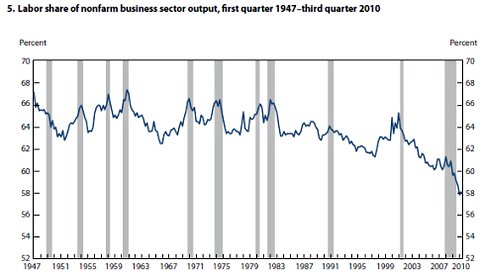

Paul Krugman is troubled by this chart from the Bureau of Labor Statistics and is looking for explanations:

It’s another way to illustrate that corporations are producing record profits while unemployment is still high and workers get an unprecedented small share of GDP growth. But it also shows the story about the prospects for workers would have been seen as very different during the Internet bubble. The long term trend would have looked flattish, and the uptick in worker share would have been consistent with all the hype about the Web ushering in a golden era for “freeters” and small businesses, that it would allow for rapid identification of and contracting with small firms, reducing the advantage of big, integrated players (yours truly thought that theory was bunk, but people believed a lot of crazy stuff in those years).

The chart is particularly useful in identifying that a shift took place after the dot com era and has accelerated (or alternatively, that trend started in the early 1990s, was reversed in the dot com era, and picked up decisively afterwards).

Krugman suggests three culprits, with the first two suggested by Nick Rowe robots and (which rdan at Angry Bear argues should be thought of as technology generally) land taking being miscategorized as income to capital. The third comes from Barry Lynn and Philip Longman, who’ve described how numerous industries have become more concentrated, increasing their leverage over suppliers and workers. Krugman finds the monopoly story more compelling:

The thing about market power is that it could simultaneously raise the average rents to capital and reduce the return on investment as perceived by corporations, which would now take into account the negative effects of capacity growth on their markups. So a rising-monopoly-power story would be one way to resolve the seeming paradox of rapidly rising profits and low real interest rates.

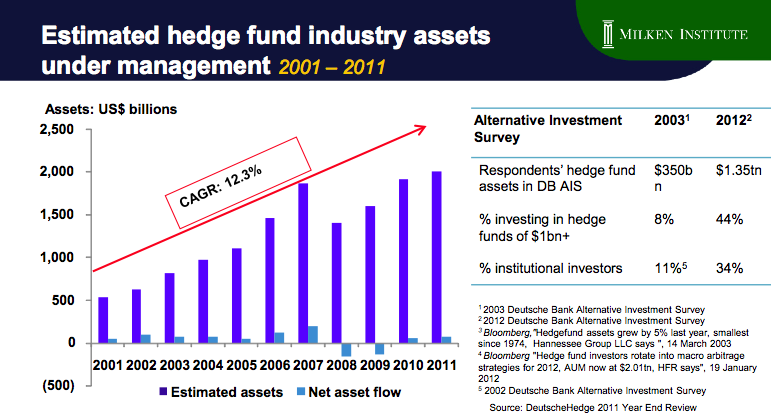

Another issue bears inspection, since it would also explain Krugman’s paradox. The massive shift in income to the top 1% has really been to the top 0.1% and that has accelerated greatly in the post-2000 era, the same time frame when the labor share fell. Upon inspection, that top 0.1% consists largely of big company CEO and top financiers, particularly hedge fund and private equity players. Executives get a great deal of their incomes via stock options; the IRS treats nonqualified stock options for tax purposes as labor income (for instance, gains on exercise are subject to payroll taxes); query what the BLS treatment is. Similarly, private equity and hedge fund managers take the overwhelming majority of their compensation as carried interest (there are mechanisms that many firms employ to get their management fees this treatment) which one would suspect would lead their income, which is actually labor income, to be classified as earnings on capital (while many also invest in the funds along side of the limited partners, the returns on their own investments in these funds for individuals below the level of George Soros are generally small compared to their share of the management fees and carried interest).

Low interest rates have led investors to pour more money into hedge funds and private equity funds:

PE funds are remarkably secretive about some things, and peculiarly, assets under management seems to be one. A quick Google search turns up data on returns sliced a lot of ways (amusing, since their methodologies for calculating returns are flawed) but no long term AUM charts. So we’ll turn to narrative. From Wikipedia:

The combination of decreasing interest rates, loosening lending standards and regulatory changes for publicly traded companies (specifically the Sarbanes-Oxley Act) would set the stage for the largest boom private equity had seen.

PE activity came to a standstill during the crisis, but fundraising has rebounded as investors are desperate for returns.

While the CEO pay story is arguably part of the monopoly story, the impact of financialization is likely a separate issue. It includes a great deal of rent-seeking that may wind up classified to significant degree as returns on capital rather than labor income. Hedge fund manager John Paulson’s “greatest trade”, the subprime short, helped turn what would have been a contained subprime bubble into a global financial crisis. Much of the activity of the activity of the private equity industry is asset-stripping, as David Stockman demonstrated in an analysis of Bain Capital’s deals (and Bain is held in high esteem by financial professionals). The much-smaller HFT industry is similarly extractive, as a post by Rajiv Sethi on a recent CFTC paper demonstrates.

And this picture would confirm Krugman’s worries. From an August post:

If this is the wave of the future, it makes nonsense of just about all the conventional wisdom on reducing inequality. Better education won’t do much to reduce inequality if the big rewards simply go to those with the most assets. Creating an “opportunity society”, or whatever it is the likes of Paul Ryan etc. are selling this week, won’t do much if the most important asset you can have in life is, well, lots of assets inherited from your parents. And so on.

I think our eyes have been averted from the capital/labor dimension of inequality, for several reasons. It didn’t seem crucial back in the 1990s, and not enough people (me included!) have looked up to notice that things have changed. It has echoes of old-fashioned Marxism — which shouldn’t be a reason to ignore facts, but too often is. And it has really uncomfortable implications.

But I think we’d better start paying attention to those implications.

Krugman turning Marxist? ;)

All he has to do is let his beard grow out.

Turning?

Please

Yeah, exactly, because Paul Krugman is such a Marxist.

It’s actually a fairly easily showable, that those with large assets tend to accumulate (given a “normal” returns path, not Paris Hilton like one) more wealth than the ones with less assets – regardless of skill. I.e. meritocracy doesn’t work in very inequal societies.

One (of the many) reasons is that zero is an absorbing boundary in monetary world (well, most of the time), and with more assets you’re much further away from zero so random fluctuations are much more likely to financially kill you. Since that in general means your remaining assets are fire-sold, the ones with assets can load on cheaply, exerbating the difference, sort of positive feedback cycle.

Meritocracy never works. The people who have the intellectual capital assets (I.e. skills) , most of them endowed by their parents/relatives, win that game, because it is strongly tilted in their favor. Most of the laments about the rising influence of hereditary capital are more indications of the tension between holders of physical capital and holders of intellectual capital, rather than, as usually acknowledged, the struggle between the “have capital” (intellectual and/or physical) and the “have not”.

The best strategy of the “have not” is to “be not”, I.e. fail to reproduce so that holders of capital don’t have an easy reserve of slave/consumers to play with in the future. Nothing frightens more the 1% (or 0.1%) than a middle/lower class who strikes on reproduction. Immigration, globalization, religious doctrine : nothing is spared to avoid the reduction of the slave/consumers pool.

I’m not sure if your comments are honest and misguided, or if you are maliciously misguiding, but there seems two problems with your answer.

First, those with skills and knowledge are screwed too: just look at the number of college grads working as baristas. Second, to then make the answer a renunciation of reproduction – that seems to be denying the vast majority of the population an important life function many enjoy (and I don’t mean the making, I mean the having ; ).

try again.

I disagree with everything you say.

Reproduction is anything but “an important life function.” People survive just fine without it.

As I suppose they do without friendship, education, leisure, wisdom, etc.

”

I’m not sure if your comments are honest and misguided, or if you are maliciously misguiding, but there seems two problems with your answer.

First, those with skills and knowledge are screwed too: just look at the number of college grads working as baristas”

There are a few reasons other than an oversupply of college educated labor for why college grads are working at menial jobs.

A. They aren’t competitive enough to get work. They possess a lack of talent.

B. They mastered a bunch of theoretical and academic material and were told by their out-of-touch professors and educational administrators that “the company” would train them, when “the company” expects the college grad to enter the job market trained on how to actually do a job. This is best embodied in the phrase “sink or swim”.

C.They picked a major and a skillset for which there is not enough demand to earn a living from.

” Second, to then make the answer a renunciation of reproduction – that seems to be denying the vast majority of the population an important life function many enjoy”

No one is denying anyone anything here–there is No One Child policy in any Western country. What you may not understand or want to believe is that bringing more people into a world that doesn’t need more labor will almost definately add to the number of unemployed and decreases living standards.

Meritocracy in America????

Are you completely daft, chum? I mean, Jensen’s work back in the late 1960s and 1970s completely blew that out of the water: the most likely indicator of future economic success in America is what family one is born into.

Truly, John Boehner, who washed out of Navy basic training, and possessor of the lowest VOCAB scores possible and still have been inducted, is Speaker of the House, for gosh sakes!

George W. Bush was president; ever seriously peruse his “military record” and school records, chum?

Sorry, charlie, meritocracy is what the plutocratic propaganda machine pumps out.

…today, around 18% of Americans graduate 4 year university or vocational equivalent…(not that “opportunity” is educational rather than economic)…while northern Europeans grad over 70%….which does engender more “opportunity”, when society is goal oriented to create taxpayers, rather than cheap labor force…

Meritocracy does work, in the sense that people continue to believe the best strategy is to compete for crumbs left behind by the top 0.1%. When truths about the top 0.1% surface, they are always diluted by sweeping in the next 0.9%, roughly half of whom are really just clinging desperately to middle class gentility as their assets waste away under the predation of ZIRP. Even on this blog, commenters routinely villify those who would preserve the savings of a lifetime through safe interest bearing investments. These by and large prudent squirrels, who resisted the temptations of easy credit and purile entertainments, are often called ‘rentiers’, an interesting inversion of monetary justice.

The truth is so obvious: a relative handful of fabulously wealthy sociopaths have succeeded in so manipulating the processes of government that they are able literally to coin money in thousands of ways which it would take an army of college professors several lifetimes to analyze and expose. Those with the necessary brain power wile away their hours, attacking one elite scam after another, hacking at the arms of a monster which simply grows more and stronger ones in response to every attack. There is no conceivable counterweight to the manipulation of the 0.1% except organization of those below, on the bottom, in the shrinking middle, in the barely respectable upper middle, with demands for economic justice as as opposed to a bit more for themselves. Big Bill Haley had it right in 1910: One Big Union. That’s why they murdered him out west somewhere.

Krugman deals with the economic issues of the precipitous decline in labor opportunities and wages. There is, however, a political issue to the catastrophe. The fight for labor is almost solely restricted to labor unions. The push to deal with inequalities is concentrated in a few columnists. Progressives, i.e. the left, are AWOL. Progressives have spent a way larger effort on the Palestinians than on labor wages. They discuss drones, Iran and reelecting rather than the outrage of CEO pay.

You left out the unspeakable horrors of puppy dog mills and the horse meat industries. All of these stories or variants, appear not only as daily feature segments along side shootings, car accidents and fires but also on the national network news programs. When they are not informing us the horrors of being unfairly treated as celebrity British Monarchs with an awful cross to bear in life, they may squeeze in a feel good story about a family whose home was saved from foreclosure by finding a million dollar comic book in the attic. Such an opportunity society we have!!!

Parts of the left (peace movement, civil liberties orientated, anti-imperialist) discuss drones and Palestine and so on (joined by others on the non-left concerned about these issues). The progressives (ie dembots) discuss lifestyle issues.

Part of the reason for this is a change in the class structure since the heyday of labor and broader left support for it.

In the days of broader support for labor, the knowledge class was small enough that it had to line up with labor to have any impact.

But now the knowledge class is much larger and has been absorbed as a servant class to rent collectors. Much of their work – especially for those dealing in words not technology – is to obscure this class structure, from themselves as well.

Up till now, the knowledge class has lined up with the rent collectors and stood by while the rent collector’s problems are worked out on the back of labor. But the rent collectors have ground down labor far enough that they increasingly need to predate on the knowledge class too. Also, even though the knowledge class has such a subordinate role in the currently existing economy, it is still the class that would be the core of the economy in the alternative future that the knowledge class is paid to prevent. The form this takes in day-to-day life is the large number of knowledge workers who know full well (even if many deny it) that they are either doing the wrong work or are doing the right work in the wrong way (medical workers).

This is why the left focuses either on distant issues or lifestyle ones. And why that could be changed.

Anyone interested or concerned about the impact of robots and automation should read the book “The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future”. It argues pretty persuasively that redistribution is going to be inevitable.

You can get it from Amazon:

http://www.amazon.com/Lights-Tunnel-Automation-Accelerating-Technology/dp/1448659817

Or there’s a free PDF at http://www.thelightsinthetunnel.com

Futurists exist to make astrologers look respectable.

and i always thought that futurists existed to make narcissitic sociopaths look respectable!

I think this is generally a straight forward consequence of easy monetary policy. When the money is available it tends to increase the capital intensity of production while trying to reduce labour dependency. One may argue that capital and labour are not exactly replaceable – but reality is in some cases they are, particularly at the bottom end of skill spectrum where it is possible.

“One may argue that capital and labour are not exactly replaceable – but reality is in some cases they are, particularly at the bottom end of skill spectrum where it is possible.”

That’s a myth, Rahul! The truth is that the top end of the skill spectrum is even MORE replaceable than the bottom end of the skill spectrum. This myth that you bring up is being perpetuate by the high-wage earners because they don’t want to see their jobs replaced by automation (i.e. robots) or shipped overseas to emerging countries like Brazil or India where the high-end wages are still significantly lower than they are in the US and Europe.

You won’t have to search long and hard in an emerging country like Brazil or India to find top-notch executives, who will work for a lot less than the vast majority of overpaid corporate executives in an advanced country like the US and Great Britain, and who are just as good if not better than most of them when it comes to creating company value or making company profits.

And you’d be wrong to think that most of the work that corporate executives do can’t be targeted for automation. Think of it this way: being a top-notch corporate executive is very much akin to being a grandmaster chess player. Most of what they do on the job largely involves algorithmic thinking. In fact, most of our IT companies have designed machines with decision making/problem solving skills that rival that of our most highly-prized corporate execs.

That’s why I propose that we replace most of our corporate executives making seven-to-eight figures with highly-intelligent robots that’ll work for next-to-nothing (24-7), freeing up the necessary funds to provide all of our low-wage worker bees with a much needed cost-of-living raise! It’s time that we get back to rewarding skills that humans will always be far better at doing, despite all of the advancements we make towards making robots more and more like ourselves.

“That’s why I propose that we replace most of our corporate executives making seven-to-eight figures with highly-intelligent robots…making robots more and more like ourselves.”

Doesn’t it all depend on who programs the robots, if they are indeed more and more like ourselves we run smack into the problem of robots funneling profits to shareholders instead of workers.

Since workers run and control the robots, that won’t happen. Be mindful, most IT specialists are working stiffs like ourselves.

I suspect you’ve arrived in utopia ahead of time.

…but like ourselves, they’d rather not be, and there’s the rub, always, for the utopian.

And what, pray tell, did the “….algoritmic thinkers (Quants) do to our economy the past ten years?????????

(“….no down side to economics of housing”?)

We need a better way.

Have you watched the movie Terminator? Our robot overlords will eventually destroy us. Not a good idea to give them power.

There’s no turning back the clock in terms of robotics, Knative. So we can either fight the robots, or use them to our advantage. Since I’m not not much of a fighter, and I detest blood and gore, I choose the latter approach to avoid life as a wretched serf forever stuck in a neo-feudal dystopian hellhole.

lol, “blood and guts”

Gore*

..considering that “financial sector” totaled 19% of U.S. economy, 2000, but today 41%, as Michael Hudson-WK Black have duly noted, we now live in a “paper debt” economy, rather than labor economy…

Kevin Phillips says a great deal of historical valued of move from manufacturing, to paper debt economy, in his book on wealth-ties of bushitters; “American Dynasty”….showing examples in Netherlands, Britain, Spain of economic disaster following shift…within 75 years…..than on slow path, now fast track…

Y’all are missing the point: the decline is due to the drop in demand for both construction workers – hey, if no one is building due to the massive overhang in capacity, no one is paying carpenters and bricklayers – and low-skilled factory jobs, such as making Levi’s jeans and the like. Plot the numbers against the share of industrial activity in the US economy and you’ll come up with a nice correlation.

Those are both legitimate structural unemployment issues, but the structural aspects account for only a small part of the unemployment problem. Analysis of unemployment shows that it’s widely spread across many fields, and hence not structural.

The recent decline in labor share started around 2001. We had a massive housing bubble and a high level of home construction 2004-first half 2007. The data don’t match your thesis.

@Yves: mea culpa. You’re right: there *should* not be the decline in that time period…but there is.

And what is the lack of activity not due to a lack of demand due to.. a lack of income for the masses ?

=> inegality decrease overall demand.

see Fordism for ideas of what capital should do in regard of wealth distribution..

Built by Mexicans. I know, I know….they spend money too.. But you know what I’m getting at.

Rents may not be just from land. Rents could be from patents and copyrighted creations.

We are seeing an increase in payments for patent infringement suits and patent trolls:

https://www.techdirt.com/articles/20120626/10452719493/29-billion-spent-dealing-with-patent-trolls-us-alone-last-year.shtml

And the long-term cost is not small:

https://www.techdirt.com/articles/20110919/17065416018/patent-trolls-cost-economy-half-trillion-dollars.shtml

Now some of that comes out as lawyer/court costs, but not nearly all of it.

You’re onto something here. A large part of the apparent countertrend in the dot-com era was fakery. “Enterprises” were developed solely for the purpose of stock manipulation, aimed at selling the corporate shell and IP to a sucker. The “employees” of those “enterprises” were not real labor, they were just window decoration.

I agree 100% with you. The patent and copyright corruption is a prime exmple of the myriad ways the law and tax systems have been corrupted to benefit owners.

http://gizmodo.com/5885644/everything-thats-wrong-with-patent-and-copyright-laws-in-one-brilliant-video

Of course, its just like everything else – laws are written by the best congress money can buy.

Of course rents don’t come just from land. A very large fraction of FIRE sector income is rent, as is income in the IP sector, as you correctly point out.

But land really is the big elephant in the room. The problem is that modern economists like to downplay its role in a modern industrial economy, whereas in fact it’s probably 10–20% of GDP in the US. (While IP isn’t tiny, it’s nowhere near as large as land.)

So while it’s entirely possible that the “mystery” here isn’t due to increasing returns to land, it’s entirely possible that land explains much of it. That would take some research, and as I hint above, economists these days are corrupted—they don’t distinguish between land and other capital.

IIRC, Mason Gaffney once wrote a paper entitled “The Corporate Tax Is a Land Tax,” which perhaps would get at some of the relevant issues.

A few flies in the ointment of free-marketeers:

• Profit is a direct function of net government spending, ie deficiits fund profits in the same way it funds savings. Without deficits profit is mathematically impossible.

• Businesses for profit by definition extract more funds from the economy than they spend into it in the aggregate. Businesses in the aggregate DO earn a profit. These funds must come from somewhere.

* Businesses cannot succeed unless the government purchases a significant subset of production…mathematically this is a necessary condition. In other words businesses can’t obtain enough revenue to succeed selling only to their employees. This is simple arithmetic.

• Household debt is borrowing from Peter to pay Paul, it isn’t possible to sustain economic growth through private debt.

Household debt (all debt actually) is limited by the level of NFA in existence. (NFA = net dollar financial assets or dollar assets with no liability claims against them). The ratio of Household debt to NFA (domestic) is stable at about 1.7 or 1.8 to 1. During the GFC it reached 2.8 to 1.

The idea that business drives economic growth has causation backwards. Businesses chase excess dollars (dollars they don’t own yet) spent into the economy (“chum”) and in doing so compete in a way that leads to steadily improving products and services. The government spending is what drives economic growth. This is the the truth capitalism doesn’t want us to know about.

I’m quite relieved to find out that after 5000 years, biz finally turned a profit at exactly the point in history when the fledgling US federal government gave themselves the right to spend. Gosh, couple more hundred years of no profits woulda put all our companies outta biz, d’ya think?

A profit is turned either at someone else’s expense, from net government spending or from from savings (which came from prior net covernment spending).

Under the current monetary system no other outcome is possible mathematically (assuming balanced trade).

I’ve never understood this. If you mean just in the markets, then maybe it’s right in a sense. But surely if I turn a piece of leather into a shoe and sell it for more than the resources it took to make it, I have turned a “profit” that did not prejudice anyone else. This idea of yours would suggest that the planet is only capable of producing exactly as much as people need to live and thrive, and anyone who turns life, labor or land into consumables is necessarily prejudicing others.

“But surely if I turn a piece of leather into a shoe and sell it for more than the resources it took to make it, I have turned a “profit” that did not prejudice anyone else.”

I agree with your basic claim, but note that in the language of classical economics, there are three productive factors: land, labor, capital. In the economic sense, “profit” (or “interest”) is the return to capital.

If you turn some leather into a shoe, then some of the return is wages (from your labor) and some from capital (tools etc you used to make it).

that’s a fair point but there may be hidden variables.

I have tried recently to think deep thoughts about what profit is and I’m not getting very far, now that I’ve discovered Adele videos and old Muhammad Ali boxing videos all on Youtube. Wow he was fast.

Consider the piece of leather itself must be priced at a level that enables your profit. If, for example, it were produced by slave labor at a price that reflects those circumstances, then it certainly would have prejudiced somebody else — but abstractly and not quantitatively.

Taken to an absurdity, the pig itself was treated with extreme prejudice, or perhaps the farmer who grew the pig, if he could not sell it for a living wage.

It is hard to make a line of this. It keeps coming to me as a circle in 3 dimensions, but every economic chart is lines in 2 dimensions. The lines go flying out to infinity, but the profits often collapse under the weight of their own debauchery and chaos.

As far as Professor Krugman is concerned, it is amazing to me how little of the world one can see from intellectual salons and libraries and universities. Since that is not my world, I can only back out the vista from that vantage point, by a process of subtraction. This exercise reveals a large sum of reality that is apparently invisible from those locations. For Professor Krugman there is always the chance to take a walking tour of Western Queens. I highly recommend it as therapy and elucidation. One subway stop is all it takes and there’ll be low buildings, not skyscrapers, many colors of paint on walls, auto shops, depots with their yellow stacattos of taxis, fried chicken stores, housing projects, trash strewn railway tracks you can walk across, old factories with brick chimneys and the full presence of the sky, with its blue ever changing with the light and from overhead to the horizon. It’s actually not bad. and you can see the economy everywhere, not like Manhattan or the library.

“if I turn a piece of leather into a shoe and sell it for more than the resources it took to make it, I have turned a “profit” that did not prejudice anyone else.”

If you did this thing and turned a profit, it was paid for in nominal dollars. The dollars could have come from someone else and the net profit for the economy as a whole is zero…money merely changed hands…it’s a zero-sum transaction.

For companies to make a net profit in the aggregate, the number of net dollars in the economy must increase…the funds must come from outside the system, because the system doesn’t create net dollars on it’s own.

Or the profit can come from drawing down savings, which exist as a result of prior net government spending (deficits), but this is obviously limited.

The key word here is “net”. If companies earn a profit in the aggregate (which they do) those funds must be spent into the economy by the fiscal authority:or they won’t earn them…the sales won’t happen.

paul: They might argue that the value of dollars would increase if there is more wealth but the same number of dollars.

Sting like a bee, baby!

If you want an answer to your question about labour, resources, and profit, check out Marx’s Capital, chapters 1 thru 3. It really hits this concept hard, in pretty clear English. The man was quite perceptive! I disagree with his theory that labour is the source of all profit (I think it comes from the interplay between use-value and exchange-value, but what do I know…) but he is the source to argue with, the rest of the so called (main stream) economists just are posers or ignoramuses.

Re: RanDomino’s comment, I would indeed so argue.

Paul is conflating aggregate profit in the business sector with economic growth. He is correct that the reason why the two track so closely together is because government expands the money supply closely enough in step with economic growth in order to keep the nominal value of a dollar roughly constant (or more accurately, slowly decreasing, since some amount of inflation is usually targeted). But if they didn’t do that, we could still have economic growth in the sense that the production of valuable goods and services could increase over time. In that situation we would have monetary deflation as a constant pool of dollars was called upon to serve as proxy for an ever-increasing pool of value. (This is the problem with a gold standard, for example).

That would certainly have negative economic consequences for the usual reason that deflation has negative consequences (since the value of money is increasing, hoarding behavior is encouraged and the velocity of money drops, reducing economic activity). But the idea that it would stifle competition and the process of continuous improvement strikes me as wrong (or at least not supported by any argument presented). Zero sum competition is still competition.

Nope, household debt is the credit card company printing money each time the card is swiped.

Your comment is without substance.

Household debt is credit against saving that hasn’t been earned or saved yet. Spending is introduced but an equal amount of spending is subtracted from the economy over time, at a rate of about 10%/year on average. The amount of credit that can be extended is linked to net financial assets as i pointed out in my comment.

Household debt can only expand as far as the fiscal authority will allow it to, unless we start lending money that we know will never be repaid. Oops.

“In other words businesses can’t obtain enough revenue to succeed selling only to their employees. This is simple arithmetic.”

Businesses are owned by people. So they can obtain enough revenue to succeed if they sell to their employees AND to their owners, which, thankfully, they do as business owners are not contemplative ascetic monks.

ummm… what about the rise of the professional / managerial class in the Democratic Party who think there is some correlation ‘tween fancy credentials and the ability to run organizations effectively? What about the fact that few of these professional / managers have … ummmm … ‘made the trains run on time’ for so many community services, aiding and abetting right wing liars against community services, and, by the way, NOT engendering enough public support of community services.

(pst! How many of YOU have been dependent on welfare, food stamps, unemployment, student financial aid, retraining, COBRA, … and the 60,000 stupid ever changing rules?)

At least the old crooks of the unions and city hall employed their cronies while mismanaging everything – now the yuppies employ their fellow yuppies to mismanage everything.

Oh yeah – and what about the staggeringly incompetent politics of these professional managerial classes? Since I moved to Seattle in ’89 when I was 29 I do see a lot of basically honest, definitely hardworking pols fighting for the shrinking scraps of the shrinking pie – I don’t see people competent at re-framing the debate, selling the re-framing, and implementing policies the public will defend against the depredations of the bandits.

Oh yeah – and what about the complete lying social climbing back stabbing yuppie f’king sell outs, like the clinton-0bummer-rahm-arne-larry-geithner cliques, ALWAYS losing to … mean meanies! boo hoo!! … Joe Lieberman!!

My wife went to Boston Girl’s Latin & turned me on to Tacitus and Plutarch and Julius this summer (think ‘Game of Thrones’ without magic) – what our lying thieving elites have done over the last 30+ years ain’t especially new – The Problem ain’t the ism-du-jour, it is secretive closed processes which allow the isms to go corrupt so the elites can steal.

rmm.

Read Peter Green’s Alexander to Actium:

The Historical Evolution of the Hellenistic Age. Very long, but also detailed. Some of the chapters focus on what is happening in the economy, culture and religion at different time periods.

Unless Plato was an idiot it is impossible to have a democratic republic as this is a contradiction in terms. Plato was Socrates student, confidant, and lover. Socrates was forced to suicide by Greek democrats because he refused to recant the public statement that “Not all positions in government should be elected, some require special skills which cannot be reliably obtained in a general election and so should be appointed.”

After Socrates death Plato did an historic freak-out and devised a system of government which Plato called republic and which was by design the opposite of the now hated democracy . He devised a republic to be run by wealthy elites, while a democracy is run by and for the majority of all citizens. A government cannot be run by both the majority of all voters AND wealthy elites at the same time – its either one or the other.

If government is constantly stalemated, who wins – the rich or the poor? The rich of course because they were making money fist over paw before and if nothing changes it’s fine with them, specially as regards their finest two creations – corporations and the notion of so called ‘free trade’ and ‘world economy’. Each of these developments exponentially increased the transfer of money from workers to the wealthy and devalued democracy (the ability of the majority to govern for the benefit of all) tremendously.

The BIG LIE is that America is a democratic republic. America is not a democratic republic, it is simply a republic and it is run by and for wealthy elites.

Your account of the reasons for the trial and execution of Socrates has no historical basis whatever.

1. The dot-com/internet/communication buildout dramatically reduced the hurdles of offshoring of higher-wage jobs.

2. Eliminating tariffs against countries without requiring them to improve their eco and labor laws. Manufacturing jobs started moving out faster with NAFTA and only the noise of the dot-com bubble masked the Giant Sucking Sound Perot warned us about. See also: http://www.askbutwhy.com/2009/08/sir-james-goldsmith-interview-on.html

3. Industrial automation.

4. AI (coming)

All these things hurt the power of organized labor, because it helped companies move production elsewhere. (Who’s left to deal with unions? Public employers can’t offshore police, fire, etc.)

Oops. Bad link. Better link to Sir James Goldsmith in 1994, talking about the consequences of increasing the pool of labor by ~4 billion: https://www.youtube.com/watch?v=4PQrz8F0dBI

True..

Welcome to the Crux:

Globalization

The end to US labor domination and the “middle class”.

Until the rest of the world’s population “rises” to a middle class, world level playing field, we face a frigid future.

Enjoy

(This from an 82 year old veteran of many labor/business trenches)

If they’re going to trade with us they must pay their workers a wage that allows them to buy some crap just like the crap we buy from them, and also meet OUR environmental standards. Or else it just doesn’t work. I could take my living standards being reduced a bit if theirs goes up quite a bit and everyone can stay employed.

That, and a shorter workweek for all! That’s all I ask (demand).

I’ve been worried about your 2) clause since Clinton helped bring us Nafta, WTO and favored nation trade status for China. Never seen a good answer for it, and here we are.

I guess I’m not that surprised no mention was made of offshoring.

At the first company I went to work for they told us to forget anything we had in any econ courses we may have taken, and we were required to read two books. IIRC, one was titled “Competitive Strategy and the other “The Structure of Production”.

“The Structure of Production” pointed out that if you are in retail or distribution, then you are in a low margin biz and must do high thruput with low “headcount/wage cost” to survive. A manufacturer has more value added and many more employees per sales revenue.

So we’ve turned into a retail economy shipping boxes from China around. Not the whole explanation, I’m sure, but how could you ignore it…unless a few people were getting rich over it and would rather not talk about it….course then there’s India too…

FYI, robots did not suddenly get better in the year 2000 as the above graph would lead the robot theorists to believe. On the other hand, there was the WTC thing….

I actually think it is a great deal of the explanation. The other problem is none of the gains in production was returned to labor. We should all be working 30 hours/week for what we who are employed make now, or something, and fill in the rest of the labor demand with the unemployed at the same rate we’re making.

Uncomfortable implications? What the hell does that mean? It kills me when guys like Krugman come right to the verge of making a decent point and then back away like they just smelled a fart. Make an assertion and defend it. Don’t do the opposition’s work for them. Oh wait, guys like Krugman are the opposition. They just like to pretend they give a shit once in awhile.

If you really want labor to have more power, organize your workplace. It’ll probably be the hardest thing you ever tried to do, but power over your job is yours if you’re organized. It may sound trite, but if you ain’t organized, you ain’t shit.

I think there is a fourth culprit… globalization and free trade. Look at the Apple model; relatively small number of well paid employees in the US, thousands of slave labor wage worker overseas, billions in profits.

I think it time to start asking if Free Trade is the bargain we want.

Not the way it’s been done, so far. As I said just above (agreeing with someone else), we have to rule that if they want to trade with us, they have to pay their workers enough to buy some of our junk, encourage them to do so, and also adhere at least to our environmental standards.

Here’s what Krugman leaves out of account: 40% (probably more now) of “corporate profits” are by the financial sector. Insurance and monopolies probably make up over 20% of the remaining. So “corporate profits” do NOT mean “industrial profits.”

Rather, the FIRE sector is draining industry as well as labor. By building debt and rent-extraction charges into the cost of living and doing business, the FIRE sector is pricing industrial output out of the market.

Krugman takes too “homogeneous” approach, as if the economy were one big factory, not a bank AND factory — with the factories being financialized.

Excellent!! The FIRE economy (financials/banks, Insurance and Real Estate) are really the paper shufflers dependent on cash flow to exercise their so-called risky investments in a financialised global corporate economy that permeates the political economy of all states.

In all fairness, this is just one blog post. Krugman has mentioned your point a number of times in the past.

Yeah. That’s why arguments that current unemployment is not “structural” are just plain silly. When the economy is structured so that you can do 60% of it just by making ledger entries, who needs people? They only make trouble.

“Krugman takes too “homogeneous” approach…”

Yeah–that’s a big problem in economic analysis.

I think it’s important to point out that the finance industry has also done a great job of murdering the mom and pop money-at-interest rentiers, a group composed mostly of old people who have their life savings invested in low-risk investments like government-insured savings accounts.

It would appear by looking at the following graph that this is not true, as interest income has steadily fallen since 1982, until now it makes up only 2% of the nation’s Aggregate Gross Income (AGI):

http://www.businessinsider.com/taxes-components-of-adjusted-gross-income-as-a-percent-of-total

However, one must remember that banks make their profits not from interest (which is an expense for the banks), but from net interest margins, that is the difference between the interest they pay to depositors and the interest they loan the money out at. This net interest margin thus contributes to the business net income share of the AGI and not the interest income share.

In the wake of the GFC, the net interest margin of the US’s 10 largest banks experienced quite an uptick, as can be seen in Figure 27 here:

“Profits and Balance Sheet Developments at U.S. Commercial Banks in 2009”

http://www.federalreserve.gov/pubs/bulletin/2010/pdf/bankprofits10.pdf

Krugman (but not NC commentors) leaves out another factor, though of course there are a group of operative factors that are tilting the returns on increased productivity away from workers and the middle class, “to those with the most assets.”

The international trade treaties that were designed by corporations and corporate politicians to allow technological and capital mobility while walling labor within the otherwise breached national boundaries should also be factored in. Treaties that completely failed to entertain the need to: attempt to standardize wages, allow workers the right to organize, apply work place standards and protection and environmental standards, have all played a part in this.

I may be dreaming but I do seem to recall Krugman defending free trade treaties during the debate back in the late 90’s as the worthwhile price for raising the prospects of the world’s poor, an admirable thought but it hasn’t turned out well to date particularly for workers in the US and I haven’t heard much from Krugman about it.

The “monopoly capital”, CEOs-gone-wild, and “financialization” stories combine rather nicely, if you let them come together, and a key word is, disinvestment.

High “profits” combined with high cash holdings and high cash payouts, in an environment of very low market interest rates, are an indicator of systemic disinvestment. If the underlying (non-financial) capital stock is actually shrinking, the marginal productivity of labor and, therefore, wages for the 90%, are going to stagnate or decline.

If the financial capital stock — if we can imagine such a beast — is being inflated by QE and the like, it can not seek returns in arbitrage against “real” capital (aka old-fashioned investment in expanding production capacity); financial capital, untethered to the “real” capital stock or land, must seek returns from usurious lending and predatory speculation.

One obvious conclusion is that we are driving this economy off a cliff. An extended period of disinvestment will not end well, as the productive resources at the end are much less than at the beginning of such a period.

And, any monetary policy tightening of the slack, which moves the financial system toward a more normal yield curve and range of interest rates, will induce a massive collapse of asset values and production of capital goods / consumer durables. (Imagine what will happen when the auto industry can no longer lease cars for near zero interest.)

test

One reason for increasing inequality is the decoupling of increases in productivity and wages that began in the 1980’s. Per-worker productivity has soared; wages have remained relatively flat. The difference: a severe tilt in the balance of power between labor and capital. To counter this trend, we may see a new wave of “Schweikism” – workers deliberately (and surreptitiously) decreasing their productivity. A successful campaign of Schweikism could reduce corporate profits from their absurdly high levels and/or force employers to hire more workers. Absent such a campaign, what prevents management from continuing to squeeze the folks who are still employed?

Labor is a requirement in the creation of wealth. Wealth is not money. Money is an infrastructure device to aid trade of wealth. Money is a measurement of wealth, a tool. Wealth creation also requires capital – that is, real capital in a wealth producing task…one that takes raw material or meta-material, capital (machines, software, paint brushes etc. ie: other created wealth) and labor to combine into something that others want to purchase via money. All the above is a production and consumption economy.

The problem is that the financial industry has created another market entirely. A market that does not interact with a production and consumption economy. It is an economy that is a gambling house…plays money to make money. A predatory economy that does not create wealth but only sidelines money out of the reach of the production and consumption economy. What others have created in wealth (labor and capital) the financial economy strips away and sidelines the unit of measure (money) into non-wealth producing activities….speculative and predatory activities that depress wealth production while increasing the number of measuring sticks.

One way to correct this split is to tax – almost out of existence – those financial activities that do not contribute to the production and consumption economy and, use the tax revenue for investment into real capital and labor such as infrastructure, education, carbon reduction, technology advancements that lower energy inputs of production, lower harmful outputs of production, fair returns to the labor component allowing an economy that is balanced…not one that favors only the measurement tool of wealth to the point where we are economically hindered, socially at risk, politically undermined, and wealth production restricted.

How does a naked short or naked long increase wealth, how do derivatives and synthetic derivatives create wealth when they are by design, de-linked from the tangible human market exchange.

When a company like Bain buys interest into a company and over-refinances existing capital investments (inflates capital costs) and, essentially converts existing wealth into money, then, removes that money via dividends, offshore accounts or other financial transactions….they have essentially created no wealth, no capital and placed the burden of debt upon labor and capital. To burden labor and real capital is to burden wealth production. This is the sucking sound we all hear.

Simply said, the balance of money between the wealth producing activities market vs. the non-wealth/ extractive/speculative activities market is strongly towards the later.

A re-balance can only be made with properly targeted taxation on the extractive market, so as, not to impede the “free-market” (gag me w/a spoon) by dis-allowing activities through over-regulation. The revenue from that taxation needs to be invested into real production and consumption markets with the idea that they should be directed towards our common good (i suggest investment in the habitability of this planet).

As an aside – I can make money from money and do not have to worry about any contribution to actual wealth production. In fact, the tax code and regulation give me incentive to practice non-productive means to acquire money.

Happened to read Krugman’s article right before this one, you kicked his ass. Keep up the good work.

Krugman is like some latter day Columbus whose washes up on lower Manhattan in 2012 and claims to have discovered America. He is talking about something that we have been talking about here for years. Krugman loves graphs just like Thom Friedman loves incoherent, impenetrable prose.

As others have noted, his graph doesn’t show exactly what he purports it to show. It reflects the explosion in the paper economy which has little or nothing to do with workers, or reality. At the same time, the picture is probably even worse than suggested because a chunk of what remains to workers may actually reflect the gains of corporate management. A better way to look at this is to do as many of us have done and look at real (inflation adjusted) wages and incomes. Do that and you see they have been flat since the late 1970s.

Robotics, misevaluation of real estate, and monopoly effects on the supply chain may all have played some role, but they rather miss the point of the predatory nature of this transfer of wealth away from workers, its real producers. In the late 70s under Volcker, it became Fed policy to treat wage gains as inflationary and to be combatted by manipulating interest rates to keep them down. So since then all gains from productivity went to capital, to investors and management. There were other factors. Also in the late 70s, we saw the birth of trends which reinforced and promoted this transfer of wealth upwards: anti-unionism, deregulation, and cuts in the tax rates of the rich and corporations. And there have been others. In the 1990s, we got NAFTA and the start of the offshoring movement. In the 2000s, we got the Enronization of the financial sector: financialization, rampant speculation, asset stripping, etc. And the shock of the housing bubble and the meltdown: devastating blows to the wealth of most Americans but from which the rich and corporations quickly recovered via multi-trillion dollar bailouts. None of this even begins to touch on the 30-40 years of criminality and class war behind what is the greatest theft of wealth in human history.

And now you tell me Krugman has found a graph he thinks has some “uncomfortable implications”? If this weren’t such a lamentable example of another failed elite thought leader, it would be comical.

But as a keeper of the fringes, Krugman is doing a bang up job keeping the public confused.

Krugman is a shill for the global inherited rich. As such he needs to be laughed at just like them. They have created a society that is a condemnation of our species and I resent it.

The graph really says it all.It says what anyone working for a living for the last ten years already knows. We are being screwed.

one excuse “they” use is that,”automation” is why wages are skyrocketing for some, and not keeping up to inflation for others… despite the increased production for the remaining workforce which should be getting increases of wages for handling the increase in production.then there would be the new fields of making and fixing and monitoring those new automatons.In the real world, the use of robots ,cutting the workforce in one factory would require the tooling and peopleing in ten others

another prevalent myth is that the financial services industry “creates” anything.and should be counted as part of the GDP.THey may have a use in any productive society, but they just watch the columns, they don’t “create” anything.If they weren’t padding the GDP numbers for the last decade or two,we would not be so suprised that america is hollow, and ripe for implosion.

But really, without getting too bogged down in real terminology… the last forty years has been the institutionalisation of the corporateist agenda.

look what we have,

people who owe too much, earn too little.except for the top of the top percent.

we have the culmination of this free trade baloney. back in the 1940’s they were wise to call it “globaloney”,but it took three decades after that to get going as nixon was crashing and carter was moving in.. they had assumed the role of republicans…the “pro-business” party,the chamber of commerce,wall st party….they also are the democratic party, so no one really opposes them with any say.they now have a firm control of all three branches of gov’t,executive,legislative,judicial. THey have the fourth estate firmly under their control as well.They control the academic industrial complex,the media informational industrial complex,the military industrial complex,the prison industrial complex,the security state industrial complex,the “could care less” health insurance industrial complex,and they are on their way to owning your socks.

these free trade deals were the lid on the coffin of the american workforce. now the nails are being set.the next pacific trade deal is on the way, things are only going to get worse.

These corporations are the new immortals, they don’t have a country or a countries laws that they are bound by, they don’t have to die, but can change names whenever expediency/liability demands it.

Who they are is the families whose money and trust funds retain all this power and give them virtual invisibility.They jet set around, have spineless, pathological, powermad minions who take the ceo jobs and the brunt of the blame,for the public consumption.

one problem with their direction is that these complexes employ ALOT of people who are now, overpaid… but really, the ship they are driving into the rocks, has them sitting up in the captains deck… and the gallows may hit first, but the captains deck is going to crash on the rocks just like the rest of the ship that they are so adroitly speeding to oblivion.

It is all so short sighted.

“It has echoes of old-fashioned Marxism — which shouldn’t be a reason to ignore facts, but too often is. And it has really uncomfortable implications.”

Holy sh!t! Someone in the MSM used the M-word! At this rate we as a society will get to actually discussing Marxism and the current and predicted crises of capitalism in this country in about…oh….another 4 decades.

F*ck, Paul, could you do idiot America a favor and spell out what those echoes of Marxism are, why the facts you showcase relate to what Marx wrote and what those Marxist implications might be, huh?

Ooops, I forgot, Krugman is one of those propagandists meant to head-off any meaningful discussions in this country by introducing a taboo topic and then letting it die.

Not discuss Marxism? Balderdash!!! My NYT column in December of 2012 TOTALLY addressed the Marxist implications of our current economic crisis. That issue’s been put to bed, son.

Thanks, Paul!

Lily livered Krugman only speaks because the MSM seal has already been broken. Nouriel Roubini told the WSJ “Marx was right” in 2011:

“Karl Marx had it right. At some point, Capitalism can destroy itself. You cannot keep on shifting income from labor to Capital without having an excess capacity and a lack of aggregate demand. That’s what has happened. We thought that markets worked. They’re not working. The individual can be rational. The firm, to survive and thrive, can push labor costs more and more down, but labor costs are someone else’s income and consumption. That’s why it’s a self-destructive process.”

http://georgewashington2.blogspot.com/2011/08/roubini-karl-marx-had-it-right-at-some.html

Rather, investors expect profit to always increase while in reality sources of profit decline. The result is financialization such as bubbles to keep profitability up as long as possible even after the cliff has been run off- but, like any Ponzi scheme, financialization is just taking from the next guy. Also, liquidating infrastructure to maintain profitability until the golden parachute kicks in- more blatantly destructive in the long run.

The MSM discourse “seal” is quite amazing.

I guess if we were to have a discussion about Marxism, then the very next day we’d all have to have our little red books and Che berets, right?

#Baader-Meinhof Group?

Maturely discuss/mention Israeli apartheid/genocide?

Better get the spray paint for some synagogue swastikas, right?

Have a dialogue about American war crimes over the last decade or longer?

Where’s a vet so I can spit in his face?

Suggest that there’s more to the official 9/11 story?

Bellevue’s got a cot for you, loon-boy!!

Nope, we just have to stay within the narrow – yet intricate – parameters that our betters have delimited for us because any mention of one of the taboo topics is – obviously – exactly the same thing as the embodiment of that topic’s most radical endpoint.

The only question I really have any more is if those in the MSM even understand that they have been confined to a certain walled garden of discourse or has the propaganda regime been so successful that they really can’t see the cell walls anymore.

Yes, yes, you can’t make a person understand what they’re paid not to but really night after night after day after day of spouting the same horsesh!t nonsense probably does wonders as to the erasure of…wait, what was I talking about, again?

Never mind.

Those are some good examples!

Really, I don’t think moderns have political discussions or dialogues. Or even, for that matter, have genuine political arguments—which, given how we’re all situated differently with reference to the classical republicans’ conception of the “common good,” is what one might reasonably expect.

Rather, moderns deploy thought stopping ideologies in an attempt to eliminate other positions.

From a political theoretical perspective, possibly it is also the notion of the “common good” (to which no one could possibly humanly object!), present at the founding moments of political modernity, that helped to further an all or nothing mindset that was hostile to diversity in political (and other) opinions.

Hannah Arendt suggests something like this was a factor in steering the course of the French revolution– initiating the first modern revolutionary purge– which did not appear in the American revolution, and which (technically anyway) attempted to incorporate a means of dealing with distinct interests into the operations and structure of the government itself.

Some have argued that the “democratic element” was effectively “purged” prior to the American founding, with which I don’t necessarily disagree. She thinks this is a good thing, because it enabled the elites to actually form a plausibly democratic government, as vs the French who ran right off the rails while fighting over the proper political attitude toward the sans culottes, and who eventually got Napoleon instead.

From a realpolitick perspective, of course, the tendency to deploy thought stopping ideologies would always have been a useful operation of power anyway, an attempt to control the masses in a purported “democracy”– or contrary wise, to rally them into some form of dissent. Thus, the classical (as in Greek) concept of the political demagogue.

Not to go off on a tangent, but perhaps the greatest political demagogues in the history of the planet were those of the Roman Catholic Church–no, not their protestant imitators, you anti-capitalist proponents of the Weber Thesis and therefore haters of Calvinists– although said protestants and Calvinists did endlessly fragment on their inability to coalesce around a “common” dogma, given the received necessity of having one.

Out of this history arises, I suppose, the notion that all rigidified thinking is “like religion” or “religious,” whereas it’s probably more useful today to cut straight to the chase and identify the interests that are motivating the pigheadedness rather than insulting people who may practice a traditional religion.

Personally, if I hear this inane “theoclassical” one more time I’m gonna scream. If you’re going to think like that, you may as well “theo-preface” everything under the sun.

So, this is also a developed habit of mind. Intellectuals like to think they are better at having discussions and dialogues than the masses or their manipulators, but I think the record there is also decidedly mixed.

I think we collectively have quite a ways to progress (I won’t say “evolve”) before we we’re regularly having civilized conversations, or even productive arguments—and maybe even preferably productive arguments– across the divides of our varied interests and perspectives. Needless to say, bipartisan politics and the use made of it by the political parties just aggravates and perpetuates this sort of thing.

Conversation is an art anyway, whereas we just think some people are “naturally outgoing,” thereby enabling some of us to relieve ourselves of the burden of becoming good geisha– (lolz! I crack myself up sometimes. Okay, end stream of consciousness). :-)

I’d like to say more but have to run, however, I vis a vis your points I always think that we modern proles sometimes give waaaay to much credit to the machinations of the elite in that it’s really not that they consciously want to prohibit certain thoughts/ideas so as to consolidate their power – as you were suggesting and which does end up happening – but that they we are at present in the West so far through the fascist looking glass that we’re not allowed to discuss certain topics so that the elite and those that mindlessly serve them don’t want to be “uncomfortable”.

That’s it.

I really don’t think most of the elite or their minions could even decipher through the blear of their propaganda-colored glasses WHY any of the issues I raised above would be controversial or important to them.

Rather, they would just feel as embarrassed because someone was speaking to them about something they don’t know about but probably should – much like if you asked a New York resident what the Yankees did last night and they couldn’t tell you.

“I’m a New Yorker, I probably should know this but don’t and don’t really care. Slightly embarrassed but still indifferent.”

“I’m an MSM analyst/politician, etc. I probably should know why 9/11, Israel, war crimes etc are important but I don’t and don’t really care. Slightly embarrassed but still indifferent.”

Much too uncomfortable.

Again, it’s that old conundrum:

Are the elite just a bunch of blundering privileged f*ckups or are they a cabal of evil geniuses?

Both models fit perfectly at different times so maybe we would better spend our time further studying this elite “f*ckup/omnipotence duality” by trying to cram them through some narrow slits in a wall and analysing the interference patterns.

Gotta run.

Ssstiglitz doesn’t ponder the fallen state of US Labor. He says it comes as a result of high levels of productivity. Or efficiency of production – whether domestic via robotics and computers or offshored via dreadful working conditions. It also comes at the risk of instability. When an economy is nothing but a finance ponzi, how can it help but crash? Mmmm, well one way to prevent the crashes is to prevent the ponzi by calling it what it is. Then the only question left is what to do with the national wealth and what products, including social products, do we want to buy. If the true cost of energy and the destruction of the environment were calculated into the “efficiency” equation, there would be a negative efficiency. No one ever considers that when lamenting the ponzi state of labor.

This posting on monopoly makes the following comments/rant most appropriate:

Inside the Matrix: The Case of American Amnesia

A young neighbor approached me the other day with a question (she’s only 20 years of age): a friend of hers was really excised to learn that the Public Utility Holding Company Act had been repealed in 2005, and she wondered why that had any importance? (First I exclaimed, “Holy crap!” as I hadn’t realized that was the case!)

I explained to her that a major monopoly failure, leading to the Great Crash and Great Depression, was the crash of Sam Insull’s power trust, which had been a highly concentrated monopoly ownership of electric utilities and power generation companies throughout the country.

Since I had her attention, I seized the moment to explain that the holding company was the financial construct meant to replace the money trusts, which had previously been exposed at obscuring corporate ownership among the super-rich (along with interlocking directorates). Holding companies allow for easy and unobtrusive — or secret — ownership, both domestic and foreign, in the same manner as that US Supreme Court Citizens United decision (2010: Citizens United v. Federal Election Commission).

I further explained that Sam Insull, although he had accomplished much that was positive in the expansion of electric power throughout America (and wasn’t in the same category as the murderous bunch of robber barons like Rockefeller, Morgan, Mellon, du Pont and Frick), he was the first known member of the super-rich to attempt to mislead the public into believing that there weren’t any real owners or ownership, it was we, the American public, who were the shareholders and investors, and therefore the owners, of their companies.

This didn’t work back in the 1920s — but later, in the 1970s and 1980s — it would become a successful propaganda meme — evidently Americans had become dumber?

Elaborating further, I explained that every so often Congress uncovers the extreme concentration of hidden wealth and monopoly ownership, then they attempt to dissolve it, normally meeting with failure.

In the late 1930s and 1940s, there was the congressional TNEC study (The National Economic Committee, major portions of which are still classified to this very day), which found a super-concentration of business ownership through a select number of banks.

The government filed an antitrust lawsuit against the banks, but with the Eisenhower administration in power, the judge, Harold Medina, ruled against the government and further ruled against any future legal action against those banks. The case, U.S. v. Morgan et al., also known as the Investment Bankers Case, or the Wall Street Seventeen, alleged that there existed a conspiracy since 1915 of said banks in engaging in monopolistic practices in underwriting, etc. The year 1915 is interesting, since it was in 1913, along with the passage of the Federal Reserve Act, the oil depletion allowance and the Sixteenth Amendment, that they also passed the legislation altering the allowable financial structure of foundations for both tax exemption purposes and for the super-rich to better hide their ownership and wealth in foundations and trusts.

Judge Medina had based his ruling on the advice of an investment banker, Harold Stuart (of Halsey, Stuart & Co.) whose bank business was mainly derived from the House of Morgan, the Morgan banks and family. Prior to that, Stuart had lost money when the Insull power trust collapsed (due to pyramiding holding companies, etc., a Ponzi setup), he had tried to disguise ownership interest in that monopoly.

We know that due to his grilling before the Pecora Committee, and he was indicted for mail fraud, and although later acquitted, no charges were leveled against Stuart for hiring a professor from the University of Chicago, to go on the radio to offer free investment advice; the professor knew nothing of finance nor economics as he was a professor of English, and simply read the script he’d been given by Stuart (reminds one of Harvard’s Niall Ferguson) [What Stuart had done was illegal stock market manipulation].

A similar scenario occurred some years later when, with President Kennedy’s urging and blessing, the great Texan populist, Congressman Wright Patman, went after the trusts and foundations (the major way the super-rich hide their ownership and wealth).

A commission was finally created to look into the matter officially, only this was after the political assassinations of the 1960s (President Kennedy, Rev. Martin Luther King, Jr., and Sen. Bobby Kennedy) and Nixon was now in the White House; a Rockefeller lackey, Peter G. Peterson, would head the commission and find nothing askew with the foundations, etc. (Peterson presently founded a pro-austerity outfit within the New America Foundation, which he partially funds, staffed with the usual suspects: Erskine Bowles, Alice Rivlin, Jim Kolbe, etc.).

Today, ask any street kid in China or Pakistan who owns most of everything in those countries, and they’ll respond, “The military, of course!”

Ask the typical American college graduate who owns ExxonMobil, JPMorgan Chase, Morgan Stanley, Bank of America, GE, AT&T or Monsanto, and they’ll respond, “Whatever!”

If one doesn’t know that the majority owners of Northup Grumman are the Bush family and James Baker (through holding companies, mostly foreign, ‘natch!), there will be no understanding of any hidden agendas.

The fantasy that there are no actual owners of the banks, the oil companies, the biopharmaceuticals, the weapons makers, etc., suggests that no one is really guilty — although those phantom owners possess all the money, all the wealth and all the control.

It is much the same as that long agreed upon fantasy of corporate personhood — something which was never voted on by Congress, nor ever came to a legal decision vote at the US Supreme Court!

When the US Supreme Court’s decision in 2000 with Bush v. Gore (litigator: Ted Olson), which stated that American citizens did not have a constitutional right to vote — hence no justification existing for the Florida vote recount, they laid the foundation for their 2010 decision, Citizens United decision (litigator: Ted Olson) that the super-rich, both domestic and foreign, had the financial right to influence US political elections.

It is really the most elegant of criminal solutions or conspiracies: there is no criminal — those super-rich don’t really exist, after all — there is no one behind that curtain operating the controls of the Wizard of Oz — what was that line from the movie, The Usual Suspects?

“The greatest trick the Devil ever pulled was convincing the world he didn’t exist.”

Sources and suggested reading:

The Fine Print, by David Cay Johnston

The Merchant of Power, by John F. Wasik

Wall Street Under Oath: The Story of Our Modern Money Changers, by Ferdinand Pecora

http://dissidentvoice.org/2009/03/wright-patmans-prescription-for-healing-the-cancerous-us-banking-system/

http://en.wikipedia.org/wiki/Pecora_Commission

http://en.wikipedia.org/wiki/Investment_Bankers_Case

http://books.google.com/books?id=YRjmQLOscGoC&pg=PA289

http://en.wikipedia.org/wiki/Ferdinand_Pecora

http://www.fee.org/the_freeman/detail/the-purposes-of-antitrust/#axzz2EaUYbN6e

http://www.dfdpo.com/bypassing_wall_street%20the%20traffic%20cop%20on%20Wall%20Street.htm

http://www.hbs.edu/leadership/database/leaders/harold_l_stuart.html

http://en.wikipedia.org/wiki/Harold_Medina

Nicely stated.

What are the chances of the public being shown the light?

What are the chances of pitting those with inheritance against the greater percentage of us that will never see much if any?

It is going to be very interesting to see what changes befall us as this Shock Doctrine event unfolds…..may you live in interesting times, indeed.

Maybe Krugman should look into raising the corporate income tax.

I thought that in this very post, or in another recent, related one, he notes in the very same vain that it’s a terrible time to be discussing cutting the corp inc tax.

Yves said:

If one takes a closer look at that graph, didn’t the downward trend actually occur in the early 1980’s? (Well actually, it was more like falling off a cliff in about 1982 or 1983.)

None of this happend by accident. As Christian Parenti explains in Lockdown America, labor’s demise was deliberately engineered. It was a deliberate policy decision. It began with Carter, but Reagan certainly took the ball and ran with it. It happened because capital was getting squeezed, which can clearly be seen in this graph: the low-point in business net income, net capital gains and other income ocurred in 1981-1982:

http://www.businessinsider.com/taxes-components-of-adjusted-gross-income-as-a-percent-of-total

Here’s Parenti:

Thanks for the comment.

What continues to gall me is that intelligent folk continue to believe that there is no organized effort behind all our social devolution. The brainwashing has been effective in hiding the puppet masters and their spawn.

I go around now asking people if the US money supply is private or public and 90% get it wrong. Many don’t believe me when I tell them otherwise. Those that do go away contemplating what our private money supply really means and it scares them more than they already are.

I like uphill battles. It gives us something meaningful to do.

ONWARD!

Why Marx? Perhaps he meant – because Marx predicted that capitalism would set the stage for its own destruction. If private industry does not address real human needs then it marginalizes itself from what life is all about. Corporations are not investing (despite record profits) because they cannot see how to make money out of the mass of humanity that actually needs things. There are so many human needs ignored or declared by right wingers to be unaffordable. So as a society we are not supposed to pursue them? Nonsense – overthrow the regime.

Most of the commentators here are missing the forest for the trees. Yes, offshoring, robots, this or that bubble are the proximate causes of this trend; but those are merely the mechanisms by which the trend is occurring.

When describing a car trip, you wouldn’t say you pushed the accelerator causing fuel to be injected into a combustion chamber where it was ignited in order to drive pistons which were connected to drive shafts and gearboxes which transferred the energy to wheels. You would say you got in your car and went.

The theft from workers and common people by owners is nothing new nor unique, and it is an inherent property of ALL forms of capitalism, despite the wishes of liberals to have their cake and eat it too. No, I’m sorry, you can’t have absentee for-profit ownership and not have a trend toward obscene economic disparity. Power begets power.

I’ll tell you when the trend started: In the late 1930s, when labor (lead by the great traitor of a union, the AFL) made a Faustian bargain with capital in order to create the middle class- a bulwark against radicalism. The emasculation began almost immediately with Taft-Hartley and McCarthyism. Without the radicals keeping the pressure up, the demise of the unions (and their beloved middle class, which was just a bribe) was inevitable.

If you want to reverse the trend, don’t bother trying to stop this practice or that one- Shall we end automation, as if labor-saving devices are inherently bad (when the real problem is one of ownership)? Who will pass a bill to ban offshoring? Do you think the rich will permit you to vote their power away? No. The only way out is to repeat the successes of the 1930s, but this time reject their bribery and compromises, because their only purpose is to destroy our organization and solidarity; to keep the basic system intact until they can chip away at it.

No. The only reasonable course is revolution- but some variety of libertarian and syndicalist, keeping the people in the drivers seat, rather than Marxist, which simply does not work. But don’t expect the existing unions to do it- the UAW had a chance to win once and for all during the GM bailout, and they rejected it in favor of trying to get back to the good ol’ days. Their response to crisis is to stick their fingers in their ears.

Either revolution or a slow death. Your choice.

Labor is a Commodity, Commodity’s are not real persons in Econ terms. Capitalists are real persons, see SCOTUS.

Skippy… its in the bible for FFS. 5000 years of ad hoc assemblage fro various opines glued together…. barf

My reading of history has always been that centuries ago when Xtianity was being challenged by the Enlightenment, the rich of the day entered a devils pact with the religious sorts assuring them ongoing credence in exchange for support of ongoing private ownership of property and unfettered inheritance.

When was the last time you saw any of the world of Xtianity question private property and inheritance?

And yes, that does mean that I think that many religions are tools of the devil who in this case are the global inherited rich puppet masters behind the curtain.

Liberation Theology. But the CIA had a few things to say about that.

Hmmm …

It appears the labors’ share of industrial output has been exported, the $2.5 trillion in Chinese and Japanese dollar reserves would have been in workers’ pockets (banks) had industrial jobs remained in the US … EXCEPT:

There never would have been a labors’ share b/c US industries could not afford their 1970s workforce. Without the export of jobs to China the companies in question would simply have failed. As it turned out, China bailed out American business (again).

The surplus represents $125 billion per year for twenty years. Is this minuscule amount of money at issue or it something else?