Marcy Wheeler put up a useful post yesterday morning, based on a Reuters article describing the efforts of Standard Chartered to combat the damage done by its making illegal transfers on behalf of Iranian banks.

Marcy picked up on how the article revealed the techniques used by big banks to escape suffering meaningful consequences of their misdeeds:

Reuters lays out the steps that SCB took that normally should be enough to minimize any consequences for violating Iran sanctions. First, you hire Sullivan and Cromwell and act contrite. Then, you pay a consultant to conduct a review and claim the violations involved just $14 billion million in transactions as opposed to $250 billion shown in your bank records.

As part of a review the bank sought to give to regulators, Standard Chartered hired Promontory Financial Group, a Washington D.C. consulting firm run by Eugene Ludwig, who served as U.S. Comptroller of the Currency from 1993-98. Promontory was hired to review Standard Chartered’s transactions tied to Iran. The bank’s review ultimately settled on the figure of less than $14 million for improper transactions.

Then you bury all the embarrassing details showing willful flouting of the rules, so the proles don’t learn how craven banks really are.

I suspect, for the reasons laid out here, that OFAC will still find a way to give SCB a nice cushy settlement. But Lawsky has revealed what really goes on behind these settlements: the coziness, the misrepresentations, the complicity in hiding the true face of banking.

Now I decided to go have a look myself. Being on the vampire shift, I didn’t go looking until mid afternoon. And guess what, the story that was now at that URL was not the same story. Yes, there was a story on Standard Chartered. But the version that Marcy worked from was apparently the original, released at 00:28 AM, titled “U.S. regulators irate at NY action against StanChart.” I’ve loaded that version in a Word and put it up at ScribD, and am embedding it below. It’s 1766 words. Be sure to download it if you are interested in this topic.

Original Reuters 8/8/12 Standard Chartered Story

The version up at 4:53 had the title “Standard Chartered begins fightback on Iran allegations” and is 1025 words. For grins, I did a version compare from the original article, which I’ve also uploaded, so you can see this is a new story.

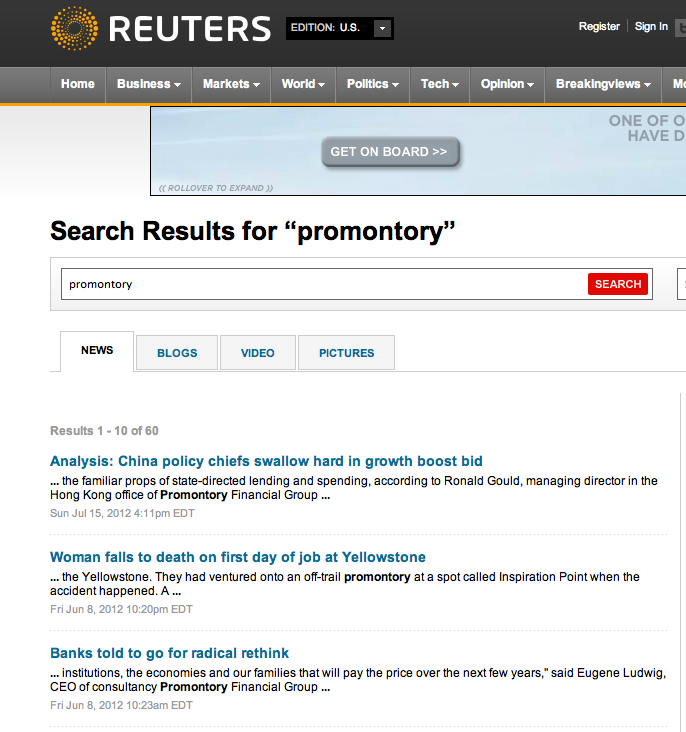

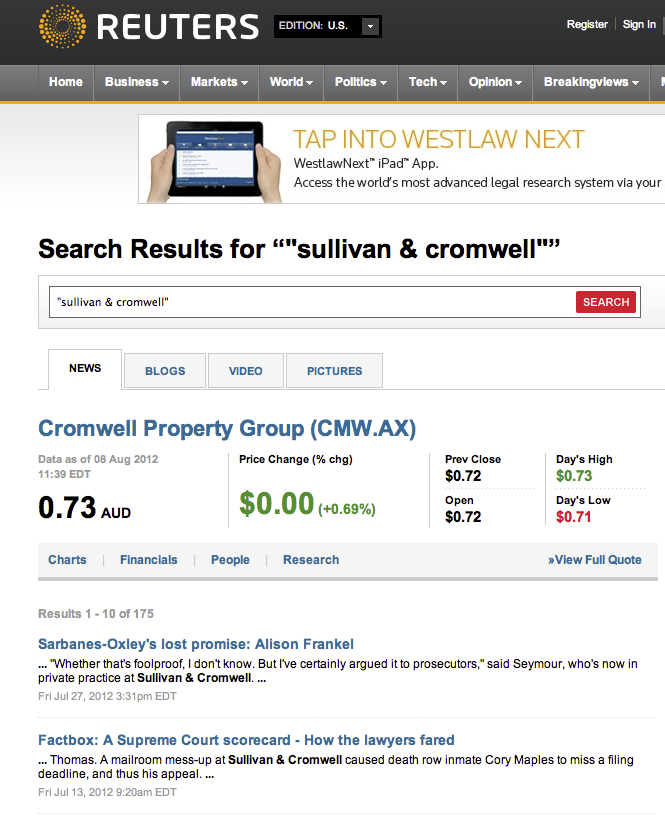

Now why is this significant? The parts that Marcy focused on, the role of Sullivan & Cromwell and Promontory, are gone. And I mean gone. This version of the story has been expunged from the Reuters website. I did these searches on the Reuters site at just after midnight on the 9th (note the results are in reverse chronological order, so the one at the top is the most recent):

Similarly:

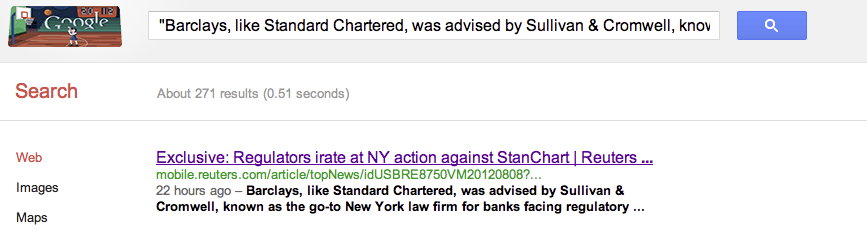

If you try searching from the story on the outside, you can see Google still has it in its cache, but when you click on the link, you get later version with no mention of Promontory or Sullivan & Cromwell (or the other juicy details in the original version):

Now it isn’t unusual for stories by Bloomberg and Reuters to morph a bit over the day, as they get more info, juicier quotes, or decide to perk up the wording a bit. But actively expunging a story with important information in it is another matter. One can only hazard how this came about. The first version is pretty favorable to the New York regulators, Benjamin Lawsky. For instance, early in the piece, it says:

Lawsky’s stunning move, which included releasing embarrassing communications and details of the bank’s alleged defiance of U.S. sanctions against Iran, is rewriting the playbook on how foreign banks settle cases involving the processing of shadowy funds tied to sanctioned countries. In the past, such cases have usually been settled through negotiation – with public shaming kept to a minimum.

But the juiciest bit is how it flags the astonishing difference between the $250+ billion in transactions that Lawsky and SCB’s sanctimonious claim of a mere $14 million in dodgy transfers came about. Recall the quote that Marcy extracted above, that the advisory firm Promontory, headed by former Comptroller of the Currency Gene Ludwig, conducted a review and “settled” on the $14 million total. Promontory has made a bit of a specialty of getting hired to do independent reviews for boards in rogue trader cases. It seems it has been using the name it developed there, plus the fact that it has many former staffers from the OCC and other regulators, to enable it to act as a big ticket fixer (note that while the article also mentions that Rodgin Cohen of Sullivan & Cromwell, long recognized as the top bank regulatory lawyer, has been engaged to represent SCB. That’s almost to be expected).

So why did the original story get disappeared? Was it the result of pressure by Promontory, pressure by SCB, or maybe even unhappy regulators who didn’t like this much detail out in the open? As Marcy Wheeler said via e-mail:”…are they trying to hide the role of Promontory in spinning this as an order of magnitude or five smaller?” When I once made an only mildly snarky remark about Promontory (this before I came to be recognized as hopelessly feral), I was contacted within 24 hours by a Promontory staffer trying to re-eeducate me.

And what was the real bone of contention between Lawsky and the bank? Per the original story:

Lawsky’s agency also received the Standard Chartered internal review, according to people familiar with the situation. But the new regulator had little interest in a settlement that didn’t yield embarrassing details about Standard Chartered’s activities, these people said.

So get this: a key condition for the bank was maintaining its undeserved squeaky clean image (if you’ve followed the press in the UK, it’s often mentioned how the management team has good reputation. So too did Goldman circa 2007). Yet the Swiss central bank made UBS hire an independent law firm to produce a report as to why it needed to be bailed out and required the information to be made public. Similarly, judge Jed Rakoff objected to the practice of having regulatory settlements with no admissions of underlying facts. The idea that if a firm is big enough, it can do bad things, write a “cost of doing business” check when it worries it might get caught, and keep the bad behavior under wraps, save some vague language in its financial reports, is yet another example of how gross the differences are between the haves and the have-nots in our two-tier system of justice. While we are unlikely to see serious change any time soon, the fact that Lawsky put some ugly facts about SCB out in the open is a welcome departure.

abrupt end there….

It does seem that the details of who in law firms do what is meticulously left out of articles generally, or perhaps more accurately, expunged.

If you don’t know the names of these people, it is hard to track how many times they appear behind the scenes, and how long they have worked, and how many times they have cycled, between the regulatory agencies and finacial companies. And of course, if you don’t know that than you can’t even bring up the pretend “ethics rules” about representing people you have regulated before your former agency.

But we need more information about the veepstakes:

http://www.salon.com/2012/08/08/the_journalistic_mind/

“If Heaven had the misfortunate of subscribing to Time (or, more likely, receiving it for free as a consolation prize for a failed sweepstakes entry), then a moment of silence is warranted to lament Adams’ pain. Then again, if Adams has access to Time in the afterlife, then he’s most certainly not in Heaven.”

Heh. Then again, what’s up with Greenwald’s fixation with—hellooo, Captain Ob(li)vious!— Professor Jay Rosen. Academic job seeking? Should we file this under “ego scoop”?

Oh, wait. Not so fast. Bob Woodward of “Woodward and Bernstein” wants our intrepid press critic to resign– because he doesn’t know how to use Facebook: http://jayrosen.posterous.com/

Fucking comical! Thanks for staying on top of this Yves. I had linked to the Reuters piece as well. I guess SCB needed a better version of the story to market their bogus threat of a suit.

Perfect example of the banana republic we’re living in today. If you don’t like the factual historical record, just expunge it and make up a new version. LOL!

The financial asshats are in rare form this week.

so the proles don’t learn how craven banks really are. Marcy Wheeler

and

the true [ugly] face of banking. Marcy Wheeler

Note the lack of qualification. :)

Yves,

Missing in your discussion of Standard Chartered is the fact that Peter Sands, its head, happens to be credited with the UK government’s strategy of bailing out the banks.

If SCB loses its patina of being a morally upstanding firm, suddenly this recommendation looks to be completely self-serving.

How fair thee Coutts Bank? Will the Queen send an armada up the Thames to secure her fortune…. IMWTK!

Skippy… have the ashes cooled yet from Barings Bank or do they light anew, so many sparks from the past.

PS. Please inform the old gal the Courtaulds are still good for the money, wink, wink.

Reuters as in Thompson Reuters is a British news org.

Labour MP John Mann has already called the Standard Chartered probe anti-British. http://seekingalpha.com/article/789331-august-15th-is-d-day-for-standard-chartered

And SCB is the latest in the line of rogue British banks which includes Lloyds, Barclays, HSBC, RBC. What’s rogues is not the banks themselves but the city of London and the system under which a major portion of the British economy depends on the financial industry based and taxed in London.

This has been fairly obvious to anyone who is not blinded by sycophancy toward Brits as much too many Americans seem to be.

revisionism.realtime…..this post goes to the heart of our collective problem. Too many have their own facts. Some get to make them up;or leave them out…as they wish.

this shows the facade of our media,inividuals may mean well and try,but the institutions seem to regularly be counted on to cover up,specifically so the public is mis-informed,dis-informed,un-informed….

sullivan-cromwell….since the days they were working for american nazi’s doing business during WWII…They are an “enemy” of the american state.but don’t they enjoy a stellar reputation,with impeccable clout.

the folks at disinformation.com had done stories like this years ago .specifically about the Time release shift of stories over “the wire”( pick a service).Like when the UN had a meeting in yugoslavia,early 90’s,and were caught bringing in sex slaves… for the attendee’s use…the you watch as the subsequent versions posted,each one less and less specific,till the last one that was so watered down, the readers would think that a sex slave ring was busted in the same town that there was to be this big meeting… and not that the logistic handlers actually were caught with sex slaves locked in the hotel where they were awaiting the un representatives…

I must also mention:

The rules are from new york,and the US… but who said Iran is a problem. The whole thing is trumped up.Iran isn’t attacking us. WE are commiting acts of war upon them. Not the other way around. WE created stucksnet,to destroy their legitimate equiptment.We assasinate their scientists ,who are innocent .We are the ones doing things that if they did them to us, we would consider it an act of war. and act of terror. we are the ones invading/and occupying two countries

on their border. WE ARE the agressors.Our tax dollars are doing this… what a waste. And then we levy sanctions against a country that hasn’t done anything..nothing compared to what we are doing.That is the elephant in this story…

The enemy of your enemy is not your friend. While I have infinite respect for the Iranian people, the Tehran regime — which engages in tactics at least as vile as that of the US and is even more corrupt than the American ruling class — needs to go.

Additionally, I hold a UK passport but recognize that it’s the right of the US as a sovereign state to determine who — like Standard Chartered Bank — does business within its borders and under what terms. If cybersabotage amounts to cyberwar (a much-hyped notion), your outrage about Stuxnet being an act of war might functionally be true, but such a strategy is infinitely preferable to a straight-out shooting war.

Interesting that it is a Labour MP who is defending SCB. It shows that as here that protecting the banks is an elite affair that transcends partisanship.

SCB seems to be putting on an aggressive full court press. So I think it is pretty much a given that Reuters pulled its story because lawyers from SCB contacted them. Along these lines, it shows that SCB’s legal team is monitoring closely any mention of the affair in the media, for the reaction to have been so fast.

And the best indicator of all appears to be we haven’t heard a peep from the Israeli govt.

Based on that, national security will be invoked.

No way to know for sure, but it’s not a bad guess to hypothesize the government monitors the web for stories like this and uses its influence with news organizations for sensitive stories. G-d forbid a reporter should lose access to a White House contact or no longer be admitted to a

White House press briefing.

Nope. What Hugh said. SCB’s lawyers, maybe the UK government leaning on Reuters back in Britain. Not the White House.

The drive for ‘fairness’ is very, very real in human groups… (and not only humans, btw). And people get pissed in a very deadly way when they believe themselves and those they care about are being cheated.

SO… there’s a lot of interest by those benefiting from such cheating to keep it hidden. And they’re amazingly good at it.

Somehow they seem to have convinced a great number of people that the massive shift of wealth to the top is because of some inherent virtuous and productive efforts of the top 1%… and that therefore the top 1% deserve even more… that’s really quite an accomplishment when you think about it.

And frankly, to the degree the rest of us buy these ridiculous arguments, the more the elite will assume we’re idiots and deserve whatever we get.

In a sense they’re right.

Quite.

They’ve done quite an admirable job of swaying large numbers of people, haven’t they?

The problem is it takes the Iron Fist of the Marxist State to set things “fair”….and we know how that’s gonna turn out (A mountain of skulls).

Yves, Your article ends mid- sentence. Is there much missing or just a few closing word ?

Aargh, and I dimly recall having a decent closing sentence. Early AM screw up of some sort. Thanks.

Marcie Wheeler is one of the finest reporters in the blogisphere. When she get her teeth into a story she eventually know more details of the event than the principals involved.

Nearly everything to do with actions by, surrounding and towards Standard Chartered show a high level of illegality and collusion to suppress wrongdoing.

First, like Dan, I agree that the real elephant in the room is what the US govt. is doing to Iran. The sanctions we have put in place are probably not legal according to international law. Where is the investigation into US sanctions?

The US govt. is tightening the noose around Iran in many ways. LucyLuLu pointed out yesterday (and the Guardian today) that Treasury is imposing multiple sanctions against Iran: “While the headlines are focused on allegations against Standard Chartered, today’s major sanction-busting deals are being done by firms that are not household names. Last week’s blacklisting by the US treasury of Bank of Kunlun Co, part of the Chinese state-owned China National Petroleum Corp, and the Elaf Islamic Bank of Iraq for “knowingly facilitating significant transactions and providing significant financial services for designated Iranian banks” was not so widely reported.” Further, sanctions are not limited to US govt. actions: “Though the claims relate to the period 2001-7, since the start of this year co-ordinated sanctions by the EU as well as the US have tightened the noose on Tehran by blocking access to the key financial and insurance markets of Europe. Iran is slowly being excluded from large parts of the global financial system, unable to sell its oil and fast running out of space to store it.” http://www.guardian.co.uk/commentisfree/2012/aug/09/standard-chartered-iran-sanctions

Sanctions (the rightness of which are not questioned in the article above) are the first illegality which bares on this case. In the MSM I see little question of the idea of Iran as the belligerant, deserving of sanctions and war. In fact, I see the opposite.

As to press collusion with the govt. and large corporations, this is extremely disturbing. People really should not have to take screen shots of prior information, information which has later been removed, not because it is inaccurate, but because it is too revelatory. This clearly shows how intertwined the govt., corporations and the press are. Our press is not a free one and investigative reporting is nearly dead.

Information on what is happening with SC is changing. Reportedly Lawsky gave Federal authorites notice that he would proceed with charges back in April. (Note– this information comes from Reuters, who claims they were leaked a letter from Treasury in response to questions from SC.) I would like a full investigation of SC, it’s attorneys, all its partners. I would like a full investigation into the disappearance of important information from Reuters. I would also like a full investigation into US sanctions and acts of war against Iran.

Reuters just became interesting, redactions and all. Yesterday their “Financing” news from Asia was stunning in its pro-derivatives plea for creating “liguidity.” I think I need a new dictionary – the article talked about Standard Charter having scratched the names of the clients it was laundering but they were known to be primarily Iran, Libya, Sudan and Myanmar. (And who else?) The transactions started in London but ended in US dollar clearing services. I’ve been wondering where Reuters swooped in from, doing what seem like reliable reports.

Iran is claiming that the sanctions violate “fundamental human rights” protected by the Geneva Convention and WTO provisions. They recently stated an intent to file claims in the WTO and International Court of Justice. A link previously posted with Iran’s official position on sanctions. The piece has obvious bias, but is not necessarily without a basis in truth:

http://www.tehrantimes.com/component/content/article/84-perspectives/100281-us-sanctions-on-iran-mockery-of-rule-of-law

Why again do we have these sanctions in place? Because they might be developing nuclear weapons? Based on possession of material they also need to provide medical treatment for their population, which the West refuses to agree to supply until after they shut down production? How widely was it reported that Turkey and Brazil amazingly brokered an agreement in 2010 to exchange their supply of low-enriched uranium for fuel for their research reactor. The agreement was rejected in exchange for imposing sanctions, being the same agreement that the Western powers had suggested themselves a year earlier.

China is where Iran gets most of its expertise, so more than Chinese banks need to be sanctioned.

If I were an Israeli citizen, I’d be quite concerned at the enabling in the name of business.

I wonder how Lawsky became aware of the wrong-doing. It seems very likely that an insider whistle-blower took the issue to the Feds (Treasury, Federal Reserve), and when they didn’t act, ended up on Lawsky’s doorstep.

I don’t think so. It looks like Lawsky’s guys just read the e-mails Treasury had already obtained and decided that they were incriminating enough that the case deserved action, rather than several more years of ‘investigation.’

READ THE ORDER. Or Marcy’s post.

Short form: in 2010 or so, SCB decided to come clean, or its version of clean. Hired Promontory, which came up with a #of only $14 million in transactions out of compliance. Went to Treasury, the Fed, the NY state regulator, the DoJ and the NY DA’s office, with said report and also waived attorney-client privilege. Dunno how much in the way of additional docs it provided. The order cited some huge number of docs (300K pages if I remember correctly) so it might have done the trick Goldman has done when it gets subpoenaed: dump such a huge number of documents that it’s really hard to find the ones with real dirt among the rest.

What appears to have happened is everyone ex the newbie Lawsky probably only read the Promontory report, as in took the elite validator at its word, in addition to the show of sincerity of providing all the docs. They probably only put juniorish guys on this. I mean $14 million? SCB probably spent more than that on car service between 2001 and 2010.

Lawsky, not getting how one is supposed to behave, appears to have gone through the underlying docs. Oops!

“I wonder how Lawsky became aware of the wrong-doing. ”

Read this and you will know, it doesn’t take long, read it,

http://www.dfs.ny.gov/banking/ea120806.pdf

The order doesn’t seem to mention how the case came to NYS DFS’s door. The 300K documents (amazing reading) would have been subpoenaed after the initial allegation/tip/proactive insight came in. It would be dispiriting to learn that the investigation started with a tip from someone serving the agenda of pro-war-in-Middle East parties (or party), and using Cuomo-Lawsky to further that agenda.

The thing is, there is so much money laundering in violation of OFAC going on — it is pretty systemic and the wink-winking from regulators is part of the “system — that it is difficult to fathom that this case received the meticulous and diligent attention it did without something beyond “a meritorious case came into our office” being involved.

No, I am sure you have this wrong.

The NY DFS was a part of a group of regulators that SCB approached about a settlement. They provided documents. They even said in their statement they had waived attorney-client privilege.

Lawsky went to the Fed, based on the information he had 3 months ago and set forth his case. The Fed apparently gave him a go ahead, not taking him seriously.

If he had subpoenaed more information, I’m sure SCB would not have been blindsided like this. Everything is consistent with them having done a huge document dump to all the regulators, and DFS was part of that group.

If SCB approached the regulators in the first instance under some amnesty program (DOJ has these for Anti Trust and probably for AML/BSA/OFAC/FCPA violations), then this is persuasive.

But, if the doc dump in aid of settlement discussions with all regulators occurred in the context of investigations that had been initiated without SCB’s consent, then questions still remain re. political agendas that may have animated the matter in the first instance.

None of this, of course, detracts from the fact that only NYS DFS appears to have “run with the ball,” with the federal counterparts apparently chosing to shelve the matter by “continuing to look into it” (which would not be inconsistent with an executive and cabinet-level request to not gum up whatever foreign policy/military strategies may or may not be in the works vis a vis Iran).

“The NY DFS was a part of a group of regulators that SCB approached about a settlement. They provided documents. They even said in their statement they had waived attorney-client privilege. ”

And you and I know they did that for at least two reasons: feedback along the grapevine, and the knowledge that their own activities had left them naked in the spotlight. Cornered beyond cornered.

Here’s hoping that somebody in NYS govt. does not like the role AIG played in fucking with their finances. Not saying the state’s squeaky clean, but 180 billion dollars is a LOT of disturbance.

And Ms.G, the Israelis have chosen to be snarky with their silence on the issue, their usual wont — I wouldn’t let it bother you too much.

This raises the issue of whether or not the recent Syrian posts were “hacked in” or whether that was a cover byh Reuters to explain their removal: http://bit.ly/OSFwEL

see also: http://www.moonofalabama.org/2012/08/syria-insurgents-give-up.html

I’m absolutely positive that we will see real justice this time.

No, no, really, I’m convinced after more than a decade of blatant disregard for the law, hundreds of thousands of lives lost and trillions of dollars p*ssed away that this case really – again- is the beginning of payback time for the elite or something like that.

Spitzer.

Obama.

Warren.

Schneiderman.

Lawsky?

Did you ever wonder how it happens that even if you don’t like football, you still find yourself watching the Super Bowl?

Or how, you still watched wrestling even though you knew it was totally fake?

Supported the troops even though you knew the wars were illegal to begin with?

Or how you still followed campaigns and voted in elections because you really thought your vote mattered?

Or how with every flagrant violation of law the W. administration had FINALLY crossed the line and was on its last legs?

I truly am not saying that this scandal has been fabricated for our consumption.

OTOH, I’m sure all the participants are actively and sincerely engaged in their respective roles.

What I’m saying is that for the rest of us – y’know, the people who’ve been on the receiving end of the lack of law and justice – are we really going to keep getting our hopes up about the potential for some bigwigs to face some sort of adequate punishment?

Isn’t our – somehow – persistent interest in and belief that the system is still working – that people are actually working for our benefit – detrimental to our overall progress?

Look, we get outraged at what THEY tell us to get outraged about.

The litany of past potential “heroes” nearly matches the list of scandals that have been swept aside.

Illegal war…long gone.

Torture…long gone.

Financial crisis…long gone.

Fraudulent mortgages…long gone.

Libor…fading fast.

Think they can’t keep dishing stuff out like this forever?

Think again.

We have to understand that enough crimes have been committed for everyone to be screaming:

STOP! No matter what new scandals or crimes are being unearthed we have thousands of terrible crimes already committed that point to the inherent sickness of the system and which need to be prosecuted before the newly introduced scandals “disappear” our righteous outrage.

Again, Yves does a great service in documenting crimes but it sometimes seems – judging by our excited levels of hope – as if we’ve really haven’t learned anything and that we’re mostly still stuck on a treadmill of unrealized expectations.

There are few words required to make it clear that we must Resist. Hoping and writing aren’t them. After 30 years on Wall Street, where I was considered the Most Dangerous Guy, for having honesty, I can justify any action taken to Stop these sociopaths.

+100!

I’ve merely perused this story and it has validated one of my memes: in a world where the control of information is in the hands of the elite, it is imperative to maintain the freedom to speak in the town square. Today’s town square is the internet and we must defend open access to the internet lest the likes of Naked Capitalism have access speeds measured in minutes, if not hours. Pay attention folks, I suspect that open access to the internet is a thorn in the side of our elite rulers.

Yes, OK, SBC did engage in a few grey area transactions but they did the right thing by informing the proper authorities in the USA and UK. Negotiations for a deal that would result in a slap on the wrist included SBC’s cooperation to continue these type of grey area transactions as part of a joint intelligence operation (CIA, DIA, MI6 & Mossad).

All of the huffing & puffing by various authority figures is intended to provide the NYDFS with cover to back down so as to not fully expose the intel op to Iran. It also explains the scrubbing of articles on the internet. If NYDFS does not back down then we should anticipate seeing Irangate 2.0 in the news in the near future.

Disclosure: I must give full credit for this information to my new (but last year’s model) Tin Foil Hat manufactured by Foojitswho? out of Japan. This information is so fresh that Debka & Drudge don’t even have it yet. This TFH is sooo awesome!

Peter Pan

” .. but they did the right thing by informing the proper authorities .. ”

They obeyed OFAC when nothing else was left for them.

read about “wild card” for insight into what you mentioned

http://www.dfs.ny.gov/banking/ea120806.pdf

I think the search hit about the woman falling off Promontory Point is a coded warning….

Orwell is constantly proven to have lacked imagination.

Yeah, I read the original version and had the same thought: “They need to shut up! They’re telling everybody how they get away with breaking the law and who’s involved!”

I will add one comment that ALL the SC articles on Reuters have had very strongly biased language of SC beeng a victim and the NY regulator being out of line. This is VERY UNcharacteristic for non-editorial articles on Reuters. That caught my attention the most.

I think this issue clicks very easily with the general public because it follows the classic hollywood script of the big boys in bed with the people with the money and the underdog defender of America that exposed it all.

This will likely be an order of magnitude more damaging for public perception of regulators and banks that the Libor issue despite it being much less relevant to them.

Found original artical

http://www.reuters.com/article/2012/08/09/us-standardchartered-iran-idUSBRE87815420120809

Yes, it is time stamped 2:36 PM as of today. And when you put “Promontory” into the search field of the Reuters site, this story now comes up. As my screen shots of last night show, it was gone as of then.

Looks like they decided to restore it.

Yes, it had definitely been disappeared for a while.

I like to think that Yves’s post triggered a Butterfly Effect … :)

This story just keeps on giving, and Reuters is clearly running interference for Standard. From a Reuters blog, of all things:

http://www.breakingviews.com/stanchart-anti-us-rant-will-resonate/21034261.article

Lawsky is being warned that US financial dominance will be yesterday if he keeps this up. He better shut up or Chinese will be the official language of finance next month.

The author of that post is blowing smoke. The world economy is slowing. The euro is tottering. And the yuan is simply too small a currency in interational markets to become the world’s reserve currency. It bears repeating that a nation can’t be the world’s reserve currency unless it runs large trade deficits, i.e. putting large amounts of its currency into foreign hands. This is very much not the Chinese case. So the author John Foley’s analysis is empty.

But what is interesting is that if you click on his name this comes up:

“John Foley is Reuters Breakingviews’ Greater China Bureau Chief, based in Hong Kong. He previously wrote on mergers and acquisitions, capital markets, consumer goods, mining and luxury. Before joining Breakingviews in 2004, John worked as a copywriter for a London-based advertising agency. John read English Literature at Exeter College, Oxford”

This explains I think the Chinese angle he places on the SCB story. He’s not trained in finance or economics. Of course, neither am I. But while clueless he still has a paying gig opining on this stuff. On the other hand, maybe that’s why he gets paid for writing these posts. This would also explain why I don’t get paid for what I write. *g*

If there’s one thing the Kleptocracy Watch in the blogosphere of smart writers and observers has demonstrated it is that Blowing Smoke Pays, and the less the writer knows the better-paid the smoke!

(Side Kudo to Yves and the good folks at the S.H.A.M.E. project.)

An unmitigated threat! It’s all out war. The British have convinced themselves they can make or break the US. I wonder where they got that idea? And are Americans that oblivious? Apparently.

They still haven’t gotten over losing Hong Kong. John Burdett’s “The Last 6 Million Seconds” makes for a cracking read on the (original) subject.

Barney Frank should like this, the British are urging all others to fall in line with their “discretion” in not naming U.S. banks that have done the same.

This is interesting. Yahoo is now carrying the original version of the Reuters story. I write “now carrying”, because the byline says it went up a little over an hour ago. Yet the Reuters online version makes no mention of any difference between what they have online now and prior versions of the story.

Anyone ask Reuters what kind of jig this is?

The first time something horrible happens, say the LIBOR fix, one can feel a sense of tragedy. When it happens a second time it happens, farce overcomes tragedy. However, we are long past the second time and the resulting farce of this year alone (and I do love farce) with SCB, Knight, HSBC, the London Whale, BATS, Facebook, the Eurozone generally …..

I just don’t have a word for it.

That’s because it requires two words: EVIL GREED.

Anyone disgree?

I am sorry that I can’t leave more room for disagreement, but those would be words. Time for Action. Resist!

It’s not a different matter for Bloomberg.

“Now it isn’t unusual for stories by Bloomberg and Reuters to morph a bit over the day, as they get more info, juicier quotes, or decide to perk up the wording a bit. But actively expunging a story with important information in it is another matter. ”

How many stories on bloomberg at the height of the crisis would start off factual, suffer an update or two with complete loss of original material or suffer complete CONTRADICTIONS of the original material ? Enough to transfer the impression of internecine warfare in bloomberg HQ.

It is relatively new to Reuters, not completely new.

Promontory staffers and bloomberg staffers may feel free to contact me with the intention of ‘re-educating’ me, but are advised not to as the little illusion they have of ‘integrity’ will not survive the experience ‘unviolated’.

lol

And for those at Reuters and bloomberg who have firsthand knowledge of said internecine warfare, rest assured the memory of the eye of scrutiny IS trained upon their organisations, whether they are aware of it or not.

lol

I did a search and found this:

You can access the cached version for any page that has been saved by Google with this:

http://webcache.googleusercontent.com/search?q=cache:http://example.com/

Change http://example.com/ to any URL. You can also create a custom search engine to go to cached versions automatically by adding a keyword before the current URL address.

Thank you.

Yves, thank you for presenting L’Affaire Reuters on NC, and for the dynamic responses and follow-ups from your readers.

Who’s going to start calling it Pressgate?

The MSM, so they can squeeze the story into their set-piece parameters, cause MEGO amongst large readership and thus allow the story to slip into “nothing to see here” land.

Sigh.

That is why I like “L’Affaire Reuters” (at least better than XXX-Gate).

Hi Yves, I did a search on duckduckgo around 9:30 pm (on phrase “Standard Chartered hired Promontory Financial Group, a Washington D.C. consulting”) — it brought up three results, emptywheel plus two other sites that carried the original Reuters story (no Reuters link though).

Yahoo UK’s 05:45 BST version is here; on superficial comparison it seems to match yours: http://uk.finance.yahoo.com/news/exclusive-u-regulators-irate-ny-044545329.html

Fillbag.com carries a 9:07 a.m. EDT version (http://www.fillbag.com/2012/regulators-irate-at-ny-action-against-standard-chartered/) as it was morphing apparently. Comparing it to your quotes is interesting:

and

and

Did someone tell Fillbag what phrases were to be changed but leave it to them to write their own quasi replacements? Stuff is just funky to read.

Should have specified I did my search at 9:30 p.m. California time.

To all the commentators and people of US in general. What is the point of putting these things online? when your system is so fucking dead for the poor. The first time anyone was allowed to settle without admission of guilt, you should have made a hue and cry and got the fucking regulatory agency guys punished for corruption. It is stupid that your money goes into paying for the investigation and then the guys who made hundreds of millions of profits go scot free paying a fine of tens of millions without admitting guilt. So either you arent men enough to act against them or like those guys, you just wanted in on the action and so agreed to a price for your silence and co-operation.

You’re “scapegoating” us, right ? hailing from the corruption-free utopia you would have us believe in.

http://www.nakedcapitalism.com/2012/08/links-8912.html#comment-783259

Why all the indignation here? We all know that bank owners rule the world and what must be done to stop them; still this is a good piece of reporting on the continue striving for world hegemony by the owners of the financial system…

The 99% VS the 1% – A battle to be fought and won with truth and unity!

Now is the time to join forces with those you would not normally consider. This is all starting to leak out to the main stream media… finally. We just need to KEEP THE HEAT on them. We will soon be posting new petition and email campaign info as well as protest ideas. We just need more people following this group and we can use resources from the Tea Party, Occupy and other groups. THEY win as long as they can keep us arguing with each other.

WE need to come together with people we wouldn’t normally work with to bring these criminals DOWN! Spread the word, others have carried the load of exposing this activity. Now we the people NEED to come out and make it a major issue in the news and in this political cycle.

JOIN US, this is YOUR cause too (Click the “LIKE” button and spread the word: http://www.facebook.com/BankAndPoliticianFinancialCorruption

Those damn global caches; why can’t information just vanish like a regulator?