By Eugenio Cerutti, Stijn Claessens, and Patrick McGuire. Cerutti is a Senior Economist at the Research Department of the IMF; Claessens is Assistant Director in the Research Department of the International Monetary Fund, Professor of International Finance Policy at the University of Amsterdam and CEPR Research Fellow; McGuire is senior economist in the Financial Institutions section, Bank for International Settlements. Originally published at VoxEU.

The starting point for systemic risk analysis for a single-country is typically the banking system1. A systemic risk analysis involves the use of disaggregated national bank data, including information on the composition of banks’ asset and liabilities, maturity and currency mismatches, and other balance sheet and income metrics. These national-based analyses then attempt to capture systemic risks stemming from common exposures, interbank linkages, funding concentrations, and other factors that may have a bearing on banks’ income, liquidity and capital adequacy conditions. Examples of such quantitative approaches are Boss et al (2006) for Austria and Alessandri et al (2009) for the UK.

Extending analysis to multi-country level – or not

Our approach, highlighted in Cerutti, Claessens and McGuire (2011) does not, however, directly extend to the multi-country level for a number of reasons:

- Lack of institutional mechanisms which ensure coordination of national approaches

International financial linkages, by definition, involve more than one legal jurisdiction. For various reasons (legal framework, accountability to parliaments and taxpayers, etc.), policy makers tend to focus on national objectives. In addition, supervision of large, internationally-active financial institutions is often dispersed among agencies in many countries, with imperfect sharing of information and limited tools to coordinate remedial actions. Moreover, a global framework for the resolution of these institutions is lacking2. There is also no formal lender of last resort to address liquidity problems in foreign currencies3.

- Greater complexity in the international context.

Differences in firms’ organisational structures and legal status, which play limited roles in a strictly national context, complicate systemic risk measurement and (crisis) management internationally.

- Scarcity of data that capture the international dimensions of systemic risk

Supervisors in each jurisdiction have access to granular data for banks operating in their jurisdiction. However, the supervision of internationally active institutions relies on data collection practices that tend to differ across jurisdictions. Moreover, confidentiality concerns generally restrict the sharing of data, even within the supervisory community.

Existing data sources and their weaknesses

As the global financial crisis has made clear, despite the difficulties of the data and some institutional challenges, analysing systemic risks in international banking is nevertheless an activity with high rewards. What existing data can be used and brought to bear on this issue? To start, it is important to note that tracking global systemic risks requires the joint analysis of data covering many financial institutions. Common exposures to a particular asset class or funding source are easily masked in aggregate data. To detect vulnerabilities requires data at the individual bank-level, collected in a consistent and comparable format, so that aggregation is possible.

The challenges

- Bank-level data obtained by national supervisors contain some of the needed information.

But the experience during the crisis showed that, in many jurisdictions, supervisors lacked critical pieces of information, specifically, data on how international banks are connected to each other. During periods of market turmoil, real-time information on how the failure (or not) of a particular institution might impact other institutions is crucial for policy decisions, but was lacking in the days leading up to the collapse of Lehman Brothers. Thus, for crisis management purposes, there is a need for more information on bank-level bilateral linkages.

- The bank-level data that are collected by supervisors are not widely shared, generally not even across supervisory jurisdictions, and only broad aggregates (if at all) are publicly disclosed4.

No single supervisor therefore has a comprehensive, yet detailed overview of the global system. And without such a view, system-level vulnerabilities can go undetected. It was difficult (even late in the crisis), for example, to gauge the size of European banks’ global exposures to US dollar centralised debt obligations, and there was virtually no system-level information on the scale of these banks’ reliance on short-term dollar funding (e.g. money market funds), which dried up suddenly amidst the turmoil. Detecting these types of stresses early on requires detailed breakdowns of banks’ assets and liabilities (i.e. by currency, instrument, residual maturity and, if possible, counterparty type and country), and their joint analysis across many banks.

- Bank-level data available outside the supervisory community are generally not detailed enough.

Commercial databases compile information from banks’ annual reports, but have considerable data lags and gaps. Information on the counterparty-sector and country are generally missing, and coverage of branches is particularly poor. In many countries, standard balance sheet data (e.g. capital asset ratios) are not even publicly disclosed — or are disclosed without much detail.

More data needed

In Cerutti, Claessens, and McGuire (2011), we provide some examples of how certain types of global systemic risk analysis can be assessed with data that is currently available.

Measurement of borrowers’ reliance on foreign bank credit

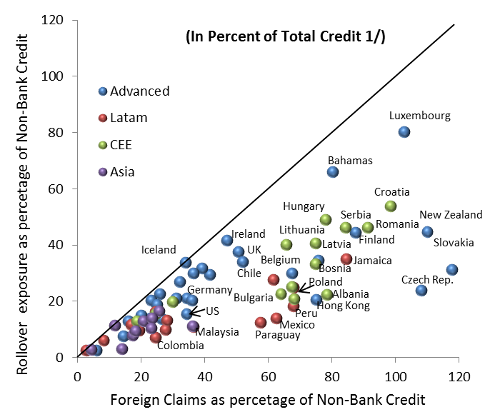

The Bank for International Settlements (BIS) consolidated banking statistics are one of the few sources of information on the extent to which borrowers in a country rely on credit from a particular consolidated banking system. However, because these data were not designed with the borrower’s perspective in mind, they overestimate reliance on a particular national banking system in cases where at least part of the banking system’s funding comes from sources in the borrower country. Combining these BIS data with bank-level data helps to illustrate the scale of the problem. The differences between the gross BIS foreign claims and the rollover exposure figures tend to be large for emerging market borrowers.5 For example, Figure 1 shows that the adjusted measure for Latin-America – in red circles – is on average only 45% of banks’ foreign claims.

Figure 1 Rollover exposure as of March 2012

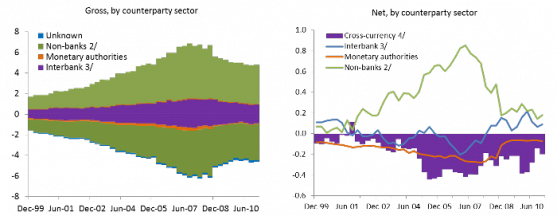

Measurement of cross-currency funding and maturity transformation

In the run-up to the crisis, many European and other non-US banks invested heavily in US dollar-denominated assets, and increasingly relied on short-term US dollar funding in the form of direct interbank borrowing and the swapping of euros and other currencies for dollars. While imprecise, BIS data help to illustrate the size of the problem since they provide some indirect information on non-US banks’ dollar funding needs in the run-up to the crisis. Figure 2 suggests a growing risk of funding problems prior to the crisis, as longer-term investments in non-banks became increasingly dependent on short-term foreign currency funding. By these estimates, large European banks depended on some $1 trillion in short-term funding on the eve of the crisis, much of it obtained via foreign exchange swaps.

Figure 2 On-balance sheet USD positions at long-USD European banks (in USD trillions)

These examples show the value of existing data for global systemic risk analysis. At the same time, they illustrate that most types of analysis still rest on a myriad of tenable assumptions and thus yield imprecise results.

How to improve the data

To improve quality and availability of data, the IMF and the Financial Stability Board (FSB) have jointly issued a report to the G20 finance ministers and central bank governors with recommendations that include the creation of a common reporting template for globally systemically important financial institutions (G SIFIs). An international working group has already produced a set of draft data templates designed to capture detailed information about banks’ asset and funding positions, and on the linkages between banks and other individual institutions (see IMF-FSB, 2011). As these initiatives go forward, the resulting data would greatly improve analyses (see IMF-FSB, 2011 for details). In parallel with these efforts, enhancements to the aggregate BIS international banking statistics, which cover a much wider universe of banks, are underway6.

Conclusions

Even with improved aggregate banking statistics and better bank-level data, other dimensions of systemic risk will likely remain inadequately covered. While better coverage of banks is a top priority, non-banks, including pension funds, insurance companies and large multinational corporations, can also be systemically important. This suggests going forward including not only such non-bank institutions in the counterparty sector breakdown of banks’ exposures, but also bringing large non-bank firms under the data gathering umbrella.

Authors’ note: The views expressed here are those of the authors and should not be attributed to the IMF or the BIS, or their respective Executive Directors or Management.

References

Alessandri, P, P Gai, S Kapadia, N Mora, and C Puhr (2009), “A framework for quantifying systemic stability”, International Journal of Central Banking, 5(3), 47-81.

BIS (2011), “Chapter VI: Closing data gaps to enhance systemic risk measurement”, BIS 81st Annual Report, June.

Borio, C and M Drehmann (2009), “Towards an operational framework for financial stability: ‘fuzzy’ measurement and its consequences”, BIS Working Paper, 284.

Boss, M, G Krenn, C Puhr, and M Summer (2006), “Systemic Risk Monitor: A Model for Systemic Risk Analysis and Stress Testing of Banking Systems”, Oesterreichische Nationalbank, Financial Stability Report, issue 11, 83-95.

Cecchetti, S, I Fender, and P McGuire (2010), “Toward a Global Risk Map”, Bank for International Settlements, BIS Working Paper, 309.

Cerutti, E (2012), “Banks’ Foreign Credit Exposures and Borrowers’ Rollover Risks: Measurement, Evolution, and Determinants”, IMF Working Paper, forthcoming.

Cerutti, E, S Claessens, and P McGuire (2011), “Systemic Risks in Global Banking: What Available Data Can Tell and What More Data are Needed?” IMF Working Paper, 11/222 and BIS Working Paper, 376, forthcoming in M Brunnermeier and A Krishnamurthy (eds.) “Systemic Risk and Macro Modeling”, NBER.

Claessens, S, R J Herring and D Schoenmaker (2010), “A Safer World Financial System: Improving the Resolution of Systemic Institutions”, CEPR-ICMB, July.

de Bandt, O, P Hartmann and J Peydro (2009), “Systemic risk in banking: An update”, in Berger, Molyneux and Wilson (eds.) Oxford Handbook of Banking, Oxford University Press.

Fender, I and P McGuire (2010), “Bank Structure, Funding Risk and the Transmission of Shocks Across Countries: Concepts and Measurement”, BIS Quarterly Review, 63-79, September.

IMF (2010), “Resolution of Cross-Border Banks — A Proposed Framework for Enhanced Coordination”, 11 June, Washington, D C.

IMF (2011a), “Camdessus Group Report”.

IMF-FSB (2009), “The Financial Crisis and Information Gaps: Report to the G20 Finance Ministers and Central Bank Governors”, October.

IMF-FSB (2011), “The Financial Crisis and Information Gaps: Progress Report to the G-20 Finance Ministers and Central Bank Governors”.

Kaufman, G and K Scott (2003), “What Is Systemic Risk, and Do Bank Regulators Retard or Contribute to It?”, The Independent Review, 371-391, Winter.

McGuire, P and G von Peter (2009), “The US Dollar Shortage in Global Banking and the International Policy Response”, BIS Working Paper, October.

1 Attention to systemic risk assessment and contagion has dramatically increased with the global financial crisis, although a precise definition of systemic risk is still lacking. See Borio and Drehmann (2009) and Kaufman and Scott (2003) for a discussion of the definition, and de Bandt et al (2009) for a recent literature survey.

2 See IMF (2010) and Claessens, Herring and Schoenmaker (2010).

3 A domestic central bank can supply liquidity in its domestic currency. But liquidity provision in foreign currencies is limited by the available foreign exchange reserves or borrowing capacity of the central bank.

4 Access to supervisory data is limited outside the home country. In some cases Memorandums of Understanding allow specific data to be exchanged between two countries. Also, in some cases, data are made available to teams conducting the joint IMF-World Bank Financial Sector Assessment Program (FSAP).

5 The rollover exposure concept measures a borrowing country’s reliance on foreign bank credit through direct cross-border borrowing (e.g. a local corporation borrowing directly from a foreign bank not operating in the country), and the proportion of lending by foreign affiliates (both foreign branches and subsidiaries operating in the country) that was not funded by local costumer deposits.

6 See BIS (2011), Cecchetti et al (2010) and Fender and McGuire (2010) for a discussion of how well-designed aggregate statistics can enhance the monitoring of systemic risks, and for more detailed discussion on the structure of banks’ international operations as revealed in the BIS banking statistics.

* * *

Lambert here: B-but professor, if banking were boring, we wouldn’t need nearly so much data, would we?

“Attention to systemic risk assessment and contagion has dramatically increased with the global financial crisis, although a precise definition of systemic risk is still lacking.”

Pornography:Potter Stewart::Systemic risk:Economists.

It’s hard to define exactly, but we know it when we see it. My, my…how convenient.

Looking for more data, prosecutors and 500 uniformed assistants surrounded Deutsche Bank HQ in Frankfurt on Friday.

http://www.fr-online.de/wirtschaft/deutsche-bank-deutsche-bank-chef-ruft-bouffier-an,1472780,21128070.html

Scurrying banksters within the glass towers apparently attempted to destroy data. At some point over the weekend Fidtjen (?) the co-boss called Bouffier, the Hessian Minister President to complain about the resulting brand damage. In the meantime the bank’s top legal officer and several colleagues are being held, apparently for refusing to cooperate with the prosecutors.

The nub has to do with a scheme to avoid paying tax on CO2 certificate deals. See the “fotostrecke” on the above site for photographic documentation of the raid.

bmeisen, re the “carbon credit certificates” matter — can’t they decide how to divvy up the spoils in Luxembourg, with the expertise of that fellow who invented Clearstream who speaks at Jesuit colleges in the U.S.–“doing God’s work” it must be presumed–and George H.W. Bush and those EU worthies in Luxembourg who were involved in BCCI? Certainly such Noble Gentlemen can help the Parties and the Counterparties to settle up squarely?

What would make the banking system more stable is a more robust economy. The economy depends on how effective monetary policy is. Under the current system the money transmission channel is blocked because the banks don’t want to lend. Therefore a good solution wood be to circumvent the banks, take away their power in setting monetary policy and redesign the central bank so it deals directly with public. Heres a more detailed explanation:

internationalmonetary.wordpress.com

I agree with everything you say, except the “banks do not want to lend” part. I think it would be closer to the truth to say, “customers don’t want to borrow,” because we are still in a balance sheet recession. The banks always want to lend, even money they don’t have.

Unfortunately, it seems unlikely that the Fed will start dealing directly with the public short anything of an outright revolution. The Fed’s current bankster-overlords just wouldn’t have it.

After reading this I checked my calendar to make certain it was not April 1. Nope, this guy was apparently serious. He doesn’t seem to understand that bank capital is largely imaginary, that bank assets have value only in dealings with Central Banks, but that bank liabilities are quite real. Of course, every bank’s liability is some other bank’s asset, so the systemic risk he talks about is really just musical chairs for bankers, boring to watch day to day and exciting only at those rare occasions when chairs are yanked away.

Meanwhile, we get stunning televised performances like the one timed beautifully to eclipse the first quarter of last night’s football game. It doesn’t seem to matter that our politicians can and will do absolutely nothing to change anything that matters as our society becomes progressively unglued, except perhaps to make them worse and to take advantage of every occasion to remind us all how important they (the politicians) are. Like good little sheep we are supposed to sit quietly though this stuff and come out at the other end feeling better about ourselves, but I cannot help wondering as this prattle drones out of the television set, and out of labored texts like this one on bank systemic risk, whether any of these so called experts has any idea what the human cost of this endless nonsense really is, or whether any of them cares, either.

There is a phenomenally simple solution to systemic bank risk and indeed several other banking problems: full reserve banking. Under full reserve banks essentially perform just one function, with a possible second one thrown in. The “one function” is simply to accept deposits and not invest them in anything. That way the money is not at risk. There is no systemic risk there. That system is suitable for instant access or checking accounts.

The second function is lending / investing (as indeed banks currently do) but that function is carried out (at least under the full reserve regime advocated by Laurence Kotlikoff) via mutual funds. Those funds can be run by banks, but such funds exist anyway, so whether banks are allowed to run those funds or not is immaterial.

In the event of those funds making a string of bad loans or investments there is no systemic problem. All that happens is that the value of the funds drops, just as the value of such funds drops at present given a stock market set back.

And as Mervyn King put it, “We saw in 1987 and again in the early 2000s, that a sharp fall in equity values did not cause the same damage as did the banking crisis.”

Interesting idea which ignores the entire purpose of the business system, which is continual recapitalization of asset values through speculation financed on bank credit created out of pretty much thin air by the grace of the FED.

Business should never be confused with industry, but it consistently has been since Veblen exposed the difference in 1904. Putting a damper on speculation would eliminate the need for MBAs, management consultants, just about every professional business class except engineers. Talk about structural unemployment! You would create an entire class of overeducated people with no useful skills whatsoever. How would they manage to eat?

I’m much amused by the idea that “entire purpose of the business system” is “speculation financed on bank credit”. All the economics text books I’ve read (that that’s quite a lot) claim that the purpose of the economy or “business system” is to produce the goods and services that people want. Of course some speculation is involved in doing that, but speculation is not the “entire purpose” or basic objective of economic activity.

Next, the idea that full reserve reduces the amount of money created “created out of pretty much thin air by the grace of the FED” is not true. It actually INCREASES the amount of that thin air money. Reason is that under full reserve, the only form of money is central bank money, as opposed to the current fractional reserve system under which about 95% of the money in circulation originates with or was created by private banks. Quite why we allow private banks to effectively print $100 bills or £20 notes is a mystery. Abraham Lincoln opposed that practice, and I agree.

For more details on the enlarged role that central bank money would play see for example this work advocating full reserve:

http://www.positivemoney.org.uk/wp-content/uploads/2010/11/NEF-Southampton-Positive-Money-ICB-Submission.pdf

Re the idea that full reserve would put a selection of grossly overpaid Wall Street MBAs, consultants and other forms of low life out of work, I just couldn’t care less. The banking industry has expanded a whapping TEN FOLD relative to GDP in the UK over the last 30 years, and by nearly as much in the US. What benefit has that brought us apart from NINJA mortgages, dodgy CDOs, credit crunches, and so on?

However, I don’t really see why the introduction of full reserve would actually much effect on the number of MBAs employed. Most MBAs are employed in run of the mill businesses hundreds of miles from Wall Street and doing something more constructive that selling NINJA mortgages and similar trickery.

Your economic textbooks suggest that the purpose of the economy or “business system” is to produce the goods and services that people want?

I believe they are confusing the “business system” with the “industrial system”. The “business system” involves systematic sabotage of the industrial system in order to generate monetary profit. Do you think monopoly or derivative trading, or commodity speculation are an integral part the industrial system? We have created a magnificent business system the rewards of which inure to fewer than 1% of the population. The so called middle class huddles under a mountain of debt and gets to choose among alternative adulterated foods, insipid beers, puerile entertainments, vapid and self aggrandizing politicians and products that mostly do not work and universally fall apart long before there is any reason for this to happen, other than continuing sales and more profits.

Veblen in 1904? Try Plato around 380BCE. The first book of Republic has an excellent discussion of the the distinction between “money making” and the production of goods and services. Point very well taken though.

Jake, you may have noticed also two words not mentioned in this Whiz Kid article: “leverage” and “arbitrage” — are the “data” on these matters available, or are they just part of the “flow” into the River of BIS?

I never know how to react to pieces that suggest, not an end to looting, but that it should be better managed so that it doesn’t blow itself up. Blowing us up, on the other hand, still seems OK.

I guess you could call it the reformer’s fallacy. It is the assumption that the reformer’s target is basically sound and serves a socially useful purpose. Neither of these is true of modern banking.

If you cut through the dross, all this post is really saying is that in a bubble, short term financing of long term illiquid positions will come to grief. When the bubble pops the illiquid positions can’t be unwound to cover the short term financing. The result is a credit freeze. Didn’t we already know this?

And shouldn’t the real focus be on elimination of bank risk rather than its assessment. If 2008 should have taught us anything, it is that banks took on huge amounts of hidden, usually deliberately hidden, risk that would have been either difficult or impossible to quantify accurately. So why try? Why not turn banking into a public utility? No hidden risks, what risks there are out in the open, and any profits can be returned to the people. Such a system would serve our banking needs, have little or no risk of blowing up, and go far in resolving the problem of interest. If interest goes to the government, then a corresponding amount can be spent back into the system by government rather than being progressively and unsustainably concentrated in the hands of a few as happens now, with all the systemic dangers for explosion that entails.

Way more informative than the post. Thanks.

Hugh: “And shouldn’t the real focus be on elimination of bank risk rather than its assessment.”

Yes, and yes, banking should be a utility.

But, Hugh, dontcha git it? They intend to “monitor” the system. Won’t that make it all better? I mean, “the observer of the quantum field” and all that. Doesn’t a Watcher from on high set matters aright?