One of the reasons I haven’t weighed in with the obligatory Lehman five year anniversary piece is that so many of them are variations on a limited range of themes, to wit:

The Horror of the Meltdown

Hagiography (and Revisionist History) of the Great Men Who (Allegedly) Saved Us from the Horrors of the Meltdown

Revisionist History on Behalf of Various Parties Who Let the Perps Get Away with Wrecking the Economy for Fun and Profit

How Nothing Much Was Fixed

How/Why All Those Smart People Didn’t See It Coming

Mind you, we’ve been getting a steady diet of these types of stories for years, so a concentrated dose, particularly for someone like yours truly, who was pretty attentive to the events in real time and all the flailing around to deal with the upheaval and engage in reregulation theater, is cloying.

And aside from all this rehash feeling more like an overdose of tired tropes than new insight, the focus on what has come to be known as Lehman weekend is also the most bankster-flattering frame for viewing the crisis. Making Lehman the critical episode averts attention the fact that the perturbations began more than a full year earlier, when the asset-backed commercial paper market seized up, and went through two additional acute phases, each requiring more radical interventions before the turmoil of September-October 2008. It also puts the spotlight on the collapse of Lehman itself, the loss of the next domino, AIG, and the political and market mayhem of the next few weeks to prevent further wreckage.

If I were a propagandist, I’d want the public to equate the crisis with the Lehman implosion. The Lehman death spiral is strongly identified with the Andrew Ross Sorkin “great men struggling to save the world economy” version of events, as well as the “could/should Lehman have been saved?” debate. It also takes attention away from the bigger questions of how much the crisis really cost, and how the Obama Administration and the Fed continued to subsidize the banks even while pretending that the crisis was past and everything was fine (ZIRP and QE, which are taxes on savers and retirees, the continuing foreclosure/mortgage mess, which was acknowledged in Geithner’s infamous “foaming the runway” comment to be all about sacrificing homeowners for the benefit of bank balance sheets). Perhaps the ugliest part of this picture is that the officialdom believes its own PR, that a zombified economy with broadly-measured unemployment in the mid-teens and years of a desperately difficult job market for young adults is a good outcome and they can rest on their laurels.

This year, the Lehman meltdown anniversary has brought out some new variants on old post-crisis themes. The add-on to the “Great Men Who Saved Us From the Meltdown” account is to contend that their efforts were successful when viewed over a longer time frame. An example is New York Magazine’s Yes, Wall Street Has Changed Since Lehman Went Bust. Let’s look at one of its arguments:

Complaint: Nobody on Wall Street has been punished for what happened.…

[I]t’s true that the Jimmy Caynes and Dick Fulds of the world are free men, and that this fact is emotionally grating….

The truth is, the big banks have been punished for the crisis in the way that hurts them much more than jail time: on their balance sheets. They’ve spent a staggering $103 billion on lawsuits stemming from the crisis (more than their entire 2012 profits, Bloomberg notes), traded below their book values, and seen their returns on equity (a core measure of profitability) plummet so low that bankers are worried that investors will give up on them.

Huh? This obtusely misses the issue. Who gets hurt by this litigation? Not the responsible parties, the bank executives and producers, but bank shareholders.

In addition, the legal costs he cites are all legal costs since the crisis, not all legal costs that resulted from the crisis. Recall that Josh Rosner developed a rap sheet as long as an arm for JP Morgan. Here is his list of of the matters underlying this $8.5 billion of regulatory settlements:

Bank Secrecy Act violations;

Money laundering for drug cartels;

Violations of sanction orders against Cuba, Iran, Sudan, and former Liberian strongman Charles Taylor;

Violations related to the Vatican Bank scandal (get on this, Pope Francis!);

Violations of the Commodities Exchange Act;

Failure to segregate customer funds (including one CFTC case where the bank failed to segregate $725 million of its own money from a $9.6 billion account) in the US and UK;

Knowingly executing fictitious trades where the customer, with full knowledge of the bank, was on both sides of the deal;

Various SEC enforcement actions for misrepresentations of CDOs and mortgage-backed securities;

The AG settlement on foreclosure fraud;

The OCC settlement on foreclosure fraud;

Violations of the Servicemembers Civil Relief Act;

Illegal flood insurance commissions;

Fraudulent sale of unregistered securities;

Auto-finance ripoffs;

Illegal increases of overdraft penalties;

Violations of federal ERISA laws as well as those of the state of New York;

Municipal bond market manipulations and acts of bid-rigging, including violations of the Sherman Anti-Trust Act;

Filing of unverified affidavits for credit card debt collections (“as a result of internal control failures that sound eerily similar to the industry’s mortgage servicing failures and foreclosure abuses”);

Energy market manipulation that triggered FERC lawsuits;

“Artificial market making” at Japanese affiliates;

Shifting trading losses on a currency trade to a customer account;

Fraudulent sales of derivatives to the city of Milan, Italy;

Obstruction of justice (including refusing the release of documents in the Bernie Madoff case as well as the case of Peregrine Financial).

Mind you, most of the ones that resulted in large dollar amounts likely resulted from the filing of litigation. Also note this list and thus the $8.5 billion total excludes payouts made by JP Morgan resulting from private lawsuits, like the $50 million awarded to billionaire Len Blavatnik because the bank lost $100 million of his money as a result of violated its guidelines for investing funds in a low-risk cash management vehicle. Finally, that total is the amount of regulatory settlements only and does not include JP Morgan’s legal costs.

Now admittedly JP Morgan has the most extreme skew of all the major banks in terms of how much bad conduct it has engaged in outside the mortgage arena. Nevertheless, you get the picture that calling all the legal costs that banks have incurred since the crisis as crisis-related is just plain misleading.

Finally, in many (likely nearly all) cases, the damages would be tax deductible, and third-party legal expenses certainly would be. So comparing these largely pre-tax charges to after-tax dividends is yet another bit of misdirection.

Let’s now turn to the stories you should be reading but from what I can tell, aren’t:

The Media and Pundits Are Wrong When They Call the Crisis a “Housing Crisis”. Repeat after me: it wasn’t a “housing crisis.” A “housing crisis” would still have been ugly, but it would not have produced a meteor-hitting-the-planet level of disruption to the markets. Look, subprime was a $1.3 trillion market. Losses were roughly 40%. That crisis would have produced a really serious recession, but not a financial system near- death experience.*

This was an “wildly interconnected and undercapitalized big financial firms got high on CDOs and other leveraged bets on housing and killed themselves and got turned into zombies” crisis. CDOs and credit default swaps allowed banks, monolines, and AIG to wind up with exposures way way in excess of the real economy value of subprime lending.

How Gillian Tett Ran Rings Around All the Financial Regulators in the Runup to the Crisis. There’s been some effort in recent years to single out economists like William White, Claudio Borio, and Steven Keen, who warned that the bubbles underway were likely to end badly. But the commentators warned about the uniquely destructive feature of this crisis, the amplification of real economy exposures, haven’t gotten the kudos they deserve. The Financial Times’ Tett and an astonishing analyst named Henry Maxey were among the few that wrote about how the leverage-on-leverage created by CDOs prior to the crisis and their potential explosive impact. The regulator that was closest to having a good real time reading (as in had many of the critical details and risks right but didn’t appreciate the key mechanisms till later) was the Bank of England in its terrific semi-annual Financial Stability Reports. Tett has been indirectly acknowledged with her star turns (the most notable in Charles Ferguson’s Oscar-award-winning Inside Job) but more formal recognition of the significance of her pre-crisis work is way past due.

Simon Johnson Was Right, Dammmit, and the Looting Continues. While many of the accounts of the last few days discuss regulatory reform and generally conclude not enough was done, few will take that sorry fact to its logical conclusion, namely, that the financial services industry is still predatory and parasitic.

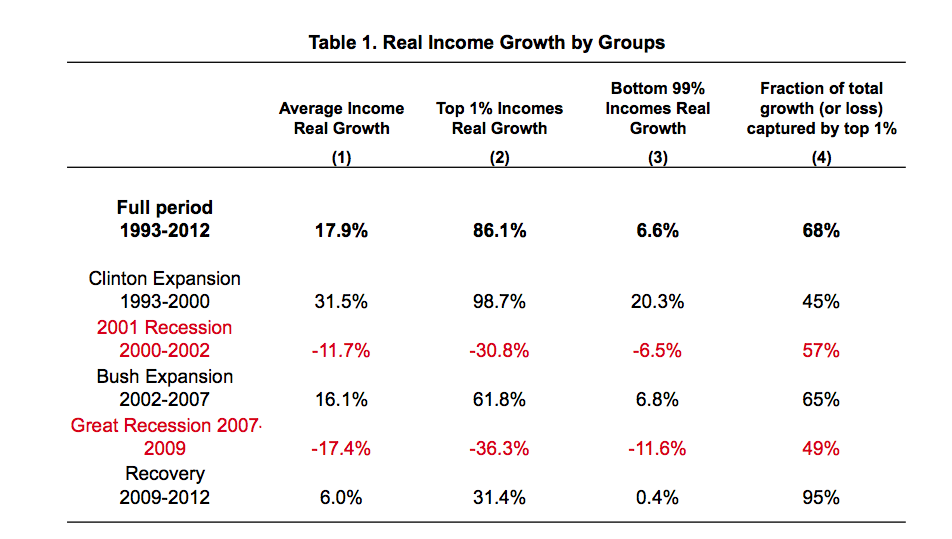

Simon Johnson, in May 2009, described the crisis as a “quiet coup” that cemented the control of financial oligarchs. The resolution of the crisis has left them even more deeply entrenched. Not only did they come out richer from the “blow up the economy for fun and profit” exercise (Wall Street bonuses in 2009 and 2010 were higher than record 2007 levels), but the rescues also placated the monied classes by goosing asset values and accelerating the redistribution of income away from ordinary people to the 0.1% and their bag-carriers. Emmanuel Saez, who with his regular co-author Thomas Piketty is generally recognized as the most authoritative expert on income and wealth inequality in the US, just released his latest update last week. It’s clear who benefitted from how the crisis was resolved:

Big Finance Could Have Been Reformed and Obama is the Reason it Wasn’t. The resigned “the banks were too powerful” meme is convenient and completely untrue. We wrote in 2010:

Recall how we got here. Early in 2009, the banking industry was on the ropes. Both the stock and the credit default swaps markets said that many of the big players were at serious risk of failure. Commentators debated whether to nationalize Citibank, Bank of America, and other large, floundering institutions.

The case for bold action was sound. The history of financial crises showed that the least costly approach is to resolve mortally wounded organizations, install new management, set strict guidelines, and separate out the bad loans and investments in order to restructure and sell them…

The widespread, vocal opposition to the TARP was evidence that a once complacent populace had been roused. Reform, if proposed with energy and confidence, wasn’t a risk; not only was it badly needed, it was just what voters wanted.

But incoming president Obama failed to act. Whether he failed to see the opportunity, didn’t understand it, or was simply not interested is moot. Rather than bring vested banking interests to heel, the Obama administration instead chose to reconstitute, as much as possible, the very same industry whose reckless pursuit of profit had thrown the world economy off the cliff. There would be no Nixon goes to China moment from the architects of the policies that created the crisis, namely Treasury Secretary Timothy Geithner, Federal Reserve Chairman Ben Bernanke, and Director of the National Economic Council Larry Summers.

Now that we’ve had more commentary from insiders like Sheila Bair and Neil Barofsky, it’s clear that Obama, who whipped for the TARP and has finance Machiavel Bob Rubin as one of his major sponsors, was never going to do anything that might inconvenience Big Finance. One of the most important measures to rein in banks would have been to restructure Citigroup, to demonstrate that persistently reckless institutions (Citi nearly failed in the early 1990s and had gotten in deep doo-doo in the Latin American lending crisis of the late 1970s) would be cut down to a less dangerous size. But that would never happen with Rubin as a Citi board member.

Had Obama been serious about banking reform, it would have been possible to get the other major actors on the same page. The Bank of England has been keen to fix banks; Mervyn King and Andrew Haldane, along with Adair Turner at the FSA, have been fierce critics (you’ve heard nothing remotely comparable from US regulators) and fought to get a version of Glass Steagall implemented. Had the US been leashing and collaring its financial firms, the Bank of England and FSA would have has more success in beating back opposition from the UK Treasury, which has been a stalwart bank defender. And the ECB? Remember how it needed US dollar swap lines in a pinch to save its financial institutions? The ECB might have grumbled a lot, but with the top regulators in the two major financial centers taking a tough stance, it would have fallen in line.

But this section of ECONNED, published in early 2010, not only recaps the crisis but anticipates where we are now. And it’s disappointing to see that there really is not much to add:

It is easy to be overwhelmed by the vast panorama of financial instruments and strategies that have grown up (and blown up), in recent years. But the complexity of these transactions and securities are all part of a relentless trend: towards greater and greater leverage, and greater opacity.

The dirty secret of the credit crisis is that the relentless pursuit of “innovation” meant there was virtually no equity, no cushion for losses anywhere behind the massive creation of risky debt. Arcane, illiquid securities were rated super-duper AAA, and with their true risks misunderstood and masked, required only minuscule reserves. Their illiquidity and complexity also meant their accounting value could be finessed. The same instruments, their intricacies overlooked, would soon become raw material for more leverage as they became accepted as collateral for further borrowing, whether via commercial paper or repos.

But even then, the bankers still needed real assets, real borrowers. Investment bankers screamed at mortgage lenders to find them more product, and still, it was not enough.

But credit default swaps solved this problem. Once CDS on low-grade subprime was sufficiently liquid, synthetic borrowers could stand in the place of subprime borrowers, paying when the borrowers paid, and winning a reward when real borrowers could pay no longer. The buyers of CDS were synthetic borrowers that made synthetic CDOs possible. With CDS, supply was no longer bound by earthly constraints on the number of subprime borrowers, but could ascend skyward, as long as there were short sellers willing to be synthetic borrowers and insurers who, tempted by fees, would volunteer to be synthetic lenders, standing atop their own edifice of risks, oblivious to its precariousness.

Institution after institution was bled dry. Yet economists and central bankers applauded the wondrous innovations, seeing increased liquidity and more efficient loan intermedation, ignoring the unhealthy condition of the industry.

The firms that had been silently drained of capital and tied together in shadowy counterparty links teetered, fell, and looked certain to perish. There was one last capital reserve to tap, U.S. taxpayers, to revive the financial system and make the innovators whole. Widespread anger turned into sullen resignation as the public realized its opposition to the looting was futile.

The authorities now claim they will find ways to solve the problems of opacity, leverage, and moral hazard.

But opacity, leverage, and moral hazard are not accidental byproducts of otherwise salutary innovations; they are the direct intent of the innovations. No one at the major capital markets firms was celebrated for creating markets to connect borrowers and savers transparently and with low risk. After all, efficient markets produce minimal profits. They were instead rewarded for making sure no one, the regulators, the press, the community at large, could see and understand what they were doing.

Magnetar and its imitators made unbelievable profits by finding a nexus of spectacular leverage, eager demand, and camouflaged risks. Whether you like the results or not, their novel use of an arcane instrument was exceptionally clever. If the world had been spared their cunning, the insanity of 2006-2007 would have been less extreme and the unwinding milder. But the hedge funds were not the only ones who fed this strategy: the other institutions who carried out the same correlation trade strategy and European bank staff padding their pockets with negative basis trades are just as culpable.

Viewing the underlying problem as one of bubbles misses the true dynamic. When borrowed funds to pump up asset values, the unwind damages financial intermediaries, and that has far more serious repercussions than the loss of paper wealth alone. Leverage offers a strategic point at which regulators can intervene. Regulators can tackle debt levels surgically by barring certain types of instruments and practices. But this effort can take place only if authorities do not cede control of the financial system to the inmates. Unfortunately, to a large degree, that has already happened.

The reason that so many words continue to be spilled on the crisis with so little fresh insight is that most pundits are unwilling to describe the degree to which it enabled the bankers to cement their control, and how much that sorry fact is costing the rest of us.

_____

* It’s almost quaint to compare the scale of interventions in global-financial crisis to that of our last banking blowup, the savings & loan crisis, in which Congress was really unhappy to for having to advance $50 billion in working capital to fund the balance sheet of the Resolution Trust Corporation (oh, and Alan Greenspan engineered a really steep yield curve for a few years to help banks rebuild their balance sheets).

“Bank Secrecy Act violations;

Money laundering for drug cartels;

Violations of sanction orders against Cuba, Iran, Sudan, and former Liberian strongman Charles Taylor;

Violations related to the Vatican Bank scandal (get on this, Pope Francis!);

Violations of the Commodities Exchange Act”

and on, and on, and on…

I’m not going to list all the crimes cause I would break the internet.

But this is what passes for thinking in our government now – WE HAVE TO SAVE THE BANKS…EXACTLY AS THEY ARE IN THEIR CORRUPT CRIMINAL STATE

incredible…

three administrations supported by both parties supported the following:

Collateral back up for mortgages shifted from historical 3-1 to 50-1.

Banks could sell mortages ASAP

People were allowed to purchase a home with zero skin in the game.

all congressional and presidential leaders have now been re elected. None thrown in Jail?

“The bankers struggled to make themselves clear to the president of the United States.

Arrayed around a long mahogany table in the White House state dining room last week, the CEOs of the most powerful financial institutions in the world offered several explanations for paying high salaries to their employees — and, by extension, to themselves.

“These are complicated companies,” one CEO said. Offered another: “We’re competing for talent on an international market.”

But President Barack Obama wasn’t in a mood to hear them out. He stopped the conversation and offered a blunt reminder of the public’s reaction to such explanations. “Be careful how you make those statements, gentlemen. The public isn’t buying that.”

“My administration,” the president added, “is the only thing between you and the pitchforks.””

http://www.politico.com/news/stories/0409/20871.html

“The titans of finance…sized up a new president who made clear in ways big and small that he expected them to change their ways.”

“The signal from Obama’s body language and demeanor was, ‘I’m the president, and you’re not.’”

Re-reading these media bloviations some 4 1/2 years later — not to mention in light of the almost total failure of this administration in the past few weeks on nearly every front — can make you appreciate what a free ride Obama had been given by the adoring press, especially in His early days in office.

History, I suspect, will not be so kind.

Awesome catch!

“Be careful how you make those statements, gentlemen. The public isn’t buying that.”

I think what is most implicit in this statement is that “the public” isn’t buying it, but president Obama was… hook, line, and sinker.

“Betrayal Politics” has certainly been around since primates. George Orwell’s “Animal Farm” catches the flavor of it. Human civilization seems to be a record of how we progress in guarding against it. We invent a technology like money which is a double-edged sword in this respect. Only in this last century are a few (MMT) beginning to get some measure of how we can best use it without screwing up our economies on a repeated basis although this clearly has to be allied to procedural fairness in the application of capitalism accompanied by campaign finance reform.

Here’s what I was looking for:

…Ron Suskind tells a remarkable story from March 2009. Three months into Barack Obama’s supposedly progressive, left-leaning presidency, popular anger at Wall Street was intense and the nation’s leading financial institutions were weak and on the defensive in the wake of the financial collapse and recession they had created.

The new president called a meeting of the nation’s top 13 financial executives at the White House. The banking titans came into the meeting full of dread. As Suskind notes: “They were the CEOs of the thirteen largest banking institutions in the United States…. And they were nervous in ways that these men are never nervous. Many would have had to reach back to their college days, or even grade school, to remember a moment when they felt this sort of lump-in-the-throat tension.

As some of the most successful men in the country, they weren’t used to being pariahs… [and] they were indeed pariahs. The populist backlash against the financial sector—building steadily since September—was finally beginning to cause grave discomfort on Wall Street. As unemployment ballooned and credit tightened, the country began to look inward, toward the origins of the panic and its disastrous consequences.

In the end, however, the frightened captains of high finance left the meeting pleased to learn that Obama was firmly in their camp. For instead of standing up for those who had been harmed most by the crisis—workers, minorities, and the poor—Obama sided unequivocally with those who had caused the meltdown. “My administration is the only thing between you and the pitchforks,” Obama said. “You guys have an acute public relations problem that’s turning into a political problem. And I want to help…I’m not here to go after you. I’m protecting you…. I’m going to shield you from congressional and public anger.”

For the banking elite who destroyed millions of jobs in their lust for profit, there was, as Suskind puts it, “Nothing to worry about. Whereas [President Franklin Delano] Roosevelt had [during the Great Depression] pushed for tough, viciously opposed reforms of Wall Street and famously said ‘I welcome their hate,’ Obama was saying ‘How can I help?’

As one leading banker told Suskind, “The sense of everyone after the meeting was relief. The president had us at a moment of real vulnerability. At that point, he could have ordered us to do just about anything and we would have rolled over. But he didn’t—he mostly wanted to help us out, to quell the mob.”

“When the bankers arrived in the State Dining Room, sitting under a portrait of a glowering Lincoln,” Suskind notes, “Obama had them scared and ready to do almost anything he said…. An hour later, they were upbeat, ready to fly home and commence business as usual”.

http://open.salon.com/blog/libbyliberalnyc/2013/06/11/paul_street_obamas_resume_of_betrayal/comment

TK421, thanks. This was Obama’s “Missed Opportunity”. The craven cowardice, vanity, and greed with which he acted is why he won’t go down in the history books as a Great President, but as the Tar Baby PuppetPrez.

The “First Black President” shall live “forever in infamy” and in ignominy. So, once again, the Elite can smirk: “Mission Accomplished.”

Obama was and is, as Paul Craig Roberts has noted, the “Fool of Fools” — the Fool of Fools for thirty pieces of silver from Massuh.

He has blown progress all to hell.

It makes me sick to read this. Obama had a rare opportunity in history, a room full of the rich megalomaniacs that controlled the world’s money, that normally would bow to nobody, on their knees. This was his opportunity to “create his legacy”, mark his place in history, and institute meaningful reform that could have healed the economy and changed the course of our nation. Instead, this will go down in history as his greatest failure, perhaps the single act that ensured America’s decline from first world nation status.

A squandered opportunity. And with nothing to offer the people Obama clings to his drones, his missiles, and his religion of American exceptionalism.

The question for me is, why? Obama is a prickly, petty, puffed-up sort of person on the inside (not talking persona)and he had the ability to have his way with these guys. Men like Obama love playing the tough guy. So why the violins?

My guess is that Obama was told that if these men decide to throw a monkey wrench into the financial system out of anger or spite, they’d sink Obama would be the new Hoover. And like Hoover Obama is an astonishingly limited thinker (funny thing is Hoover was even smarter than Obama, but he was also the soul of conventionality). Obama was so afraid to be blamed for something negative by the press, the pundits, and the money men that he just decided to roll over and give these “experts” (Obama being a big believer in experts) what they needed to “fix” the economy themselves. At last that’s how I read it.

Question: who pays $300,000 for a one-hour speech given by a former president?

Answer: Organizations funded by the men who were in that room.

Whereas [President Franklin Delano] Roosevelt had [during the Great Depression] pushed for tough, viciously opposed reforms of Wall Street and famously said ‘I welcome their hate,’ TK421

Nevertheless, FDR saved banking from itself with government deposit insurance. Less hate, more principle and justice, please.

As always , you slice ’em and dice ’em.

Thanks for this article.

No better re-cap of how utterly usurped our democracy has become to the interests of the rentier class – how utterly weak we as a people have become to the fear mongering of the elite and, how they believe their own lies in the face of the overwhelming real world harm evident about us all.

Thanks again Yves for this post. The deluge of propaganda is making us all sick; there isn’t an honest account anywhere. Obama is going to say today that, gosh, not enough opportunity has trickled down. Gee. How did this happen? I’ve had the feeling all day, because of the relentless lack of factual news – a quiet day, that the whole nation is just going to go postal all at once.

Yes Yves, thanks. I don’t know what I would do without the work you do and this site to help keep me sane.

Edward Saez, who with his regular co-author Thomas Piketty Emmanuel, not Edward, Saez.

My name dyslexia strikes again. Fixed, thanks.

“synthetic borrowers” – a world of Deep Mischief in this coinage.

Hand in glove with MERS? the destruction of the People’s property rights?

This was no accident. This was part of the “Conspiracy” to “Rule the World” by engaging in “War Crimes” and “Crimes Against Humanity” REDUX.

Paulson was on Meet the Press yesterday. He lobbied for the need for the public to let go of their anger toward bankers. He pointed out that all the money from the bailout, unlike the auto bailout, has been repaid. He warned that there will be future financial crises, not because because there has been no reform, but because these crises have long been a part of our history. While he admitted this past one was unusually severe, he implied crises were expected historical events rather than the result of malfeasance.

Yves mentioned The Quiet Coup by Simon Johnson. If anyone hasn’t read it, I highly recommend it. I’ve used it as a good introduction to the financial crisis for people who are as yet uninitiated. It doesn’t require a sophisticated finance background, instead providing a high level picture of how the financial elite have corrupted government in the same ways he saw in third world “banana republics” requiring IMF bailouts. He also talks about what solutions were required for those countries to become economically stable, solutions which they invariably resist until brought to their knees (missed opportunity of meeting with Obama written about by Ron Suskind, posted above), and which the US has not implemented. Excellent and succinct article by Johnson, my personal favorite article on the crisis, perhaps because it led me down the path to discovery of the true causes of the crisis.

http://www.theatlantic.com/magazine/archive/2009/05/the-quiet-coup/307364/

He warned that there will be future financial crises, not because because there has been no reform, but because these crises have long been a part of our history. LucyLulu

Because our insane money system LENDS purchasing power into existence and via extensive government privileges too.

With equity-based money, purchasing power is SPENT into existence so there is nothing to repay, much less at interest. So a bust is not built-in as it is with the current system.

Moreover, the true crime is that a government-backed credit cartel even exists in our so-called free market economy. How is that remotely just? It isn’t.

How much of this is lying, and how much willed self-deception? It’s as if people years ago had figured out how to deal with outbreaks of the Black Death, but then collectively deluded themselves insisting no such remedy existed, or had ever even been employed–just accept such outbreaks as inevitable and keep on plowing your fields.

It’s astonishing, breathtaking, and terrifying all at the same time

How much of this is lying, and how much willed self-deception? James Levy

There’s something going on at the spiritual level, I’d bet. It’s been like pulling impacted wisdom teeth trying to convince people that money need not be debt and that the boom-bust cycle is thus unnecessary.

Ephesians 6:12

King James Version (KJV)

12 For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Yes, it’s an ideological struggle.

F. Beard, money always was and always will be a form of debt, and it is always basically the same “thing”, no matter who issues it. Your proposal of having private enterprises issue “money” as “common stock” which can be redeemed for goods they produce is just a proposal to issue money as debt – but just not call it debt. This last part is not an advance, imho.

There is much good in your way of thinking, but is it the be-all and end-all?

Your proposal of having private enterprises issue “money” as “common stock” which can be redeemed for goods they produce is just a proposal to issue money as debt – but just not call it debt. Calgacus

A debt must necessarily be paid OR ELSE; a person could sit on some common stock forever with no ill consequences.

but is it the be-all and end-all? Calgacus

No but it is one way to ethically create endogenous private money and a practical way too, given modern communications and computers, so there is no longer, if ever there was, an excuse for a government-backed credit cartel.

And how exciting it’ll be when that dragon falls! And fall it will though I’m not sure mankind is up to it or at least not our generation but one should try anyway, given the enormous good that will result for humanity.

“There will always be financial crisis’s” seems to be a meme the financial sector would like us to accept. Thought Elizabeth Warren did a good job of shooting it down on her nationwide interview. It’s especially sweet starting at the 2:00 minute mark.

http://www.youtube.com/watch?v=pJxvqw2qlHw&list=PLJSTLmalFu_QgIw1qLTxfCmw3B8tHGnRn&index=1

Of course there are people who still firmly believe the crisis was caused by greedy home buyers.

” crises have long been a part of our history”

Except from 1933 to 2000 or so. With notably rare exceptions…

And “the bailout money was paid back” is one of the biggest lies going.

I remember reading that article when it came out. His economic discussion suffers a bit from an austerity bias, but his summary of the political situation is excellent.

It’s rather depressing to see how little has changed in four years. The only significant change I can see on rereading is his comment about the low regard that senior banking executives were held in by the public. That was true in 2009, but four years of spin and revisionist history have pretty much cleared up that little problem.

I stopped reading Johnson when his little buddy over there, James Kwak, started flogging for Obamacare, but I didn’t think this article “suffered from” an austerity bias so much as it called the austerity bias.

The fraudsters would avail themselves of their crony capitalism connections in the government to bail themselves out and then make the public pay. I never got the impression he thought this was a good plan, he was just alerting us that it was THE plan.

I suppose we could bail them out and not make the public pay. That would be not-austerian. I’m not sure this constitutes a good plan either.

The things that made me think he had an austerity bias were (1) his association with the IMF, which has always had austerity as its MO, and (2) throwaway comments like “default on its sovereign debt and become an economic pariah” which seemed to imply that repayment of external debt mattered above all other considerations. (See how well that’s working for Greece).

I do think he was spot on regarding the role of crony capitalism (I was including this under the ‘political’ heading) and I agree that this is usually the fundamental problem that needs to be solved. Until it is solved, anything else is papering over the real problem.

I also caught Paulson on Meet the Press yesterday and when he mentioned that the banks all repaid their bailout money and the government made money on those bailouts “unlike the auto bailout” I was struck by how far removed these elites are from what their job should be. The auto bailout produced dividends in middle class jobs and real economic stimulation, unlike the bank bailout which just served to dress up bank balance sheets and enable executives to pay themselves ever increasing bonuses while laying off hundreds of thousands of lower level employees. At least the auto industry makes a real product.

Speaking of “Hank”, any opinion on this? http://www.businessweek.com/articles/2013-09-09/hank-five-years-from-the-brink haven’t seen it & likely won’t given its sponsors…

Thanks Yves for speaking the truth.

The hagiography surrounding Hank Paulson is really something. It’s like making Richard Nixon the hero of Watergate.

My advice to friends: If you come across an analysis of the financial crisis or the mortgage crisis, do a word search for “fraud.” If the word doesn’t show up, no need to waste your time reading any further.

There’e been a lot to ignore lately.

This is by contrast one of the better, more insightful / lateral appraisals of the recent historical unfolding:

http://www.pieria.co.uk/articles/psychological_games_and_financial_crises

Thanks for the link. I’d forgotten about that site. Pieria, and Frances Coppola, posts a lot of insightful and interesting work.

Citi nearly failed in the early 1990s and had gotten in deep doo-doo in the Latin American lending crisis of the late 1970s

————————————————————

Yves, you fail to mention another important point which is what two financial institutions were major causes for the 1929 crash. Goldman and National Bank. Now we all know who Goldman is because they did not rebrand themselves but guess who the successor to National Bank is. If you say Citi ding, ding, ding you won the prize now please pay your fair share at the door. If you believe this is a representative republic all you have to do is look at this fact and say WTF why are these two entities allowed to still exist in the US.

It is because people have been inculcated (like consistent F Beard) to never think about who OWNS the bankers and how they got and maintain that control over long periods….its inheritance, the concept that is never discussed in “good” company.

true, and not only “inheritance” but the “right of primogeniture”. Sacred cows.

Well, if you want, I’d go for an equal redistribution of the common stock of all large US corporations. That’s in addition to a Steve-Keen-like universal bailout of the entire population and land reform too.

And why? Because the thieving money system has robbed the entire US population via unethical purchasing power creation and if you’ve read your Old Testament you know that theft requires restitution.

Who owns all the property? Is that included in your distribution?

How do you make the “equitable distribution” lasting? Hint, hint…limit inheritance.

Thanks for thinking.

How do you make the “equitable distribution” lasting? psychohistorian

Leviticus 25 does not allow agricultural land to be permanently sold. Instead, the land reverts back to the original owners or their descendants no more than 50 years later.

In addition, the Bible commands debt forgiveness every 7 years and forbids theft and usury (except from foreigners) so the current money system, the source of so much wealth inequality, has to go.

Agricultural land is largely corporate owned and what is not is in the process of becoming, plus the fracking thingy, toxic floods, loss of pollinators, genetic contamination, etc and even if you were to apply biblical law ie. revert – there absolutely no way it would work today, too many humans.

Skippy… Hint… it was written century’s ago in bits and pieces… to rationalize their regional problems with the knowledge base they had… its about as applicable as using veterinary skill on a modern luxury car.

its about as applicable as using veterinary skill on a modern luxury car. skippy

Not hardly. The teachings of the Bible are mostly timeless plus God Himself helps one to reach understanding if one seeks therein.

But keep listening to people who by their own admission will soon be nothing? Or so they hope? That’s not exactly a winning strategy, is it?

The Lord knows the thoughts of man,

That they are a mere breath. Psalm 94:11 New American Standard Bible (NASB)

But keep listening to people who by their own admission will soon be nothing? Or so they hope? That’s not exactly a winning strategy, is it?

On the contrary, Mr Beard! You see, as a Pastafarian I have the pleasure of knowing that in the afterlife I will enjoy Heaven’s beer volcano and stripper factory to their fullest extent. Sadly, you, as an unbeliever, will be consigned to Hell — where the beer is stale and the strippers have V.D. But it’s not too late, Mr Beard. You too may be touched by His Noodly Appendage!

Perhaps when that happens you will reconsider the wisdom of lecturing others on snippets pulled at semi-random from a 2,000+ year old text written by a peripatetic and horrifyingly sexist Semitic tribe.

I would consider it rather offensive the way you dismiss others because of their (lack of) belief in the afterlife… however, since I know what’s in store for you there I feel satisfied to overlook it.

Hint, hint…limit inheritance. psychohistorian

Why? If wealth is ethically earned (especially on a level playing field) then why should it be expropriated? Do you wish to negate the following?

A good man leaves an inheritance to his children’s children, and the wealth of the sinner is stored up for the righteous. Proverbs 13:22

Caution: “ethically earned” – everyone claims this. But as Balzac reminds us:

“Behind every great fortune is a great crime.”

At the end of the day he’s just another – Free Market Breather – Fan Boy. Free Market boils down to a deity decides the winnars and losers and the orb is going to blow up anyway, so why not enjoy the ride;O!

Ex Friedmanite, Ranoid, still close to the tree thingy… banks just get in the way of his Free Market Dream. Now the owners are – just not acting – in – accordance – to gawds will, need to be shown the as interpreted beardy truth.

skippy… after that its just a holding pattern till rapture. I wonder if hes considered the homeland problems, manifesting, in his own back yard some day. It seems part and parcel of the deity board game.

And you are an ex-mercenary, yes?

Then congratulations to both of us for being able to learn.

The Chaplin+ gawd and country said it was ok… Murder inc. said there was profit in it, so it was ok… the head of state swore on one bound, so it was ok…

I thought for my self and said… this is a load of rubbish and got pissed about it.

Skippy… Libertarians et al… is about the self… but… can’t think for the self… can’t trust each others word… so they write it down… yet at the end of the day… they always have to find a priest… to adjudicate.

PS. Learning means leaving your bias (past thunkit) at the door, something you demonstrably can not, regardless of the evidence.

Learning means leaving your bias (past thunkit) at the door, something you demonstrably can not, regardless of the evidence. skippy

How old are you, skippy? Are you a child? I’ve lived long enough to see firmly held beliefs reversed and then reversed again! So you expect me to be swayed by whatever long-winded evidence you sandbag me with? I’ve spent decades in the trenches and swamps reaching what faith I have and I’m not about to turn back now. For what possible reason? So I can be as hopeless as you are?

And what do you object to anyway? Ethical money creation? Just restitution? Thou shall not steal? Or the fact that I give credit to the Bible for those ideas rather than simply plagiarize them?

You protest too much.

The fact that you can be, shown to be, patently incorrect, on so many things is why. Actually its a freak show. Your total dismal of any thing contrary to your – personal – beliefs is a deep seated pathological viewpoint.

Cognitive neuropsychiatry, the study of psychiatric disorders using the methods and models of cognitive neuropsychology, has paid particular attention to monothematic delusions, which include the Capgras, Cotard, and Fregoli delusions, mirrored-self misidentification, and reduplicative paramnesia. These delusions have attracted a fair amount of philosophical interest. Pathologies of Belief (Coltheart and Davies, 2000) is a welcome manifestation of this interdisciplinary interest. Originally published as a special edition of the journal Mind and Language, it consists of eight essays by psychologists and philosophers.

What are pathologies of belief? That question is not answered in this book, not directly at any rate. Clear examples can sometimes suffice, and in this case, I think they do. Obviously, the above-mentioned delusions are thought to qualify as pathologies of belief; otherwise, the book would not have the title it has. There is one chapter about theory of mind deficits (as indicated by failures on false belief tasks, for example), so presumably they qualify too. All well and good, but even if we leave aside the question of what else counts as a pathology of belief (for the book never claims to be comprehensive anyway), there is still clearly room for debate about whether all cases of delusions and theory of mind deficits count, and if not, Why? This matter is addressed in several of the chapters, though really only with respect to delusions.

The psychology of belief is, of course, a staple of the philosophical diet, so it is not surprising that some philosophers are showing a keen interest in the study of cases in which the normal processes of belief fixation go awry. The philosophers represented in Pathologies of Belief are all, broadly speaking, from the cognitive science stable, as are the psychologists. Although the discussions and arguments contained in the book are diverse, I came away feeling that while a reasonably united front was being presented, I was not much the wiser in regard to the alternatives (apart from psychodynamic approaches, which are fairly criticized for being unable, in and of themselves, to account for why many delusional subjects have some kind of neurological abnormality or damage).

Together, the essays in Pathologies of Belief illustrate in various ways what I take to be two general requirements and one desideratum for cognitive neuropsychiatry’s success. The requirements, which I see as applicable to psychology in general, are the need for a pluralist approach and the need to keep the personal and subpersonal levels of description and explanation distinct, while seeking to show how accounts at one level relate to accounts at the other level. The desideratum is that we have accounts that develop general links between experience and reasoning and, thus, between deficits in each. I shall discuss each of these issues in turn.

Many of the chapters advocate or illustrate a pluralist approach. They see cognitive neuropsychology as being a very promising paradigm for advancing our understanding of psychiatric disorders but are also of the view that a full understanding of those disorders requires input from research at multiple levels of enquiry. Certainly, they mean by this input from different levels within cognitive neuropsychology (evidenced, for example, by a useful reminder in Currie’s chapter of the distinction between high-level functional explanations and explanations that appeal to the underlying biology). However, there is also the suggestion that elements of theories from other paradigms should be included, even those sometimes seen as being in opposition to cognitive neuropsychology (e.g., psychodynamic theories).

Andrew Young’s chapter, for example, is an extended and convincing argument for why a cognitive neuropsychiatric approach is the leading contender for explaining certain delusions. An important part of this argument is psychodynamic theory’s inability to account for the neurological damage found in many but not all cases of monothematic delusions. (Some instances of these delusions, sometimes observed in schizophrenics, do not have identifiable neurological correlates, as Breen et al. discuss in their chapter.) Yet Young is careful to embrace a multilevel approach to the study of delusions that incorporates neurological and psychological (including, perhaps, psychodynamic) factors: “There are actually a number of different phenomena [involved in…

http://muse.jhu.edu/login?auth=0&type=summary&url=/journals/philosophy_psychiatry_and_psychology/v008/8.2atkinson.html

Go read the link on AGW in links 9/17/2013, we did that, contrary to your past opines. CO2 good for plants shezzz. Furthermore I have changed in the time Ive been here, you have not. You only see banks as a problem, everything else is okie dokie, corporations destroying peoples lives, highest extinction rate in human history, air – water – soil depletion, fishery’s, a world. But nope its just banks and sprinkle equity everywhere and all is just fine, myopic comes to mind.

skippy… you don’t have a clue what ethics and morals are, bigot, as you have to consult a book of barbarous antiquity to search for them. If you destroy the future, what good is it, what you do today. Your executive functions test quite low imo, probably due to conditioning, which is acerbated by your previous condition, you were medicated for to be functional.

PS. By the way the messiah I questioned you about, that built the wall, was an employe of the Persian Emperor. Do you understand the historical significance of this observation?

More sandbagging. Meh.

Btw, I don’t deny I have problems. And I’m seeking a cure. But you? If you keep your sanity till death, I’ll be surprised unless your demise is soon and unexpected. But who’s to say you’re sane now? I won’t venture that since you’ve no plans to survive your very precarious, certain to end, present existence.

You only see banks as a problem, skippy

Yeah. Ever hear of Occam’s Razor? But I could get even more fundamental and point to the Fall Of Man but that’s too much for Progressives. Instead, I thought “Thou shall not steal” was something we could all agree on. I was wrong, at least in your case.

Freak show? Maybe but births do tend to be a bit messy. But what hope do you have?

As for the Messiah thing, speak more clearly so I can understand what in the heck you’re talking about. I can forgive your misspelling but taciturn gibberish is a bit much.

Btw, if the above is all your own words, I’m impressed that you can communicate but if not, please learn to use quotes or something else to avoid plagiarism.

If you destroy the future, what good is it, what you do today. skippy

Because humans, at least some of us, will live to see a new Heavens and a new Earth is what good it is.

Or do like the present scheme of nature “red in tooth and claw?”

everything else is okie dokie, corporations destroying peoples lives, highest extinction rate in human history, air – water – soil depletion, fishery’s, a world. skippy

I never said that. And when one attacks the root of a problem it is assumed by most (but not you?) that one is attacking the branches as well.

Conversely, attacking the branches but not the root is a vain endeavor since new branches will sprout.

There are a thousand hacking at the branches of evil to one who is striking at the root. Henry David Thoreau

The messiah thing… Your biblical knowledge is pretty basic and narrow, one bookitis coupled with a cultist review group will do that. The fact you can not make the connection to a “Wall – payed for messiah” is indicative of your lack of over all knowledge. Here let me help you along, waling wall. Then there’s the case of search engines which you could use to inform your self, but, do not. I fear the only search engine you engage is bias confirmation, this is not a learning tool.

Look they had banks back in your fantasy days and before, they just did not hold what we consider money in them. You really should keep – your word – and read Graebers book for a primer. Then expand into as many geographical cultures outside your home base as you can. Its quite myopic to focus on one location so fervently, making such bold statements about our species physical and cultural evolution, the knowledge of is growing everyday, especially to young kids (mental castration).

Plagiarism… the link is there and just because the formatting is not to your tastes it does not suggest wrong doing… projection on your part… hell that’s what your entire tomb does… it projects a false reality upon others and the entire world… and it slaves minds to it.

As it says… a slave too… hence you identify in the first person as a slave… to another… freely… in a submissive act. This act is dignified by its marketing usage as an “act of love” ie. Freewill – Surrendered first person self into slave status = Love thingy. See: Shane Hannity on fuaxnewbs thanking gawd that Murdoch has so much money (job creator), that he can have a life. Do you grock that? Shane sees Murdoch as as his personal Master and will unquestionably follow his command. He by his own volition stood in the doorway, in front of all the world and pierced his ear… so all could see he was a willing slave for life.

Getting it yet? You have to become a slave first – in order – to become free… sort of like a lobotomy can set one free… eh… free from making the big decisions… free from responsibility of ones acts… as one can have them voided post facto every weekend or on bended knee at home. What kind of ethos is that?

Anywho… “everything else is okie dokie, corporations destroying peoples lives, highest extinction rate in human history, air – water – soil depletion, fishery’s, a world. – skip

I never said that. And when one attacks the root of a problem it is assumed by most (but not you?) that one is attacking the branches as well.

Conversely, attacking the branches but not the root is a vain endeavor since new branches will sprout.” – beardo

You have diminished or out right denied claims to that effect. On the root problem. That is where I attempt to illuminate the issue, incoherent beliefs from antiquity that refuse to accept hard data and more informed theory is not a rational choice, especially when it projects end time theory’s. Number one on the list of false theory’s is our species or some deity created this world for us, we do not own it, we consume it. It has a variable carrying capacity, extend beyond that measure and not only do we snuff a hole lot of life out, we diminish future life’s potential and technological elasticity is a real bitch… you never want to go there… seriously. Just think of derivatives, Fookmeshima, mental incoherence ie. the endless list of stored potential waiting for the quantum moment.

Banks… sigh… are just big silos – corporations are the farm – distribution system for the big silos. So if you get rid of the banks the corporations just become the new banks which by their nature, will grow into big banks… again. You fix nothing and create a lot of pain and destruction. That’s why making banks public utility’s makes more sense. It avoids most of the damage and helps create a more level playing field for economic endeavor and is more responsive to society’s needs. But naw you would rather try and enforce your myopic view that is a result of cobbled together homily’s, spread out over so much time, when people spent more time killing each other than learning and the vast bulk of humanity was in some form of slavery, a state that was created for the benefit of a very small few percent of the total population.

PS. You enslave, where, I would set free… which is more ethical and moral… eh.

Your biblical knowledge is pretty basic and narrow, one bookitis coupled with a cultist review group will do that. skippy

Actually it’s 66 books with 39 authors. That’s quite a conspiracy and maintained over about 1000 years.

Banks need government privileges to survive to any large extent else who will trust them?

So are you unwilling to cut the banks lose from the government teat?

Huh?

I never said it was a conspiracy… projection on your part.

There are actually more cannons that you count… your tomb does not include them all and then theres the high probably that some are lost forever. But like I said its just ex nihilo metaphysical opinion from antiquity, who’s authors constantly argue over other dead peoples ex nihilo opinion ad infinity.

All private enterprise functions under Government auspices… full stop. Its why its called a Sovereign Nation State… duh.

skippy… The Government we have today is heavily influenced by Wall St. think tankistan, the wealthy, MIC, any TBTF private enterprise. So until it starts working for a better society and not the short term interests of a few… expect more pain.

I’ve lived long enough to see firmly held beliefs reversed and then reversed again! So you expect me to be swayed by whatever long-winded evidence you sandbag me with?

Evidence is what doesn’t change even when your beliefs do.

“But opacity, leverage, and moral hazard are not accidental byproducts of otherwise salutary innovations; they are the direct intent of the innovations.”

Yes. Financial innovation was never about increased liquidity or efficiency, but how to loot multiples beyond the actual value of markets.

How could they be about efficiency when you need to be a NASA engineer to understand how they work?

Bingo! Decades of future expectations brought forward for a select few and when that was not good enough they double tapped the victims with bailouts.

skippy… can you even work out the man hours this wee problem incorporates… is it more than the energy we have left[?] can the orb service that?

The next Fat Goose is India. You only have to read the business press there to understand what is going on. The Finance Minister, Mr.P.Chidambaram is a Harvard alumnus who is either remarkably naive about what is going on or completely disingenuous. He is making a trip in a few weeks to the US to meet Jacob Lew. He is also traveling to Frisco to prostrate himself in front of ‘Foreign Institutional Inverstors'(FIIs). These are the people who in recent days withdrew billions of dollars from India which caused the Rupee to crash from around the high 40s to 63 rupees to the dollar. The Prime Minister Manmohan Singh is another mystery. He went to Cambridge and was taught by Joan Robinson. Don’t these people know what is going on? All of these factors are complicated by yet another – Raghuram Rajan took the helm of the Reserve Bank of India, the India Fed equivalent. One hopes fervently that Rajan is onto the tricks of the Global Fat Cat Financier class but Rajan is also a mystery. Everyone talks about his ‘he warned about the derivative danger in 2003 and Summers called him a Luddite’ story but Rajan went to University of Chicago and one wonders how much of the ‘self equilibrating’ Friedman drivel he swallowed whole. It is pretty amusing to read about what is going on in India – especially the ‘letters to the editor’ section of major newspapers. You can witness the parade of rubes, the true believers who cry themselves hoarse about how we should libearlize, liberalize, liberalize and allow foreign banks and investors to bring their cash in and do whatever they wish. Amazing stuff. P.T.Barnum’s words ring true. In the stage that is the World, the financial fat cats know that there is one ‘sucker nation state born every minute’.

Two economists had more influence on Manmohan Singh than Joan Robinson, namely Nicholas Kaldor and IMD Little. The latter, who supervised his Oxford doctorate, argued for liberalisation of the Indian economy. As for Raghuram Rajan, it was in 2005 that he warned about derivatives, not 2003.

Fat Goose finessed through British Raj Elite DNA atop the pyramid, with caste system firmly in place. This new British Imperium is meant to force Americans to hit the “Road to Bangladesh”. Tyler Cowan tells it: “Average Is Over” — the KissFriedmanPinochet Paradigm of Division of 15%rich/85%poor, and this in America spells R E V E N G E of the Paymasters. The Chinese Raj Elite likewise.

Will Americans take this Forty Years War Against American Ingenuity lying down?

Applause with a standing ovation – to not only Tett, but also to Yves (perfect 3-line dénouement as well).

Both of whom, are real Maestros (albeit sadly rare in my opinion) inaudible within the thundering testosterone pit.

Who gets hurt by this litigation? Not the responsible parties, the bank executives and producers, but bank shareholders.

In theory there is some cost to the executives and producers through loss of bonuses due to the diminished profits.

The question then becomes: does that loss offset the outsized gains they had from inflated bonuses based on illusory profits during the run-up to the crisis? It’s an easy question to answer (hint: unlike profits, bonuses never go below zero). So if you take a longer term view, ‘punished’ is not really a good word for what executives and producers have experienced. ‘Rewarded’ is closer. ‘Richly rewarded’ is closer still.

The blueprint for blowing up the economy for fun and profit (as Yves puts it) remains the same:

1. Understate risk

2. Multiply risk using derivatives, while understating and/or concealing the extent of the multiplication.

3. Scale up massively, to the point where activities under #1 and #2 start impacting the real economy and (further) invalidating the underlying models. Take advantage of the additional opportunities this offers for understating and multiplying risk.

4. Repeat #1 through #3 until a crash occurs, wiping out all the profits that were earned (although not the bonuses paid on those profits)

5. Demand to be made whole by taxpayers. Threaten Armageddon due to the realization of all the multiplied risks if it’s not done.

The GFC was the test case for this strategy. It was a success. Nothing has been done to prevent a repeat. The next time will be worse (and even more lucrative for the perpetrators).

Depending on the size and velocity of the next crash, there may not be the possibility of a federal bailout. If it happens with this congress, there would be no chance of getting a multi-trillion dollar deal passed. Plus, given that there has been no reform to the system, we can’t really expect the next time to be a small affair, or that it will take much time to develop.

As Yves points out, the lead up to and the 5 years since was no time of honesty. Everything was fine, business was as usual, and nothing was out of the ordinary. Those banks did not really need the bailouts, the market had it under control. The markets may get their swipe at it yet, and I hope they do. Banking will never look the same, and it shouldn’t.

the point of repeating all of these lies and mischaracterizations so often is so that we come to view the financial crises with the same lens we have been conditioned to use on WWII–through the power of Anchors Aweigh, Casablanca, and History Channel reruns about how noble we are in facing down an unflinching foe. Lehman doesn’t seem to be as satisfying a foe as ol’Adolph, though.

Additionally overlooked:

Destruction of middle class

Untold loss and suffering

Many people that told the truth and attempted to reform were rejected by the establishment (Elizabeth Warren, perhaps soon, Janet Yellin, many others)

5 years of “don’t fight the Fed” life support and PPT – Plunge Protection Team (??)

Bastardization and loss of faith in anything resembling fairness, just reward, DEMOCRACY.

The realization that the world really turns around offshore wealth escape.

Too much to even account for.

Presidents and Congress people voted for the following:

1. 3-1 historical collatoral to 50-1

2. 100% of all mortgages could be sold to others ASAP

3. Homes could now be purchased with zero skin in the game.

No Presidents or Congress people have been thrown in Jail.

Most have been re elected over and over and over and over again. They learned that all you have to do is blame it on Wall Street and the Bankers.