Bloomberg reported that productivity gains in the US are tepid, and that’s a sign of economic weakness:

Four years into an expansion, the productivity of American workers has slowed and some economists say there are few signs it will soon rebound.

Employee output per hour grew at an average 0.7 percent annual rate over the past 12 quarters, which economists at JPMorgan Chase & Co. say is a pace so slow it’s rarely seen outside of recessions. Gains since the recovery began in June 2009 have averaged 1.5 percent, the weakest of the nine postwar expansions that lasted as long, according to IHS Global Insight.

This is more significant than readers might realize. The two sources of growth are demographic growth (more people) and productivity gains. Every time the topic of growth arises, some readers argue that we can’t afford more growth because it implies more resource consumption. But productivity-driven growth does not have that character. It means your are producing the same goods and services with less labor input. So if you replace your receptionist with a phone prompt system, you don’t have to have as much office space, you can get rid of the electricity and equipment once used to support him, the receptionist does not consume gas going to and from work, and so on. So, generally speaking, you reduce resource demands.

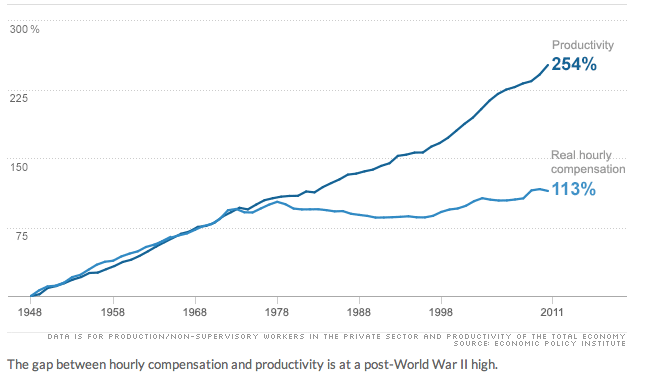

It also can’t be stressed enough that the unprecedentedly high corporate profits we’ve seen are the direct result of businesses hogging the benefit of productivity gains for themselves. Warren Buffett famously warned in 1999 that a corporate profit share of GDP of over 6% wasn’t sustainable. Analysts now peg the corporate share at anywhere from 11% to 14%.

Now the Bloomberg piece argues that the reason that productivity gains are flagging is because employers don’t see opportunities to deploy technology to improve output. But the reality is more complicated.

One of the big drivers of productivity gains has simply been making workers do more for the same pay. The evidence is pervasive. You see it in Walmart cutting staffing to the level where lines in stores and inability to keep shelves stocked is leading shoppers to go to other discounters and pay more as a result of the degradation of the shopping experience at Walmart. With Walmart itself accounting for over 2% of US GDP, the effect there is marked. Similarly, it appears that companies are increasingly asking employees to do un or underpaid work, in violation of labor laws. The rise of unpaid internships, too many of which violate with IRS rules, is one illustration (there needs to be a significant training component; the Conde Nast drill of having interns make copies and run errands for celebrity bosses in a no-no). And on the high end of the food chain, people that I know who are still on the corporate meal ticket are doing what would have been 1.5 to 2 jobs ten years ago.

In other words, the idea that technology has been the driver of productivity gains bears some examining. There is considerable evidence that it has also come from squeezing employees. And the Walmart example suggests that companies are hitting the limit of how far they can go without degrading the product/service to the point where they start losing sales (air travel shows that you can reduce the quality of the service a great deal and still not drive customers away).

And we have another “end of paradigm” dynamic at play. As we discussed in ECONNED, the US economy changed in the late 1970s from one where rising wages were seen as the driver of growth. Instead, policy-makers looked to deregulation (which was depicted as allowing companies to become more efficient) and rising levels of household debt allowed consumers to increase their spending levels in the absence of wage gains. But consumer debt is not productive debt (it does not fund drivers of economic productivity).

Even though consumers have been increasing their debt levels again, the biggest driver is student debt. And that’s arguable the most negative. Student debt is senior and can’t be discharged in bankruptcy, so it represents a millstone that borrowers carry with them for years, even decades, crimping spending in what used to be peak expenditure year and delaying new household formation. And student loan defaults are already scary high. The official 12% that are now 90+ days dqlinquent, as bad as that is, is misleading. That’s based on the total outstanding when students get to defer making payments while in school. When you adjust for the percentage that are obligated to be making payments, the delinquency rate is much higher. The New York Fed provided this rough cut analysis based on the data in early 2012, which gives you a sense of the magnitude of the difference:

….we find that as many as 47 percent of student loan borrowers appear to be in deferral or forbearance periods, and thus did not have to make payments as of third-quarter 2011. Specifically, 17.6 percent of borrowers had exactly the same balance in the third quarter as in the second quarter of this year, and 29.1 percent increased their overall student loan balance by taking on new originations or accruing interest to the balance.

We then recalculate the proportion of borrowers with a past due balance excluding this group of borrowers. We find that 27 percent of the borrowers have past due balances, while the adjusted proportion of outstanding student loan balances that is delinquent is 21 percent—much higher than the unadjusted rates of 14.4 percent and 10 percent, respectively

In other words, both the number of borrowers and the amounts in delinquency roughly double.

Student loans have been making a meaningful contribution to aggregate demand.

If origination slows it’s another negative for growth and output to add to the tax hikes and spending cuts.

This is not to say I favor the student loan channel for education. Quite the contrary, in fact.

But just like the savings and loan credit expansion leg propelled the Reagan years, the .com and y2k credit expansion the Clinton years, and the sub prime credit expansion the Bush years, to a much lesser extent the student loan credit expansion has supported the current modest recovery.

And when they end the support ends.

But the stock market continues to party as long as investors believe the Fed can sprinkle pixie dust on the financial markets and spare them losses. But as economist Herbert Stein said, “If something cannot go on forever, it will stop.” We look to be nearing that point, but a lot of clearly unsustainable trends, like the dot-com bubble, went a lot further than the sober-minded thought possible. But the flip side is the longer we go past logical correction points, the uglier the day of reckoning is likely to be.

As we discussed in ECONNED, the US economy changed in the late 1970s to one where rising wages were seen as the driver of growth. FROM one, not TO one, I think.

Whoops, will fix, thanks!

” Every time the topic of growth arises, some readers argue that we can’t afford more growth because it implies more resource consumption. But productivity-driven growth does not have that character. It means your are producing the same goods and services with less labor input. So if you replace your receptionist with a phone prompt system, you don’t have to have as much office space, you can get rid of the electricity and equipment once used to support him, the receptionist does not consume gas going to and from work, and so on. So, generally speaking, you reduce resource demands.”

Umm,,, no, not necessarily. Cf. the Jevons paradox. Of course, the argument that recessions are good because they slow down resource consumption is even stupider and more ignorant, (since they diminish the economic resources for replacing resource-inefficient capital). But it doesn’t follow that GDP growth alone will be conducive to decreased aggregate resource consumption. The capitalist syndrome of over-consumption for the sake of over-production must be addressed more directly than that. And re-distributing income away from excess “investment” and toward more sustainable living standards and quality of life would be part of the solution, (rather than relying on increasing gross output through increasing the productivity of capital).

I said “generally speaking”.

And we aren’t talking about the same thing.

The Jevons paradox SPECIFICALLY is about technological change that would reduce the use of specific inputs. So more fuel efficient cars reduce the use of fuel in theory but Jevons argues in practice you get a rebound effect.

By contrast, I am discussing that the reduction of the use of labor (which is what productivity gains are about, the metric is labor productivity) has the ancillary effect of reducing resource consumption.

Yves,

>> So more fuel efficient cars reduce the use of fuel in theory but Jevons argues in practice you get a rebound effect.

Well, Jevon argues you get more than a rebound. You might end up using more fuel than ever, because driving has been made so more efficient and net-beneficial for each individual user.

And I’m not sure Jevon’s paradox comparison isn’t appropriate here.

Indeed, although I do it a bit, I don’t go *out of my way* to “conserve” or recycle because I’m swayed by a consequentialist argument: All I’m doing is making gas cheaper for someone else’s gas guzzler or leaving room in the landfill for someone else’s future garbage. We must encourage elimination of externalities (by appropriately charging for waste) or else my voluntary caring temporarily subsidizes someone else’s apathy.

1. The expression “rebound effect” does not preclude an ultimate increase in usage. The Wikipedia discussion of the Jevons effect uses that phrase, suggesting that it is the term of art favored in the academic literature:

This increase in demand may or may not be large enough to offset the original drop in demand from the increased efficiency. The Jevons paradox occurs when the rebound effect is greater than 100%, exceeding the original efficiency gains. This effect has been called ‘backfire’.[2]

Consider a simple case: a perfectly competitive market where fuel is the sole input used, and the only determinant of the cost of work. If the price of fuel remains constant but the efficiency of its conversion into work is doubled, the effective price of work is halved and twice as much work can be purchased for the same amount of money. If the amount of work purchased more than doubles (i.e., demand for work is elastic, the price elasticity is greater than 1), then the quantity of fuel used would increase, not decrease. If however, the demand for work is inelastic (price elasticity is less than 1), the amount of work purchased would less than double, and the quantity of fuel used would decrease.

A full analysis would also have to take into account the fact that products (work) use more than one type of input (e.g., fuel, labour, machinery), and that other factors besides input cost (e.g., a non-competitive market structure) may also affect the price of work. These factors would tend to decrease the effect of fuel efficiency on the price of work, and hence reduce the rebound effect, making the Jevons paradox less likely to occur. Additionally, any change in the demand for fuel would have an effect on the price of fuel, and also on the effective price of work.

http://en.wikipedia.org/wiki/Jevons_paradox

2. You are still missing my point. Corporations are keen to cut labor because in most industries expenses key off headcount (more bodies means more office space, furniture, travel expenses, electricity, etc). Since companies continue to be fixated on cutting cost even as unemployment is high and wages are stagnant, there’s no evidence of a rebound effect as far as labor is concerned. And that means the fact that cutting headcount lowers resource use is still a valid observation.

I thought your essential point was referring to the receptionist as ‘he’. My reaction was he he he.

Apart from this speculative foray into resource consumption, I found your analysis spot on. ‘Productivity’ is important to corporate success, because labor represents a drain on the ability of executives to loot. Yesterday, I sat in a line of cars watching a truly humongous truck replacing a huge and presumably full dumpster with an empty one. The process was entirely automated. Presumably, the full one is hauled away to dumpster heaven, thus eliminating God only knows how many jobs.

The driver is lucky that truck cannot self direct. At least she still has a job. LOL.

Warning: the following is a snarky rant, but I’ve lost my patience with “term of art from academic literature”, especially economic literature. So here is a blow by blow comment on the Wiki piece on Jevons Paradox.

“Consider a simple case: a perfectly competitive market where fuel is the sole input used, and the only determinant of the cost of work.”

First, state the world is such simplistic terms as to be meaningless – but you do sound scientific because you use 4+ syllable words.

“If the price of fuel remains constant but the efficiency of its conversion into work is doubled, the effective price of work is halved and twice as much work can be purchased for the same amount of money.”

Then quickly spout off psuedo mathematical sounding words, but never provide an equation – that would show how silly your initial statement is.

“If the amount of work purchased more than doubles (i.e., demand for work is elastic, the price elasticity is greater than 1),”

Nice touch, throw in an undefined term (price elasticity) like everyone would know what you mean or what it is.

“… then the quantity of fuel used would increase, not decrease.”

Now, about half way thru your discourse, make a flat out statement of truth. Ignore the snickering in the back row from the non-believers who know that in the real world, consumption is not linear nor constant based on only one variable.

“If however, the demand for work is inelastic (price elasticity is less than 1),…”

Again, reuse that early non-defined term, but with a new word to keep padding your argument and hiding the feeling – Must be right! It’s so hard to understand! (No, it is wrong and lacks human emotion, that’s all).

” the amount of work purchased would less than double, and the quantity of fuel used would decrease.”

Got them now, made another serious sounding truth that is traceable back to the original statement, but only with difficulty.

“A full analysis would also have to take into account the fact that products (work) use more than one type of input (e.g., fuel, labour, machinery), and that other factors besides input cost (e.g., a non-competitive market structure) may also affect the price of work. ”

No s* Shylock! Really? You think? This is the get out of jail free card against the non-believers and for those who do believe and have deep pockets to finance more silly economic studies.

“These factors would tend to decrease the effect of fuel efficiency on the price of work, and hence reduce the rebound effect, making the Jevons paradox less likely to occur. Additionally, any change in the demand for fuel would have an effect on the price of fuel, and also on the effective price of work.”

Wrap up the argument with more 4+ syllable words that hide and confuse whatever the original argument or point to prove was about.

>> 2. You are still missing my point. Corporations are keen to

Keen to. But, are they? During the last 3-4 years, are private employers hiring more than they’ve laid off? Are they increased resource usage or decreased it? (How much of any increase should we attribute to demographics?)

…

I’m not missing your point or other observations. I’m just not sure that overall labor and resource usage is actually going down or that the prior reader’s citation of Jevon’s paradox is so inapt.

If you look at the stats over the last at least 15 years, large corporations have been in aggregate shrinking headcount. Did you miss all the headcount reductions they announced in 2012?

This matters because it is large corporations (ex Walmart) that generally have higher paid and more stable jobs. So if they worsen the terms of employment, less stable/attractive employers can worsen their offerings.

And I can tell you that big corps have been squeezing actual and effective compensation massively once you get below the C level. Mid level corp jobs that paid $350,000-400,000 in the early 2000s pay more like $200,000 now (I’ve heard this from recruiters). And as I indicated in the post and a reader confirmed, people in corporate jobs are also being pushed to the max in terms of their duties. What would have been 1.5 or 2 jobs 15 years ago is now only 1 job.

I don’t see how you can not get that these amount to major effective wage cuts.

It is small businesses that have been doing the hiring that has taken place in the economy. And again as indicated, they price with reference to what the big boys are doing. And there there are also indications that they aren’t increasing wages much/at all. How many times have there been stories of employers saying they can’t hire people that we’ve featured here skeptically, and readers have confirmed the employer simply isn’t willing to pay market rate?

Whether the substitution of capital input for labor input decreases energy and resource inputs is per se indeterminate. But that is precisely what it means to raise labor productivity. And the first-order effect is to lower the employment of labor, which reduces natural resource inputs only because it reduces labor incomes and thus consumption demand. That labor would have to be re-employed elsewhere to sustain the consumption demand required to realize the profits and “value” of invested capital, and thus would resume and perhaps increase the strain on energy and natural resource inputs.

So the model of increasing consumption demand to increase investment demand and thereby increase the growth of output by raising the level of productivity doesn’t “generally” mean a reduction in natural resource utilization, but the contrary.

I think it’s fair to divide the problem into short-run, medium-run and long-run issues. But consumption demand stimulus to induce increased “private” investment only addresses the short-run cyclical problem and not the medium-to-long-run structural issues, which would require re-distributing income away from capital, (rather than goosing fictitious capital “values”), the “destruction” of the value of much current infrastructure and productive capital stock, both “physically” and in terms of the financial asset claims laid upon it, and the mobilization of new investment in infrastructure and productive capital to render the system more sustainable in both natural resource and social equity terms.

What that means for economic “growth” is the puzzle. But we could start with a progressively ratcheted up carbon tax-and-rebate scheile to induce changes in both consumption and investment, which cushioning the impacts and maintaining broad popular support via a kind of anti-rent, comparable to the resource rents currently distributed to the citizens of Alberta, Alaska, Norway, and the like.

Alex.

Price elasticity is legit. All words are made up somewhere.

It’s the concept that when prices for certain things (as in some things more than others) go up or down, the demand for them goes up and down too. Or doesn’t.

If it’s a 1-to-1 ratio, then they go up or down together. More than 1, and the difference is bigger. Less and it’s less.

It makes alot of sense, really. No matter what the price of food is tomorrow, I have to eat it… so I’ll have to pay. < Low elasticity.

However, if an airline rises it's prices, I might just drive or take another carrier. Maybe I'll stay home.

Nice work. Thanks.

yes it is…muchas gracias Yves

What we have here is a failure to CLOSE THE GAPS YOU MONSTERS.

this was a conscious decision made by the “powers that be” in the 70s. along with the hike in the price of oil made at a Bilderbergers meeting in Sweden. From: Gods of Money

Wall Street and the Death of the American Century

by F. William Engdahl

p265

In May 1973, with the dramatic fall of the dollar still vivid, a group of 84 of the world’s top financial and political insiders met at the secluded island resort of the Swedish Wallenberg banking family, at Saltsjoebaden, Sweden. This gathering later came to be known as Prince Bernhard’s Bilderberg Group. At the meeting, the group heard an American participant outline a ‘scenario’ for an imminent 400% increase in OPEC petroleum revenues.

p266

In May i972 a year before the Bilderberg Saltsjoebaden [Sweden] talks, the Shah had met with [Henry] Kissinger and President Nixon in Teheran. Nixon and Kissinger promised the Shah he could buy any US military equipment he wanted from the US defense arsenal except nuclear weapons, and he would be permitted to do it without US Congressional OK.

In order to finance the huge purchases, the Shah would need vastly higher oil revenues. Chase Manhattan Bank, of course, was Iran’s bank, the Shah’s personal bank, National Iranian Oil Company’s bank, the Pahlavi family bank, and the Pahlavi Foundation’s bank. The entire financial empire of the Pahlavi regime was a Rockefeller operation from top to bottom.

p267

Present at Saltsjoebaden [Sweden] for the May 1973 gathering were David Rockefeller of Chase Manhattan Bank, by then the acknowledged ‘chairman of the board’ of the American establishment; … Zbigniew Brzezinski, the new Executive Director of David Rockefeller’s private Trilateral Commission and soon to be President Carter’s National Security Adviser … Henry Kissinger had also been invited to the gathering.

The powerful Bilderberg elite group that met in Sweden in May 1973 had decided to launch a colossal assault against industrial growth in the world, in order to tilt the balance of power back to the advantage of American Wall Street financial interests, and specifically to support the vulnerable dollar, the heart of their global financial and economic power. In order to do this, they would use their most valuable strategic weapon-their control of the world’s oil flows.

The Bilderberg policy was put into effect six months later in October 1973 when US diplomacy was deployed to trigger a global oil embargo, shockingly enough, in order to force the intended dramatic increase in world oil prices. Since 1945, world oil trade had by international custom been priced in dollars because American oil companies dominated the postwar market. A sharp and / sudden increase in the world price of oil, therefore, meant an equally dramatic increase in world demand for US dollars to pay for that necessary oil. In addition 1 to making Exxon, Mobil Oil and the other Rockefeller companies into the largest corporations in the world, it would make their banks-Chase Manhattan, Citibank and a handful of others-into the world’s largest banks.

The Rockefeller-dominated American financial establishment had resolved to use their oil power in a manner no one could imagine possible. The very outrageousness of their scheme was to their advantage. No one could conceive that such a thing could possibly be deliberate. It was.

p268

In October 6, 1973, Egypt and Syria invaded Israel, igniting what became known as the ‘Yom Kippur’ war. The Yom Kippur war was not the simple result of miscalculation, blunder, or an Arab decision to launch a military strike against the state of Israel. The entire series of events leading up to the outbreak of the October war had been secretly orchestrated by Washington and London, using powerful ‘back door’ diplomatic channels developed by Nixon’s National Security Adviser, Henry Kissinger.

Kissinger effectively controlled the Israeli policy response through his intimate connection with Israel’s Washington ambassador, Simcha Dinitz. Kissinger had also cultivated channels to the Egyptian and Syrian side. His method was simply to misrepresent to each party the critical elements of the other’s position, ensuring the outbreak of war and the subsequent Arab oil embargo.

… The war brought about the very oil price shock discussed at the Bilderberg deliberations of the previous May in Saltsjoebaden [Sweden], some six months before the outbreak of the war.

OPEC and the Arab oil-producing nations would be the scapegoats for the coming rage of the world over the resulting oil embargo to the United States and Europe and an ensuing huge increase in oil prices, while the Anglo-American interests that were actually responsible, stood quietly in the background, ready to reap the windfall.

… One enormous consequence of the ensuing 400% rise in OPEC oil prices was that the risky North Sea investments of hundreds of millions of dollars by British Petroleum, Royal Dutch Shell and other Anglo-American petroleum concerns could produce oil at a profit. It was a curious fact of the time that the profitability of the new North Sea oil fields was not at all secure until after Kissinger’s oil shock. At pre-1973 world oil prices, the North Sea projects would have gone bankrupt before the first oil could flow.

… The US Treasury ‘arrangement’ with Saudi Arabia on dollar pricing of oil was finalized February 1975… Under the terms of the agreement, the huge new Saudi oil revenue windfall would be channeled largely into financing the US government deficits.

… The Bilderberg scheme was operating fully as planned. The Eurodollar market that had been built up over the previous several years was to play a decisive role in the offshore petrodollar ‘recycling’ strategy. Subsequently, Rockefeller’s Chase Manhattan Bank estimated that between 1974 and the end of 1978 the oil producing countries of OPEC generated a surplus from oil exports of $185 billion, more than three-fourths of which passed through Western financial institutions, the lion’s share through Chase and allied banks in New York and London, and from thereon as loans to the Third World.

… From 1949 until the end of 1970, Middle East crude oil prices had averaged approximately $1.90/barrel. They had risen to $3.01 in early 1973, the time of the fateful Saltsjoebaden meeting of the Bilderberg group who discussed the imminent 400% future rise in OPEC’s price. By January 1974 that 400% increase was a fait accompli.

A side benefit was the debt slavery of most of the third and developing world to pay for this price increase.

The stagflation of the 70s was an unintended consequence.

This wage price inflation (notice it just kept wages the same in real terms) was fixed by the Reagan administration in the US and the Thatcher administration in England. Globalisation completed the work of castrating the power of the workers that had been gained in the Great Depression and the Cold War.

F. William Engdahl?

Really?

Who denies AGW as a conspiracy and thinks oil just comes bubbling up from underground and is limitless?

AGW isn’t a conspiracy.

It’s a fraud.

It’s a (pseudo)scientific fraud perpetrated by many parties, each having it’s own (ofter incompatible) reasons to sing up with it.

Like Wall St. casino, it’s well beyond a mere conspiracy.

one doesn’t have to believe everything someone says to believe they are right about many things. What he says tracks for me about how the price of oil was used to control recently decolonized nations. As to disbelieving in Anthropogenic Global Warming, I am skeptical myself. Even the science they use to show how CO2 in the atmosphere helps to keep the Earth warm (and isn’t the same as how a greenhouse warms) says doubling it will only warm the Earth 1degree C. It must be doubled again to warm the Earth 2 degrees. The excess warming the AGW ers are predicting comes mainly from the feedback mechanisms. they use computer models based most on the atmosphere and do not fully integrate the effect of the ocean. To claim that the present level of climate knowledge has a full understanding of all the feedback mechanisms in the Earth’s climate would be claiming a lie.

@gepay

not only that, those model don’t model clouds.

For now clouds are a total mystery, no one can say for sure what and how big is their effect on cliamate. And they are part of the (in)famous CO2-H2O feedback!

if a person is scientifically educated and still claims that “the science is settled” then s/he is a fraudster. Period.

the climate science is as far from being settled as it was 50 years ago.

@Yves:

Less labor output means replacement machine output OR less output by both. This last state is an industrial recession or depression. There are no other alternatives.

Machines are not inherently productive, they cost more to operate in total than they can offer in output. That this is so is self-evident: if machines could pay for themselves they would do so, they would have done so over the centuries of industrial machine existence. There would be no debts, only the increase in machines and the retirement of debts as soon as they appear.

Instead, more machines = more debt, everyone is suffocated by it. Industries are bits of theater offered by tycoons to meet the demands of fashion; collateral for rounds of loans made largely to the tycoons — which now amount to the tens of trillions of dollars and other currencies. The loans are the source of the productivity that is generally attributed to the machines: all productivity — and real production — comes from finance.

This is why the banks have gained ascendency over all of us. No loans = no industry or industrial ‘productivity’. When you defend industrial productivity you are defending something that does not exist.

What matters RE the productivity of labor relative to the so-called productivity of machines … machines are property, they are collateral, non-slave labor by itself is not. As an employee, your boss cannot borrow against you; after all, you might quit tomorrow! He can only borrow from you, which he does, and from others like you, enough to bankrupt entire countries. It is your obligation … not the bosses’ … to repay the tycoons’ immense debts!

Meanwhile, the mad machines run on devouring capital, once gone it is gone forever leaving nothing but ruin. That is the endgame of industrial so-called productivity: replacement of non-renewable resources with landfills and poison in the air and water.

@ Yves:

That doesn’t make sense because the ex-receptionist will still consume as much or more as he or she did while working at the one job and will do so until death … or economically destroyed as in Greece, Yemen, Syria … or dying Detroit, France, Portugal, Spain … to come Japan, China then the US.

The task of modern business is to package and sell waste as a product: this is about as anti-productive as it is possible to be! Businesses stop enabling consumption when they fail, not before. Given enough failures there is enough poverty to register in marketplaces as demand destruction. Right now, the only hope for your kids and theirs’ is more demand destruction and the onrush of poverty, for people to become too broke to participate in the current self-annihilating regime.

Steve,

With all due respect, have you ever worked for a big corporation or been within hailing distance of a cost cutting study?

You do NOT need replacement by machines to enhance productivity. The Japanese did it all the time through the process called kaizen. A lot of it consisted of getting rid of worker and managerial activities that were extraneous. For instance, did implementing just in time inventories require an investment in machinery? No, it required (for the most part) changing PROCEDURES.

Similarly, if you’ve had any contact with corporate America, a lot of the labor cost cutting has simply come about, literally, by getting rid of jobs and allocating THE SAME WORK to remaining employees. You have, say, 8 people doing the work formerly done by 10. That is achieved by having them work more intently (fewer breaks, less banter), figuring out themselves how to work smarter (with the threat that if they can’t get the extra work done, they’ll be fired), and effectively forcing them to work more hours for the same pay.

Bingo. Much of what people assume results from capital is the profuct of better procedure and organization.

Those things are also “technology”, but as a society we seem to only asociate that term with hardware and software.

Sorry for the typos.

Yves, you confuse Kaizen with BPR. The Kaizen method is Japanese management concept for incremental (gradual, continuous) change (improvement). K. is actually a way of life philosophy, assuming that every aspect of our life deserves to be constantly improved. Key elements of Kaizen are quality, effort, involvement of all employees, willingness to change, and communication.

Japanese companies distinguish between innovation (radical) and Kaizen (continuous). K. means literally: change (kai) to become good (zen).

The foundation of the Kaizen method consists of 5 founding elements:

1. teamwork,

2. personal discipline,

3. improved morale,

4. quality circles, and

5. suggestions for improvement.

Out of this foundation three key factors in K. arise:

– elimination of waste (muda) and inefficiency

– the Kaizen five-S framework for good housekeeping

1. Seiri – tidiness

2. Seiton – orderliness

3. Seiso – cleanliness

4. Seiketsu – standardized clean-up

5. Shitsuke – discipline

– standardization.

It is clear that it fits well in incremental change situations that require long-term change and in collective cultures. More individual cultures that are more focused on short-term success are often more conducive to concepts such as Business Process Re-engineering.

When Kaizen is compared to BPR is it clear the K. philosophy is more people-oriented, more easy to implement, requires long-term discipline. BPR on the other hand is harder, technology-oriented, enables radical change but requires major change management skills

The Just In Time implementation is not Kaizen, it’s most definitely BPR. One of the principal disadvantage of managing a just-in-time inventory system is that it requires significant coordination between retailers and suppliers in the distribution channel. Retailers often put major trust in suppliers by syncing their computer systems with suppliers so they can more directly monitor inventory levels at stores or in distribution centers to initiate rapid response to low stock levels. This usually means build up of technology infrastructure, and human resources which is very, very costly (ask SAP or Oracle). This coordinated effort is more involving on the whole than less time intensive inventory management systems.

lost for words. again eh, Susan? Truth sucks at your age eh?

A little off topic, but that chart showing wages so far below productivity demonstrates one big reason why creating money a la MMT would not lead to inflation.

Balderdash!

Every dollar has a connection, which transcends space and time, with every other dollar in existence. If government creates a single bill, it will instantly communicate its status to all the other dollars and they will immediately devalue themselves.

Because all inflation is monetary, even violating the physical laws of the universe to make it happen!

The only thing that is growing, is the need for accounting the abstraction of fictitious capital and the wealth it putatively represents. Since most of humanity has solve the animal problem of survival, food, shelter and security, to live beyond that ripe old age of 30, the social constructs presented as the social order have been run through a progressive array of arrangements, all of which eventually end. Nothing grows interminably. Human beings stop growing, plants stop growing, eventually, the sun will go cold. You get the point. Only in the abstracted mindset of capitalism does life go on for ever and ever, world without end amen. Well, the world does end. Everything ends. Except the high esteem capitalism holds itself in.

Getting more from less, productivity gains, is not getting more from nothing, it is getting more from less labor costs. And labor costs are always higher and demanding, because labor is composed of reasonably intelligent people who sooner rather than later come to the conclusion that they are the source of what is produced and that they want more from the existing arrangement which seems to benefit certain people handsomely, others less so. Productivity is thinning the ranks of the herd, it is getting more milk from fewer cows, more bang for less buck but at some point getting more from less inevitably leads to simply getting less from less. Just as getting less from more and more, simply throwing money at a problem, but not solving the problem is counter productive, the threshold has been crossed where austerity gives you gains. Now, more than ever, less just gets you less and at some point, it will get you nothing at all.

“So, generally speaking, you reduce resource demands.”

You have an interesting idea there. Interesting because while that may work in one-off cases, every graph I’ve ever seen of resources from the past century shows a general exponential ramp up in extraction and use–in other words increases in efficiency are leading to increases in resource use. Curiously some economists developed a theory of this phenomena: http://en.wikipedia.org/wiki/Jevons_paradox

Alan Nasser’s (Links 5/8/13) article (http://www.counterpunch.org/2013/05/03/the-economics-of-over-ripe-capitalism/) resolves Jevon’s Paradox in historical context. The grand quote at the end from Keynes (Economic Possibilities For Our Grandchildren) brought to mind (in contrast) that intellectual pipsqueak Niall Ferguson. Nasser also has an enlightening interview on the Student Debt Bubble in Z Magazine. (http://www.alannasser.org/interviews/student_debt_bubble.html)

Yves,

And on the high end of the food chain, people that I know who are still on the corporate meal ticket are doing what would have been 1.5 to 2 jobs ten years ago.

is a spot on observation. I’m one of them — fewer people doing more work is the norm — and means that there are more hours in the day to work (the ubiquity of “checking email/having a call” after dinner or the never-ending ping of a new email that needs to be looked at).

The pernicious side-effect of this is that while staff are very productive, most organizations (and I’ve been in 3 large ones in the last 10 years) have zero/zip/nada bench strength. Someone leaves and there’s a mad scramble to find a replacement who can do exactly what was being done before and with the same level of proficiency (very little up-the-learning-curve permitted)

More importantly is that these jobs require a HUGE amount of experience so there are few if any opportunities for newcomers (either fresh out of school or new to an industry/profession) to enter to get the experience necessary.

Certainly in my career (and more than once) somebody looked at my skills and decided to “take a chance” to give me that first opportunity. Those “chances” are few and far between today.

The increase in productivity from micro processors only go as far as taking out extraneous wait time from work. Since sheer horsepower/capacity of the devices and storage now have made the human reaction the slowest part of any work process, there is very little productivity increase unless one takes out the human from the task.

In the meantime wage earners have been robbed of their share of productivity gains being fooled by income tax decreases masquerading as wage increases and the ability to buy cheap stuff.

You can only squeeze so much blood out of stone.

When an entity can take $1000.00 & create $10,000 out of thin air without a printing press,could we be living in a giant ponzi scheme?

The reality in 2008 was that many in the banking world were at 30 to 1 or $30,000.00 for that initial $1K of leverage.

And that is before you start talking about the leverage of derivatives.

Gawd only knows the real accounting of and machinations of the global inherited rich and their puppets in FIRE and the world’s governments. It is all kabuki to maintain control over the masses by those elite, some of who have been at the top for centuries.

KOCH BROTHERS

They may bid to obtain the Bankrupt Chicago Tribune for,, to them, a measly $625 Million.

They would then spread their Libertarian Views via Chicago Tribune, Los Angeles Times, Baltimore Sun and Orlando Sentinel.

They have already done long term damage for the Middle Class by financing the election of 50 Tea Party members to the House to Cut Government for the middle class -Cut taxes for the rich.

On the Jevons Paradox, see this challenging view from the left: “The Denialism of Progressive Environmentalists” ( http://monthlyreview.org/2012/06/01/the-denialism-of-progressive-environmentalists ).

I prefer the term “hollowed out” to “played out.” Things die for lots of reasons.

America is dying because FIRE sector parasites are eating her guts. The last thing to go will be the military, then comes the land rush for all this beautiful real estate.

So productivity is lagging. This is news? 5 years ago Stiglitz explained how productivity eats its own lunch. Which everyone has always known but prefers to deny. But suddenly everyone has realized that if we do not change the way we respond we’re screwed. That’s probably good. And look what Elizabeth Warren is doing. She’s dashing to the podium to help out the exhausted banks with all those defaulting student loans, or more clearly stated, she’s dashing to the podium with a bill to lower student loan interest. Isn’t she wonderful? Why isn’t she writing a bill for a jobs program for unemployed graduates? That’s because no capitalist can figure out how to make labor productive any more. Warren Mosler adds another piece to the puzzle of Liz’s extreme excitement by explaining that student loans have been about the only thing pulling this current “economy” forward. This is productive?

Yes, but rather than a bill to lower loan interest and save the banks from themselves, as Warren is doing, the banks would prefer a bill requiring those defaulting on student loans to sell their tender young organs to pay back the loans and the interest.

This “productivity” red herring is happening simultaneously with a demand by corporations and their representatives for more immigration reform. So corporations can hire directly from oversees and bring ’em all here and etc. It’s mind boggling.

“But productivity-driven growth does not have that character. It means your are producing the same goods and services with less labor input. So if you replace your receptionist with a phone prompt system, you don’t have to have as much office space, you can get rid of the electricity and equipment once used to support him, the receptionist does not consume gas going to and from work, and so on. So, generally speaking, you reduce resource demands.”

so quite predictably (how could it be otherwise)

“It also can’t be stressed enough that the unprecedentedly high corporate profits we’ve seen are the direct result of businesses hogging the benefit of productivity gains for themselves.”

this was the whole purpose the neoliberal coup, wrecking the economy and the culture for the past 40 years. Well they got everything that wanted and more and now “productivity”, even the regressive, backwards kind of “growth” you get from crushing the labor force, is “flagging”…the next step is the return of chattel slavery (already underway via the private prison industry)

How accurately are the inputs and outputs measured for this term ‘productivity growth’? At its simplest defionition, productivity is the ratio of output to input. Does it account for the offshoring/transfer pricing effects. I do seem to recall the-great-Greenspan mentioning that productivity measures might not account for the trend toward outsourcing.

How would this be significant? It would be easier to game the productivity numbers. American companies transfer most of their work to offshore conbtractors or offshore subsidiaries. They fire the majority of their domestic manfacturing and engineering professionals. They close manufacturing sites and now do not have to comply with environmental or health and safety regulation (substantially lowering input operating cost). They buy and assemble parts from offshore, either from contracotr or subsidiary, purchased at a fraction of the previous cost, and sell the product(usually inferior quality) for a slightly lower price in the USA. As an aside, the financial sector provides the critical service of extending debt to the now less-well-employed (on the aggregate) citizenry), so that they can keep on buying despite the loss of good jobs. The cheaper prices does encourage some hoarding by consummers, so sales revenue might rise slightly, even as unit prices decline slightly. Presto, revenues stay the same (or decline slightly), cost goes down, and productivity metric goes up. Executinve bonuses are paid out, and the middleclass and lowerclass citizens go into debt.

I wonder what is the make-up of made-in-USA exports are now? I am sure in the 1980’s the US was a much more formidable industrial power, with a much broader range of exports and expertise, that what it exports now. (Probably videogames, movies, pornograghy, guns and butter).

We really still are a “nation of slavers, smugglers and fanatics.” Enslavement of labor and taxation without representation for the lower classes. An elaborate trading scheme to avoid taxes and eliminate risk to “capital investment.” And the seat of government occupied by irrational, greedy, pretentious law makers.

Machines don’t just increase productivity, they can also reduce back-breaking work that needs doing. They tend to reduce skill, making workers who can do the work less scarce (we once paid an 11% supplement for left-handed welders in my shipyard). In productivity terms, one runs the machine on the basis of strategic/tactical work under something like total productivity maintenance (TPM). The ideal is to have the machine running 100% 24/7/365 on the most profitable work possible – though in reality there are many considerations.

Just in time is essentially inventory management to do with the value chain – making profit faster than costs accrue. The essential move is an accounting one in restricting inventory to a minimum and hence any borrowing costs on stuff being processed. In manufacturing JIT usually means more machines and IT to track material on its way to and through the factory.

A key productivity increase comes through the experience curve – we get better organised through practice and there are many ways to augment this – whatever we call them they are all essentially union-bashing and getting the work done with less people in less time and with less skill or more embodied skill (skill in the machines, IT etc).

Modern HR likes to think of productivity in terms of profit per employee. Of course, one can spreadsheet costs, do all sorts of analysis to cut out waste, do market segmentation and all the rest to maximise returns (which isn’t efficient in the sense of taking money from the system by ‘overcharging’ when possible). Part of the trick is externalising as much as possible from the firm’s P & L and stealing tax credits and tax generally through transfer pricing offshore and exploiting infrastructure including health infrastructure, education and pensions – contributing as little as possible.

This is not really productivity at all – and no one who has done hard work in rotten conditions thinks working harder is a good thing. This is Domesday Book productivity prepared to break backs, relocate people and exclude many as ‘waste’ or an impoverished reserve army pour encourage les autres.

I reckon, as an academic, I could produce most non-science taught programmes for around £2K a year – against about £12K costs plus living expenses in the current system. I’m confident students could get more attention and better learning resources for my fee. This is happening slowly, but there is huge resistance – more than the Luddites ever put up. Underlying structures have changed and we still seem to fondly imagine productivity/efficiency will continue in a system efficient at producing new jobs to take up displaced labour. A system that can’t even provide jobs for our graduates! In this system it is more productive to have many people under-employed, unemployed, doing silly jobs like selling us fraudulent finance and so on than to produce against what we need to have a decent society. Economics remains the weird ideology of the rich and against the production of reasonably happy people living without want.

Even on spreadsheets we use one can see much ‘productivity’ is gained by paying lower wages, robbing and not providing pensions – a tragedy of the commons. Yves’ analysis feels right to me – satellite television channels seem a good example – they are hitech but inexpensive to run with dire repeats and telesales. The opportunity is there for a university of the air, weird market segments of people like me who want truthful news, no schmaltz, foreign films and series – but we get the easy business plan of 57 channels and nothing to watch.

Technology is always about machines and people and broadly its the combination that affects productivity and business decisions. The lecture could have disappeared 20 years ago and replaced by interactive electronic productions – of course, the lecture is very productive in keeping our professors in tenure. The wizards (crooks) running our HEIs have done little with technology and whatever they can to reduce staff costs – experienced real-world people for young PhDs etc.

We miss the real point in economics – we approach robot heaven and are doing nothing to change our ideologies and the ready-to-hand calculations of economics and business practice. Managers are now paid huge amounts. There is generally no evidence they are any good. One has to wonder if they are there to prevent real productivity – the emergence of a global high wage world democracy.

It’s important to remember that labor was being squeezed to enhance economic growth through excess money creation. By keeping wages stagnate it put a brake on inflation as the money supply outgrew the economy’s productive capacity. This dynamic provided our policy makers with an incentive to foster inflationary cycles to promote economic growth. This was largely what happened during Greenspan’s tenure at the Federal Reserve. As Yves noted, by doing this it forced workers to become more productive in terms of efficiency, increased work loads, and so on. Of course this growth strategy required consumers to pay higher prices in terms of wage hours worked for their goods. In neoliberal literature (propaganda) this predicament was solved through globalization and off-shoring. Thereby creating a influx of cheaper goods into the market.

Now it’s becoming obvious that this growth strategy isn’t working in the long term. With the Fed presently unable to hit it’s inflation targets. Even though it is rapidly expanding credit through it’s money printing. It’s increasingly desperate efforts are proving to be more than futile, since it’s efforts appear to be contributing to the speculative excess of the markets. These factors reinforce President Hoover’s expressed skepticism over the Fed’s ability to stimulate the economy;

“Under non-boom conditions, however, the public was not disposed to take advantage of the increased credit. Again one part of the theory upon which the Reserve System was founded was tested—the idea that business could be activated during depression by Federal Reserve credit expansion and lower discount rates. Subsequent events showed it had little effect in that direction. Credit expansion certainly proved to be an effective method of promoting a speculative boom when people were optimistic. But when they were pessimistic, it had no effect whatsoever.”

Under Chairman Meyer the Fed initiated a program of large scale purchase of bonds on the open market. Which over a matter of years had a diminished effect on the economy. This should sound familiar to any individual paying attention to Bernanke’s present actions. Ultimately the Fed took a backseat to the Treasury during the depression as it realized the limitations of monetary policy.

The money printing and increased unemployment should be having a positive effect on productivity. Instead we’re seeing a slowdown in productivity that heralds another round of economic contraction. It’s anybody guess when this will catch up with the stock market. (Though my guess is sometime in the autumn, ’cause that’s why we call it fall. Har, har!)

Empire Distribution

This is what no one wants to hear, but I am telling you anyway:

There are non-conforming, self-destructive law breakers; several classes of conformers, subject to rewards and penalties by choice, linked in slave/master relationships; their chosen directors; and socially non-conforming, law abiding, developers. From the perspective of labor, the latter, the directors are eunuchs, beholding to legacy females, none of whom have any clue how an economy actually functions, except to behave in a manner that preserves the status quo, for as long as possible.

An empire, whether socialist, communist or capitalist, is a herd, subject to mob rule, which is fine, only so long as there are easily exploitable resources to ensure acceleration of demographic replication, that there is a revolving door of scapegoats and future generations to pay the bill. At the end of the cycle, the empire cannot get anyone to pay the bill, hence the viral growth and collapse of the financial sector, along with its dependent economies.

Digital accounting credits are not cash. They are debt. The corporations are hoarding debt. Beware; labor never maintains its investments within an empire’s reach. Labor ignores capital thievery so long as system gravity is useful, to fuel up.

No change may be initiated within an empire, but change occurs at quantum intervals, accordingly. The fact is we need a 20 hour workweek, we need to allow each other to raise our own children, and we need to group into communities by tradable surplus. Grouping to address deficits only accelerates deficits, which are sunk costs, gravity.

But you go ahead and prove me wrong.

Firms have also gone flexible – perhaps hoarding core labour,keeping numbers to a minimum and productivity at maximum. Expansion is only temporary to meet tactical orders. This is unlikely to cause much expansion in long-term jobs with good conditions (which involve considerable on-costs for the firm).

There is another type of economy which typically does not invest heavily in labour productivity boosting technology or operational evolution: the plantation labour/ slave labour economy. Why invest when labour comes so cheap.

Bangladesh comes to mind….

CHANGE COURSE

1945-1980 democrats worked hard in creating a successful middle class

that had jobs that paid enough to afford a nice home,

Health Care and Education for children.

Since 1980, it has been decades of loading them with debt in order to afford a middle class life style. Since 1980, the top 1% had an 281% after Tax income increase and middle 20% got 25% which was less than. Inflation. The wealthy had the money to loan and took advantage of it.

The Outsourcing of our Manufacturing Industries was biggest sham and hit on the middle class and decent paying jobs.

The Tax Code was loaded with goodies for the rich and corporations

There is a series of Solutions to reverse course before we go over that cliff.

Progressive Flat Tax by Group. Tax Total Income not AGI with the loads of exemptions

Assure a progressive Flat Tax that will balance our budget and start paying down that horrid Republican created Debt of $15,800 Billion

Fed fund campaigns and election—6 months—3 primary 3 general—free equal tv time—No personal or outside money. Debate a week=12-=adequate to evaluate candidates

Since no need to raise campaign funds keep em on job not on road.

Ban ALL federal employees from accepting anything with a financial value.

This closes K Street Bribery.

It give middle class a chance to win an election since they cannot be bought.

Burn the tax book—It gets enough revenue $1300B that immediately balances our budget.

Start anew—Exemptions must serve a common good not fat wallets

clarence swinney burlington nc