Yves here. Ilargi is correct to not only flag QE as a continuing subsidy to banks, but to highlight data that shows its magnitude. It’s important to keep in mind what a terrible substitute this is for fiscal stimulus, and that Fed officials continue to defend it despite its ineffectiveness rather than call for better remedies.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth, Cross posted from Automatic Earth

A report issued by McKinsey Global Institute last week in my opinion warrants more scrutiny than I’ve seen it get so far. It addresses the effect of (ultra-) low interest rates on different segments of economies over the past five years, and it leads to a number of interesting questions. But let me take a step back first. What many at this point may not remember or fully grasp anymore is that quantitative easing (QE) is an unconventional policy used by monetary authorities which was specifically “invented” to be able to (further) manipulate interest rates.

Conventional expansionary monetary policy, which as a rule involves a central bank buying short-term government bonds, is aimed at lowering short-term market interest rates. But when these short-term rates are at or close to zero, QE can be used to purchase assets of longer maturity, aimed at lowering longer-term interest rates “further out on the yield curve”.

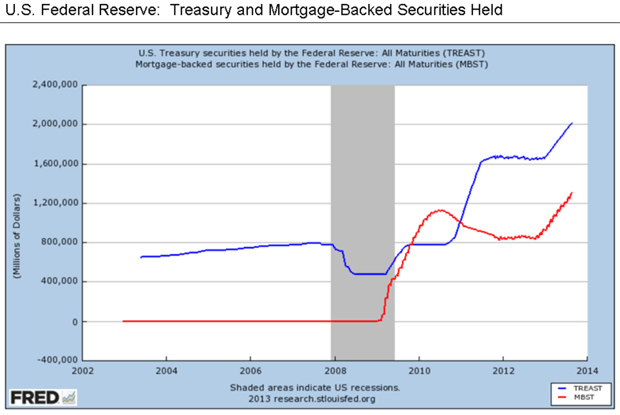

One of the Fed’s main QE targets of course has been, and still is, the purchase of mortgage-backed securities, a fact that warrants 1000 questions all by itself (like: why is the Fed still, with the economy allegedly out of the crisis, buying tens of billions or dollars a month worth of commercial housing market debt risk off Wall Street Banks?), but we’ll keep those for later. Suffice it to say that labeling QE a bond-buying program (we see that a lot) is not nearly 100% correct, as the Fed’s own data shows:

How about a short refresher on 5 years of US QE, based on Wikipedia:

The US Federal Reserve held between $700 billion and $800 billion of Treasury notes on its balance sheet before the recession. In late November 2008, the Federal Reserve started buying $600 billion in mortgage-backed securities. By March 2009, it held $1.75 trillion of bank debt, mortgage-backed securities, and Treasury notes, and reached a peak of $2.1 trillion in June 2010.

Purchases resumed in August 2010 when the Fed “decided” the economy was not growing robustly. After the halt in June, holdings started falling naturally as debt matured and were projected to fall to $1.7 trillion by 2012. The Fed’s revised goal became to keep holdings at $2.054 trillion. To maintain that level, the Fed bought $30 billion in 2- to 10-year Treasury notes every month.

In November 2010, the Fed announced a second round of quantitative easing, buying $600 billion of Treasury securities by the end of the second quarter of 2011. The expression “QE2” became a ubiquitous nickname in 2010.

A third round of quantitative easing, QE3, was announced on 13 September 2012. In an 11–1 vote, the Federal Reserve decided to launch a new $40 billion per month, open-ended bond purchasing program of agency mortgage-backed securities. Additionally, the Federal Open Market Committee (FOMC) announced that it would likely maintain the federal funds rate near zero “at least through 2015.” On 12 December 2012, the FOMC announced an increase in the amount of open-ended purchases from $40 billion to $85 billion per month.

Armed with that memory support, we can turn to McKinsey:

QE and ultra-low interest rates: Distributional effects and risks

There is widespread consensus that the conventional and unconventional monetary policies that world’s major central banks implemented in response to the global financial crisis prevented a deeper recession and higher unemployment than there otherwise would have been. These measures, along with a lack of demand for credit as a result of the recession, contributed to a decline in real and nominal interest rates to ultra-low levels that have been sustained over the past five years.

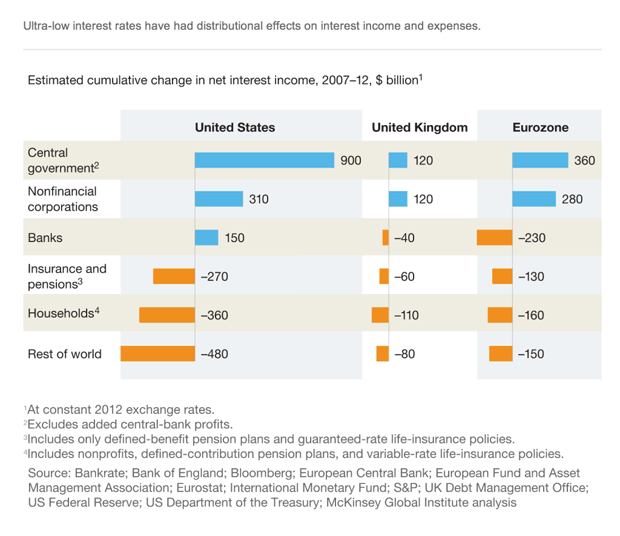

A new report from the McKinsey Global Institute examines the distributional effects of these ultra-low rates. [..] From 2007 to 2012, governments in the eurozone, the United Kingdom, and the United States collectively benefited by $1.6 trillion both through reduced debt-service costs and increased profits remitted from central banks.

Nonfinancial corporations benefited by $710 billion as the interest rates on debt fell. Although ultra-low interest rates boosted corporate profits in the United Kingdom and the United States by 5% in 2012, this has not translated into higher investment, possibly as a result of uncertainty about the strength of the economic recovery, as well as tighter lending standards. Meanwhile, households in these countries together lost $630 billion in net interest income, although the impact varies across groups. Younger households that are net borrowers have benefited, while older households with significant interest-bearing assets have lost income.

The impact that ultra-low interest rates have had on banks has been mixed. They have eroded the profitability of eurozone banks, resulting in a cumulative loss of net interest income of $230 billion between 2007 and 2012. But banks in the United States experienced an increase in effective net interest margins and a cumulative increase in net interest income of $150 billion. The experience of UK banks falls between these two extremes.

Life-insurance companies, particularly in several European countries, are being squeezed by ultra-low interest rates, so much so that if this environment were to continue many of these insurers would find their survival threatened.

Theoretically, ultra-low interest rates may have resulted in higher asset prices, and this effect may have offset lost interest income for households and other investors. But we find a mixed picture.

Rising bond prices are the flip side of declining yields, and the value of sovereign and corporate bonds in the eurozone, the United Kingdom, and the United States increased by $16 trillion between 2007 and 2012. Investors that mark the value of their assets to market have therefore seen a significant gain on their fixed income investments, at least on paper.

Ultra-low interest rates are likely to have bolstered housing prices by lowering the cost of mortgage credit. This effect is most clearly seen in the United Kingdom, where the majority of mortgages have variable interest rates that have automatically adjusted downward. The impact is less clear in the United States, where the recovery in housing prices has been dampened by an oversupply of housing, high levels of foreclosures, a predominance of fixed-rate mortgages, tightened credit standards, and the prevalence of homes with negative equity whose mortgages cannot be refinanced.[..]

Ultra-low interest rates do appear to have prompted additional capital flows to emerging markets, particularly into their bond markets. Purchases of emerging-market bonds by foreign investors totaled just $92 billion in 2007 but had jumped to $264 billion in 2012. Emerging markets that have a high share of foreign ownership of their bonds and large current account deficits will be most vulnerable to capital outflows if and when central banks begin tapering current policies.

There are likely to be risks ahead whether asset purchases are tapered and interest rates rise or, alternatively, if current monetary policies continue and interest rates remain low. In the first scenario, the benefits gained or losses incurred could be reversed. [..] rising interest rates could lead to a collapse in leveraged trades and could pose a threat to some financial institutions.

Capital flows to emerging markets could reverse. Investors in bond markets forced by accounting rules to mark to market could face large write-downs. Eurozone countries could be caught in a crosswind if rates increase in the United States before they do in Europe, leading to a shift in foreign capital from Europe to the United States. In the second scenario, life insurers and banks in Europe would experience continued erosion in their profitability. A continuation in ultra-low interest rates could also prompt higher leverage and the return of asset-price bubbles in some sectors, especially real estate.

The McKinsey people explain it quite well, but I think it would be good, for one thing, to add some population numbers for perspective. Eurozone population is 334 million, US 317 million, UK 63 million. So you need to multiply UK numbers by about 5 to get comparable (per capita) numbers to the other two. Some things that stand out from that point of view: UK insurance and pensions are much worse of than those in the Eurozone, UK households are even worse than that compared to Eurozone, and the Rest of the World suffers much more from the US than from the others (not surprising, since US Treasuries are everywhere).

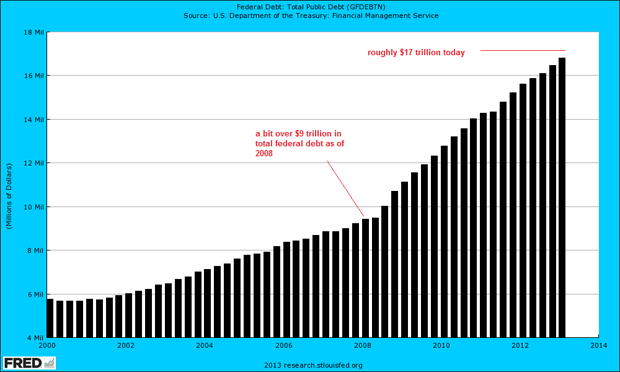

Let’s just lift one thing out of that graph, the US government’s $900 billion increase in net interest income. For the simple reason that it gets me thinking. Thinking, for instance, that the national debt would have been almost $1 trillion higher if not for that. But then again, what’s a trillion among friends in the grand scheme of things, right?

Or, to put it into words:

Federal Debt Jumped $409 Billion in October; $3,567 Per Household

The debt of the federal government, which is normally subject to a legal limit, jumped by $409 billion in the month of October, according to the U.S. Treasury. That equals approximately $3,567 for each household in the United States, and is the second-largest one month jump in the debt in the history of the country. In the continuing resolution deal sealed by President Barack Obama and the Republican congressional leadership last month, the legal limit on the federal debt was suspended until February 7 of next year.

The single greatest one-month increase in the federal government’s debt came in October 2008, when Congress enacted the Troubled Asset Relief Program to bail out the financial industry. In that month, the debt subject to the legal limit climbed by about $545 billion.

At the close of business on Sept. 30, 2013, the last day of fiscal 2013, the federal debt subject to limit stood at $16,699,396,000,000. At the close of business on Oct. 31, 2013, the first month of fiscal 2014, the debt subject to limit stood at approximately $17,108,378,000,000.

Thus, during October, the debt increased $408,982,000,000 – or about $3,567 for each of the 114,663,000 households the Census Bureau estimates there are in the United States.

From May 17, when the Treasury was approaching the previous debt limit, until Oct. 17, when Congress enacted the CR suspending the debt limit until February, the Treasury reported that the debt closed each business day at $16,699,396,000,000 – or about $25 million below the then-legal-limit of 16,699,421,095,673.60.

Got to love that last bit: though the debt kept rising, the Treasury merrily reported it as the exact same for 5 months. Who needs the truth when you can just as easily fake it?

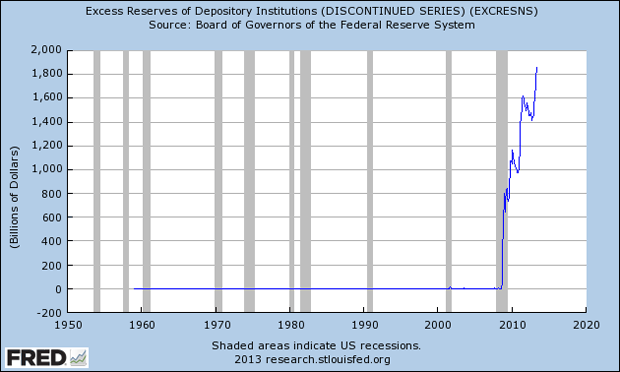

So how did the banks do? We can see a direct reflection of the Fed purchases of bonds and MBS, which we saw in the first graph, in this one:

And no, you’re right, the excess reserves don’t yet quite add up to the total bonds and MBS purchases. So what happened to the rest of it? Easy. I give you, from Fortune two months ago:

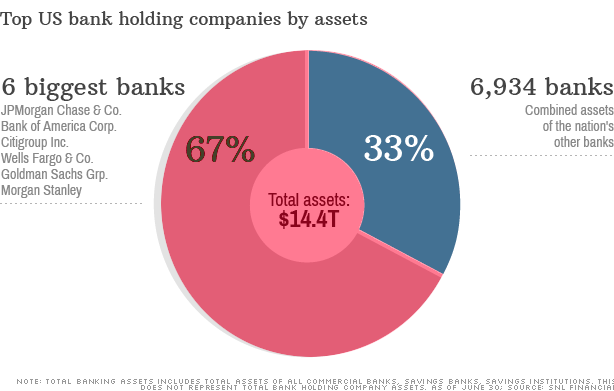

By every measure, the big banks are bigger

Assets at the six largest U.S. banks are up 37% from five years ago. What happened?

One third of all business loans this year were made by Bank of America. Wells Fargo funds nearly a quarter of all mortgage loans. And held in the vaults of JPMorgan Chase is $1.3 trillion, which is 12% of our collective cash, including the payrolls of many thousands of companies [..]

A lot has changed since the financial crisis. A number of large banks and Wall Street firms have disappeared. There are new regulations in the works meant to limit risky trading and bring derivatives that compounded the financial system’s losses into regulated markets. Subprime lending has been coming back recently, but it’s still a fraction of what it once was.

But at least one of the widely recognized causes of the financial crisis is not only still around, it has perhaps gotten worse. By every measure I can think of, and I have tried a bunch, the big banks are bigger than they were five years ago, at the dawn of the financial crisis. [..]

The six largest banks in the nation now have 67% of all the assets in the U.S. financial system, according to bank research firm SNL Financial. That amounts to $9.6 trillion, up 37% from five years ago. And the big banks seem to be getting better at acquiring assets all the time. The overall growth of assets in the system in the same time is up just 8%.

The biggest bank in the nation, JPMorgan, has $2.4 trillion in assets alone – the size of England’s economy. And JPMorgan is seven times larger than the nation’s No. 10 bank U.S. Bancorp, which itself has $350 billion in assets – along the lines of Austria — and at this point is probably part of the TBTF club as well. Also way up: Profits. The four biggest banks in the U.S. alone, which along with JPMorgan include Bank of America, Citigroup, and Wells Fargo, made collectively nearly$45 billion in the first six months of the year, nine times what those same banks made five years ago.

I’ll throw in a few numbers from Michael Snyder:

Too Big To Fail Is Now Bigger Than Ever Before

• JPMorgan Chase

Total Assets: $1,948,150,000,000 (just over 1.9 trillion dollars) Total Exposure To Derivatives: $70,287,894,000,000 (more than 70 trillion dollars)

• Citibank

Total Assets: $1,306,258,000,000 (a bit more than 1.3 trillion dollars) Total Exposure To Derivatives: $58,471,038,000,000 (more than 58 trillion dollars)

• Bank Of America

Total Assets: $1,458,091,000,000 (a bit more than 1.4 trillion dollars) Total Exposure To Derivatives: $44,543,003,000,000 (more than 44 trillion dollars)

• Goldman Sachs

Total Assets: $113,743,000,000 (a bit more than 113 billion dollars – yes, you read that correctly) Total Exposure To Derivatives: $42,251,600,000,000 (more than 42 trillion dollars)

That means that the total exposure that Goldman Sachs has to derivatives contracts is more than 371 times greater than their total assets.

Michael Snyder’s right: too big to fail has only become bigger, and therefore even harder to fail. Courtesy of quantitative easing. Well, and creative accounting.

But that is not at all how QE has persistently been presented to the people. It’s presented both by Bernanke and by his footsoldiers as an effort to heal the American economy and create jobs. For which there is so little evidence that they get away with throwing ever more money at the by now too bloated to fail banks, and always under the same guise. And as the American people seem to believe them, banks and investors are just happy with all the free money and low interest rates. It’s as if nobody pays, and if someone does pay, who cares, they don’t raise their voices, do they?

One of Bernanke’s footsoldiers is Janet Yellen, and she’s set to take over the Fed soon. Here are some pieces from her Senate hearing speech last week:

It has been a privilege for me to serve the Federal Reserve at different times and in different roles over the past 36 years, and an honor to be nominated by the President to lead the Fed as Chair of the Board of Governors.

The past six years have been challenging for our nation and difficult for many Americans. We endured the worst financial crisis and deepest recession since the Great Depression. The effects were severe, but they could have been far worse. Working together, government leaders confronted these challenges and successfully contained the crisis. Under the wise and skillful leadership of Chairman Bernanke, the Fed helped stabilize the financial system, arrest the steep fall in the economy, and restart growth.

For these reasons, the Federal Reserve is using its monetary policy tools to promote a more robust recovery. A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases. I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.

In the past two decades, and especially under Chairman Bernanke, the Federal Reserve has provided more and clearer information about its goals. Like the Chairman, I strongly believe that monetary policy is most effective when the public understands what the Fed is trying to do and how it plans to do it. At the request of Chairman Bernanke, I led the effort to adopt a statement of the Federal Open Market Committee’s (FOMC) longer-run objectives, including a 2% goal for inflation. I believe this statement has sent a clear and powerful message about the FOMC’s commitment to its goals and has helped anchor the public’s expectations that inflation will remain low and stable in the future.

We have made progress in promoting a strong and stable financial system, but here, too, important work lies ahead. I am committed to using the Fed’s supervisory and regulatory role to reduce the threat of another financial crisis. I believe that capital and liquidity rules and strong supervision are important tools for addressing the problem of financial institutions that are regarded as “too big to fail.”

Yellen’s not going to change a thing. It’s steady as she goes, everything on red. The banks can rest assured, the money will keep on coming their way. The banks that are bigger than they ever were, and by now form a risk to the security of the country, not just the economy. JPMorgan is now as big as the entire UK economy. Can’t let it fail. And if you can’t let it fail, you’re going to find yourself giving in more and more. Not a situation any society should put itself in.

Yellen has been in and out of the Fed system since 1977. She was a member of the Fed’s Board of Governors from 1994-’97, and became chair of Clinton’s Council of Economic Advisers from 1997-’99. She was President of the San Francisco Fed from 2004-’10. In other words, when Greenspan, Summers and Rubin opened up the floodgates to hand Wall Street full access to every dime the American people ever earned, Janet Yellen was on her post and happily went along with it all.

And now she’s being installed to make sure the music keeps playing on Wall Street. But once you include the games played with US unemployment numbers, like for instance the Labor Participation Rate, unemployment is a lot closer to 10% than it is to 7.3%. So why would you still believe that the Fed is looking out for American jobs, or that QE is the best way to do that?

By 2012, Americans had lost $630 billion just in net interest income, some $2000 per capita. Today, that amount is undoubtedly higher. And Janet Yellen, faithful puppet of the architects of America’s worst ever financial crisis, will do her best to make sure it keeps on rising.

Why doesn’t America recognize the failure of QE and try something different? $85 billion a month, over $1 trillion a year, is about $3000 for every American, or close to $10,000 per household. If that were handed not to banks, but to these households, and it could achieve the same economic efficiency that foodstamps have, i.e. they create $1.7 worth of – primarily local – economic activity for every $1 they’re worth, the average household would have $10,000 extra to spend, and the benefit to the economy would be $17,000. That couldn’t fail to create jobs.

It’s theoretical, of course, and things being as they are, it’s almost certain that it will remain a theory only. But even if you would take just, let’s say, 10-20% of the amounts presently spent to relieve too big to fail but already failed anyway banks of their mortgage debt risk, that would still do a lot more to revive the economy than all of QEs relief does. Not that that’s hard, mind you, since QE has only made matters worse for the people. That’s what that graph from McKinsey tells us.

<iframe width=”600″ height=”338″ src=”//www.youtube.com/embed/k0t0EW6z8a0?feature=player_embedded” frameborder=”0″ allowfullscreen></iframe>

…aaaand people still can’t take on more debt ’cause they just lost their jobs and their wages are on long-term decline while prices keep rising, and ObamaCare is about to shaft them hard where it hurts. So no taper this year, in fact they may have to increase the money printing to $100 Billion per month. Oh no that’ll cause prices to continue rising while wages continue stagnating, and that’ll mean they’ll have to increase QE even more… but that’s spiraling in the wrong direction.

Let them taper, and then we can watch this house of cards blow sky high. The yield on the 10-Year will make the decisions for them. Maybe then we can get on with the business of serious structural reform.

They’re threatening to taper by 13Dec or 14Jan.. maybe they do want to see 210 million Americans go unemployed (the unempl rate would stay below 9% of course, but everybody just stops working).

Eventually all wealth will be held by just one guy. Let’s hope he spends alot. Today if you take out the top 300 incomes in America the per capita income stats already match Brazil. I say keep going, get that one guy everything he wants. That’s the Yellen/Draghi plan anyway. Then fetch a tumbril because it will be time for Thermidor

Great piece. Best one in a long time. The only thing lacking or perhaps area I would have liked to see followed up more was discussion linking the lost income of households to changes in consumption patterns or in other words an attempt to measure the income effect of lost interst on savings.

“Everything in Economics is a Balance Sheet” by Karl Denninger speaks to the fact that whenever there is a winner (homeowners with cheap rates/the banks who mark to model), there is always a loser on the other side (savers).

Savers are being reamed. Anybody interested in a class action law suit?

Debt fret is the majority report on the fiscal end. In other words there is and has been no stomach for fiscal stimulus. With that in mind, and not to blindly defend the Fed, but absent low interest rates where would unemployment be without QE? What would aggregate growth be? On the other hand might it be argued that if the Fed had not embarked on QE and unemployment remained at or near 10% would not the politics pushing fiscal policy have forced Congress to provide much more stimulus directly to the people, and likewise would not rates in this deflationary environment remain low absent QE anyways?

Did you see the movie The Sting?

http://www.imdb.com/title/tt0070735/

The Fed plays its role to dupe the proles in an elaboately choreographed ruse, and it plays its part very well.

“… dup the proles”

Oh yeah! You mean the ‘proletariate’!! That means ‘working classes’, right? That’s ‘good’ humanity! As opposed to those who don’t work and suck of the blood of other humanity. Right? Evil capitalists! Love that everything boils down to good verses evil classes of humanity. And class warfare. And all the other dreck rhetoric of Marxism.

Me? I don’t buy into proletarian-speak. Nor am I suckered into thinking QE has done any good. On that narrow scrap of principle we agree. I believe in the solutions proposed by Simon Johnson and David Stockman. No FED intervention through TARP or QE. Should have let the TBTF banks go bust. Top levels of bank management should have been immediately swept out. Then FDIC moved into to examine the books. Normal bankruptcy procedures after that. Stockman claims the carnage would have been confined to the canyons of Wall Street, with a small group of very rich people losing all their money. [Shedding tears….]

You can rant out Marxist solutions. And I’ll rant out free market solutions.

“Free markets”?

Can you tell me where I might find one of those?

Or are they like the great Russian Utopia, as Victor Arwas puts it? “Their Utopia, like Erewhon,” he concludes, “was nowhere.”

‘True Socialism’?

Can you tell me where it exists?

Words like ‘free markets’, ‘socialism’, ‘bourgeois’, and ‘capitalism’ have been so tossed about and politicized, that they have come to have no meaning at all.

I’ll start off with another of your favorite words, ‘neoliberalism’. Is it any more than an all-purpose term of abuse for anyone who disagrees with Marxism? Well yes, I think the term does designate something substantial and is still quite useful in discussion of economics. I rely on Philip Morowski, who has written a book quite in tune with your thinking:

“Never Let a Serious Crisis Go to Waste: How Neoliberalism Survived the Financial Meltdown”

Mirowski does pretty well at defining neoliberalism. He says neoliberalism does not advocate any true form of laissez faire economics. Instead, Neoliberalism uses the state apparatus to impose a certain kind of market economy on society. This ‘market’ is supported in all ways possible, while concerns with human welfare are deemed less consequential or insignificant.

Happy? One slight problem with Mirowski and other Marxists thinkers is that they trot out a time-worn rhetoric of class warfare, the evil rich verse the impoverished working masses. Such simplistic thinking is good for sloganeering and mud-slinging, but the reality is that modern society is a lot more complex than cabals of rich banksters verses the exploited masses. And your like-minded friend Mirowski has another problem; he piles on conspiratorial nonsense with his concept of the “Neoliberal Thought Collective”. Yeah right, obscenely rich banksters have made puppets out of all governmental and educational institutions, and we ordinary citizens are no more than brainwashed drones of neoliberalism.

Joseph Stiglitz does much better in opposing establishment economics, and he doesn’t have to resort to conspiracy-hobbled rhetoric. I am delighted by his tagging of mainstream economists as ‘market fundamentalists’. There is indeed something seriously wrong with mainstream economics, and Stiglitz is broadly more capable of diagnosing the problems than is a hack like Philip Morowski.

From Mexico, you believe in social justice as do I, and that is abundantly clear from your many posts here. We just disagree on the roads toward achieving that social justice. I’ll stick with the remedies offered by Simon Johnson, David Stockman, and Joseph Stiglitz. You can stick with whatever remedies you find from Marx, Lenin and Engels. I doubt that you can budge my opinions or that I can budge yours, buy I will nevertheless try to crack open my mind when you have something of substance to say.

BTW, ideology warps clear thinking. Care to debate that?

Well you know, Murky, not everyone buys into your two-world theory: free markets good, Marxism bad.

You seem to believe that all you have to do to win an argument is to dress yourself up in the finery of virtue while concomitantly painting your opponent with the face of evil. And to do that you trundle out that trusty old artillery piece of McCarthy warfare, convinced that branding your enemy as a Marxist is all that’s necessary to bear off the palm.

Now I’m positive that would work like a charm at http://www.redstate.com/ . But I’m not so sure it will work the way you intended it here on Naked Capitalism.

Marx was without a doubt the most influential political and economic philosopher of 19th century. But that does not mean we have to either demonize him or canonize him. We can take what we want of his oeuvre, and leave the rest.

That is, for instance, what the Rev. Martin Luther King did. Here’s what King had to say about Marx:

The quote from MLK is from his essay “My Pilgrimage to Nonviolence.”

From Mexico said:

“Not everyone buys into your two-world theory: free markets good, Marxism bad.”

I do not subscribe to any such nonsense. Marx had some good ideas and some very bad ideas. Likewise with ‘free markets’. A gamut of ideas from genius to moronic have been written about ‘free markets’. Like you say, we can take the good and chuck the rest. But you’ve got me wrong on another issue. I have zero interest in your political affiliations. It’s okay by me if you are find value in Marxism. I lived in the so-called ‘socialist paradise’ of the former Soviet Union, so Marxism is quite familiar to me. But the edifice of Marxism has crumbled in recent years. Likewise, the ideology of free market capitalism is currently undergoing serious erosion, thanks to economic recession and deteriorating standards of social welfare.

You claim that ‘free markets’ nowadays are non-existent, but don’t give detail. Is it that you think free markets are non-viable? Or is the corruption so great that no reform is possible? My view is that the free market system is damaged but functional; I don’t see Western style capitalism as bankrupt yet. And though I don’t like the word ‘neoliberalism’, it does designate an economic ideology which has caused damage to social welfare on a global scale.

Good quote from MLK. But I don’t see much redeemable in Marx. The problem for me is less about Marxism being right or wrong, and more about the problem of swallowing an ideology whole. Ideologies generally don’t come piecemeal, and when swallowed whole can do terrible things. Witness the bloody 20th century, when millions of people were killed over ideologies of nationalism, fascism, marxism, and capitalism. Radical Islam is a current example of ideology gone horribly wrong; it legitimizes murder. It’s this systematic packing of predigested ideas into the human brain that deprives us of the capacity for independent thought and sound moral judgment. Brainwashing? No thanks. That’s why I cringe, duck, or openly object to anybody ranting out ideology, no matter whether it’s Marxism, bible thumping, or free market fundamentalism.

Okay, time for you to get the last word. I’m done.

ideology warps clear thinking. Care to debate that?

Murky appears to be a sassier version of Banger.

Get IQ.

Get stuffed. Better yet, get yourself back to Free Republic where you and your Randian chickenshit bullshit might be taken seriously.

Those who comment here are careful observers,, readers, and thinkers, so when they say there is not and never has been a free market, they know what they’re talking about.

Just for emphasis: There’s no such thing as a free market, and everybody goddman well knows it.

Rand was yet another ideologue, and one of the worst.

Someone here said free markets don’t exist? Omigod! A proclamation must mean it’s the truth!

As for the quality of discourse at Naked Capitalism, it’s generally excellent. There is always some nasty squabbling, dog-piling, egotistical grandstanding, and so forth, but that is minor. The quality of ideas and tolerance for those who express opposing ideas is what is so exceptional about Naked Capitalism.

notice how this version of the free market still has to have the FDIC and courts and all of the other govt appendages come out to sweep the bad actors out of the room.

not that I disagree with the plan as they stated it. but it would have been incomplete without relief at the bottom of the pyramid.

One doesn’t have to be a Marxist to have grave reservations regarding capitalism and its attendant alienating effects:

http://libcom.org/files/Fredy%20Perlman-The%20reproduction%20of%20daily%20life.pdf

Perhaps this helps:

“Wu and Xia find that monetary policy has recently been a bit more expansionary than usual (pushing the shadow rate about 0.6% more negative over 2011-2013 than the traditional monetary policy rule would imply), as a result of which their estimates imply that the current unemployment rate is 0.23% lower than it otherwise would have been.”

http://www.econbrowser.com/archives/2013/11/summarizing_mon.html

and this:

“The table below summarizes estimates that have been arrived at using a number of alternative data sets and methodologies for what we could expect to be the consequences for the 10-year Treasury rate of an additional $600 billion in Fed purchases. The estimates vary and are characterized by considerable uncertainty, but most studies would predict a 15- to 25-basis-point decline in the 10-year yield.

http://www.econbrowser.com/archives/2013/10/estimates_of_th.html#more“

Raúl Ilargi Meijer says:

Paul Volcker, Alan Greenspan, Ben Bernanke and Janet Yellen are not nice people. They do bad things. They are the archenemies of rank and file Americans.

And yet those same rank and file Americans go out of their way to run interference for them, uncritically adorning themselves in the same ideological garments the bankers use to cover their naked interest. Witness these Naked Capitalism comment threads every day. How does one explain this?

The theologian Reinhold Nieburh offered the following explanation:

And for those who prefer psychoanalysis over theology, Leonididas K. Cheliotis offers this explanation of the phenomenon:

Well, for long time there were a contract between those who are “governed” with ruling oligarchy deftly covered in propaganda slogans during the Cold-war. Until de-industralization take place that worked well, and until spoils of “imperial overstretch” became insufficient for both, oligarchy and its constituency. “Governed” has been fully supporting every imperial endeavor therefore one shouldn’t be surprised with a commentariat.

Now we can see what is know as Foucault’s boomerang, i.e. militarization of domestic political scene and class war in full swing.

http://michael-hudson.com/2012/03/federal-reserve-system/

Michael Hudson is great.

But the old-guard Keynesian assessment of the Fed is every bit as condemnatory as the classical-Marxist one. Here, for instance, is John Kenneth Galbraith:

Galbraith wrote that in 1975.

I think his prediction has been vindicated. As he noted, by 1975 the Fed was well on its way down the road to perdition (once again). And it has continued down that pathway unrelentlessly, and with a zeal that can only be described as quasi-religious. And when I say religious I mean religious in the very worst sense of the word. As Niebuhr charged of Christianity: “It can not be denied” that the “Christian faith is frequently vulgarized and cheapened to the point where” its “faith in heaven is sometimes as cheap as, and sometimes even more vulgar than, the modern faith in Utopia.”

You raise some extremely important points, and a theme that David Malone is picking up as well. This is a den of thieves, and they are hiding behind the cloak of the state, presenting themselves as a solution to problems which they themselves created and continue to support. The sooner people grasp this reality, the sooner we can stop the bleeding.

http://www.golemxiv.co.uk/2013/11/the-new-world-order-part-1-the-destruction-of-the-nation/

As stated in that post, “State security has a ring of the Stasi about it. And for good reason. Protecting the interests and security of the State is quite different from protecting the interests of the people who make up the Nation. One is about protecting you and me. The other is more about protecting the position, power and wealth of those who make up the State and its various organs of power. State security is about the security of the jobs and social postion of those who are ‘the State’. It is about the security of a particular arrangement of power and those who benefit from that arrangement. Which one does the NSA or GCHQ serve?”

As he stated, I think it is very difficult for people to distinguish between “National Security” (the people) and “State Security”.

I think Malone has it right.

People get hung up on the capitalism and socialism bit, but as Hannah Arendt pointed out, there’s really no difference between state socialism and state capitalism. “We have here twins,” she said, “each wearing a different hat.” It’s the +state+ part that is so pernicious.

beggar thy FOAF

Awesome post. As much as I hate to admit, Summers, the chief engineer of all for Wall Street and none for you, is probably correct. Washington keeps employing folks like Yellin, etc… to ensure Main Street owes Wall Street for everything they own.

While it is good to have a clear picture of what QE does, this has a sense of ‘fighting the last war.’

With QE, the Fed has sold us a bill of goods. Bernanke said it would operate via stock, not flow. That was a lie. Bernanke said he could end QE at any time. That was proven to be another lie when ‘the taper’ proven to be nothing but a head fake (Wall Street is

addictedacclimated to QE). He said the latest round of QE is aboutthe childrenthe unemployed. But he counts unemployed using BLS’s bullshit headline number.Bernankes Fed is political, and his QE is simply a backdoor bailout for the

Wall Street elitefinancial industry. How much of a ‘give’ to Wall Street will get the economy started? Its now clear that they don’t have a f*cking clue. Now bubbles are officially sanctioned by our most respectedquislingsPhDs who suck aon the teat of Wall Streetat morality/ethics.One gets the sense that as long as tribute continues to be paid, the hostage will NOT be released.

This post covers a lot of ground, but it fails to mention a most important development: bail-in’s.

The Financial Stability Oversight Board (one of the few things created by Dodd that the financial industry seems to be OK with!!) can allow TBTF institutions to suck money from their customers.

TBTF has been fixed: in addition to the Fed put, we now have the TBTF call.

I think this can be viewed as part of the huge derivative problem mentioned in the post. As with MF Global being a type of triparty repo where they used their customers money market funds to place risky bets and then got them called in by the third party intermediary JP Morgan when they started to go bad. Or with the superpriority of Detroit’s interest rate swap losses which are being paid back before pensions.

Many of these derivatives were fraudulently created via LIBOR etc. I would like to see a task force including Satyajit Das start to look into unwinding these before more money market funds, pensions etc start to disappear into the banks coffers.

I keep repeating myself but, what the heck.

Any policy that increases real estate prices (land prices and not the product of labor…the buildings) forces people to have less for cosumption/demand. If I have to pay inflated rent or aquisition cost for a place to live, or, if I am a business and have to pay inflated rent for a place to do business then I will have less for real cosumption or real production —- it is that simple. Add to that our unjust revenue system that favors economic rent seeking over wealth creation (all wealth creation requires labor) and you will have the situation we have today — it is as simple as that. To cure this inequity, this injustice…. rebalance our revenue system to de-tax the products of labor (wealth) and tax the products of rent extraction – it is as simple as that.

What to do with the revenue gained from taxing economic rent? put it to use for public financing (infrastructure, fighting global warming, increasing efficiencies, transitioning to sustainable living on this planet, education, safety net, health care as a right, cleaning up our excrement IE: investment in wealth creation, investments in things that lower the cost of living and working while raising the standard of living for all.

“The six largest banks in the nation now have 67% of all the assets in the U.S. financial system, according to bank research firm SNL Financial. That amounts to $9.6 trillion, up 37% from five years ago. And the big banks seem to be getting better at acquiring assets all the time. The overall growth of assets in the system in the same time is up just 8%”

Well, 2/3 done!!!

We say Too Big Too Fail, but we mean to piddling to fool with…like the 99%

Somewhere after the 2008 crash when Hank Paulson and Ben Bernanke went to the Senate to get TARP passed and the next QE a decision was made, probably by the TBTFs themselves, that no money would be spent on a jobs program or on infrastructure or anything to get the real economy going again. If this decision was made because of all the concerns about high interest rates, as outlined above, then it has been a conscious deception on the part of the banks, the Fed, the Administration and both the Senate and the House to go along with the cover story. Inflation is so dreaded that any spending to create a functioning economy is verboten. As long as unemployment is high, i.e. forever, interest rates can be kept low. And curiously the Fed has just lowered its target to 5.5% – it’s almost as if it is eliminating all other possibilities for the sake of a long, slow, relentless deflation. They have probably calculated that in the end a 10-year deflation will be considerably cheaper even with unemployment benefits and soup kitchens and a bankrupt retail consumer, than the inflation of creating a new, real economy.

So if inflation is the real danger to TPB, and we are all catching on to the ruse, then it is time to deal with inflation directly with things like price controls and other central planning measures, instead of impoverishing 300 million people and wasting an entire generation of college grads without jobs.

And the other thing I’ve been suspecting for a long time, since all developed countries and central banks are up to the same game, is that there is a consensus among them than global climate change has become critical. The CO2 already in the upper atmosphere will stay there for hundreds of years and there isn’t anything we can do to clean it up. And if we add more we are going to be devastated by climate catastrophes just like the Philippines was last week. It is going to be a very desolate planet. When I heard both Bernanke and Rogoff make little aside comments on climate change and the environment on their economics panel, broadcast last week on CSPAN (Summers has been silent on this one – except to say that Africa is under-polluted!) I felt like my suspicions had been confirmed.

TPTB don’t fear Inflation. They fear commonsense tax reforms that would eliminate the parasitic behavior.

“Quantitative Easing”… the title of the policy alone is intended to both elevate its common usage through mimicry and to deter inquiry by the 99 percent; i.e., “This wealth transfer policy is simply too complicated for you to grok, so fuggedabowdit !! ”

But as Ilargi has so comprehensively summarized, we can clearly see its intended first level results.

The subject is rarely if ever discussed publicly, but I consider a brief discussion of QE mechanics essential to understanding what is going down, and how Wall Street and its ancillary arms benefit from the policy at the People’s expense.

My limited and perhaps flawed understanding of QE is as follows:

The FED, which creates “money” out of thin air, is an indirect buyer of long-term US Treasury debt securities and Mortgage-Backed Securities. The Fed buys these debt securities solely from the Fed’s nineteen “Primary Dealers”. The Fed is not a direct buyer of U.S. Government bonds from the U.S. Treasury nor of MBS from the GSEs – the explicitly U.S. Treasury guaranteed (since 2008) but privately owned Government-Sponsored Enterprises engaged in securitizing and guaranteeing mortgages; i.e., Fannie Mae and Freddie Mac.

In and of itself, I don’t find the fact that the FED is essentially indirectly monetizing USG debt and funding the nation’s budget deficit to be an objectionable aspect of QE policy. Rather, it is the lack of transmission of money into the real economy through fiscal outlays by the US government, and the current distribution structure for FED money that so favors large financial institutions and secondary level participants in the financial sector, that I find objectionable:

1.) The Cash money the FED creates is being directed into purchases of financial assets rather than into fiscal spending that would benefit the broader population. Financial asset purchasing power is compounded through the leverage of the fractional reserve banking system and debt leverage. It is this policy and system structure which has so elevated risk and enabled speculators to increase financial asset prices that directly benefit the small segment of the population that controls the majority of financial assets in the world;

2.) The “money” has essentially been kept locked up in financial assets as financial asset prices have been relentlessly pushed up since the Great Financial Collapse;

3.) As a result, real economic activity has been and is being suppressed, the Velocity of money is at historically low levels, and households and small business participants in the real economy are basically faced with the functional equivalent of “tight money”;

4.) When the “money” is finally “released” from its imprisonment in a crash of stock, bond and other financial asset prices, that “money” will concurrently be destroyed as asset prices fall. However, the concomitant destruction of money, which will be exacerbated by the associated debt leverage, will likely only occur after a narrow coterie of insiders have exited their securities positions and perhaps even taken massive short positions through the options and futures markets.

5.) Unfortunately for us, the public’s debts that were issued by our Treasury and subsequently used to fuel the long ramp in stock and bond prices, will remain as obligations of American taxpayers under the current monetary regime unless the FED is fully nationalized (including the Fed’s preferred stock). Too, we will again have to deal with capital losses among the financial intermediaries.

If our debt-based monetary system is irretrievably broken, then let’s have a national conversation about it, acknowledge it if necessary, and get on with the necessary restructuring. Attempting to perpetuate the status quo by blowing recurring asset bubbles and threatening savers with negative interest rates and other forms of bail-ins if they don’t buy equities or long bonds at these elevated prices is not only a tacit admission of policy failure, but is becoming both tiresome and unhealthy. —Me; November 18, 2013

Our monetary system is not broken. Our tax system is broken. And Wall Street is using the extra dough to corrupt our politics further and wrest more concessions.

Hedge Funds and others that benefit from Carried Interest *LOVE* QE.

stupid peon’s analysis:

the financial industry would have almost NOTHING without the arms of Big Gov feeding it, clothing it and mending its self-inflicted wounds at all points.

sell inflated mortgages and sell them on. sell and own nonsensical MBS and foist them onto the Fed. use the Fed near-free money to buy guaranteed treasuries, plus speculate and drive up the costs of stocks & commodities.

these institutions would have absolutely NOTHING without gov. largesse. well, they would have the bank accounts of the rest of us, and some actual investments in companies and such. basically, whatever they could earn by ‘honest’ banking labors.

and yet we are constantly blamed for all of this, and have been since the beginning. I didn’t remember being given an opportunity to ‘vote’ for any of this, either via my measly amount of dollars nor with my reps.

Thanks, anon y’mouse. You said it much more succinctly than I. I agree, they’re among the biggest Welfare Queens on the face of the planet IMO.

… Talk about a sense of entitlement and a need for Entitlement Reform.

“And no, you’re right, the excess reserves don’t yet quite add up to the total bonds and MBS purchases. So what happened to the rest of it? Easy. I give you, from Fortune two months ago:…”

This is without a doubt the biggest nonsequitor I’ve read all day (and that’s saying a lot).

QE adds directly to the monetary base which by definition equal to the sum of reserve balances (the deposits of banks with the Federal Reserve) and currency (physical cash):

http://research.stlouisfed.org/fred2/graph/?graph_id=147064&category_id=0

Between August 2008 and October 2013 the monetary base has increased by $2.74 trillion which is equal to the $1.23 trillion in assets purchased under QE1, plus the $570 billion in assets purchased under QE2, plus the $940 billion in assets purchased under QE3. Reserve balances have increased by $2.36 trillion. The difference is due to the $380 billion increase in the amount of currency.

Now, how one goes from an increase in currency, to an increase in the assets at he six largest banks, is something of a mystery. (Blame it on the Underwear Gnomes?)