Cyprus, as its President Nicos Anastasiades predicted but no one outside Cyprus quite believed would happen, has resoundingly defied the will of the Eurozone in failing to surrender a single Parliamentary vote to a diktat to haircut depositors to save its number two bank, whose failure would in all likelihood bring down Cyprus’s entire banking system. The members of the President’s own party abstained despite his resigned support for the deal. And mind you, this was after the terms revised to allow for deposits under €20,000 to be spared.

The EU was utterly unprepared for this rebellion. Heretofore, threat of withholding of funds and financial armageddon were sufficient to bring legislatures and national leaders to heel. Anastasiades, by contrast, didn’t even try to keep Parliament voting until the results changed. The finance minister tendered his resignation as an admission of failure but Anastasiades rejected it and has him negotiating with the Russians, at a minimum to restructure a €2.5 billion loan from 2011 but clearly to see if Russia will ride in to the rescue.

Although I have not seen an official announcement that banks will remain closed beyond their last scheduled opening time of this Thursday, it now appears the new target date is next Tuesday. Cyprus seems to be working on several backup plans in parallel (more on that later): a good bank/bad bank plan, trying to persuade Russia to bail it out, and leaving the Eurozone. Note that it is also working to put capital controls in place; these seem inevitable even if, miraculously, the Russians decide to write a very large check (although those controls might be less restrictive than under other scenarios). But absent a retreat by the Troika (which seems extremely unlikely) or a big Russian bailout (which is also unlikely but less so), it seems difficult to imagine than any other plan could be implemented by next Tuesday (eg, either a bank restructuring or a Euroexit). So considerable dislocation is likely to result, with unknown but potentially serious knock-on effects.

The reaction from Germany was vitriolic. From the BBC:

Germany’s finance minister has warned Cyprus that its crisis-stricken banks may never be able to reopen if it rejects the terms of a bailout.

Wolfgang Schaeuble said major Cypriot banks were “insolvent if there are no emergency funds”.

In reality, this was merely repeating the ultimatum he’d apparently issued when delivering the deposit haircut, um, tax ultimatum last week, but there’s a big difference between a private threat and a public one.

But despite the browbeating, the Germans appear to realize they’ve created a huge problem for themselves. It’s key to understand that this crisis was created by the Troika. Cyprus asked for a bailout nine months ago and the deadline is a bond payment this June. And while it has become fashionable to pin the blame for this mess on Cyprus, the backstory is more complicated. From Cyprus.com:

Not all the banks are in the same condition.

(a) Cyprus has two money-center type banks: Laiki (Popular) Bank and Bank of Cyprus.

(b) Laiki was purchased by a Greek vehicle (Marfin Investment Group) backed by Gulf money. Marfin’s purchase of Laiki took Laiki from being a fairly conservative local bank to being highly exposed to Greece. Laiki is definitely insolvent and needs to be restructured.

(c) Bank of Cyprus has been more conservative vis-a-vis Greece, but still has meaningful exposure. It is conceivable that, given time, Bank of Cyprus could survive.

(d) Beyond the main two banks, there is Hellenic Bank (a much smaller bank with much less Greek exposure), Cyprus Development Bank (no Greek exposure), the Co-ops (no Greek exposure) and the Cyprus subsidiaries of foreign banks (aka, Russian, English, etc banks), also with no Greek exposure.

(e) All the local oriented banks (BoC, Laiki, Hellenic, Coops) have exposure to the local real estate market that went through a bubble during the 2000-2009 period. This exposure however is not short-term and could be resolved over the period of years. It is a problem, not a crisis, and is offset by the fact that the two main banks have quasi-monopolistic earnings power locally. Given the time and some financial represssion (a la the United States) and the local issues would be manageable.

In other words, the bank that is the epicenter of the problem was driven into the ditch by foreign buyers. Now admittedly, the local bank supervisors did nothing to stop that, but can you point to a single national bank regulator (ex the Canadians) that put much in the way of constraints on their banks prior to the crisis?

And the idea that Cyprus is a hotbed of Russian Mafia money also appears to be exaggerated. This looks to be a combination of a need to scapegoat the latest supplicant to the Trokia plus Anglo-German prejudice against Central and Southern Europe.

Not to put too fine a point on it, Wachovia laundered over $800 million of Mexican drug money, and Standard Chartered admitted to “at least” $250 billion of Iran related money laundering. And HSBC, which paid the biggest fine ever in the US for drug-related money laundering for Central American groups, is now being charged by Argentina for similar activities. Let’s not kid ourselves. Citigroup has had a huge wealth management business, concentrated on Latin America, since the 1980s. What do you think that is about? To a significant degree, like Swiss private banks, Citigroup is the recipient of funds expropriated from national governments. For people like Martin Wolf of the Financial Times to get sanctimonious about what Cypriot banks are up to is more than a tad disingenuous, particularly when his own paper, the same day, describes how five Russian M&A transactions are having to be reworked due to the bank freeze in Cyprus. Yes, there is clearly dirty banking going on there. But it appears only 28% of the deposits are Russia related. A significant, if not overwhelming amount of that activity appears to be no worse than GE’s tax avoidance. And remember, depositors of every bank are being haircut to bail out the miscreant Laiki. That includes the roughly €3 billion of largely Russian deposits in the perfectly solvent Cyprus subsidiary of the Russian bank VTB.

The bail-in demand was sprung on Anastasiades with no warning, apparently in the hope that a new President would cave. That looks to have been a serious miscalculation.

Handelsblatt, for instance, was handwringing over the Cypriot refusal, stressing that it put the EU in an untenable situation. The second largest bank, Laiki, will become ineligible for ELA loans without a rescue. But as Schaeuble has said, Cyprus’s entire banking system is at risk under that scenario. And the EU has designated Cyprus as systemically important. So letting it founder would be “almost impossible”. At the same time, the Germans are acutely aware of the risk of letting a country defy them and win concessions as a result. In the charming broken English of Google Translate:

…the Euro-rescuers are in a dilemma: either they lose even more confidence or help Cyprus – no matter what the cost.

Buckling would be long-term effects. “The signal for future bailouts would be fatal,” says [Nicolaus] Heinen [Europe expert at German Bank Research]. “Conditions for future bailouts could be formulated even softer to prevent the negative attitude of the parliaments catching on.”

This issue was not lost on other countries. For instance, KeeptalkingGreece, in Greeks stunned to hear Cypriot MPs attacking EU and reject the bailout, wrote (hat tip Richard Smith):

Greeks are deeply stunned and green from envy, to hear the debate inside the Cypriot Parliament during the crucial voting on bank deposits tax….a friend called me.

“Look at them, look at them. They say NO to Troika, they will down vote the bank tax and our politicians said Yes to every dot and comma imposed by the Troika. Shame on them!”…

Unbelievable things are spoke, down there in the Cypriot Parliament.

Something that neither conservative Nea Dimocratia nor socialist PASOK ever did. Every parliament debate before loan agreement voting turned to a blame-game between the two parties that governed the country for almost four decades and ruined it with their policies.

Instead for fighting a minimum of negotiation, they instead signed one loan agreement after the one and caused sheer panic among the Greek citizens with the total economical state collapse. As if we the loan agreements, we do have heating oil or medicine for our patients….

And where might the Cypriots go from here? It’s important to understand that Cyprus only had options ranging from bad to worse, thanks to the ham-handed EU intervention. Even if the Parliament had accepted the depositor cram-down, the very announcement of the idea has done tremendous damage to the banking system. You can expect capital flight, even with controls in place. This bailout is certain to be inadequate merely due to the economic impact of the loss of wealth. That almost assures a second goring of depositors. Why sit around and wait for that to happen? And you can’t be an international banking center with capital controls in place.

Now the IMF is supposedly working with Cyprus on a good bank/bad bank plan for its two biggest banks. But I can’t fathom how that works, since, as Macro Man pointed out, the real point of a good bank/bad bank plan would be to leave all those nasty English law bonds that would normally have been hard to restructure in the bad bank (now maybe the IMF is actually up for stiffing those investors, who knows). But you’d need also to have a hard look at what authority the local banking regulator has, and what resolution procedures are like (bank seizures and liquidations are basically special variants of bankruptcy law that apply only to banks). And as we indicated, this solution still torches the international banking business in Cyprus and thus will put the economy into a serious recession, if not a depression.

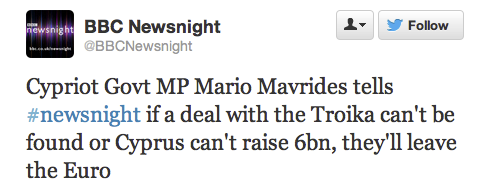

Second is to leave the Eurozone. This is not an idle threat.

As you can tell from above, the Troika has done so much damage already that the incremental costs of leaving the Eurozone would likely be considerably offset by depreciating the currency and being able to stimulate the economy by deficit spending. They also have greater hope of restoring something in the way of an international banking business after the shock of the currency devaluation wears off than they do under the tender ministrations of the Troika.

The cynic in me wonders if the crippling Cyprus international banking business is not simply an accidental by-product, but in fact was the motivator for the ambush of the new President. As the Financial Times indicates, legitimate Russian businesses are scrambling to move their deals to other tax haven centers, like Luxembourg. Remember that Russia is funneling arms to Syria. That means paying arms merchants. I would assume it’s harder to move those payments quietly through banking centers in the US or UK banking complexes than one largely outside it (well, you can always use overinvoicing and other tricks, but I assume that is more cumbersome).

Now the Eurozone is actually not keen about the idea of a Cyprus exit, since any country leaving raises the ugly possibility that someone else will depart. That in turn will lead to deposit flight of the countries seen to be most at risk (Portugal, Spain, Italy). That was straining the Eurozone prior to the OMT, which managed to calm down depositors enough to arrest money-moving. If the Cypriots were to impress upon the Troika that they were deadly serious about leaving, there is a small possibility that the Troika will blink and allow the ECB to keep funding Laiki while they wrangle. I am not certain that this leads to happy endings so much as keeping a tense situation in play.

The final alternative is that Russia stumps up enough cash to salvage Cyprus. Cyprus approached Russia nine months ago for assistance and was rebuffed, but as we will discuss, there has been one change in the interim that might lead Russia to change its posture.

To take the EU out of the question entirely is probably on the order of €30 billion, which seems a tall order for a €17 billion or so economy before the Eurozone stomped, Godzilla-like, all over its international banking business. Many people have focused on the rumor that Gazprom had offered to lend €13 billion in exchange for development rights in offshore gas fields, which Gazprom later denied. Now aside from the fact that these fields no doubt have others vying for development rights, the Troika would also probably want to retrade a deal that had Russians getting their hands into the country’s major economic asset. So even if Gazprom resurfaces, it is unlikely to act as a savior.

But Cyprus has another asset which the Eurocrats seem to have forgotten about: its real estate. Cyprus has a major airbase which is important to British operations in the Middle East. As reader Claudius pointed out in comments yesterday:

What has really pissed-off Russia was when, despite denials and assurances from the US state department, a meeting was held in Ankara (November 2012) with the American Ambassador to Cyprus, John Koenig, along with British, Greek and Turkey government heads. The meeting discussed a plan: British bases in Cyprus will be turned into NATO bases – the ‘three-party guarantee’ of Britain, Turkey and Greece will be abandoned – and NATO will take over. America wants its ships there.

However, there was one small snag; for Cyprus, the plan is neither legal nor constitutionally permissible. When, last year, Nikos Anastasiades pushed for a majority in the Cyprus parliament to vote for and pass an act for the Cyprus to join NATO’s ‘Program for Peace’ (PfP); Cyprus being the only member of the 27-nation European Union that is not in NATO. President Christofias (whom helped broker the Russian $2.5Bln investment) vetoed it, citing that the act violated the Constitution and the separation of powers (one of Cyprus’ ‘basic principles’) as the PfP is neither “an international organization nor a treaty of alliance”.

Nevertheless, and much to the Russia’s chagrin, the UN Secretary-General’s Special Advisor on Cyprus Alexander Downer has continued to develop talks with, now, Prime Minister Anastasiades whereby British bases in Cyprus will be handed to NATO as part of a new ‘Cyprus Peace Plan’ (one that encompasses PfP).

How long the veto is, somehow, voided or nullified, is not an easy guess. So, if Russia can buy time, presence and influence in Cyprus by paying $30Bln to bail out Cyprus and save the day, it can keep NATO out and import all the couscous it wants; it’s a bargain.

Now €30 billion is a lot to pay for a soft assurance and to merely serve as a spoiler for an uncertain period of time. A more hardball strategy would be military Keynesianism. Russia would love to have a port in the Mediterranean, or alternatively, an airbase (Cyprus apparently has four big ones, one its main commercial airport, one the British airfield, one dormant one in DMZ and one in the north. Query whether there are any open or low population areas that could be converted to an airbase).

Now would Russia get very far with a scheme like that? The Americans and Nato would go absolutely bonkers. I’m not sure how this would game out, but the mere announcement of a Russian-Cypriot pact would put the US, England and Germany in overdrive figuring out how to get the Russians out. And that would seem to at least mean improving on the financial terms offered to Cyprus, and giving the Russians some assurances on the Nato plan.

In other words, the Russians could throw a serious monkey wrench into Nato’s plan to stick a base into what Russia regards as its back yard. Whether Russia sees the opportunity and is willing to escalate international tensions to a fever pitch remains to be seen, but it would be a very clever way to exploit the Trokia’s blunder.

Update 8:30 AM: Ekathimerini apparently reports (the site is busy!) that Russia will buy Laiki for €4 billion. This will put the Troika in an amusing quandary, since they had demanded that Cyprus stump up €5.8 billion but the threat was cutting off Laiki from the ELA. If Russia will now make sure Laiki is solvent, the Troika’s grenade has been disarmed. And for €4 billion plus ongoing support, they might have gotten a handshake on that airbase too. This looks to have been well played, given the circumstances, if the rumor pans out.

Ah, so much for rumors! Like the Gazprom investment story, it has now been denied.

Update Bloomberg pieces on the ramifications of a Russian bailout, the latest from the ECB re ELA, and from Renaissance Capital on why Russia has a dog in this fight (video).

Oh, and then there’s Turkey’s dog; and the ECB sticks to its guns.

The banks in Cyprus are now to stay closed until Tuesday…

This is a great and very informative post. Thank you.

I realize this is a dumb and ignorant comment, but I am dumb and ignorant, and NC (Yves) has just shone some light in the darkness.

As the old saying goes, “There are no dumb Q’s, only dumb answers” or, complete silence!

Russia would love to have a port in the Mediterranean, or alternatively, an airbase. Now would Russia get very far with a scheme like that? The Americans and Nato would go absolutely bonkers

History shows that governments regard gaining geopolitical advantage as ‘priceless.’ They are the world’s most fanatical property investors, hewing hard to the dictum of ‘Only buy, NEVER SELL!’

If it’s merely a coincidence that Cyprus’s financial plight went critical mass three weeks after it installed a pro-NATO president, then it’s at least a grand cosmic irony.

Although the parties involved would be loathe to admit it, geopolitical strategy almost certainly trumps issues of mere paper money. It’s not that often that a well-populated Mediterranean island with good infrastructure comes up for sale or lease.

Buy now, or wait till the next century. The Great Game is on!

“It’s not that often that a well-populated Mediterranean island with good infrastructure comes up for sale or lease.”

Just read the news at RIA Novosti: Kredite gegen Beitritt: Kreml lockt Zypern in postsowjetisches Wirtschaftsbündnis

http://de.rian.ru/politics/20130320/265766755.html

Maam;

Another aspect of the Russian “Great Game”(smanship) appears to be the anticipated expiration of the Assad regime in Syria. Assad seems to have been Russias last ‘real’ friend in the region. Becoming Big Brother to the Cypriots would be a reasonable substitution, minus all the expensive arms aid Syria had soaked up over the years. The big plus, as you pointed out, for Russia: A warm water port for the Russian Navy, and or airfield for the Russian Air Force.

Russia having a presence in Cyprus makes sense going forward. The Med is becoming a new hotbed. Libya remains a factionalists’ heaven, Syria spirals out of anyones’ control, the Palestinians would love to have even the threat of Russian Navy escorted “humanitarian” convoys into Gaza to tease the Israelis with, and the last big question: If the Euro Periphery does indeed “Go South” as it were, could the Russians get in on the ground floor in creating a new All Med regional power bloc?

Interesting times.

Club Med, with Ukrainian hotties?

Sign me up!

Lol! That was good Jim!

apologies for my repeat comment..but

I think we will know for sure soon enough.

Should Cyprus’ Finance Minister Michalis Sarris symbolically return to Nicosia aboard an Antonov-225 (which holds the world record for airlifted payload at 189,980 kilograms (418,834 pounds)), I believe we can assume there’s a Russian bailout aboard ($30Bln weighs about 302,092Kg).

What’s Cypriot-Greek for: “Grease in our time”?

Dear Claudius;

Good symbolic gesture if it comes off. That Antonov could have a company of Russian Air Force ‘Surveyors’ to check out the facilities too.

Plus, if the Russians can pull this one off, how about some sort of stealth infiltration of Greece done by the ‘back door’ via Cyprus? I can imagine the shades of all the Russian Ministers and Commissars smiling down from that Rodina in the Sky in fond appreciation of their successors gambit. I’d look for some sort of attempt by Russian banking interests to take strong positions in some of Greeces’ smaller, better managed banks in the near future.

And we used to think that the ‘Great Game’ was only played in the Hindu Kush!

Speaking of ironies – many believe that the U.S., the globe’s capitalist giant, flat spent the USSR into the ground with the arms race, sent Milton Friedman’s boys in to show them how capitalism is done, and now Russia threatens to invade NATO using ‘gasp’ capitalism as its invasion force! Even ol’ Bill Shakespeare would be impressed by the irony.

On the other hand, its about time they started to put Prozac in the water for the people. The constant state of anxiety this halting salvation/deepening crisis merry-go-round has generated is making us all just a tad jittery. Pass the Dickel.

Agreed. I was surprised to see Cyprus not already part of NATO. Given the sorry state of Syria, I think Cyprus is a perfect substitute for Russia, sort of like Taiwan to the US.

This is a perfect chance for Russia to snatch Cyprus.

Is there any way the Cypriot would keep money even in their banks even if ECB would agree now to prop up the banks? It might be a crazy idea but redenomiation of deposits to rouble with the full backing of Russian Central Bank together with recapitalization of local banks by Russian money, with concessions of airbase, ports, gas right, etc. of course, could calm things down. Far fetched, yes. But nobody thought of deposit confiscation either before this week…

It lloks to me like the Russians are flattering to decieve, or possibly jut sh*t stirring. If they’re not going to buy Laiki, which would surelly have been the most effective, if also perhaps a pretty expensive move on their part, what good are they going to do?

If they’re not willing to stump up 4 billion, why wait around for them to commit 30?

They pulled a similar stunt with Iceland back in the day, IIRC. Noises were made about a big Russian loan or bailout, and there were ominous analysises about a new base for Russian military units right there in the north Atlantic.

It came to nothing, and Iceland surelly has at least as much strategic importance , long term, for Russians that Cyprus.

Synoptocist;

Yes, but, I don’t remember Iceland being a major money transshipment point either, for anyone. Russia has Archangel and Konigsberg for access to the North Atlantic. Either is usable in times of trouble. (Would the Danish Navy really attack transshipping Russian frigates?) Too, Iceland is securely within the NATO sphere of interest.

Cyprus however, is part of a long standing and venerable Russian strategy. It is centrally located for anyone wanting to influence the Middle East. Just ask the Mandarins in Whitehall about that. The U.K. still has a regiment on Cyprus. Why bother with that if it’s not worth that much?

I’m not saying Cyprus isn’t a stategically important place, but I think it’s no more important than Iceland, basically. And Iceland WAS a major money transshipment point, by anyones standards.

The UK would certainly be far more freaked out by having a Russian base up there than by a port in Cyprus.

Anyway, it’s going to be interesting to see what happens. But as the Russians didn’t just stump up for Laiki, or lend the Cypriots 5-6 billion, I get the impression they’re just kinda screwing around, looking for a freebie.

Dear Synopticist;

I didn’t know about Icelands ‘laundering’ ways, I stand corrected. Since the “restructuring” of Iceland, (an earlier series of comments from a real Icelander, [months ago] cast some doubt on the extent of Icelands apostasy,) where did the business once passed through Iceland go to? The trail of the “Hot” money might make interesting reading.

There certainly is value not having to go through the Turkish straights which are restricted. But I tend to agree that no port is worth 30B. That could pay for so many other toys.

Dear IF;

Have you priced munitions lately? 30B is a bargain!

There are other players in the Middle East. Most notably, Turkey.

If Russia could manage to woo Turkey, Russia would have, basically, won outright. Iran is already friendly with both Russia and Turkey. Iran and Turkey are the two rising powers in the area.

Meanwhile, the US, NATO, and EU have been snubbing Turkey for no good reason (racism perhaps) for 20 years.

I hope you are aware that Turkey has been a member of NATO for decades, and one of the many reasons it is not in the European Union is because it has been occupying and colonizing the northern third of Cyprus since the 1960s.

Thanks for peeling back the layers of the onion, Yves!

Very interesting Yves, though I thought “what Russia regards as its back yard” was over-egging the pudding.

By the by, somewhere this morning I saw an American (I think) remarking on the 60,000 UK personnel in Cyprus. WKPD reports ” In total, some 3,500 British personnel are based on Cyprus.”

Please stop using the term “haircut.” It’s cheeky and fun but it’s a euphamism for theft. Let’s just use “theft.” Thanks.

Well, when it’s bonds held by hedge funds or banks, it’s not theft. It’s one of the possible outcomes on a business deal.

And the high net worth individuals who finance hedge funds and the self-paid billionaires who operate banks react as reasonable adults, of course.

“Remember that Russia is funneling arms to Syria. That means paying arms merchants. ”

Does it? Under the Communists, Russia owned its own weapons factories outright.

Don’t have the reference at hand, but as I recall the US market share of the world’s trade in weapons of death (“arms for peace”) has gone from 60% under Bush/Cheney to 85% under Obomber. Now that is a growth industry! Probably the only non-financial growth industry left in rustbucket USA—.

So before we get too self righteous about Putin playing the same game in Syria we should look in the mirror.

You still have to pay middlemen to get the arms to your buddies. If you think the US is gonna let Russian ship ferry arms to Syrian ports right under their noses, you are smoking something strong. I’m sure they get hazard pay and they probably need to look like (or actually be) involved in legitimate businesses.

And the Russians may be funding the regime in other ways, They need gas, for instance. Remember Ollie North?

You must be tired Yves. We forgive you but Russia is NOT supporting the Syrian rebels – they are supporting (sort of) Assad. Actually, I think Russia is sick and tired of the U.S. destabilizing then toppling regimes across the region and then arranging their trading strategies to favor the U.S. But I think you are right – Russia sees Assad’s fall as imminent and I suspect very interested in Cyprus’ plight.

Doesn’t Assad still control the main port in Syria?

He fled to Latakia not too long ago, and I’m sure he wouldn’t mind a re-up of some of dat sweet rebel-killing arms.

FWIW, Turkey is a member of NATO. Do you really think they want the US to take over the Cyprus bases? I don’t.

I thought I made clear this sort of deal would never be consummated, the mere rumor of talks (if it ever got that far, remember the President is pro-Nato) would make the US and Nato go nuts and would lead to serious backpedaling on the financial plan and maybe some private concessions to Russia (they’d never be made in public, too embarrassing).

Thank You Yves!!! Continue bringing hypocrisy to light with facts and wit!

Expose the hypocritical guile of this unjust edict to privitize gains and socialize losses.

If one wants to know what´s going on in Germany – right, read the BBC.

The point is not that the BBC has any insight. The point is that Schaeuble is making public threats. The BBC recounted them in a compact form. This was widely reported in the media.

Putin is a wiley chess player. Thanks for putting the Cypress finance issue in geopolitical perspective. Brzezinski eat your leathery heart out.

Really interesting. Of all the nations, whether in NATO or not, who would consider air and naval bases in the Mediterranean to be critically important, I’d think the US is the most likely. The US, the UK and the Saudis. I heard a report a few days ago on who’s got the most oil: Russia is numero uno – the nation with the richest oil reserves; Saudi Arabia is second; the US is third (I assume this includes our close alliance with Canada). So since Russia already has so much oil, it wouldn’t be wise to let them have military bases on Cyprus where they could interfere with “our” interests. This would explain our relentless push to make them go back home and develop a market for China. It also might explain why we’re stirring the shit in Bulgaria (that bus bombing thing a while back). If the Russians just backed out of buying Laiki Bank for 4Bn, it was probably because we said we’d pay Cyprus more. After all that’s the Pentagon’s black budget and nobody will ever have to fess up.

If I were Putin, I would wait until ECB stupidly pulls the plug, aka ELA, on Cyprus. This will maximize his bargaining power because Cyprus will have no choice. You don’t want Cyprus to shop both sides. If ECB folds then the problem solves itself. Recapitalization by itself is meaningless at this point. The banks can operate even with negative equity as long as ECB provides liquidity. Who really thinks Commerzbank is well capitalized anyway?

In the leap to geopolitical strategy I suspect we may under-play the role of corruption in all this. In the ‘great game’ one can advance quite sensible arguments that Anglo-American finance purportedly encouraged the Nazis in a plan to pit Germany against the USSR and reap gains in control of oil. Literature is legion.

We all know these and other arguments are impossible to resolve. We come up against ideological commitments based on grand narratives similar to the ones Popper despised in Freud (denial) and Marx (false consciousness). No science can work with these and we are fairly useless in developing a parology (Lyotard)of legitimation.

We can’t even do some commonsense money chasing. I think we do know where the general money ends up – it has been pouring to the rich for decades and we can measure this. What we lack is any means to chase specific money – as in where has the Cyprus money gone. There are plenty of excuses available (exposure to Greek bonds and what appear stupid banking decisions)- but we also know there are people making vast profits from bankruptcy (pace Bill Black).

It’s been put over to us that snatching deposits in Cyprus is somehow ‘fair’ – despite the availability of articles like this one. My own suspicion is this is theft and being perpetrated by whoever is controlling the ‘Ponzi’ in the shadows. I understand that if I lose on the 3.30 p.m. at Haydock my money has not disappeared but gone from my pockets to Paddy Power. This is a long way from being told by my bank that my 10 grand has been lost on Greek bonds I did not bet on. We should know where the bets made in Cyprus have gone and who won on the other side of them (i.e. where the money is now as opposed to just no longer being available to us). This leads me to wonder, if it is ‘fair’ to ask people who made no bets to cover bets made, why is it not ‘fair’ to have a transparent audit in which money is recovered through a wealth tax? The logic is clear.

This, of course, is where the grand narratives (that postmodernism and science tell us we should be incredulous towards) kick in and we start inter-coursing the Laffer curve and stress the need for offshore accounting or else the sky will fall. It’s ‘fair’ to take ordinary savings (and let’s face it Cyprus is just the latest method) held in ordinary banks, but not apply something like the proceeds of crime act on the trail of the real lost money to who has it now.

The idea that these banks in Cyprus have lost 30 billion euros is being taken too easily – the excuse is at the level of ‘we had a cold snap and gave it to bank employees to run their central heating stoves’. We should want to know more on the crimogenic state of the financial system. In support of this I’d refer to the myth being spun that Russian mafia deposits will take the haircuts – this no doubt appeals to our notion that getting crooks to pay is fair – why stop there and not go for a proper audit to go after the real crooks and find out where any assets are?

Mon Dieu!

Holy Moly!

Are you truly asking for “TRANSPARENCY”????

(The buzz you hear overhead is your own personalized drone!)

No Sierra 7 – the buzzing comes from my own Mechano-built counter-establishment, proactive anti-first-strike, get the retaliation in first drone negator shield.

Even the Boston Consulting Group (once of stars, dogs, question marks and cash cows)reckon 29% of wealth will be confiscated before this is over. Transparency is a throw away word of the double-speakers, recognised in drone code as ‘harmless idiot, cheaper to brand a lunatic than waste munitions on’. My ‘plan’ can beat the question ‘who is left to appoint new untouchables to get an honest job done’?

oops! Can’t.

Thank you Yves for a comprehensive and even-handed presentation of the Cyprus financial crisis. Another twist which the Troika probably wasn’t expecting: the Archbishop of Cyprus formally placed the entire wealth of the Greek Orthodox Church of Cyprus at the government’s disposal this morning in a brief, eloquent, understated public announcement. I’m not sure how much wealth is actually involved, but there are 600 parishes and a great many monasteries sitting on … probably, tens of billions. If I understood correctly, the offer to the government was that the Church to mortgage its entire wealth to purchase bonds. I’ll see if I can learn more later this evening.

Who does he think he is, Anthony Quinn?

Cyprus Seeks Divine Intervention to Financial Crisis http://abcnews.go.com/Business/cyprus-church-pledges-bailout-funds/story?id=18775337

Thanks, Yves, for such thorough reporting. I notice that Paul Krugman seems to be stuck on the moneylaundering aspect of this story, but he says that he’s “trying to wrap my head around” it.

Paul K. can’t get past the Russian angle because if he did he’d have to admit that there’s no difference between Ivan The Russian Oligarch who launders dirty money in Cyprus and JPM Slimin’ Dimon and HSBC laundering money for international drug cartels and declared (OFAC) enemies of the U.S.

Krugman’s stake in not seeing the truth is so deep at this point that he really can’t be relied on to write or say anything useful.

Don’t know how I left out Corzine and MF Global from the short list of examples of US dirty-money “russians.”

Plus Caymen, Bermuda, Panama, Wyoming, Delaware, probably even NYC, London, Hong Kong, Singapore, Langley…

and if you think about it real hard, the NY Times and WaPo turns dirty subscription money into bleached airy things to hang out in the sunlight to dry.

But of course! And I also don’t know how I managed to leave out the Oligarch-in-Chief here in Krug’s very own backyard — Michael Bloomberg.

Yes, today’s posts on Cyprus are outstanding.

And Krugman seems utterly – and atypically – lost on the analysis and implications of the situation.

Maybe the “Russian factor” has cluttered his powers, somewhat.

“cluttered” … more like massive blind spot (charitably)

The UK has a large money-laundering and tax-free system explained in Vanity Fair this month. It is independent from the UK government. Perfect to process the overseas money even from Russia while maintaining their air base in Cyprus. Perhaps the EU will have new respect for the global implications of their financial instability.

I see where this is headed.

If the two big banks go under, Cyprus loses 40% of its GDP.

Cyprus is mostly a service economy (real estate, tourism), 78%, and most of that comes from Russians.

So there is no way that Cyprus can alienate its Russian clients.

The solution is for the government itself to recapitalize the banks, by essentially borrowing from the churches and pension funds (i.e. church and funds buy government bonds). The church owns a significant portion of the banks, part of the airline, and lots of real estate. The Church owes a favor to the government because it does not pay taxes.

The Church pledges holdings as collateral and takes out mortgages on its real estate.

Essentially, the government, Church and pensions will collude to create money out of nothing to paper-backstop the banks. The government is never, ever going to actually foreclose on or seize the pledged assets of the Church or pensions.

After the agreement, capital controls may be in place for a short while until things settle down. Also, the Cypriot government will have a little talk with the big Russian depositors and/or Russian government and make sure the big deposits don’t leave the country. Maybe the Russians will buy part of the banks, or give them credit-lines.

Cyprus gives into neither the Troika or Russia, and things stay much the same as they were.

So it will be another can-kicking exercise, capitalism’s favorite sport these days. Some day in the future Cyprus will face the same or another crisis – but that’s another day.

Meanwhile, down in little ol’ New Zealand, this from Gordon Campbell at scoop.co.nz:

“…In New Zealand, an almost identical money grab plan in the event of an emergency has been given the name Open Bank Resolution Policy (OBR).It is due to be locked into place here in June by stealth…”

Kudos to the NZ Green Party for blowing the whistle on this one, a government plan no less. (The link in Gordon’s article to interest.co.nz is worth pursuing, especially for enlightening comments below the article – and for homework check out New Zealand on the nakedcapitalism list upper right – certainly opened my eyes. )

That warning gives New Zealanders time to stage a “stroll” on their banks; taking their money out in measured stages between now and June. Could New Zealand (or any society) be so very civil-society organized so as to let the poorest get all their meager money out first? With near-poor and then middle-class people taking out larger amounts in stages?

Acording to a NZ Government spokesman: “New Zealand is experiencing moderate growth and as recently as yesterday the IMF said that the Government’s approach was striking the right balance. The World Economic Forum Global competitiveness Index recently ranked New Zealand’s banks third in the world for soundness. They are well capitalised and new capital requirements will make them stronger still.”

And of course the NZ Government is free to print as many NZ$ as it might need.

On the other hand Cyprus’ banks all passed the EU Stress Test less than two-years ago and its President was elected on a promise that bank deposits wouldn’t be touched. Moreover there’s no deposit insurance in place in NZ at the moment so even OBR might be an improvement.

But I have to wonder – if I did stroll down to the bank and pull out my funds there’s nowhere obvious at the moment to put it that’s anywhere safer, apart from under the mattress.

My Cypriot Brothers and Sisters:

Well done! Well done, kicking the Western capitalist vultures, the hyenas, and the locust in the teeth. Well done kicking this genocidal West where it hurts most! Well done exposing what the West is all about.

Brothers, stand firm! Stand firm, because the days of the West are numbered. You are the David that will bring down this monstrous Western Goliath. Follow the example of our Latin American brothers and round up all the IMF thieves, WorldBank thieves, EU and ECB crooks, and give them 3 (three) hours to leave your island and go back to their own hellish countries.

Brothers, do not forget and do not forgive what the West has done to Cyprus already. Do not forget and do not forgive the pain you endured these past 40 years. Do not forget your dead loved ones. Do not forget how Henry Kissinger gave away one third of your beautiful island to those Turkish rats. It is time to take back your land. It is also time to kick those drunken British perverts off of your island, and bring in our Russian Orthodox brothers.

The West is finished. Western Europe is now a bankrupt and decrepit hell hole of liars and a den of thieves. America is a defeated, broken, and dishonored nation, unable to win a war against a minor 12th century nation. They are losers. They are history. They are an embarrassment to humanity. Ship these hideous monsters off of your beautiful island today!

Brothers, throw these infernal demons out of the land of Aphrodite. Kick them off of your sunny shores. Kick them back to their desolate, frigid northern Hades of ice where they belong.

You, Cypriot brothers now stand at the crossroads of history. You will be the spark that ignites the fire that will consume this demonic West. Light up that fire, brothers! Have no fear! We will all join you. We will all shake this Western vermin once and for all.

Finally, do not forget what these monsters did to our sister, Greece. Do not allow them to do that to you too. Throw the vampires off of your back now! Thow it off, and then crush its head under your heel!

Godspeed, my Cypriot brothers!

Interesting….

Turkish rats?

http://en.wikipedia.org/wiki/Ayios_Nikolaos_Station

It’s a GIANT electronic listening post for the UK, aimed right at all of the hot spots in the Middle east. Not sure of the offical name. It makes up the part of the UK territory that sticks into Northern Cyprus, beyond the UN zone, connecting to the rest of the UK terriotry with just one road.

Airports

I took a few hours over the weekend and looked at them. The major commerical airport is in Larnaca. But, looking through their traffic, there aren’t enough business jets.

http://en.wikipedia.org/wiki/List_of_airports_in_Cyprus

Much more intersting are the military airports. Akrotiri is a massive, cold war military/air base.

The curious airport, called military, is kingsfield. It’s runway is only 4,000 feet long. Too short for most military aplications. But, it’s just about perfect for the jet set.

It’s in very good shape. It must have been rehabbed within the past 5 years. The only pictures/videos I could find were of gliders using it. The glider group, called “kingsfield crusaders”, uses the airport. Great name, huh?

Has anyone on the ground seen business jets using this airport? It’s perfect for it, and would explain the lack of business jet traffic at Larnaca. It’s RAF, so I could find no records of flights.

Map with some marks showing possible “antennas” in the area of Strovilia or Ayios Nikolaos.

http://mapper.acme.com/?ll=35.08515,33.89935&z=14&t=H&marker0=35.09695%2C33.88458%2C6.7%20km%20WxSW%20of%20Famagusta&marker1=35.08522%2C33.90372%2C5.4%20km%20WxNW%20of%20Dherinia&marker2=35.08733%2C33.89960%2C5.8%20km%20WxNW%20of%20Dherinia&marker3=35.08115%2C33.90166%2C5.4%20km%20WxNW%20of%20Dherinia

Wiki Polital map of the area-

http://en.wikipedia.org/wiki/File:Dhekelia-CIA_WFB_Map.png

You can get in tighter using Google Maps–

https://maps.google.com/maps?q=N+35.08515+E+33.89917

The imagery is the same either way. Disregard above.

Bob,

I am sure that barbaric nation called United Kingdom (a.k.a. little Britain) is using those airports to clandestinely transport people destined for torture and murder at its various dark sites. What else do you expect from a country like little Britain? What else except murder, genocide, torture, lies, and theft.

It is time to get these disgusting British perverts off of Cyprus. Time for colonies has long passed.

It’s not just UK, and it’s not new…

http://en.wikipedia.org/wiki/ECHELON

My favorite of these bases was the now closed and decommissioned-

http://en.wikipedia.org/wiki/Teufelsberg

Very good tour of the closed base-

http://dasalte.ccc.de/teufelsberg/

“comrade, they are building a giant cock and balls, we must retaliate”

In case that joke did’t get through…

http://dasalte.ccc.de/teufelsberg/teufelsberg-Pages/Image43.html

Cyprus and Iceland demonstrate that it is easier to impose unpopular, and unjust, antisocial measures in larger countries. Why? there may be several reasons. Bipartisanship in large countries migth be one.

Mono-ethnic mono-culturalism in small or tiny countries might be another . . . allowing for a sudden “Pearl Harbor effect” in response to the right stimulus.

I could more simply understand the Cypriot actions as a gambit. They saw Greece, did not want that, so Anastasiades may have privately turned to Russia for help first. I could understand if the Russians had told him to go through the motions with the Troika first, then return later. This would be not unlike the Wizard’s conditions, telling Dorothy to, “First bring me the broomstick of the Wicked Witch of the West.” If the shock of the Germans on the Cypriot rejection of their conditions is real, then I think the analogy could work. The final outcomes may be similar too, and the Russians have plenty of interest in helping the small and meek Cyprus.

Where there’s smoke, there’s accounting control fraud? A paranoid and cynical observer might translate all the pearl clutching about Russian money into “Look! Over there!” Not one iota of evidence, of course.

* * *

On another note, I keep Googling “Grillo Cyprus” and coming up empty….

The question is: cui bono ?

Having the financial “industry” of Cyprus destroyed will move the money to other Anglo-Saxon places like Cayman Islands. On top of that the Anglo-Saxons are punishing the Russians for their support of the Assad regime. And the nice thing is that everone thinks it were the Germans. So basically nothing new – it is always the same story.

That’s exactly right, as I mentioned 2 days ago. Forget Caymans — nearer to The City: Jersey, Guernesey, Isle of Man and (possibly) Cardiff. Is Gibraltar one of these too?

If we were playing Hercule Poirot and considering who stands to gain, Bank of England make the cut (though it sure isn’t alone!)

Been wondering about Monaco too. Supposed to be a place to play will all your money, but can’t help thinking some may keep it there too. In a hedge fund, of course. None of this “let’s lend it to Greece” stuff.

Then I don’t think we can really count the Swiss out of the game yet.

Monaco is an Oligarch tax-shelter by excellence — and as with all the others, the Oligarchs are a veritable United Nations Rainbow. I don’t know if the Boston Oligarch (Mike Bloomberg) is using Monaco to shelter some of the eye-popping 100s of millions that he has amassed while looting New York City for 12 years, but you’d have to guess that it’s only a few degrees of separation from a Prokhorov, or a Slimin’ Dimon or a Jack Lew, etc.

But if Russia ( with or without Chinese help) rescues Cyprus and Cyprus turns the bases over to Russia and the Shanghai Cooperation Organization; will the punishment have been worth the price?

(Never mind. I read downthread that Cyprus can’t just turn over the bases to Russian use. Maybe various orchestrated pressures could keep the bases British as in Not NATO though.)

“In other words, the bank that is the epicenter of the problem was driven into the ditch by foreign buyers. ”

Who in their right mind would want to put millions more into this failed bank with its current owners and senior management still in place? Is it not time to put the bank into resolution?

Considering the magnitude of the increase in the Federal Reserve’s balance sheet since November 1, 2012, and the slightly greater decrease in the ECB’s balance sheet, I am left wondering if a portion of QE Cash isn’t going into Southern European CBs?

If so, the size of the Cyprus bailout would appear to warrant some official consideration vis a vis cost-benefit tradeoffs regarding other issues mentioned here.

Of course, it would be a stretch to see how that policy might fit into the Fed’s “dual mandate”, or the “sequester” if done on the fiscal side of the House.

The importance of Cyprus for the russians has been largely underestimated in this and the previous post. I can understand why the EU is considered so bad, but what’s happening in Cyprus is more complex than represented in the NC posts. I think that this short extract from a favourite of yours is just an indication to explore more deeply what’s happening:

On page 249 of Treasure Islands, Nicholas Shaxson’s excellent book on the global offshore tax system, we find this interesting nugget:

Having gone out of its way to welcome wealthy Arabs in the 1980s and rich Japanese and oil-rich Africans in the 1990s, the City has more recently, with the help of conduit havens like Cyprus, aggressively courted Russian oligarchs, providing them with bolt-holes beyond the reach of Russian law enforcement. By April 2008 a hundred companies from the former Soviet Union’s Commonwealth of Independent States (CIS) were listed on the London stock exchange…

The rest is here:

http://ftalphaville.ft.com/2011/04/20/551141/between-greek-default-and-dodgy-russians/

there are other very interesting posts on Alphaville, this one is also interesting:

http://ftalphaville.ft.com/2013/03/18/1427472/first-they-came-for-the-deposits/

I think it’s NOT SO EASY to understand where the truth is and what’s really happening. It is more than sure that Joerg Asmussen was contrary to the small depositors expropriation so something else is probably happening…

About the UK bases on Cyprus:

http://www.sbaadministration.org/home/admin_background.htm

“Under the Treaty of Establishment, the Bases remain Sovereign British Territory under the Crown until “the Government of the United Kingdom, in view of changes in their military requirements, at any time decide to divest themselves of the sovereignty or effective control over the SBAs or any part thereof”.”

Russia might experience some difficulties in getting those bases.

Correct… the USAF has been in and out of them with UK permission for decades. So not sure what all that stuff about US taking them over via NATO is all about.

It seems that the US might need the UK bases in Cyprus to hit Iran:

http://famagusta-gazette.com/us-eyes-british-bases-in-cyprus-for-iran-mission-p17024-69.htm

Maybe a transfer of bases to Nato control could allow the US to bypass considerations regarding legality of such an action?

If the USAF has indeed been flying in and out of the bases for decades then either they did have the explicit permission of the Cyprus Government or they did so in defiance of Cyprus international agreements and treaties.

Under the Treaty of Establishment, only UK forces are referenced and only UK forces permitted free reign within Cyprus’ territorial borders (air land and sea). The UK cannot simply confer or transfer those powers (within its Treaty) to NATO forces simply by it being a member of NATO.

Equally, and importantly, the UK can only operate within UK law, Treaties and other international obligations within its ‘Sovereign Bases’. So, for example, members of UK forces are subject to UK laws as far as Human rights, powers of detention etc etc are concerned. NATO forces are, on the other hand, are each subject to their respective countries’ laws (though there are common NATO laws). Members of the US forces would be, primarily, subject to US law, US Treaties and obligations on a NATO base – and repatriated to stand trial in the US.

And this, arguably, is just one reason why you might want to change a UK Treaty of Establishment into a NATO Treaty of Establishment. By including Cyprus in a NATO alliance – then converting the UK bases to NATO bases – NATO forces can use Cyprus without the UK’s ‘restrictive’ and ‘quaint’ legal ”inconveniences”.

Plus, there’s a lot more money in providing bases to NATO than there is in having bases leased to Britain.

Please reread. I never said get the current base. Russia does not want Nato (as in the US) to get the British base. Russia wants to stop or at least considerably delay that.

So the play would be for rumor to get out that Russia was negotiating for port access or to build its own base (if there’s any place one could plausibly be installed). Stress rumor, no one in the West would let this go anywhere. This ploy would be to force a redo of the financial deal.

That’s really good data, thanks. I’d certainly speculated about Russians in the those ports, but I didn’t know they weren’t Cypriot territory!

The Cyprus bases are a “United Kingdom Trust Territory”. Under the terms of the treaty, ‘A UK Trust Territory refers to territories which have that status immediately after the entry into force of this Treaty for the purpose of the application of the nationality law of the United Kingdom’.

In that context the bases are not owned by the UK they are administrated and operated as “Sovereign” – i.e. a Sovereign Base with applicable UK laws, administration, powers of detention etc. – and the UK government makes lease payments (though arguably not since 1965) to Cyprus for the use of the land (somewhat akin to HK and China, but without the 100 years leasing).

Interestingly, in November 2009, the United Nations said Britain had ‘offered to hand over almost half of its sovereign territory in Cyprus to facilitate a peace deal between the island’s divided Greek and Turkish Cypriots’. This idea being in accordance with the terms of the Treaty’s ANNEX B, Part II, SECTION 1; which states ‘The Government of the United Kingdom shall have the right to continue to use, without restriction or interference, the Sites in the territory of the Republic of Cyprus listed in Schedule B to this Part of this Annex, but shall terminate the use of those Sites as soon as practicable’.

Given the ECB’s current treatment of Cyprus’ banks, I believe Anastasiades (Cyprus) believes the treaty’s ‘practically possible’ might be, practically, anytime soon.

To expand my previous comment (separate post). You will need to read other post to understand the basis for a NATO dimension in all of this.

There’s a geopolitical (and now economic) dichotomy in Cyprus right now, but it’s not (or wasn’t) philosophical it’s purely about the money and who’s the better sugar daddy There are two plays going on: Domestic and International.

Domestically, Anastasiades benefits least from Russia’s $2.5Bln, Christofias most. Christofias’ got his and he’s keeping it; he’s been promoting Russian “development” in Cyprus for the longest time (perceived as a hard-line supporter of Russian investment) and calling Russia a strategic partner’” of Europe and a “pillar of capitalism”.

As such Anastasiades has/had been pushing for a constitutional amendment to get around Christofias power of veto and allow NATO/CfC in (see previous posts). Once the amendment is passed there would be a concomitant “Foreign Bases Land Reform Act” that would better define the terms and conditions for leasing bases to NATO than those that currently exists with Britain (which, under it’s present agreement pays, practically, nothing – since 1965). Needless to say, there’s $Bln’s and land in them-there bases.

Internationally; implicit to any Anastasiades constitutional amendment, was/is that the European Union would continue to support Cyprus’ debt until Gas revenues (for which Anastasiades has a great personal interest) comes on stream beginning 2015 -2020 (and the revenues are 100%+ of GDP (see previous post)).

However, Given the recent actions of the ECB/Germany, Anastasiades (Cyprus) is left with one of two developments:

1.) the European Finance ministers didn’t get the US’-NATO memo, and once the ECB demanded a haircut on deposits Anastasiades’ (Cyprus’ parliament) hand was forced; he’s had to get into this present play with Russia (question is, what does Russia/Christofias want in exchange and, as a third leg, how does this stand with Anastasiades?).

2.) It could be everyone got the memo, but a ‘sensitive’ Germany is saying to the US/NATO: ‘you want the bases there; you pay-off the Russian/Cyprus banks”.

Claudius, you know a lot of stuff.

So much to comment on

First Germans don’t want to be seen bailing out either tax hven or Russians evading taxes.

Second , the Gas situation, surprised the Cypriots don’t have more levverage here. The country is strategically and economicaly important(natural gas, Syria, Turkey, Israel?)

Lastly, the stock market seems disconnnected from reality? Are we so banking on Beranke?

On Renaissance Capital:

Cyprus Tax Prompts Swiss LGT to Cut Ties to Russian Alfa, RenCap

http://www.sfgate.com/business/bloomberg/article/Cyprus-Tax-Prompts-Swiss-LGT-to-Cut-Ties-to-4363935.php

Who is Renaissance Capital (or short RenCap)?

Read The Daily Beast:

Putin’s Biggest Threat: Billionaire Playboy Mikhail Prokhorov.

Renaissance is a Moscow-based investment bank

Of course. But banks have owners.

Moving on to Africa

http://www.businessweek.com/magazine/content/11_02/b4210058424523.htm

No, you have the wrong model. This is an INVESTMENT BANK. As in boutique, does fund management and deals. Does not require a lot of capital.

How interesting. Pokhorov is Mike Bloomberg’s new BFF — he bailed out Forest City Ratner by taking over the Barclay’s Nets Arena project (he bought the Nets) and providing hundreds of millions of dollars to “prop up” the massive hideous high rise “redevelopment” plan that is about to destroy a huge swath of Brooklyn.

Check out the photo-op with Bloomberg — The Two Oligarchs yucking it up as they “score” another massive piece of other people’s assets.

http://www.nydailynews.com/new-york/vew-nets-arena-opens-mayor-bloomberg-kicks-mets-fans-article-1.1164695

And p.s. — I wouldn’t be surprised if Prokhorov and Bloomberg are involved in “ventures” to scoop up municipal and state things like roads, bridges, police departments, schools and hospitals on the cheap as the cities and states stagger on their last financial legs.

This is me being Faith Popcorn.

I am quite impressed with this article, extremely impressed

Some history:it’s not investment in greek sovereign debt that was Laiki’s problem.

http://ftalphaville.ft.com/2012/06/15/1045041/cyprus-popular-bank-money-is-gone-allegedly/

and the reuters article referred to (from june 2012)

Jun 13, 2012

http://www.reuters.com/article/2012/06/13/us-greece-marfin-idUSBRE85C0M920120613

Thanks, Yves. I’ve been following this and you have brought a lot of new things to light.

This is great. I’m getting out the popcorn and settling in for a little Mediterranean / Euro drama!

You’re gonna love it

Good article, it connects the important threads!

It’s hard to tell what is going to happen next other than the key word will be ‘LESS’. Someone is going to do without, or everyone is going to do with less. That’s really what this is all about.

A suggestion: for the EU establishment to offer small payments to Cypriot bank depositors — a hundred euros per account should do the trick — for their troubles then walk backward. The ECB can continue to fund Cypriot banks until a reasonable resolution can be obtained. The world is not going to end tomorrow.

BTW: it’s still entirely Draghi’s fault. This is simply a knock-on effect of the Italian election. @ Yves:

Should have been done last year.

This would never have happened if there was a lot of German money in those banks or if German banks were large creditors.

I know that I am stating the obvious, but it is worth repeating what has been the driving force behind the EU’s “rescues” thus far (pure national interest)

The biologist in me must point out parasitism is the most common life form on Earth. We don’t seem to understand the financial parasite at all well. I was looking at Lyme disease recently and suspect any real ‘following the money’ would reveal a similar, complex system. Our giant squid metaphor is all too simple.

TIME TO PAY THE PIPER

Cyprus wants to leave the Euro? Good riddance!

Entering a common money is a binary decision. Not one where you take the good when it’s coming good and leave the bad when it turns bad.

Like the Greeks, they were living beyond their means on borrowed time and “borrowed” Russian money. They thought that could go on forever?

Political classes all over the world are having a comeuppance. Even in the US.

For the longest time both the Legislative and Executive Functions have had an easy time in running the country economically. Even the US, which got away with wasting trillions on useless foreign wars, was not harmed by its expenditures. Rather, its gross error was the lax oversight by national agencies of its credit and finance markets. (Of course, the US dollar is a Reserve Currency, which mitigates the consequences of feckless economic management considerably.)

In Europe, Angela may call it profligacy, whilst the more apt term is “kicking the can down the road”. That is, maintaining a burgeoning debt-mountain whilst not attending to the more critical objective of stopping its inexorable growth by turning it over.

In the US, the blame can be places squarely upon a wacky Republican T-Party (T for Troglodyte) that insisted stupidly upon Budget Austerity – this very same party that had spent money ridiculously on unnecessary waring just previously!

MY POINT? We, the sheeple

What can a people do when they give leadership (in Legislatures and in Executive branches) to hapless representatives who can only manage national economic policy by “kicking the can down the road” rather than “biting the bullet”. Meaning assuming debt recklessly beyond any practicable management measure.

Wakey, wakey! It’s time to pay the piper for gross national mismanagement – and that means all of us yokels at the bottom of the political totem-pole.

Because we voted into office the political class we have. So, let’s stop blaming “those bastards” (meaning everybody else). The real problem lies with We, the Sheeple.