By Richard Alford, a former New York Fed economist. Since then, he has worked in the financial industry as a trading floor economist and strategist on both the sell side and the buy side.

Five years after the financial crisis and halfway to a lost decade, economists, policymakers and the public are looking for answers that will restore economic health and vibrancy. Their concern has increased recently with the approaching “fiscal cliff” and the possibility of a double-dip recession. To find remedies, they’ve examined past financial crises that were followed by protracted economic downturns. In the US, the precedent studied and cited most frequently has been the Great Depression of the 1930s, including the double dip of 1938. Unfortunately, economists have produced a variety of inconsistent explanations for both the initial contraction and the prolonged period without a self-sustained recovery.

In a relatively recent development, economists examining the Great Depression have explored the role of non-monetary financial factors, such as defaults, wealth effects and informational asymmetries, to explain why it took until 1944 for the economy to return to the level of real income seen in 1929. The research has been focused on the balance sheets of banks and businesses. With the advent of the lost decades in Japan, economists have paid even more attention to the balance sheets of financial institutions. The recession of 2007 in the US is widely viewed as a “balance sheet recession” with the focus again on the balance sheets of financial institutions and commercial enterprises. Non-conventional monetary policies have been adopted at least in part because of the belief that a balance sheet recession reflects capital market imperfections that have rendered the normal monetary policy transmission mechanism inoperative.

In a 1978 Journal of Economic History article titled “The Household Balance Sheet and the Great Depression,” Mishkin noted “… the status of the household balance sheet has received little emphasis.” And it has received little attention since 2007 except for occasional calls for debt relief.

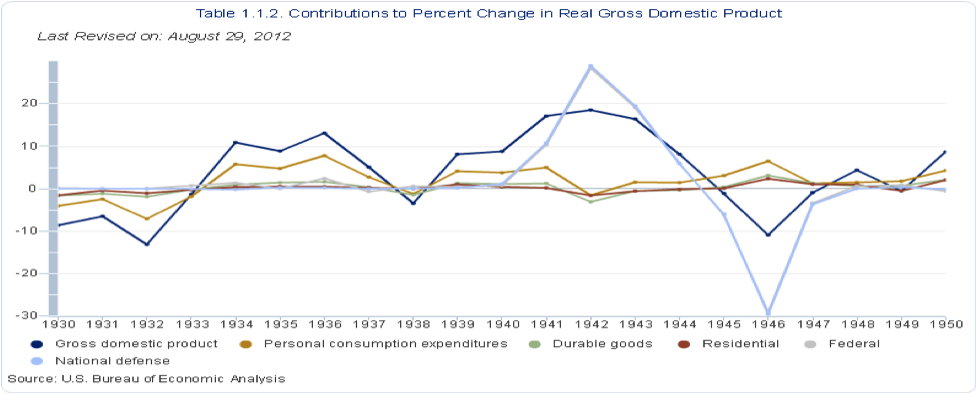

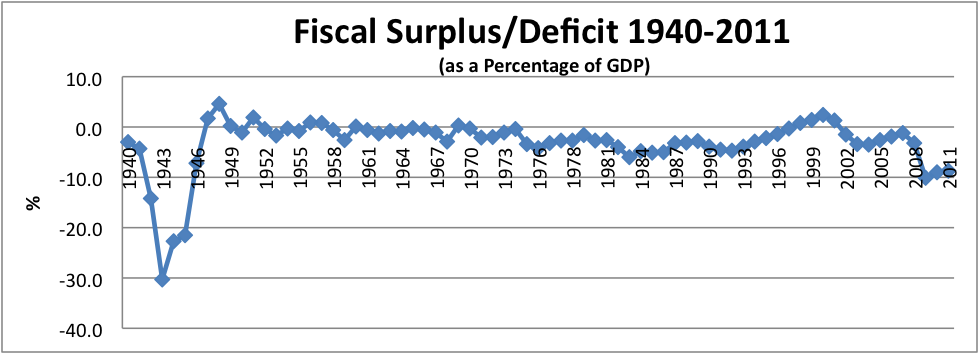

The scant attention paid to the household sector balance sheet may come with a cost. The accompanying chart shows the importance of counter-cyclical increases in consumption expenditures and residential investment immediately after WWII. These unusual counter-cyclical increases in demand helped stabilize the economy, as Federal expenditures were falling. These increases in consumption expenditures and residential investment were driven by rebuilt household balance sheets (click to enlarge).

This perspective has implications for policy when a recession or financial crisis significantly damages the household sector’s balance sheet. In those cases, stimulating the economy in the short-run by reducing savings, increasing consumer expenditure on durable goods, and increasing debt loads are counterproductive in the medium-to-long–run. Yet a number of programs designed to combat the Great Recession fall into this group. These policies include “Cash for Clunkers,” which encouraged households to decrease savings, stock up on automobiles (a durable good), increase their debt load, and increase their ratio of real-to-financial assets. It also includes interest rate policy that discourages current savings and forces many to draw down on savings accumulated over a lifetime, thereby reducing income and consumption in the future. These policy-induced changes in household balance sheets make it less likely that, in the future, consumption demand will be able to offset the drag resulting from fiscal retrenchment.

A number of factors are responsible for the failure to consider the contribution of the household balance sheet to economic performance, especially prior to 1950. First, household balance sheets are determined by a host of macroeconomic variables, therefore the behavior of balance sheets cannot be viewed as an independent cause of changes in economic performance. However, the repair of household balance sheets can still be a necessary precursor to a recovery from a balance sheet recession, especially when the economy faces a “fiscal cliff .”

Second, the data prior to 1950 is limited. Goldsmith, Lipsey and Mendelson (NBER 1963) constructed estimates of the “National Balance Sheet” for selected years prior to 1945 and for each subsequent year until 1958. A more complete picture of the behavior of household balance sheets between 1922 and 1949 can be put together by employing annual observations or estimates of investment in residential real estate, the average age of the housing stock, the number of passenger cars registered, and household sector savings. While the quantity and quality of the data is such that it cannot definitively answer the questions posed by economists and historians, the exercise will provide an additional perspective on the behavior of the household balance sheet and its link with economic performance in the post-war period.

Third, much of the data that exists is not inflation adjusted. Comparisons and analyses would be easier and more informative if the series were all “real” adjusted by an appropriate price index or deflator.

In summary, the financial position of households changed dramatically between 1929 and 1949. Consumer debt and household mortgage debt both fell in nominal terms between 1929 and 1933. Between 1933 and 1939, consumer debt more than doubled, but mortgage debt managed a mere 6+% increase. In total, the two forms of debt increased by approximately 27.5%. From 1939 to 1945, the increase in consumer and mortgage debt was less than 2%. Between 1945 and 1949, consumer debt more than tripled and mortgage debt more than doubled.

The asset side of the household sector’s balance sheet also saw dramatic changes. The value of equity investments plunged between 1929 and 1933. Equity holdings had not returned to the 1929 peak (in either nominal or real terms) by 1949. The value of other asset holdings behaved differently. Between 1939 and 1945, Currency and demand Deposits increased by almost 250% and then drifted lower between1945 and 1949. The household sector’s holdings of federal government securities increased by over 600% between 1939 and 1945. Holdings of government securities drifted sideways between 1945 and 1949 to end the period on balance lower. Real assets were also affected. Data in the Historical Statistics of the United States and the Statistical Abstract of the United States confirms that the average age of the housing increased from 1928 until 1945 and consumer durables moved in line with the economy until the war and grew dramatically after the war.

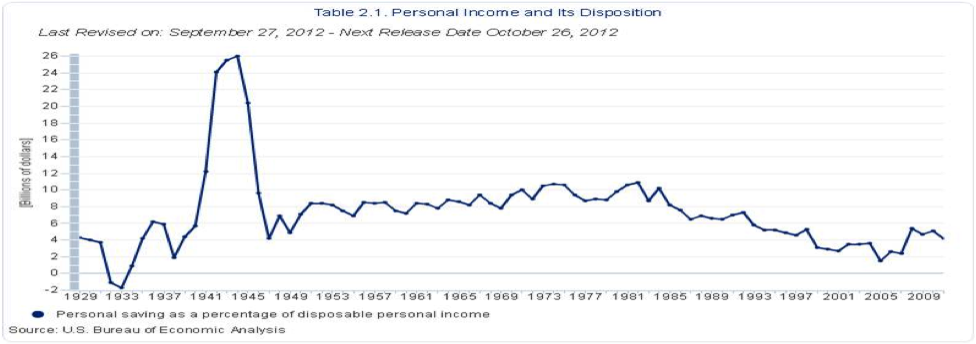

The change in the behavior of households is perhaps most dramatically reflected in the changes in household savings. When measured as a percentage of disposable income, US households saved 4-5x as much during the years between 1941 and 1945 as they had at their peak in 1929 and 3-4x as much as they did in the post-war period (click to enlarge).

By the end of the war, the household sector’s balance sheet asset mix had been recast. Households had increased their holdings of safe, liquid financial assets, while economic dislocations prior to the war, rationing during the war, and depreciation resulted in declines in real assets (click to enlarge).

During the recession of 1938, consumption expenditures and residential investment declined, yet they expanded during the recessions of 1945 and 1949. These post-WWII counter-cyclical increases in consumption expenditures and residential investment suggest that the recasting of the household sector’s balance sheet helped insulate the economy from the fiscal cliff at the war’s end. However, given that economists and historians have been unable to arrive at an agreed-upon explanation for the depth and length of the Great Depression and the fact that balance sheets are endogenous, it would be a mistake to view the improvement in household balance sheets as a complete explanation of the emergence of a post-war self-sustained recovery. Nonetheless, the behavior of the household sector’s balance sheet sheds some light on the wisdom of economic policies aimed at producing a recovery from a recession in which the household sector’s balance sheet has been damaged. This is especially relevant when the recovery must be self-sustaining given impending fiscal retrenchment.

Despite the dramatic and sudden fiscal retrenchment post-WWII, the US economy only experienced an 8-month long recession in 1945,. However, the authorities may actually face a greater challenge now than they faced then. After the war, US households were both willing and able to increase consumption relative to GDP. During the war, consumption as a percentage of GDP was well below its historical average. The end of war time rationing and shortages allowed consumption to mean revert. Tax receipts declined by about of 5% of GDP between 1944 and 1947. This served to increase disposable income and consumption relative to GDP. The personnel savings rate had been well above the average during the war. This forced savings during the war left the household sector with greatly increased holdings of liquid bank deposits and government securities. The household sector was clearly financially able and willing to increase current consumption, its holdings of consumer durables and its debt load, as well as to demand new and better consumer durables and housing.

Today, consumption remains above its post-war average as a percentage of GDP. The likelihood of pent-up demand buoying consumption expenditures is remote and any reversion to the mean will reduce consumption. Given the recent popping of the housing bubble, it is unlikely that household sector demand will drive an increase in residential real estate investment such as the increase that occurred after WWII. Furthermore, the probability of tax receipts falling as a percentage of GDP and thus supporting disposable income and consumption is remote and inconsistent with fiscal retrenchment. During WWII, policy forced increased savings and a rebuilding of household balance sheets. Recent policy created negative after-tax real rates of return, discouraged savings and promoted the purchase of durable goods. Recoveries in household financial assets have been dominated by recoveries in the value of real estate and equity prices, but it is unlikely that households will increase spending based upon unrealized gains in real estate and equity assets as they did prior to the tech and housing bubbles.

Assuming a fiscal retrenchment, balance-sheet-driven increases in consumption relative to GDP will have to carry a much larger share of the burden than they carried after WWII, if the economy is to grow. Assuming a decline in demand from the government sector (19.5% of GDP) as part of fiscal retrenchment and a decline in consumption demand (71+%) as a result of mean reversion and the fiscal retrenchment (higher taxes and lower transfer payments), then GDP growth will depend upon the remaining components of demand (9.5%) growing quickly enough to more than offset the decline in demand by the household and government sectors (90.5%).

To the extent that macroeconomic policies since 2007 have contributed to recent increases in economic activity and declines in unemployment by preventing the rehabilitation of the household sector’s balance sheet, they have done so at the expense of delaying the return to a self-sustained economic expansion. These policies may ultimately contribute to a Japan-like outcome for the US: years and years of slow growth with an economy dependent on larger budget deficits and continuous extraordinary monetary policy. The policies have not solved the macroeconomic economic problem facing the country, but rather postponed and perhaps increased the ultimate cost of the required adjustments.

Less formally, can monetary policy, which rebuilds the balance sheets of financial intermediaries at the expense of the balance sheets of households and other economic agents they intermediate between, really be the path to lasting recovery?

Another timely and relevant article from NC.

If I read correctly, business spending will have to increase dramatically to offset the declines in government and consumer spending.

I have a different number for public sector spending, including local/state/federal, 40% of GDP in 2010 as compared to 20% in 2001.

For businesses to start spending, we don’t need a President who tells us, “you didn’t build that”, we need one who says “you built that”.

Less taxes, less regulation and more accountability should be the order of the day. Instead, we are getting the opposite.

Wrong on all accounts. Less taxes and regulation will do nothing as the structural problems will not allow it. It will just drain more from the real economy and allow reckless cronyism to flurish farther.

I somewhat agree with you.

Although I’m certain lower taxes is better for the economy, the issue is spending, not taxes.

The government is borrowing tons of money to fund deficits. Imaging if instead of borrowing, they hiked taxes?

Would people accept it? Of course they won’t, but they sure support spending. It doesn’t make sense, how can people want more pending but not pay for it?

Well, we are paying for it now and we’ll pay for it again in the future. We are morons. When the government borrows and spends, they drive up prices, our cost of living. Hit number 1.

Our children will again pay for it via higher taxes to pay for the same spending we already paid via higher prices. We are idiots.

But that’s the way we want it.

Everyone wants more programs and more spending. Don’t blame Washington, they are a reflection of our stupidity.

Your last comment about spending draining from the economy is wrong.

The economy you speak of has zero to do with stupid pieces of papers and digits, it has to do with food, housing, transportation, clothing, roads, factories, computers.

More le less paper doesn’t change it. Profits, interest, greed is what drives that economy.

The economy you speak of has zero to do with stupid pieces of papers and digits, it has to do with food, housing, transportation, clothing, roads, factories, computers. @Kilo

Those pieces of paper are legal contracts that extinguish debts and allow their bearers to take ownership of productive assets. The electronic digits are backed by those same contracts. They mediate, animate and guide the economy’s more obvious objective manifestations. Money isn’t just a scoreboard tally; it’s a real and complex economic good.

I understand.

So although humans need water to survive, it’s the number of cups that’s important, not the water.

You do know that dollars are essentially cups holding wealth, yes?

@Kilo: You’re forgetting the labels on the cups. Those are very important!

So although humans need water to survive, it’s the number of cups that’s important, not the water.

I told you exactly what a dollar is. You’ve responded with a mere metaphor. I never said the cups were more important than the water. Someone posting in your name said that the cups had ZERO to do with the water.

Not that I’d ever accept that wild choice of a metaphor. An economy without money is music without the score. Made all the time, but with none of the complexity a scheme of coordination can bring.

You DO know that dollars are essentially a musical score, yes? /sarc

It multiplies like a bunny wabbit too. Must be organic. Maybe sentient, but I hear there is smart money and also dumb money.

In reply To Bert_S

That there is allowed to be be the crux you state is at the source of it all.its human nature to desire to be the one that wins, so humans set up ways for that to happen.

I think there needs to be a clearly defined two-tiered system in which those who want to gamble and play the exciting ‘odds’ games are allowed to do so freely. And those who just want bread and butter investments to last throughout their lifetime’s (ie municipalities and such) should also be allowed to do so. The only way to accomplish that is to create two equal but distinctly different types of investment arenas (gamblers and bonders) and never again shall the twain meet. Sounds so familiar…

OK, I’ll bite, the structural problems which you didn’t specify, but I’ll assume you’re referring to unfunded entitlements, are still there, and still down the road.

Those are separate and distinct from the topic of the post, being how to stimulate GDP, which $5T of spending before QE3 hasn’t accomplished.

I think you missed the point, which is why more Socialism is not the answer. It only expands one factor in the problem set. The other being wealth and income inequality. Regulated free markets and decentralization are the answer, which takes power away from the oligarchy, and therein lies the rub.

It seems you’re long on criticism and short on solutions, yourself.

Oh I have solutions.

Stop government spending, balance the budget. How you get there will be painful irrespective of route.

It will be painful, but it’s the only way if you want businesses to hire again. Unless you feel small companies can compete against governments.

Either we take the pill and get it over with, or drag on the bottom for years and years. All because some geniuses refuse to accept reality.

Kilo, balancing the budget is a sure way to send the economy into a recession.

budget deficit = private sector surplus.

The private sector after it lost trillions in housing wealth tries to save and wants to be in surplus. If you don’t allow that by balancing the budget, you will have a depression.

Serious debt reductions were tried 7 times, 6 times there was a depression, the 7th were Clinton surpluses, we are living the wake now.

http://rodgermmitchell.wordpress.com/2009/09/07/introduction/

Trying to read this while moving ads flash by is next to impossible. I gave up and will wait for the comments to find out what the post is about.

Sorry, but there is no self-substained expansion. The Boomers can’t power the demand and thus business spending. Energy crunches have started, needed innovation, we cannot give yet. The party is over.

This is what the poster above and this article do not understand. Anything else=epic contraction as the US essentially falls apart. We can do it quickly or slowly. To quickly may destroy everything and bring a “Visigoth” type reaction from the herd. Pillaging and destroying further.

Unless we make wholesale structural changes. Don’t take the government, corporations or bankers as fools. They know this adjustment needs to be made, but they see a slow steady growth period into this transition where they keep their merits.

In otherwards, either Japan or depression, you have your pick. Because only those 2 options are on the table.

Again, you miss the point for the very reason you’ve already pointed out. US unfunded entitlements are the Himalayas.

You can bury your head in the sand, but employment must increase through an expansion of GDP. The current system is rigged against employment, so there has to be some sort of shake up.

No, you are completely and utterly wrong about this. Go look at Latvia and tell me how well that experiment is working. Even the hookers are leaving the country.

Read these, for starters:

http://www.nakedcapitalism.com/2012/09/were-not-broke-and-the-clinton-surpluses-destroyed-the-us-economy.html

http://www.nakedcapitalism.com/2010/07/our-new-york-times-op-ed-on-the-corporate-savings-glut.html

http://www.nextnewdeal.net/sites/default/files/wp-content/uploads/2010/12/a-world-upside-down

http://www.nakedcapitalism.com/2010/08/guest-post-modern-monetary-theory-—-a-primer-on-the-operational-realities-of-the-monetary-system.html

Great article.

Here in Britain this issue has been more apparent because in theory we’ve gone down the ‘austerity’ route in order to reduce public deficits. Our private debt load is one of the highest in the world, yet our leaders policy is twofold – fiscal retrenchment supported by ultra loose monetary policy.

It is literally the modern equivalent of pushing on a string. Households groaning under the burden of debts, savings and incomes being trashed with inflation yet our leaders attempt to force feed us credit until we puke.

All that has happened is that the rich have become richer and the much vaunted ‘re-balancing’ has not occurred, the better off households continue to import ever more goods from abroad as they feel better off.

I have been going around telling anyone who will listen that Osborne’s ‘Plan A’ cannot work until Private sector debts are tackled. So thankyou for your great article – I hope this becomes a much more mainstream topic of discussion.

If anything, this helps point out what happens when looking in the rear view mirror while driving, especially if the vechicle is a 50 ton bulldozer, without regard to any bluprint, aside from destroying something. Recovery @ 1944, the U.S. Greatest Generation builds, hands off to the Boomer Generation, who then tear it up, handing off to the Y-Generation who contiue while driving that 50 ton bulldozer. Perhaps if the laws of the land were followed, instead of modified through corruption, exchanging the majority of incarcerated inmates with theose responsible for this destruction, then just maybe, the country could rebuild itself?

For a peak at our future, the IMF just announced a “warning” on Jap banks. Seems they have trouble borrowing cheap from the BOJ and buying 1% JGBs.

No money in it, I guess.

The IMF must have been in a snitty mood last night. They also announced Euro banks will need to sell $4.5T in assets thru next year. Must be all those BMW leases. So it sounds like next year we will be flooded with JGBs and ABS to buy. Call your broker!

I wish the IMF, the Fed, the majority of economists and most of the MSM would apologise to Japan for its handling of their financial crisis. Having spent a good deal of time in that country and being completely aware of its failings I can at least try to view their actions objectively. I would never claim the MoF in Japan was a stand-out example of wonderful competence. Mistakes, they made a few. A lot even.

But the scorn and derision meted out to the Japanese now seems very difficult to justify. A lot of it smacked (smacks) of xenophobia and even racism.

Exhibit A: Tim Geithner

Exhibit B: Ben Bernanke

Exhibit C: Bank of America, Citi, JPM etc. etc.

And so on.

If you only knew the true story. In the 1990s, we told them they needed to re-structure their banks. In 2008-2009 thereabouts, they told us we needed to re-structure our banks.

I am pretty certain (having senior contacts in Japan) that the “clean up your banks” advice was dispensed only after years of deficit spending and loose money didn’t provide much economic lift.

I also separately am pretty sure that Japan overplayed how bad things were to keep the US from busting its chops about keeping the yen really weak. Japan is a military protectorate of the US, so we can push it around a lot more than other advanced economies.

The idea isn’t to enlarge household balance sheets, it’s to rape and pillage them. Ownership is the old model, being a mandated renter the new one. Renters only need enough “balance sheet” to pay the rent. Any more is dangerous. The government will provide the enforcement (Guido – at the expense of the

citizensrenters) and the owners will provide the tube.Whether it’s software which you will now rent from the web and store your data on their cloud, the dwelling you live in, the car you drive, the road you drive it on, or the prison they slam you into when you start to ask questions, the tube you exist on will not be your own.

Balance sheets are for f**king retards.

“… being a mandated renter the new one.”

And that’s the real meaning of ObamaCare. Thanks, “progressives”!

Alford once again deftly misdirects.

Oh my! The data was not available until now. NOW we have the data! Praise the lord.

Such BS. What has happened here is not an innocent policy goof-up due to lack of historical insight.

“Brooklin Bridge says:

October 10, 2012 at 8:50 am

The idea isn’t to enlarge household balance sheets, it’s to rape and pillage them. Ownership is the old model, being a mandated renter the new one. Renters only need enough “balance sheet” to pay the rent. Any more is dangerous. The government will provide the enforcement (Guido – at the expense of the citizens renters) and the owners will provide the tube.

Whether it’s software which you will now rent from the web and store your data on their cloud, the dwelling you live in, the car you drive, the road you drive it on, or the prison they slam you into when you start to ask questions, the tube you exist on will not be your own.

Balance sheets are for f**king retards.”

“Farming” other human beings has always been a favorite activity of alpha apes but nature balances this with counter-dominance. Which, of course, is the reason you’ve been busy setting down your opinion!

Speaking of farming, the last historical period the owning class owned and the productive class had to borrow (rent) most of their goods and chattels used to be called the Dark Ages. The legal system, over time, awarded ownership to the laird and the serfs held possession at the pleasure of the master.

Think of the Irish from Cromwell to the Irish Republic. And, now, back again.

A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men who, even if their action be honest and intended for the public interest, are necessarily concentrated upon the great undertakings in which their own money is involved and who necessarily, by very reason of their own limitations, chill and check and destroy genuine economic freedom.

Seems that people fail to realize how choking to the household balance sheet high (bubbled) real-estate and rent prices are. Tell me why, a business is paying higher and higher prices every year to a landlord who has not improved his building for 15 years – every time a rent is raised or the price of a home goes up – the person or company that rents or buys the property has less excess to do other things. According to construction data – constructing a new building is not much more expensive than it was 15 years ago (yes more efficient buildings are a little more but price is offset by efficiencies in operating costs) — the only thing that has changed is the land value. Land value is increased by the people, the services (sewer, water, police etc.) When prices go up for a place to do business – the business must put that cost into the service or product (capital and labor + overhead) sold and this hurts competition – the only one making out like a bandit is the landlord or lending institution who raises his rent or interest to capture the gain he did not create through labor and capital.

Now the thinking is that somehow raising the cost of real-estate (land + improvements) will somehow make everything work again (lower wages + increased living expenses does not make the consumption of goods and services expand). Taxing the improvements on land only penalizes those making improvements. Allowing the lords to capture the value of what others created (increased land values) instead of taxing it back into the public space is backward. Maxing out the interest that the lender can charge (tax collection into the private sector) by convincing everyone that real estate will go up in value (convincing everyone that leverage was risk free)was an obvious backfire waiting to happen and the banks knew it – history should have taught them that because they were the geniuses and great men who had vision, knew better – well they turned out to be confidence men playing the bubble game. But despite all this, the important thing is that the real estate bubble would have developed in any event, simply because of the exponential financial dynamics at work and the increasing tax favoritism for real estate – taxing labor and industry rather than land rent.

The problem is that what people call “the economy” has been financialized. In the United States last year, 40 percent probably more of corporate profits were made by the banking sector.- crazy and unproductive.

‘Laborers knowing that science and invention have increased enormously the power of labor, cannot understand why they do not receive more of the increased product, and accuse capital of withholding it. The employer, finding it increasingly difficult to make both ends meet, accuses labor of shirking. Thus suspicion is aroused, distrust follows, and soon both are angry and struggling for mastery.

It is not the man who gives employment to labor that does harm. The mischief comes from the man who does not give employment. Every factory, every store, every building, every bit of wealth in any shape requires labor in its creation. The more wealth created the more labor employed, the higher wages and lower prices.

But while some men employ labor and produce wealth, others speculate in lands and resources required for production, and without employing labor or producing wealth they secure a large part of the wealth others produce. What they get without producing, labor and capital produce without getting. That is why labor and capital quarrel. But the quarrel should not be between labor and capital, but between the non-producing speculator on the one hand and labor and capital on the other.

Co-operation between employer and employee will lead to more friendly relations and a better understanding, and will hasten the day when they will see that their interests are mutual. As long as they stand apart and permit the non-producing, non-employing exploiter to make each think the other is his enemy, the speculator will prey upon both.

Co-operating friends, when they fully realize the source of their troubles will find at hand a simple and effective cure: The removal of taxes from industry, and the taxing of privilege and monopoly. Remove the heavy burdens of government from those who employ labor and produce wealth, and lay them upon those who enrich themselves without employing labor or producing wealth.’

— unknown author written in 1924 —

Exactly the same scenario we are witnessing today, and why there needs to be a shake up in the system, which privatizes profits and socializes risk.

If any one remembers it was President Ronald Reagan that first introduced the idea that when it comes to the economy “government isn’t the solution, government is the problem”. He, I believe, incorrectly believed that cutting taxes will force the government to cut spending rather that ask congress to cut spending so we can cut taxes. I disagree. As much as I distrust the government you have to admit the government of the United States has kept the now 50 states in the government. What does that mean? We could have ended up as Europe with 50 different nations struggling individually to grow and prosper or as it happened we all joined together to form the most successful country in the history of mankind. It was and is the federal government that managed to hold everyone together for the betterment of our country as a whole. So why “Starve the Beast”? The 1% realize that without a central clearing house, the government, that money could instead be funneled through people, not the government. If the money were to go to individuals they would take a percentage making themselves rich but if the money flows directly to the government then nobody makes a profit except, of course, the government. The government is made up of people working for a central organization for the benefit of all. Why weaken that? Who builds and maintains the bridges, roads, fixes the potholes, and hires the school teacher, fire fighter, or police person? Individuals will, if it benefits them, but the government does it because it benefits all. Ideally the government will dispense the money evenly where it will do the most good. But if individuals have the money it will benefit themselves. So, as much as I hate to say it, we need a strong federal government to hold our country into one and not fifty different ones.

Good grief! What the world needs right now is LESS CONSUMPTION, the capital basis is destroyed by turning it into simple garbage. Adding more iJunk and poisoned dog food does nothing over the long term to benefit anyone. There are the new billions of humans with no useful tools, these billions have nothing to do but to multiply themselves (and hope they don’t starve).

Presumably the author of this article is educated in an arcane semi-science but there is a distinct absence of common sense. Are humans smarter than yeast??

Credit is a form of infrastructure, and such public investment is what enabled the United States to undersell foreign economies in the 19th and 20th centuries despite its high wage levels and social spending programs. As Simon Patten, the first economics professor at the nation’s first business school (the Wharton School) explained, public infrastructure investment is a “fourth factor of production.” It takes its return not in the form of profits, but in the degree to which it lowers the economy’s cost of doing business and living. Public investment does not need to generate profits or pay high salaries, bonuses and stock options, or operate via offshore banking centers.

This is excerpt from prior posting here on NC – sorry for not ascribing

As a slumlord for 20 years, the real rent extractors that are driving the increase

in rents are the local taxing bodies. While federal taxes have moderated State and local taxes have boomed. That’s why landlords have no money for improvements. Even if you bought low the real estate taxes are exceeding the rent increases you can obtain in this tight rental market. Nice huh?

I am no fan of any slum lord, I am no fan of one who thinks taxation is what makes it hard for you to turn a buck – seems to me that you think your tax dollars are not going where you want em to go like – maybe providing enough services to your property that will raise it’s value and increase the rent you can charge. Sounds to me like you leveraged out some of your equity (based mostly on inflated/bubbled property valuations) and face higher debt service costs than you did 20yrs ago. Based on the fact that your renters all pay your tax burdens, upkeep burdens, financing costs, utilities etc. for you and, payed for the equity you have accumulated – I would not be surprised that you would be grateful to them by making sure the property is in a state not habitable for most.

Again, I apologize if I sound rude or offensive to a slum lord.

It does point out that if housing is too expensive and, in my experience, renting for equivalent housing is even more expensive – then the individual balance sheets of most people (household/renthold) have a long way to go before any semblance of a recovery will take hold.

What is that squeeze we all feel, what is that sucking sound we all hear – I venture to say it is the sound of the financial services companies (gamblers, frauds, corruptions) sucking the empty milkshake glass with their straw – soon they will be sucking air.

Every shred of economic growth over the last thirty years has been powered by debt. We’ve hit the limit due to the inability of households to service that debt. The government through it’s military Keynesian policies has failed in providing the economic stimulus that the domestic economy requires. Even though every president since Reagan (except Clinton who had the tech/internet bubble) has used this policy to stabilize the economy while doubling the national debt in the process.

Our situation will not turn out like Japan. Japan could export to a healthy world economy. Our situation will be another Great Depression. Where economic growth will be anemic and probably under 2% until the bad debts have been wiped out in some form or another. Every policy taken since ’08 has had one goal in mind; to kick the can. Any real reform that would address the economic crisis would redistribute wealth from the top 10% to the bottom 90%. As long as the top 10% monopolize the income gains in this country there will be no stable recovery.

This can play out in any number of ways. During the Great Depression the Hoover Administration more then quadrupled federal spending that went straight to state, municipal, and local support for the safety net. At the same time he cut military spending and raised income taxes to create revenue. Since most Americans were not war profiteers and didn’t pay incomes taxes this effectively redistributed wealth from the top to the bottom. What was a tepid recovery in 1931 was shattered by world events in Europe. While in ’32 Roosevelt was elected on a platform of deficit reduction. When Roosevelt got serious about the deficit in ’37 he shattered every economic gain the average American made since 1929. Which was only one of Roosevelt’s major economic mistakes. Confiscating gold at $20.67 and then revaluing it upwards deprived the American economy of badly needed purchasing power.

What that above scenario has in common with the present is that America is cursed with people who are driven solely by ideology. Whether it’s an attitude of laissez-faire, a belief in American individualism, a phobia against deficit spending, or a gold hoarding mentality. All of that has an effect of creating more dead money not circulating in our economy. Everything old is new again.

Good god man, enough that Hoover “quaded” government spending 4 times. NO HE DID NOT. Nominal government spending dropped slightly by 1932 and that was even with the origin of public works projects FDR would accelerate into the 30’s. The deficit quaded, but that was due to the crash and huge loss of tax revenue. It wasn’t like the government spent big then anyway. If Hoover had tried to balance the budget, there would have been no funds to run anything.

The big spending Hoover is a Rothbard lie and Rothbard was Karl Marx Jr. in his real goals: global dictatorship. His by the merchant. Jack London called it the Iron Heel.

What I meant to say is that he quadrupled government social spending. By his own account the federal government had 420 million dollars immediately available for public works in 1929. Mostly through pre-crisis budgets and savings. Which in November ’29 he directed the relevant departments to dispense with at an accelerated rate. The Federal Reserve’s own numbers prove that the deficit spending began under Hoover. Even with the implosion of government revenue that turned into a tidal wave with the economic turmoil in 1932. Between the subsequent budgets, the expenditure of revenue surpluses from previous budgets, the decrease in military spending, and his administrations other actions it is far from an inconceivable assertion. Even a few New Dealers gave him some credit for his actions.

Sources:

US Federal Budget receipts and expenditures ’29 – ’65

http://fraser.stlouisfed.org/download-page/page.pdf?pid=45&id=55601

Memoirs of Herbert Hoover Vol. 3 The Great Depression

http://www.ecommcode.com/hoover/ebooks/pdf/FULL/B1V3_Full.pdf

@The Gizmo51

Saint Ronnie was the first to take anti-government propaganda into the big leagues. Before that, it was part of the rumblings among the club set, observed by Christopher Lasch in The Revolt of the Elites and the Betrayal of Democracy.

Government can work the way it is supposed to. Which is why so much time, trouble, lies, money, and violence is spent to stop it.

“The policies have not solved the macroeconomic economic problem facing the country”

The macroeconomic (and Political) problem facing the country is kleptocracy. Household balance sheets are poor because they have been looted. We need only look at the distribution of wealth in this country to see who did the looting.

Mr Alford asks, “Less formally, can monetary policy, which rebuilds the balance sheets of financial intermediaries at the expense of the balance sheets of households and other economic agents they intermediate between, really be the path to lasting recovery?”

The question doesn’t arise, because the policies aren’t designed to produce ‘lasting recovery,’ they’re designed to increase wealth of financial coroporations at the expense of the general population. It’s what the Economic Policy Institute accurately characterised as ‘Failure by Design’ in its 2011 report of the same name.