As we described in earlier posts in this series (Executive Summary, Part II, Part IIIA and Part IIIB), OCC/Federal Reserve foreclosure reviews meant to provide compensation to abused homeowners were abruptly shut down at the beginning of January as the result of a settlement with ten major servicers. Whistleblowers from the biggest, Bank of America, provide compelling evidence that the bank and its independent consultant, Promontory Financial Group, went to considerable lengths to suppress any findings of borrower harm.

These whistleblowers, who reviewed over 1600 files and tested hundreds more in the attenuated start up period, saw abundant evidence of serious damage to borrowers. Their estimates vary because they performed different tests and thus focused on different records and issues. When asked to estimate the percentage of harm and serious harm they found, the lowest estimate of harm was 30% and the majority estimated harm at or over 90%. Their estimates of serious harm ranged from 10% to 80%.

We found four basic problems:

The reviews showed that Bank of America engaged in certain types of abuses systematically

The review process itself lacked integrity due to Promontory delegating most of its work to Bank of America, and that work in turn depended on records that were often incomplete and unreliable. Chaotic implementation of the project itself only made a bad situation worse

Bank of America strove to suppress and minimize evidence of damage to borrowers

Promontory had multiple conflicts of interest and little to no relevant expertise

We discuss the third major finding below.

Concerted Efforts to Suppress Findings of Harm

Both Bank of America and Promontory suppressed and ignored both broad categories and specific examples of borrower harm. We’ll discuss how this occurred from two vantages. The first was organizational: that the reviews were structured and managed so as to make it hard for particular cases of borrower harm to get through the gauntlet. The second was substantive: that the bank and Promontory excluded some types of harm entirely and insisted other aspects of the review be focused as narrowly as possible, which served to minimize and exclude evidence of borrower abuses.

Organizational obstacles to identifying borrower harm

After recruiting “claim reviewers” with meaningful mortgage document and foreclosure experience with the understanding that their job was to ferret out evidence of damage to borrowers, Bank of America and Promontory put in place a structure to impede those efforts.

The two major elements were:

A “Quality Assurance” department that consistently rejected all but the most egregious instances of borrower harm

Bank of America management pressure against pursuing troubling evidence

The Orwellian “Quality Assurance” department. After the claims reviewers completed a test on a borrower, they uploaded their files, including their “harm notes,” into CaseTracker, the program which was the backbone of the entire project. Promontory asserted that because it could see all the information uploaded into CaseTracker, that it, and not the Bank of America-based staffers, were performing the reviews.

However, the files next went to the Quality Assurance department, which was in Bank of America and staffed with both permanent employees and contractors. The reviewers would have the opportunity to rebut any objections QA made before the file was sent on to Promontory.

Curiously, Bank of America had discussed the formation of QA and some related efforts with the reviewers:

Reviewer B: Like, when the QA department was formed, Promontory kind of questioned,” Well, why are you, you know, QAing the work that we’re going to be looking at,” and then they formed a group called [crosstalk]

Yves Smith: Oh, QA was BofA’s idea!

RB: Yes.

YS: Ohhhhh. That’s important to know.

RB: And then they formed the AI team, which was the Additional Information team, and the process was supposed to be that we were to review the loan, then it would go to QA, then it would go to Promontory, and then it went through whatever process at Promontory it went through, and if Promontory found harm, this was Bank of America’s original explanation, if Promontory found harm, it would then come back to the AI group to review again. Promontory at one point, it was a rumor that they had fought this and said, “No, we are the third party, you don’t need to review our work, we’re reviewing your work.” So then they, the Bank of America changed it to where the AI group was just going to be formed in case the reviewers didn’t upload some information that Promontory might need, then they could contact the AI group and say, “Okay, we still need a copy of this loan mod or this workout analysis or whatever.” So that was all Bank of America’s idea.

The reviewers report that QA would regularly dispute findings of harm but would wave tests that had no findings of harm on to Promontory. They were aware of the results because the initial reviewer would be given the opportunity to rebut QA objections (in fairness to Bank of America, the team leaders often assisted in these efforts). No reviewer knew of a single instance when QA sent a file back for an incomplete review or a querying whether a fact pattern amounted to harm. All reviewers had full access to CaseTracker, so they could also look at the audit notes and see what happened to borrower files when they went to QA.

All reviewers report serious pushback from QA.

Reviewer A: Oh. Gosh. I – we were all getting very frustrated, and I know that I was, I was running sometimes 50% of my files would come back and I would be, it would be suggested that I change my opinion.

Yves Smith: And what happened –

RA: Or change an answer as to whether or not something, you know, a modification was actually offered or not offered or improperly offered. I would say 50% of the time. And then I would have to go to my PC, my proficiency coach, and make my case as to why the quality control people were wrong, and if the proficiency coach – again, may or may not be a Bank of America employee – if I could not come to an agreement with them, then it was passed on to my section manager, who was always a Bank of America employee, and we were always butting heads because, first off, you asked my for my opinion and I feel that this happened in harm towards the borrow– for the borrower. And you’re telling me it didn’t happen, and I’m reading it, and you’re telling me that what I’m reading isn’t the case…

YS: I just want, I just want to ____, so you were basically saying they were trying to say the things that you were saying were factual determinations, like the borrower, you know, made a $25,000 payment that was lost, or something, and they were saying, “No, no, no, that’s your opinion.” I mean they were trying to recharacterize factual matters as opinion?

RA: Or –

YS: Is that part of it?

RA: Yes, as an opinion, or as that it didn’t happen the way I am interpreting the notes.

YS: Mmhmm.

RA: That was very common.

YS: So the arguments really were not about your conclusion about the severity of the events, they were trying to deny that the events happened, to deny, to say that your harm conclusion was wrong.

RA: Oftentimes, yes.

From a different reviewer:

YS: You said you were very diligent in following things up. Did you – you know, you said you thought there were 30% of the cases you looked at, there was borrower harm….what percentage of the time, when you identified harm, did it seem to get flagged through, or you’re basically saying you were told that was irrelevant?

RB: Yes….

YS: So every time when you identified, it got suppressed.

RB: Right.

YS: Right.

RB: Right.

YS: Okay, so 100% rejection.

Bank of America management pressure against pursuing troubling evidence Given the ambiguous and open-ended test questions (discussed in depth in this post), many researchers stove to be thorough. Not surprisingly, that put them at odds with the Bank of America managers. “Digging” was discouraged:

YS: Now, we were told that people who were more diligent were labeled “diggers,” and that was considered a bad thing.

RB: Yes…

MS: Were you ever criticized for digging?

RB: Initially I was. Initially – and I was the only person that had a lot of bankruptcy knowledge in my group, so if I brought something up, or if I would just say, you know, “How would this get addressed, because this is what I found,” they would say, “Don’t. You know, it’s not going to get addressed. You have to stick to your questions.” So I just, I learned very quickly what my place was there, and I just stuck to it.

Although RB learned to toe the line, he described how other reviewers were not as compliant.* Reviewer E was one of them:

Reviewer E: I had one where the person got a modification. They capitalized everything – the back-due payments, the fees – and then they gave them a HAMP trial mod, and the homeowner was, like, “I don’t want HAMP. I have a mod.” So they just took both mods out of the system but kept everything capitalized. A year later?

YS: Mmhmm.

RE: Another mod. Another HAMP trial mod. Capitalized everything. They said, “I don’t want HAMP! I have a mod.” What did they do? Took it all out of the system but kept it capitalized. So now it’s been capitalized twice. [crosstalk]

YS: The same interest, the same fees –

RE: Same fees, same back-due payments, everything. Third mod finally stuck. But now the guy’s payment is $250 higher because we’ve recapitalized everything till he signs. That file got taken away from me because I was digging too deep.

RB discussed the “digging” of another reviewer:

RB: One person was this way, went to one of the managers, I think the last week that we were there, and said, “Hey, I have a problem with this test,” and he just kind of rolled his eyes and said, “I know, just like every other test.” And she’s also the same person that found a borrower that made like a $20,000 payment and the whole payment just disappeared out of the system.

YS: Mmmm.

RB: The borrower did not get the money back. It was never applied to any fees or any payments. It just was gone. And that was escalated to, you know, someone else. They pulled the loan out of her queue, and she would repeatedly ask, “Hey, did anybody hear about that loan?” And they would repeatedly tell them to stop digging.

Other terms of opprobrium were “going out of scope” and “going down rabbit holes”. Reviewer A stressed that Bank of America had little tolerance for that:

You would, uh – you could also be dismissed for what they called being a digger, and – for instance if you had, if you were doing a C test but you found harm in a particular loan and it went off in a different direction other than specifically something addressed in the C test, you were called a digger. And if you made notes in the system regarding something outside of the scope of your test, you ran a risk of getting yourself in some pretty hot water and winding up with the call later that night from your agency saying, “Well, you know, you should – you’re not allowed to go back.”

Substantive efforts to limit or bar findings of borrower harm

Predictably, Bank of America staff tried to eliminate and minimize any evidence of damage to borrowers. The main ways they did that were:

Excluding some major types of abuses from the reviews entirely

Narrowing the scope of the reviews

Document/record fixes and fabrications

Excluding some major types of abuses from the reviews entirely In Part II, we described how the reviewers found that Bank of America engaged in some practices systematically that hurt borrowers. We need to underscore that some of these systematic, and perhaps pervasive types of bad conduct were omitted completely from the reviews. Bear in mind that all of them have been flagged in the media and by foreclosure defense attorneys as abuses they see often.

One big one was impermissible charges in Chapter 13 bankruptcies. Many borrowers lose their homes to them.

During the period when a borrower payment plan is being approved and the 60 months under the plan, all creditors are “stayed”, meaning they cannot impose new charges on the borrower. All claims (principal, interest, any fees owed) must be submitted to the court prior to the negotiation of the plan. The borrower must make his 60 months of payments under the court approved plan. Chapter 13 plans are very demanding and contemplate that the borrowers live meagerly. The borrower emerges with no debts and (unless he had an unexpected windfall) no savings.

Servicers often (too often) accumulate late fees or other fees during a bankruptcy, even though these fees are not allowed (payments made pursuant to a Chapter 13 are timely irrespective of what the mortgage originally specified), and hit the borrower with them shortly after emerging from Chapter 13. The borrower is by design broke and can’t afford court fees. Many borrowers lose their house this way.

Many of the reviewers had bankruptcy experience and knew these charges weren’t legal. Yet when they asked about how to include them in their reviews, the trainers incorrectly told them that it was legal to incur fees during the bankruptcy but not charge them then. This appeared to be the belief of the Countrywide managers who were supervising the reviews. Perhaps more important, Promontory, which was responsible for the design of the reviews, was responsible for making sure all laws, and bankruptcy law was specifically mentioned in the OCC consent order, were complied with. Yet Promontory appears to have taken its view of what was kosher from Bank of America rather than from relevant law. The result is that this abuse was completely ignored.

Another type of borrower abuse that the reviews wouldn’t consider was zombie title. That occurs when a servicer completes all the steps up to the sale of the home, sometimes including evicting the borrower, yet neither takes title itself nor sells the property to a third party (in other cases, the borrower, led to believe eviction is imminent, leaves on the assumption the bank is about to take the house). Recall that the reviews included foreclosure actions that started in 2009 and 2010 so foreclosures left in limbo that started during this period would be eligible for relief. Yet as we demonstrated earlier, complaint letters that cited this sort of problem were rarely addressed properly and rejected when they were because they did not fit in the review template.

Another conveniently-omitted abuse was the all-too-common HAMP trial modification hell, in which borrowers made all their trial modification payments, were told to ignore foreclosure notices (the foreclosure process would continue in parallel with the trial mod) and reassured that they were likely to get a permanent mods and then were foreclosed upon, were also typically excluded from the review. One reviewer described his frustration:

That was a big question was, was the modification offered and in place and what determined whether a modification was actually in place and were payments made? For instance, if someone was offered a trial modification and made their payments in a timely manner, the letters for the trial modification stated, “If you’ll make the next six payments, you will be offered a permanent modification.” Well later on, I mean, these, some people would make seven, eight, nine, ten payments. Nothing would happen in regard to a permanent modification. And so we would be asked, was a trial modification in place or was a permanent modification in place? Well, the letter said six months, a permanent – after six months of payment, a permanent modification would be offered. Well it wasn’t, and the person made 10, 12, some – I remember a case where someone made 18 trial modification payment, they were never offered a permanent modification. So the letter said six months. So I said, “Yes, there was a permanent modification in place. They paid as agreed, the letter said they would be offered the permanent modification, they exceeded the number of payments, nothing happened. So, yes, there was one in place.”

That would create a tremendous argument, because is it in place or isn’t it? If I said it wasn’t in place, there was no permanent modification in place, that stopped the investigation. Well, that’s not right, because they made more than the required number of payments and you’re saying, just, there was no permanent modification in place?

This example raises a much bigger issue. Reviewer A was almost certainly wrong, in that a permanent modification was not in place, the borrower had instead been left in a trial modification limbo and then foreclosed on. However, the media and policymakers discussed this type of abuse frequently. The tests at Bank of America by design omitted one of the biggest groups of harmed borrowers and this reviewer was refusing to sanction that ruse.

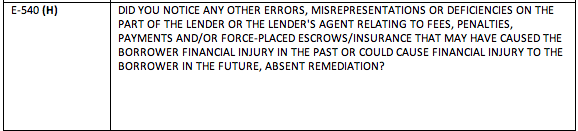

Narrowing the scope of the reviews. All the reviewers complained of how Bank of America personnel (not necessarily the team leaders, but QA and the unit managers) would go to sometimes logic-defying lengths to narrow the scope of the tests, even though several of the major tests had open ended questions to allow the reviews to provide information about types of harm not captured elsewhere. See, for instance, this question from E test:

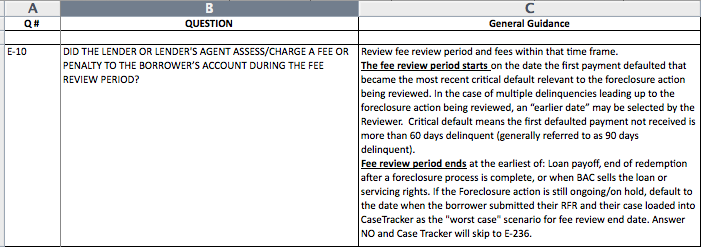

One of the regular battles was over the review period. The staffers in Tampa Bay were processing borrower complaints relating to foreclosures completed in 2009 and 2010. Bank of America managers would instruct the reviewers to look back from the completed foreclosure to what it called the nearest critical default and no further. But the questions form that they used when undertaking the test told them to use earlier default dates if they saw fit (see the “General Guidance” column, click to enlarge):

Even when reviewers complied with that directive, they got resistance:

RB: Well, one was the very first question, which was question E10, and it would ask if the fees were charged to the borrower’s account during the review period. Well, the review period for us was different than the review period for the whole rest of the project. So we were not just going by anything that was, you know, related to a foreclosure during 2009 and 2010, we were going by the original default date.

YS: Mmhmm.

RB: Now if they did bring the loan current, originally we were told six months, we were told three months, we were told all different kinds of things, but we were told if they brought the loan current for a specific amount of months, we could skip that default and go to the next one.

YS: Mmhmm.

RB: So if you answered the question yes, there were fees charged to borrower’s account during the review period, inevitably the QA department would take it back and argue with you over review period.

YS: Well that also just sounds crazy, because the whole – one hates to say it, the whole point of foreclosure – not, well, the whole point, but foreclosures inevitably involve – I mean it just sounds Orwellian. Foreclosures inevitably involve charging extra fees, and yet if you say you did what was permitted during a foreclosure, even if they only did stuff that was permitted, it got kicked back. I mean, that’s –

RB: Right.

YS: Is that what you’re saying?

RB: Pretty much.

YS: Oh my God….

RB: Well, and sometimes too we had to go through a guide that was provided to us on an Excel spreadsheet, and it was all these investor allowable fees, so there was Fannie, Freddie, HUD, FHA, VA, all of them were on the spreadsheet that we had to go through and compare each fee with what was allowable. But the more – the bigger your review period, even though we had a different review period, you know there were, the easier chance you’re going to have of finding something wrong, so it was almost like they would even argue with you about your review period, even though you were following what you were told and what was on the guide, just to shrink it down and make it just a shorter timeframe that you were reviewing. Now, if you even had a foreclosure that was in with that, say they had a foreclosure in 2004 and you had to review the fees as a part of that, because that was in your review period, it would still get kicked back and QA would say that you were not reviewing fees within the scope of the project.

Reviewer C similarly pointed out that the reviewers on her tests (E and F) had latitude to choose longer review periods but still faced resistance:

RC: A lot of times we had what was called a fee review period, and we would, we would start with the latest default that had to do with the foreclosure action we were reviewing, and – default meaning 90 days. And there could have been several defaults, and a lot of times the quality analysis analysts didn’t agree with what our fee review period was, although it was very subjective. So, most of the time if I got anything back for that, I would just say, “Well, this is what I’m choosing, this is what I’m sticking with.” And normally, I had gone back farther than what they were saying to go back.

YS: And….what would your basis be? Your basis would be it started X because of X, this reason. What would their – why would they choose a narrower period?….

RC: So a lot of times borrowers will be late 90 days, catch up, you know, and it’ll happen again and again.

YS: Right.

RC: So – you know, in our instructions we were told we can back further if we choose to do so.

Some files wound up not being subject at all to certain tests. It’s one thing to have that be an accident, but when the team leaders were told about it and refused to remedy it, it was clearly intentional. Both the B and D tests (done together by one set of reviewers) and the E and F tests (done by a different group) had questions requiring them to confirm that a particular foreclosure activity had occurred before proceeding.** The reviewers were directed to look at the “Foreclosure Account Followup Screen” in the main servicing system, AS400, for verification. That screen listed all the steps that had taken place relative to a foreclosure action.

But it turns out that screen was not always reliable. One reviewer would check the Foreclosure Review Account Followup Screen against court filings and found out the screen would be wiped clean if a borrower who had had the foreclosure process start later got a modification. This was germane because any fees relating to a foreclosure that had started were often capitalized in the modification. If those foreclosure actions or the fees were not proper, the borrower would have been eligible for compensation, but most reviewers would miss that. This reviewer would perform his check of these earlier foreclosure actions, and flag that the earlier tests (B and D) had missed them in their file review (B and D included tests of whether the foreclosure process was executed in keeping with applicable laws). He would also raise the omissions with his team leader and unit manager, and was told “Don’t worry, Promontory will catch that.” He’d check these files periodically after they went to Promontory and never saw the omitted tests completed.

Document/record fixes and fabrications. Reviewer A discussed a problem with breach letters, which are the first letter sent to borrowers in the foreclosure process. Defective breach letters would point to harm under the tests that related to whether the foreclosure executed properly:

Well, we were having a very difficult time locating breach letters, you know, the letters of acceleration, and our pipelines were getting clogged up with – because we would have to wait for these documents … And so oftentimes we would have to have someone go find these, what we call document retrieval unit, try and find these, and our pipelines were getting very clogged up waiting for someone to find these documents and eventually we started getting breach letters sent back to us, say, from a Countrywide file, but the breach letter was on Bank of America letterhead. But it was a Countrywide file. How did it get on Bank of America letterhead? So there was a big hue and cry through the, at least through the level 3s, saying, “What in the world is this? You know, this is a Countrywide loan, it has Countrywide loan numbers, it’s on Bank of America letterhead. How is this supposed to be legitimate?” Eventually all those files were taken away from us…it was causing enough of a stir so that we were simply told to stop what we were doing as far as these breach letters were concerned, and if we had a breach letter that was missing we were to notify management and it would be sent to another team…

And we were told at one point that the breach letters were sent out registered, and we oftentimes would ask, “Well, can you give us the receipt?” And of course there was, “No, those don’t exist anymore. They get thrown away.” Well, you know, I don’t necessarily believe that, but nonetheless these loans were taken away from us and given to another team, the breach letter team, who was then assigned to take care of them and we wouldn’t see them again for the most part.

In case you think this is one of those “mere paperwork” issues, a January 23, 2013 ruling in Florida, Bank of America v. Casey, in favor of a borrower on this very issue says otherwise (hat tip Florida Foreclosure Fraud Weblog):

In the most fundamental sense there is a world of difference between having to bring a court action to assert the non existence of a default or any other defense to acceleration and the right to assert in the foreclosure proceeding the non existence of a default or any other defense to acceleration. The former requires affirmative action on the part of the borrower to file a complaint, which almost all are ill equipped to do, or pay an attorney to do so. It also requires the payment of a filing fee at a time when the borrower is least capable of doing so. It is significantly different from taking no action, waiting until the foreclosure proceeding is filed and then asserting why acceleration is not correct or specifying other defenses. To equate the two is to ignore both the terms of plaintiff’s mortgage and the economic burden of the substituted language.

Also, equation of the two requires one to ignore the Supreme Court pronouncements in this area. This is one of the few times in the history of Florida jurisprudence where the Florida Supreme Court has deemed it necessary to subject an entire industry to special rule due to the industry’s documented illegal behavior. The amendment of Fla. R. Civ. P. 1.110 (b) was a direct result of the robosigning scandal. The comments to the rule amendment, In re Amendments To The Florida Rules Of Civil Procedure, 44 So.3d 555, 556 (Fla. 2010) indicate the depth of the court’s concern with this industry. To suggest now that a non-party, to whom the owner of the note has delegated its obligations, has “substantially” complied with the notice provision by wrongly telling the borrowers they have to file a separate law suit to assert their defenses turns logic on its head.

In Florida, many appellate cases have also reversed lower court foreclosures on this very issue,*** often relying on Paragraph 22 of a standard Freddie/Fannie mortgage form (used extensively for GSE and non-GSE mortgages alike).**** It is likely there are favorable rulings on this question in other states.

Moreover, in the case of the Bank of America letters in Countrywide files, it is not clear whether defective letters were sent out on time, or whether the files were sloppily doctored after the fact (as in letters on Bank of America rather than Countrwide letterhead were loaded in after the fact). The failure to send a breach letter would put homeowners in non-judicial foreclosure states with short timetables like Georgia and Texas at a severe disadvantage. In those states, after a letter is sent (or in these cases, perhaps not), the next step is the advertisement of the pending foreclosure sale, and that serves as the notification of the sale date. Those ads run two weeks prior to sale, which is hardly enough time to intervene even if the borrower manages to see or hear of the pending sale on the day the notice appears.

Another controversy discussed widely among the Tampa Bay reviewers (the open floor plan, team structures, and use of instant messaging facilitated gossip) were the missing fee notification to North Carolina borrowers during foreclosures.

In October, the matrixes for the tests involving fees were updated, and it included new material on state fees. One major new item was that North Carolina law has a strict policy on fees, that the fee must be charged to the borrower within 30 days of being rendered and the borrower had to be notified in writing of the fee within 45 days being charged (there were some minor exceptions to this rule).

Many reviewers on the fee tests were unable to find any such letters; even a more savvy reviewer who thought that some of his colleagues might not have been as diligent as they could have been about looking said on average only 10% to 20% of the letters were in the system. Even a reviewer who was tasked to other tests mentioned them. He’d gone looking for them on his North Carolina files and had found none.

However, one reviewer who did find them pointed to a suspicious pattern:

Reviewer E: This didn’t come down until October…or November. And –

YS: What do you mean, this “come down”? It wasn’t included in your reviews, or – ?

RE: Yeah! We didn’t know about this rule. It was a new rule that nobody knew about. Well, I was, I had a file that happened to be North Carolina that I was in with someone when this new rule came out. So I had to go back in and look for it. Nothing there. So I just let it sit for a minute and moved on to another file. About two weeks later, there were 50 of those letters that magically appeared in the system.

YS: Mmmm. Wow.

RE: Very common.

YS: So you’re, you’re saying that while the review was on, Bank of America was fixing the documents, uploading stuff in the system?

RE: They weren’t there, and then magically when the law was brought to light?

YS: Mmhmm.

RE: Magically they started appearing, in the thousands.

YS: Yeah. Wow.

RE: Where there’s no proof they got mailed? Nothing. It’s –

YS: Yeah.

RE: – just a one-page document –

YS: Right.

RE: – that has a fee on it.

When I went back to the reviewer with the argument that he might have simply not looked thoroughly enough the first time, he replied:

There was only one place in the system for documents like this to be, which was in the I portal [see the link to the program in the blue box, second row, on the left] in Port Com Docs. When I was first looking at the borrower records I mentioned to you, there were only ten documents there, no fee notification letters at all. When I went back into the file, there were 20, and the new ones were all North Carolina fee letters. And I saw other letters appearing in borrower files. You’d see a document with a title, say, “Inspection fees” but if you clicked on it, it was a blank page. I’d come back later, and it would be completed, with a date and a fee amount.

This reviewer also stated that a colleague working in a different building claimed to be on a team of roughly 300 people that was documents, changing servicing notes, backdated fees, and reclassifying fees so they would look as if they had been charged to investors rather than borrowers. We have not obtained confirmation of this charge, but as we pointed out in an earlier post in this series, virtually every borrower file had reclassified fees, well beyond the level that can be attributed to corrections of mistakes. So while we are not certain there is a fire here, there is certainly a troubling amount of smoke.

__________

* In this series, all reviewers are described as male irrespective of actual gender.

** For instance, question E-150: “Was a foreclosure sale initiated?” and question E-190: “If the foreclosure sale has not occurred, will the borrower be obligated to pay the amount of the impermissible miscalculated fees and/or penalties in the future if not corrected?”

* This is a partial list (hat tip Evan Rosen):

Judy v. MCMC Venture, LLC., 100 So.3d 1287 (Fla. 2nd DCA 2012) (summary judgment reversed where notices of default failed to specify the breach);

Konsulian v. Busey Bank, N.A., 61 So. 3d 1283 (Fla. 2d DCA 2011) (summary judgment of foreclosure reversed when bank did not defeat affirmative defense relating to failure to provide the acceleration notice);

Sandoro v. HSBC Bank, USA National Association, 55 So. 3d 730 (Fla. 2d DCA 2011) (final judgment of foreclosure after summary judgment reversed where record reflected genuine issues of material fact regarding whether Mr. Sandoro had been provided with a notice of acceleration because such notice was a condition precedent);

Goncharuk v. HSBC Mortgage Services, Inc., 62 So. 3d 680 (Fla. 2d DCA 2011) (summary judgment of foreclosure reversed when issue of acceleration notice remained even though nonmoving party did not file an affidavit in opposition);

Laurencio v. Deutsche Bank National Trust Co., 65 So. 3d 1190 (Fla. 2d DCA 2011) (plaintiff not entitled to summary judgment where it had not established that it had met the conditions precedent to filing suit, i.e. it had not established that it gave Homeowner a notice which the mortgage required);

Frost v. Regions Bank, 15 So. 3d 905 (Fla. 4th DCA 2009) (summary judgment of foreclosure reversed when bank did not factually refute the Frost’s lack of notice and opportunity to cure defense);

Lazuran v. Citimortgage, Inc., 35 So. 3d 189 (Fla. 4th DCA 2010) (summary judgment of foreclosure reversed when affirmative defense of improper acceleration not sufficiently addressed);

Valencia v. Deutsche Bank National Trust Co., 67 So. 3d 325 (Fla. 4th DCA 2011) (foreclosure summary judgment reversed when there was a discrepancy between the date of default alleged in the foreclosure complaint and the dates referred to in the notice to cure letters that were allegedly sent to borrowers).

** 22. Acceleration; Remedies. Lender shall give notice to the Borrower prior to acceleration following Borrower’s breach of any covenant or agreement in this Security Instrument (but not prior to acceleration under Section 18 unless Applicable Law provides otherwise). The notice shall specify: (a) the default; (b) the action required to cure the default; (c) a date, not less than 30 days from the date the notice is given to Borrower, by which the default must be cured; and, (d) that the failure to cure the default on or before the date specified in the notice may result in an acceleration of the sums secured by this Security Instrument, foreclosure by judicial proceeding and sale of the Property. The notice shall further inform Borrower of the right to reinstate after acceleration and the right to assert in the foreclosure proceedings the non-existence of a default or any other defense of Borrower to acceleration and foreclosure. If the default is not cured on or before the date specified in the notice, a Lender at its option may require immediate payment in full of all sums secured by this Security Instrument without further demand and may foreclose this Security Instrument by judicial proceeding. Lender shall be entitled to collect all expenses incurred in pursuing the remedies provided in this Section 22, including, but not limited to all attorneys’ fees and costs of title evidence.

OK … we have a smoking crock of odoriferous material.

You know and I know that some people committed fraud. These frauds lead to folks losing money. In other words crimes were committed.

Do we need to go back in common law to the magna carte to gets some rights to have our grievances heard?

Seriously … have we been so wedged by stuff (gay marriage, abortion, immigration, obamacare et al) that we can’t bring a coalition of the majority to bear on getting these dad gum crooks put into the slammer?

I’d make a relatively large contribution to a honest to god law and order candidate

Hows that for putting my money where my mouth is?

Sorry to say I don’t know one.

Yves, I have been reading the series and each piece sends a new wave of revulsion through me and I may vomit shortly. I hope other whistle blowers come forward. I have been through most of what you write. Except I managed to have the bank attorney vacate her own motion to keep my home while in compliance with a modification. Five years now fighting. The home that is now ravaged by Sandy. No heat, electric, water or appliances. Good Lord. What pray tell will be the next sickening turn or twist in this mess?

Keep up the great work Yves. You are inspiring.

To pull the whole story together it will take someone to put a human face — like yours and other people who have commented on these threads — on the suffering and immense psychic damage inflicted by the financial industry. It has to be conducted like a criminal trial, where the victims are put on the stand, their pain and suffering put on exhibit for everyone to see — and not reduced to some commodity as neoclassical economists are want to do (See the writings of Gary Becker and Richard Posner for examples of this.).

The research that Yves is doing is invaluable and absolutely necessary. It is a different part of the prosecution.

The question is: “Why are criminal prosecutors not doing this research?”

Oh, I forget. President Obama — Mr. Fraud — has converted the entire Justice Department into the legal defense team of the finance industry.

That my friend, would be one hell of a follow-up on Frontline’s Untouchables. Methings Yves may know these guys. Also, if anyone knows, I would like to know how the Untouchables did as regards ratings and web-viewing.

Yves….monumental work…do hope you are considering publishing a book on this one….

Someone should email this article to Lanny “We looked hard.” Breuer.

I hope there is a focus on the IT systems in future parts of this story. That is where the smoking gun is. It is the Achilles heel for any court action.

In order to properly authenticate business records under the business records exception to hearsay, the testifying witness must possess a working knowledge of the specific recordkeeping system that produced the document.

Needless to say , the systems are seriously compromised and any effort to audit the systems integrity via discovery would most likely result in a nice settlement for the “borrower”.

I would call Yves’ audit of the foreclosure reviews a complex analysis, making things perfectly simple to understand. And what it proves is that the banksters operations were not complex, they were just illegal, incompetent and continuously obfuscated. I used to think that nobody would ever be able to pull this stuff together well enough to make the case for intentional fraud. I have now changed my mind. Yves just did it.

And—there is no Statute Of Limitations for fraud…

Fraud is fraud, no amount of whitewashing can cover that up. I can’t understand how anyone can think that BofA did anything but commit deliberate, planned fraud on a massive scale. There is no way that this can be explained any other way: no one is that incompetent.

Now the real question: what is to be done? Obviously the current administration shows absolutely no interest in investigating (let alone prosecuting): the clear implication of all of this is that BofA appears to be operating as a criminal organization, one that quite clearly has suborned what few watchdogs were set to oversee its operations. Massive fraud with careful concealment and planned obfuscation, the best prerequisites for fraud.

Despair is a cardinal sin, hence I do not despair. But it’s hard not to be really, really close to it.

The deposit of the note as an asset followed by a transfer of funds to the seller means the bank brought nothing to the table. With no skin in the game they have no claim to the property as they could not have sustained any loss.

Its not just BoA, its all banks, in all cases, where GAAP rules were followed.

To John Opie:

“….no one is that incompetent.”

Surely you jest, sir!!!!

Anyone that has followed this mess, and become somewhat familiar with the large number of individuals and their “personalities” that occupied and headed these institutions since the mid 2000’s must come away with the sense that “incompetence” reigned far more than “outright illegalities and fraud”.

One example is the actions of so many “risk managers” in the financial institutions that have become so deeply involved in this mess, their protestations and their suprior’s outright censoring of those protests. To me that is incompetence, not fraud. And, yes greed as many of those overseers were paid not only base salaries but bonuses for more incompetence on the job.

What would you call Alan Greenspan’s outright admission before Congress that “….he was wrong about markets self-adjusting for (incompetence) mistakes?” (para)

I’d call that outright colossal incompetence.

That is not to say that it appears that outright fraud and in many cases, criminality is/has not been a part of this rape of so much of the trusting, unsuspecting American public. (And so much of the rest of the consumer world)

…were that I jest.

At this level of organized incompetence, it is incomprehensible that the banks could stay in business. Seriously: the simpler solution that the veneer of incompetence was created deliberately in order to obfuscate the fraud. If you’re going to defraud on such a massive scale, then creating a convenient pool of scapegoats is a minor matter and costs, in comparison to the rewards, a pittance.

If not, then everyone involved should be removed from the gene pool. This level of incompetence is a threat to the continued survival of the human race.

..for what reason do we suppose banks held two sets of books…???..AND are un-auditable…

Yves – perhaps you could send this to Eric Schneiderman. I just read his interview with somebody yesterday (I forget where, maybe livinglies.wordpress.com) and he is expanding his investigation. He wants to nail down “the intent to defraud” and these whistleblowers in your article would definitely prove that.

Deb

If you have been following this issue, you would know that Schneiderman has his blinders on – as do all the other regulators.

Anyway, be assured the he knows of this series but will not acknowledge the existence of the series, or the substance contained therein.

I am a NY voter and will never vote for him again for anything. What a disappointment.

Alan

The name of the game here is fraud! Unfortunately, we’re seeing blatant fraud in our government and every facet our economic system. Ethics has gone out the window. Look at the Libor scandal and many other scandals that are ongoing. I’m convinced that the stock market is now being manipulated. It’s apparent that no one is being held liable for committing fraud, so it’s growing like wildfire. Any settlement that Bank of America, or the other big banks, are offering to victims of foreclosure fraud, is just a smoke screen, if it ever actually happens. The Federal Reserve continues to print money like mad men, with no regard for the inevitable dollar devaluation. A very few, at the top, continue to aquire staggering wealth, while the rest of us go broke. Americans must start to face the hard fact that this country is going down, if order isn’t restored soon.

How is it even remotely possible to prove clean title today?

Question, I’ve been wondering for sometime now how it might be possible to get the files of the review for individuals? I signed up the first week possible. I got my Rust ID and submitted my complaint with specific dates, names, times and very specific actions or inactions by the servicer. How could I compel the results? Also, how could we get the release of the OIG Audit?

This is strong evidence of a criminal conspiracy. It is a federal crime to cause false entries to be made in the books and records of a federally chartered bank. BofA almost certainly committed tens of thousands of infractions over the course of this sham review. I imagine that there are all kinds of other crimes involving interference with a government investigation and making false statements to OCC officials also.

I would encourage Yves to do a follow-up piece where she asks various government officials (OCC, Fed, members of Congress, etc) for comment. Get them on the record!

The only loans that would be part of the bank books and records would be the bank owned loans, not the securitized ones. The latter are the overwhelming majority. The serviced loans are owned by a New York or Delaware trust, the servicer is acting as an agent of the trustee.

I have to clarify here, as it is unlikely the trustee has possession of the loan documents. The document custodian has the copy of the loan files, and it may be the servicer or it may be another entity. The custodian, or at least the initial custodian, is specified in the trust agreement or psa. Wells Fargo (MN location), for example, is typically the custodian on the securitized loans that they service. IIRC, Countrywide also was custodian on the MBS loans they serviced. In fact, it came up in testimony in a NY lawsuit that the loans had never left Countrywide to be transferred to the trust, and the note was later mailed for the trial from where it remained at Countrywide. I don’t know about Bank of America, if they have custodial facilities or not, probably do though.

That was a NJ case – Kemp v. Countrywide. Hilarious case, too, since the CW manager was sent by BOA/CW to testify about how they had the note. I think her name was Linda DeMartini.

Sadly for CW, she was refreshingly honest, and talked about how they never delivered the notes, and how they always created the allonges solely for foreclosure purposes!

This woman had been overseeing CW loan documents for TEN YEARS.

Yet the very next day, BOA threw her under the bus, and claimed she had no idea what she was talking about!

Anyone who has a CW originated loan, and is defending a foreclosure, must review and use this case. It’s a whopper!

But at some point the bank that securitized and sold had to make entries in its books as to what it sold — e.g. value and nature of thing sold (overpriced junk). And at some point the bank that originated had to make book entries about the loans/batches of loans that it sold to the securitizing bank. And so on.

I think Fraud-Guy is on to something when he focuses on the “causing to make false/misleading entries in a bank’s books and records.”

…ny or delaware “trust”…shaxson has plenty to say about these=”Treasure Islands”…

Yves,

You have done an outstanding job pulling together eyewitness testimony into a narrative of events as viewed from the ground level. That is amazing, and a testament to your dedication and expertise. Well done.

With that said, unless we have a clearer understanding of what was being said and done higher up the food chain we will never understand whether this mess was deliberate or just another oops moment on the part of a well intentioned agency.

My perspective is that this was an elaborate stall tactic to get us through the election. Look busy, raised to high art. If there was a credible opposition party with its own plan to see justice done THEY could be raising objections to this farce. But there is no one. A few Dems who disagree with the president’s team, but are powerless to effect change.

There’s a lot being said about Zero Dark Thirty and Argo right now as movies that laud government. But that is totally wrong. They laud ordinary people getting amazing things done despite government and politics. This series reminds me of those people, fighting the system and winning. In the fight against financial corruption, however, the little guy cannot win. It is an Argo or ZDT in which the good guys die and Bin Laden gets away.

We have to keep hoping for change and preparing for salvation. We have no choice, really–the alternative is despair and suicide. But the happy ending may not happen for us.

Levi…more of a “Merry Christmas Mr. Lawrence”…definately NOT the propaganda=LIES perpetrated by Zero dark and Argo…ever see the Hitler propaganda films???….

What’s the statute of limitations on RICO?

Ya got RICO, SarbOx….

Too bad that we can’t sue the Holder and Breuer for non-feasance. But sine they are lawyers, maybe we can find what states they are in and proceed to have the law licenses revoked….

civil Rico = 4 yrs

I want to see Brian Moynihan in jail

How can it be that we are in a situation in which a brilliant documentation of unjust behavior will most likely be ignored?

How can it be that the necessity of rendering justice seems so unlikely?

Have we created a structure of power which claims to decide what the true good of the citizen is even in defiance of our opinions?

Have we created a structure of power (the Washington consensus) which professes to follow a conception of truth based on the laws of the marketplace in economics?

Have we created a structure of power (the Washington consensus) which professes to follow a conception of truth based on a more and more authoritarian dictatorship of experts in the merged central committees of both the Market and the State?

And has this structure of power (the Washington consensus) in its search for objective truth (and its supposedly scientific rules) succeeded in depoliticizing all of us– to the point where our primary political response is to beg for someone in a position of illegitimate authority to somehow save us from injustice?

I have been following your investigation of the HAMP housing debacle and believe I may have information that would be relevant. I am a Paralegal who started looking into a mod for my mom in 2009. As a result I went to work for a modification company and became their compliance supervisor. Upon the release of new HAMP comprehensive in September 2010. I began escalating files to the the Presidential offices of Chase, Wells BOA and Citi, while this was helpful, it did little to fix the review problems industry wide. The banks seemed to be working with a script that was contrary to guidelines but consistent from bank to bank, the goal of which was to deny modification and foreclose

I used the file escalations as the bases for submissions to the IFR. The files are address the compensation the borrower may be entitled to under the IFR compensation framework, the coordinating HAMP guideline that was violated substantiating the violation, an outline of the clients experience from the first contact with the bank to the date of the IFR submission, and all supporting documentation. A review of these files clearly supports the allegation made by the reviewer in this piece. You can see the same scenario consistently case by case. While BOA was certainly a major violator, Chase was by far the worse bank we worked with.

I have contacted Congressman Cummings Office regarding this matter but I harbor no false hope that this matter will ever be addressed or resolved by the government. I continue to assist those homeowners who want continue their modification request, but very little has changed in the banks response. I would be happy to provide you with information from the files we were submitting that substantiate the information you are getting from this investigation.

Sherri,

If you’d like to discuss this further, please reply to this comment and leave a valid e-mail address in that field. I tried sending an e-mail to the address you provided and the message bounced back.

Thanks!

Jim,

..perhaps we could “art-ify” the answer-a new television series, “Ask Orwell”…

I am no lawyer but this statement right here:

“Promontory, which was responsible for the design of the reviews, was responsible for making sure all laws, and bankruptcy law was specifically mentioned in the OCC consent order, were complied with. Yet Promontory appears to have taken its view of what was kosher from Bank of America rather than from relevant law. The result is that this abuse was completely ignored.” – suggests that Promontory is subject to civil liability for each and every improper foreclosure/mod. that caused injury they reviewed. Uh, they might consider hiring a lawyer?

Yves, in your book you detail how compensation schedules for many firms led to the wholescale abandonment of risk controls – did they also ignore their in-house counsels – or were they too corrupted by the vig?

“An audit in San Francisco found that 84 percent of foreclosures were performed illegally, while another in North Carolina found “singular irregularities” in roughly three-quarters of the mortgages reviewed.

So i shouldn’t have been such a surprise when an as-yet unpublished GAO report showed that these rosy reviews were disastrously flawed.

But then, the insiders had it wired. The reviewers included Promontory Financial Group, whose CEO was Comptroller of the Currency under President Bill Clinton. Then he became a senior attorney at Wall Street defense firm Covington & Burling. Small world: The Attorney General of the United States worked at Covington & Burling too.

Promontory and the other reviewers have an underlying conflict of interest: they’re reviewing their own client base. That’s the same conflict of interest that corrupted the for-profit “ratings agencies,” leading them to rate their clients’ toxic mortgage-backed securities as “AAA.”

Promontory was also the firm that said “well over 99.9 percent” of the loans issued by Standard Chartered bank complied with the law and only $14 million of them were illegal. Then the bank admitted that $250 billion of its deals, not $14 million, were illegal. That’s 17,000 times as much illegality as Promontory found in its ‘review.’ (17857.142 as much, to be precise, but who’s counting?)

Promontory kept the foreclosure gig anyway, with no objection from Washington’s regulators or law enforcement officials.

But then, who around that table would question Promontory? We know them, they probably thought. We’ve always known them.

Promontory and the other “independent” reviewers collected $1.5 billion in fees for worthless work, from a settlement that was supposed to help the occupant of that empty chair.”

I am SICKENED with every new installment as I ecognize myself and my case specifically in one of those modification hell examples. Like any abuser, they deny, blame the victim and continue their abuse unfettered and without consequence. You just feel violated. I will suffer from the effects of their emotional abuse and mishandling of my case and grand larcerny for the rest of my earthly days. Fabulous work Yves, you should go on Frontline or 60 Minutes with this.

The banks are criminal enterprises. They acted criminally in the run up to housing bubble burst, through the meltdown, and continue to do so 4 1/2 years on. They have been aided and abetted in their activities by both government and the judicial system.

What Yves is describing here is not a program to solve a problem but to make it go away. I write on the issues of unemployment and jobs, and I see a similar process at work. I call it winnowing or whittling. Basically, you take a massive problem and you successively remove or shave off parts until there is very little left, certainly nothing that would constitute a crisis or special or emergency action. So it is that the powers that be can take a jobs crisis involving nearly 30 million unemployed and underemployed and who knows how many millions or tens of millions poorly employed in McJobs and with restrictive definitions, official rates, and kickers like structural unemployment knock the country’s job crisis down to a couple million, a problem to be sure but nothing to get too exercised about.

We see the same process here. This represents only one small portion of the spectrum of financial crimes that have occurred. Only one portion of it: foreclosure, fees, mods is being looked at. Promontory is basically a cutout. This is a review of one bank, supposedly one of the better or even the best of the lot in this area, effectively being conducted by itself. Within this one small area, large numbers of cases are defined out of the review. Of those that remain, information is poor or nonexistent, and even where information exists supporting documentation is lacking, and even if such documentation exists it could well be a forgery by the bank.

So we have a problem. We know it is massive, but by the time the authorities get through “analyzing” it, it gets reduced to something so small that a parking ticket would look like a serious felony in comparison. There is nothing incompetent about this. In a kleptocracy, it is standard operating procedure. The PTB would not even contemplate doing this much except for their belief that the rubes need such charades to keep them confused and quiet.

It really is mind-blowing, isn’t it — the scale of wrongdoing is almost beyond cognitive capacity.

Russia scraps law enforcement deal with US in new blow to ties:

http://news.yahoo.com/russia-scraps-law-enforcement-deal-u-blow-ties-192433529.html

Seems the US is giving the Russians a run for their money when it comes to corruption….

How many parts in the series?

I think the interesting part of this is that it demonstrates you can’t commit a large scale fraud in which everyone down to grassroots level is complicit. At the lower levels people won’t be in on the take, and the more of them there are the greater the risk that you get some with a conscience, or who decide not to play along. So at some point there has to be a dividing line between people who are acting in good faith, or believe they are (your whistle blowers) and others who are systematically subverting them. This series gives a pretty good picture of that boundary.

This does raise the question of why anyone in their right mind would borrow from a bank. I’d almost rather do a deal with the Mob – at least they believe in personal relationships.

Fannie/Freddie “manufactured defaults” began when de-regulation began—thanks to repeal of Glass-Steagal, and Wall Street got in bed with the TBTF banks…then this (previously manufactured default debt) was presented as FUNDED LOANS in the SUBPRIME securitization machine…but they were NOT “funded loans”, except for a little cash out here and there—they were mostly refinances in the subprime…anyway only COLLECTION RIGHTS were transferred at closing in the subprime—and borrowers PAYMENTS were securitized—not a “loan”—you can’t securitize “collection rights”…the trusts are and always were empty. They are foreclosing in the name of an empty securitization trust, and an unidentified, mysterious “investor” is in the shadows—which is actually just a third party JUNK DEBT BUYER DEBT COLLECTOR. It’s all unsecured debt…that’s why there is all this fraud and cover-ups going on—they don’t want the truth out—the truth of the massive UNSECURED DEBT…dischargable in BK. Lanny Breuer and all those guys know it’s all unsecured debt and all this fraud went on in the subprime…and they are hoping it will just go away…but, it’s not.

Terrific series. Brilliant reporting work.

I’m sickened reading these articles, because any half-baked prosecutor ought to be making a name for her/himself out of bringing these abuses to light. Instead we linger in the dim light of this zombie recovery, wondering if there is anyone in a position of power who is willing to stand up for justice.

We are fortunate to have reporters with Yves’ skill and industry knowledge doing the spadework that others are so reluctant to tackle.

Any reax from BAC yet?

IMHO, no one is willing to stand up for justice because they don’t want prosecute the government…which is what they would have to do…because all roads lead to government involvement.

Actually, the folks at Justice, like Lanny Breuer, want “justice” in whatever political sense they mean that to be.

What they don’t want is the rule of law. Far too inconvenient, unless, of course, it’s convenient to use to further the cause of bringing “justice” to fruition.

Many thanks Yves, even though it is so disturbing as to make me want to cry. The injustice to those affected, the depravity of the perpetrators, the corruption of the system, the dereliction of duty – the whole heap of merde!

I do not see how to salvage the system: wishing for it to self-destruct may simply amount to wishing for even greater misery while waiting for it to get fixed also amounts to continued misery.

If we ever get the chance to start over again, we need to (i) entrench a system of ethics in a way that is actionable but w/o recreating a theocracy equivalent; and (ii) create foolproof systems that cannot be gamed. In the former case, one should be held accountable for one’s actions that clearly violate some ethical principle (i.e. besides law) such as treating someone in a manner that you would not like to be treated in yourself. The latter case will require transparency in form and function and vigilance in observation (e.g. the Australian imperative to vote). If it is transparent, but we choose not to look, abuses can happen. If it is opaque, we cannot detect abuses when they occur.

If not with these, with what, when, how? It seems Occupy was not enough. Are we facing the need for an outright revolution? I never thought that I would contemplate such a question – it is very distressing.

Thank you Yves for this series. I started following naked capitalism while searching for information regarding foreclosures a year ago when I myself entered foreclosure hell. But I had an idea of what I was getting into. My mom however was put on a trial mod back in 2010 and then foreclosed on by Bank Of America. It was horrific for her she lost everything practically. She had no idea what she had done wrong because she had done everything they asked her to. Thanks for naked capitalism, I wish I could donate but my husband and I are both unemployed and with our two children are currently living in my in-laws basement. I am a civil engineer and quit working a year ago when we had our second child along with complications that made working not an option anymore. My husband lost his job in August, he’s an attorney. We honestly can’t find jobs and don’t know what will happen. Thanks for this website, it helps me to know that there are people bigger than me who see the problems.

Someone (anyone), please bring Yves’ sterling efforts on this story to the attention of one (or more) of these:

http://annenberg.usc.edu/AboutUs/Awards/SeldenRing.aspx

http://nieman.harvard.edu/NiemanFoundation/Awards/AwardsAtAGlance/WorthBinghamPrizeForInvestigativeJournalism.aspx

http://shorensteincenter.org/prizes-lectures/goldsmith-awards-program/investigative-reporting-prize/

https://www.ire.org/awards/

http://www.pulitzer.org/citation/2011-Investigative-Reporting

http://www.cjr.org/

http://www.poynter.org/

http://jimromenesko.com/

I have been following this mortgage crisis since 2008 I have researched so much on this my brain hurts. And to be honest with you after what I have learned is a way of life I can’t live anymore. Words can’t explain what it feels like to lose everything you own right before your eyes overnight. I have been living this mortgage nightmare for the last 4 years, fighting for my life and beat myself up every single day trying to figure out where I went wrong ,what did I miss? How can I be so stupid, why did I not catch it. I am a very intelligent person and very knowledgeable in the industry for the last 14 yrs. from being a waitress into real estate then into the corporate world as a Senior Account Manager in the title industry I worked so hard for all my life and was very successful at what I did. Nothing has ever come easy for me in life made mistakes, bad decisions and was able to get back up brush off my knees and move on if there is a will there will be a way. I don’t give up and when I have been wronged or hurt I fight even harder. There always was a way you just had to find it. Single Mother on my own with 2 children no child support but managed to raise the most beautiful children in the world. I purchased my first home never thought would ever happen in 2005 was working for First American Title thought my job was stable being with company for 6 years our branch was always one of the top 5 out of 32 in maricopa county my market share for my territory was consistent at 85% loved what I did thought job was stable most of my income was generated through commission and did get salary from 2004 -2006 my income was at 6 figures the market went crazy. When I bought my home I knew in the back of my mind and being in the industry it wasn’t going to last and planning for my commissions to drop but still enough to make payments on house I lived and worked in same town small community lived there for 27 yrs.Did all my banking with Bank of America for years knew the branch manager very well then she switched hats to loan officer. I was aware at the time hearing about these new loans banks were coming out with too good to be true loans, but thought it was the smaller banks doing this and hearing the escrow officers complaing about them. So figuring Bank of America National Bank knowing the loan officer so well I felt I would be safe and sense of security thinking there is no way bigger banks would be involved with SHADDY mortgages. And I wanted to deal with one bank with all my accounts checking, savings, and money market and so on. I knew I was paying a bit more in loan costs thought it was worth it again sense of security. Did credit app see what I was qualified for and approval had some credit issues had to do with my ex husband but cleaned it up and was approved for a loan up to 520,000 found a house 438,000 it was my 41st birthday my contract was accepted best birthday gift ever! What a sense of accomplishment ever for me I was so PROUD of myself words couldn’t explain. As you can only imagine at that time work was non-stop 12-14 hr. days overworked escrow staff it all was happening so fast and production was so out of control. I was in sales and it got to the point when I would come back to office with 5-6 more deals and girls in the branch would say I can’t open those today put them at the bottom of the pile as they would snarled at me. I always want to help people in any way so I had one of the girls show me how to enter the file into system to open them I picked up real quick being a realtor helped quite a bit when it came to legal descriptions parcel maps ect…. I even became a notary so If escrow officer need signatures on documents or something I was able to do that. That is when I discovered how easy it was to be a notary. I always thought you had to go through extensive training and it being an OFFICIAL. It was easy as a phone call down to our corporate office and few days later go to my office on my desk was a notary stamp. Being so busy and going through loan process at same time I got all my documents they wanted met with loan officer and told her straight out this is what my plan is with house it needed some updating wanted to put a pool in and I had already figured that into my budget but did not want push it with my income to where it would leave me after all bills just scraping by, I wanted somewhat of cushion when needed. Told her these are my numbers she said I will work up a couple different options for you to see what works best. Mind you she was working with a 640 credit score I knew I was going to pay more interest because of my credit history I was prepared for that. Going back to my real state days I was looking at my situation income mainly as if I was self-employed because of the commission factor. In real estate you would be looking at a 45 day closing at least was not a slam dunk deal because of it being a higher risk loan. I already knew there would be a chance of not being qualified down the road. First American Title had for employee’s cost was $2 month (employee club) that had a network of affiliates that would give discounts rent a car, travel flowers BANKING ect. Wells Fargo was on that list and my loan officer told me that B of A in process of being put on that list and I would be eligible for discount on my loan perfect timing I thought. Felt good more secure now that First American and B of A are now affiliates or should I say Partner in crime. 2 days later my loan officer calls to meet to discuss loan options I have document she did Bank of America Purchase loan analysis that is even fraud spelled equal housing wrong and no logo “wops” that is dated 8/2005, I am trying so hard to make a long story short but I am well aware of the little things that makes it official and legal. I closed on home 11/2/2005 signed 3 sets of loan docs same date and time 1 & a 2nd and home equity line of credit need I say more I have every piece of paper disclosures everything down to the money order receipt for closing. I will go into more detail if I can speak with a live person. Move into my new house painted inside new carpet pool bringing value up made my payments on time every month never late seeing how they set me up automatic debit overdraft protection and linked all my accounts so if I didn’t enough in 1 account they take from other this way I would always pay on due date and no late fees. I have that disclosure as well. Which leads in to a TRAGEDY they drained all my accounts Laid off from job in 9/2006 workforce reduction so they called it over 6 yrs with company job performance always above and exceeded change in sales management at corporate my Branch manager was transferred different branch and whole company shift it seemed anybody who had any real knowledge about business were disappearing, and replaced with people that were young and no knowledge of industry. I was devastated why how could this what did I do wrong. Major blow I did go to different company Security Title 5/07 making not even half the income I was. I now have to close my 401 k to afford house, served first foreclosure notice 1/2008 then another 3 days later different trustee. I filed chapter 13 2/2008 industry started to crash closed branch now unemployed. That is where my fight began couldn’t afford attorney and represented myself more detailed documented info again when I talk with someone. Objected to claim from B of A recommendation from BK Judge. They tried several times submitting claim and was rejected by court. This went on for over a year, pulled my credit report so I knew exactly and who I owed money. And saw B of A already charged off account. BK was dismissed I could not afford payment so Went to chapter 7 that was m April 2010 which stopped sale when I called cal western trustee with BK# to stop sale and curious to know what what the certificate of occupancy stated and signed by bank they told property was vacant which confirmed there is something majorly wrong, informed trustee that I was sitting at my desk in my house as we spoke never left property at anytime. Again ran my credit report and B of A changed loan acct#’s and charged off AGAIN, chapter 7 was discharhed Nov. 2010. B of a reported on credit report I was discharged July 2011 I questioned over and over filed complaints to every government official out there up to the president I have all communications dated time stamp congressman David Schwekart sent most documents in a complaint filed on my behalf to the OCC. OCC responded accepted complaint in OCT. 2011 have letter with case # and stated it would take 60 days for a response. OCC sent B of A complaint. B of A sent me a letter stating they received complaint from OCC and was acknowledging my QWR request and would respond in 60 days. There was a sale date for my home to auction on Nov. 2, 2011 Info I found on trustee posting site Never any notice of any sale was given to me. Called bank to make sure that sale was to be postponed due to Complaint and dispute of amount owing and they said it was. Day of sale to take place at 2pm I called trustee 8 am to verify the sale was put on hold and was told it was not Bank never called. Back on phone with bank was told by advocate they are putting sale on hold as we spoke not to worry. And I fell for it, I lost my home that day at 2pm. Third party investor bought it and put a 5 day notice to vacate on my door later that day. JUST LIKE THAT I LOST IT ALL matter of minutes. The panic mode I was in calling trustee telling them it was mistake sale was put on hold told them about occ complaints QWR letter from bank which trustee had no knowledge of I had to fax copies of letter to them have those as well, thinking in my mimd it was technical error that they would correct have much more details on that issue I went to court JUSTICE and fighted whole way through again representing myself investor had attorney and I lost . Judgement against me for back rent attorney fees and so on . Overnight I have a landlord behind in rent taking my home. What did I miss here, so of course I appealed I have no job unemployment is gone I was physically evicted on Dec.29, 2011 New Years eve weekend thrown to the curb as if I were a piece of trash given only 10 min. to grab what I could and my 2 golden retriever’s locked out of my home and not allowed back be arrested criminal trespassing. EVERYTHING I owned kids videos,pics,awards there whole childhood memories, my financial docs Not Bank those were in my trunk. Medical records prescriptions. That was one issue I didn’t research being evicted and my rights. I was told by investor I needed to pay judgment and a daily storage fee before he would let me back in. I was not aware I was able to be let back in property 1 time no upfront fees to get those things so of course I am now fighting for my life with no money, spending hours waiting in court waiting to get back in front of judge almost a week in the meantime this evil minded investor thought he had the right to sell everything I had by having an estate sale as if I were dead. Never again was given notice about sale discovered it through internet advertised WHOLE HOUSEHOLD FOR SALE. My whole body went numb I was able to get money to pay judgment before sale took place and informed investor attorney that I had money when can I arrange to get my things. Attorney responded that I have no right to my things that my 21 days notice ended 24 hrs. ago Notice I never received It was all was happening so fast so wrong so after several detailed emails back and forth again I lost, tried order protection denied. Day of sale went to local sheriff dept. begging them to please go to my home and check and find out location of my personnel info. There is my whole life being now disclosed to strangers going in and out of home buying my things, Sheriff finally gave in and went to property I had to park across street was not allowed on property so I am watching this with my very own eyes and balling my eyes out and there was not a thing I can do as people are walking out with my shoes my clothes it was almost like someone holding gun to one of my kids head and being tied up the harder I fought the worse it got . I have been homeless going from whoever I could stay with for 1 year now emotionally mentally physically abused no money no clothes shoes nothing, I am so embarrassed , I don’t even feel human I am trying so hard to hang in there it gets harder everyday , How does one move on? My life just isn’t worth it anymore I am tired of being looked at as if I were crazy person when I try to explain this I have been in counseling and recently cut off of state medical and food stamps, I don’t want to live another day of this and see no light at the end of my tunnel trying to get help from someone anyone all of these so called programs not to mention consent orders and my begging for help no response to my complaints and the turning of heads from government officials and being told there is nothing they can do no funds available for assistance. I have to believe in my heart that there is somebody out there that can I still won’t give up even if it kills me and sadly enough it probably will. I was in foreclosure for 4 years for a reason and it was not by luck in any way, it was my fighting for my rights the whole way through, if you want to see a case of ongoing fraud it would be mine. I have the burden of proof beyond reasonable doubt. I will be surprised if I do get response I am not seeking legal advice just for help. Thank you for your time and will copy this and put in file with the rest.

Thank You

Dawn

Email: dhogan45@live.com

Phone: 480-695-6498

Dawn, I feel your pain—you are NOT alone…this nightmare was created by the banks, Wall Street, and our government. It is unsecured debt—collection rights only—that was transferred in the subprime..all this insanity is a giant cover-up of that fact… When deregulation happened, the Wall Street casino/ponzi machine went full speed ahead—we are the casualties/road kill from that giant fraud machine…please hang in there…the truth has been and continues to be covered up…but it can’t be covered up forever. We were kicked out, too—I am renting a house now, I have two teenagers, a husband out of work, I can’t work much because of physical issues, and we would be in a homeless shelter if it weren’t for my father helping us—we are one of the lucky ones. The truth is empowering—we have to keep promoting the truth. Our life here on this planet is short—money or no money—and we just happen to be living in a strange, unprecedented time…keep the faith—this physical existence is not our true reality—our true reality is spiritual, and that’s all we have to take with us to the next world—which I truly believe there is…I know that might not make you feel any better, but I believe it’s true…this has helped me a lot: bahai.org

Hang in there—you are a beautiful spirit—I will keep you in my prayers!

Dawn,

You can live through anything if you have a desire too. If I may offer suggestion, see your malefactors day of reckoning.