There are times I feel sorry for the business reporters at the New York Times. As Eddie Bernays, the father of the public relations industry, pointed out in his 1926 book Propaganda, half the articles on the front page of the Grey Lady back then were what he called propaganda, as in they were covered at the instigation of business or political interests who were seeking to bring the public to accept their point of view.

Now the problem is that much of what passes for journalism these days runs afoul of the old Yankee saying, “Fool me once, shame on thee. Fool me twice, shame on me.” Anyone who has been paying attention to the news will recognized that some of these stories are not just obvious plants, but they are simply not credible. That’s not saying the facts are inaccurate, it’s the storyline that’s a howler. And it is also fair to point out that the slant an article winds up with may not be the doing of a reporter so much as his editor.

The latest illustration is an article by Ben Protess in the New York Times titled Prosecutors, Shifting Strategy, Build New Wall Street Cases. At least in the web version, this is the picture immediately under the headline:

I’m not sure whether this picture is an effort at Big Lie imagery, or whether someone in the Times’s layout department is a subversive. But using Lanny Breuer at the face of a new “get tough with banks” posture at the Department of Justice alone fatally undercuts the article.

In case you managed to miss it, the Frontline documentary The Untouchables had these sections involving Breuer:

NARRATOR: FRONTLINE spoke to two former high-level Justice Department prosecutors who served in the Criminal Division under Lanny Breuer. In their opinion, Breuer was overly fearful of losing.

MARTIN SMITH: We spoke to a couple of sources from within the Criminal Division, and they reported that when it came to Wall Street, there were no investigations going on. There were no subpoenas, no document reviews, no wiretaps.

LANNY BREUER: Well, I don’t know who you spoke with because we have looked hard at the very types of matters that you’re talking about.

MARTIN SMITH: These sources said that at the weekly indictment approval meetings that there was no case ever mentioned that was even close to indicting Wall Street for financial crimes.

LANNY BREUER: Well, Martin, if you look at what we and the U.S. attorney community did, I think you have to take a step back. Over the last couple of years, we have convicted Raj Rajaratnam. Now, you’ll say that’s an insider trading case, but it’s clearly going after Wall Street. We—

MARTIN SMITH: But it has nothing to do with the financial crisis, the meltdown, the packaging of bad mortgages that led to the collapse, that led to the recession.

And later:

NARRATOR: In a September 2012 speech, Lanny Breuer gave a speech explaining his reluctance to indict a major bank.

LANNY BREUER: — the kinds of considerations in white collar cases that literally keep me up at night.

MARTIN SMITH: You gave a speech before the New York Bar Association. And in that speech, you made a reference to losing sleep at night, worrying about what a lawsuit might result in at a large financial institution.

LANNY BREUER: Right.

MARTIN SMITH: Is that really the job of a prosecutor, to worry about anything other than simply pursuing justice?

LANNY BREUER: Well, I think I am pursuing justice. And I think the entire responsibility of the department is to pursue justice. But in any given case, I think I and prosecutors around the country, being responsible, should speak to regulators, should speak to experts, because if I bring a case against institution A, and as a result of bringing that case, there’s some huge economic effect — if it creates a ripple effect so that suddenly, counterparties and other financial institutions or other companies that had nothing to do with this are affected badly — it’s a factor we need to know and understand.

TED KAUFMAN: That was very disturbing to me, very disturbing. That was never raised at any time during any of our discussions. That is not the job of a prosecutor, to worry about the health of the banks, in my opinion. Job of the prosecutors is to prosecute criminal behavior. It’s not to lie awake at night and kind of decide the future of the banks.

Breuer’s performance, such as it was, led to this parody:

So having visually underminded itself, how does the article proceed? Here is its premise:

In a recent round of actions that shook the financial industry, the government pushed for guilty pleas, rather than just the usual fines and reforms. Prosecutors now aim to apply the approach broadly to financial fraud cases, according to officials involved in the investigations.

Really? Someone needs to tell bank investors how scared bank executives are. This is KBE, the ETF designed to match the Keefe Bruyette’s large bank index, versus SPY, the EFT for the S&P 500, for the last three months (click to enlarge):

And in fairness, Protess does question the official position fairly high up in the story, at the start of the fourth paragraph (the usual convention in a real puff piece is to wait at least nine or ten paragraphs before a negative word is said):

But critics question whether the new strategy amounts to a symbolic reprimand rather than a sweeping rebuke. So far, the Justice Department has extracted guilty pleas only from remote subsidiaries of big foreign banks, a move that has inflicted reputational damage but little else.

The officialdom honestly seems to have persuaded themselves that indicting a foreign subsidiary and getting a guilty plea is a meaningful concession. Help me. That is what is so disheartening about dealing with an (at best) captured prosecutors. Their idea of what is reasonable is so distorted that is is painfully obvious that there is no reason to expect any change in behavior.

The real tell here is the lack of any interest on behalf of the Feds, including the Schneiderman task force, to go after Lender Processing Services. I know for a fact that people with relevant expertise presented serious ideas about how to go after LPS to Schneiderman personally, so his failure to act is not a function of ignorance. And LPS was a linchpin in establishing bad conduct across the major servicers who were its clients.

But not only could no one be bothered to go after LPS for its role in servicing abuses (more on that in future posts), they could’t even be bothered to punish it seriously for past criminal conduct. As we wrote in an earlier stage in this saga:

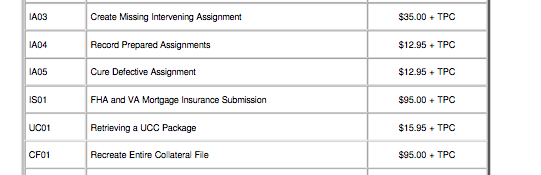

The Department of Justice and the state of Missouri have each announced criminal plea bargains with one Lorraine Brown, former chief executive of DocX, the Lender Processing subsidiary best known for its price sheet for fabricating the mortgage documents a servicer, or frankly, anyone would need to claim they had standing to foreclose on your home. Funny how that particular DocX product was mentioned no where in the plea deals.

This admission of guilt by Brown for wire and mail fraud on the federal level and fraudulent and forged document filings in Missouri now allows the Obama Administration to claim it has sent another “executive” to jail. And the bizarre progress of this case was that the Missouri attorney general had sued both Brown and LPS, and you’d expect them to cut a deal with Brown to go after the bigger target, LPS. But it’s likely Brown was not very sophisticated; she apparently went to an interview with the FBI without the advice of counsel. Rule number one is don’t lie to the FBI, and the document release Tuesday show that Brown did. And her attorneys let LPS get in front of her. The firm paid $2 million in fines to Missouri and “cooperated” in going after small fry Brown (rather than the bigger fry of LPS’ clients). Nicely played.

Now get this: normally we favor going after executives rather than the institution when you are dealing with major banks, because the institution has legitimate businesses that have nothing to do with the bad conduct. By contrast, LPS is a comparatively small player ($2 billionish in revenues) with a deeply problematic business model. Like the ratings agencies, it is a small pockets player that acts as a liability shield for the big boys. It’s a worthy goal to take players like that out when they play fast and loose with the law.

Remember, in the extract above, the only conduct that was admitted to was robosigning over a million documents. And the public had been trained to think robosigning, which is a fraud on the court, is no biggie.

LPS settled for a mere $35 million, and that for robosigning alone. Fraud expert Lynn Szymoniak thinks 4 million documents could be at issue. Mr. Market thought that was a screaming bargain; the stock traded up over 7% the day the settlement was announced.

Notice also that no one bothered prosecuting the document fabrication at DocX. We and other sites reported on how brazen they had been:

So back to the Times’ sad effort to pretend the Powers That Be are serious. If they can’t be bothered to go after a second tier player where you had an executive ready to provide evidence, don’t tell us that we should believe you now. And Protess noted towards the end of the piece that the authorities might be deterred by big bank huffing and puffing:

The strategy will face significant roadblocks.

For one, banking regulators are likely to sound alarms about the economy. HSBC avoided charges in a money laundering case last year after concerns arose that an indictment could put the bank out of business. In the first interest rate-rigging case, prosecutors briefly considered criminal charges against an arm of Barclays, but they hesitated given the bank’s cooperation and its importance to the financial system, two people close to the case said.

The Justice Department will also face resistance from Wall Street. In meetings with authorities, banks are trying to distinguish their activities from the bad behavior at UBS and Barclays, according to the industry lawyers. One lawyer who represents Deutsche Bank acknowledged that Wall Street was girding for battle over the push for guilty pleas.

So I’m not sure who the audience for this play acting is supposed to be. The public knows this emperor has no clothes, yet he continues to prance around naked.

This reminds me of “Peanuts”

Lucy (federal prosecutor) I am going to prosecute those banks good and hard, Charlie Brown (public)

Charile Brown: OK, Lucy said she is going to prosecute. Now, she hasn’t in the past, but she knows I know that, so she must be willing to prosecute now to make so bold a public statement – she would look ridiculous if she doesn’t prosecute.

I am going to run up and kick that prosecution football a Mile!!!

Charlie Brown running…..

Lucy pulls prosecution football away….

Arrrggggghhhhhhhh!!!!!!!!!

When both the prosecution and the defense are playing for the same team, there’s only one phrase that seems to capture the gravity of the dilemma:

“Houston, we have a problem.”

http://www.youtube.com/watch?v=lTSVOnhLtCs

Every time I see “Recreate Entire Collateral File: $95” I can’t help but laughing out loud.

Reminds of that Philip K. Dick novel but retitled (no pun intended) “We Can Falsify It for You Wholesale”

It’s just a short story, and it’s called We Can Remember it for you Wholesale, the basis for the silly Schwarzenegger movie Total Recall. Just for your own records. Sorry, hate being an “e-corrector,” but PKD’s storie are something like sacred territory for me. :)

Er, oops misinterpreted the “retitled” bit anyway. My bad.

No P. K. Dick fan can ever possibly be bad :-)

That makes perfect sense to me, my reaction tends towards his novel: “LIES, INC.”

For those of you unaware of PKD, here is brief synopsis:

“In this wry, paranoid vision of the future, overpopulation has turned cities into cramed industrial anthills. For those sick of this dystopian reality, one corporation, Trails of Hoffman, Inc., promises an alternative: Take a teleport to Whale’s Mouth, a colonized planet billed as the supreme paradise. The only catch is that you can never comeback. When a neurotic man named Rachmael ben Applebaum discovers that the promotional films of happy crowds cheering their newfound existence on Whale’s Mouth are faked, he decides to pilot a scapeship on the eighteen-year journey there to see if anyone wants to return.”

Words and Deeds. This administration has always excelled when it comes to one of these.

Ha! Maybe this is part of a ham-handed and not very well thought-out efford to rehabilitate Lanny Damaged-Goods Breuer after the undignified circumstances of his departure from DOJ in the wake of The Untouchables!

You just never know, what with it being S.O.P. for FedGov to co-ordinate content with NYT …

Final chart at the end speaks the loudest. The market reaction (not the knee-jerk algo-driven one, but the broader trend) to these sorts of announcements helps clarify just how much is propaganda and how much is actual regulation.

Hint: it’s nearly all the former.

I’ll say this for Lanny — at least he left and we never had to watch him prance around naked.

This reminds me of the tactics of global warming deniers. They don’t have to be right, they just have to raise doubts in the population at large.

Pointing out that the NYTs is engaged in propaganda on behalf of the administration is one of the most important things you do at NC (even though we all are already aware of it). Because everyone, especially Obama, knows that the dismal failure to prosecute Wall Street goes to the heart of the credibility of democracy in the United States (and Obama’s lack of integrity). This is no exaggeration. Ask any “man in the street” and even the dimmest will be well aware that the banks/wall street got away with something big and the Administration is in on it.

So this public relations battle for the hearts and minds of the general public over the issue of prosecuting (or not) is of vital importance to the White House. The NYTs is extremely important in this battle. Like the Propaganda Department of the Communist Party of China, the NYTs provides an enormous amount of truthful, legitimate information to the public. Its investigative journalism continues to be superb, sometimes even on the continuing Wall Street bailout fiasco itself. So when China’s Propaganda Dept or the NYTs wants to issue important government propaganda (i.e., a complete fabrication) to the public, the info comes with a large dose of credibility because of the good will and credibility it has earned from producing that endless stream of legitimate information.

The manipulative words/phrases used in the NYTs article are striking. All designed to lead to the conclusion that the DOJ is reasonable. In just three short sentences from the article, a half dozen lies/manipulations are told with each use of certain words (caps are mine):

“So the government is seeking a BALANCED approach, aiming to HOLD BANKS ACCOUNTABLE without shutting them down. Prosecutors CONSULTED federal policies that REQUIRED them to WEIGH ACTION with “collateral consequences” like JOB LOSSES. Mr. Breuer also COLLECTED INPUT from staff, including the head of his fraud unit, Denis J. McInerney, a former defense lawyer who represented Arthur Andersen.”

Ha ha. Does anyone really believe that Breuer needed to “consult” or “collect input” from anyone (other than Holder) before deciding to prosecute not a single major perpetrator of the biggest most damaging fraud in history? Or that federal policies (what policies?) required Breuer to “weigh” “job losses.” This NYTs article is astonishingly preposterous. But as a model for propaganda the author should get the Nobel Peace Prize for superbly exonerating an important recipient of the Prize. The article never mentioned Obama, as if he has no role in deciding who his DOJ prosecutes.

One aspect of every propaganda-decoding exercise is listening for the dog that did not bark (or, in this case, the name that was not mentioned). It is often the elephant in the room.

“The article never mentioned Obama … ”

Nice catch.

I seem to have been informed by Yves that her article was criticizing only the Obama Administration, and not also the NYT.

Although I agree with you that the NYT is systematically deceptive and not to be trusted, the exchange that I had with her (below) indicates that she was not intending in this article to criticize the article, much less the NYT.

Apparently you misunderstood her article in the same way that I did.

If you deleted the propaganda from the NYT you would only be left with the advertising and the sports results.

You have government propaganda on the one hand and corporate propaganda on the other. The reporters dance around collecting quotes from government hacks and corporate flacks.

I am continually amazed that otherwise intelligent people expect to find objectivity in the Times. The best that can be said for it is that the tone is softer and the verbiage more tasteful than that deployed in more reactionary rags, but that only makes it more insidious IMHO.

from Mexico says:

“When both the prosecution and the defense are playing for the same team, there’s only one phrase that seems to capture the gravity of the dilemma:

“Houston, we have a problem.”

http://www.youtube.com/watch?v=lTSVOnhLtCs”

Yep and Houston traced the problem to a faulty “Revolving Door Government” component but couldn’t get funding from Congress to fix it.

Obama went to the Tulia, Texas school of criminal justice, described here beginning at minute 35:18

http://www.youtube.com/watch?v=6CyuBuT_7I4

In a time of austerity, the decision as to where to spend scarce federal law enforcement dollars must be carefully weighed. And after taking on the ultra-dangerous drug users and pushers of the Tulias of the world, there’s just no money left to go after the bankers.

As Michael Hudson pointed out a while back, since the decision was made to give all the money and then some to the banks to keep them alive, there is no money let over for government or society. So it is even more egregious than spending the money properly in the first place. There was a report on Japanese TV last nite (MHz) about how now they are finally starting to move Japanese real estate. They held a big kinda-auction thing for ultra rich people from the Asian rim and many of these clients bought more than one Tokyo property (the list showed prices like 195,000,000 – so I assume they were going for 20m $US). So finally after 2 decades Japan has decided to get this stuff off the books of the Japanese banks? So the banks can now spend money into the economy for Abe no doubt. But what if your banks are up to their eyeballs in fraud? You can’t make it all OK with a shuffling of the assets. Which is what I think Obama thinks he is going to do very soon now.

Politico: Obama – The Media Puppet Master

http://www.bostonglobe.com/opinion/2013/02/19/the-reason-foreclosures-will-continue/nab14SKLSnImck8pPVWMBL/story.html

Seems like the NYT’s owned Boston Globe is working the same side of the street.

Sorry, comment was meant to go with Dave Dayen’s excellent piece.

Thanks for pointing out that article in the NYT-owned Boston Globe. It provides yet further evidence that the rot at the NYT corporation runs to the top, above any single one of their properties. Yet again: the fish stinks first from the head.

Who do you think is putting on this “theater production”?

It was our government officials who bet the US Treasury on the fatally flawed “GSE Business Model” by issuing guarantees on the MBSs.

If the public ever follows it all back to the first players involved in the Model, ie Frank and Dodd, etc., perhaps then they will stop this nonsense.

Yves, in your headline, you claim to be attacking the honesty of the Administration, but in your article, you are attacking the honesty of the New York Times; and yet you don’t say that you are doing that; you say:

“And in fairness, Protess does question the official position fairly high up in the story, at the start of the fourth paragraph (the usual convention in a real puff piece is to wait at least nine or ten paragraphs before a negative word is said):”

Then you quote Protess:

‘But critics question whether the new strategy amounts to a symbolic reprimand rather than a sweeping rebuke. So far, the Justice Department has extracted guilty pleas only from remote subsidiaries of big foreign banks, a move that has inflicted reputational damage but little else.’

You then continue: “The officialdom honestly seems to have persuaded themselves that indicting a foreign subsidiary and getting a guilty plea is a meaningful concession.”

Your implication there that “The officialdom” (regardless of whether this is the Administration, the Times, or whatever else — and you are not clear on even that) “honestly” does what it does, seems false to me; but I don’t see which falsehood your article is attempting to convey.

For my part, both the Administration and The New York Times appear to be systematically dishonest and untrustworthy, and there is a serious issue to determine how and why they are so, rather than to bury what seem to me to be excuses for the one, the other, or perhaps both.

I suggest you re-read the post.

The first paragraph discussed how dating back to the 1920s, Eddie Bernays classified half the articles in the New York Times to be propaganda, that they were messaging for powerful interests. That + the opening comment that I sometimes feel sorry for the NYT writers clearly coveys that the NYT article under discussion is official PR (obviously from the Administration) and the poor Times writer has to dress it up.

If you can’t understand something that basic, I can’t help you.

Yves, when you said

“The officialdom honestly seems to have persuaded themselves that indicting a foreign subsidiary and getting a guilty plea is a meaningful concession,”

I must now assume that you were referring there to the Administration specifically, and not at all to Protess’s report in the Times.

However, you had led into that excerpt from protess by saying:

“And in fairness, Protess does question the official position fairly high up in the story, at the start of the fourth paragraph.”

I had gotten the impression from that “And in fairness” (and also from your reference to Bernays at the opening) that your article was at least partly a critique of the NYT.

I now realize that I had gotten confused — you were criticizing only the Administration in this piece, not at all the NYT.

I still can’t figure out why you made that Bernays-reference at the opening, then, nor that “And in fairness.”

Sorry, but sometimes I don’t understand what you are saying, even though I greatly respect your commentaries and therefore want to understand them.

Perhaps if you had not referred to Bernays, nor said “And in fairness,” I would have understood correctly.

I do not understand how you can be confused.

The Administration is pushing its line about bank prosecutions. The NYT is dutifully carrying the Administration’s water. The reference to Bernays, that they press has long been in the business of carrying news “stories” that are in fact media plants, is not a novel observation.

I am saying that Protess is either trying to preserve some semblance of being a reporter despite the constraints of this type of story (by putting the obligatory “other side” a little earlier than you normally see.

Ah. The distinction I was missing was between:

(1) The NYT “freelancing” (creating its own) propaganda;

(2) The NYT reprinting press releases with slightly modified text.

You were referring to (2), not (1), when you talked about propaganda in the NYT Thanks for the clarification, Yves.

You need to read Bernays. Propaganda is never freelanced in the way you mean it (a freelancer is still paid for directly by the person who publishes the piece). People can be hired to do propaganda, but the media is an outlet for propaganda, as in it runs a high proportion of stories that are generated by powerful interests. That is precisely what Bernays was talking about when he read the front page of the Times 80 or so years ago. Half the stories were planted.

“Planted” sounds so organic….

The prophetic movie They Live may propose the only remaining solution:

https://www.youtube.com/watch?v=Wp_K8prLfso

“Anyone who has been paying attention to the news will recognized that some of these stories are not just obvious plants, but they are simply not credible. That’s not saying the facts are inaccurate, it’s the storyline that’s a howler.”

Speaking of this, take a look at Forbes’ recent headline about the foreclosure reviews:

Finding Little Evidence Of Foreclosure Fraud, Feds Give Up

http://www.forbes.com/sites/danielfisher/2013/01/08/finding-little-evidence-of-foreclosure-fraud-feds-give-up/

This was written by “senior editor” Daniel Fisher, at the same time you were doing fantastic work on the review flaws described by whistleblowers. Many of us commenters on Forbes pointed out the issues, and I even attempted to post links to your series…but my post was deleted. (Hmmm!!!)

And despite our comments (of which there are now 14 pages), Fisher remains adamant that no “current” borrowers were harmed by the rampant fraud and illegal behavior. So it’s all fine and good… move along…

Thanks for posting and highlighting the juxtaposition of this “senior editor” with Yves’ series.

This one elicits a huge “wow.”

Good piece. I especially appreciate your observations on the Big Lie imagery; we’ve got the mighty Breuer with his finger mid-wag in the first still, and a video still of him looking all ascowl as though he were sucking on a dirty penny. It really connotes “game change.”