he is and that’s very interesting.

“The author is clearly somewhat anti-establishment…”

Did a little digging and I can now vindicate this point completely (it’s amazing what you can read into a person’s politics and opinions from their tone). Dizard is indeed a champion of the Austrian School:

John Dizard: Vindication of Austrian economists and their theories

http://www.ft.com/intl/cms/s/2/80339208-3c3e-11db-9c97-0000779e2340.html#axzz1VDNakMHJ

“If the founding Austrians had Marxists and Keynesians as their opposition theorists, the present-day Austrians have Alan Greenspan and Ben Bernanke and their enablers in the US political system.

While the profit motive is central to the Austrian economic model, what really motivates the practitioners is the prospect of being able to say “I told you so”, which is much more satisfying than merely getting rich.”

Bang. And that’s why learning something about LitCrit isn’t just a waste of time.

Good summary. “Austrian economists” are permanent contrarians, rather than people with any actual point of view.

If they’re starting to demand bailouts, it probably means bailouts are extremely unpopular now.

Well, you have legit Austrians like George Selgin. Then you have pampered “my father was a prominant freemason, but they wouldn’t accept me” types like Ron Paul. Who gets off lusting over the gilded age America and how its economic systems would thrive today. What a rebel!!!!

Of course, Ron showed his immmaturity when he agreed with the radical left that we should have a 100% reserved system with US treasury doing all the money creating……….ouch. He got ripped for that by the real Austrians. Don’t worry, then he said, he would put gold on top of it so they wouldn’t “spend to much”. I couldn’t stop laughing.

Nothing wrong with the Austrian school. Much like the Marxist school’s rediculousness, they value capital over all over being, much like the Marxists value labor over all other being. Traditional states and governments are both chided in Marxism and Austrian philosophies.

I have no object to bailouts, as long as they are accompanied by arrests of bankers and stockbrokers. And nationalizations. And arrests/purges of those bureaucrats who aided the looting. Then if bailouts are a good idea for the ordinary common people, I’m good with the idea.

‘Hysterical antipathy ’twas created within the debt ravaged lower classes’ La di da di da….Populist my foot!

Consider the implications of a Tobin tax, alluded to by Sarkel-Merkozy in their ‘Summertime Blues’ press conference today.

At one whack, a Tobin tax will erase nuisances such as high frequency trading. But it also will reduce more legitimate short-term trading volume and liquidity.

If you’re holding euro-denominated equities or debt on a short-term horizon, the obvious conclusion is to SELL NOW before the market dries up more.

This is not an argument against a Tobin tax, but rather a knock on their exquisitely bad timing for introducing one.

So how does returning to the older system (and the system in the UK where there is a 50 bp tax) do much except slow turnover. HFT really does not help the capital allocation function of the markets and is just another way for the house (the banks) to extract money from the gamblers at the great wall street casino. Anyway if you include the capital gains effects for HFT types the tax will be really 60% of the amount since it should increase the basis and decrease the proceeds from a transaction. Note that NY state had such a tax from 1905 to the mid 1980s. (The exchange threatened to leave in the early part of the century but did not)

Slowing turnover is a goal in itself. Currently markets are heavily, heavily, heavily manipulated by “high frequency traders” and automated programs run by a small number of megabanks. This means the prices often reflect absolutely no real investors. Slowing turnover slaughters these useless wastes of market space.

One more thums up for the Tobin tax. As far as Iam concerned slower is better. Slow it way the hell down. penalize people/machines that want to trade intraday – or intra second. They add no value at all. They are not needed for “liquidity”. Liquidity was just fine on the 1970s and 1980s before these computerized parasites were invented. Time to kill off the parasites.

Well said – let’s rape anything that moves! No way in hell are economists going to come between me and a return to the sensible market place where Henry Ford housed every ‘Murican that needed a car, and an obtainable low cost cottage with oil heat and water closet was provided for convenience and luxury. But soon thereafter, the high speed flim-flam came!

Jim,

A Tobin tax is only ‘bad timing’ is so far as there should already have been a Tobin tax. But better late than never.

HFT was partly to blame for the recent stock market huge swings down and up. A Tobin tax will be a win-win: less HFT and intraday trading, and more tax revenue (hence, less taxation for citizens).

An investor, as opposed to a speculator, buys for longer term, hence a buy-sell spread, and Tobin tax are less a concern.

Why is it that in most countries in Europe a tax is collected (or dodged) on everything you buy — consumables, services, a house, car, art,…. — except when buying financial products?

Contrary to the post, large Money funds, like JPM treasury euro domiciled, are actually increasing repo share in 20bln fund to 80% from 30%-60% previously to cover costs. Funding seems to be flowing…

One of today’s proposal was a “golden rule’ that all countries adopt a balanced budget amendment. With current zero to negative GDP growth and more austerity programs from France to Italy to Ireland how does a country ever get to a balanced budget without cutting out the entire social net? This balanced budget idea is a guaranteed death spiral that will lead to social/political revolt.

“not considering …a good bank/bad bank structure was remarkably short-sighted”: you can say that again. Was it stupidity or corruption?

There are Sovereigns and there are the Slave States.

Sovereign states do whatever is in their best interest – if their debt burdens to foreign creditors get too unmanageable – the “politely” tell the creditors to get lost – huh – whatchoo gonna do abouit eh?

Slave states ( Like japan, Saudi Arabia etc) – have no such options. Their govts are corrupt in the deepest sense – they owe their allegiance to the foreign masters more than to their own people. They dont have any freedom of action – they need permission to do anything – their brains are dead – they cannot think outside of the current framework ( or the framework set up by their mASSters).

This is the right framework with which to analyze Europe today.

Watch the hapless japanese bureaucrats helplessly watch the Yen getting pushed into its deflationary black hole. No response. Just limp wristed chit chat . That what happens – if you get a govt that is “enslaved” to foreign interests.

Lets just hope that 2 years from now – when some US govt decides to make the american people and their “grandchildren” – pay debts to the chinese for having provided plastic pooperscoopers and barbeque mitts to the grandparents generation n- they get run out of town on a rail.

OK – must be the excellent Lagavulin 16 yo – but I have to disagree with the fearmongering that this or that measure will “kill” the markets.

really? maybe if one is a day trader type – this stuff is life or death. But really – OK so Novartis gets cut in half – really? Can I please mortgage my house and buy as much as I can. I mean it would be trading at a sustainable PE of 4 and a dividend yield of 10%. Since none of the boy – wonder quant tyes want any of it – I would be more than happy to oblige. Not a disaster at all.

Sooo – the high priests of that medieval “science’ of economics – say balanced budgets – huh/ based on what? Do the economists have any foundations at all? I mean do they even stand on firm ground? Any evidence? Any hypotheses that have been harshly tested? No? Still wantt to call it a “science” – or maybe its just a bunch of second and third rate intellects suffering from physics envy? But they are indeed convenient idiots for the politically ambitious to use as their court jesters.

Krugman The Klown was on CBC-TV a couple of weeks ago, advocating 20% inflation. Paraphrase: “If I had a magic wand that could create 20% inflation overnight, I’d use it.”. I laughed uproariously. Has any “serious” economist ever in history recommended 20% inflation as good economic policy?

Anyway, it appears the economy stubbornly refuses to fit into the box Krugman has prepared for it. Now he’s frustrated, and willing to break it into pieces in order to MAKE it fit. Oh, the delicious insanity of our times!

BOMBSHELL! Yves, you are the Campbells of financial reporting: Mmmm, Mmmm good.