Yves here. As someone who does not see in three dimensions, the headline metaphor breaks down for me, but it is still a good attention-getter.

By Izabella Kaminska, a former banker who writes for FT Alphaville. Cross posted from FT Alphaville via New Economic Perspectives

We’ve discussed MMT’s recent foray into the mainstream, and the confusion it has consequently courted.

But that’s the funny thing about the theory. It is naturally divisive because most of the time it fails to communicate its message succinctly. Which is weird, since the premise is actually fairly simple to understand. We’d say it’s akin to looking at an autostereogram. Once you get it, you never see things quite the same way again. But at the same time, try as they might, some people will never be able to see the image. Ever.

And it all rests on one key fact (at least as far as we can tell!) . Rather than treating money as an object of wealth or somebody else’s debt, a means to trade … MMT treats money as a claim on wealth, a product of trade.

This one view makes all the difference. Unlike the first viewpoint, which assumes that debt and money came out of trade, MMT believes debt, or more specifically monetary credit, pre-dates trade. Coinage and all forms of monetary token are thus just a physical representation of what is actually an innate credit system. In and of itself, money — the token — has no value. And this is largely why a fiat monetary system can work. The monetary unit doesn’t need to be a ‘valuable’ piece of metal. It’s who guarantees the token that matters. In modern times, that means the state.

What’s more, suppress the credit system (which in the case of the United States is represented by the government’s debt) and inevitably you suppress an economy’s ability to trade. And this, by the way, is why MMTers believe government debt can never really constrain an economy whose government controls the official currency. Furthermore, this is also why in a time of crisis they believe you need moregovernment guarantees, not less — hence their support of higher debt limits.

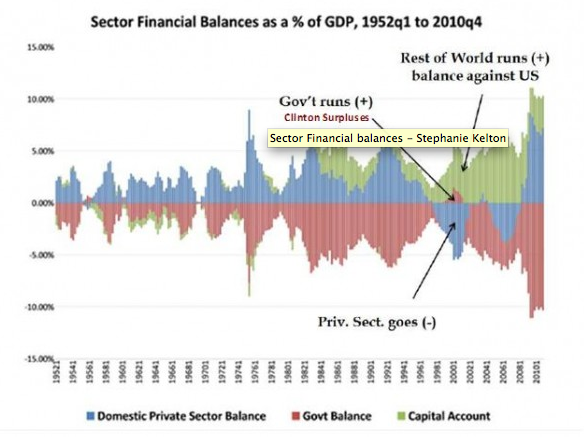

If one chart sums up the theory best we think it’s this one from Stephanie Kelton:

What the chart demonstrates beautifully is the symmetry that applies to the balances of a centrally controlled credit system.

That’s to say, for the US domestic private sector to carry a positive balance, the government must in effect carry a negative balance.

This makes a lot of sense if you think of the United States as representing a completely self-contained credit system, where only one official government controlled currency is allowed (and no foreigners can buy US debt). If the economy is to be kept well lubricated and functioning, the government must be willing to take on more debt on behalf of its citizens when the situation calls for it. Think of it as the private sector positve balances (or savings) representing claims on goods and services which haven’t as yet been redeemed. If not for the government’s negative balance, these claims would be represented by billions of private negative balances instead — representations of debts/credits between individuals. Money earned, and taxed, but not yet redeemed. Everything from your right to redeem a dozen baked rolls from your baker one day in the future, to your right to claim 10 days worth of medical services from your local doctor.

Allowing the government to take on those debts/credits (and really we’re talking more about credits) in place of your counterparties allows for claim standardisation. This not only ensures claims can be redeemed more quickly, having a greater wealth effect on the economy, they can also penetrate the system more completely. Furthermore, they are given a state guarantee in place of a private guarantee.

No more is there a risk that the doctor’s services you earned (by fixing the boiler at the medical centre) are lost because the doctor in question has passed away. You will still be able to redeem the services due to the intermediary role played by the government. Your claim is now against the government, not the doctor. You can thus redeem it with anyone who feels inclined to settle transactions with government paper instead of private paper. And why wouldn’t they? Everyone, after all, has a use for official government currency since it’s the only payment unit which will be accepted for the settlement of tax bills — a.k.a the government’s redemption of the claims it has against you.

In a way, the government, via its debt issuance and willingness to take on negative balances, acts as the ultimate central counterparty, clearer and intermediary to the trillions of transactions and trades that take place in its economy every day. The system’s claims against counterparties (of lesser credit quality than the government) are transformed via the financial framework into claims against the state. This is achieved either by convincing those with positive claim balances into signing them over to the state (via debt auctions) or by having the government “spend” on services directly, creating entirely new claims in the process that then circulate through the system.

Taxes, meanwhile, reflect the government’s own ability to redeem the claims it holds against you, generated in the first place by spending on your behalf.

The budget surplus issue

Of course, if the government runs a budget surplus, and receives more tax receipts than it spends — things can get tricky. Some believe surpluses are actually the equivalent of eating away at the stock of wealth in the system. That’s to say, worse than mere monetary tightening.

That’s largely because there are limits to what the government can do with the surpluses. For example, it can use them to pay down existing government debt (by buying back securities), or to borrow less in the new budget year. Alternatively it can offer more tax cuts, or deploy the surpluses into foreign or private investment securities (a la China).

This, though, is dangerous territory for an economy which is already suffering from a shortage of safe assets already (safe stores of value). That is to say, an economy which has generated more claims than it is currently prepared to redeem.

John Carney at CNBC’s Net Net, for example, has explained the problem as follows:

More importantly, even when it isn’t wasted on stupid government projects, the surplus itself is a waste. If it bothers you that the government spends tax money on bridges to nowhere, you should apoplectic when the government takes tax money and spends it on nothing at all. That, of course, is exactly what happens when our federal government taxes more than it spends. The financial assets of the people are simply confiscated.

But more to the point, if the government runs a surplus, it stands to reason that the private sector has to take on a negative balance in exchange, (see Kelton’s chart once again).

Though, if non-domestic claims against the government enter the frame things get even more complicated still. The debt which was originally intended to help mediate the credit transactions of its own citizens is sucked out of the system entirely, forcing the private sector to mediate transactions with non-government securities (and thus more risky guarantees) instead.

The more demand there is for US government securities from abroad, especially in an environment where the government is not willing to generate additional debt, the more the private sector’s negative balance is forced to rise to compensate.

This, by the way, is a situation we are now arguably seeing in Australia.

The MMT response, of course, would be simple. Issue more government debt and let the government take the negative balance, not the private sector.

That’s not to say, however, that there is never a constraint to debt.

It is possible that the state ends up guaranteeing many more claims than are actually possible to redeem — like with our doctor’s example above, because the counterparties who issued the credits are no longer around to make good on them. In that sense a fair share of the claims circulating through the system routinely represent a surplus. As that share rises, the purchasing power of active claims is reduced, since there are more claims than available redemption options. This will naturally be inflationary, and calls for the government to limit the amount of credit stock in the system, which can be achieved by taxation.

So the question is, which situation are we in now? One where there are more claims than redemption options (capacity to satisfy claims) — thus the rush for safe stores of value, of which there are not enough to guarantee everyone’s claims — or one where there is enough capacity to match claims, but not enough government credit to lubricate the system?

Hard to say, really (presuming you buy the MMT view in the first place).

“If one chart sums up the theory best…”

Agreed but its worth noting whose idea it was, Wynne Godley.

More fundamentally, the budget balance is equal to the difference between the government’s receipts and outlays, but it is also equal, by definition, to the sum of private net saving (personal and corporate combined) plus the balance of payments deficit.

If the private sector decides to save more, the government has no choice but to allow its budget deficit to rise unless it is prepared to sacrifice full employment; the same thing applies if uncorrected trends in foreign trade cause the balance of payments deficit to increase.

http://www.guardian.co.uk/business/2005/aug/28/politics.comment

To me its obvious there is vast excess capacity due to the massive unemployed labor pool, now over 20% according to shadowstats, and not enough cash amongst those who would actually spend it. How is this not obvious to Miss Kaminska?

I am WAY overdue in debunking this “scarcity of safe assets” crap.

It is NOT end investors who are eating these good assets up. It is big honker trading firms who need to provide collateral for derivatives positions.

Yves, I know that you have a lot on your plate, but I would really appreciate a post on this sometime.

Many of the so-called “Left Neoliberals” have advanced the lack of safe assets argument, which seems prima facie correct given negative real interest rates on ten-year US bonds, without examining what is causing such a demand in the first place. If it is indeed collateral for derivatives this changes the ballgame a bit, doesn’t it? That is, it would seem to be a direct manifestation of the shadow banking system in the ‘normal’ banking system…

Yves-

While I don’t doubt the role of trading firms using Treasuries as collateral, foreign central banks own about $4.5 trillion of U.S Treasuries, up about 12% in the last year and 30% in the last 2 (based on most recent data as of June 2011). There’s a total of $15 trillion or so outstanding including securities held by the Fed and intragovernmental, but that portion totals about $6.3 trillion and grew at 18% over the last year and 23% over the last two. So you’ve got nearly $11 trillion of a total $15 trillion in debt securities held by various governments around the world, including our own, and they increasing their holdings at a solidly double-digit clip. All other private holders, depository insitutions, and “other” own about $2.1 trillion combined, a pittance compared to global CBs. Even if we assumed that entire $2.1 trillion is held by trading firms for collateral purposes (a silly assumption), any impact of changes in demand is likely to be felt at the margin. It seems to me the scarcity of safe paper is due to aggresive buying by governments around the world, as opposed to demand for collateral against trading positions.

I’d like to know if there’s another way of looking at this, because this is how I’m interpreting the data.

http://moneyaswealth.blogspot.com/2010/09/best-political-quote-in-over-100-years.html

Best Political Quote in Over 100 years!

“If men can create electronic bookkeeping entries representing debt and loan them into circulation, men can surely create electronic bookkeeping entries as a payment and spend them into circulation with no debt. Which do you prefer?”

– Gregory K. Soderberg, Rep. Candidate MN. Lt. Gov., 2010

………..

http://www.monetary.org/intro-to-monetary-reform/faqs

1) Won’t the government creating new money for infrastructure and other expenses cause inflation?

No. While this is an important concern, some of it is anti-governmental propaganda and it need not cause inflation, depending on where the new money goes, for example:

When new money is used to create real wealth, such as goods and services and the $2.2 trillion worth of public infrastructure building and repair the engineers tell us is needed over the next 5 years, there need not be inflation because real things of real value are being created at the same time as the money, and the existence of those real values for living, keeps prices down.

If it goes into warfare or bubbles (real estate/Wall Street/etc.) it would create inflationary bubbles with no real production of goods and services. That is the history of private control over money creation. It must end now. Government tends to direct resources more into areas of concern for the whole nation, such as infrastructure, health care, education, etc. The AMA Title 5 specifies infrastructure items including human infrastructure of health care and education to focus on.

Also remember, the American Monetary Act eliminates ‘fractional reserve banking’ which has been one of the main causes of inflation. And remember new money must be introduced into circulation as the population and economy grow or is improved, or we’d have deflation.

2) How can we trust government with the power to create money? – Won’t they go wild (and again cause inflation)? Don’t you know that government can’t do anything right?

Two Points:

A. The U.S. Constitution binds government to represent the interests of the American people – “to promote the General Welfare” and empowers our Federal Government to create, issue and regulate our money (Article I, Section 8, Clause 5). We must hold our officeholders responsible to the laws. Do you want us to deny the Constitution? In favor of who? Enron? Bear Stearns? J.P. Morgan? Goldman Sachs? Lehman Brothers? Please get real! Our choice is to let those pirates continue to control our money system or to intelligently constitute the MONEY POWER within our government.

Under the American Monetary Act, the Congress, the President and the Board of the Monetary Authority will all be responsible if any inflation or deflation takes place, and the people will know that they are responsible. They are specifically directed to avoid policies that are either inflationary or deflationary.

Do you really trust the “ENRONS” to dominate our money? Look how they have abused that power! And Yes Damn it! Enron was on the Board of the Dallas Federal Reserve Bank!

B. Finally and most importantly, an examination of history, despite the current prejudice and massive propaganda waged against government, shows that government control of money has a far superior historical record to private control over money systems. See the AMA brochure, and the LSM, Chapter 16. History shows that government has a far superior record in controlling the money system than private money creators have. And Yes, that includes the Continental Currency, The Greenbacks, and even the German hyperinflation; which by the way took place under a completely privatized German central bank! The German hyperinflation is really an example of a private money disaster.

The Lost Science of Money book, chapter 12, uncovers the beginnings of the attack on government and found it started with Adam Smith himself in an attempt to block moves to take back the monetary power from the then private Bank of England, and put it back into government, which had done a good job in monarchical management of the money system, with only one exception under Henry VIII.

3) Why should we give the government even more power?

Because our money system belongs to society as a whole. It is too important to trust to unrepresentative and unaccountable private hands, preoccupied with private gain, with little regard for the detrimental consequences of their actions on the country, and outside our system of checks and balances. Just look what they have done!

4) How can we prevent government from abusing its power once it can create money directly?

The same way we prevent it from abusing any power, by upholding the rule of law and by participating in democratic political processes; and through reasonable structural limits.

5) Should we let private banks keep some part of the money creation privilege?

Absolutely not! History shows that the private interests, if given any privileged power over money, eventually undermine the public interest, and take over the whole thing. We know this from historical case studies in at least 4 major historical situations – the U.S. “Greenbacks”, The nationalization of the Bank of England, and the Canadian and New Zealand monetary experience. Anyone who proposes allowing the banks to keep any part of the power to create money are either ignorant of monetary history or are shilling for the banks.

Under the American Monetary Act we do have the best of both worlds. We keep the benefits of having the professionalism and expertise of a competitive banking system in the private sector, but we take away the dangers of having them dominate our monetary and public policies with their narrow short term profit focus, by removing their privilege to create money. Ultimately this is a question of morality. No such special privileges can be allowed to particular groups; especially the monetary privilege, which confers power and wealth on them at the expense of the rest of society.

6) Well then, should we nationalize all the banking business?

What kind of “Kool Aid” are you drinking and who gave it to you? The banking business is obviously not a proper function of government; but providing, controlling and overseeing the monetary system is definitely a function of government. No private party can do that properly. Markets have utterly failed to do that. They have concentrated wealth, have harmed the average American and now broken down entirely, except for assistance from our government. Who would keep money in banks today, except for the FDIC guarantees?

But banks should remain privately owned, because when reasonably structured, they perform very necessary functions, and can do it professionally and conveniently. Who within government would run the banking business? Bankers however, have nothing in their training, experience or their souls that qualifies them as masters of the universe – to control our society as the money power confers upon them.

Banks should act as intermediaries for their clients who want to get a return on a deposit or similar investment; and their clients who are willing to pay for the use of that money. But banks must not create the money. The money system belongs to the Nation and our Federal Government must be the only entity with the power to issue and regulate our money as the U.S. Constitution already mandates. We nationalize the monetary system, but don’t nationalize the individual banks. That would be a dangerous step towards fascism. Private enterprise is a powerful mechanism that can produce excellent results when properly structured and regulated. That is an important American “theme!” The AMA does not throw out the baby with the bathwater! But it most certainly gets rid of the bathwater, which is private money creation. That acts like a private tax on the rest of us!

We regard such nationalization proposals (nationalize all banking) either as an inability to understand the difference between nationalizing the money system and nationalizing the private banking business, OR as possibly attempts to actually block proper monetary reform, because you’d have to change the essence of America in order to do it. So it distracts from real reform. The AMA reform that we advocate actually puts into place the system that most people think we have now! People think our money is provided by government. They erroneously believe that the Federal Reserve is already a part of our government. They think the banks are lending money which has been deposited with them, not that they are creating that money when they make loans. Under the AMA many of those things people already believe about money and banking actually become true! It’s a natural fit with already existing attitudes.

7) Doesn’t your AMA proposal merely continue with a fiat money system?

Shouldn’t we be using gold and silver instead? Wouldn’t that provide a more stable money?

Our system is absolutely a fiat money system. But that’s a good thing, not a bad one. In reaction to the many problems caused by our privatized fiat money system over the decades, many Americans have blamed fiat money for our troubles, and they support using valuable commodities for money.

But Folks! The problem is not fiat money, because all advanced money is a fiat of the Law! The problem is privately issued fiat money. Then that is like a private tax on all of us imposed by those with the privilege to privately issue fiat money. Private fiat money must now stop forever!

Aristotle gave us the science of money in the 4th century B.C. which he summarized as: “Money exists not by nature but by law!” So Aristotle accurately defines money as a legal fiat.

As for gold, most systems pretending to be gold systems have been frauds which never had the gold to back up their promises. And remember if you are still in a stage of trading things (such as gold) for other things, you are still operating in some form of barter system, not a real money system, and therefore not having the potential advantages as are available through the American Monetary Act!

And finally as regards gold and silver: Please do not confuse a good investment with a good money system. From time to time gold and silver are good investments. However you want very different results from an investment than you want from a money. Obviously you want an investment to go up and keep going up. But you want money to remain fairly stable. Rising money would mean that you’d end up paying your debts in much more valuable money. For example the mortgage on your house would keep rising if the value of money kept rising.

Also, contrary to prevailing prejudice, gold and silver have both been very volatile and not stable at all. Just check out the long term gold chart.

8 ) How can a bank lend money if they have to keep 100% reserves?

The 100% reserve provision applies only to checking accounts. This question results from economists classifying our AMA as a “100% reserve” plan, as the Chicago Plan was known. But our plan fundamentally reforms the private credit system, replacing it with a government money system. The accounting rules are changed.

Banks will be encouraged to continue their loan activities by lending money that has been deposited with them in savings and time deposit accounts; or lending their capital that has been invested with them. It is in the checking account departments that the banks presently create money when they make loans in a fractional reserve system. This will be stopped by new bank accounting rules. Making loans from savings account is a different matter, because real money, not credit will have been transfered into such accounts, and loaning that out does not create new money or give the bank any seigniorage, that belongs to our society. Some money loaned out of a savings type account might later get redeposited into another savings account and again be reloaned, but its the same money, not any newly created money, and will reflect that way on the bank’s books. This is sufficient to solve the problem of banks creating “purchasing media” by loaning their credit which then functions as money in the present system. (for details see the wording on pages 8, 9, and 14 of the American Monetary Act at http://www.monetary.org/amacolorpamphlet.pdf)

Various types of accounts will have differing requirements: e.g. matching time deposits to loan durations, lessening the “borrowing short term and lending long term” problem. Money market and mutual fund type accounts can be very flexible. The principle applied will be to encourage good intermediation of money between clients who want a return on their money and those willing to pay for using it; but will prohibit money creation. Checking accounts will become a warehousing service, for which fees are charged. Good accountancy can achieve these results. (Please see # 9 below for more info on the many sources of money for these accounts.)

9) If banks are no longer allowed to create money, where will banks get enough money to fill client’s needs for money under the American Monetary Act?

We devote substantial space to this question because economists so used to confusing credit and money have to get used to the idea of money instead of credit. Usually they want to know how the AMA creates money within the present bank accounting framework. Well it does not! The AMA will change the accounting rules to deal with money not credit.

There will be several substantial sources of money for banks to satisfy their clients money needs:

a) Title III of the AMA converts through an accounting procedure, the existing credit the banks have circulated through loans (about $6 to 7 trillion, roughly the existing “money” supply) into US money, no longer bank credit. That process will indebt the banks to the government for the amount converted over and above their capital. At present when bank loans are repaid to the banks by their customers, those credits/debts go out of circulation/out of existence and the credit money supply contracts as loans are repaid, until they make new loans. But under the American Monetary Act, since it’s now money, those monies will not go out of circulation the way the credits did. They are repaid to the government in satisfaction of the debt the banks incurred in converting them from credit to money. That goes into a pool which can be used by Congress for the items in Title V of the AMA (as described on pages 8 and 9), or it can even be re-lent to the banks at an adjusted interest rate. Note: this action de-leverages the banks, but does not reduce the money supply.

b) Probably the most important source of funds for bank lending will be the continuing government expenditures, over and above tax receipts, such as social security and other payments by government on the items in Title V of the American Monetary Act. Also the engineers tell us that $2.2 trillion is now necessary to make our infrastructure safe over the next 5 years. That’s $440 billion new money per year. Also the health care and education provisions, and grants to states in Title V can be introduced as new money. ALL these will eventually be deposited into various types of bank accounts where provisions of the Act will allow this money to be lent or invested. The banks will be lending and placing this money that has been deposited with them; not lending credit they create, masquerading as money. They will have to compete to attract such deposits from citizens and companies.

c) Title II of the AMA specifies the repayment of US instruments of indebtedness (bonds/notes/etc). Instead of being rolled over as at present, new US monies will be paid to the bondholders as they become due. Those people/institutions will be looking for places to invest that money. One place would be in bank stock, which is a source of lending funds for banks. Of the $5 to 7 trillion in US bonds and notes privately held, about 3.5 trillion is due within 1 to 5 years; .72 trillion is due in 5 to 10 years; .35 trillion is due in 10 to 20 years. All these amounts will represent newly created US money and will eventually find their way to becoming new lend-able or investable bank deposits and even investments in banks.

d) Finally the AMA does not allow the banks to decide their own leverage situations. The Act essentially eliminates most leverage from the banking system in a healthy, non deflationary way. That will be good. They will no longer be able to pretend they were “banking” when they made bad loans overextending their positions and creating bubbles, in order to grab huge bonuses on imaginary profits. In other words banks will no longer be able to make loans in a bubble creation process. That will be a big improvement!

10) How will the U.S. Treasury create the money?”

The same way the Federal Reserve does now, as simple account entries, but as income, without the accompanying debt obligations. It’s described in the AMA, Sec. 103 NEGATIVE FUND BALANCES: The Secretary of the Treasury shall directly issue United States Money to account for any differences between Government appropriations authorized by Congress under law and available Government receipts.

11) Is there any chance the AMA could eliminate the federal income tax?

It “could,” and though that’s not likely in the near future, it is the direction the AMA goes in. Thanks to the immense savings our government will experience through control over its money system, taxation should decline substantially for middle and lower income groups. It should be raised for the super rich.

In addition the AMA should directly lead to substantial reductions in interest rates, because as the US pays off its national debt in money rather than rolling it over, those receiving those payments will be looking for places to loan and invest those funds. Interest rates should drop substantially.

12) Why does the American Monetary Act have an 8% maximum interest rate, including all fees?

Because before 1980/1981, forty nine States had “anti-usury” laws which limited normal interest rates to a maximum of between 6% and 10% p.a. (one state had 12%). The American Monetary Act takes the middle of this range to represent a restoration of the interest rate limits prevailing across the country prior to 1980/1981. See page 9 of the AMA.

13) Won’t you be breaking the sanctity of contracts when you convert the existing bank credit already in circulation, into U.S. Money?

No. First of all a contract requires understanding of the terms by all parties to it, and that certainly did not exist. But more likely it will be viewed as very acceptable by the banks, considering the security it confers on banking, especially when the alternative is going broke. There would be no reason to extend the legal tender privilege (acceptance for taxes) to the credits of any disagreeing banks.

14) How would the ACT affect our position with China?

The ACT would have a number of positive effects on Chinese – American Trade. Particularly it would encourage the Chinese to use more of their dollar earnings to really trade with us rather than just sell to us, and then invest their earnings in US bonds as at present. More details forthcoming!

15) What about other countries, and international systems such as the IMF (International Monetary Fund) and the BIS (Bank for International Settlements)?

We’d expect other countries to follow quickly in our footsteps to each obtain the advantages of issuing their own national monies. The United Nations is already putting forward suggestions that member states shift now to nationally created, debt free; interest free moneys. They are way ahead of the US Congress just now. A much reformed IMF, already organized under United Nations Article 57; #3, will see a greatly expanded role for the SDR and more responsibility for international accounts clearing as well as real assistance to member states, rather than acting as a destructive collection agent for the big banks. The role and importance of the BIS should be rapidly reduced, and perhaps eliminated. Just look at the mess created under their guidance and rules. Some job they did!

16) The latest craze “question” making the rounds in the organized disinformation campaign that is attacking our national psychology, is not a question at all, but a vicious assertion:

“Government is so corrupt and so much in the hands of the worst people and they won’t ever let you do this reform! Or any good thing”

This popped up simultaneously from LA to Seattle. I’ve told friends to put that stupidity out of their minds. This assertion, designed to discourage, is a variant of the Sun Tzu method of winning the battle by convincing the opposition not to fight because they can’t win. It reminds me of the cyborg “Borg Wars” line “Resistance is futile” from the Star Trek New Generation series. Don’t fall for it!

As our people suffer more deeply from the unfortunate monetary/banking system, any remaining bad elements in government can and must be cleansed. That’s what we’ll do instead of whining about it. Become a part of the solution not a cry-baby! Get up and fight for your family and nation!

“Put a stone in your stomach!” is an old phrase of Zulu warriors when summoning courage. Earlier tonight I saw an electric message on a local banks billboard:

“If you think you can, you can. If you think you can’t, you can’t!”

Yeah! We never said all bankers are evil, but there’s a very bad controlling element among them.

17) Why didn’t nationalized money systems work in the former Soviet countries?

Because their monetary systems were still controlled from within their banking systems, using the same faulty methods. The 1966 Federal Reserve publication Money, Banking, and Credit in Eastern Europe states:

“In the communist countries, money is created in the same way as in capitalist countries – through the extension of bank credit. This fact is not generally recognized or accepted in the various countries of Eastern Europe. The result is that a good deal of confusion emerges from their economic literature with regard to the nature of money and the role of the monetary process and the function of the banking system.… Since Marx identified money with gold, the official theory holds paper money to be merely a substitute for gold and ignores deposit money.” (p. 42-43)

Sound familiar? Their politicians and economists were as dumb as ours!

18) Won’t we get hyper-inflation like Zimbabwe?

No. For governments or anyone to issue money, there has to be a functioning society with enough rule of law and physical and social infrastructure to support the creation of values for living. Zimbabwe unfortunately does not have those pre-requisites; thus their society is falling apart.

19) Should we have the individual 50 states own banks? Like North Dakota?

More Kool-Aid and distractions…Look folks the objective is to get the banks out of the Money creation field, not to get the government into banking!! A highly distracting idea that does not in any way accomplish any necessary reform! Instead it gives our fraudulent banking system a moral free pass! It is mind boggling that progressive people fall for this. (see the home page for an in depth article by Jamie Walton on this)

20) How about local currencies?

Local currency movements can help people to understand the money problem but it would be an illusion to think that local currencies would stop a mismanaged, unjust national system from unfairly concentrating wealth; from being a motivating factor for warfare; from financing harmful polluting activities even when saner alternatives exist. Understand also that a national currency properly placed under governmental control gives much greater local control than the present national currency under private control, because locally, our voting power can exert influence on national policy.

And remember the principle of subsidiarity put forward by E.F. Schumacher. His slogan was not “small is beautiful.” What E.F. Shumacher actually said is what the AMI is saying: Use an “Appropriate scale”- do things on an appropriate scale. That dominant scale in the currency area is national and will continue to be for the foreseeable future. The appropriateness of acting on the national level must be recognized.

…………….

Greenbacks.

…….

http://monetary.org/wp-content/uploads/2011/11/DesignOpenMacro.pdf

Workings of A Public Money System

of Open Macroeconomies

– Modeling the American Monetary Act Completed –

(A Revised Version)

Kaoru Yamaguchi ∗

Doshisha University

Kyoto 602-8580, Japan

E-mail: kaoyamag@mail.doshisha.ac.jp

Abstract

Being intensified by the recent financial crisis in 2008, debt crises seem to be looming ahead among many OECD countries due to the runaway accumulation of government debts. This paper first explores them as a systemic failure of the current debt money system. Secondly, with an introduction of open macroeconomies, it examines how the current system can cope with the liquidation of government debt, and obtains that the liquidation of debts triggers recessions, unemployment and foreign economic recessions contagiously. Thirdly, it explores the workings of a public money system proposed by the American Monetary Act and finds that the liquidation under this alternative system can be put into effect without causing recessions, unemployment and inflation as well as foreign recessions. Finally, public money policies that incorporate balancing feedback loops such as anti-recession and anti-inflation are introduced for curbing GDP gap and inflation. They are posed to be simpler and more effective than the complicated Keynesian policies.

1 Introduction: Public vs Debt Money

………..

http://www.monetary.org/demonstrations

Email this Webpage to all of your Contacts and Print the Following:

(1) A half page Flyer announcing the HR 2990

which should be handed to everyone at a demonstration.

(2) A full page flyer describing HR 2990,

a hard-hitting piece that should be handed to the same people at a demonstration.

(3) The Need for Monetary Reform,

a one page (double-sided) sheet for those who want to know more. It’s exactly 800 words and you can reprint it easily, even get it into newspapers.

(4) A fact sheet on HR 2990

describing what the bill does to stabilize America’s financial situation, including the creation of 7 million of jobs.

(5) Our 32 page booklet,

which includes some history, our answers to the 20 most frequently asked questions, the American Monetary Act, and much more. Copy and photocopy the one attached, or get preprinted ones from us at 10 copies for $30.

(6) HR 2990

(7) Follow The Dick Distelhorst Plan to Advocate for Monetary Reform!

Dear Friends of the American Monetary Institute,

We now face a major opportunity its important to respond to. Across the country thousands of Americans, young and old, are demonstrating around the Federal Reserve Banks of Chicago, and Boston; Wall Street in NY and ever more places, linked to below.

snip

What do the Occupiers want? Mainly Economic Justice!

To get economic justice, you must have monetary justice and the AMI has been working at gaining monetary justice since 1996. We have made progress. Our research results, The Lost Science of Money by Stephen Zarlenga demonstrate that decades of research and centuries of experience shows that three things are absolutely needed:

The present form of the Federal Reserve System must be ended – it must become a part of our government – what people mistakenly think it is now! In the Treasury Department is best.

The accounting privilege that banks now have to create what we use for money out of debt, must stop once and for all. What’s called fractional reserve banking must be decisively ended.

The Congress must understand and be empowered to create new money and spend it into circulation as money, not debt. For example the $2.2 trillion dollars the Engineers tell us is needed for infrastructure over the next 5 years. As the system progresses, health care and education, and grants to the states are made.

Now some good news: Congressman Dennis Kucinich (D Ohio. 10th Dist) on September 21st, introduced HR2990 which does those very things!!!! Congressman Conyers of Detroit co-sponsored it.

We need to see that people realize there is a bill which achieves these goals, already in the Congress. That they can help by asking their representatives and Senators to support it. Also their school Boards, State reps and Senators, City Councils, newspaper editors, etc, etc, etc.

We have materials which can help them do all that, available for the asking, but first they have to become aware of HR 2990, and there are five attachments, at the top of the page, which will help you make it clear to them.

I’m suggesting you print these out, photocopy several hundred of them and head to the nearest demonstration! Stay at least a few hours. Let me know what happens. To find the nearest demonstration to your location, Google: “Occupy(insert your city here)” and check it out.

Warm regards to you and good luck! Remember this is a non-partisan activity!

Stephen Zarlenga

AMI

Bev, I appreciate your point of view and even agree (I think) to some degree, but I do object to what seems to me to be the “hi-jacking” of the NC comment privilege with a WAY over-long entry.

It’s not only inconsiderate to other readers; I imagine it’s ineffective, as I’ll bet most readers simply scroll through as quickly as possible to get to a comment that someone has actually put time and thought into. That’s what I did.

I read the first 9 paragraphs. Even though I agreed with most of what I read, I just couldn’t justify devoting an hour to this comment. It clearly should have been an article, provided the editorial control that is around here felt it worthy of such. This would have allowed it to be formatted for readability, figures added, etc.

Not easy to understand was the reason to put the frequently asked questions in whole…thinking that one could pick and choose among the questions that they themselves had and scan the rest.

Even economics professors do not teach this according to Yamaguci who had to learn this outside of his formal economics training.

http://markcrispinmiller.com/2011/12/occupy-the-economics-department-everywhere/

http://www.commondreams.org/view/2011/12/14-0

…..

It is a lot. But, the consequence of not knowing about this is that it cannot happen, that changing away from bankers Debt Money does not occur which will harm many more peoples’ lives. My postings are too long, but long enough to get a good idea of the concepts, and simple also. It is the public and mainly politicians who have to be taught.

The honorable Jim Sinclair who believes in a commodity currency says that America’s Internation Balance Sheet is always balanced in gold, also says we have a short time line before things buckle and suggests that we get any of our stocks registered in your own name or get paper certificates. http://www.jsmineset.com/

How much time we have is unknown, for our economy or to talk on this site to educate as fast as possible. I hope even more people at this site who know more and write better than I do, post about this more. We must support important ideas on this site, and also support and protect all politicians like Rep. Dennis Kucinich and Rep. John Conyers who work on HR 2990 the NEED Act to control public money for the public’s benefit.

If we do this well, it means there could be enough public money put into circulation to get extremely important infrastructure, research and development done which would require the hiring of many people.

http://moneyaswealth.blogspot.com/search?q=desalination

…you could turn this economy around in a flat hurry, launch a full scale, value added infrastructure rebuild, pay off our debts, build a thousand ship ocean clean-up fleet (for oil, toxic chemicals and plastics), bring desalination plants online, rebuild the electric grid, provide jobs, jobs, jobs, and heal the world of this economic cancer called debt money.

Or, do as you have been doing and rearrange the deck chairs some more, as this debt money system begins to groan in earnest, rivets popping and our nation taking on water faster then we can bail it out. It will sink. It’s math – you can’t outrun it, no matter how many knobs you turn or switches you flip – you cannot borrow yourself out of debt!

If the GWP (Gross World Product) is just over $70 Trillion, and the U.S. owes over $250 Trillion, how will raising taxes fix that balance sheet? How will cutting spending fix this when the gross production OF THE ENTIRE WORLD cannot pay what we owe?

You cannot fix it with the same thinking as created this debt cancer. You need a cure.

………

Dear Teachers, Teach our Politicians:

http://www.monetary.org/

http://www.monetary.org/wp-content/uploads/2012/01/N.E.E.D.-Resolution.pdf

Not easy to understand was the reason to put the frequently asked questions in whole…thinking that one could pick and choose among the questions that they themselves had and scan the rest.

Educate as fast as possible. I hope even more people at this site who know more and write better than I do, post about this more. We must support important ideas here, and also support and protect all politicians like Rep. Dennis Kucinich and Rep. John Conyers who work on HR 2990 the NEED Act to control public money for the public’s benefit.

If we do this well and the NEED Act passes, it means there could be enough public money put into circulation to get extremely important infrastructure, research and development done which would require the hiring of many people.

http://moneyaswealth.blogspot.com/search?q=desalination

…you could turn this economy around in a flat hurry, launch a full scale, value added infrastructure rebuild, pay off our debts, build a thousand ship ocean clean-up fleet (for oil, toxic chemicals and plastics), bring desalination plants online, rebuild the electric grid, provide jobs, jobs, jobs, and heal the world of this economic cancer called debt money.

Or, do as you have been doing and rearrange the deck chairs some more, as this debt money system begins to groan in earnest, rivets popping and our nation taking on water faster then we can bail it out. It will sink. It’s math – you can’t outrun it, no matter how many knobs you turn or switches you flip – you cannot borrow yourself out of debt!

If the GWP (Gross World Product) is just over $70 Trillion, and the U.S. owes over $250 Trillion, how will raising taxes fix that balance sheet? How will cutting spending fix this when the gross production OF THE ENTIRE WORLD cannot pay what we owe?

You cannot fix it with the same thinking as created this debt cancer. You need a cure.

………

Dear Teachers, Teach our Politicians:

http://www.monetary.org/

http://www.monetary.org/wp-content/uploads/2012/01/N.E.E.D.-Resolution.pdf

So, you’re with some institute or something?

A link would be fine.

No. I support Rep. Dennis Kucinich’s HR 2990 and all politicians who support his effort to help everyone with a debt-free and interest-free public money.

how does MMT understand the cost of money, i.e. interest rates?

It’s set exogenously by the central bank. They set it by buying and selling bonds (and other stuff) through open market operations.

Central bank sets the ‘risk-free’ rate of return on government bonds. This (along with the rate of inflation and the cost of paying interest on deposits) then influences the ‘high-risk’ rate of interest on mortgages, etc.

I Don’t See an AutoStereogram but I Do See a Cubist Windmill

What’s a cubist windmill? It’s a windmill whose blades spin in 16 directions at once — around and around in a 2-dimensional circle like in normal space, but also slashing around through 4-dimensional space/time as it traces out the artists cubist expressional perception. I figure that’s at least 16 directions. 16 = 2 raised to the 4th power. A 16-axis circle = a circle in 4 dimensions. At least to me, anyway.

The thing that bothers me about this sectoral balances stuff is the crash of metaphors. They have 3 “entities” — the private sector, the foreign sector and “the government”.

The private sector and the foreign sector are 2 separate populations. They are different human beings. There is no overlap. But the government and the private sector are the same human beings. They are identical sets. A single set transacting with itself. An x = x situation.

So when the private sector engages in transactions with the government sector, there is no real financial flow between different people. It’s the same group of people transacting with itself. The windmill blades don’t move, even in two dimensions. But when the private sector transacts with the foreign sector, there are two distinctly different populations, transacting through space and time.

There are other logical confusions in the post, but they relate to what money is. The state guarantee and private guarantee are differences in degree less than in kind. The degree is the extent of forced cooperation and the number of people involved. And all economic activity is simply forms of social cooperation and money is simply that in the abstract. Where cooperation doesn’t exist, it can be encouraged by population wide forced spending (govt) or by private sector voluntary spending. It’s like the collision of motivation between ego and superego in the individual, sort of.

The accounting identities sort of obfuscate the underlying reality of the primary energies and psychic/social structures.

You can also take the private sector and divide it into the “orange” sector and the “blue” sector and have two distinct groups of people. And since money = property like wave = particle, if the blue sector migrates to a land of plenty, with fertile fields and fish-filled streams, then they are rich with property that manifest as money if they cooperate with themselves and with the orange sector. The cooperation and social structures that take their form from the interplay of individual and group imagination and that guide it seem to me to be the final underlying reality, and everything else is a projection of it.

How do you do this? I actually think I can see what you are talking about.

I still haven’t got to grips with MMT … I often see advocates in blog comments saying “we needn’t worry about government borrowing, just monetize the debt, we have our own printing presses!” and then when asked about inflationary impact they say “oh we can suck money out of the system via taxation”.

Yeah, well if I thought we were going to run a massive fiscal surplus any time soon, I wouldn’t worry about government debt either.

plus they seem to get over excited about unimportant details like claiming a great truth about the financial system (shock horror!) is that bank create money simply by electronically credit accounts. So what? I could send you a letter by carrier pigeon telling you you now have £100 on deposit at the bank of Luis Enrique. I’d still need to finance that £100 somehow if you attempted to use it.

I often see advocates in blog comments saying “we needn’t worry about government borrowing, just monetize the debt, we have our own printing presses!” Luis Enrique

The debt of a monetarily sovereign nation IS money! It is already “monetized”! To pay off that debt would just be an asset swap of a non-interest-paying form of fiat for an interest paying form of fiat.

I’d still need to finance that £100 somehow if you attempted to use it. Luis Enrique

One way is to make a deal with everyone who receives those claims for that money to split the interest you receive with them IF they don’t redeem those claims. That’s interbank lending. Thus the banking system as a whole IS in the money creation business.

you wouldn’t need to finance it. that is a myth for lttle peepul

I’ll repo it with the LTRO or the Fed and we’ll split it then default. Nobody will care who’s anybody.

Mrs. Ivanna Buckor II

Cash & Cash Partners

PO Box 7

Grand Cayman Beach & Tennis Club

If it comes by pigeon that would be so cool! I’ll take pichaz!

You might need to finance that 100 pounds, but the government doesn’t. It creates the 100 pounds simply by increasing a number in its database.

So if this is simple, clear, and true, what is it that people with “money” fear to see re their claims on government, or government on them? Or is it a question of WHICH people with money? Is it taxation, inflation or some other (to them) deleterious effect? Is it only some functions of the financial side of the kleptocracy that would be seriously affected by MMT implementation? Does Apple still get to sit on $100 billion in serf-labour profit? Do the mega-wealthy actually start paying taxes?

If MMT does not by design compel current, substantial wealth/power redistribution, and limits on future accumulation of “claims” then what is it aiming to do? Perhaps it’s just possible that once you’re in the 5% and own virtually everything, it really doesn’t matter which money it is so long as YOUR CLAIM is always honoured? But I don’t get the sense that they’re the ones to get much worried about anything.

To Fiver

MMT isn’t necessarily looking to “implement” anything – at its core, it is simply a description of the essence of “money” and how it works.

Many MMT folks have prescriptions for various things, that are not necessary components of the theory. E.g. the “job guarantee” programs

I think this is a great article at pointing out the root of many people’s difficulty in getting MMT is deeply conceptual. If you believe money has intrinsic value, MMT is hard to get. But if you believe that money is whatever we as a society (at whatever scale you think is appropriate) will accept as informationally-insensitive (thanks, Gary!) accounting tokens (and the chartalists point out that the state can compel such acceptance by demanding some particular item in payment of taxes), then MMT is just a simple description of the world…

“I think this is a great article at pointing out the root of many people’s difficulty in getting MMT is deeply conceptual. If you believe money has intrinsic value, MMT is hard to get.”

Well, I wouldn’t agree that it’s a great article, because even though I understand that Modern Monetary Theory is actually Modern Monetary Reality, this article was way over my head.

However, the video “Money As Debt” (free on the Net) and Bill Still’s book, “No More National Debt” are pretty comprehensible. Also, if you don’t have time for Still’s book, his video “The Secret of Oz” is pretty.

oops…”The Secret of Oz” is pretty accessible to the average person.

So agree. Very easy to understand.

http://www.youtube.com/watch?v=swkq2E8mswI

http://www.secretofoz.com/index.php?option=com_content&view=frontpage&Itemid=1

Also:

Bill Still’s “No More National Debt”

http://www.billstill.com/nomorenationaldebt/

“An impressive and highly informative book, exactly right for its time. Bill Still explains

the fundamental flaw at the heart of our debt-based money system, and how to eliminate it. With a background in journalism, he brings passion, honesty and an exacting attention to historical detail, and so makes the reader feel the urgency of this central question for every nation. The international perspective shows unarguably that the problem is global. The book is also bang up to date, and with HyperScan technology it can remain so.”

Dr. Bob Welham, Bristol, UK

“Excellent! Required reading for every student. I like the fact you write like a normal person, and not as though you’re trying to impress everyone with your knowledge.”

Kenneth Hulsberg, Riverview, Florida, USA

About the HyperScans

This is the world’s first book to be powered by

HyperScan QR codes. Simply download a

free QR-code reading application to your

smart phone such as QuickMark and your cell

phone camera will take you to supplemental

video, pictures, sound and graphics that leap

off the page.

……………

About No More National Debt

What’s killing the U.S. economy? It’s the national debt and its interest payments. For the first time, written in simple terms, the following secrets of our money system are explained:

Nations don’t have to borrow.

Nations can create their own money without debt.

Nations can’t get out of debt – or even “pay down” their national bebt under the current system. Why? Because it is a debt-based economic system; all money is borrowed.

In his 10th book, Bill Still lays out a message of hope, supported by centuries of evidence. His sweeping account shows that nations don’t have to borrow their money into existence; nations can create their money without debt.

Throughout history, every time this money system has been employed, prosperity follows. In fact, creating a nation’s money without debt is THE most important power of a sovereign nation.

With humanity’s personal and economic freedom hanging in the balance, “No More National Debt” sounds a battle cry for a new human rights movement for the 21st century — a single fix for the economy that can wipe out most of the world’s hunger, poverty, disease and misery.

Selected Books and Films by Bill Still

1996: The MoneyMasters, 223-minute video documentary, Royalty Productions, a documentary history of the privately owned central bank system and its effects on American history. Over 70,000 copies sold. The 15th most watched film of all time on the Internet.

1997: Why America Is Free: A History of the Founding of the American Republic 1750-1800. 208-page hardback on slick glossy paper aimed at the home-school audience, published by the Mount Vernon Ladies’ Association for the Society of the Cincinnati. Over 100,000 in print.

2010: The Secret of Oz, 111-minute video documentary, Still Productions. The monetary reform symbolism embedded in the most popular children’s story of all time, The Wonderful Wizard of Oz. The film won Best Documentary of 2010 at the Beloit International Film Festival; The Silver Sierra Award at the Yosemite Film Festival; and The Silver Screen Award at the Nevada International Film Festival.

…………..

http://www.youtube.com/user/bstill3/featured

…………..

http://www.youtube.com/watch?v=c9U3lHCgylo&NR=1&feature=endscreen

“A Gold Backed World is a Terrible Mistake” : Bill Still – Part 1 of 2

http://www.youtube.com/watch?v=wOacViyCMhQ

Debt-Free Government Issued Money = Sovereignty : Bill Still – Part 2 of 2

…………..

http://www.youtube.com/watch?v=oJLel-2MBYU&list=UUhZRoC9bMegevAxFmee1oSA&index=9&feature=plcp

SR 31 World Revolution???

………..

Bill Still is running for President under the Libertarian ticket in 2012. His plateform is to bring back public money, debt free for the public interest.

………..

If the economy is to be kept well lubricated and functioning, the government must be willing to take on more debt on behalf of its citizens when the situation calls for it. Izabella Kaminska [bold added]

How is a monetarily sovereign nation spending money into existence “taking on debt”? Where are the interest payments? What does the government “owe”?

How is a monetarily sovereign nation spending money into existence “taking on debt”? – F. Beard

I wondered about that as well. As far as I can see, the government side of We The People is not in the habit of spending money into existence. So Izabella Kaminska must be talking about continuing the current practice of taking on debt, confident that there would be a backstop, in that We The People, who created a monetarily sovereign nation, can bail ourselves out by fiat.

So Izabella Kaminska must be talking about continuing the current practice of taking on debt, confident that there would be a backstop, in that We The People, who created a monetarily sovereign nation, can bail ourselves out by fiat. citizendave

The MMT crowd is reluctant to admit that government borrowing is not necessary. They justify it for the sake of the banking system!

“We, the Banks of these United States, in order to Establish a more Perfect Union [of the Banks] and promote the general welfare [of the Banks] do hereby …”

When will people realize we don’t need banks?

“When will people realize we don’t need banks?”

Not soon enough for you or me, F. Beard.

How is a monetarily sovereign nation spending money into existence “taking on debt”? – F. Beard

I wondered about that as well. As far as I can see, the government side of We The People is not in the habit of spending money into existence.

No, the US government spends money into existence all the time – whenever it spends. That is “the reserve accounting at the heart of MMT” (Bill Mitchell, from memory) – and which they usually do a godawful (Mansoor H. Khan) job of explaining. The difference between “printing money” & “printing bonds” (as we do today, what is misnamed “government borrowing” is trivial.) The whole point of the “borrowing” game nowadays is to distract the sheeple, so they can be fleeced, by making them hate money that goes to them, and love having money go to the con-men. The game is not important in itself, and is only a minor source of income to the con men.

What does the government “owe”?

As to what the US gov owes the recipients of its money, the holders of its bonds, its dollars, its debt, see my reply to H. Alexander Ivey further down.

F Beard’s heard me a million times about this – a dollar bill is just as much debt as its twin brother born a bit latter, called a bond.

“Some believe surpluses are actually the equivalent of eating away at the stock of wealth in the system”

Undoubtedly why life was a living hell when Clinton ran a surplus, and why we are now in paradise…

To put it in gold-bug terms, a government surplus is like dumping gold down a mine shaft. (A balanced budget is like banning gold mining).

F. Beard,

Don’t forget the underlying physical reality of currency issuance. All spending (previously saved money or new money)will use real resources (labor, raw materials, infrastructure).

Therefore, our society’s real concern is not only stop usurers but also how to keep “real production” going given increased population and peak fossil fuels. Part of the answer is to increase the efficiency of what we get out of fossil fuels and part of the answer is conservation and better/fairer distribution/allocation of energy resources. (i.e., social credit).

Mansoor H. Khan

Don’t forget the underlying physical reality of currency issuance. Mansoor H. Khan

I never do. Money and real resources are in a dynamic balance where ideally the growth in real resources keeps up with money supply growth and vice versa.

And by real resources I include skills and technology. No vulgar materialist I.

…and the third part is optimal scale of the human economy within the finite ecological reality. What is the optimal scale of the economy, how far beyond it are we already, and when will economics finally accept resource/waste throughput and entropy as fundamental?

Actually, the two parts of the answer are:

Part one: to stabilize and reduce human population (by educating women, giving them legal rights and independent incomes, and making birth control readily available — this will stabilize the population within a generation or two, easily)

Part two: to restructure all industrial activity in a non-fossil-fuel dependent manner. Solar power will probably be the most important.

Things may have seemed fine and dandy during the Clinton years. But the private debt load started to grow faster than it had since the late 1920s. That’s not a coincidence.

The Clinton surpluses drove a massive expansion of credit. Additionally, there was money-like savings being created by the internet bubble.

The problems with these forms of money creation is long term credibility and mark to market of that credibility. Credit expansion can last a long time, but when the credit is backed by real world assets, those assets can change in value.

Upward changes in value are greeted with additional borrowing, which is effectively leverage on nearly the same real world asset base.

But when the downward cycle starts, it all unravels. You need to recognize this basic truth: Credit demands to grow as the economy grows.

This credit can be of many different forms, but the economy will demand more liquidity to support more real world activity. You couldn’t run our economy with $1. You need a few trillion floating around just to keep things moving.

But this then begs the question of credibility. The private sector is highly credible in the long term, but the valuation of the underlying assets which support the credibility is highly variable.

The government is more credible in some ways, because it’s a honey badger – It doesn’t care about valuation. It collects taxes.

So the government is a great candidate for supplying some large portion of the credit deficits necessary to keep the economy moving.

The problem comes in when people start to think this government deficit is the dog and not the tail. Government deficits are necessary, and they need to get bigger and bigger for the economy to function properly.

Private investment and savings are the big drivers of the economy, and any theory which relegates these two workhorses to a secondary place is misguided.

I really, really like MMT. It’s changed my life. But lets face it – MMT puts an abnormal focus on the actions of government.

This is why Cullen Roche, beowulf, and I created Modern Monetary Realism, which also uses the sector balance equations Stephanie Kelton shows so nicely above. We recognize those balances rule our economy. But we also emphasize the private sector creates a vast majority of the real wealth of the world.

The government deficit is big part a grown-up approach to using the sector balances. But the foreign sector isn’t nothing. We’ve slouched to become a class of rentiers just as Lord Kaldor said we would due to allowing the Trade Deficit to become too large.

This is a great topic and I am very glad for the recognition MMT is getting. I worked for 18 months to help spread the word on MMT. The analytical of MMT framework is fantastic.

But as you go farther down the rabbit hole, keep in mind MMT isn’t the only way to approach those sector balances. Over at MMR, we’re using those same sector balances, but just approaching them with a strong focus on private initiative, freedom, and balance.

For someone diving into MMT this is this best summary I’ve read of its shortcoming. I will certainly look into the ideas of MMR. I’m an engineer and being a mathematically based person I do have some problems with the all encompassing assumptions it makes. After all just about anything can be made a mathematical proof with judiciously chosen boundary conditions. Overall though its a very informative theory. What I find troublesome about MMT is that a large number of its advocates, especially true here at NC, defend MMT as a simple mathematical theory but then simultaneously use it to justify a social agenda which must be the correct path for us all because, by golly, there’s a mathematical formula behind it. Good to see an alternate viewpoint.

In the days before I worked for myself I had heard the cliché may times, “you need to think outside of the box”. My response has always been the laws of physics, i.e. the box, are not about to change. However we are free to make the boundary conditions whatever we like.

Thanks OTAY!

Feel free to stop by our blog anytime. MMT is good, but we think it places too much emphasis on government as being the only way the private sector can save.

We’re going to be around and you’ll see more of MMR popping up all over the place as time goes by.

OTAY, like you I’m an engineer. Like you I’ve detected the same bias typified by an almost dogmatic reason-by-identity hand wave that is then used to justify a policy that conveniently supports a certain ideological program. In studying it for some time I’ve seen a sort of ideological refrain forming which to my eyes undermines the claim of being a nuts-and-bolts neutral analysis. I agree with Mike above that where MMT seems to fall largely on one side of the analysis–probably due to their starting with government expenditures part of the macro equation and reasoning toward the savings side of the equation–MMR seems to more equitably analyze both the net savings side and the government expenditures, and in so doing returns the private sector to a position of prominence. Put another way, MMR more fully acknowledges the [some would say pivotal] role that investment plays in the macro equation, and thus MMR enables me to more constructively look at it in the more understandable terms of my daily life in business. That said, I leave my faculties open for more learning, and I reserve the right to alter my opinion at a later time. You know how we engineers are.

Excellent point!

“The problems with these forms of money creation is long term credibility and mark to market of that credibility. Credit expansion can last a long time, but when the credit is backed by real world assets, those assets can change in value.

Upward changes in value are greeted with additional borrowing, which is effectively leverage on nearly the same real world asset base.”

MMT is not an economic system, it is a compnent

Credit is not necessary to expand the economy.

Remember MV equals growth.

Stamp money increases volocity

There were NO ‘Clinton surpluses’.

The debt of the US has increased every month for the last 30+ years, except for one, last I looked.

Those ‘surpluses’ were the standard lying by government, where it counted SS taxes as an asset, bought Treasuries with them, spent the result. No corresponding liability for the now-spent ‘asset’ except the increase in the national debt.

That is not a surplus.

MMT has failed to communicate it’s premise succinctly. But “[O]nce you get it, you never see things quite the same way again.”

But some people just don’t get it, and thus never see the light, the image.

Sounds just like a dogma. It will change your life once you accept it, but if you don’t its because you just aren’t blessed with the image. Consequently, any arguments against MMT are automatically discredited, since the person making the argument doesn’t see the light.

Religious fundamentalism, anyone?

Or a paradigm shift. Or dropping ideological blinders.

Religious fundamentalism, anyone? don

Not really. In the case of the autostereogram, the image is objectively there if one can perceive it. Those who can see it will all agree as to what it is (allowing for normal human differences).

So . . . the object is there to be seen, if only the subject sees it.

If the subject does not see it, it is due to the failing of the subject (those having what Lambert refers to as ideological blinders).

On the other hand, maybe it is the subject that constitutes the object. Without the subject, the object doesn’t exist.

Kind of like the drumbeat around MMT, where the monetarists act as missionaries out to recruit more believers, who together constitute the belief that saves us all. The non-believers be damned.

On the other hand, maybe it is the subject that constitutes the object. Without the subject, the object doesn’t exist. don

Money is a contentious topic which is why I believe we should have both government and private money supplies. Government is force and the private sector should be purely voluntary yet we try to make do with a single money supply for both sectors!

Did you ever hear a joke, but you didn’t laugh because you didn’t get it? And then somebody explains it to you, and you still don’t get it? And then hours or years later, you suddenly laugh because you finally got it?

Story of my life, CD…

How many does it take to “get it” before the joke can be considered funny ?

Is there intrinsic value in a joke because the originator thought it funny, even if no one else laughs (gets it) ?

And is the joke still funny if the most laugh but someone got hurt ?

( i see how all three questoins relate to the topic here, when considering the analogy, but not my fault if no one else gets it)

Why the Fed system?

To control the world?

It was a system to allow the exspansion of the

money supply without more gold. It also had a system of cap

The word was capital controls.

Money can be expanded contracted pushed and pulled.

We have politicized it as a weapon of WMD for individuals and countries.

Greece and Iran are experiments even though we don’t know how to use it peacefully, endlessly arguing about a stimulus or austerity, to tax or not or why.

While MMT is explained again with two parts making the whole, the private and the public = the whole economy, the political question of who controls each part is a necessary part of explaining the economy. If the private sector sits on $2Trillion, waiting for a better time, and the government is controlled by republicans who do not want the public debt to go up to compensate for the private surplus, the economy grinds to a halt not for a lack of understanding, but for a deliberate political goal. The goal of ending the New Deal/Great Society/Civil Rights Progress is done with the stick of austerity.

Whatever means to power can be had will be taken hold of, and not enlightenment in the hands of reactionaries who even when they do understand the issue, lie to create the reactionary political adherents who will support their cause under false pretenses.

The case of the newly revealed Summer’s Memo, where Romer’s high end of deficit spending in the $1.8Trilllion neighborhood was completely redacted from the memo presented to Obama. And his best and brightest only presented to him not a strictly rational Brandeis Brief, but a truncated politically correct set of parameters, politically correct in the eyes of Summers and downgraded to what he clearly saw was the realpolitik, that any discussion in the trillions was never, ever going to happen with the congress and senate as it was constituted .

I find it hard to believe that the wealthy privately believe in economic fairy tales but rather, publicly espoused whatever debunked bullshit they please for Machiavellian purposes. MMT shows the circulation of money, as claims throughout the private and public sectors in way that has explanatory power in a theoretical sense, but must include the politics for a sound and complete analysis. MMT may be bar coded as a badge of the wrong politics by reactionary elements in the nation or not, due to how it furthers political empowerment, not due to its lack of academic rigor. It is about taking sides and identify whose side you are on. MMT is worming its way into the cadres of agitators, policy development and decision makers, it just has not been officially branded by warring political camps in a definitive fashion, yet.

The chart by Stephanie Kelton on sector financial balances would at first glance confirm that the US private sector balance should be a mirror of the government balance. This goes back to the early work of Wynne Godley, but the trouble is that sectoral balances are a lot more complicated than that I think. Wynne Godley and Mark Lavoie in Monetary Economics (An Integrated Approach to Credit,Money, Income, Production and Wealth) expanded on this idea to include the balances of different actors within the private sector and government sector, with perhaps in my view a suggestion that how you change those balances matters. A review of that work by the Levy institute came up with some startling conclusions especially around interest rates for example.

A higher rate of interest produces a paradoxical effect, bringing about a positive impact on output and employment in the long run.

Getting back to Izabella’s post we come across the apparent first gotcha when she points out this is the case for a completely self-contained credit system only (which the US is not). Fortunately she comes back to the point later when she starts talking about non domestic claims. Something I feel is much better explained in Godley and Lavoie’s Monetary economics where they detail the effects of floating currencies, preferences, flows and how currency moves can cause GDP shocks, but not necessarily inflation. I did not really buy into the either or situation at the end of the article either and will be interested in Yves ideas on the scarcity of safe assets. Steve Keen would point out that even with something like the Stock-Flow Consistent (SFC) Model by Lavoie and Godley it still has ideas relating to equilibreum which may not be true (see Keen’s monetary circuit theory).

So now we have to contend with MMR MMT and MCT which are all variations around the similar post keynesian ideas, with all slightly different conclusions and starting points. What I think is missing from discussions are the differing opinions within post keynesian economics and its derivatives. I guess for me the last word should go to Marc Lavoie and his slightly tongue in cheek critical look at MMT (some readers will have seen and read this before here), not least because it mentions Naked Captalism and in a way is quite supportive of MMT.

http://www.boeckler.de/pdf/v_2011_10_27_lavoie.pdf