Yves here. This short piece by Robert Gordon is important because it seeks to quantify the impact of a phenomenon that economists have noticed a bit late in the game: that the benefits of GDP growth, which used to go mainly to labor (via increased hiring and better wages) now benefit capitalists fare more than ordinary workers. The shift towards increases in GDP favoring corporate profits at the expense of labor became pronounced in the weak Bush expansion (we commented on it in a 2005 article) and Gordon’s effort to try to translate that into the impact on unemployment levels is a useful step forward in the debate.

By Robert Gordon, Professor in the Social Sciences and Professor of Economics at Northwestern University. Cross posted from VoxEU

The US is missing millions of jobs. This column argues that the total is 10.4 million. It claims that 3 million of these can be traced to the weakened bargaining position of labour and the growing assertiveness of management in slashing costs to maintain share prices. Moreover, this employment gap is not shrinking because of the ‘double hangover’ effect—an excess housing supply and besieged consumers unwilling to spend.

High and persistent unemployment in the US has emerged as one of the most important macroeconomic legacies of the 2007-09 world economic crisis. While the decline of business activity in the US was no larger than in Europe, the US is an outlier in its outsized response of the unemployment rate to its decline of output (IMF 2011).

Here we quantify the shortfall of US employment – some 10.4 million missing jobs – and ask: Why did the number of jobs decline so much and why has it recovered so little? Two sets of causes stand out.

First, there has been a changing balance of economic power in the US between management and labour in the past two decades that has led to more aggressive firing of workers when business profits head south.

Second, the large negative output gap (actual real GDP below trend or potential) is not shrinking, due to the “double hangover” persisting in the aftermath of the housing bubble.

By explaining why the recovery of aggregate demand has been so weak, we provide an understanding of the refusal of the large negative output gap to shrink – a refusal shared by its twin, the employment gap.

Dimensions of the job shortfall: 10.4 million missing jobs in the recovery

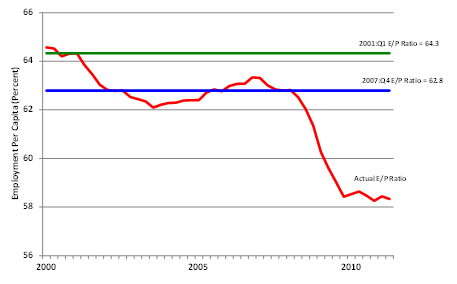

Part of the job shortfall is reflected in the rise of measured unemployment. The rest comes from a decline in labour-force participation. The employment-population ratio (hereafter E/P) measure combines the two.1 As shown in Figure 1, the ratio (as shown by the green line) was 64.3% at the NBER business-cycle peak in 2001:Q1. By the next peak (2007:Q4) it had fallen to 62.8% (blue line).

This descent from 64.3% to 62.8% led numerous commentators to lament that the 2001-07 US economic recovery was not a complete recovery. Indeed, the seemingly ‘minor’ 1.5% drop in the ratio represents more than 3.6 million ‘missing’ jobs – even before the recent recession.

In mid-2011, the ratio (wavering red line) is only 58.1% — far below 2001 and 2007 levels.

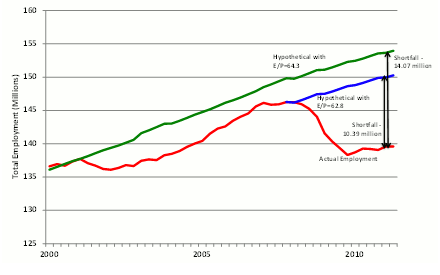

How many jobs are lacking? Figure 2 shows that the shortfall amounts to 10.4 million missing jobs compared to the 2007 version of normality and a much higher 14.1 million missing jobs compared to the 2001 definition. In the rest of this analysis, we take the less ambitious 2007 value for the ratio of 62.8% as the relevant benchmark.

Figure 1. Actual vs two criteria of normal employment per capita, 2000:Q1-2011:Q2

Figure 2. Actual vs hypothetical employment, 2000:Q1-2011:Q2

What caused the destruction of 10.4 million jobs?

The first explanation is the change in managerial power. For decades I have been tracking the responsiveness of labour-market variables to the output gap (see most recently Gordon, 2003, 2010).

Before the mid-1980s a 1% change in the output gap would generate roughly a response of 0.45% in the similarly defined gap of the Employment Population ratio.

The rest of the 1% shortfall of real GDP would show up in declining productivity and in hours per employee.

The observed ratios in the data for 1954-86 are roughly consistent with the predictions made by Arthur Okun (1962) in what soon became christened as “Okun’s Law.”

After the mid-1980s, however, these responses changed in a process I have described as the “Demise of Okun’s Law.” The response of the ratio jumped from 0.45 in the 1954-86 interval to 0.78 in an otherwise identical regression equation applied to 1986-2011. This means that when output slumps, employment drops much more than it would have done previously.

The “disposable worker hypothesis”

When the economy begins to sink – like the Titanic after the iceberg struck – firms begin to cut costs any way they can; tossing employees overboard is the most direct way. For every worker tossed overboard in a sinking economy prior to 1986, about 1.5 are now tossed overboard. Why are firms so much more aggressive in cutting employment costs? My “disposable worker hypothesis” (Gordon, 2010) attributes this shift of behaviour to a complementary set of factors that amount to “workers are weak and management is strong.” The weakened bargaining position of workers is explained by the same set of four factors that underlie higher inequality among the bottom 90% of the American income distribution since the 1970s – weaker unions, a lower real minimum wage, competition from imports, and competition from low-skilled immigrants.

But the rise of inequality also has boosted the income share of the top 1% relative to the rest of the top 10%. In the 1990s corporate management values shifted toward more emphasis on shareholder value and executive compensation, with less importance placed on the welfare of workers, and a key driver of this change in attitudes was the sharply higher role of stock options in executive compensation. When stock market values plunged by 50% in 2000-02, corporate managers, seeing their compensation collapse with profits and the stock market, turned with all guns blazing to every type of costs, laying off employees in unprecedented numbers. This hypothesis was validated by Steven Oliner, Daniel Sichel, and Kevin Stiroh (2007), who showed using cross-sectional data that industries experiencing the steepest declines in profits in 2000-02 had the largest declines in employment and largest increases in productivity.

Why was employment cut by so much in 2008-09? Again, as in 2000-02, profits collapsed and the stock market fell by half. Beyond that was the psychological trauma of the crisis; fear was evident in risk spreads on junk bonds, and the market for many types of securities dried up. Firms naturally feared for their own survival and tossed many workers overboard.

3 million missing jobs due to altered management response to recession

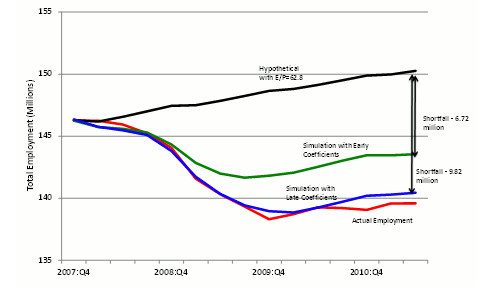

Figure 3 provides the results of a simple experiment regarding the loss of jobs.

Labour-market responses to business-cycle shortfalls were quite different when estimated with regressions over the 1954-1986 (“early”) and 1986-2011 (“late”) sample periods.

Responses of employment and other labour market variables were much larger in the “late” period (as predicted by the disposable worker hypothesis).

Given the decline in the output gap, simulated employment fell short by 9.82 million with the “late” dynamic adjustment behaviour, quite close to the 10.39 million actual shortfall. Yet with the “early” coefficients employment fell by a substantial but significantly smaller total of 6.72 million.

Figure 3. Actual vs hypothetical and dynamic simulation employment, 2007:Q4-2011:Q2

Thus labour’s weakened bargaining situation with changes in management behaviour toward greater emphasis on cost-cutting in recessions accounts for roughly 3 million lost jobs in the current jobless recovery. The other 6.72 million would have been lost even with the earlier responses because the output gap was so large.

Why is aggregate demand so weak? The ‘double hangover’ explanation

This explains the outsized job cuts that came in response to the recession. But we are still left with the question of explaining why the output gap is still so negative 2 years after the NBER business-cycle trough (June 2009).

America’s double hangover goes back to the consumption binge that accompanied the 2000-06 housing bubble.

The residential construction industry was building houses at a pace much higher than the underlying rate of household formation.

Housing demand was boosted by speculators who bought new condominiums hoping to “flip” them for easy profits and by mortgage brokers who were out combing the weeds for low-income families to whom they could peddle dangerous adjustable-rate interest-only mortgages.

Consumption of all types, particularly of durable goods like autos and appliances and services like nail salons and child tutoring, grew faster than income, implying an ever-declining personal saving rate.

Households could use not only their own income to buy consumer goods and services but could finance expenditures in excess of income through second mortgages and refinancing that allowed them to drain cash from their appreciating residences.

Once the bubble burst and house prices began to tumble, the ‘double hangover’ began.

The first hangover was the excess supply of housing.

This led to a glut of unsold houses and condos that put continuous downward pressure on home prices. Foreclosures added to the glut; each foreclosure raises the supply of vacant housing units by one unit while increasing the demand for housing units by zero, because the foreclosed family has by definition defaulted on its mortgage and cannot obtain credit for several years into the future. Many homeowners avoided foreclosure but were “underwater,” with houses now worth less than the face value of the mortgage and thus faced the hapless choice of draining resources to pay the mortgages or defaulting, with the consequence of a ruined credit rating.

The second hangover was the impact of excessive indebtedness.

Just as consumption could exceed income as debts were being run up, so the second hangover required consumption to be below income while debts were paid off. The ratio of total household indebtedness to personal disposable income rose from 90% in 1995 to 133% in 2007 and has since fallen just to 120%. Year after year of saving and underconsumption will continue as households continue to pay off debts.

Just as hangovers have negative impacts on family members and job performance, so the double hangover of the slump in residential housing investment and in personal consumption expenditures has spilled over to other components of GDP. Nonresidential investment was hit as firms supplying consumers and home builders reduced their need for new computers, machinery, factories, office buildings, and hotels. State and local governments, by law required to balance their current budgets, began to lay off school teachers and other employees.

Dissecting the shortfall of aggregate demand

We now turn to the “shortfall” of each component of aggregate demand.

The shortfall is defined relative to the previous business-cycle peak in 2007:Q4, so if the ratio of a component of spending to potential GDP has declined by 3.0% between 2007:Q4 and 2011:Q2, we describe its shortfall as 3.0%.

The sum of all these shortfalls adds up to the -9.2% output gap.

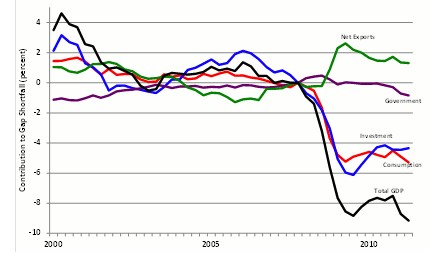

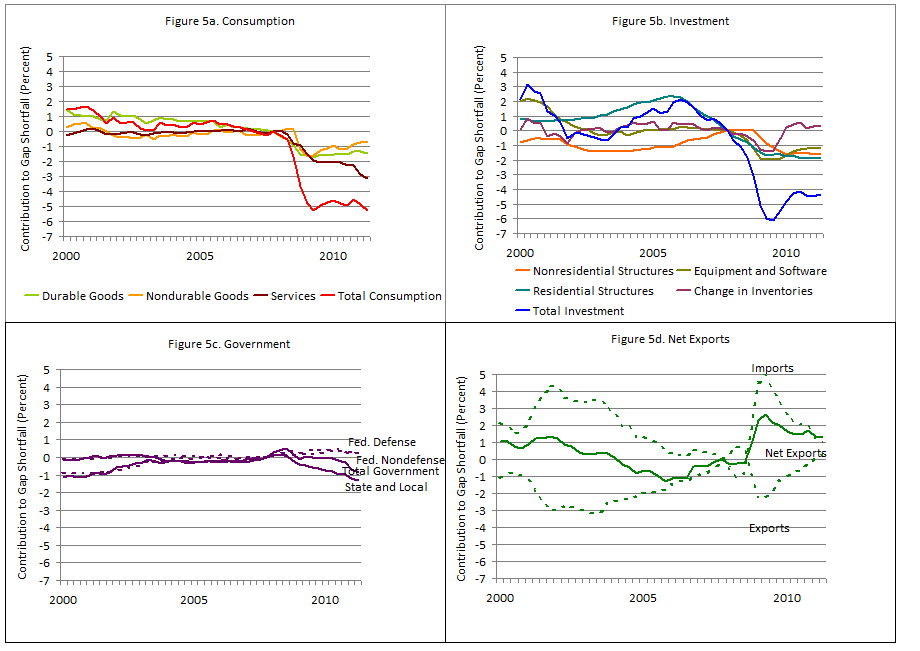

Figure 4 illustrates the gap shortfall relative to normal for total GDP and its four major spending components. The total gap shortfall is shown by the black line and is divided into the shortfall of consumption (red), investment (blue), government spending (purple), and net exports (green).

Consumption and investment are roughly tied in their contribution at about -5% of potential GDP,

Government makes a small negative contribution; and

Net exports make a substantial positive contribution.

Notice that in 2000 and again in 2005-07 the total gap was positive rather than negative, and this was mainly attributable to a positive gap for equipment investment in 2000 and housing investment in 2005-07.

Four graphs in the addendum (see Figures 5a-5d below) show the subcomponents of the four main types of spending. The surprising result that by far the biggest part of the consumption shortfall is provided by services, which has more than twice the shortfall of durable goods. Over the past two quarters the consumer-services shortfall has become even larger. The services and durables gaps were positive for the entire period between 2000 and 2006, indicating that easy credit and cash-out refinancing were used for consumer services, not just to finance consumer durables.

Figure 4. Components of gap shortfall, 2000:Q1-2011:Q2

In contrast to the overall consumption shortfall – which continues to be as negative as in early 2009 – the total investment shortfall is somewhat smaller now. Surprisingly the current shortfall for nonresidential construction is almost as large as for residential construction. This occurs because much of the collapse of residential construction had already occurred between 2006:Q1 and 2007:Q4.

Figure 5c (below) decomposes government spending into state and local government spending, federal military, and federal nonmilitary spending on goods and services. Transfer payments, including unemployment compensation and social security payments, are by definition excluded from GDP. Total government spending’s contribution to the output gap was positive in 2008, neutral in 2009, and has become increasingly negative (i.e., contributing to the overall shortfall in total GDP) since early 2010. The small positive contribution of the two federal government components has been more than cancelled by declining state and local spending.

Net exports (Figure 5d below) have helped to offset the shortfall in the other spending components. In 2011:Q2 exports returned to the same ratio of potential GDP as in 2007:Q4, i.e., the total of real exports in the past 3.5 years has grown as much as potential real GDP (that is, by 9%). Imports, which are a subtraction from real GDP, have not recovered to their ratio to natural real GDP and thus have prevented the total output gap from being larger than it is. Without the contribution of the decreased level of imports, the total output gap would have been -10.2 instead of -9.2%.

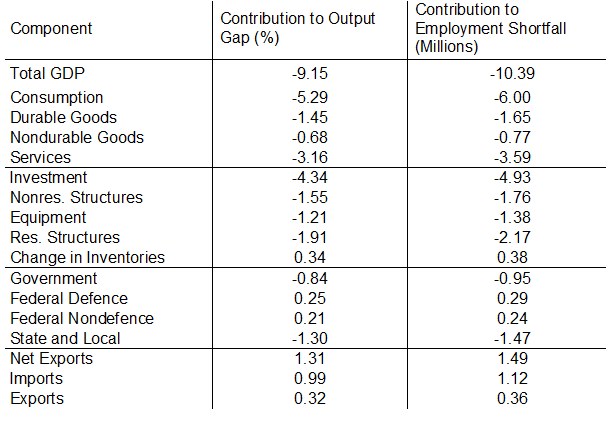

Translating lost spending into lost jobs

Table 1 lists the major components of spending and the subcomponents and displays the percentage shortfalls already displayed in Figures 4 and 5. Then we use the shares of each subcomponent in the total output shortfall to calculate the jobs shortfall for each subcomponent. Notice that this method treats all components of spending as equally labour-intensive, an acceptable approximation for this exercise. It includes in the jobs shortfall attributable to, say, residential structures, not just the construction jobs in the residential industry but all the jobs involved in raw materials and intermediate inputs to that industry, including lost jobs in providing lumber, nails, tools and equipment, heating and cooling equipment, built-in appliances, and more.

The shortfall of consumer-services spending is the largest subcomponent; it translates into 3.59 million missing jobs.

Next come the 2.17 million lost jobs in residential construction (on top of those lost between 2006:Q1 and 2007:Q4),

the 1.76 million in nonresidential structures,

1.65 million in consumer durables,

1.47 million in state and local government, and

1.38 million in equipment and software.

The overall simulated job shortage would have been 11.88 million but for the helpful performance of net exports. It’s positive contribution brings the figure to a smaller but still unfortunate 10.39 million.

Table 1. Contribution of GDP components to output gap and employment shortfall, 2011:Q2

Conclusion

A change in labour market dynamics accounts for about 3 million of the over 10 million missing jobs in mid-2011. This shift can be traced to weakness of labour and growing assertiveness of management. But even with the labour-market institutions of 1955 through 1985, the weakness of aggregate demand in the recession and recovery would have cost roughly 7 million jobs instead of the 10 million jobs that are actually missing compared to normal economic conditions such as occurred in 2007.

The recession itself is usually and correctly traced to the collapse of the housing bubble and the post-Lehman financial panic. But the recovery has been unusually weak, completely unlike the economy’s rapid bounce-back in 1983-84, and this requires an explanation as well. The best place to start is the double hangover approach, which explains not just the collapse of residential structures investment but also the continued and growing weakness in consumer spending. Perhaps the most surprising result of this essay is that the spending component responsible for the largest share of the missing jobs is not residential investment but consumer spending on services.

This is not the place to talk about remedies.

The spending decomposition shows that fiscal policy has failed in that the government spending sector has made the output gap shortfall worse, not better.

The double hangover theory helps to explain why monetary policy is impotent, no matter how much “Quantitative Easing” is attempted.

Authors including Hall (2011) focus on the zero lower bound as the crux of the Fed’s problem and ignore the complementary problem of low interest-insensitivity of consumers who are trying to pay off old debt instead of taking on new debt.

The failure of consumer and investment spending to respond to an ever-lower 10-year government bond rate, which fell below 2.3% this past week, demonstrates that the problem is an “IS” curve that is very steep if not vertical at an output level far below that necessary to generate a normal level of employment. The vertical IS curve is just as relevant for understanding today’s economy as that of the 1930s, and it plays an essential role in the twelfth edition of my macro textbook (2012) in explaining why monetary policy may at times be impotent, just as it did in the first edition more than three decades ago.

Addendum: Details on the aggregate demand shortfall (click to enlarge)

That’s it then.. the only solution is to borrow more and give the TBTF banks another $$Trillion so they can gamble food prices up another 20%.. and we hand the long-term unemployed another year of benefits of course, so they won’t interfere with the recovery.

http://panzner.typepad.com/.a/6a00d83451591e69e2014e8a75ad18970d-pi

Kevin Phillips (Nixon’s editorialist-economist), in his books, “American Dynasty” and “American Theocracy” shows U.S. “financial sector” accounting for 20% of U.S. economy

prior to 2001-by 2007, the total Phillips describes has doubled to 40%.

But look, why did big “investment banks” want bad “securitized mortgages”? Fact is, they were using these

as collateral, to borrow against, to collude in commodities-

futures markets, and derivatives..which some document (Robert Johnson-designated Senate Banking Committee Chairman) state now value $600 Trillion, up from $880 Billion, 2001:

http://www.newdeal20.org/wp-content/uploads/2009/10/raj-revised-testimony1.pdf

The government is not for the poeople or of the people anymore and has not been for a long time. It is just now getting worse and getting more out into the public. The government is run by the financial corporations. All politicians are bought and paid for and they allow the criminal behavior , that of course is hurting the average american the most, go on without repercussions.

It is disgusting but we do not have a “for the people” government any more. Obama has just revealed it to more people with his campaign that pulled the wool over everyone’s eyes. Played all those who voted for him as suckers and fools and if they vote for him again they will be doing themselves in…unless they are part of the elite class.

Isn’t this also positive feedback ?

Throwing more people out of work allows you to force down wages too – due to high unemployment.

It’s all kind of terrifying considering that the government, which is, in theory, supposed to be responsible to the people is now protecting this kind of behavior.

And Obama is twisting the knife with his austerity and “free trade” agreement job programs.

I believe the term your searching for is “wage compression.”

The Maestro of Collateral Damage, Greenspan, is a big proponent of wage compression. Imagine that, flaws in his thinking are still being exposed, who would a thunk’ it.

I genuinely think wage depression was exactly the goal. In order to remain competitive in a global labor market, our labor costs must drop to a rate where there is limited benefit to off-shore labor. As the living standards in India and China rise, ours are dropping. At some point they come into balance. Wage depression is also rather popular with US capitalists, so everyone with a vote that counts is on board.

Yes. Permanently high DISemployment is an elite policy goal, shared by both legacy parties, and successfully achieved by Obama (“Only Nixon can go to China.”) Permanently high DISemployment keeps wages low, and productivity high, by putting workers in fear. And corporate profits are higher than ever, so Obama’s owners are happy.

Permanently high DISemployment also will have the happy effect of shortening life expectancy, a la the former Soviet Union, through stress, loss of housing, loss of insurance and health care, and so forth. This has various actuarial benefits that our feral elite has no doubt taken into account.

Art,

Look to Naomi Klein’s, “The Shock Doctrine” for the “goal”..

privatize all government resources (including education which is being channeled to “charter schools”, then to internet schools-no more messy non-conforming thinking..)

Some of us in polysci circa 1970’s-80’s watched the same thing happen in South-Central America-check out William Blum’s, “Killing Hope”, or Perkins’ “Confessions of An Economic Hit Man”…

I’m in complete disagreement with the statement that ‘wages must drop’ for the US business sector to remain competitive with other country’s businesses. This may be the official party line from the corporate elites who want us all to believe that the vast majority of workers are nothing more than worthless instruments easily disposed of. Why is the concept of increasing this nation’s worker and factory productivity not even in the picture? That is not a rhetorical question; overseas factories often contain the latest in technological development. What these other manufacturers often lack, like their US counterparts, (research needed here, I’ll grant) is top notch management that has received an education that would allow them to see the bigger picture. Wages and benefits (such that they may be) comprise about %10 of the cost of making most goods, services may cost slightly more as they are often more labor intensive.

I feel quite strongly that discussions about increasing productivity need to be pushed up by all of us who are concerned about the terrible situation we are in. Finally before closing this littel rant out-workers in this coutnry are often more productive than those overseas. A joint effort of workers and management needs to:

1. Work together to build communities that support all of us in reaching fully our real potential as humans and workers.

2. Improve our education system and move it out to the farthest reaches of our society-high, low, middle, income, or IQ, or skill sets –we all deserve much better.

3. Criminal punishment needs to be in place for corporate entities who work to ship jobs overseas while they work to tear down the society and culture that houses them.

“The weakened bargaining position of workers is explained by the same set of four factors that underlie higher inequality among the bottom 90% of the American income distribution since the 1970s”

The solutions are rather obvious.

-Tom Geoghegan’s suggestion that union organizing be added to the Civil Rights act

-Raise minimum wage to at least 1968 equivalent ($10/hr ) and index it to inflation (with EITC above that)

-Zero out trade deficit with Warren Buffett’s import certificate market

-E-verify every job applicant, auction off H1-B visas to the highest bidder and use proceeds to fence the entire Mexican border.

Sad to say, the last president who’d support anything like these was Richard Nixon, and the last presidential candidate, Nixon’s old speechwriter Pat Buchanan.

You are leaving out the elephant in the room: health insurance costs. Just about every wage gain that J6P SHOULD have gotten went into skyrocketing health insurance premiums. Unless we get health care costs under control, there won’t be any fixing of our wage issues.

Good point, and it certainly strengthens my point vis as vis Nixon. Congress would have passed and Nixon (or, by that time, Ford) would have signed the Kennedy-Mills universal Medicare bill in 1974 but for (oddly enough) opposition from the AFL-CIO who wanted Kennedy’s original Medicare for All (to use modern parlance). As ex-SSA chief Robert Ball explained in a 2001 interview:

“The Kennedy-Mills Bill came about as follows. Nixon had proposed a health insurance plan that provided benefits, health insurance benefits I’m talking about, national health insurance benefits, but through a subsidization of private insurance, which has now gotten to be, a popular approach again. Because I wanted a government program, operated by the government, I didn’t like the subsidization approach. I took the same amount of money that Nixon required for his plan, the same amount of government money that Nixon required for his plan, and instead said, “Well, let’s just take that and do what we can with that amount through a regular, traditional, old-fashioned Kennedy-type national health insurance plan… the legislative guy for the AFL-CIO, says, “We don’t want to take half, we want the whole thing and we can get the whole thing next time.” So they won’t support it… So it just doesn’t really go anywhere for that reason. And I’m sure, the leadership of the AFL-CIO is pretty sorry about that.

http://www.ssa.gov/history/orals/ball1.html

Nixon is on video working with staffers to “invent” GMO’s…a way of channeling healthcare $$$$ to privatized profit$…

If you are going to index the minimum wage, you shou consider indexing it to CEO compensation, Bankster compensation or Congressional compensation/pensions.

Build a fence along the border and let real Americans organize! Yikes! Throw in nationalizing GM and free gas and ammo for every first born.

Illegal immigration can undermine working conditions for all Americans. It can’t be prevented by building a wall. The answer is to prevent employers from employing illegals on a large-scale and systematically attacking benefits for legal residents. This may require harsh measures directed at employers, not at illegals crossing borders.

Furthermore a simple citizen registration requirement would work wonders. This would require all residents to register with municipal authorities when they change residency, i.e. move to a new town. Those who do not register do not get a drivers’ license, do not get social services, do not get a bank account.

Open the borders wide open – capital floweth freely, so should labor. Article 13 of the Universal Declaration on Human Rights. Closed borders protect the interests of ruling elites. Pan-American union yes.

Could someone please send this piece to Mish Shedlock?

He won’t care. He has blinders on when it comes to the value of labor. There are no blind as those who will not see and for Mish, capital matters more than labor, there’s not even a whiff that maybe they both might be equally important.

Ideology has closed his mind on the topic.

Agreed. Peter Schiff suffers from that same disease; it’s not limited to Americans but they do seem far more likely to be suffering from it. All that free-market, pro-business, anti-labour Kool-Aid from the cradle on, it’s hard to shake it loose I guess.

That Bernanke speech in full

1. Long-term economic growth…(teee heeee)

2. Are we Japan???… Noooooooooo

3. Doh what happened to the recovery???

4. We have bailed out the banks and allowed them to stumble into some option ARMs (shome mishtake surely ed.)

5. Dem bloggers wuz right…

6. We shot our load fueling the housing bubble…

7. It was dem wot done it….

8. We are strongly influenced in our outlooks by changes to wrong outlooks ..

9. Carry trade anyone?

10.We are thinking about some some new fangled obscure thingy it will take you time to figure out…

11. I still luv the house builders….

12. ….you all gonna die…but should party on before your final appointment with our bloated healthcare system

13. ….I knbow some of you spent some time at Esalen

14. you peeps just have no idea how to plan…

15. When’s someone gonna clean up our mess… its gettin embarrassin’…

16. Sayonara suckers!

I do think that it is not just the problem with the lost bargain for workers; it is the lost demogratic process of being able to elect someone that has the ability, courage and integrity to go after those corrupting entities.

We have to find our way back to the RULE OF LAW

http://scare2012.blogspot.com/

“Rule of law” requires transparency, oversight, accountability..all missing since Bushit…in which Obama is wallowing.

Truth is the issue..

Those pesky internal contradictions. The conventional economists are finally starting to see it, even though they prefer to call it a “liquidity trap.” At least Roubini had the honesty to say that “Marx was right.”

You know the realization that we’re in deep shit is hitting when Bill Gross comes on CNBC and says that the government must start providing jobs for the unemployed. After the interviewer picked his jaw off the floor, he asked, “Do you mean something like the WPA?” And Gross said, “Yes.”

And Gross said, “Yes.” Goin’ South

The actual reality is that the US population is not owed meaningless jobs but actual MONETARY COMPENSATION for the looting done by the government backed usury and counterfeiting cartel.

Even Bill Gross can figure out that a consumption economy depends on the people having money. I know capitalists are supposed to cheer every round layoffs, but some of them are finally starting to wake up to the fact that the dollars in their pockets come from consumption demand. That consumption comes from people with jobs that put money their pockets to spend.

It really isn’t rocket science.

It’s the trickle-up theory. Also known as a rising tide lifts all boats.

Gross’ Total Return Fund has been net short US treasuries since April. So of course he would like more gov spending and more inflation. It would make his short call look good. The opinions of money managers (like Gross and Buffett) should come with asterisks.**

**This is just Maximilien’s opinion and he may be long treasuries.

It all goes back to the money system – a government backed and enforced counterfeiting cartel. Without that then it is likely that corporations would be largely owned by their employees and any productivity increases from outsourcing and automation would accrue to them too.

Aren’t foreign competitionvand less union rights supposed to help the economy, as argued by Adam smith and Milton Friedman ?

This is exactly what I was talking about last year in “Rise of the Machines”:

http://www.wcvarones.com/2010/07/rise-of-machines.html

But most prescriptions from the left would seem to make the problem worse: more unionization, more rigid and expensive labor, more open-ended liabilities for every worker hired. All that only accelerates the incentives for offshoring and automation.

Funny you say that because we had great periods of economic growth coupled with higher rates of unionization after World War II.

Also, the Powers That Be don’t have to allow corporations to offshore. Corporations can also suck it up and be team players, but they won’t do that because they’re greedy scum.

Corporate America and their criminal politician lackeys are brewing a storm and don’t even realize it. They’re too busy sipping their champagne from fine crystal glasses to even notice.

People like you are odious.

I’m odious because I’m a realistic observer of economic trends?

Funny you say that because we had great periods of economic growth coupled with higher rates of unionization after World War II.

Yeah, we didn’t have robots that could do everything back then either.

Also, the Powers That Be don’t have to allow corporations to offshore.

Smoot-Hawley much? Read Jared Diamond on trade and civilization.

Corporations can also suck it up and be team players, but they won’t do that because they’re greedy scum.

In this hyper-competitive environment, corporations that hire large, expensive, unionized labor forces would quickly be out of business.

I’m not saying it’s a good thing. It is what it is. If you’ve got any new ideas, I’m all ears.

How peculiar. You chastise all criticisms of the way globalization is being brought to us by TPTB, and then you ask for alternatives. Trust me: the US is not required by law to actually reward companies for outsourcing; yet it still does so. It was not required to sign NAFTA, but it did so. It could’ve written a different NAFTA (or WTO) treaty, but it did not. All of these things (and many others besides) happened specifically in this way to create such a ‘hypercompetitive’ (which, oddly, only seems to lead to more oligopolies forming) environment. It has nothing to do with some kind of necessary truth that globalization has to happen at the rate it’s happening.

“Realism” is fine, but you don’t seem to recognize the political nature of the economic choices being made.

Also: Jared Diamond is a hack when he talks about modern societies. If you read his books, you come away with the idiotic belief that Africa is doomed because of the force of the environment acting upon it, rather than because of the very specific history of 400 or so years of exploitation by the West. Ever see him take the latter fact seriously? I know I haven’t.

Sure, trade agreements could have been done smarter or slower, and that could have been a good thing.

But the bigger problem for labor is automation. We just don’t need people to do lots of stuff or make lots of stuff they used to do. Wal-Mart crushed Mom & Pops, and now Amazon is crushing Wal-Mart. You think Amazon employs as many people per retail sale dollar as Mom & Pops did fifty years ago?

The post office is on its way out as nobody needs paper mail hand-delivered any more. Financial services operations staff are being laid off as their jobs are automated.

Meanwhile, no new huge labor-intensive industries to replace all these jobs are on the horizon.

Are we to start a new Luddite revolution smashing the machines?

Foppe said:

“Are we to start a new Luddite revolution smashing the machines?”

The unemployment problem caused by “machines” was solved by C.H.Douglas in the 1920’s.

http://en.wikipedia.org/wiki/Social_Credit

I have heard that John Maynard Keynes was very influenced by the ideas of C.H.Douglas. Keynes ideas are very much consistent with Douglas’ ideas but C.H.Douglas goes much further.

Mansoor

Ain’t Capitalism great? Human ingenuity advances technology and potentially eliminates a lot of dangerous and/or drudging work, and that becomes a survival issue for workers.

Rather than sharing the benefits of these technological improvements, a few Capitalists reap all the benefits and throw millions onto the street. And of course, they hide behind government patents to protect their rents, all the while genuflecting to the Holy Free Market.

Not just capitalism, technology is a huge part of that. Society has been cleanly divided over the past 10 years into the technologically literate and everybody else.

Aside from entertainers and sports stars, there are very limited opportunities for those who aren’t dialed in to technology to make any serious money in the future.

As you mentioned, technology is eliminating drudge work. Skills which used to require physical labor and craftsmanship are done by computer and robot now. The chances for an average person to make a living wage and raise a family on have dropped significantly. This creates a permanent underclass.

I recently read an (unsourced) stat in Eisenstein’s “Sacred Economics” that at the end of the 19th century it took about 10 human hours to produce the necessities, whereas today it takes but one. We don’t need human labour the way we used to, and this is speeding up. We can’t stop it, nor should we want to (in the right socioeconomic framework). Something has to change, and deeply, or this process will tear society to pieces (it is doing so already, but will get much worse).

Mansoor mentions the social dividend, which I think is an essential part of the solution. A number of parties in Germany (Greens, CDU, SPD and now the PSG) have it one their programme in one form or another, or are discussing it seriously. The idea (Grundeinkommen) has big gun support from the business community too. Martin Luther King was strongly in favour. Dignity must no longer come from waged labour, it can’t anymore. More and more work and belonging to one’s group must be about contributing to that group in some area one is passionate about. The rewards will be belonging, dignity and stronger community, and far less consumerism-related bling and glitter. Money needs to be seen as that which enables or frees us to contribute to or work for society in the best way we are able, rather than as something we have to work ‘hard’ to earn. Humans want to contribute, want to feel needed. Hence depression and despondency when they can’t.

China mandates that any foreign company wanting to utilize its rare earth minerals must invest in factories within its borders. Perhaps if US pols approached “free trade” the same way Chinese pols have done, unemployment would be much lower.

A large labor surplus is a perfectly predictable outcome of automation, we’ve had some version of this since the 30’s. The last time we dealt with it by pushing women, children and seniors from the work force and by lowering the work week and in a bunch of other ways.

However the easy choices are long gone, we can’t keep young people out of the work force too long or the educated class won’t reproduce (c.f a lot of places right now) , women are not going to stop working and no one wants to pay for 25 years of retirement.

What we might try is social credit instead. Just take a large percentage of the economy and redistribute it directly as cash and indirectly as medical care and be done with it.

This will require immigration controls and a host of changes but they are doable.

If we wish to also lower the work week and such, we will have to pay more for services of all sorts. No more cheap eating out and a host of other things will need to change. People are not going to like this but given the alternative may well be a consumption drought, chronic instability and a situation where the most desirable citizens have the fewest offspring, its still the best choice.

And to those reading, we have a societies been taking advantage of people’s poor reproduction habits, religious impetus and lack of birth control options for centuries. That freeloading is not going to work, if you want an educated populace and a modern state or if you you have to pay for it.

Wage depression was always the goal – fine but how does this benefit the fat cats in the end? Driving wages down continually also depletes your potential market of buyers for your products, no? This means that the wards have taken over the asylum indeed. The sagacious stratagem of setting up Foundations and Think tanks and Freshwater economic departments with the express purpose of shilling for the rich has become a tad too efficient it seems. At the right moment when they needed to remember the old Keynesian macroeconomics they discover that they have thoroughly forgotten what it was. Sandwich in hand, no mouth to put in situation! Hilarious!

PaulArt Said:

“also depletes your potential market of buyers for your products, no?”

Too many high earners focus far too much on “accumulating” bank balances or “investing” and complaining about “high taxation” but don’t understand the simple truth that is:

The purpose all production (or production capacity) is consumption.

They don’t (in general) view the economy as something that always balances supply and demand (in aggregate). They don’t understand that low (aggregate) demand means lowered value of their investments. Accumulation of dollars becomes a goal in itself and they don’t see the relationship of these “accumulated dollars” to the large society they live in.

Mansoor

with the exception of multi-national prime exporters -the condition you are pointing to will reduce income for everyone – in the chain of supply of goods and services –

they are now conditioning people to reverse the process of converting “desires to needs” – going foward steadily we will be converting needs to “i dont really need that” – this conversion wil affect the “culture” of consumption not just temporary demand – even those with considerable disposable income will be effected with change in attitude – then as this process takes hold the small business people – guys that own 3 jiff lube outlets or whatever service or distribution business somewhere and think they are rich and concerned with not paying the last 5% of their taxes – will see demand drops of 25% + which is the difference between making money and having a significant loss –

the impact at this level will be the most pronounced – but since many of these people are tea party or republicans – the change in the polticis will be most interesting within the next three years as it all plays out

without transaction “turnover” – velocity of money – the whole system will become uglued – especially for contract lawyers / litigators / accoutants / administrators of all kinds – white collar

the spiral down is now accelerating far beyond the blue collar manufacturing base that was nailed 15 years ago with GATT

“also depletes your potential market of buyers for your products, no?”

No problemo – When you control the state you just order the state to buy your products/services and charge the taxpayers accordingly. Many taxpayer-supported businesses now skip the “product/services” part entirely, it is inefficient, apparently.

Why would the real players care about saturated markets here in the US when there is an emerging middle class wanting better living standards cropping up in several of our trade partners. Mexico, India and China are all emerging markets with growing middle classes.

For how long can we expect 5% of the world’s population to consume more than 20% of the world’s resources just by using its inflated money?

I just don’t see how countries with more than 300M people can stay competitive and honest.

“Wage depression was always the goal – fine but how does this benefit the fat cats in the end? ”

The main goal of the rich is winning the game, which is about the relative position of the players, not the value of the high score. The rich already have so much more than they can meaningfully consume. By impoverishing the middle classes they gain relative status, power, and (until the revolution) security.

It’s no fun flying first class if everyone else can.

Michael Kimmel writes about three historical shifts of male roles from the late 18th century, early 19th, and the last which is the current role. The first two identified as the Genteel Patriarch; land ownership, rules his rural estate, family oriented, and virtue; think Thomas Jefferson. Next, the Heroic Artisan; Urban craftsman/shopkeeper,family and community active; think Paul Revere. Both lived in causal accord, supported participatory democracy, and individual autonomy within the context of their time.

By 1830’s the casual symbiosis was shattered with the emergence of Marketplace Man. This current male type derives his identity entirely from his success in the capitalist marketplace. The primary goal is accumulation of wealth, power, status, and possessions. Today’s Marketplace Man has radically transformed Capitalism into a sport. It’s only about winners and losers. They don’t see much less care about the laborers as they are the subordinates that are a dime a dozen. The laborers and consumers are not competitors in the power games.

Marketplace Man’s primary focus are the opponents who are his peers. All are dominant players. And in highly competitive sports games the goal is to demolish the opposing team. Winner takes all. Marketplace Man sets his sights on the trophy. His definition of masculinity is dependent upon the acquisition of power, status, and tangible goods as evidence of his success. The good of society, morals, character, integrity, and honor are for the chumps. It’s all about who wins the game.

“He who has the most toys when he dies wins” Robert Brannon

Another big “elephant in the room” ignored here: multinationals must adhere to national laws regarding the firing of workers. In Europe and much of Asia this is very costly; in the US there is no penalty. So where will corporate make cuts? There or here? It’s a no-brainer.

American workers have no protection, therefore they have a target on their heads in any downturn.

Linked.

Should we keep all the people at home for 8 hours a day watching TV? Perhaps we should lock them up, because we know that doing so is profitable. That of course, is pathological. But you’ve espoused the elite argument and it comes closer to Stalin e’ery year. Obama, the kleptocrats’s point man, gets Immelt appointed and tasked to get Americans back to work. Just cannot make this sh$t up.

Share prices have been maintained because of speculative liquidity provided by the Green-nanke crew at the FOMC. Plenty of companies with cash and single digit PEs now trade at double and triple the price of a couple of years ago with little growth.

This is nonsense. It isn’t about share price but walkaway pay packages and CASH.

The proof is debt. The VAST majority of companies deficit spend. They are all ponzi-ists extraordinaire. If they were concerned with the fundamental health of their companies, they would run surpluses and return profits to shareholders. Many don’t even pay dividends! Look at Amazon etc.!!! And workers no longer have pricing power because of cheap overseas labor.

The groundwork is being laid for the next period of major upheaval. Make no mistake.

If they were concerned with the fundamental health of their companies, they would run surpluses and return profits to shareholders. Mike C.

Wrong! Dividends are a waste. As for borrowing from the counterfeiting cartel that makes sense too from the corporation’s viewpoint. If they don’t their competitors will.

It ALL goes back to the filthy government backed and enforced money monopoly for private debts.

Does anyone really, I mean “really”, “really” believe that that adherence to “free market” ideology will magically (by invisible hand) produce the best that can be done to solve all the world’s economic problems ? I don’t see evidence of this. Of course I also don’t see evidence of a particularly “free market” either. I do see evidence that the US happens to occupy naturally blessed land mass with the most navigable rivers with the most arable farmland, with an incredible trasportation system, the most ideal climates, and natural borders for security. I see the economic success of the US as being due to to this, more than to “free market” ideology. Success in the US was pretty much a no-brainer. Imagine what the Chinese or Japanese could have done with the US section of the North American Continent. Canada just doesn’t have the climate or dirt, or transportation or weather. Neither does Mexico or Brazil or Russia or africa or I honestly think an awful lot of folks are misguided and fooling themselves trying to apportion responsiblity for past US economic success to the “system” rather than to being just plain fortunate in terms of available resources.

All the QE or Fiscal Policy in the world is not going to change the weather or create better soil or more rivers or topography or more oil-coal-gas, or any of the natural blessings the US has. China has 5x’s the population and 20% of the farmland that the US has. I’d like to see more realistic discussion that more fairly assigns the benefits of different economic strategies. It’s an obvious fact that economic theory is secondary to reality and that reality does not spring from any economic theory.

I can understand concerns about fairness in distribution of worldly benefits and consumption, but here we (US Citizens) are in posession of the best real estate in the world and our ridiculously wasteful standard of living reflects that.

I personally see that our ridiculously wasteful standard of living is a result of economic ideology rather than human greed. Corporate Greed, is a different animal.

I see the economic success of the US as being due to to this, more than to “free market” ideology.

——–

Vast expanse with small population. War in Europe and US helps rebuild. Now over 300 million people to feed, dress and house but all the land is already owned. Just like Europe one hundred years ago.

The US has become what the colonists left behind.

I saw a comment about Luddites and I think there’s something to look at there. The existance of the Egyptian Pyramids is clear evidence that Egypt once had a significant excess of labor. I think 80% of the population worked in agriculture, where in the US, I think the figure is 3%. I’ve always “built” and “fixed” things in my life and I’m currently engaged in a guitar building project. This is an economically stupid thing to do because I can buy a guitar that’s better thatn anything I’m going to be able to build (at the moment). Technology and the economic system has made incredible quality “stuff” available “cheap”. At the same time, technology and the availability of cheap (good) “stuff” has robbed people of the ability to create for a living – Oh; don’t bother building that, you can just go down to Wallmart and buy a better one for less than it will cost you to purchase materials, and besides, you could be playing video games, texting on your iphone, or playing golf, or making more money to spend on other quality built “stuff”. I’ve actually had my Redwing wrokboots resoled, but in general, it’s cheaper to “recycle” the old ones to the local landfill, and buy new stuff cheaper. Cobblers and shoe repair shops are pretty much gone. I marvel at the craft and skill that went into thoe old Victorian homes in San Francisco – carpenters won’t be developing those skills or have the oportunity to use them (unless they work for Larry Ellison) They’ll mostly be building pretty generic, repetitive, uncreative stuff. What is the definition of “quality”? (Zen and the Art of Motorcycle Maintenence?) What activities give life meaning?

m currently engaged in a guitar building project. This is an economically stupid thing to do because I can buy a guitar that’s better thatn anything I’m going to be able to build (at the moment).

——–

I garden, knit and sew. Everytime I work with my hands I realize how much entropy is in the system and how much our lifestyle is due to oil.

Good on you, keep doing it. That’s what “work” is, not what we’ve been told it is. And if that sounds cryptic, consider the fact that Americans who did the bidding of their corporate pay masters are up to their eyeballs in debt and losing their homes. Run with the hobbies, that’s as honest and healthy and liberating as one can get.

I look at it as a mixed blessing because I’m not really suited for a tribal lifestyle.

I’m not either. I need to be self-sufficient. Some people need the comfort of the tribe. Some of us want to live on the outskirts and interact with the tribe when we choose to.

Long story short: Bernanke was absolutely right in Jackson Hole. THe Fed can’t do much, it is the job of the politicians to remedy the problems.

I’m not naive enough to think for a moment they’ll do anything that would displease their Masters. As Stoller wrote in his post today:

Which means workers themselves will need to take matters in their own hands.

It will require savvy, patience and a hefty dose of virulent activism. The alternative is destitution, poverty and fascism.

Re: “the benefits of GDP growth, which used to go mainly to labor (via increased hiring and better wages) now benefit capitalists fare more than ordinary workers.”

There’s a basic problem in talking about GDP (Gross Domestic Product) and it’s that there is no longer any such thing as the “American economy.” The capitalists are causing “increased hiring and better wages,” but not in the US. If you want to find those 10.4 million missing jobs, look in Asia.

There are 2.4 billion people in India and China and their lives are getting better. What was China like thirty years ago and what is it like now? “To get rich is glorious” said Chairman Deng.

I worked for JPMorgan Chase in 2002 when the bank was first establishing offshore programming sites and data processing sites in India. At that time, an fully-qualified Indian programmer could be hired for 30% of what it would cost to hire an equivalent programmer in the US. It’s a global market and US workers are priced out of the market.

It does no good for economists such as Robert Gordon to say that greedy capitalists are the problem. Haven’t socialist-minded academics always been saying that? Are they greedier now then earlier? Marx denounced their greediness 160 years ago.

All of the economic discomfort and malaise in this country is due to “creative destruction” as described by Schumpeter. The reason that Americans are so upset is that they are now the ones being destroyed while others, such as in Asia, are creating and prospering.

Creative destruction is just a cowardly way to depersonalize the depredations of the rich on the rest of us.

It is the thesis of many here that, in fact, things are different this time around. While greed has always been with us as well as corruption in government, we have never seen before the institutionalization of these into a real kleptocracy. This didn’t happen yesterday. The kleptocratic construction has been going on for 35 years. It has been responsible for thefts and frauds in the multi-trillions greater by far than anything we have ever seen in history.

As for US workers being priced out of the market, that is based on two fallacies. The first is that the price of foreign labor is not accurately “priced” because it does not take into account environmental costs and the costs on labor stemming from its abuse in developing markets. The second is the concept of the market itself. The markets that we have now are rigged constructs run by and for the rich. No surprise that they don’t serve the interests of ordinary Americans.

“India. At that time, an fully-qualified Indian programmer could be hired for 30% of what it would cost to hire an equivalent programmer in the US.” Yet, there’s a limited supply of those qualified, employable programmers. Many businesses that have outsourced complain that despite India’s large pool of skilled labor, employable programmers are not easy to come by. I tend to believe this because it explains why wage inflation is higher in India and China than the developed world, yet consumption has remained flat. This is probably because the prevailing wages in India and China are below subsitience.

“There are 2.4 billion people in India and China and their lives are getting better. ”

At this time, I bet only two hundred and forty million of them will actually tell you that their lives are getting better if you polled them. The vast majority fall under the Iron Law of Wages. The vast majority will never reach a Western standard of living because it is physically impossible for 2.4 billion people to consume as much as as a few lucky millions in the developed countries.

The pursuit of acquiring enough food, clothing, and energy to survive is one thing, the pursuit of wealth is a zero sum game because acquiring wealth means acquiring more than what is needed. Historically, it was seldom achieved honestly. Extortion and usury were how most people became wealthy. Asia’s “competitibe advantage” is overpopulation; a large number of people willing to do anything to escape poverty and hunger.

“I worked for JPMorgan Chase in 2002 ”

That explains everything. Only at JP Morgan can fierce competition for limited resources in a zero sum game situation be turned into something less ominous like “creative destruction”.

I’m sorry, “. Asia’s “competitive advantage”.

This article uses the employment-population ratio to analyze jobs lost. But you need to go the labor force-population ratio to study the number of jobs needed. Based in part on this, for July, I calculated the number of disemployed, that is those unemployed and under employed, at 29.2 million, for a disemployment rate of 18.2%. This is not to contradict anything in this piece but just to point at another dimension of the problem.

My formative experiences on this were not as capitalist but as manager. With fear and trembling, we laid off whole departments at one company I was catapulted into as a young manager. To our relief, to our astonishment, the result was that all our problems diminished, and as we persisted, vanished.

We had not seen it clearly at the time we started the program, but the problem was simply that we had too many staff. We could afford to pay them. What we could not afford was to have them come in and work. And work they did, and as they worked, they made work for everyone else, and the result was like swimming through treacle.

I well remember asking one junior manager, if he had to take over the work done by a department with some – 50-60 people in it, how many more staff would he need. He came back to me later in the day and said 3. We swallowed hard and did it, and he was right.

The problem is partly bargaining power. But the problem is also overmanning is a total disaster for everyone. Look at the history of Japanese cars in the US. Its the story of quality, and because the main point of automation is to increase quality, its also a story about entitlements and overmanning. British manufacturing has had many of the same stories – overmanning leading to poor quality, and the source of the overmanning was usually a refusal to automate or do process improvement, because it cost jobs.

The classic is Rover of course. They had to kill the company as a result of their frenzied efforts to ‘save jobs’.

We do have a horrendous problem, looting by the managerial elite at the expense of shareholders and salaried staff. It too dooms competitiveness. I do not know what the answer is. But having more people working than a company you need is not part of the solution, its part of the problem.

My humble suggestion would be to invest some of your time reading “Sacred Economics”. A lot of solutions and recommendations in there; radical ideas, but the situation demands radical.

There are ‘lights out’ factories in Japan; no human workers involved at all. And really, we have hardly even begun. If humanity really put its mind to it, reduced consumption, reoriented its raison d’etre so to speak, we’d ‘need’ hardly any human labour at all, not in the production of the basics anyway. Why should we invest so much energy flogging this dead horse? Because shelling peas or packing meat is such dignified work? Because consumerism is so very beautiful? Or because the elites are looking forward to massive societal breakdown? Radical change is the only possible way forward.

Radical change. “Forward”

Forward ~progress, as in the modern sense of the word with a capital “P”. What would this “Progress” look like?

Once the coal runs out and oil runs out, all that automation will come to a standstill and we would have to imagine that the people dealing with that situation would be more spoiled and entitled then many who are excused from work now. I mean, work is already a privledge and not a right. Imagine how much more ingrained that would be in a future where all work is automated? I can already see whole crowds of people fainting at the thought of using a plowshare.

Look, the thing is, humans aren’t just competing with machines for jobs. Humans compete with machines for resources as well. Machines use more resources in their entire product cycle than a human. Has anyone quantified how much water factories use? If fossil fuels supply wasn’t an issue and automation increased exponentially, humans would be “urbanized” to the point that cities would resemble factory farms. People would be wondering where all the land and wood went, and why getting a glass of freshwater was more difficult to obtain than an antibiotic.

Also consider, the 1980’s gave us the return of the “efficiency argument”, and the great age of rollups, M&A began. Greenspan and Friedman and Reagan have thrown up a surge of monopoly. The artisans are gone. Disruptive, innovation encumbered. Farmers pay ransom to Dean Foods and Monsanto and Walmart. Many of our top companies today benefited from the anti-trust of the 1970’s.

I went to find one of my favorite counter examples – PBM Products. A rapidly expanding baby formula and nutritional company, and well:

Recently, Perrigo, the largest manufacturer of OTC Store-Brand Pharmaceutical products, acquired PBM, a large producer of store-brand infant nutritional products.

http://www.pbmproducts.com/about-us.aspx

They’ve even taken Paul Mannings story down! He has two children with type 1 diabetes. He expanded his diabetes formulas to private label and he won significant shelf space across major retailers. His competitors lost a number of court cases against him. He donated some of his profits to research. The story would make an amazing HBS case.

Barely readable. But pretty good up until the IS-LM rubbish at the end:

“The spending decomposition shows that fiscal policy has failed in that the government spending sector has made the output gap shortfall worse, not better.”

Repeat after moi: “Correlation is not causation; correlation is not causation”.

No mention of out-sourcing?